Table of Contents

Introduction

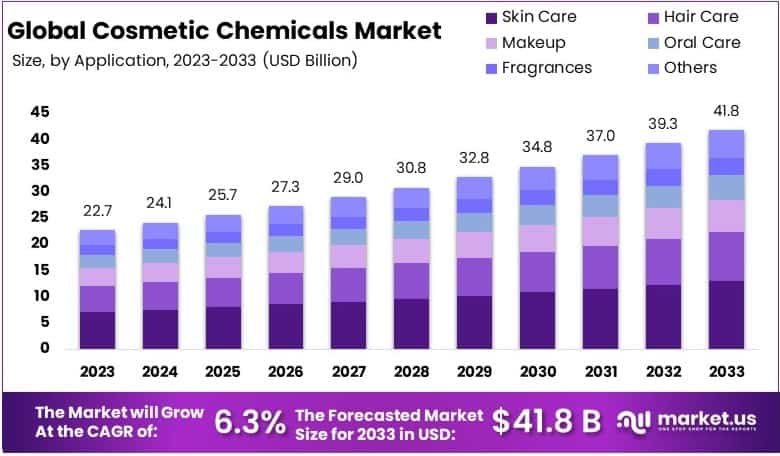

The Global Cosmetic Chemicals Market is poised for substantial growth, projected to expand from USD 22.7 billion in 2023 to an estimated USD 41.8 billion by 2033, achieving a CAGR of 6.3%. This growth can be attributed to several key factors including rising consumer demand for personal care products, technological advancements in cosmetic formulations, and increasing investments in research and development by leading market participants.

Despite these drivers, the market faces challenges such as stringent regulatory standards and environmental concerns related to the production and disposal of cosmetic chemicals. Recent developments in the industry include the introduction of eco-friendly and sustainable products, which are gaining traction among consumers. Companies are increasingly adopting green chemistry practices to mitigate environmental impact and comply with global regulations, which is reshaping the market landscape. These dynamics are critical for stakeholders to consider as they navigate the future of the cosmetic chemicals industry.

Recent developments in the cosmetic chemicals sector highlight the strategic moves by major companies like Solvay SA, Croda International PLC, Evonik Industries AG, and Stepan Company, reflecting an industry-wide emphasis on sustainability, technological advancement, and market expansion.

Solvay SA has made significant strides, focusing on sustainability and efficiency. The company completed the partial demerger, forming two separate entities, Solvay and Syensqo, to better focus on their respective strategic goals. Solvay has set ambitious sustainability targets, including becoming coal-free in several plants by 2025 and aiming for carbon neutrality by 2050. This shift underscores Solvay’s commitment to environmental responsibility and operational efficiency.

Croda International PLC has recently expanded its capabilities in the biotechnology sphere by acquiring Solus Biotech, a leader in biotechnology-derived active ingredients. This acquisition aligns with Croda’s strategy to enhance its offerings in the beauty care and pharmaceutical sectors, emphasizing the growing importance of biotech solutions in the cosmetic chemicals market.

Stepan Company, while specific recent developments were less prominently discussed, continues to be a significant player in the market, known for its production of specialty and intermediate chemicals used in a wide range of consumer and industrial products, including cosmetics.

Key Takeaways

- Market Value: The Cosmetic Chemicals Market was valued at USD 22.7 billion in 2023, and is expected to reach USD 41.8 billion by 2033, with a CAGR of 6.3%.

- Product Type Analysis: Emollients & Moisturizers dominated with 30.9%; essential for their hydrating properties in skincare products.

- Application Analysis: Skin Care led with 31.2%; significant for its extensive use in cosmetic formulations.

- Dominant Region: North America held 35.6%; crucial due to high consumer demand and advanced cosmetic industries.

- Analyst Viewpoint: The cosmetic chemicals market is highly competitive with significant growth opportunities in skincare and haircare products. Future trends indicate increased demand for natural and sustainable ingredients.

Cosmetic Chemicals Statistics

- On average, American women use 12 beauty products a day that contain around 168 chemicals.

- American men use an average of 6 cosmetics that contain 85 different chemicals.

