Table of Contents

Introduction

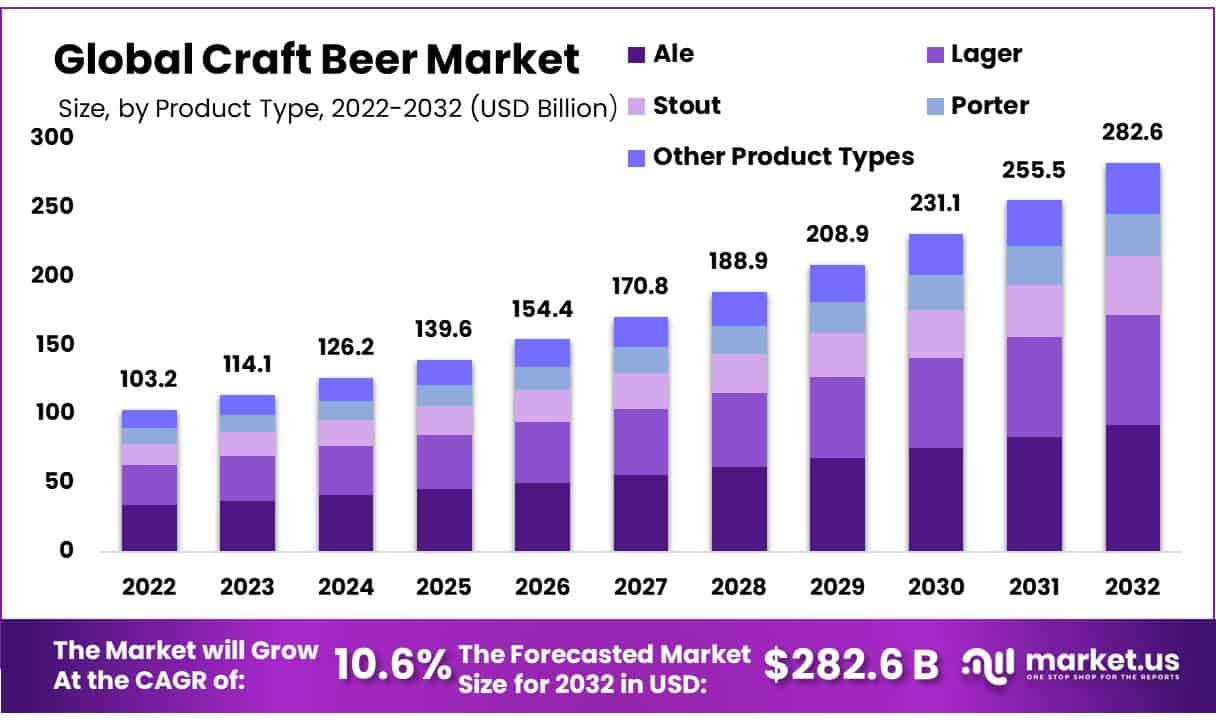

The global craft beer market is poised for significant growth, expecting to expand from USD 103.2 billion in 2022 to approximately USD 282.6 billion by 2032, achieving a compound annual growth rate (CAGR) of 10.6%. This growth is driven by a surge in consumer demand for diverse and innovative beer flavors and the growing influence of craft beer across various regions.

However, the market faces certain challenges. Supply chain disruptions, particularly those affecting the availability of local and seasonal ingredients, pose a risk to production stability and consistency. Moreover, craft breweries must navigate complex regulatory landscapes, varying significantly by region and impacting market entry and expansion strategies.

Recent developments within the sector underscore its dynamic nature. For instance, in 2023, significant mergers and acquisitions have occurred, reflecting consolidation trends as companies aim to leverage brand loyalty and expand their market presence. Additionally, the rise of non-alcoholic craft beers caters to a growing segment of health-conscious consumers, adding to the market’s diversification.

Anheuser-Busch InBev (AB InBev) has been actively resizing its portfolio in the craft beer segment. In a notable move, AB InBev sold eight of its craft beer brands to Tilray, a global cannabis and beverage company. This sale included brands such as Shock Top, Breckenridge Brewery, and Blue Point Brewing Company, among others.

