Table of Contents

Introduction

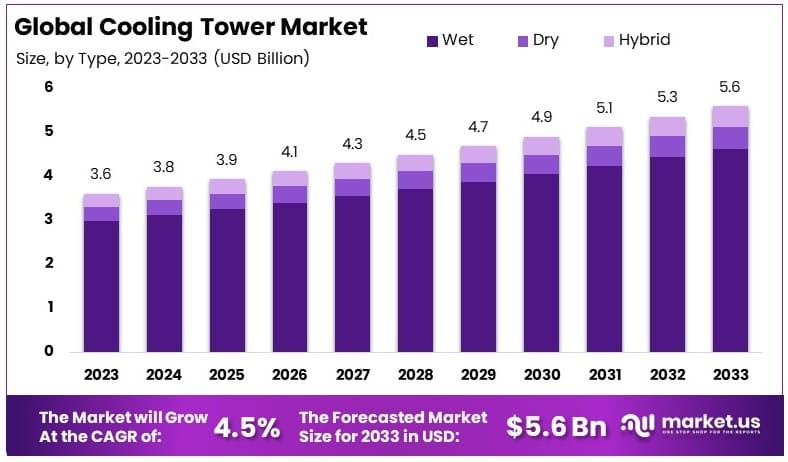

The Global Cooling Tower Market is poised for significant growth, projected to increase from USD 3.6 Billion in 2023 to USD 5.6 Billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period from 2024 to 2033. This expansion can be attributed to several key drivers including heightened demand in various industrial sectors such as power generation, HVACR (heating, ventilation, air conditioning, and refrigeration), and manufacturing, where cooling towers play an essential role in maintaining optimal operational temperatures and efficiency.

However, the market faces challenges such as stringent environmental regulations concerning water usage and the disposal of chemical effluents, which compel industry players to innovate more sustainable and efficient cooling solutions. Additionally, recent developments underscore the market’s adaptation to these challenges, with advancements in technology leading to the creation of energy-efficient and environmentally friendly cooling towers. Such innovations are crucial in sustaining market growth amidst increasing ecological concerns and regulatory pressures.

The competitive landscape of the cooling tower industry is characterized by a mix of established players, regional specialists, and innovative newcomers. Companies like Krones AG, MITA Cooling Technologies Srl, Babcock & Wilcox Enterprises, Inc., and JAEGGI Hybridtechnologie AG are leveraging their technological prowess and strategic partnerships to maintain and expand their market share. Factors such as product portfolio diversity, geographical reach, technological innovation, and strong after-sales service are critical in gaining a competitive edge.

Krones AG, a prominent player in the cooling tower industry, recently entered into a strategic partnership with GEA Refrigeration Technologies. Announced in October 2023, this collaboration aims to develop energy-efficient cooling tower solutions specifically for the beverage industry. This move underscores Krones AG’s commitment to sustainability and innovation in cooling technology.

MITA Cooling Technologies Srl has been active in enhancing its product offerings and expanding its market reach. The company is known for its focus on industrial and commercial cooling solutions, emphasizing sustainable practices. In recent years, MITA has introduced several advanced cooling systems that incorporate IoT and smart technologies, allowing for real-time performance monitoring and predictive maintenance. This approach not only improves efficiency but also reduces operational costs and environmental impact.

Babcock & Wilcox Enterprises, Inc. continues to strengthen its position in the cooling tower market through strategic projects and technological advancements. In September 2023, the company secured a significant contract to supply cooling towers for a new power plant in the Middle East. This project is part of Babcock & Wilcox’s broader strategy to expand its footprint in the energy sector, leveraging its expertise in providing robust and efficient cooling solutions for large-scale industrial applications.

Key Takeaways

- Market Value: The Cooling Tower Market was valued at USD 3.6 billion in 2023, and is expected to reach USD 5.6 billion by 2033, with a CAGR of 4.5%.

- Product Analysis: Open circuit towers dominated with 43.2%; essential for their efficiency in various industrial cooling processes.

- Type Analysis: Wet cooling towers dominated with 82.7%; preferred due to their effectiveness in heat dissipation.

- Material Analysis: Fibre-reinforced plastic dominated with 29.4%; crucial for its durability and resistance to corrosion.

- Application Analysis: HVAC dominated with 55.4%; critical due to the growing demand for climate control systems.

- Dominant Region: APAC held 31.2% market share; significant due to rapid industrialization and infrastructure development.

- High Growth Region: North America projected substantial growth; driven by advancements in energy-efficient cooling technologies.

- Analyst Viewpoint: The market is moderately saturated with high competition. Future growth is supported by technological advancements and increased environmental regulations.

