Table of Contents

- Introduction

- Editor’s Choice

- Cruise Market Overview Statistics

- Global Cruise Passengers Carried and Growth Rates Statistics

- Countries Leading in the Cruise Industry Revenue Statistics

- Largest Cruise Ships Worldwide – By Gross Tonnage

- Leading Ocean Cruise Destinations Worldwide

- World’s Busiest Cruise Ports

- Global Average Capacity for Ocean Cruise Ships

- Most Expensive Global Cruise Ships- By Construction Price

- Demographics of Cruise Passengers Statistics

- Cruise Passenger Attitudes and Behaviour Statistics

- Cruise Tourism Future Projections Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Cruise Statistics: The cruise industry has a rich history, dating back to the 19th century, with modern cruising gaining popularity in the mid-20th century.

The industry caters to diverse interests and preferences by offering various types of cruises. Including ocean, river, expedition, theme, and luxury cruises.

Popular destinations span the globe, from the Caribbean’s pristine beaches to Europe’s historic cities and Alaska’s stunning scenery.

Major players like Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings dominate the market, offering unique experiences.

Recent trends focus on sustainability, technology integration, health and wellness, and customization. Reflecting the industry’s continuous evolution to meet consumer demands.

Editor’s Choice

- The global cruise market has demonstrated a steady upward trajectory in revenue at a CAGR of 11.50%.

- As the market expanded in 2023, total revenues rose to $8.8 billion. Accompanied by an increase in ocean cruises to $7.04 billion and river cruises to $1.76 billion.

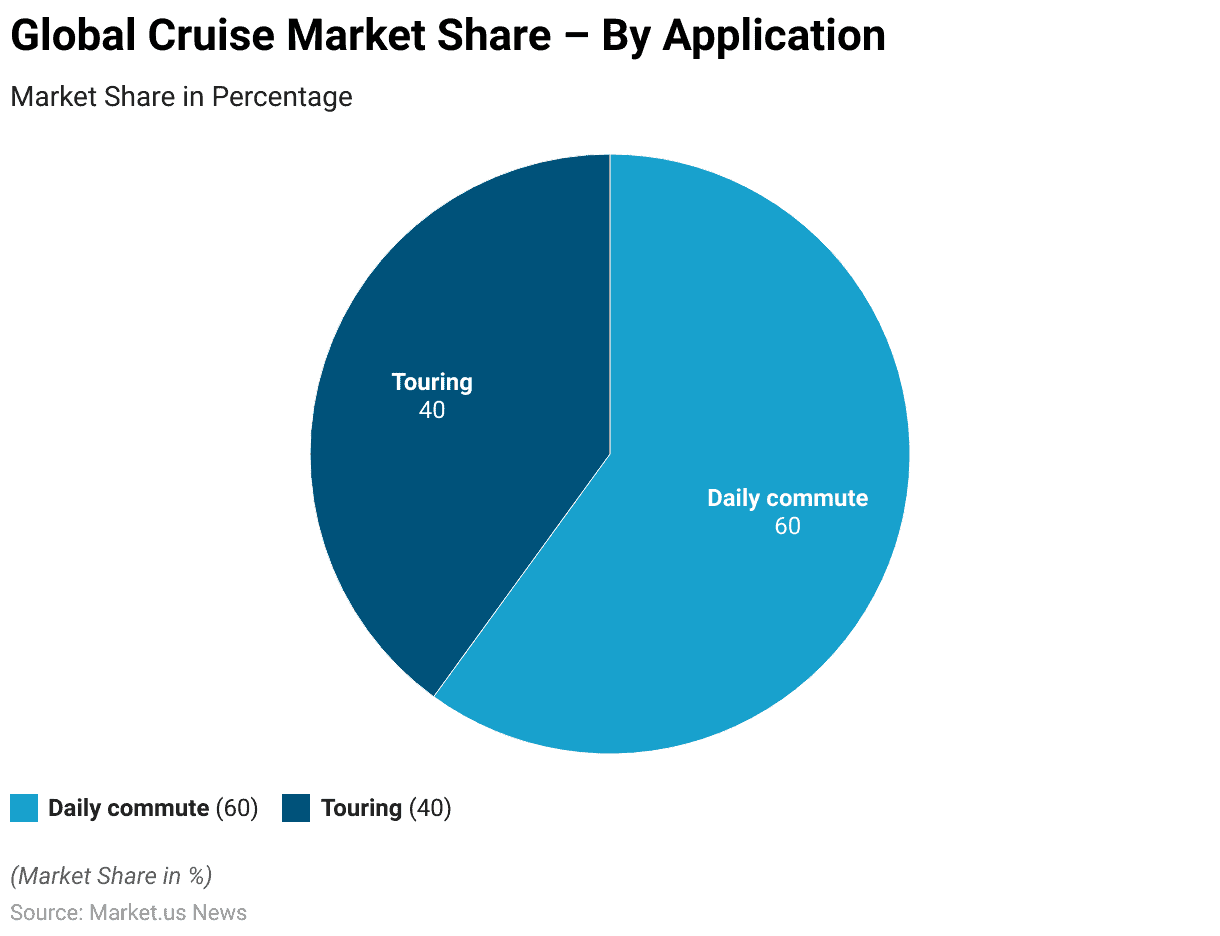

- In the context of market share distribution for different applications. Daily commuting commands a significant majority, accounting for 60% of the market.