- 1 in 3 consumers don’t check the ingredients in their cosmetics before buying or using them.

- 55% of American women believe that the FDA regulates ingredients in cosmetics.

- 60% of consumers believe it is very important to tighten controls on chemicals used in cosmetics.

- The FDA bans only 11 chemicals from being used in cosmetics, whereas hundreds and thousands are banned across many other countries.

- In December 2022, Congress passed a bill to grant the FDA powers to regulate the manufacturing process for cosmetics.

- The market for natural personal care products is growing, with 74% of women with children and 60% of women without children expressing the importance of purchasing green or natural beauty products.

- The FTC has taken action against companies falsely marketing products as “all natural” or “100% natural” when they contained synthetic ingredients.

- 1 out of 4 consumers would like their preferred skincare brands to be eco-friendly.

- Cosmetic industry statistics show that 92% of buyers would be more loyal to a brand if it supported environmental or social causes.

- Gen Z spends an average of $2,048 yearly on beauty products, followed by Millennials at $2,670, Gen X at $1,517, and Baby Boomers at $494.

- 75% of Americans say beauty products, cosmetics, and services are important to them — and they’re willing to spend big on these items. On average, consumers spend $1,754 a year on these products.

- Parabens are the most widely used preservatives in cosmetics. They are present in approximately 75-90% of cosmetic products, due to their effectiveness and low cost. Typical concentrations range from 0.01% to 0.3%.

- 1 of every 13 women and 1 of every 23 men are exposed to ingredients that are known or probable human carcinogens every day through their use of cosmetics, demonstrating the widespread exposure to harmful chemicals.

- There are approximately 170 PFAS ingredients used in cosmetics and personal care products in Europe.

- Researchers from the University of Notre Dame, Indiana University, and the University of Toronto cataloged PFAS concentrations in 231 cosmetic products from the US and Canada.

- Face, lip, and mascara products had the highest proportions of high-concentration PFAS, with 82% of waterproof mascaras containing high levels.

- Only 8% of the screened products listed PFAS as an ingredient, due to lack of regulatory disclosure requirements.

Emerging Trends

- Clean Beauty Movement: The clean beauty trend emphasizes the use of safe, natural, and non-toxic ingredients. Consumers are increasingly demanding transparency and avoiding chemicals like parabens, sulfates, and phthalates. This shift has led manufacturers to innovate with plant-based alternatives and eco-friendly formulations, enhancing product safety and sustainability, which appeals to health-conscious and environmentally-aware consumers.

- Biotechnology and Bio-Ingredients: Advances in biotechnology have enabled the development of bio-based ingredients for cosmetics. These include bio-fermented extracts, probiotics, and sustainably sourced bio-actives. Such ingredients offer unique benefits, such as enhanced skin microbiome health and improved bioavailability. The trend supports sustainability by reducing reliance on petrochemicals and promoting renewable resources.

- Personalized Skincare: The trend towards personalized skincare is driven by consumer demand for products tailored to individual skin types and concerns. Advances in AI and genetic testing are facilitating the development of bespoke formulations. This approach enhances efficacy and consumer satisfaction, leveraging data-driven insights to create products that address specific skin needs and preferences, thereby improving outcomes.

- Sustainability and Green Chemistry: Sustainability is reshaping the cosmetic industry, with a strong focus on green chemistry. This involves designing products and processes that minimize environmental impact, such as using biodegradable ingredients and sustainable packaging. Innovations include the development of eco-friendly preservatives and the reduction of water usage in production. This trend aligns with global sustainability goals and consumer expectations for eco-conscious products.

- Advanced Anti-Aging Technologies: There is a growing demand for advanced anti-aging solutions incorporating cutting-edge technologies. Ingredients like peptides, stem cells, and growth factors are gaining popularity for their proven efficacy in promoting skin regeneration and collagen production. These technologies are designed to target aging at a cellular level, offering more effective and long-lasting results, appealing to the aging population seeking to maintain youthful skin.

