Table of Contents

Introduction

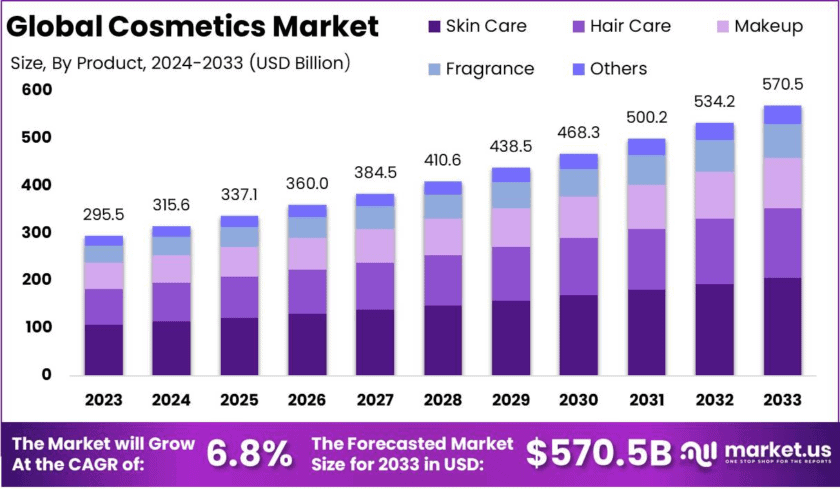

The Global Cosmetics Market is projected to grow from USD 295.5 billion in 2023 to USD 570.5 billion by 2033, registering a compound annual growth rate (CAGR) of 6.8% during the forecast period from 2024 to 2033.

The cosmetics market encompasses a broad range of beauty and personal care products designed for skin care, hair care, makeup, fragrance, and other grooming needs. It includes an array of products such as moisturizers, cleansers, shampoos, makeup items (e.g., foundations, lipsticks, eyeshadows), perfumes, and anti-aging treatments. The market is driven by both mass-market and premium brands, catering to diverse consumer segments and preferences. With a focus on enhancing appearance, personal hygiene, and overall well-being, the cosmetics market combines functional and aesthetic value, contributing significantly to the global economy.

The growth of the cosmetics market is fueled by several factors, including the increasing emphasis on self-care and grooming, particularly among millennials and Generation Z consumers. Additionally, the rise of social media and beauty influencers has transformed consumer behaviors, making cosmetics an integral part of daily routines. Technological advancements in product formulations, such as natural and organic ingredients or anti-aging solutions, also contribute to the market’s expansion. Furthermore, urbanization and rising disposable incomes in emerging economies have amplified demand for premium and innovative products, positioning these regions as pivotal growth engines.

The demand for cosmetics is strongly influenced by evolving consumer preferences, with a growing shift towards sustainable and cruelty-free products. Consumers today are more conscious about product ingredients, ethical sourcing, and environmental impacts, which has led to an increased preference for clean beauty and eco-friendly packaging. In addition, there is a rising demand for personalized cosmetics tailored to specific skin types and individual needs, a trend that brands are capitalizing on through advanced AI-driven solutions.

The cosmetics market offers significant opportunities, particularly in the areas of innovation, digital engagement, and geographic expansion. Brands are increasingly investing in R&D to develop products that align with consumer trends, such as the demand for natural and sustainable ingredients. The rapid growth of e-commerce platforms and the digital beauty space offers new channels for market penetration, enabling brands to reach global audiences more effectively. Emerging markets in Asia-Pacific, Latin America, and Africa also present lucrative opportunities due to rising urban populations and increasing purchasing power. Moreover, collaborations with tech firms to create AR-based virtual try-ons and personalized skincare solutions provide additional avenues for growth, enhancing customer experience and loyalty.

Key Takeaways

- The global cosmetics market is forecasted to expand from USD 265.4 billion in 2023 to USD 449.1 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.4%.

- The Skin Care segment emerges as a key driver, commanding a 36.2% market share in 2023, fueled by strong consumer demand for anti-aging solutions and natural product formulations.

- Women remain the primary consumer group, representing 66.9% of the market, supported by a broad portfolio of products and an increasing shift toward personalized beauty solutions.

- hypermarkets and supermarkets accounted for the largest share at 24.2% in 2023, owing to their convenience and extensive product variety.