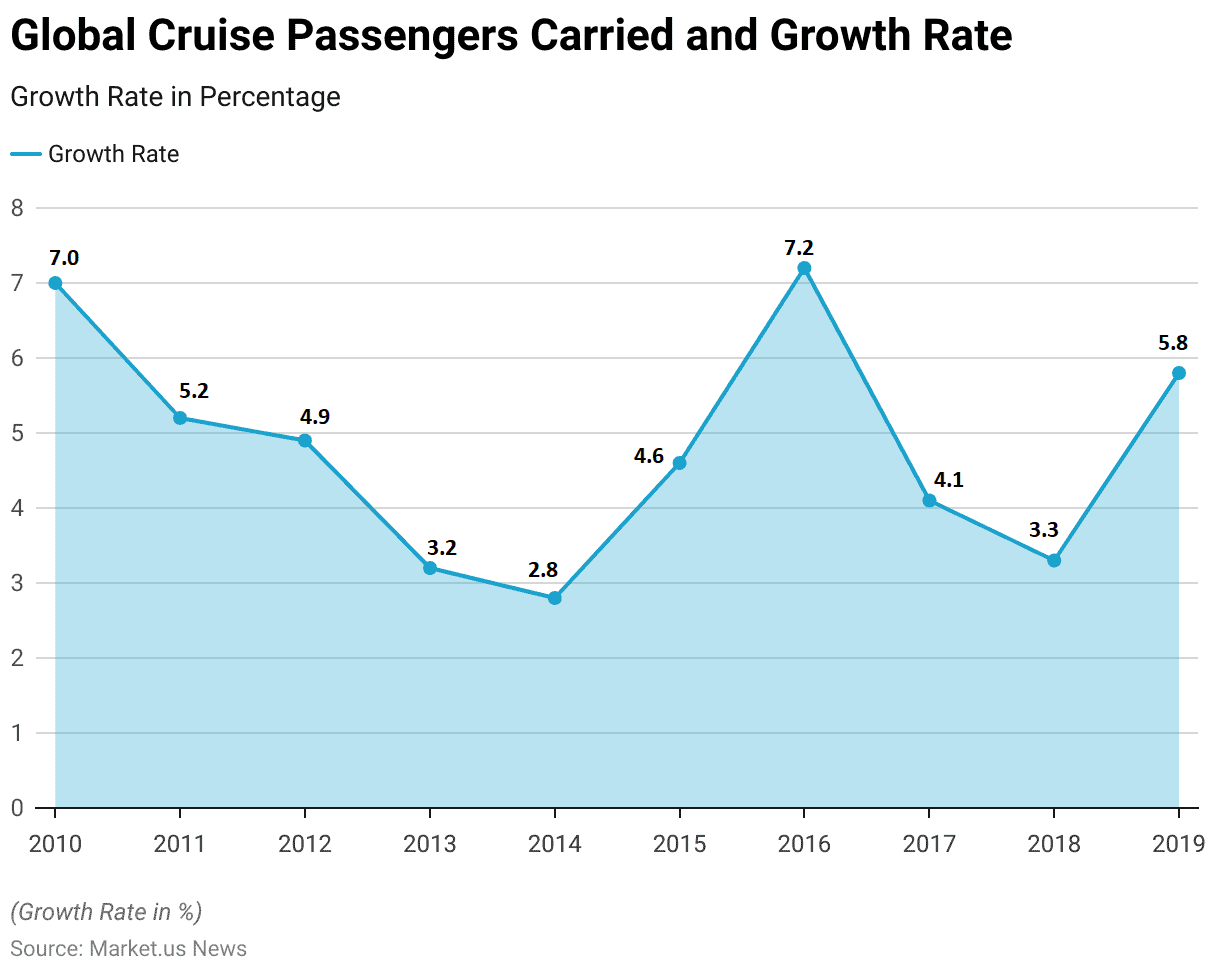

- The cruise industry experienced a resurgence in 2019, with a growth rate of 5.8%. Reflecting renewed interest and increasing demand for cruise vacations.

