Table of Contents

Introduction

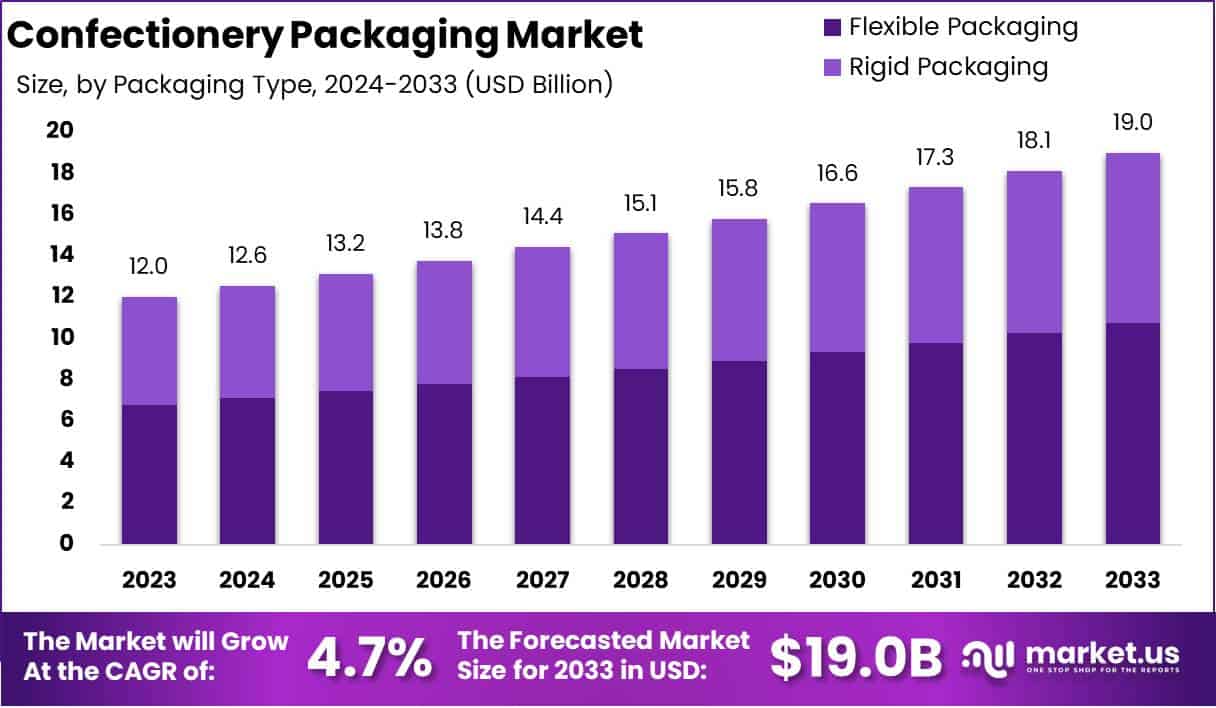

The Global Confectionery Packaging Market is projected to grow from USD 12.0 billion in 2023 to approximately USD 19.0 billion by 2033, registering a compound annual growth rate (CAGR) of 4.7% during the forecast period of 2024 to 2033.

Confectionery packaging refers to the specialized packaging solutions designed to protect, preserve, and present various types of confectionery products, including chocolates, candies, gums, and other sweet treats. The packaging is engineered to maintain product quality, ensure food safety, extend shelf life, and enhance visual appeal to attract consumers.

It encompasses a wide range of materials like plastic, paperboard, metal, and flexible packaging that are tailored to suit the specific needs of the product and the brand’s marketing strategy. Beyond functionality, confectionery packaging is often designed with vibrant colors, attractive graphics, and unique shapes to create a strong brand identity and influence consumer purchasing decisions.