The deal, valued at $85 million, is part of AB InBev’s broader strategy to streamline its operations and focus on its more profitable brands. This transaction will significantly expand Tilray’s U.S. market presence, making it the fifth-largest craft beer company in the country. The acquisition includes all associated employees, brewing facilities, and brewpubs, aiming to enhance Tilray’s production and distribution capabilities

The craft beer market continues to benefit from a strong consumer shift towards premiumization and variety, with ales leading the charge due to their wide range of styles and flavors. This trend is complemented by the global expansion of craft breweries and an increase in collaborative efforts, which together facilitate innovation and consumer engagement.

Key Takeaways

- Projected CAGR for global craft beer: 10.6% from 2023-2032.

- Popular craft beer categories: Ales (32.6%), Porters, and Stouts.

- Alcoholic craft beer dominates the market with over 80% share.

- Distribution split: On-trade and off-trade channels hold 60% market share.

- North America leads, with 38% global craft beer market share in 2022.

Craft Beer Statistics

- Breweries in the U.S.: Over 8,000 craft breweries exist in the United States as of 2023.

- Market Growth: The craft beer market witnessed a 6% growth in 2022.

- Market Share: Craft beer holds about 25% of the total beer market share.

- Revenue: Craft beer sales generated $29.3 billion in revenue in 2022.

- Production Volume: Craft beer production reached 24.7 million barrels in 2022.

- Employment: The craft beer industry employs over 161,000 people.

- Variety: Craft brewers produce over 200 beer styles, offering diverse options.

- Export: Craft beer exports from the U.S. increased by 12% in 2022.

- Craft beer sales volume in 2023: 269.5 million barrels.

- Percentage of beer drinkers who prefer craft beer: 23%.

- Increase in craft beer sales volume from 2022 to 2023: 4.6%.

- Alcohol by Volume (ABV): Typically ranges from 4% to 10%, with some specialty beers reaching up to 15% ABV.

- International Bitterness Units (IBU): Varies from 5 IBU for light beers to over 100 IBU for highly bitter IPAs.

- Original Gravity (OG): Usually falls between 1.030 and 1.090, representing the density of the wort before fermentation.

- Final Gravity (FG): Typically ranges from 1.002 to 1.030, indicating the density of the beer after fermentation.

- Color: Measured in SRM (Standard Reference Method), with values ranging from 2 SRM for pale lagers to 40+ SRM for stouts and porters.

- Carbonation Level: Typically between 2.0 to 2.5 volumes of CO2, providing the desired level of fizziness.

- Serving Temperature: Varies from 38°F to 55°F (3°C to 13°C), depending on the style and personal preference.

- Calories: Can range from 100 to 300 calories per 12-ounce serving, with higher ABV beers typically containing more calories.

- Price: Prices vary widely depending on factors such as brand, style, and location, but can range from $1 to $20 or more per bottle or can.

Emerging Trends

- Diversity in Beer Styles: Craft beer continues to embrace a broad spectrum of flavors and styles. Particularly notable are hazy and juicy IPAs, which remain popular for their fruity and cloudy characteristics. Additionally, there’s a significant interest in sour beers and lagers, once considered less typical for craft breweries, which are now gaining popularity due to their refreshing flavors.

- Innovations Beyond Traditional Beers: Many craft brewers are expanding their product lines beyond traditional beers. This includes experimenting with ready-to-drink (RTD) beverages like hard kombuchas, hard teas, and even craft spirits. This trend reflects a shift towards offering a wider variety of alcoholic options to cater to diverse consumer tastes.

- Non-Alcoholic Options: The rise of health-conscious consumers has propelled the growth of non-alcoholic craft beers. These beverages are designed to offer the complex flavors of craft beers without the alcohol, catering to those who seek to enjoy beer taste responsibly. The technological advancements in brewing are making these options more authentic and flavorful.

- Sustainability Initiatives: Environmental responsibility is becoming a priority within the craft brewing community. Many breweries are implementing sustainable practices, such as using eco-friendly packaging, sourcing ingredients locally to reduce carbon footprints, and managing waste more effectively by recycling brewing byproducts.

- Technological Innovations in Brewing: Craft breweries are also focusing on technological improvements to enhance efficiency and sustainability. This includes optimizing the use of resources like water and carbon dioxide and exploring new brewing techniques that can enhance flavor profiles or reduce production costs.