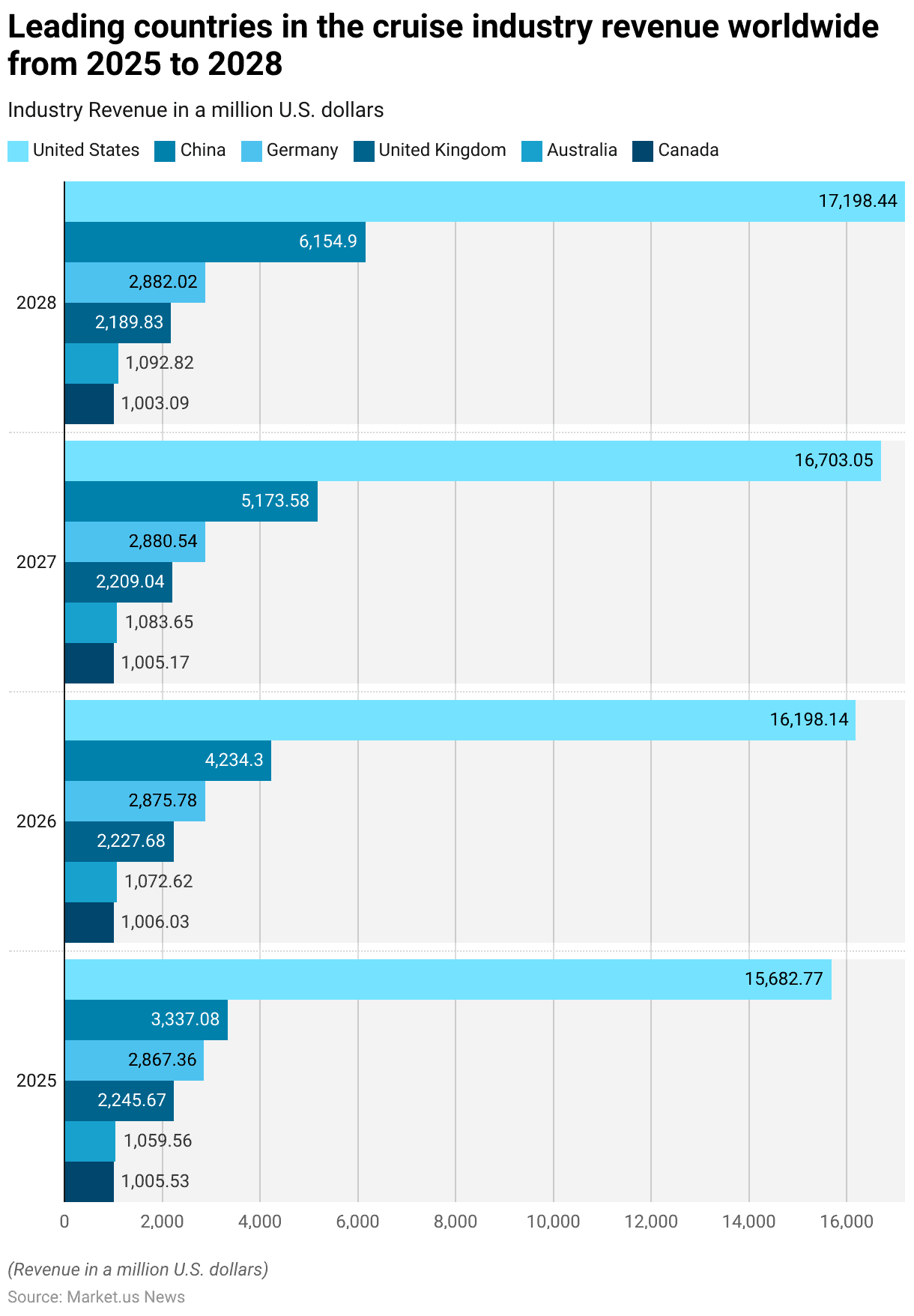

- The United States consistently maintained its dominant position from 2025-2028. With revenue figures steadily increasing from $15,682.77 million in 2025 to $17,198.44 million in 2028.

- The leading ocean cruise destinations worldwide, as of the latest data. Highlight the Caribbean, Bahamas, and Bermuda as the most popular choice. Commanding a significant share of 45% of all passengers.

- By 2025, the global average capacity for ocean cruise ships is expected to peak at 764,440 tonnes.