The confectionery packaging market encompasses the global industry involved in manufacturing and supplying packaging materials and solutions specifically tailored for confectionery products. This market includes diverse packaging types such as wrappers, boxes, tins, pouches, and jars, catering to a variety of segments within the confectionery industry, from premium chocolates to mass-produced candy.

It serves both retail and industrial channels, providing packaging that meets food safety regulations and enhances product aesthetics. The market’s growth is driven by evolving consumer preferences, advancements in sustainable packaging technologies, and the increasing focus of manufacturers on innovation to differentiate their offerings.

The growth of the confectionery packaging market is fueled by several key factors. First, the rising global demand for confectionery products, particularly in emerging markets, is expanding the need for diverse packaging solutions. Second, evolving consumer preferences for convenient, resealable, and portion-controlled packaging have prompted manufacturers to innovate and develop more versatile packaging options.

Demand for confectionery packaging is closely linked to consumer consumption trends in the confectionery industry. The growing appeal of on-the-go snacking and the rising preference for single-serve packaging are significant demand drivers. The shift towards healthier confectionery options, such as sugar-free or organic candies, has also spurred demand for packaging that can communicate health benefits and cater to conscious consumers.

The confectionery packaging market presents several opportunities for growth and innovation. One of the primary opportunities lies in sustainable packaging solutions as brands increasingly commit to reducing their environmental footprint. Innovations in biodegradable, compostable, and lightweight packaging materials are gaining traction among both manufacturers and consumers.

Moreover, digitalization in packaging—such as QR codes and augmented reality (AR) features—is creating new marketing and engagement opportunities. The rise of e-commerce also presents a growing opportunity, as packaging must now be designed not only to attract consumers but also to withstand the rigors of shipping while maintaining product integrity and appeal. Expanding confectionery consumption in emerging economies, fueled by urbanization and increased disposable income, further bolsters growth potential in this market.

Key Takeaways

- The Global Confectionery Packaging Market is anticipated to expand from USD 12.0 billion in 2023 to USD 19.0 billion by 2033, achieving a CAGR of 4.7% from 2024 to 2033.

- Flexible Packaging Accounting for 56.5% of the market, flexible packaging leads due to its cost-effectiveness, lightweight nature, and alignment with sustainability initiatives.

- Plastic Material With a 53.4% market share, plastic remains the preferred material, attributed to its versatility, affordability, and strong preservation capabilities.

- Chocolate Confectionery This segment holds the largest share at 42.1%, driven by broad consumer appeal and increasing demand for premium packaging.

- North America The region dominates with a 37.2% share of the market, supported by high confectionery consumption levels and a strong focus on sustainable packaging solutions.

Confectionery Packaging Statistics

- 2% growth in confectionery launches over five years (till September 2023).

- 94% of consumers expect brands to ensure products are eco-friendly.

- Bio-based claims in confectionery packaging grew by 114% (October 2018-September 2023).

- Loving Earth launched rose-infused chocolate in Australia in January 2024 with 97% PCR fiber packaging.

- 63% of confectionery launches are packaged in plastic (Innova).

- Pez introduced Paw Patrol Candies in Brazil using 80% recycled PET blister packs.

- Cox & Co developed 100% paper flow-wrap for chocolate, replacing compostable plastic.

- 72% of Americans find packaging designs influential in purchasing decisions.

- 94% of consumers prefer brands with clear, accurate product labeling.

- 60% of sustainability efforts focus on recyclable and recycled content packaging.

- 50% of US consumers are willing to pay more for sustainable packaging.

- Globally, 69% of consumers see compostable and plant-based packaging as sustainable.

- Sustainable products grew 2.7x faster than traditional products due to consumer preference.

- 75% of the global label market is dominated by pressure-sensitive labels in 2023.

- 60% of consumers are willing to pay 14% more for resealability and easy storage.

- 81% of consumers notice new packaging, and 39% purchase because of it.

- Younger consumers (18-34) value resealability, easy storage, and easy opening.

- OECD nations contribute 14% of global plastic leakage, with 11% from macroplastics and 35% from microplastics.