Cooling Tower Statistics

- Engineered plastic cooling towers use 30% to 75% less energy compared to forced draft designs.

- Businesses using engineered plastic cooling towers can save up to 40% on energy costs.

- These systems can recycle about 98% of the water used in process cooling or air conditioning.

- A metal cooling tower typically has a shelf life of up to 15 years.

- High-density polyethylene (HDPE) plastic cooling towers have a life expectancy of more than 20 years.

- According to a 2017 CDC study, cooling towers were linked to three Legionnaires’ disease outbreaks in New York City, resulting in 213 cases and 18 deaths.

- Approximately 1 liter of water is lost for every 600 Kcal of thermal load dissipated in evaporative cooling towers.

- The theoretical limit for cooled fluid in evaporative systems is defined by the wet bulb temperature, which is typically about 10°C lower than the ambient temperature.

- An approach of 2-3°C to 5-6°C for the difference between the wet bulb temperature and the cooled water temperature meets the needs of most modern facilities.

- According to the Wisconsin Economic Development Corporation (WEDC), more than 600 companies operate within Mexico’s HVAC industry, producing various components and systems, including cooling towers.

- Approximately 90% of HVAC units shipped to the United States are produced by companies with manufacturing operations in Mexico, highlighting the country’s critical role in the North American HVAC supply chain.

- The number and intensity of extreme weather events have grown exponentially over the past 50 years, leading to increased demand for cooling devices as temperatures reach record highs.

- Cooling systems, which are a significant part of the HVAC industry, currently account for over 10% of the world’s electricity consumption. This highlights the substantial energy demand from these systems.

- Over the past 50 years, the number and intensity of extreme weather events have increased exponentially. These events are estimated to cause over 115 deaths and USD 202 million in losses daily, driving higher demand for cooling devices to cope with rising temperatures.

Emerging Trends

- Increased Adoption of Hybrid Cooling Towers: Hybrid cooling towers are gaining popularity due to their ability to operate in both wet and dry modes. This versatility helps industries minimize water usage and manage energy more efficiently. These towers are particularly beneficial in regions with water scarcity, aligning with global sustainability efforts.

- Advancements in Cooling Tower Technology: There is a significant focus on enhancing the efficiency and longevity of cooling towers through advanced materials and design innovations. New materials like corrosion-resistant composites extend the life of cooling towers while also improving their operational efficiency, leading to lower maintenance costs and better performance.

- Smart Cooling Systems: Integration of smart technologies into cooling towers is becoming more prevalent. Sensors and IoT devices are used to monitor conditions and optimize performance in real-time. This technology helps in predicting maintenance needs, improving energy management, and reducing operational costs, thus enhancing overall system reliability.

- Sustainability Initiatives: Sustainability is a key driver in the cooling tower industry. More companies are adopting eco-friendly designs and practices, such as using recycled water and deploying energy-efficient components. These practices not only reduce environmental impact but also improve public perception and compliance with regulatory standards.

- Water Treatment Innovations: Innovative water treatment solutions are being developed to reduce the prevalence of legionella and other harmful contaminants in cooling towers. These advancements include ultraviolet light treatment and advanced biocides, which are more effective and environmentally friendly compared to traditional chemicals.

- Expansion in Data Center Applications: The growth of data centers globally has led to increased demand for cooling towers that can efficiently remove vast amounts of waste heat generated by servers. Cooling technology improvements are being tailored specifically for the high-density heat loads of these facilities, ensuring optimal server performance and reliability.

- Regulatory and Standard Developments: New regulations and standards aimed at improving the environmental footprint and safety of cooling towers are shaping industry practices. Compliance with these standards is crucial for companies to avoid penalties and meet corporate sustainability goals, driving innovations in design and operational practices.

Use Cases

- Industrial Cooling: Cooling towers are essential in industries like chemical, petrochemical, and oil refining where they help in maintaining a stable temperature of machinery and processed materials. This is crucial for safe operation and to ensure the quality of the final products.

- Power Generation: In power plants, cooling towers are used to remove excess heat from the steam cycle. This improves the efficiency of power generation and extends the lifespan of equipment by preventing overheating, thereby maintaining optimal operational conditions.

- HVAC Systems for Large Buildings: Cooling towers support Heating, Ventilation, and Air Conditioning (HVAC) systems in large buildings and complexes by dissipating heat from the air conditioning systems. This helps in maintaining a comfortable indoor environment efficiently.

- Data Center Cooling: Data centers require high-efficiency cooling to manage the heat produced by dense server racks. Cooling towers provide a cost-effective cooling solution, ensuring the servers operate within safe temperature limits, which is vital for system reliability and performance.