Use Cases

- Expansion of Distribution Networks: The strategic partnerships between craft brewers and distribution companies are crucial for market expansion. These partnerships allow craft brewers to access established distribution networks, enabling them to reach more bars, restaurants, and retailers, thereby increasing their market presence and profitability.

- Incorporation of Local Ingredients: The increasing availability of local ingredients, such as hops and craft malts, is driving innovation in the craft beer market. For instance, the rise in U.S. hop production, which saw a value of $662 million in 2021, supports the crafting of diverse and regionally distinct beers. This not only appeals to consumer preferences for local products but also supports regional agricultural economies.

- Diversification into Non-Alcoholic and Low-Alcohol Products: Amidst a growing health-conscious consumer base, there is a significant trend towards non-alcoholic and low-alcohol craft beers. This diversification allows craft breweries to cater to a broader audience, including those who enjoy the taste of beer but prefer to avoid alcohol due to health reasons or lifestyle choices.

- Growth in the U.S. Market: The U.S. craft beer market has shown robust growth, with an estimated value increase from $29.03 billion in 2022 to a projected $52.47 billion by 2028. This growth is facilitated by the rising demand for diverse and flavorful craft beers, the trend of small-scale breweries, and increasing consumer expenditure on premium alcoholic beverages.

- Craft Breweries as Social Hubs: Craft breweries often function as community hubs, offering a social space that enhances customer engagement and loyalty. They are not just places to drink beer; they serve as venues for community events, social gatherings, and cultural celebrations, thus embedding themselves into the local culture and lifestyle.

Key Players Analysis

Anheuser-Busch InBev (AB InBev), the world’s largest brewer, has been recalibrating its craft beer portfolio. In a notable move, the company recently divested eight of its craft beer brands to Tilray Brands, significantly downsizing its presence in the craft beer segment. This sale included well-known brands such as Shock Top and Breckenridge Brewery among others, signaling a shift in AB InBev’s strategy towards focusing more on its core brands and possibly other beverage sectors like spirits-based ready-to-drink products. This strategy reflects a broader trend in the beer industry where large corporations are re-evaluating their craft beer operations amidst changing market dynamics and consumer preferences.

Beijing Enterprises Holdings Limited, primarily known for its utilities and real estate ventures, also operates in the beverage industry through its subsidiary, Yanjing Brewery, one of China’s major beer producers. While not traditionally known for craft beer, the company has the potential to leverage its substantial distribution network to tap into the growing craft beer market in China, where consumer interest in diverse and premium beer options is rising. This could represent a strategic expansion opportunity for Beijing Enterprises as the global craft beer market continues to evolve.

Carlsberg Group continues to make its mark in the craft beer sector by focusing on specialty and premium brands. Despite facing a challenging economic environment, Carlsberg has reported growth, particularly in Asia, underscoring its strength in international markets. The company has been actively managing its portfolio, emphasizing innovative and regionally tailored offerings that cater to evolving consumer tastes. This strategic focus on quality and local flavors is helping Carlsberg maintain its position as a key player in the global beer market

Diageo PLC, traditionally known for its leadership in spirits, has ventured into the craft beer sector through acquisitions and innovation. The company owns the Guinness brand, which includes craft-style offerings like the Open Gate Brewery in Dublin, where it experiments with new and experimental beers. Diageo’s approach combines its extensive experience in premium beverages with innovative brewing techniques to capture a significant share of the craft beer market, leveraging its global distribution network to reach a diverse customer base.

Dogfish Head Craft Brewery, a pioneer in the craft beer industry, continues to innovate with its unique and diverse beer offerings. Known for their off-centered approach, Dogfish Head consistently pushes the boundaries of traditional brewing. In 2023, they have introduced a series of new and intriguing beers, including a variety of IPAs and unique concoctions like the “Catchy Chorus,” a hazy double IPA, and the “BoDeGose,” a session sour with exotic ingredients. They also continue to produce fan favorites like the 60 Minute IPA and the rich, complex World Wide Stout. These efforts highlight Dogfish Head’s commitment to creativity and quality in the craft beer sector.

