Table of Contents

Introduction

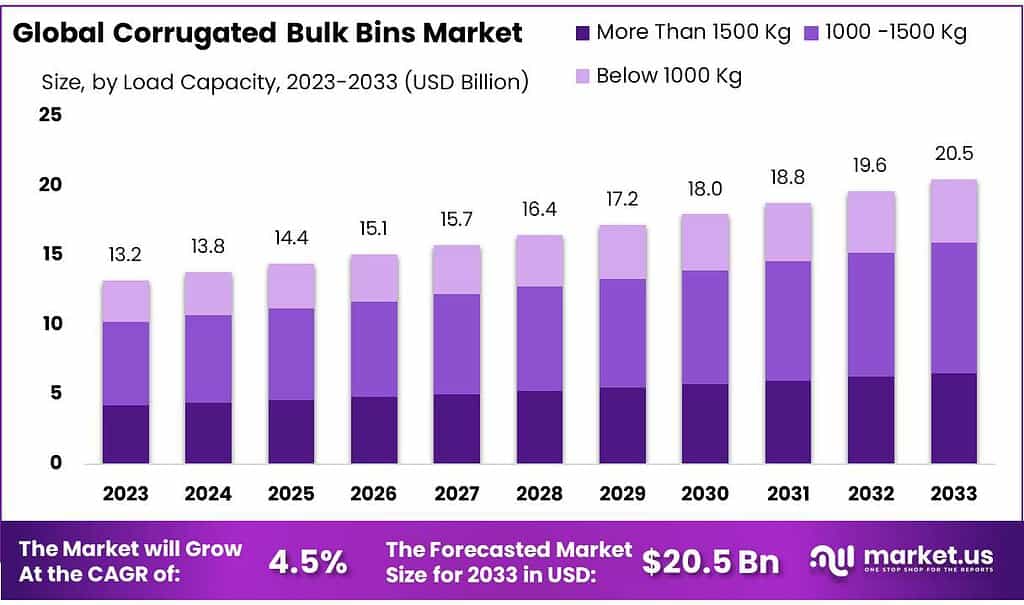

The global corrugated bulk bins market is projected to experience significant growth, with its size expected to reach approximately USD 20.5 billion by 2033, up from USD 13.2 billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2023 to 2033. This market expansion is driven by several factors, including increasing demand for sustainable packaging solutions, advancements in recycling technologies, and the growing e-commerce sector.

Corrugated bulk bins, also known as corrugated bins or bulk boxes, are large, durable containers made from corrugated fiberboard. They are widely used across various industries for the storage, handling, and transportation of bulk goods such as fruits, vegetables, industrial components, and other commodities. The fluted layers of paperboard in these bins provide structural strength, making them suitable for heavy-duty applications while also being cost-effective and recyclable.

One of the key growth drivers for the corrugated bulk bins market is the increasing consumer and corporate awareness regarding environmental sustainability. The shift from plastic and steel containers to corrugated materials is gaining momentum as businesses seek to reduce their carbon footprint. The development of innovative, lightweight, and durable corrugated bins that address transportation and packaging challenges further supports market growth. For instance, DS Smith’s launch of DryPack, a fully recyclable, water-resistant seafood box, exemplifies innovation in sustainable packaging solutions.

However, the market faces challenges related to the customization and flexibility of these bins. Tailoring corrugated bulk bins to specific dimensions and strength requirements of various products can be complex and requires precise manufacturing processes. Despite these challenges, the benefits of reducing transportation costs and environmental impact make corrugated bulk bins an attractive option for many industries.

Recent developments in the market highlight the focus on sustainability and efficiency. For example, Cartocor SA introduced the bliss format for packaging milk and yogurt sachets, which offers significant savings in logistics and materials. Additionally, Greif Inc.’s new manufacturing facility in Dallas, Texas, aims to expand its capacity in the bulk corrugated business, creating opportunities in the South and Southwest regions of the U.S. and Mexico.

The food and beverage industry remains a significant user of corrugated bulk bins, driven by the need for reliable packaging solutions for online grocery shopping and e-commerce. The push for eco-friendly packaging solutions is also evident in the efforts of companies like Cascades, which launched a new closed basket made of recycled corrugated cardboard in January 2023.

Key Takeaways

- Market Size and Growth Expected to grow from USD 13.2 billion in 2023 to USD 20.5 billion by 2033, at a CAGR of 4.5%.

- Preferred Load Capacity Bins with 1000 to 1500 kg capacity dominated, making up over 45.6% of the market due to their optimal utility.