Cruise Market Overview Statistics

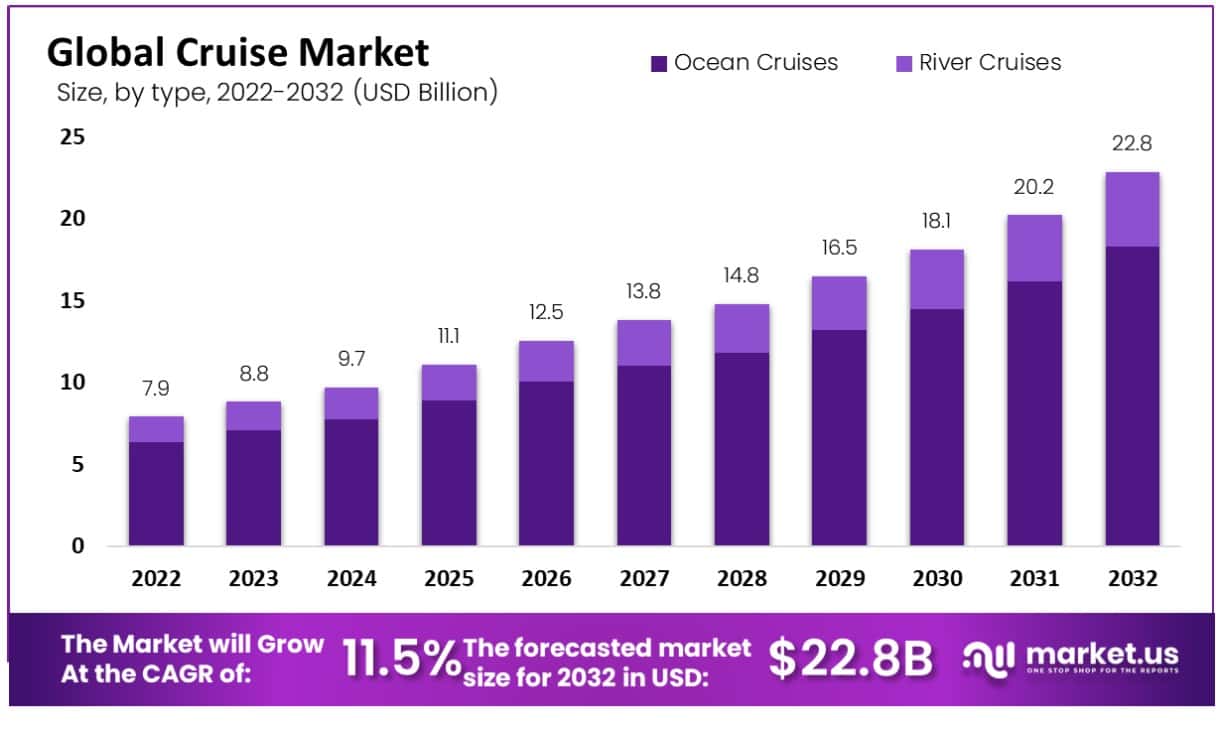

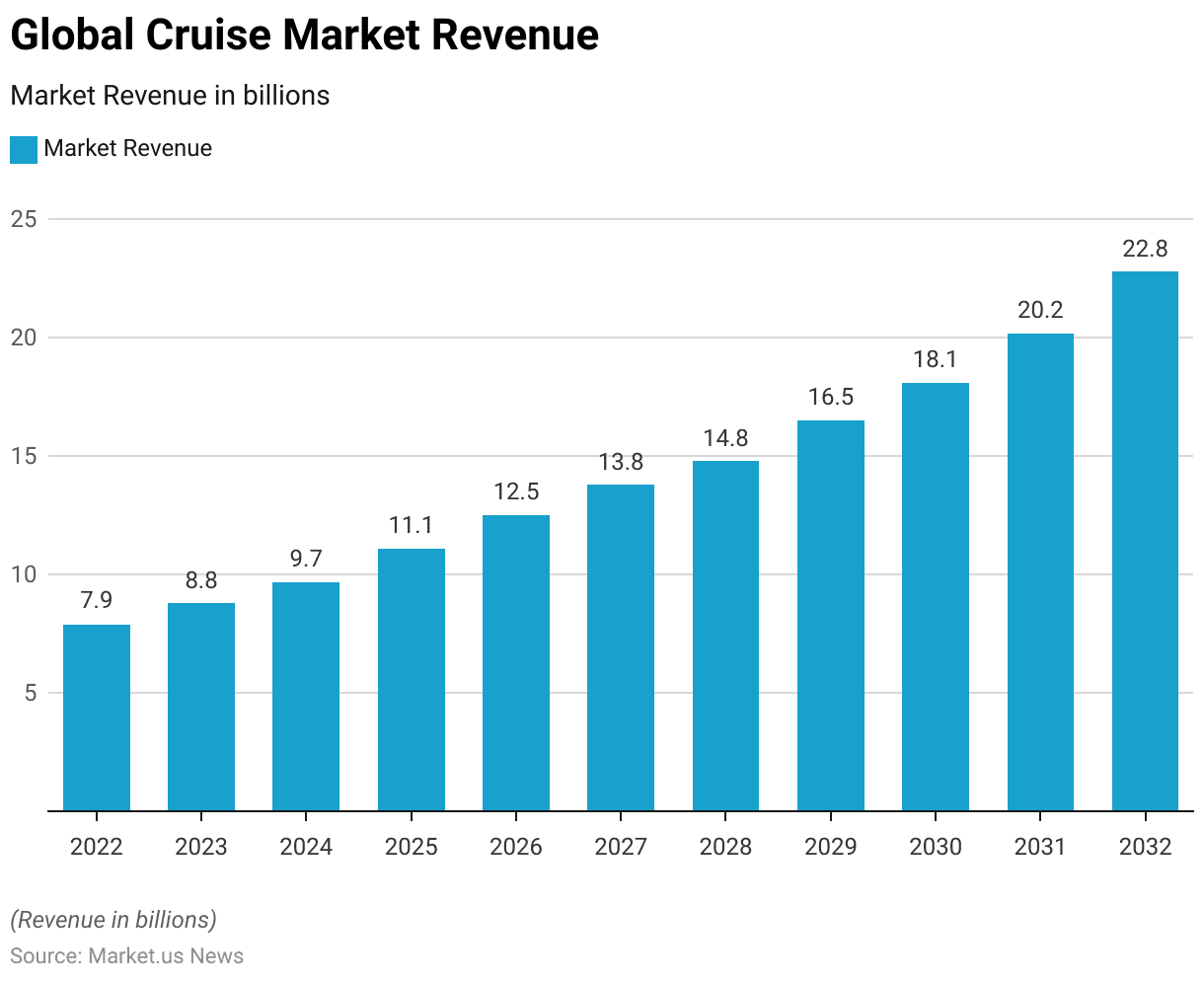

Global Cruise Market Size Statistics

- The global cruise market has demonstrated a steady upward trajectory in revenue at a CAGR of 11.50%, commencing with $7.9 billion in 2022.

- The following year, 2023, saw an increase to $8.8 billion, indicating a resilient growth trend.

- This positive momentum is expected to continue, with projections showing a gradual rise each subsequent year. In 2024, the market is anticipated to reach $9.7 billion. Followed by a significant jump to $11.1 billion in 2025.

- The upward trend persists through the latter half of the decade. With revenue climbing to $12.5 billion in 2026 and further to $13.8 billion in 2027.

- By 2028, the market is expected to generate $14.8 billion. Leading up to a more pronounced increase to $16.5 billion in 2029.

- The growth pattern remains robust into the next decade. With revenues forecasted at $18.1 billion in 2030. Followed by $20.2 billion in 2031, and reaching $22.8 billion by 2032.

- This consistent expansion highlights the cruise industry’s resilience and its capacity to attract a growing base of customers globally.

(Source: market.us)

