Table of Contents

Introduction

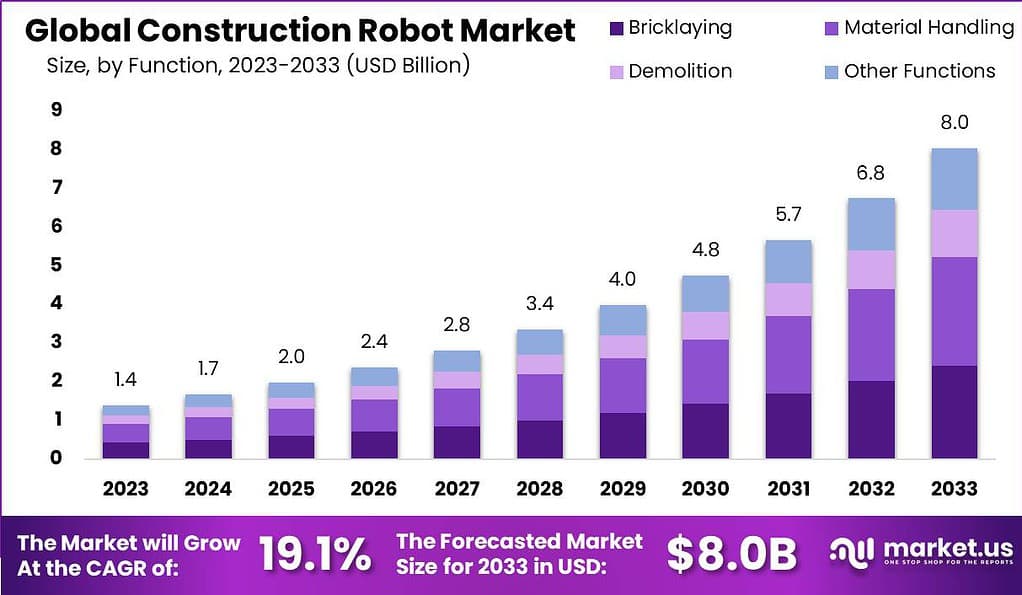

The global Construction Robot Market is witnessing significant growth, with an estimated value of USD 8.0 billion by 2033, representing a robust CAGR of 19.1% from 2024 to 2033. Construction robots, equipped with advanced technologies, are revolutionizing the industry by automating various tasks such as bricklaying, material handling, demolition, and more. These robots enhance productivity, safety, and cost-effectiveness in construction operations, addressing challenges such as labor shortages and the need for sustainable practices.

The Construction Robot Market is witnessing a significant evolution, driven by the integration of automation and robotics into the construction sector. The growth of this market can be attributed to several factors, including the increasing demand for faster construction processes, the need for improved safety on construction sites, and the rising emphasis on minimizing human errors.

However, challenges such as high initial investment costs and the lack of skilled professionals to operate and maintain these advanced machines pose hurdles to the market’s growth. Despite these challenges, new entrants find opportunities in innovative solutions that address these issues, alongside the potential for partnership and collaboration with established construction firms.

To learn more about this report – request a sample report PDF

Key Takeaways

- The global construction robot market is estimated to reach USD 8.0 billion by 2033, exhibiting a robust CAGR of 19.1% from 2024 to 2033.

- Material handling robots held a significant market share of over 35.2% in 2023, driven by their ability to enhance safety, efficiency, and cost-effectiveness in construction operations.

- Robotic arms captured more than 70.5% of the market share in 2023, showcasing their versatility and efficiency in tasks ranging from welding to material handling.

- The residential use segment accounted for over 51.6% of the market share in 2023, highlighting the increasing adoption of construction robots in tasks such as bricklaying and painting to expedite construction processes.

- The global trend of urbanization, with approximately 55% of the world’s population residing in cities, is a significant driver of the construction robot market, propelling demand for efficient and sustainable construction solutions.

- The Asia-Pacific region emerged as a frontrunner in the construction robot market, capturing over 35.1% of the market share in 2023, driven by rapid urbanization and government initiatives promoting technological innovation.

Construction Robot Statistics

- Over 50% of major construction sites are estimated to utilize robotic systems for tasks such as bricklaying, tiling, and material handling.

- Approximately 60% of construction companies are projected to employ robotic systems for tasks like 3D printing, concrete placement, and rebar installation.

- Around 70% of construction equipment manufacturers will offer robotic solutions for tasks such as earthmoving, excavation, and grading.