- Minimalist Formulations: The minimalist trend focuses on simplicity and fewer ingredients in cosmetic formulations. Consumers are favoring products with straightforward, effective ingredients without unnecessary additives. This trend encourages the use of multifunctional ingredients and aims to reduce potential allergens and irritants. It also supports the development of streamlined, easy-to-use product lines that enhance user experience and product transparency.

Use Cases

- Skincare Products: Cosmetic chemicals are extensively used in skincare products like moisturizers, serums, and cleansers. These chemicals enhance product performance by improving texture, stability, and absorption. Ingredients like hyaluronic acid and glycolic acid are common for their moisturizing and exfoliating properties, addressing needs ranging from hydration to anti-aging.

- Sun Protection: Sunscreens incorporate a variety of chemical agents that absorb or reflect harmful UV rays. These chemicals, such as oxybenzone and avobenzone, are crucial for protecting the skin from sun damage and preventing long-term effects like skin cancer and premature aging. The effectiveness and safety of these chemicals ensure their widespread use in both standalone sunscreens and daily skincare products with SPF.

- Hair Care Formulations: Cosmetic chemicals are vital in hair care products, including shampoos, conditioners, and styling agents. They serve functions such as cleansing, conditioning, and providing heat protection. Silicones, for example, are used to impart smoothness and shine, while sulfates are common cleansers that help foam and remove oil and dirt from hair.

- Color Cosmetics: Chemicals in makeup items such as lipsticks, foundations, and eyeshadows contribute to color, longevity, and texture. Pigments and dyes provide the color, while other chemicals like dimethicone help in creating a smooth application and finish. Preservatives are also used to extend the shelf life and maintain the product’s integrity.

- Nail Care: Nail polish and removers use various chemical solvents and plasticizers to enhance aesthetic appeal and durability. Chemicals like toluene and dibutyl phthalate help improve the polish’s appearance and application. However, due to health concerns, there is a growing trend toward safer, non-toxic alternatives in nail care formulations.

- Anti-Aging Treatments: Anti-aging products utilize advanced chemical compounds like peptides and retinoids to reduce signs of aging such as wrinkles and loss of skin elasticity. These chemicals stimulate skin repair and collagen production, essential for maintaining youthful skin appearance. Their efficacy in visible age reduction makes them popular in both clinical and over-the-counter products.

Key Players Analysis

Solvay SA, a prominent player in the cosmetic chemicals market, has demonstrated resilience despite challenging economic conditions. In 2023, the company’s net sales reached €4.88 billion, reflecting a 12.6% organic decline due to lower volumes and prices. However, Solvay’s underlying EBITDA remained stable at €1.246 billion, supported by positive net pricing and cost reductions. Notably, Solvay completed a partial demerger in December 2023, transferring its specialty businesses to a new entity, Syensqo. This strategic move aims to unlock further value and focus on high-growth, high-margin businesses.

Croda International PLC, a leader in specialty chemicals, has continued to strengthen its position in the cosmetic chemicals sector. In 2023, Croda reported sales of £1.694 billion, despite a challenging macroeconomic environment and reduced inventory levels across markets. The acquisition of Solus Biotech enhanced Croda’s portfolio with biotech-derived active ingredients. The company achieved a 5% increase in free cash flow to £165.5 million and maintained a strong balance sheet with net debt at £537.6 million. Croda remains focused on innovation and sustainability, driving growth in consumer care and life sciences.

Evonik Industries AG, a global leader in specialty chemicals, recently inaugurated a new sustainable biosurfactant facility in Slovakia, emphasizing its commitment to innovation in the cosmetic chemicals market. The company reported a revenue of $16.29 billion in 2024. Significant activities include the divestment of its superabsorbents business to ICIG and a €500 million loan from the European Investment Bank for R&D. The first quarter of 2024 saw an adjusted EBITDA rise of 28% to €522 million, driven by strong performance in its Specialty Additives and Nutrition & Care divisions.

Stepan Company, active in the cosmetic chemicals market, focuses on producing surfactants and other specialty ingredients. In 2023, Stepan acquired PerformanX Specialty Chemicals to enhance its personal care product portfolio. The company reported a revenue of $2.3 billion in 2023, driven by growth in both North American and international markets. Stepan’s expansion efforts include increasing its production capabilities and broadening its market reach through strategic acquisitions.

