Table of Contents

Introduction

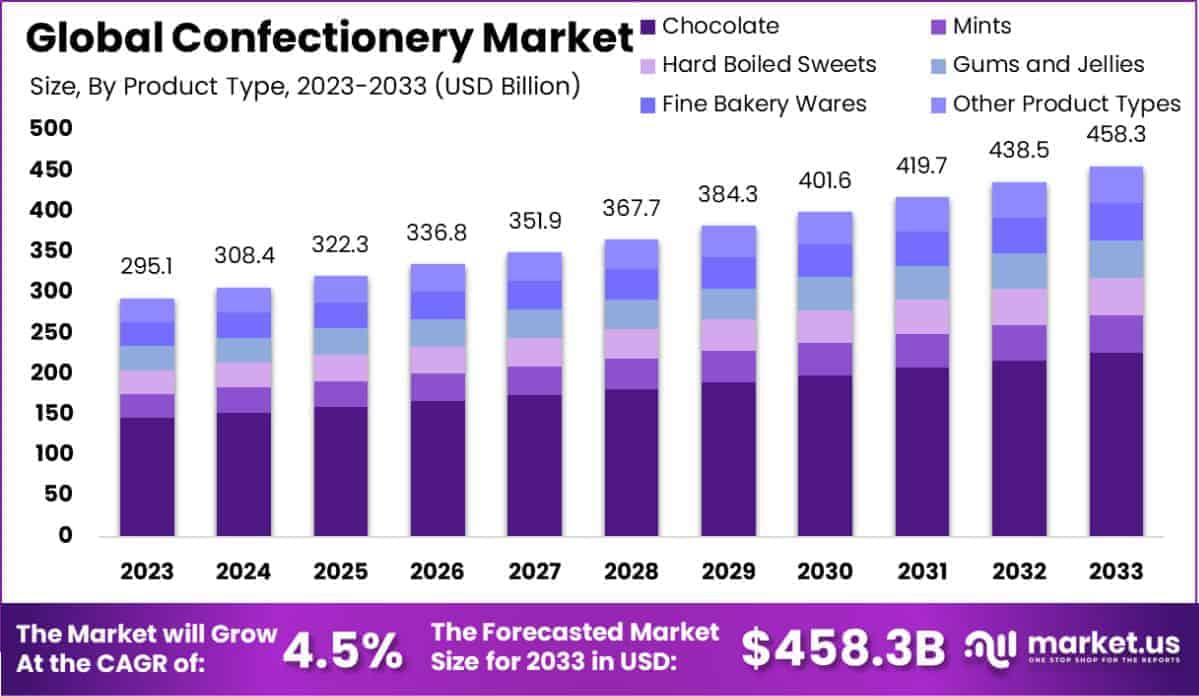

The Global Confectionery Market is projected to grow from USD 295.1 billion in 2023 to approximately USD 458.3 billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.5% over the forecast period of 2024 to 2033.

Confectionery refers to a broad category of food products that primarily consist of sugar or other sweeteners combined with a variety of ingredients, such as chocolate, fruits, nuts, and flavorings. It encompasses a wide range of items including chocolates, candies, gums, mints, and sugar-based treats. Confectionery is typically associated with indulgence and celebratory occasions, playing a significant role in cultural traditions and gifting practices worldwide.

The confectionery market represents the global industry focused on the production, distribution, and sale of sweet-tasting goods. This market is characterized by its diverse product offerings, catering to consumers across demographics and geographies. It includes large-scale multinational players, such as Mars, Nestlé, and Ferrero, alongside regional and niche producers. The market spans various segments, including chocolate confectionery, sugar confectionery, and gum, each catering to specific consumer preferences and occasions.

The confectionery market is experiencing steady growth, driven by several key factors. Rising disposable incomes, particularly in emerging economies, have increased the consumption of premium and artisanal confectionery products. Additionally, changing consumer lifestyles and the growing trend of on-the-go snacking have boosted demand for conveniently packaged sweets. Innovations in product formulation, such as the incorporation of natural and healthier ingredients, are further enhancing the appeal of confectionery among health-conscious consumers. Seasonal and festival-driven demand also significantly contributes to market expansion, with brands capitalizing on these occasions through targeted marketing campaigns and limited-edition offerings.