- North America led the market with a 33.7% share, driven by high levels of consumer spending and a continuous stream of innovative product launches.

Cosmetics Statistics

- The global cosmetic industry is expected to generate $108.41 billion in 2024.

- Skincare comprises 42% of the total global beauty market.

- 58% of consumers spend between $1 and $100 monthly on skincare and makeup products.

- Social media ads influence 37% of shoppers when discovering new cosmetic brands.

- Online sales of U.S. beauty products are projected to reach $45 billion by 2027.

- 75% of consumers are willing to pay a premium for a personalized beauty shopping experience.

- 50% of consumers prioritize buying beauty products from brands that support diversity and inclusivity.

- The U.S. cosmetics market generates approximately $49.2 billion annually.

- The global beauty industry generates over $100 billion in annual revenue.

- The men’s personal care market is forecasted to reach $276.9 billion by 2030.

- Skincare is set to generate up to $177 billion by 2025.

- Beauty companies spent $7.7 billion on advertising in 2022.

- U.S. cosmetic retailers reported $17.09 billion in online sales.

- The global beauty industry revenue is anticipated to surpass $120 billion by 2025, despite an 8% decline in 2020.

- L’Oréal leads the beauty sector, generating $18 billion more in sales than Unilever.

- American women spend an average of $85 per month on haircuts, makeup, and skincare.

- American men spend around $2,928 annually on grooming products and services.

- The Asia-Pacific region dominates with over 40% of the beauty market share.

- Americans spend an average of $244 to $313 monthly on cosmetics.

- The global cosmetics industry’s total value stands at $571.10 billion.

- The industry experiences an annual growth rate of 3.8%.

- Personal care products represent 44.4% of the cosmetics market, valued at $253.3 billion.

- The U.S. beauty and personal care market is worth about $91.4 billion, accounting for 22% of global value.

- 61% of beauty consumers followed or visited a cosmetics brand on social media as of June 2019.

- 27% of young women never leave home without makeup.

- A survey shows 58% of girls aged 8 to 18 wear makeup, with 65% starting between 8 and 13 years.

- Skincare accounts for 42% of the global cosmetic market.

- Hair care represents 24% of the global market, following skincare.

- Makeup sales generate $77.8 billion of the $380.2 billion global cosmetics market.

Emerging Trends

- Sustainable Beauty: Increasing consumer demand for eco-friendly and ethically sourced products is driving brands to adopt sustainable packaging, vegan formulations, and cruelty-free practices.

- Personalized Skincare: Advanced AI and skin diagnostics are enabling brands to offer tailored skincare solutions based on individual skin types and conditions, enhancing consumer loyalty.

- Clean Beauty Movement: A shift towards transparency in ingredients has led to a surge in “clean beauty” products, emphasizing non-toxic, safe, and natural ingredients free from harmful chemicals.

- Men’s Grooming Expansion: The men’s grooming segment is rapidly growing, with more brands introducing skincare, beard care, and cosmetic products tailored specifically for male consumers.

- Tech-Integrated Beauty: Augmented reality (AR) and virtual try-on technologies are transforming the shopping experience, allowing consumers to test products virtually, enhancing convenience and engagement.

Top Use Cases

- Skincare Solutions: Targeted products like moisturizers, serums, and sunscreens address diverse skin concerns such as anti-aging, hydration, and protection against environmental damage.

- Makeup Enhancement: Foundations, lipsticks, and eye products enhance appearance and self-expression, catering to various skin tones and evolving beauty trends.

- Personalized Beauty: Customizable products based on individual skin type, preferences, and even DNA analysis offer tailored solutions, enhancing user experience and loyalty.

- Sustainable and Clean Beauty: Consumers increasingly prefer eco-friendly and toxin-free cosmetics, leading brands to innovate with natural ingredients and sustainable packaging.

- Male Grooming Products: The growing demand for men’s skincare, beard care, and grooming products highlights expanding demographics and market opportunities beyond traditional gender boundaries.

Major Challenges

- Regulatory Compliance: Adhering to diverse global regulations and standards for ingredients and labeling can be complex and costly, affecting product development timelines.

- Sustainability Demands: Growing consumer demand for eco-friendly and cruelty-free products forces companies to invest in sustainable practices, increasing production costs.