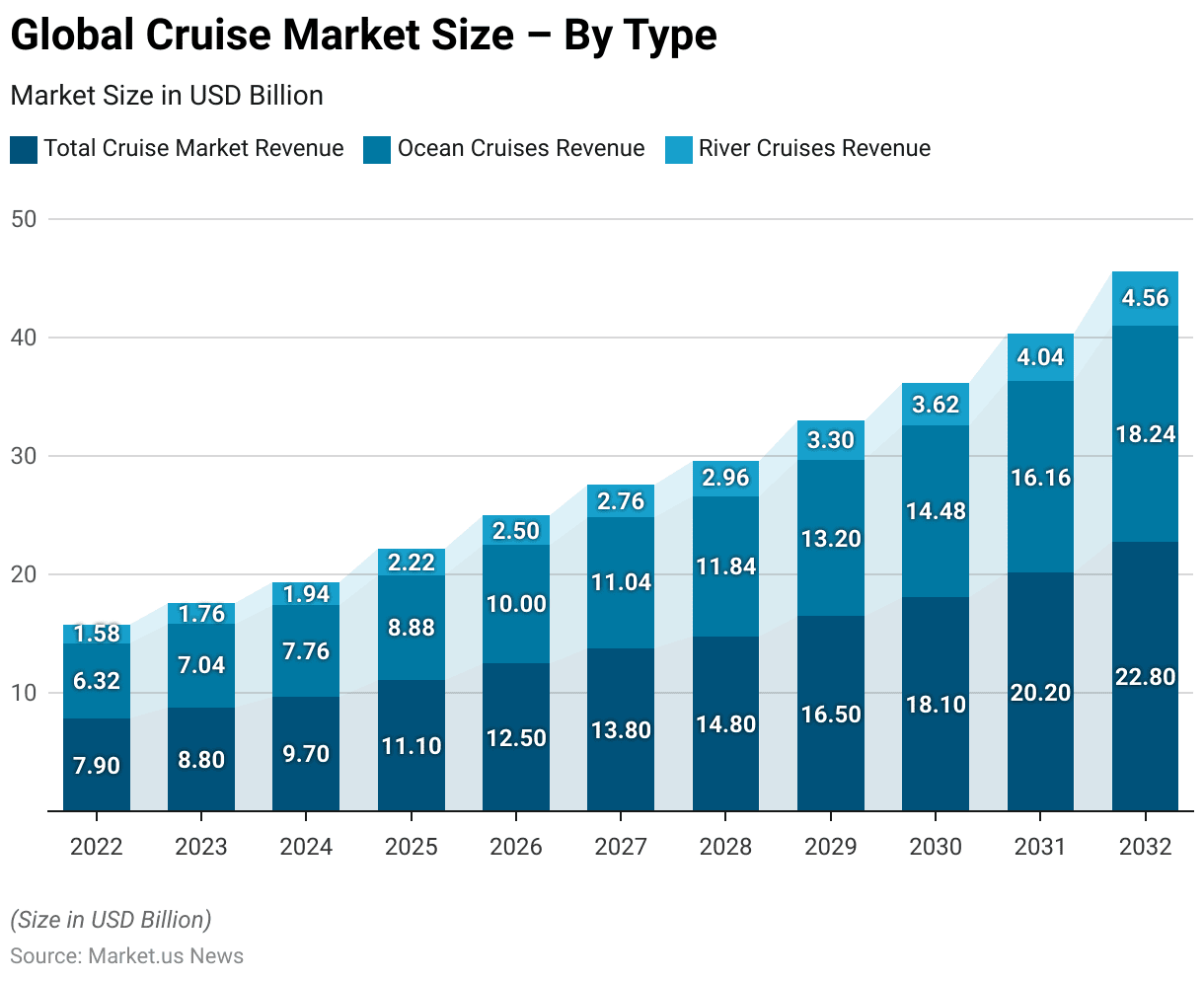

Global Cruise Market Size – By Type Statistics

- The global cruise market is segmented into ocean and river cruises, each showing distinctive growth patterns. In 2022, the total cruise market revenue stood at $7.9 billion. With ocean cruises contributing $6.32 billion and river cruises $1.58 billion.

- As the market expanded in 2023, total revenues rose to $8.8 billion. Accompanied by an increase in ocean cruises to $7.04 billion and river cruises to $1.76 billion.

- This trend of growth persisted through the subsequent years. By 2024, total revenue reached $9.7 billion. With ocean cruises at $7.76 billion and river cruises at $1.94 billion. The market continued to flourish, with total revenue escalating to $11.1 billion in 2025. Ocean cruises accounted for $8.88 billion and river cruises $2.22 billion.

- The upward trajectory maintained momentum into the late 2020s. With total market revenue growing to $12.5 billion in 2026. Ocean cruises make up $10.00 billion, and river cruises $2.50 billion. By 2027, the figures rose to $13.8 billion overall, with ocean cruises at $11.04 billion and river cruises at $2.76 billion.

More

- The growth trend continued with total revenue reaching $14.8 billion in 2028. Ocean cruises contributed $11.84 billion, and river cruises $2.96 billion. Significant growth was observed in 2029, with total revenue at $16.5 billion. Ocean cruises at $13.20 billion, and river cruises at $3.30 billion.

- Heading into the 2030s, the market expanded to $18.1 billion in 2030. With ocean cruises at $14.48 billion and river cruises at $3.62 billion. The market peaked in 2031 with a total revenue of $20.2 billion. With ocean cruises generating $16.16 billion and river cruises $4.04 billion.

- By 2032, the total market surged to $22.8 billion. With ocean cruises contributing $18.24 billion and river cruises reaching $4.56 billion. This data underscores a robust and sustained growth in the global cruise market. Particularly emphasizing the dominant share held by ocean cruises over river cruises.

(Source: market.us)

Cruise Market Share – By Application Statistics

- In the context of market share distribution for different applications. Daily commuting commands a significant majority, accounting for 60% of the market.

- This underscores the primary role of this application in the everyday lives of consumers. Where reliability and efficiency are likely key drivers.

- On the other hand, touring holds a 40% share, indicating a robust interest in this area as well.

- While touring may cater to more leisurely or non-routine travel. Its substantial market share suggests it is also a critical component of the market. Appealing perhaps to different consumer preferences and needs.

- Together, these segments illustrate a diversified market landscape where both daily commuting and touring are integral to the overall dynamics of the industry.

(Source: market.us)