- It is expected that over 65% of construction firms will utilize robotic systems for tasks like welding, cutting, and surface finishing.

- The adoption of robotic systems for infrastructure inspection and maintenance, including bridges and tunnels, is projected to grow by 25% compared to 2023.

- Robotic systems are also being used for automated construction site monitoring, surveying, and progress tracking, with an expected 35% year-over-year increase.

- The adoption of autonomous mobile robots (AMRs) for material transportation and logistics on construction sites is anticipated to grow by 40% compared to 2023.

- The use of robotic demolition and deconstruction systems for selective dismantling and recycling is expected to increase by 30% year-over-year.

- Robotic systems for painting, plastering, and insulation installation are estimated to be employed by over 60% of construction companies.

- The adoption of robotic systems for prefabrication and modular construction is projected to grow by 30% compared to 2023.

Emerging Trends

- Autonomous Operation: Construction robots are increasingly capable of operating autonomously, performing tasks without human intervention. This trend is fueled by advancements in artificial intelligence and machine learning, allowing robots to navigate complex environments and make decisions in real-time.

- Modular and Scalable Solutions: There is a shift towards modular robots that can be easily scaled or adapted based on the project’s size and complexity. This flexibility allows for a more efficient allocation of resources and the ability to tackle a wider range of construction tasks.

- Integration with Building Information Modeling (BIM): BIM technology, which creates digital representations of physical and functional characteristics of places, is being increasingly integrated with construction robotics. This integration allows for more precise planning, execution, and modification of construction projects, enhancing overall efficiency and reducing errors.

- Enhanced Safety Features: As the adoption of construction robots rises, so does the emphasis on safety. Modern construction robots are equipped with sensors and safety algorithms to prevent accidents, ensuring the well-being of human workers on-site.

- Sustainability and Green Construction: Robots are playing a pivotal role in promoting sustainable construction practices. They enable more precise material handling and reduce waste, supporting the construction industry’s shift towards environmentally friendly practices.

Top Use Cases

- 3D Printing of Buildings: Construction robots are at the forefront of 3D printing technologies, enabling the rapid construction of buildings from digital designs. This method significantly reduces construction time and material waste, showcasing a sustainable approach to building.

- Demolition and Recycling: Robots equipped with specialized tools can perform demolition tasks more efficiently and safely than human workers. They can also sort and recycle construction waste, minimizing the environmental impact of construction projects.

- Bricklaying and Masonry: Robotic arms with high precision are being used for bricklaying and masonry work, accomplishing these tasks with unprecedented speed and accuracy. This not only speeds up the construction process but also reduces labor costs.

- Concrete Dispensing: Robots are used for precise concrete dispensing in complex forms or areas difficult for humans to access. This ensures better quality and durability of the construction work, optimizing the use of materials.

- Inspection and Maintenance: Drones and robotic crawlers are deployed for the inspection of hard-to-reach areas of construction sites, such as high-rise structures or bridges. They provide real-time data for maintenance and repair, ensuring the longevity and safety of the structures.

Real Challenges

- High Initial Investment: The upfront cost of acquiring and integrating robotic systems can be significant, deterring smaller construction firms from adopting this technology. This includes not just the purchase price but also the expenses related to training staff and retrofitting existing systems.

- Technical Skills Gap: There is a notable skills gap in the construction industry, with a shortage of professionals trained to operate, maintain, and repair these sophisticated robotic systems. This gap presents a hurdle to the widespread adoption of construction robotics.

- Integration with Existing Processes: Seamlessly integrating robotic systems into traditional construction workflows can be complex, requiring significant changes to standard operating procedures. Resistance to change among workers accustomed to traditional methods can further complicate this integration.

- Safety and Compliance Issues: As robotic systems become more common on construction sites, ensuring their safe operation and compliance with existing regulations and standards becomes increasingly challenging. The dynamic nature of construction sites adds another layer of complexity to ensuring safety.

- Technological Limitations: Despite rapid advancements, robotic systems still face limitations in handling the unpredictable and varied environments of construction sites. These limitations can restrict the types of tasks robots can perform and their effectiveness in certain conditions.

Market Opportunity

- Training and Education: The skills gap presents a market opportunity for training and education programs focused on robotic system operation, maintenance, and repair. This includes both formal education and on-the-job training modules.

- Customization and Retrofitting Services: There is a growing need for services that customize robotic systems to fit specific construction tasks or retrofit existing equipment to work alongside robots. Companies that offer these specialized services can capture a significant market share.