- Supply Chain Disruptions: Dependence on global suppliers for raw materials makes the industry vulnerable to geopolitical tensions, natural disasters, and logistical challenges.

- Intense Competition: High market saturation with numerous established brands and new entrants puts pressure on pricing and differentiation strategies.

- Evolving Consumer Preferences: Rapidly shifting trends and beauty standards require constant innovation and adaptation, increasing R&D and marketing expenditures.

Top Opportunities

- Rising Demand for Natural Products: Increasing consumer interest in organic and plant-based cosmetics creates opportunities for brands to develop clean, eco-friendly product lines that build trust and loyalty.

- E-commerce Expansion: The growth of online shopping and social media marketing enables brands to reach global audiences directly, enhancing visibility and expanding customer bases with lower overhead costs.

- Personalized Beauty Solutions: Advances in AI and data analytics allow companies to offer customized skincare and makeup products, meeting individual needs and creating a premium, tailored experience.

- Male Grooming Market Growth: The expanding male grooming segment provides a fresh avenue for product diversification, tapping into an audience increasingly interested in skincare, beard care, and cosmetic products.

- Emerging Markets Potential: Growing middle-class populations and rising disposable incomes in regions like Asia-Pacific and Latin America open up new, lucrative markets for both mass and premium cosmetic brands.

Key Player Analysis

- L’Oréal Group: The world’s largest cosmetics company, L’Oréal generated 41.18 billion euros sales in 2023. The company dominates across various segments including skincare, makeup, and hair care. It leverages a strong portfolio of brands like Maybelline, Lancôme, and Kiehl’s, alongside its innovative digital marketing strategies and e-commerce platforms

- Estée Lauder Companies : With revenues reaching $15.91 billion in 2023, Estée Lauder is a leader in luxury cosmetics, skincare, and fragrance. It focuses on premium brands such as MAC, Clinique, and Bobbi Brown, maintaining its edge through constant innovation and expansion into emerging markets.

- Procter & Gamble (P&G): P&G holds a significant share in the beauty and grooming sectors, with sales surpassing $14 billion in 2023. The company’s portfolio includes leading brands like Olay and Pantene. P&G’s growth is supported by its investment in product innovation and sustainability initiatives

- Unilever : Generating around €10 billion in sales in the beauty segment, Unilever’s portfolio includes Dove and TRESemmé. The company’s strategy revolves around promoting sustainable beauty and expanding its digital footprint to capture more market share, particularly in Asia and Latin America

- Shiseido Company, Limited : A major player in the Asian and global markets, Shiseido reported revenue of approximately ¥1.2 trillion ($8 billion) in 2023. The brand’s strength lies in skincare and premium cosmetics, driven by its innovation labs and focus on digital transformation to enhance customer engagement

Recent Developments

- In April 2023, L’Oréal acquired the premium skincare brand Aesop from Natura & Co. for $2.525 billion. This acquisition strengthens L’Oréal’s luxury skincare offerings and marks one of the largest transactions in the beauty industry that year, showcasing the strategic focus on premium skincare.

- In September 2024, Euroitalia acquired the beauty and fragrance rights for Moschino from Aeffe Group. The initial payment was 39.6 million euros, with further payments planned by the end of 2024. This acquisition is aimed at expanding Euroitalia’s luxury fragrance portfolio.

- In August 2023, e.l.f. Beauty acquired Naturium, a high-performance skincare brand, for $355 million. This investment broadens e.l.f.’s product range, appealing to both millennials and male consumers, and expands its customer base significantly.

Conclusion

The global cosmetics market is dynamic and rapidly evolving, driven by increasing consumer awareness of beauty, wellness, and self-care. With the rise of digital platforms and e-commerce, companies are more capable than ever of reaching diverse demographics, expanding their market presence worldwide. Key trends, such as the demand for natural and sustainable products, inclusivity in beauty, and the growth of the male grooming segment, highlight the shifting landscape where innovation and adaptability are paramount.

Leading players continue to leverage technology and consumer insights to develop personalized and eco-conscious solutions, ensuring sustained growth and relevance in this competitive industry. As emerging markets gain purchasing power, the cosmetics sector remains poised for significant expansion, propelled by a blend of tradition and modernity.