- Refrigeration and Cold Storage: Cooling towers are used in the refrigeration process where they help in removing heat extracted from the refrigerated spaces. This application is critical in maintaining the necessary low temperatures in facilities such as cold storages and food processing plants.

- Processing Plants: In processing industries like pharmaceuticals and food processing, cooling towers are employed to control the processing temperatures, which is essential for product consistency and to meet strict industry standards.

- Renewable Energy Projects: Cooling towers are also becoming increasingly relevant in renewable energy projects, such as concentrated solar power plants, where they help in cooling fluids used to generate power. This aids in enhancing the efficiency and effectiveness of renewable energy production.

Key Players Analysis

Babcock & Wilcox Enterprises, Inc. (B&W) provides advanced cooling solutions through its SPIG® product line, which includes natural draft, induced draft, and hybrid cooling towers. These systems are designed to meet high standards of seismic and wind load resistance, corrosion resistance, and low-noise emission. In 2023, B&W reported robust financial performance and secured significant contracts, including a notable $9 million project for a hydrogen production facility. Their continuous innovation in cooling technologies strengthens their market position.

SPX Corporation, through its SPX Cooling Technologies division, offers a range of advanced cooling towers under the Marley brand, renowned for energy efficiency and innovation. The company recently completed the acquisition of Cincinnati Fan, enhancing its HVAC cooling platform. SPX reported a revenue target of $1.93 to $2.0 billion for 2024, up from $1.74 billion in 2023. The new Marley NC Cooling Tower series features significant advancements in cooling capacity and energy efficiency, underscoring SPX’s commitment to sustainable and innovative cooling solutions.

ILMED IMPIANTI SRL, established in 1981, is a renowned player in the cooling tower industry, providing innovative solutions for various applications. Their portfolio includes a range of preassembled open and closed-circuit cooling towers, modular towers, and field-erected towers, designed for flexibility and efficiency. Recently, they introduced the IC 3-AR series, enhancing their product lineup. With over 10,000 systems installed in more than 90 countries, ILMED IMPIANTI continues to expand its market presence, focusing on turnkey projects and comprehensive water cooling solutions.

Kelvion Holding GmbH specializes in heat exchange solutions, including cooling towers, designed to meet diverse industrial needs. Their recent advancements include the introduction of the new EcoMi modular cooling tower series, which offers improved energy efficiency and reduced environmental impact. Kelvion’s strategic focus on innovation and sustainability has driven substantial revenue growth. In 2023, Kelvion reported robust financial performance, bolstered by increased demand for their high-efficiency cooling technologies across various sectors.

JACIR – GOHL, part of the COFINAIR Group, has a robust presence in the cooling tower industry, offering innovative solutions like the new ZYRCO adiabatic coolers and X-TAR crossflow cooling towers. Recent strategic acquisitions, including the Italian company DECSA, have expanded their product range and market reach, allowing them to provide comprehensive cooling solutions across various industries. JACIR – GOHL’s focus on energy efficiency and product innovation has solidified their position in the European market.

EVAPCO, Inc., a leading manufacturer in the cooling tower sector, has introduced several new products, including the eco-ATWB-E Closed Circuit Coolers and the eco-LSWA Closed Circuit Coolers, which are designed to provide higher energy efficiency and lower water usage. The company has reported significant revenue growth, driven by their commitment to sustainability and innovation. EVAPCO continues to expand its global footprint, focusing on advanced technologies and environmentally friendly solutions to meet the growing demands of the cooling industry.

EWK, established in 1957, specializes in designing and manufacturing high-efficiency cooling towers, evaporative condensers, and adiabatic equipment. Their recent innovation includes the EWK Modular Cooling Tower range, which is pre-assembled at the factory to reduce installation time and costs. This new range is made of corrosion-resistant fiberglass-reinforced polyester and is designed for medium to large industrial applications. In 2023, EWK also entered the CO2 capture technology market, demonstrating their commitment to environmental sustainability and advanced cooling solutions.

Conclusion

The cooling tower market is projected to witness significant growth over the coming years, driven by increasing industrialization, rapid urbanization, and the rising demand for efficient cooling solutions. The advancements in technology and the shift towards sustainable and energy-efficient cooling systems further bolster market expansion. However, challenges such as stringent environmental regulations and the high initial costs of advanced cooling towers may restrain growth to some extent.

Despite these challenges, the overall outlook for the cooling tower market remains positive, with substantial opportunities for innovation and investment. Companies that focus on developing eco-friendly and cost-effective solutions are well-positioned to capitalize on the evolving market trends. As industries continue to prioritize energy efficiency and environmental sustainability, the demand for modern cooling towers is expected to rise, ensuring steady market growth in the foreseeable future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)