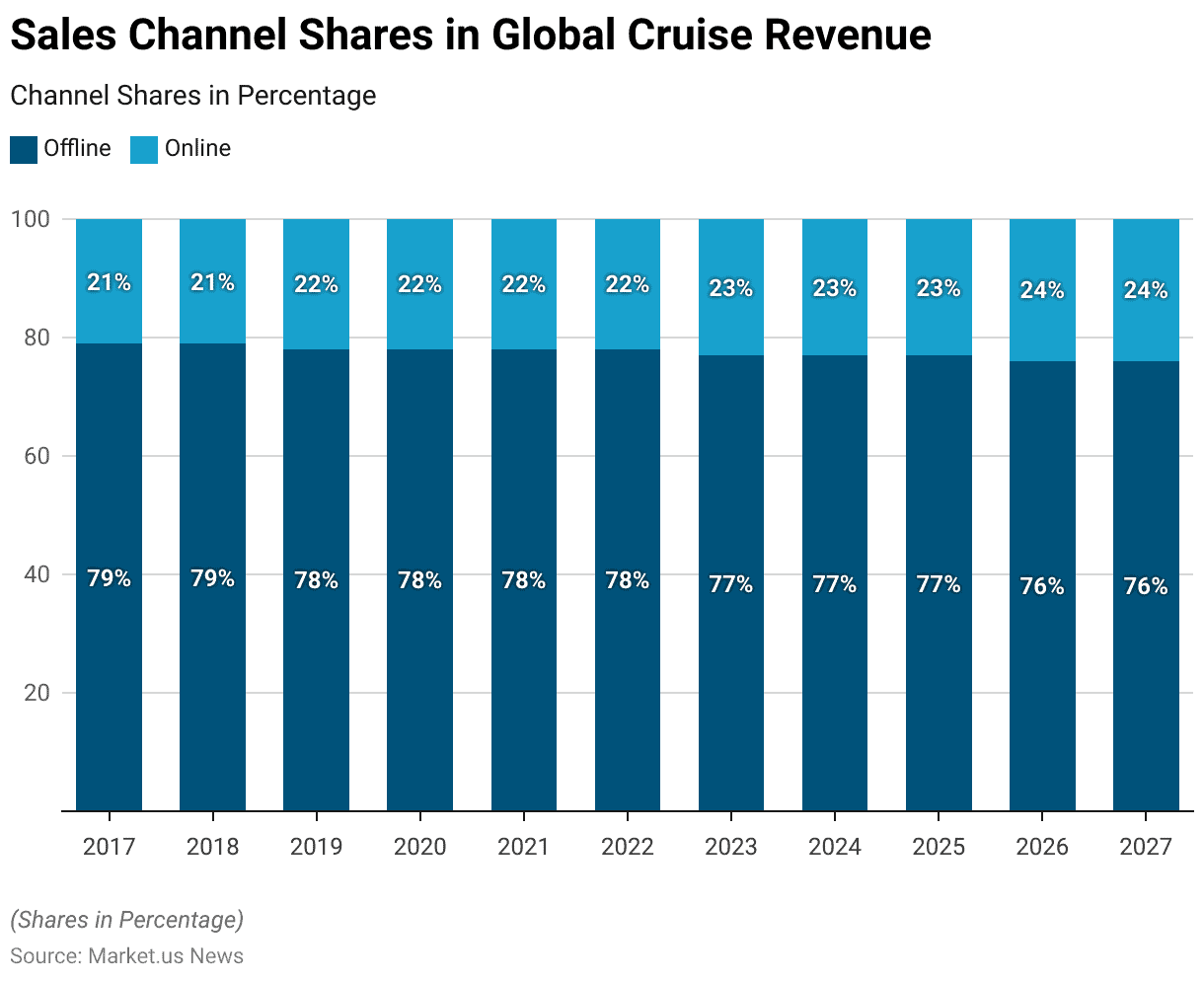

Sales Channel Shares in Global Cruise Revenue

- From 2017 to 2027, the distribution of sales channels in global cruise revenue has remained relatively stable, with offline channels consistently holding the majority share.

- In 2017, offline sales accounted for 79% of revenue, while online sales constituted 21%.

- This trend persisted through 2022, with offline channels maintaining a steady 78% share and online channels at 22%.

- However, a gradual shift occurred from 2023 onwards. With offline sales declining to 77% by 2025 and further to 76% by 2027.

- Conversely, online sales saw a corresponding increase, rising to 23% in 2023 and eventually reaching 24% by 2027.

- This evolving pattern reflects the growing influence of digital platforms in the cruise industry. As consumers increasingly turn to online channels for booking and purchasing cruise packages.

(Source: Statista)

Global Cruise Passengers Carried and Growth Rates Statistics

- Between 2010 and 2019, the global cruise industry experienced fluctuating growth rates in the number of passengers carried annually.

- Starting at a growth rate of 7.0% in 2010, the industry saw a slight decrease to 5.2% in 2011. Followed by further declines to 4.9% in 2012 and 3.2% in 2013.

- This downward trend continued into 2014 with a growth rate of 2.8%.

- However, the industry rebounded in 2015 with a growth rate of 4.6%. Followed by a significant increase to 7.2% in 2016. In 2017, growth moderated to 4.1% and further to 3.3% in 2018.

- The industry experienced a resurgence in 2019, with a growth rate of 5.8%, reflecting renewed interest and increasing demand for cruise vacations.

- Overall, these fluctuations demonstrate the dynamic nature of the cruise industry. Influenced by various factors, including economic conditions, market trends, and consumer preferences.

(Source: Port Economics Management)

Countries Leading in the Cruise Industry Revenue Statistics

- From 2025 to 2028, several countries emerged as leaders in the global cruise industry in terms of revenue.

- The United States consistently maintained its dominant position throughout this period. With revenue figures steadily increasing from $15,682.77 million in 2025 to $17,198.44 million in 2028.

- China experienced significant growth, rapidly climbing the ranks to become a formidable player in the industry. Starting at $3,337.08 million in 2025, China’s revenue surged to $6,154.90 million by 2028, reflecting its expanding market presence.

- Germany remained relatively stable, with revenue figures hovering around the $2,800 million mark from 2025 to 2028.

- The United Kingdom and Australia exhibit slight declines in revenue, yet they remain significant contributors to the global cruise industry.

- Canada’s revenue remains relatively consistent, hovering around the $1,000 million mark annually.

- This data underscores the enduring prominence of the United States in the global cruise market, with China emerging as a promising contender. At the same time, other nations maintain their positions within the industry’s landscape.

(Source: Statista)