Consumer demand for confectionery remains robust due to its universal appeal as a comfort food and indulgence. Shifting dietary trends have led to a growing preference for organic, vegan, and sugar-free options, prompting manufacturers to diversify their product portfolios. Millennials and Generation Z, in particular, are key drivers of demand, seeking experiential and aesthetically pleasing products that align with their values, such as sustainability and ethical sourcing. The advent of e-commerce has further amplified demand by providing greater accessibility to a wider range of products, including exclusive and international brands.

The confectionery market presents significant opportunities for growth and innovation. The rising focus on health and wellness offers scope for the development of low-calorie, functional, and fortified confectionery products. Moreover, sustainability initiatives, such as the use of eco-friendly packaging and fair trade-certified ingredients, can help brands strengthen their appeal to environmentally conscious consumers. Emerging markets, particularly in Asia-Pacific and Africa, offer untapped potential due to their growing middle-class populations and changing consumer preferences. Leveraging advanced technologies, such as AI-driven personalization and augmented reality marketing, can further enhance consumer engagement and drive differentiation in this competitive landscape.

Key Takeaways

- The global confectionery market is projected to reach a valuation of USD 458.3 billion by 2033, growing from USD 295.1 billion in 2023 at a CAGR of 4.5% during the forecast period (2024–2033).

- In 2023, the chocolate segment dominated the confectionery market by product type, accounting for a 49.5% share.

- Supermarkets and hypermarkets emerged as the leading distribution channel in 2023, capturing a 38.0% market share.

- The adult demographic represented the largest end-user segment in 2023, contributing 55.1% of the market share.

- Europe led the global confectionery market in 2023 with a 37.2% share, generating USD 109.7 billion in revenue.

Confectionery Statistics

- Chocolate confectionery dominates 55% of the global confectionery market.

- Sugar confectionery holds a 30% share of the global confectionery market.

- Gum products represent 15% of the global confectionery market.

- Mars, Incorporated leads the market with a 14.4% share.

- Ferrero Group controls 9.5% of the global confectionery market.

- Mondelez International has a 9.2% share in the global confectionery market.

- The U.S. consumes 18% of the world’s chocolate supply.

- Switzerland has the highest per capita chocolate consumption globally, at 8.8 kg annually.

- 25% of millennials consume candy daily.

- The average American consumes 22 pounds of candy each year.

- Europeans, on average, eat 5.2 kg of chocolate annually.

- 62% of consumers eat chocolate at least once a week.

- 38% of consumers eat candy weekly.

- 70% of consumers prefer chocolate over other candy types.

- 58% of consumers are open to paying more for premium chocolate.

- Milk chocolate is favored by 44% of consumers over dark or white chocolate.

- 65% of consumers prefer individually wrapped candies.

- Supermarkets are the preferred purchase location for 42% of confectionery buyers.

- 75% of consumers enjoy chocolate as a snack.

- Hard candies are favored by 30% of consumers in the sugar confectionery segment.

- Bite-sized confectionery is preferred by 35% of consumers.

- 55% of consumers are interested in trying new and innovative flavors.

- 40% of consumers look for confectionery products with natural ingredients.

- 28% of consumers eat candy to enhance their mood.

- 50% of consumers seek confectionery with reduced sugar content.

- 45% of consumers purchase confectionery products as gifts.

- Milk chocolate is preferred over dark chocolate by 60% of consumers.

- Chocolate-based confectionery is favored by 70% of consumers.

- 52% of consumers are willing to try plant-based confectionery alternatives.

- Clean-label ingredients appeal to 65% of confectionery consumers.

- 48% of consumers eat confectionery as a reward or treat.

- Halloween accounts for 10% of annual candy sales in the U.S.

- Gummy candies make up 8% of the candy market.

- 70% of Americans say they prefer dark chocolate over milk chocolate.

- During winter holidays, the average American consumes 3.4 pounds of candy.

- On average, Americans eat 25 pounds of candy corn over a lifetime.

- 90% of parents admit to eating their children’s Halloween candy.