- Type Preference Pallet Packs led the market with a 55.4% share, favored for their efficiency in handling and transporting goods.

- Format Popularity Double Wall bins, preferred for their durability, held a 42.7% market share, showcasing demand for robust packaging.

- Leading Application The Food & Beverage sector was the top user, accounting for 28.7% of the market, highlighting the need for hygienic transport solutions.

- Regional Dynamics Asia Pacific leads with over 36.5% market share, while Europe’s focus on sustainability forecasts rapid growth in renewable packaging solutions.

Corrugated Bulk Bins Statistics

- Demand for corrugate has been growing steadily at an average of 2–3% per year in Europe.

- where it dominates with a 63% market share over other packaging material alternatives such as plastics.

- A World Health Organization study has indicated that in developed countries with sophisticated storage, packaging, and distribution systems, wastage of food is estimated at only 2–3%. In developing countries without these systems, wastage is estimated at between 30% and 50% (Soroka, 2002).

- PE is the dominant plastic material in use today, with a 56% market share.

- Around 70% of all corrugated cardboard boxes find new life through recycling efforts.

- cardboard is biodegradable and recyclable, with a high recycling rate of 92.9%.

- The industry contributed just 0.8% to global emissions, significantly lower than plastic’s 4.5%.

- Recycling Rate 93% for cardboard boxes in 2022. Reduces waste and conserves resources.

- Energy Savings 25% to 50% less energy to recycle flowers’ carbon footprint.

- All told, supermarkets in the U.S. each process eight to 30 tons of solid waste from corrugated cardboard per month, reports TheBalance.com.

- About 65 percent of OCC generated in the United States is currently recycled.

- If disposed of by “dumping,” one year’s use of OCC will require almost 3,000,000 cubic yards of landfill space.

- Producer Price Index for Corrugated and Solid Fibre Box Manufacturing The index measuring cardboard costs increased from 342.1 in May 2020 to 369.4 in May 2021.

- Billerud Flute®’s a much higher compression strength compared to traditional Kraftliner, you can go down in grammage by up to 30% in the center liner layer.

- LCA posits that corrugated boxes for produce only have an average recycled content of 38.4 percent.

- Dennis Colley, Executive Director of the Corrugated Packaging Alliance, while not seem to dispute the 38.4% recycling rate.

- Recovery of old corrugated containers reached a record 92.9% in 2015.

- Around the country, 95% of Americans have access to community-based curbside and/or drop-off corrugated recycling programs.

- Nearly 52% of the recovered fiber collected for recycling in the U.S. is used to make containerboard for more boxes

- More than 32% is exported to other parts of the world where virgin fiber is scarce, and the remainder goes to other products like tissue and printing and writing papers.

Emerging Trends

- Sustainability Takes Center Stage: The increasing emphasis on eco-friendly packaging solutions is a major trend. Corrugated bulk bins, made from recyclable and biodegradable materials, are gaining popularity as companies strive to reduce their environmental footprint. This includes the use of recycled materials and eco-friendly inks, as well as designs that minimize waste. Companies are also adopting sustainable practices in their operations to align with consumer demand for green packaging solutions.

- Customization and Personalization: With the rise of e-commerce, there is a growing need for personalized and branded packaging. Businesses are investing in customized corrugated bulk bins to enhance the customer experience and differentiate themselves from competitors. This includes advanced printing technologies that allow for unique designs and personalized messages on packaging. Tailored packaging solutions help reduce excess material usage and improve the overall aesthetics of the product.

- Digitalization and Automation: The integration of digital technologies and automation in the production of corrugated bulk bins is transforming the industry. Digital printing advancements enable more intricate and colorful designs, while automated packaging lines improve efficiency and reduce labor costs. Enhanced digital systems also facilitate better supply chain management and real-time tracking of production and delivery processes.

- Improved Durability and Performance: Innovations in materials and design are leading to more durable and high-performing corrugated bulk bins. These improvements include enhanced strength-to-weight ratios, advanced cushioning materials for better protection of fragile items, and water-resistant coatings to ensure products remain undamaged during transportation. These advancements help in reducing shipping costs and improving the overall reliability of the packaging.

- Smart Packaging Solutions: The adoption of smart packaging solutions is on the rise, with the integration of technologies like RFID for better inventory management and tracking. These solutions provide real-time data and improve the efficiency of logistics and supply chain operations. The use of smart packaging is expected to enhance the functionality and value of corrugated bulk bins, making them a crucial component of modern packaging strategies.

