Table of Contents

Introduction

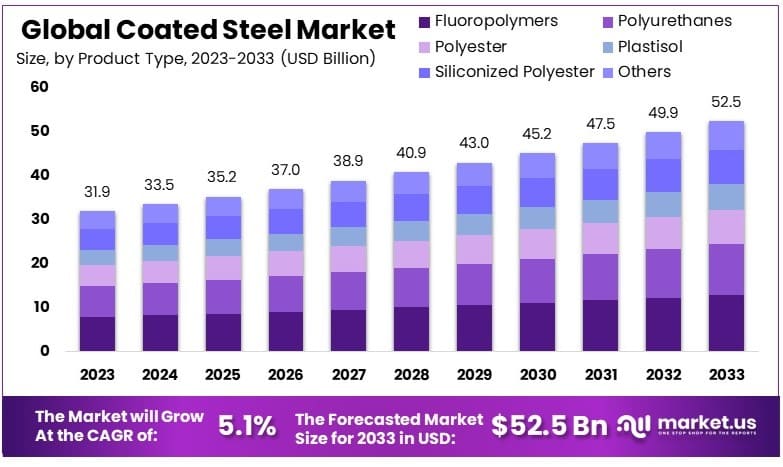

The Global Coated Steel Market is on a trajectory of notable expansion, anticipated to grow from USD 31.9 billion in 2023 to approximately USD 52.5 billion by 2033, with a steady CAGR of 5.1% throughout the forecast period from 2024 to 2033. This market’s growth is driven by increasing demands in the construction and automotive industries, where coated steel is favored for its durability and resistance to corrosion.

Additionally, advancements in technology have led to the development of more environmentally friendly and efficient coating processes, further bolstering market growth. Despite these positive trends, the market faces challenges such as the volatility of raw material prices and stringent environmental regulations which could affect production costs and compliance. Recent developments in the sector include the introduction of innovative coating materials that offer enhanced performance and lower environmental impact. These developments are expected to support the continued expansion of the coated steel market, even as it navigates potential obstacles.

ArcelorMittal, a leading player in the coated steel industry, has made significant advancements in recent years, particularly in the development and deployment of innovative steel coatings. One notable development is the introduction of Magnelis® coated steels. In 2019, ArcelorMittal launched the new ZM620 grade, a thicker, 620g/m² coating variant that significantly enhances the lifespan and corrosion resistance of steel products, especially in harsh environments. This product is particularly beneficial for structures like solar plants where durability and resistance to harsh conditions are crucial.

In addition to Magnelis®, ArcelorMittal has made strategic investments to expand its production capabilities. In 2020, the company announced an investment of $24M CAD to add the production of Alusi®-coated Usibor® Press Hardenable Steel (PHS) in its Hamilton facility in Canada. This steel is primarily used in the automotive sector for making vehicles lighter yet stronger, demonstrating ArcelorMittal’s commitment to innovation in high-performance materials.

Another revolutionary advancement from ArcelorMittal is the Jet Vapor Deposition (JVD) technology, which was first launched in 2017 in Belgium. This technology marks a significant step forward in metallic coating processes, offering a uniform and high-quality coating that enhances the durability and performance of steel products. The JVD process is highly flexible, allowing for different coating thicknesses and can be applied to a variety of steel grades. This technology not only improves product quality but also reduces the environmental impact compared to traditional coating methods.

Key Takeaways

- Market Value: The Coated Steel Market is projected to grow from USD 31.9 billion in 2023 to USD 52.5 billion by 2033, at a CAGR of 5.1%.

- Product Type Analysis: Fluoropolymers dominate with 24.6%, due to their superior properties and wide-ranging applications.

- Process Analysis: Coil coating leads with 45.2%, favored for its efficiency and high-quality output.

- Form Analysis: Liquid form dominates with 72.6%, preferred for its versatility and ease of application.

- End-Use Analysis: Building & construction leads with 42.9%, driven by high demand for durable and corrosion-resistant materials.

- Dominant Region: APAC leads with 38.7% market share, fueled by extensive industrial and construction activities.

- High Growth Region: North America holds a 25.4% market share, supported by advancements in manufacturing and infrastructure projects.

Coated Steel Statistics

- World crude steel production for the 71 countries reporting to the World Steel Association (worldsteel) was 148.1 million tonnes (Mt) in January 2024.

- In January 2024, China produced 77.2 Mt, down 6.9% compared to January 2023. India produced 12.5 Mt, up 7.3%, and Japan produced 7.3 Mt, up 0.6%.

- Steel demand was forecasted to grow by 0.4% in 2022, reaching 1,840.2 million tonnes.

- Steel demand is expected to increase by 2.2% in 2023, reaching 1,881.4 million tonnes.