Emerging Trends

- Shift Towards Health-Conscious Offerings: Consumers are increasingly seeking healthier confectionery options, leading manufacturers to develop products with reduced sugar content, natural ingredients, and functional benefits. This trend is evident in the growing popularity of sugar-free and fortified candies.

- Rise of Premium and Artisanal Products: There is a notable demand for premium and artisanal confectionery items, as consumers are willing to pay more for high-quality, unique flavors, and aesthetically pleasing products. This shift is driving innovation and diversification within the industry.

- Sustainability and Ethical Sourcing: Environmental concerns are influencing purchasing decisions, prompting confectionery companies to adopt sustainable practices and ensure ethical sourcing of ingredients. This includes using eco-friendly packaging and obtaining certifications like Fairtrade to appeal to environmentally conscious consumers.

- Integration of Technology in Production and Marketing: Advancements in technology are enhancing production efficiency and enabling personalized marketing strategies. Companies are leveraging data analytics to understand consumer behavior and tailor their offerings accordingly, leading to more targeted and effective marketing campaigns.

- Expansion of Online Retail Channels: The growth of e-commerce has significantly impacted the confectionery market, with more consumers purchasing sweets online. This shift has encouraged companies to strengthen their digital presence and develop direct-to-consumer sales models to capture a broader audience.

Top Use Cases

- Gifting and Celebrations: Confectionery products are integral to gifting during holidays and special events. In the U.S., households are projected to spend an average of $30.89 on Halloween candy in 2024, totaling a record $4.1 billion.

- Everyday Indulgence: Consumers seek confectionery items for daily enjoyment. In 2023, 92% of the global population consumed chocolate, highlighting its role in routine indulgence.

- On-the-Go Snacking: The demand for convenient snacks has boosted confectionery sales. In 2023, snack bars experienced significant growth, with consumers favoring them over traditional snacks.

- Health-Conscious Alternatives: There’s a growing market for healthier confectionery options. In 2023, 50% of consumers preferred sweets with at least 60% natural ingredients, driving the development of products with reduced sugar and natural components.

- Premium and Artisanal Products: The premium confectionery segment is expanding. In 2024, the global market for white chocolate, a premium product, is projected to grow by $9.11 billion, with Europe accounting for 44% of this growth.

Major Challenges

- Rising Raw Material Costs: The industry is experiencing increased prices for essential ingredients like cocoa and sugar. For instance, cocoa prices surged nearly 45% since the start of 2024, reaching £5,302 per metric tonne by September. This escalation is attributed to poor harvests in major cocoa-producing regions such as the Ivory Coast and Ghana.

- Supply Chain Disruptions: Global events have led to significant supply chain challenges, affecting the availability and cost of raw materials. These disruptions have resulted in production delays and increased operational costs for confectionery manufacturers.

- Labor Concerns: The industry continues to grapple with issues related to child labor, particularly in West African cocoa farms. Reports indicate that approximately 2.1 million children are involved in hazardous work in cocoa production, raising ethical concerns and prompting calls for more stringent labor practices.

- Health and Nutrition Trends: There is a growing consumer shift towards healthier eating habits, leading to decreased demand for traditional confectionery products high in sugar and calories. This trend challenges manufacturers to innovate and offer healthier alternatives to meet changing consumer preferences.

- Environmental Sustainability: The confectionery sector faces scrutiny over its environmental impact, particularly concerning deforestation linked to cocoa farming. For example, in the Ivory Coast, deforestation has reduced the country’s elephant population from several hundred thousand to about 200–400, highlighting the need for sustainable sourcing practices.

Top Opportunities

- Health-Conscious Offerings: There’s a rising demand for confectionery products that cater to health-conscious consumers. This includes options with reduced sugar, organic ingredients, and functional benefits like added vitamins or minerals. Developing such products can attract a broader customer base.

- Premium and Artisanal Products: Consumers are increasingly willing to pay a premium for high-quality, artisanal confectionery items. This trend is evident in the growing popularity of craft chocolates and gourmet candies, which offer unique flavors and superior ingredients.

- Expansion into Emerging Markets: Regions such as Asia-Pacific and Latin America present substantial growth opportunities due to increasing disposable incomes and changing dietary habits. Tailoring products to local tastes and preferences can facilitate market penetration.

