Table of Contents

Introduction

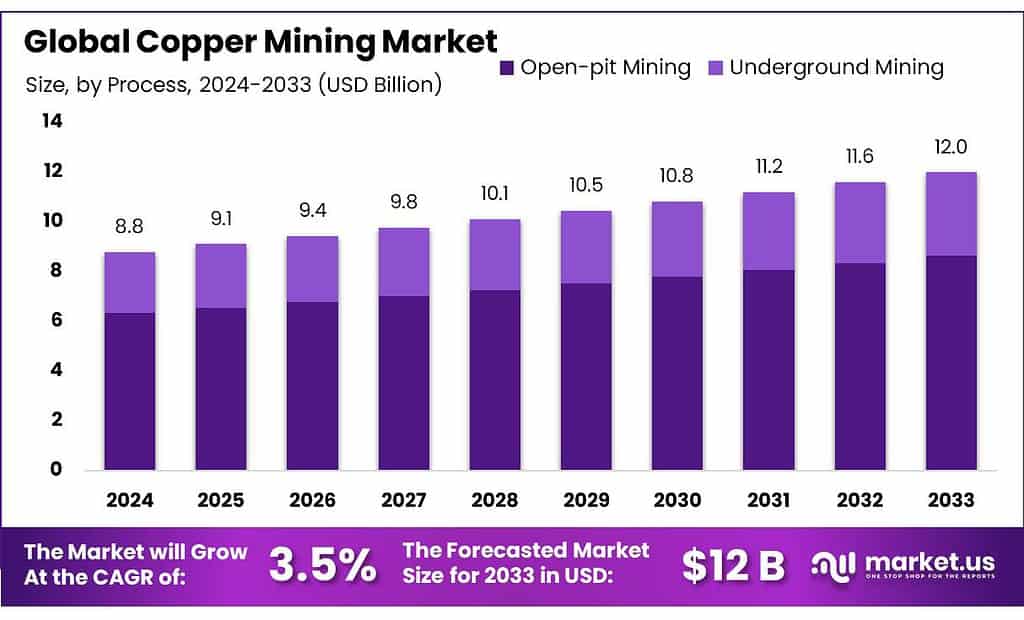

The copper mining market, valued at USD 8.8 billion in 2023, is projected to reach around USD 12 billion by 2033, expanding at a compound annual growth rate (CAGR) of 3.5%. This growth trajectory is propelled by the escalating demand for copper driven by the global push towards renewable energy, electrification of vehicles, and extensive infrastructural developments. Countries like Chile, Peru, and the Democratic Republic of Congo are pivotal, with Chile alone producing approximately 22.7% of the global supply, despite facing challenges such as declining ore grades and stringent environmental regulations.

However, the sector faces significant hurdles, including geopolitical tensions, operational efficiency pressures, and supply chain disruptions, which are compounded by the global economic slowdown and environmental concerns. These challenges necessitate a vigilant approach from copper mining companies, focusing on sustainability and technological innovations to maintain and boost production levels.

Recent developments in the industry underscore a strategic pivot towards resilience and innovation. For instance, major mergers and acquisitions, as well as investments in new mining projects and expansions by key players such as Glencore and First Quantum, highlight the industry’s response to current market demands and future prospects. These strategic moves are crucial for companies to secure their supply chains and expand their market presence in anticipation of future copper demands.

African Copper Plc.: As a significant contributor to the copper mining industry, African Copper Plc focuses on exploration and development in key regions known for copper richness. They aim to expand their operations through strategic initiatives and exploration projects, which are crucial for sustaining production in the competitive copper market.

Key Takeaways

- Copper Mining Market size is expected to be worth around USD 12 Bn by 2033, from USD 8.8 Bn in 2023, growing at a CAGR of 3.5%.

- Open-pit Mining held a dominant market position, capturing more than a 72.4% share.

- 1.0% – 1.5% copper grade segment held a dominant market position, capturing more than a 38.4% share.

- Primary copper held a dominant market position, capturing more than an 84.3% share.

- Metal Processing Industry held a dominant market position in the copper mining sector, capturing more than a 56.3% share.

- Building & Construction Industry held a dominant market position in the copper mining market, capturing more than a 44.2% share.

- Asia Pacific (APAC) dominates the copper mining market with a 41% share, translating to a market size of USD 3.6 billion.

Copper Mining Statistics

- South Australia hosts 68% of Australia’s economic demonstrated copper resources, with 89Mt of contained copper. Most of this is hosted within IOCG-style deposits within the Gawler Craton and G2 Structural Corridor.