- Average world steel use per capita has increased from 150 kg in 2001 to around 220 kg in 2023.

- By 2050, steel use is projected to increase by around 20% compared to current levels.

- The housing and construction sector, the largest consumer of steel, uses more than 50% of the steel produced.

- India’s Directorate-General of Trade Remedies (DGTR) recommended anti-dumping duties (ADDs) ranging from $28.70 to $199.50 per tonne for imports of aluminium and zinc-coated steel products from China, South Korea, and Vietnam.

- The energy used to produce a tonne of steel was reduced by around 60% in 2022 compared to the previous 50 years.

- In 2021, around 680 million tonnes of steel were recycled globally, making steel the most recycled material in the world.

- The recovery and use of steel industry co-products reached a worldwide material efficiency rate of 97.65% in 2022.

- The top three importers of coated steel are Vietnam with 754,199 shipments, followed by Mexico with 156,619, and Russia with 151,916 shipments.

- The market for Zinc-Magnesium-Aluminium alloy coated steel grew eightfold, from about 15,000 tonnes in 2020 to 120,000 tonnes in the last fiscal year.

- Driven by the renewable energy sector, the market for this alloy-coated steel is expected to double to 250,000 tonnes, with a market value of ₹2,200 crore this fiscal year.

Emerging Trends

- Increased Demand for Durable Building Materials: Coated steel is becoming more popular in construction due to its durability and resistance to corrosion. This trend is driven by the need for longer-lasting materials in infrastructure projects and residential buildings.

- Growth in Automotive Applications: The automotive industry is increasingly using coated steel to reduce vehicle weight and enhance fuel efficiency without compromising safety. This shift is aligned with the global push for greener, more efficient vehicles.

- Advancements in Coating Technologies: Technological innovations are leading to the development of new types of coatings that offer improved protection against corrosion, UV radiation, and extreme temperatures. These advancements enhance the functional properties of coated steel, broadening its applications.

- Rising Use of Pre-painted Steel: Pre-painted coated steel is gaining traction for its aesthetic and protective properties, particularly in consumer appliances and automotive parts. This eliminates the need for additional painting, reducing costs and environmental impact.

- Sustainability and Recycling Practices: There is a growing trend towards using environmentally friendly coating processes and materials that are less harmful and recyclable. Steel producers are focusing on reducing emissions and waste during production to meet environmental regulations and consumer expectations.

- Expansion in Emerging Markets: Coated steel markets in Asia, Africa, and South America are expanding rapidly due to urbanization and industrial growth. This is leading to increased demand for coated steel in these regions, driving global market growth.

- Integration of Smart Technologies: The integration of smart technologies in the production of coated steel is enhancing efficiency and quality. This includes the use of automation and data analytics to optimize coating processes and product performance.

Use Cases

- Automotive Industry: Coated steel is extensively used in the automotive industry for body parts, frames, and components because it resists rust and extends vehicle life. It contributes to both the safety and longevity of automobiles.

- Construction: In the construction sector, coated steel is a staple for roofing, wall panels, and structural components. Its ability to withstand environmental elements like rain, snow, and heat makes it ideal for building exteriors.

- Appliance Manufacturing: Home appliances such as refrigerators, washers, and dryers often use coated steel. This material prevents rust and maintains the appliance’s aesthetic appeal over time.

- Energy Sector: Coated steel is critical in the energy industry, especially for constructing structures in harsh environments, like offshore platforms in the oil and gas industry. It helps in preventing corrosion caused by water and harsh weather.

- Infrastructure: Bridges, highways, and transport systems rely on coated steel for guardrails, signposts, and overhead sign structures. Its corrosion resistance ensures long-term durability, reducing maintenance costs and enhancing safety.

- Agriculture: Agricultural equipment and storage facilities often utilize coated steel to prevent damage from moisture and chemicals. This usage ensures a longer lifespan for equipment exposed to the elements and harsh working conditions.

- Consumer Goods: Coated steel is also found in smaller consumer goods, such as outdoor furniture and garden tools. It protects these items from weathering and wear, maintaining functionality and appearance.

Key Players Analysis

ArcelorMittal has been active in the coated steel sector, focusing on green steel initiatives. Recently, they launched a groundbreaking low-carbon emissions project at their Dofasco plant in Hamilton, Ontario, aimed at reducing emissions by 60% by 2028. Additionally, ArcelorMittal reported a first-quarter 2024 revenue of $4.7 billion, reflecting their strategic investments, including the $2.2 billion acquisition of Companhia Siderúrgica do Pecém in Brazil.

Baosteel Metal Products Co., Ltd. is a significant player in the coated steel market, recently enhancing its non-oriented silicon steel production for new energy vehicles. They have become the largest global supplier in this niche, with total supplies surpassing 600,000 metric tons. In a strategic move, Baosteel also acquired a 48.6% stake in a steelmaker for $1.5 billion to strengthen its market position.