Use Cases

- Agriculture and Food Industry: Corrugated bulk bins are widely used for storing and transporting fresh produce, such as fruits and vegetables, as well as bulk commodities like grains and nuts. Their ability to maintain structural integrity under heavy loads and their ventilated designs make them ideal for preserving the freshness of perishable goods during transit. For example, these bins are commonly used for shipping watermelons, pumpkins, and other heavy produce from farms to markets.

- Industrial Components and Automotive Parts: In the manufacturing sector, corrugated bulk bins are used to handle and transport heavy industrial components and automotive parts. Their strength and ability to be customized to different sizes and shapes ensure that parts are securely packaged and protected from damage during shipping. Companies often use these bins to streamline logistics and reduce the risk of damage to expensive machinery parts.

- Retail and E-commerce: The retail industry benefits from corrugated bulk bins for the storage and display of bulk items in stores. In e-commerce, these bins are used for the efficient packaging and shipment of large orders. Their cost-effectiveness and ease of branding make them a popular choice for companies looking to enhance their packaging solutions while also providing a sturdy container for bulk shipments.

- Pharmaceuticals and Chemicals: The pharmaceutical and chemical industries use corrugated bulk bins to transport bulk quantities of raw materials and finished products. The bins’ ability to be lined with protective coatings or liners ensures that sensitive chemicals and pharmaceutical ingredients remain uncontaminated and safe during transport. This use case highlights the importance of customization in meeting industry-specific requirements.

- Beverage Industry: In the beverage industry, corrugated bulk bins are used to transport large quantities of bottled or canned beverages. The bins’ strength allows for stacking and efficient space utilization in warehouses and during transport. Their design can be tailored to provide additional protection for fragile glass bottles, ensuring they reach their destination without breakage.

- Waste Management and Recycling: Corrugated bulk bins are also employed in waste management and recycling operations. They are used to collect and transport recyclable materials such as paper, plastics, and metals. Their recyclability aligns with the sustainability goals of waste management companies, making them an environmentally friendly option for handling recyclable waste.

Major Challenges

- Customization Complexity: Tailoring corrugated bulk bins to meet specific requirements for different industries and products can be complex. Each product may require unique sizes, shapes, and strength specifications, which necessitates precise manufacturing processes. This complexity can increase production costs and lead to longer lead times. Customization issues often deter smaller companies from adopting these solutions due to the higher costs involved.

- Material Costs and Supply Chain Issues: The cost of raw materials, particularly paperboard, can fluctuate significantly. These fluctuations can impact the pricing and availability of corrugated bulk bins. Additionally, supply chain disruptions, such as those caused by the COVID-19 pandemic, have led to increased costs and delays in the production and delivery of these bins. Managing these costs and ensuring a stable supply chain remains a challenge for manufacturers.

- Environmental and Recycling Challenges: While corrugated bulk bins are marketed as eco-friendly solutions, the recycling process is not always straightforward. Contamination of recyclable materials and the lack of efficient recycling infrastructure in certain regions can hinder the overall sustainability of corrugated bins. Moreover, developing bins that are both highly durable and easily recyclable presents a technical challenge.

- Competition from Alternative Packaging Solutions: The market for packaging solutions is highly competitive, with alternatives such as plastic and metal containers offering their own set of advantages, like higher durability and lighter weight. These alternatives can sometimes provide more cost-effective or practical solutions depending on the specific use case, posing a challenge to the adoption of corrugated bulk bins.

- Regulatory Compliance: Meeting regulatory requirements for packaging, especially in the food and pharmaceutical sectors, adds another layer of complexity. Ensuring that corrugated bulk bins comply with various regional and international standards can be resource-intensive and may require continuous adaptation to changing regulations.

Market Growth Opportunities

- Sustainability and Eco-friendly Packaging: As environmental concerns continue to rise, there is a growing demand for sustainable packaging solutions. Corrugated bulk bins, being recyclable and biodegradable, align well with this trend. Companies can capitalize on this by enhancing their eco-friendly attributes, such as using higher percentages of recycled materials and adopting greener production practices. This trend is expected to drive market growth, especially as regulations around packaging waste become stricter.

- E-commerce and Online Retail Growth: The rapid expansion of e-commerce and online retail offers a significant growth opportunity for corrugated bulk bins. These bins are ideal for shipping large quantities of goods, providing durability and protection during transit. With the e-commerce market expected to grow at a CAGR of 14.7% from 2021 to 2026, the demand for reliable and efficient packaging solutions like corrugated bulk bins is set to increase.