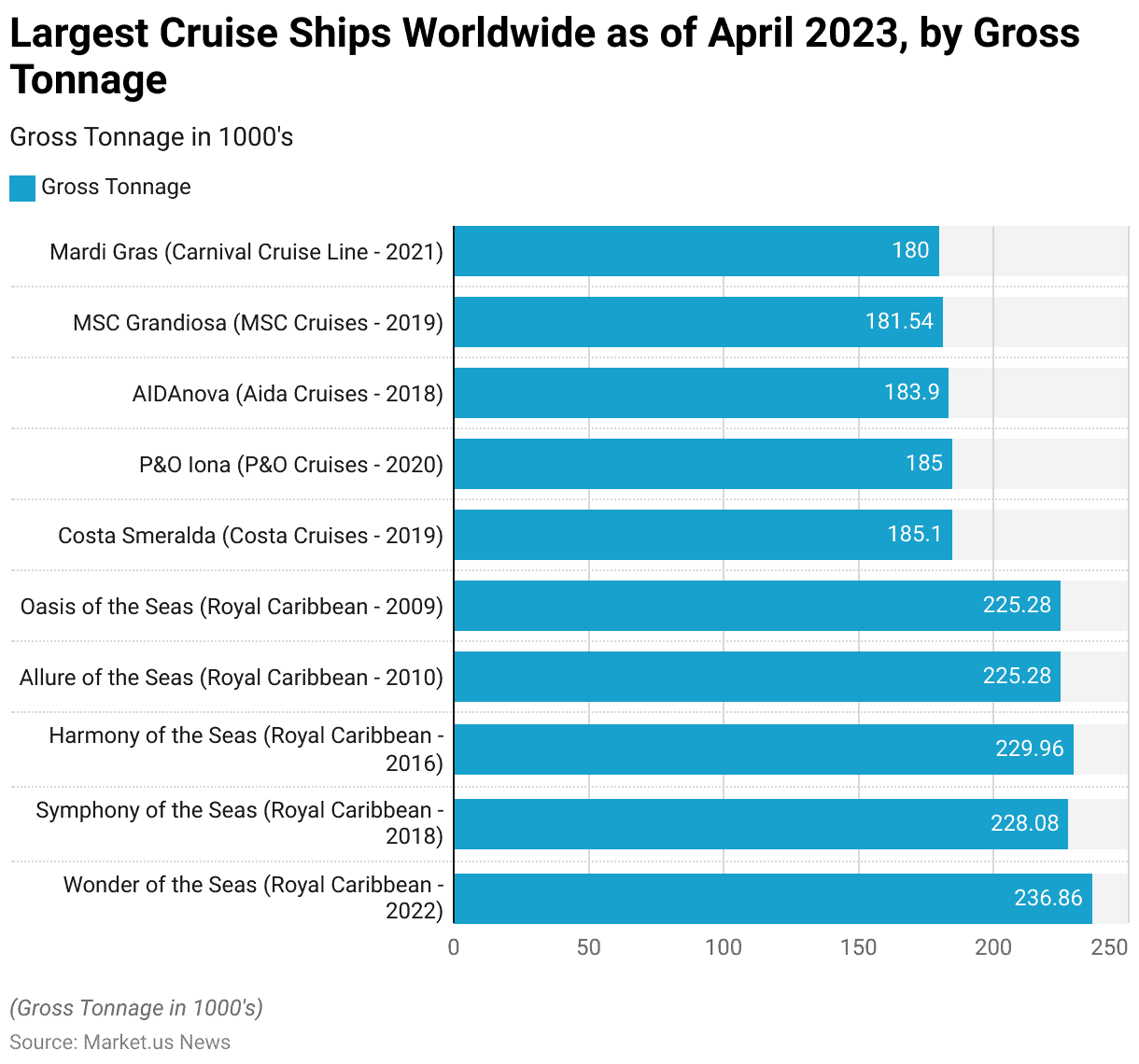

Largest Cruise Ships Worldwide – By Gross Tonnage

- As of April 2023, the largest cruise ships worldwide, ranked by gross tonnage. Reflect the dominance of Royal Caribbean International in the industry.

- Topping the list is the Wonder of the Seas, launched in 2022, boasting an impressive gross tonnage of 236.86 thousand.

- Following closely are other Royal Caribbean vessels: Symphony of the Seas (228.08 thousand), Harmony of the Seas (229.96 thousand), Allure of the Seas (225.28 thousand), and Oasis of the Seas (also 225.28 thousand).

- Costa Cruises’ Costa Smeralda, introduced in 2019, stands out as well with a gross tonnage of 185.1 thousand, alongside P&O Cruises’ P&O Iona at 185 thousand.

- Aida Cruises’ AIDAnova, launched in 2018, follows with 183.9 thousand gross tonnages.

- MSC Cruises’ MSC Grandiosa, introduced in 2019, also makes the list with a gross tonnage of 181.54 thousand. Carnival Cruise Line’s Mardi Gras unveiled in 2021, rounds out the selection with a gross tonnage of 180 thousand.

- This data showcases the substantial size and scale of these vessels, reflecting the ongoing competition among cruise lines to build ever-larger ships to attract passengers.

(Source: Statista)

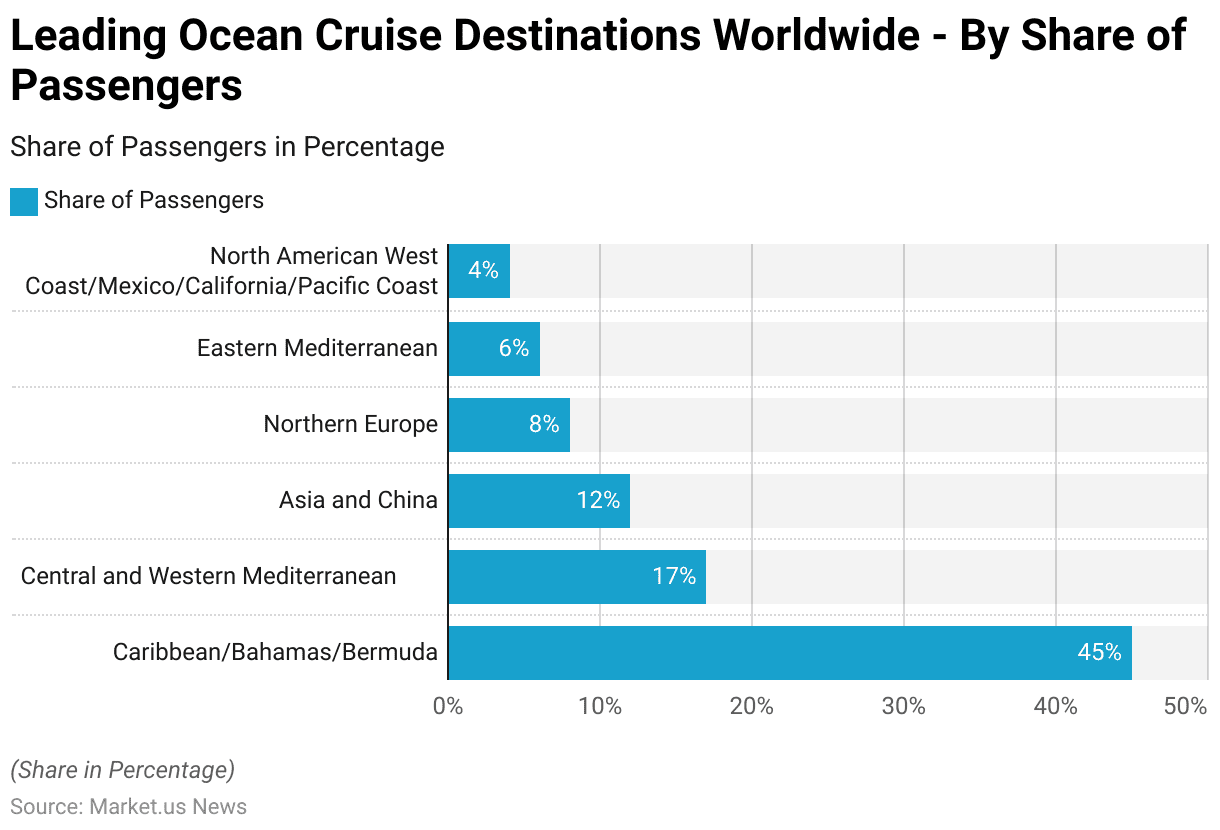

Leading Ocean Cruise Destinations Worldwide

- The leading ocean cruise destinations worldwide, as of the latest data, highlight the Caribbean, Bahamas, and Bermuda as the most popular choice, commanding a significant share of 45% of all passengers.