- Plastics account for 3.4% of global greenhouse gas emissions.

- Plastic packaging contributes 40% to global plastic waste.

- Only 9% of plastic waste is recycled globally; 15% is collected.

- 19% of plastic waste is incinerated, 50% landfilled, and 22% unmanaged.

- Approximately 30 million tonnes of plastic waste is in oceans; 109 million tonnes in rivers.

- Over 120 countries have limited single-use plastic bans, mainly targeting bags.

- EUR 25 billion/year needed for better waste management in low and middle-income countries.

- $48 billion in 2023: U.S. confectionery sales driven by inflation.

- Over 98% of American consumers bought chocolate, candy, gum, and mints in 2023.

- Holidays account for 64% of annual confectionery sales.

- 86% of consumers view treats as a permissible part of a balanced lifestyle.

- 80% of consumers believe in a link between physical health and emotional well-being.

- 90% of consumers buy chocolate for indulgence.

- Interactive packaging features increased by 39%.

- Enhanced barrier properties in packaging rose by 24%.

- Travel-friendly packaging grew by 31%.

- Easy-open features in packaging saw a 29% increase.

- Zero-waste packaging initiatives increased by 38%.

- Heat-sealed pouches rose by 19% in adoption.

- Child-resistant packaging features increased by 15%.

- Smart packaging with QR codes grew by 45% in the confectionery sector.

Emerging Trends

- Sustainable Materials and Compostability: Confectionery brands are increasingly adopting biodegradable, compostable, and recyclable materials, responding to growing consumer demand for eco-friendly packaging. This shift includes using plant-based plastics, paper, and edible films, aiming to reduce environmental impact. Biodegradable packaging materials, such as kraft paper and post-consumer recycled (PCR) fibers, are now common in new launches. In fact, packaging with bio-based claims grew by 114% between 2018 and 2023.

- Flexible Packaging Solutions: Flexible packaging is becoming a preferred choice due to its cost efficiency, lightweight nature, and minimal environmental footprint. It supports easy recycling and uses fewer resources than rigid packaging. As flexible packaging technology advances, manufacturers are optimizing barrier properties to protect confectionery items while maintaining sustainability. This segment is projected to grow significantly, reaching $304 billion globally by 2030.

- Smart and Interactive Packaging: Brands are leveraging technology to make confectionery packaging more engaging. Innovations include QR codes, augmented reality (AR), and sensors, which allow consumers to access product information, brand stories, and promotions via their smartphones. Digital printing also supports personalized packaging, enabling customers to customize designs with names or messages, enhancing the overall consumer experience.

- Plastic Reduction Initiatives: Confectionery manufacturers are actively reducing plastic use, influenced by regulatory measures like the EU’s Single-Use Plastics Directive. Efforts include transitioning to paper-based alternatives, such as wax-free twist wraps or fully recyclable paper pouches. Constantia Flexibles’ EcoTwistPaper, for example, replaces plastic entirely while maintaining product protection during transport and storage.

- Circular Economy Integration: The focus on the circular economy has grown, with brands aiming to minimize waste through recycling, reusing, and upcycling packaging materials. This approach extends throughout the product lifecycle, from development to disposal. Major brands are also implementing Extended Producer Responsibility (EPR) policies, ensuring that manufacturers are accountable for managing packaging waste.

Top Use Cases

- Sustainable Packaging Solutions: Increasing consumer preference for eco-friendly packaging drives confectionery brands to adopt sustainable materials like biodegradable, compostable, and recyclable options. About 67% of consumers prioritize products with less plastic packaging, prompting a shift toward paper sleeves, recycled materials, and even plant-based plastics. .

- Resealable and Portion-Control Packaging: With growing health consciousness, resealable packaging formats like zip pouches and snap-close packs are gaining traction. These formats support portion control and enhance convenience, particularly in chocolate and sugar confectionery segments. The demand for these features is rising, as evident from the increased popularity of resealable packaging, which aligns with consumer trends toward smaller, snackable portions.