Symrise, a leading player in the cosmetic chemicals market, recently strengthened its market position by acquiring Giraffe Foods Inc. This strategic move is expected to enhance Symrise’s capabilities in creating custom taste solutions. In 2023, Symrise reported a revenue of €4.6 billion, reflecting its robust performance in the market. The acquisition of Giraffe Foods aligns with Symrise’s strategy to expand its product portfolio and leverage advanced R&D capabilities to meet customer demands.

Ashland Inc., specializing in additives and specialty ingredients for personal care, reported a first-quarter 2024 revenue of $564 million. The company has been addressing challenges in customer demand and inventory levels. Recently, Ashland announced the closure of its CMC production in Hopewell, Virginia, consolidating operations in France. Despite these challenges, Ashland remains focused on innovation and strategic growth, with plans to improve margins and increase sales throughout the year.

Givaudan, a key player in the cosmetic chemicals market, recently announced the acquisition of the fragrance company Privi Speciality Chemicals Limited, aiming to enhance its capabilities in fragrance creation. In 2023, Givaudan reported sales of CHF 7.1 billion. This strategic acquisition supports Givaudan’s growth strategy and strengthens its position in the fast-growing Indian market, allowing for expanded innovation and product offerings in fragrances and beauty.

Eastman Chemical Company, a significant player in the cosmetic chemicals market, recently completed the sale of its Texas City operations to INEOS Acetyls for $490 million. In 2023, Eastman reported a revenue of $9.2 billion. The company also introduced plastic waste into its Kingsport methanolysis facility, expecting to generate revenue soon. Despite facing weak demand and inventory destocking in key markets, Eastman demonstrated strong cash flow, generating approximately $1.4 billion from operating activities in 2023.

Lonza Group, a key player in the cosmetic chemicals market, reported strong financial results for 2023 with sales reaching CHF 6.7 billion and a CORE EBITDA margin of 29.8%. Recently, Lonza acquired Synaffix B.V. to enhance its bioconjugates offering, particularly in the field of antibody-drug conjugates (ADCs). Additionally, Lonza signed an agreement to purchase a large-scale biologics site from Roche in Vacaville, California, for USD 1.2 billion, significantly increasing its manufacturing capacity for mammalian biologics.

Lanxess, active in the cosmetic chemicals sector, focuses on sustainable and innovative ingredients. In 2023, Lanxess reported a revenue of approximately €8.1 billion. Recently, the company launched a new range of preservative-free ingredients for personal care products, enhancing its portfolio with eco-friendly solutions. This aligns with Lanxess’s strategy to meet the growing demand for sustainable cosmetic ingredients and maintain its competitive edge in the market.

The Dow Chemical Company, a leader in the cosmetic chemicals market, launched two new grades of REVOLOOP™ recycled plastics resins in 2024, aimed at enhancing sustainability in packaging solutions. These resins, made with up to 100% post-consumer recycled plastics, align with Dow’s commitment to advancing circularity. In 2023, Dow reported sales of approximately $45 billion. The company also sold its flexible packaging laminating adhesives business to Arkema for $150 million, focusing on core, high-value segments.

BASF SE, a prominent player in the cosmetic chemicals sector, focuses on innovative and sustainable solutions. Recently, BASF launched a new range of bio-based surfactants for personal care products, enhancing their eco-friendly portfolio. In 2023, BASF reported sales of €87 billion. The company’s strategic efforts include significant investments in R&D to drive innovation and maintain a competitive edge in the cosmetic chemicals market.

Conclusion

The market for cosmetic chemicals is poised for significant growth, driven by increasing consumer demand for beauty and personal care products. Innovations in product formulations and a shift towards sustainable and natural ingredients are key trends shaping the industry. However, regulatory scrutiny and consumer safety concerns remain challenges that companies must navigate carefully.

By focusing on research and development, and adhering to global standards, companies in the cosmetic chemicals sector can enhance their market position and meet evolving consumer preferences effectively. Thus, the future outlook for the cosmetic chemicals market appears robust, with opportunities for growth and innovation in response to changing consumer needs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)