- Safety and Compliance Solutions: Developing safety protocols, compliance software, and monitoring systems tailored for robotic applications in construction offers a ripe opportunity. These solutions can help construction firms navigate the regulatory landscape and ensure safe operations.

- Robotic-as-a-Service (RaaS): The high initial cost of robotic systems can be mitigated by offering them as a service, allowing construction firms to pay for robotic capabilities as an operating expense rather than a capital investment. This model can accelerate the adoption of robotics in construction.

- Advanced Sensing and AI: Investing in the development of advanced sensing technologies and AI algorithms can enhance the capabilities of construction robots, enabling them to navigate more effectively in complex environments and perform a wider range of tasks.

Top 12 Companies

- ABB Ltd.: Renowned for its expertise in industrial robotics and automation solutions, ABB Ltd. stands at the forefront of the market, providing cutting-edge technologies that enhance efficiency and productivity across various sectors.

- Brokk Inc.: Specializing in remote-controlled demolition robots, Brokk Inc. has established itself as a key player in the construction and demolition industry, offering safe and efficient solutions for challenging tasks.

- Caterpillar Inc.: With a longstanding reputation for manufacturing heavy equipment and machinery, Caterpillar Inc. remains a dominant force in the construction sector, providing a wide range of products tailored to meet diverse customer needs.

- Komatsu Ltd.: Recognized for its innovative construction and mining equipment, Komatsu Ltd. continues to set industry standards with its state-of-the-art machinery and technological advancements, catering to global markets.

- Built Robotics Inc.: Pioneering the field of autonomous construction equipment, Built Robotics Inc. is revolutionizing the industry with its self-driving machinery, offering increased safety, efficiency, and cost-effectiveness on job sites.

- Boston Dynamics: Known for its groundbreaking advancements in robotics and artificial intelligence, Boston Dynamics pushes the boundaries of innovation with its agile and dynamic robotic platforms, showcasing the potential of robotics in various applications.

- FBR Ltd.: Focused on automated construction technologies, FBR Ltd. is committed to transforming traditional construction methods through its robotic bricklaying systems, streamlining processes and enhancing construction efficiency.

- Hilti Corporation: A global leader in providing innovative solutions for the construction industry, Hilti Corporation offers a comprehensive range of tools, systems, and services designed to optimize construction processes and improve project outcomes.

- Clearpath Robotics, Inc.: Specializing in unmanned vehicle solutions for research and industrial applications, Clearpath Robotics, Inc. delivers reliable and versatile robotic platforms that enable automation and autonomy in various environments.

- Ekso Bionics: Focusing on exoskeleton technology, Ekso Bionics develops wearable robotic devices that augment human capabilities, with applications ranging from rehabilitation to industrial tasks, enhancing productivity and ergonomics.

- Construction Robotics: Dedicated to advancing construction automation, Construction Robotics develops innovative solutions such as its SAM (Semi-Automated Mason) bricklaying robot, aiming to revolutionize traditional construction practices.

- Husqvarna Group: Known for its expertise in outdoor power tools and equipment, Husqvarna Group offers a wide range of construction products, including robotic lawn mowers and demolition equipment, catering to both consumer and professional markets.

Recent Developments

In 2023:

- FBR Ltd. partners with M&G Investment Management to fund and deploy three Hadrian X robots equipped with Dynamic Stabilization Technology (DST) in the USA, marking a significant advancement in outdoor robotics for construction.

- Advanced Construction Robotics Inc. launches IronBOT, a robust robot capable of lifting, carrying, and placing rebar weighing up to 5,000 pounds. IronBOT enhances construction efficiency and safety while complementing TyBOT, another robot from the company, known for quickly tying rebar, achieving over 1,100 ties per hour.

Conclusion

In conclusion, the construction robot market is experiencing significant growth and adoption as construction companies seek innovative solutions to improve efficiency, productivity, and safety in the industry. The research findings indicate a widespread acceptance and utilization of robotic systems across various construction tasks such as 3D printing, concrete placement, welding, bricklaying, and more. The projected adoption rates for robotic systems in different areas of construction demonstrate the industry’s recognition of the benefits that automation and robotics bring.

The use of construction robots offers advantages such as increased productivity, reduced labor requirements, faster project completion, and improved accuracy. These robots can handle repetitive and labor-intensive tasks, reducing human error and allowing workers to focus on more complex and creative aspects of construction. Additionally, robotic systems contribute to enhanced site safety by minimizing human exposure to hazardous conditions.