- Flexible Packaging for Cost-Efficiency: Flexible packaging—such as wrappers, pouches, and stick packs—has become the preferred choice for confectionery brands due to its lightweight nature and lower production costs. This format also allows for efficient transportation and reduced environmental impact, given that it uses fewer resources.

- Smart and Interactive Packaging: Confectionery brands are leveraging technology in packaging to enhance consumer engagement. Augmented reality (AR) features, QR codes, and personalized designs enable brands to offer immersive experiences and detailed product information. These innovations are not only attractive but also provide transparency, helping brands build trust. For instance, Mars Wrigley allows consumers to customize M&M’s packaging, indicating a rise in demand for personalized and interactive packaging solutions.

- Premium and Gift-Ready Packaging: Premium packaging solutions—such as high-quality boxes, embossed wrappers, and artisanal designs—are gaining popularity for gifting purposes. These solutions aim to create a memorable unboxing experience and are particularly popular during festive seasons and holidays. The premium confectionery segment is growing rapidly, with packaging playing a crucial role in driving sales. As of 2023, 40% of global confectionery launches featured enhanced packaging designs to appeal to premium consumers

Major Challenges

- Sustainable Packaging Demand: There is a strong shift towards eco-friendly packaging solutions, driven by consumer preference for biodegradable, recyclable, and compostable materials. Major brands are increasingly adopting sustainable packaging to meet regulatory requirements and environmental goals. Growth of Flexible Packaging: Flexible packaging, such as pouches and wraps, is gaining traction due to its lightweight nature and cost-efficiency. It offers advantages like reduced transportation costs and longer product shelf life, making it suitable for on-the-go consumption.

- Premiumization and Luxury Appeal: The demand for premium and artisanal confectionery is boosting the need for luxury packaging solutions, such as embossed boxes and metallic finishes. These packaging options cater to gifting trends and upscale branding, particularly in mature markets like North America and Europe.

- Smart Packaging Integration: Smart packaging features, such as QR codes and NFC, are becoming popular for enhancing consumer interaction. These technologies provide digital engagement, including product information, promotions, and details on sustainable sourcing, appealing to tech-savvy consumers.

- Expansion in Emerging Markets: Rapid urbanization and growing disposable incomes in emerging markets like China, India, and Brazil are driving demand for confectionery products. Companies are focusing on introducing packaging that aligns with local preferences while also offering familiar global brands, supporting market growth

Top Opportunities

- Surge in Sustainable Packaging: The shift toward sustainable packaging is a primary growth driver, with rising consumer demand for eco-friendly materials like recyclable and biodegradable options. Major brands are adopting such packaging to meet regulatory standards, reduce environmental impact, and improve brand image.

- Expansion of E-commerce and On-the-Go Packaging: The growing trend of online shopping has led to higher demand for durable, tamper-proof, and visually appealing packaging that can protect products during shipping. Additionally, the rise of on-the-go snacking has fueled demand for portable, single-serve packaging formats, particularly for chocolates and candies.

- Premium and Luxury Packaging Demand: The demand for high-end confectionery, especially for gifts and special occasions, is driving the need for premium packaging solutions like metallic finishes, embossed designs, and glass containers. This is particularly evident in mature markets like North America and Europe, where consumers seek visually appealing, gift-worthy packaging.

- Integration of Smart Packaging: Brands are increasingly adopting smart packaging technologies, such as QR codes and NFC chips, which allow consumers to access digital information, promotions, and sustainability credentials. This integration helps enhance customer engagement and brand loyalty while supporting transparency in the supply chain.