Statistic depicts the global consumption of refined copper from 2010 to 2015. In 2010, the consumption of copper stood at 19.1 million metric tons worldwide. By 2015, the total worldwide copper consumption amounted to 21.8 million metric tons.

Nearly 28 million tonnes of copper are used annually. Copper production begins with the extraction of copper-bearing ores in mining or recycling of scrap metal.

Asia was the second largest producer at 16%, followed by Europe with 14%, North America and Africa at 12% each, and Oceania with 5%. Peru has also been making steady gains in production since 2015, accounting for 10% of production in 2020.

Around 8,000 BCE, copper was first used as a substitute for stone, and around 4,000 BCE, humans began casting copper to shape it in molds.

In 2020, copper mining in Canada produced exports valued at $7.3 billion.

Canadian copper mines produced 475,898 tonnes in 2020.

Canada’s copper exports were valued at $7.3 billion in 2020.

Copper was the fourth most valuable mineral product in Canada in 2020.

As of 2020, British Columbia was responsible for over half of Canada’s copper production.

There are over 30 facilities across Canada involved in copper mining.

Copper demand is expected to increase 275 to 350 per cent by 2050.

Copper output fell more sharply at theBHP-controlled Escondida mine, with production during the month shrinking 6.8% to settle at 98,000 tons.

At the Collahuasi mine, which is jointly run by miners Glencore and Anglo American, the data showed copper production inched up 1.9% to a reach 42,300 tons.

Emerging Trends

- Increased Demand from Clean Energy Sectors: The transition to renewable energy and the widespread adoption of electric vehicles are driving significant demand for copper, known for its excellent electrical conductivity. This demand is anticipated to grow substantially, with projections suggesting a major increase in global copper demand by 2050.

- Technological Advancements in Mining: There is a strong focus on integrating advanced technologies such as artificial intelligence and automation within mining operations. These technologies are not only enhancing efficiency but are also reducing environmental impacts, making mining operations more sustainable

- Recycling and Secondary Use of Copper: The industry is seeing a rise in the recycling and secondary use of copper. This is driven by environmental considerations and the need to secure supply chains amid rising primary copper demand. Recycled copper is increasingly becoming an important source of supply

- Strategic Investments and Dealmaking: Mining companies are actively engaging in mergers, acquisitions, and strategic partnerships. This trend is geared towards stabilizing supply chains, improving production capacities, and accessing new resources, which are crucial for sustaining long-term growth

- Navigating Geopolitical and Economic Challenges: Companies in the copper mining sector are also focusing on navigating the uncertainties presented by geopolitical tensions and global economic fluctuations. This involves dynamic strategizing to adapt to changing scenarios and manage associated risks

- Sustainability and ESG Focus: There is a concerted effort within the industry to enhance Environmental, Social, and Governance (ESG) practices. This is evident from the sector’s increasing engagement in sustainable and responsible mining practices, aiming to minimize environmental impact and improve social governance

Use Cases

Copper mining plays a crucial role in various industries, notably in the transition to clean energy, due to copper’s excellent electrical conductivity. It’s integral to the manufacturing of renewable energy systems such as solar panels and wind turbines, and also in electric vehicles (EVs), where copper is used extensively in batteries and motors. For instance, an electric car requires about 172 pounds of copper compared to just 48 pounds in a gasoline-fueled vehicle. This underscores the growing demand for copper as the world shifts towards lower-carbon technologies.

Moreover, the copper mining process itself has evolved with significant advancements in technology. The use of bioleaching, for instance, has allowed for more environmentally friendly extraction methods. This process uses microorganisms to break down the ore and extract copper, reducing the need for energy-intensive and chemically laden conventional methods.

From an economic standpoint, copper mining is a major contributor to global economies, particularly in countries rich in copper resources like Chile and Peru. It supports infrastructure development, creates jobs, and contributes to GDP growth. Additionally, the recycling of copper plays a significant role in meeting global demand and minimizing environmental impact, as recycled copper retains all the chemical and physical properties of newly mined copper.

In terms of resource management, innovations in mining technology not only aim to enhance efficiency but also to reduce the environmental footprint of mining activities. This includes improvements in the processing stages, where new crushing and grinding techniques have significantly optimized the extraction and processing of copper ore.

Major Challenges

- Resource Depletion: One of the foremost challenges is the depletion of accessible high-grade copper ores. This depletion is exacerbated by rising exploration costs and a scarcity of new discoveries, which makes it difficult to replace depleted reserves. As demand for copper surges, particularly for renewable energy and electrification, the lack of significant new deposits poses a threat to supply continuity.