- Sustainable and Ethical Production: Consumers are becoming more conscious of the environmental and ethical aspects of their purchases. Offering confectionery products that are sustainably sourced and ethically produced can enhance brand reputation and appeal to this growing demographic.

- Digital and E-commerce Channels: The shift towards online shopping has accelerated, providing an avenue for confectionery brands to reach consumers directly. Investing in robust e-commerce platforms and digital marketing strategies can drive sales and brand loyalty.

Key Player Analysis

- Mars Incorporated: Mars, Incorporated is a privately held American multinational known for its diverse portfolio, including confectionery, pet care, and other food products. In 2023, Mars reported net sales of approximately $50 billion. The company’s confectionery segment includes iconic brands such as M&M’s, Snickers, and Twix. In August 2024, Mars expanded its snacking division by acquiring Kellanova for $36 billion, enhancing its presence in the global snack market.

- Mondelēz International, Inc. : Mondelēz International, headquartered in Chicago, is a global leader in snacks and confectionery, with brands like Cadbury, Toblerone, and Oreo. In 2023, the company reported net revenues of $31.5 billion. Mondelēz holds a significant share in the global chocolate confectionery market, particularly in regions like Europe and North America. In July 2024, the company partnered with Lotus Bakeries to expand the Biscoff brand in India, aiming to tap into the growing demand for premium cookies in the region.

- Nestlé S.A.: Nestlé, a Swiss multinational, is one of the world’s largest food and beverage companies, with a substantial confectionery segment that includes brands like Kit Kat, Smarties, and Aero. In 2023, Nestlé’s confectionery sales contributed significantly to its total revenues of CHF 92.6 billion. Facing rising cocoa costs, Nestlé announced potential price increases for its chocolate products in July 2024 to maintain profitability.

- The Hershey Company: Based in Pennsylvania, The Hershey Company is a leading North American confectionery manufacturer, known for brands such as Hershey’s, Reese’s, and Kit Kat (under license). In 2023, Hershey reported net sales of $10.4 billion. The company held a 23.6% share of the U.S. confectionery market in 2021, making it the leading confectionery company in the United States.

- Ferrero Group: Ferrero Group, an Italian multinational, is renowned for products like Nutella, Ferrero Rocher, and Kinder. In 2023, Ferrero reported consolidated revenues of €12.7 billion. The company has been expanding its global footprint through strategic acquisitions and product innovations, solidifying its position in the premium confectionery segment. In October 2024, Ferrero’s Nerds Gummy Clusters became one of the most popular candies in America, generating over $500 million in sales that year.

Recent Developments

- In October 2024, The Hershey Company (NYSE: HSY) announced plans to debut innovative snacks and share insights on category management at the NACS Show Expo in Las Vegas from October 8-10. Focused on evolving consumer preferences, Hershey aims to strengthen its portfolio of sweet, salty, and better-for-you snacks while providing retailers with actionable strategies for merchandising and queuing.

- In July 2023, Ferrara Candy Company, part of the Ferrero Group and the largest sugar confections company in the U.S., agreed to acquire Dori Alimentos, a leading Brazilian sweets and snacks manufacturer. The deal, executed through Ferrero’s holding company, CTH, underscores Ferrara’s strategy to expand in international markets. Financial details were not disclosed.

- On November 2023, Mars Inc revealed its agreement to acquire Hotel Chocolat Group plc for £534 million. Approved by the Hotel Chocolat board, the acquisition values the company at 375 pence per share, offering a 170% premium over its pre-announcement share price, signaling Mars’ strategic push into premium confectionery markets.

Conclusion

The global confectionery market is poised for substantial growth, driven by evolving consumer preferences and innovative product developments. A notable trend is the increasing demand for healthier options, prompting manufacturers to introduce products with reduced sugar content and natural ingredients. Additionally, the rise of premium and artisanal confections reflects consumers’ willingness to invest in unique and high-quality treats. Sustainability and ethical sourcing have become critical considerations, influencing purchasing decisions and encouraging brands to adopt eco-friendly practices. The expansion of online retail channels further enhances market accessibility, offering consumers a diverse range of confectionery products at their convenience. Collectively, these factors contribute to a dynamic and promising future for the confectionery industry.