- Growth in Emerging Markets: Rapid urbanization and rising disposable incomes in regions like Asia-Pacific, Latin America, and Africa are driving increased demand for confectionery and its packaging. Companies are focusing on tailored packaging solutions that cater to local preferences, boosting the overall market growth in these regions

Key Player Analysis

- Amcor plc: Amcor is a global leader in packaging solutions, renowned for its flexible and rigid packaging offerings. The company emphasizes sustainable packaging innovations, such as using recycled materials and lightweight designs, which reduce environmental impact while maintaining product freshness. Amcor has a strong market presence across North America, Europe, and Asia-Pacific, driven by its advanced barrier technologies that enhance shelf life.

- Berry Global Inc.: Berry Global is a major player in the flexible packaging sector, particularly prominent in the North American and European markets. It specializes in high-barrier packaging solutions that preserve confectionery freshness while focusing on reducing plastic use and increasing recyclability. The company actively invests in research and development to enhance the performance and sustainability of its packaging products.

- Mondi Group: Mondi Group is a leading European packaging company known for its sustainable solutions, particularly in paper-based packaging for confectionery. The company has been at the forefront of replacing conventional plastic with eco-friendly materials, supporting the global shift toward sustainable packaging. Mondi’s innovations in paper-based wrappers and compostable solutions have strengthened its market presence.

- Smurfit Kappa: Smurfit Kappa is a dominant player in paper-based packaging, with a strong foothold in Europe and the Americas. It is known for “shelf-ready packaging,” which is designed for ease of display in retail environments. This type of packaging not only improves logistics efficiency but also enhances product visibility and consumer appeal. Smurfit Kappa focuses on innovation and sustainability, aiming to reduce waste and increase recyclability.

- Sonoco Products Company: Sonoco Products Company is a key player in both rigid and flexible packaging, with a strong presence in North America’s confectionery market. The company’s product offerings are designed to provide robust protection, preserve freshness, and enhance product visibility. Sonoco emphasizes sustainable packaging, focusing on high-barrier and recyclable materials that cater to the evolving needs of confectionery manufacturers.

Recent Developments

- On August 14, 2024, Mars, Incorporated, a leading multinational in the pet care and food sectors, announced its intent to acquire Kellanova (NYSE: K), a prominent player in the snack and plant-based food industries. The acquisition is an all-cash deal valued at $35.9 billion, equating to $83.50 per share. This offer reflects a 44% premium over Kellanova’s average share price over the previous 30 days and a 33% premium above its 52-week high as of early August 2024. The transaction values Kellanova at 16.4 times its adjusted earnings for the 12-month period ending June 29, 2024.

- In 2024, International Paper, a prominent company in the packaging and paper sector, agreed to an all-stock acquisition of DS Smith, a deal valued at around $7.2 billion. DS Smith’s board has endorsed the agreement and urged shareholders to approve it, signaling a significant move within the competitive landscape of the London-based firm.

- In 2023, Barry Callebaut, a leading global chocolate manufacturer, released its 2024 trend insights, highlighting consumer interest in novel flavor profiles despite rising costs. The global chocolate market is projected to exceed $128 billion by the end of 2024, with an anticipated annual growth rate of 2% in volume over the next five years.

- By mid-2024, global mergers and acquisitions (M&A) displayed mixed trends: total deal value increased by 5% compared to the same period in 2023, while the number of transactions dropped by 25%, continuing a downward trend that began in 2022. The first half of 2024 recorded about 23,000 deals, with a combined value of $1.3 trillion, a decline from the peak of nearly 34,000 deals worth $2.7 trillion in late 2021.

Conclusion

The global confectionery packaging market is set for steady growth, driven by rising demand for sustainable, convenient, and innovative packaging solutions. As flexible packaging leads due to its cost-efficiency and versatility, there’s a strong shift toward eco-friendly materials. Europe remains the largest market, while Asia-Pacific shows the fastest growth, fueled by urbanization and rising incomes. North America emphasizes premium packaging due to strong confectionery consumption and gifting trends. Future success will depend on sustainability, innovation, and adapting to evolving consumer needs.