Dongkuk Steel Mill Co., Ltd. is actively involved in the coated steel sector, recently contracting with Tenova to enhance furnace efficiency, aligning with their sustainable steelmaking goals. In 2024, Dongkuk Steel reported a strategic acquisition of a 26.23% stake in Dongkuk CM Co., Ltd. for KRW 57.9 billion, indicating their expansion and investment in advanced steel technologies.

Kobe Steel, Ltd. has made significant strides in the coated steel market, with a recent focus on expanding their high-quality steel production. In early 2024, they reported a revenue increase driven by their new electro-galvanizing line, which caters to the growing demand in automotive and construction sectors.

JSW Steel Coated Products Limited, a subsidiary of JSW Steel, has recently launched JSW Magsure, a zinc-magnesium-aluminium alloy coated steel product aimed at reducing India’s reliance on imports. The company has invested approximately ₹500 crore to establish a production capacity of 0.9 million tonnes per annum at its Karnataka and Maharashtra facilities. This strategic move supports the company’s goal to capture a significant share of the growing domestic market, driven by the renewable energy sector. JSW Steel’s coated products division reported a revenue of ₹7,767 crore for the latest quarter.

Severstal, a prominent player in the coated steel market, continues to innovate and expand its offerings. Recently, Severstal launched a new line of galvanized and color-coated steel products tailored for the construction and automotive industries. This expansion aligns with their strategy to enhance product quality and increase market share. In the latest financial report, Severstal noted a 10% year-over-year increase in revenue from their coated steel segment, reflecting strong demand and successful market penetration.

BlueScope Steel Limited reported a net profit after tax (NPAT) of $439 million for the first half of FY2024, supported by a strong performance across its diversified portfolio. Recently, BlueScope has invested in expanding its North Star facility in Ohio, increasing its annual production capacity by 950,000 tons. The company is also constructing a new metal coating line in Western Sydney and an electric arc furnace at New Zealand Steel, emphasizing its commitment to sustainable steel production.

ThyssenKrupp Steel Europe continues to strengthen its presence in the coated steel market with the recent launch of its new continuous annealing line, enhancing production efficiency and quality for automotive steels. In its latest financial report, ThyssenKrupp Steel Europe posted a revenue increase driven by higher demand in the automotive and construction sectors. The company’s strategic focus on innovation and quality improvements is expected to bolster its market position further.

Nippon Steel Corporation has significantly advanced its coated steel offerings with the launch of ZEXEED™, a high corrosion-resistant coated steel designed to meet increasing market demand. The product offers twice the resistance in flat areas compared to conventional high corrosion-resistant steel, making it ideal for harsh environments. Additionally, Nippon Steel’s acquisition of U.S. Steel for $1.4 billion aims to enhance its technological capabilities and market reach. The company reported robust financial performance, underpinned by strategic investments in technology and sustainability.

J. K. Steel Strips LLP, an emerging player in the coated steel market, has been expanding its product range to meet diverse industrial needs. The company recently launched a new line of galvanized steel strips, targeting the construction and automotive sectors. This move is part of their strategy to enhance market presence and cater to increasing demand for high-quality coated steel products. J. K. Steel Strips LLP has reported a notable increase in revenue, driven by strong domestic sales and expanding export markets.

United States Steel Corporation has made significant advancements in the coated steel market, highlighted by their collaboration with CarbonFree to implement SkyCycle carbon capture technology at the Gary Works facility. This project, set to begin operations by 2026, aims to reduce carbon emissions and produce sustainable steel. Additionally, U.S. Steel reported a net earnings of $171 million for Q1 2024, reflecting strong financial performance driven by innovative and eco-friendly initiatives.

NLMK Group has recently launched a new antibacterial coated steel product designed to protect surfaces from hazardous microorganisms, ideal for medical and hygiene-critical facilities. The company has also introduced a zinc-aluminium-magnesium coating for improved corrosion resistance, catering to demanding environments. These innovations align with NLMK’s strategy to enhance product quality and meet stringent market requirements.

Conclusion

The coated steel market is poised for substantial growth, fueled by its critical role in industries such as construction, automotive, and consumer goods. The demand for coated steel is driven by its durability, corrosion resistance, and aesthetic value, which make it a preferred choice in harsh environments and for visual applications.

Manufacturers are encouraged to focus on technological advancements and eco-friendly production processes to meet regulatory standards and consumer expectations for sustainability. Furthermore, market players should explore new applications and geographic expansion to capitalize on emerging opportunities. By staying attuned to industry trends and technological innovations, stakeholders can effectively navigate the competitive landscape and harness the potential of the coated steel market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)