- Technological Advancements in Packaging: Innovations in packaging technology, such as digital printing and automation, are creating new opportunities in the corrugated bulk bins market. Digital printing allows for customization and personalization, making bins more attractive for branding purposes. Automation in manufacturing can increase production efficiency and reduce costs, making these bins more accessible to a broader range of industries.

- Expansion in Emerging Markets: Emerging markets in Asia-Pacific, Latin America, and the Middle East offer substantial growth opportunities. These regions are experiencing rapid industrialization and urbanization, leading to increased demand for robust packaging solutions. For example, the Asia-Pacific market is expected to grow significantly, driven by strong economic growth and rising consumption patterns.

- Increasing Demand in the Food and Beverage Sector: The food and beverage industry continues to be a major user of corrugated bulk bins due to the need for safe and efficient transportation of perishable goods. The trend towards sustainable packaging in this sector further boosts the demand for corrugated bulk bins. The market in this sector is projected to grow at a CAGR of 4.3%, reflecting the ongoing need for reliable bulk packaging solutions.

Recent Developments

In 2023 and 2024, Mondi Group has been actively advancing its position in the corrugated bulk bins sector by focusing on sustainability, innovation, and strategic investments. Throughout 2023, Mondi completed significant investments in organic growth projects amounting to €1.2 billion, with half of this amount directed towards the corrugated packaging sector. Key developments included the ramp-up of new production lines at the Kuopio mill in Finland and the Świecie mill in Poland. By March 2024, Mondi reported that these projects were on track and expected to contribute significantly to their EBITDA from 2025 onwards. Additionally, in July 2024, Mondi secured 11 awards in the Crescents and Stars for Packaging competition, highlighting their innovation in sustainable packaging solutions. This ongoing commitment to enhancing production capabilities and sustainability is positioned to support Mondi’s growth in the corrugated bulk bins market as demand for eco-friendly packaging solutions increases globally.

International Paper Company has been actively enhancing its presence in the corrugated bulk bins sector throughout 2023 and 2024 by focusing on innovation, sustainability, and expansion of its production capabilities. In 2023, the company launched several initiatives to bolster its product offerings and improve operational efficiency. For instance, in June 2023, International Paper opened a state-of-the-art corrugated packaging facility in Atglen, Pennsylvania, with an investment of $100 million, aimed at increasing production capacity and meeting the growing demand for bulk packaging solutions. This facility is part of their strategy to serve the expanding e-commerce market, which heavily relies on durable and sustainable packaging options.

In 2023 and 2024, WestRock Company has made significant strides in the corrugated bulk bins sector by focusing on expansion, innovation, and sustainability. In the first quarter of fiscal 2024, WestRock invested $247 million in capital expenditures, which included projects aimed at enhancing their corrugated packaging capabilities. This period saw an increase in segment sales to $2.42 billion, up from $2.34 billion in the same quarter the previous year, partly due to the inclusion of sales from their recent acquisition in Mexico. Additionally, WestRock announced the construction of a new corrugated box plant in Pleasant Prairie, Wisconsin, in January 2024, to meet the growing demand for their products in the region. The second quarter of fiscal 2024 saw continued investments with $301 million allocated to capital expenditures, maintaining a focus on expanding their corrugated packaging operations. Despite facing challenges like lower selling prices and volumes, WestRock managed to offset some impacts through cost-saving measures and strategic investments in new facilities.

In 2023 and 2024, DS Smith Plc has continued to strengthen its position in the corrugated bulk bins sector by focusing on innovation, sustainability, and operational efficiency. For the fiscal year ending April 2023, DS Smith reported a revenue of £8.221 billion, marking an 11% increase compared to the previous year, and an adjusted operating profit of £861 million, up 35% from the prior year. Throughout 2023, the company emphasized meeting customer needs with innovative solutions and enhancing its sustainability performance, which helped gain market share despite a challenging economic environment.

Conclusion

The corrugated bulk bins market is experiencing robust growth driven by the increasing demand for sustainable packaging solutions and advancements in recycling technologies. As industries worldwide shift away from plastic and steel containers, corrugated bulk bins offer an environmentally friendly and cost-effective alternative, bolstered by innovations in design and materials.

Key trends influencing this growth include the adoption of green packaging solutions, spurred by regulatory support and consumer preferences. The integration of RFID technology in corrugated bulk bins for improved tracking and inventory management is expected to further enhance market appeal. Additionally, the food and beverage sector remains a significant driver, leveraging the durability and recyclability of these bins to meet the logistical challenges of transporting perishable goods.