Heineken Holding N.V. has been actively engaging in the craft beer sector, leveraging its global brand to enhance its craft beer offerings. Despite facing a challenging market environment, Heineken has focused on expanding its craft beer portfolio through strategic acquisitions and innovations, catering to a growing demand for specialty beers. This approach is part of Heineken’s broader strategy to diversify its product offerings and meet the evolving tastes of beer drinkers worldwide, thereby maintaining its prominence in the competitive beer market.

Squatters Pub and Beers, established in 1989 in downtown Salt Lake City, has been a pivotal player in Utah’s craft beer scene. It began as Salt Lake City’s first brewpub, spurred by Utah’s changing laws that allowed brewpubs to operate. Over the years, Squatters has expanded its influence and offerings, creating a wide range of craft beers that have remained popular for decades. The brewery’s commitment to innovation is highlighted by its recent launches like the 147 West Broadway series, which includes unique takes on IPAs that tap into the latest brewing trends. This series not only showcases Squatters’ ability to innovate continuously but also its dedication to capturing the essence of craft brewing—creating beers that are both trendsetting and reflective of their community roots.

Sierra Nevada Brewing Co., a pioneer in the craft beer industry since its inception in 1980, has continued to influence the sector profoundly through its dedication to quality and innovation. Known for its iconic Pale Ale, which played a pivotal role in sparking the American craft beer revolution, Sierra Nevada has consistently introduced bold and varied beer styles to cater to an ever-expanding audience of craft beer enthusiasts. The brewery is renowned for its sustainable brewing practices and a broad portfolio that includes a range of IPAs, lagers, and special collaborations, such as the Oktoberfest Festbier created with Germany’s Kehrwieder Brewery. This blend of tradition and innovation ensures Sierra Nevada remains a key player in the craft beer scene, continually adapting to consumer tastes and environmental considerations.

The Boston Beer Company, Inc., established in 1984, is a prominent figure in the craft beer industry, renowned for its Samuel Adams brand. Despite facing challenges such as a decline in shipment volumes and competitive pressures, the company remains a key player due to its strong brand portfolio and innovative approaches. Recent initiatives include revamping its flagship Boston Lager to enhance its taste and market appeal. The company also embraces diverse beverage offerings, expanding beyond beer to include hard seltzers and ciders, demonstrating its adaptability in a shifting market landscape.

United Breweries Limited, a prominent player in India’s alcoholic beverage industry, has made significant strides in the craft beer sector. As a subsidiary of the global brewing leader Heineken N.V., United Breweries commands a strong presence in the Indian market with its flagship Kingfisher brand, which is widely recognized both domestically and internationally. The company continues to innovate within the craft beer segment, focusing on expanding its product range to meet the evolving tastes of consumers. With a robust manufacturing network and a commitment to quality, United Breweries has established itself as a key player in India’s growing craft beer market, contributing to its reputation as a dynamic and forward-looking company in the global beer industry.

Kove USA, Inc., based in San Diego, California, stands out in the craft beer sector for its unique approach to brewing. They specialize in creating ready-to-drink craft cocktails that are both inspired by and dedicated to reflecting the vibrant, beachside lifestyle of San Diego. Their product line includes innovative flavors like Party Wave Punch, Dragon Fruit Margarita, and Desert Rose Paloma, all of which are designed to resonate with the laid-back, sunny vibes of their locale. Kove focuses on offering products that are not only appealing in taste but also in their environmental impact, using organic ingredients and maintaining a commitment to sustainability. This approach has positioned them as a creative and eco-conscious player in the craft brewing scene.

Conclusion

The craft beer market is undergoing a dynamic evolution, highlighted by its expanding diversity in beer styles and flavors, and the strategic embrace of both traditional and innovative brewing approaches. As the industry adapts to the growing consumer demand for local, sustainable, and varied beer options, craft brewers are increasingly leveraging local ingredients and expanding their product lines to include non-alcoholic and low-alcohol variants, meeting the needs of health-conscious consumers.

The U.S. craft beer market, with its expected growth from $29.03 billion in 2022 to $52.47 billion by 2028, reflects not only an increased consumer preference for quality and flavor but also the industry’s ability to adapt to broader economic and social trends. Moving forward, the craft beer industry appears poised for continued growth, driven by its ability to innovate and respond to the nuanced tastes of a diverse drinking audience.