- Environmental and Regulatory Pressures: Environmental stewardship is becoming a top priority, with a focus on reducing the environmental impact of mining activities. This includes stringent regulations around waste management, water use, and biodiversity conservation. Companies are required to adopt more sustainable mining practices, which often involve higher operational costs and technical challenges.

- Geopolitical and Market Risks: The copper mining sector is also susceptible to geopolitical tensions and regulatory changes. Issues such as resource nationalism, where countries impose strict controls over natural resources, can affect mining operations and investment. Moreover, fluctuating copper prices and market dynamics add an additional layer of complexity to financial planning and operational stability in the sector.

- Technological and Innovation Gaps: While the industry is pushing towards innovation, such as more efficient ore processing techniques and waste recycling, there is a gap in the adoption and commercialization of these technologies. The slow pace of technological advancement can hinder the sector’s ability to improve efficiency and reduce environmental impacts.

- Financial and Investment Challenges: The capital-intensive nature of mining requires substantial upfront investment, which can be difficult to secure given the current economic climate and competition for funding. The industry must navigate financial constraints while striving to invest in new projects and technologies that will ensure future growth and sustainability.

- Supply Chain Disruptions: The sector is prone to supply chain vulnerabilities, which have been highlighted by recent global events that disrupted transportation and production. These disruptions can lead to sudden shortages and impact global copper supply, underscoring the need for robust supply chain management.

Market Growth Opportunities

- Increased Demand in Key Industries: The demand for copper is expected to surge due to its critical role in various industries, especially in renewable energy and electric vehicles. Copper’s excellent conductivity makes it indispensable for electric wiring and components in green technologies, with projections indicating substantial increases in copper usage for renewable energy infrastructures like solar and wind power installations, as well as electric vehicles.

- Geographic Expansion: There are significant opportunities for geographic expansion, particularly in regions like Latin America and Asia-Pacific. Latin America, for example, continues to be a hotspot for copper mining due to extensive copper reserves and favorable mining conditions. Countries like Chile and Peru are leading copper production, with ongoing expansions expected to enhance their output significantly. Similarly, the Asia-Pacific region is crucial, with countries like China and Indonesia contributing to both demand and supply. The increased infrastructure development and urbanization in these regions are driving the copper demand.

- Technological Advancements and Efficiency Improvements: Innovations in mining technology are expected to reduce costs and increase efficiency. This includes the adoption of automated and remote technologies that can streamline operations and mitigate the impact of labor shortages. Furthermore, advancements in processing technologies that enhance ore recovery and minimize environmental impact are also critical growth areas.

- Strategic Investments and Partnerships: There is a growing trend towards mergers, acquisitions, and strategic partnerships within the copper mining industry. These alliances are crucial for companies looking to expand their operations and tap into new markets, ensuring a steady supply chain and access to emerging markets.

- Sustainability and Regulatory Compliance: As environmental regulations tighten globally, there is a push towards sustainable and responsible mining practices. Companies investing in environmentally friendly technologies and practices are likely to gain competitive advantages, particularly as global standards on emissions and environmental impact become more stringent.

- Recycling and Secondary Recovery: The recycling of copper presents an additional opportunity, as it is a highly efficient process that can significantly supplement primary copper production. The industry is focusing on enhancing the efficiency of recycling processes to meet the growing demand and reduce environmental impact.

Key Players Analysis

Advance SCT Limited, primarily known for its work in trading and recycling electronic components, has not disclosed significant activities directly within the copper mining sector as of 2023 or 2024. The company’s focus remains on the sustainable management and recycling of electronic waste, which indirectly supports the copper industry by recovering copper used in various electronic devices.

African Copper Plc, a key player in the copper mining sector, focuses on the exploration, development, and operation of copper projects. In 2023, the company continued to leverage its assets in Botswana, enhancing its exploration activities to bolster copper production amidst growing global demand. African Copper’s strategic initiatives are aimed at maximizing the yield from their existing resources while ensuring sustainable practices in their operations.

Amerigo Resources Ltd. had a productive year in 2023, managing to exceed its copper production guidance, a trend that it expects to continue into 2024. The company is known for its MVC operation in Chile, which processes tailings from the world’s largest underground copper mine, demonstrating both innovation and resilience in a challenging market.

Amerigo’s focus remains on maintaining efficient operations and capitalizing on the robust demand for copper, essential for modern technologies and renewable energy sectorsmerican, a major player in the global mining sector, reported a substantial increase in copper production in 2023, achieving a 24% rise to 826,000 metric tons, though slightly below the upper end of its forecast range. For 2024, the company has set a production target range of 730,000 to 790,000 tons.

Anglo American’s copper operations, particularly at the Quellaveco mine in Peru, play a vital role in their growth strategy, focusing on copper’s essential use in electric vehicles and renewable infrastructure. Despite facing operational challenges such as poor ore grades in Chilean operations, the company is optimistic about meeting its production targets.

In 2024, BHP Billiton Ltd. demonstrated a strong operational performance in the copper mining sector, highlighted by record production at several of its mines, including Spence and Carrapateena. This surge in production is part of a broader trend of growth across BHP’s copper operations, contributing to a significant increase in their overall output by 9% compared to previous years. This growth is underpinned by a combination of disciplined execution of their business strategies and a favorable market environment for copper, driven by high global demand, especially from industries like renewable energy and electric vehicles.

Caribou King Resources Limited, however, does not appear in the recent data or news updates for 2023 or 2024 within the context of copper mining. Therefore, no current information is available about their activities or performance in the copper mining sector during these years. For the most accurate and up-to-date information, monitoring industry reports or the company’s announcements would be advisable.

In 2023, Codelco, the largest copper producer globally, faced several challenges that led to a decrease in production. The total copper output for the year was approximately 1.424 million metric tons, marking an 8.4% drop compared to 2022. This decline was attributed mainly to operational difficulties and lower ore quality.

Despite these setbacks, there were signs of recovery in the latter part of the year, suggesting a potential increase in production for 2024 to around 1.34 million metric tons. This recovery is supported by improvements in mining processes and the anticipated resolution of operational issues.

In 2023, First Quantum Minerals experienced a decrease in copper production, achieving 708,000 tonnes, which was 68,000 tonnes lower than in 2022. This reduction was largely due to operational ramp downs at their Cobre Panama site. For 2024, the company expects to boost its production, with forecasts ranging from 370,000 to 420,000 tonnes of copper. Despite challenges, including operational adjustments and market conditions, First Quantum is focused on continuing its operational efficiency and growth.

Freeport-McMoRan Inc., another significant player in the copper mining sector, has also demonstrated robust performance, although specific recent data for 2023 or 2024 was not detailed in the latest searches. Typically, Freeport-McMoRan is known for its substantial contributions to global copper supply, particularly from its major mines like Grasberg in Indonesia and various operations in North and South America. The company’s performance is closely tied to global copper prices and demand, particularly from major markets like China and the U.S., where copper is crucial for various industrial applications, including electronics and construction.

In 2023, Glencore International AG reported a copper production of 1,010,100 tonnes, a decrease from the previous year, influenced by the sale of its Cobar asset and lower by-product production. For 2024, they are projecting copper production to stabilize between 950,000 and 1,010,000 tonnes. Glencore continues to focus on expanding its operations, notably with the acquisition of a significant stake in the MARA project in Argentina, positioning the company to enhance its copper output significantly over the coming years. This project is set to produce over 550,000 tonnes of copper annually once operational, underscoring Glencore’s strategic investments to bolster its copper production capacity.

In 2023, KGHM Polska Miedź S.A., a leading global copper and silver producer, reported a slight decrease in copper production, totaling approximately 700,000 tonnes, down from 708,000 tonnes in 2022. This decline was primarily due to operational challenges and maintenance activities. However, in 2024, KGHM has shown signs of recovery, with production levels stabilizing and aligning with their strategic objectives. The company continues to focus on enhancing operational efficiency and expanding its international mining projects to bolster future output.

Freeport-McMoRan Inc., a major player in the copper mining sector, reported a strong first quarter in 2024, with copper production reaching 1.1 billion pounds, up from 965 million pounds in the previous year. This increase was largely driven by enhanced operations at their Indonesian mines. The company also benefited from higher gold sales, which more than doubled to 568,000 ounces. Despite facing challenges such as fluctuating copper prices, Freeport-McMoRan remains focused on optimizing production and managing costs to maintain profitability.

Conclusion

In conclusion, the global copper mining sector is set to experience significant growth driven by increasing demand from key industries such as renewable energy and electric vehicles. Opportunities for expansion are particularly pronounced in regions with extensive copper reserves like Latin America and Asia-Pacific, where strategic investments and technological advancements are likely to propel production capabilities.