- Following closely, the Central and Western Mediterranean regions capture 17% of the market, while Asia and China attract 12% of passengers, reflecting the growing interest in this region.

- Northern Europe and the Eastern Mediterranean follow suit, each accounting for 8% and 6% of passengers, respectively.

- North American destinations along the West Coast, including Mexico, California, and the Pacific Coast, contribute 4% to the global cruise market.

- This distribution underscores the diverse appeal of cruise travel, with tropical paradises like the Caribbean alongside historic and culturally rich destinations in Europe and Asia attracting a substantial portion of global cruise-goers.

(Source: CLIA One Resource 2022 Passenger Data)

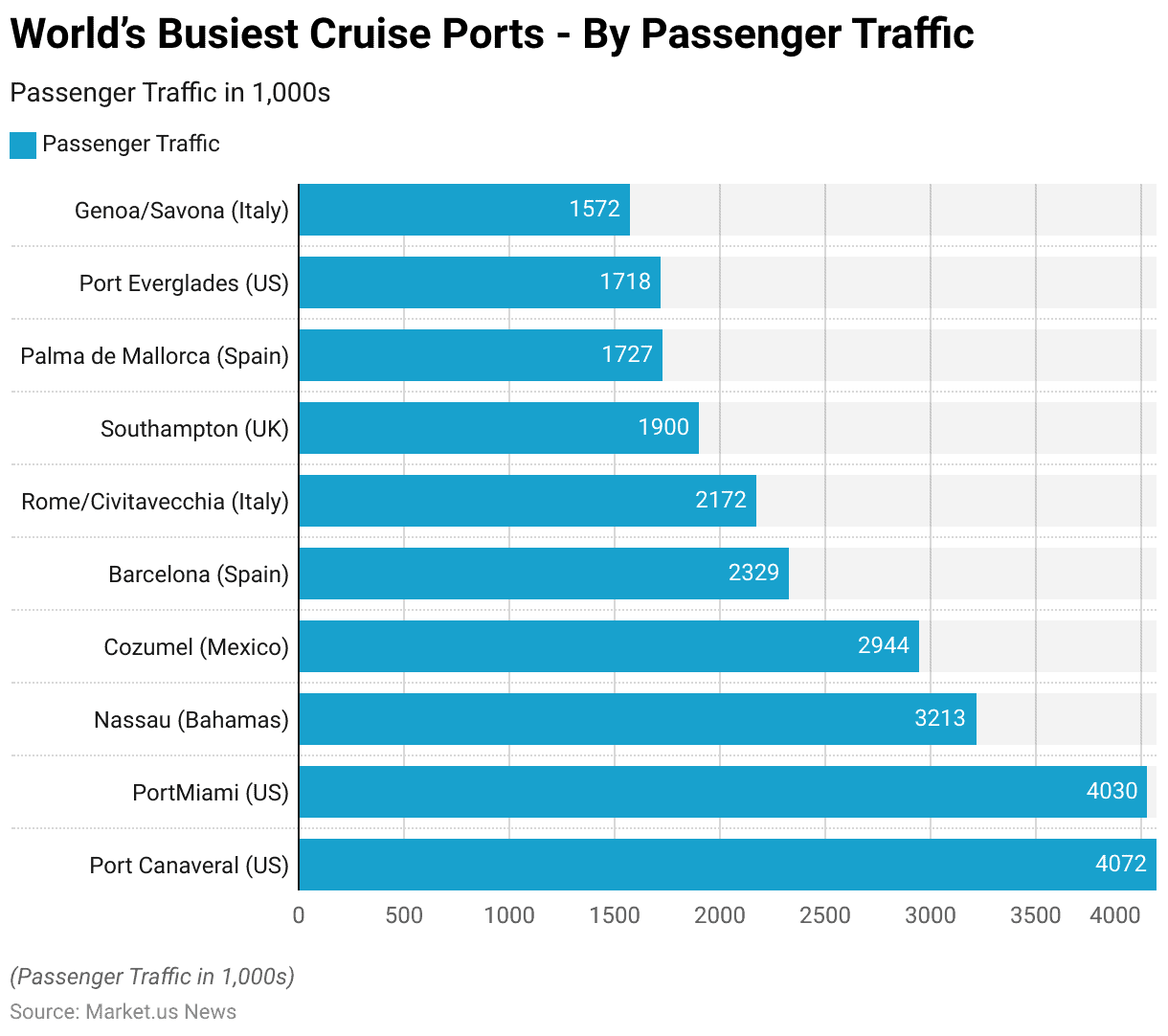

World’s Busiest Cruise Ports

- In 2022, the world’s busiest cruise ports by passenger traffic showcased a diverse range of destinations across the globe.

- Leading the pack were two ports in the United States, Port Canaveral, and PortMiami, with passenger traffic of 4,072 thousand and 4,030 thousand, respectively, reflecting the significant role of the United States in the global cruise industry.

- Following closely behind was Nassau in the Bahamas, attracting 3,213 thousand passengers, followed by Cozumel in Mexico with 2,944 thousand passengers.

- European ports also featured prominently, with Barcelona in Spain welcoming 2,329 thousand passengers, while Rome/Civitavecchia in Italy and Southampton in the UK hosted 2,172 thousand and 1,900 thousand passengers, respectively.

- Palma de Mallorca in Spain and Port Everglades in the US both saw substantial passenger traffic, with 1,727 thousand and 1,718 thousand passengers, respectively.

- Rounding out the top ten was Genoa/Savona in Italy, which had 1,572 thousand passengers, highlighting the global appeal and popularity of these cruise destinations.

(Source: CLIA One Resource 2022 Passenger Data)

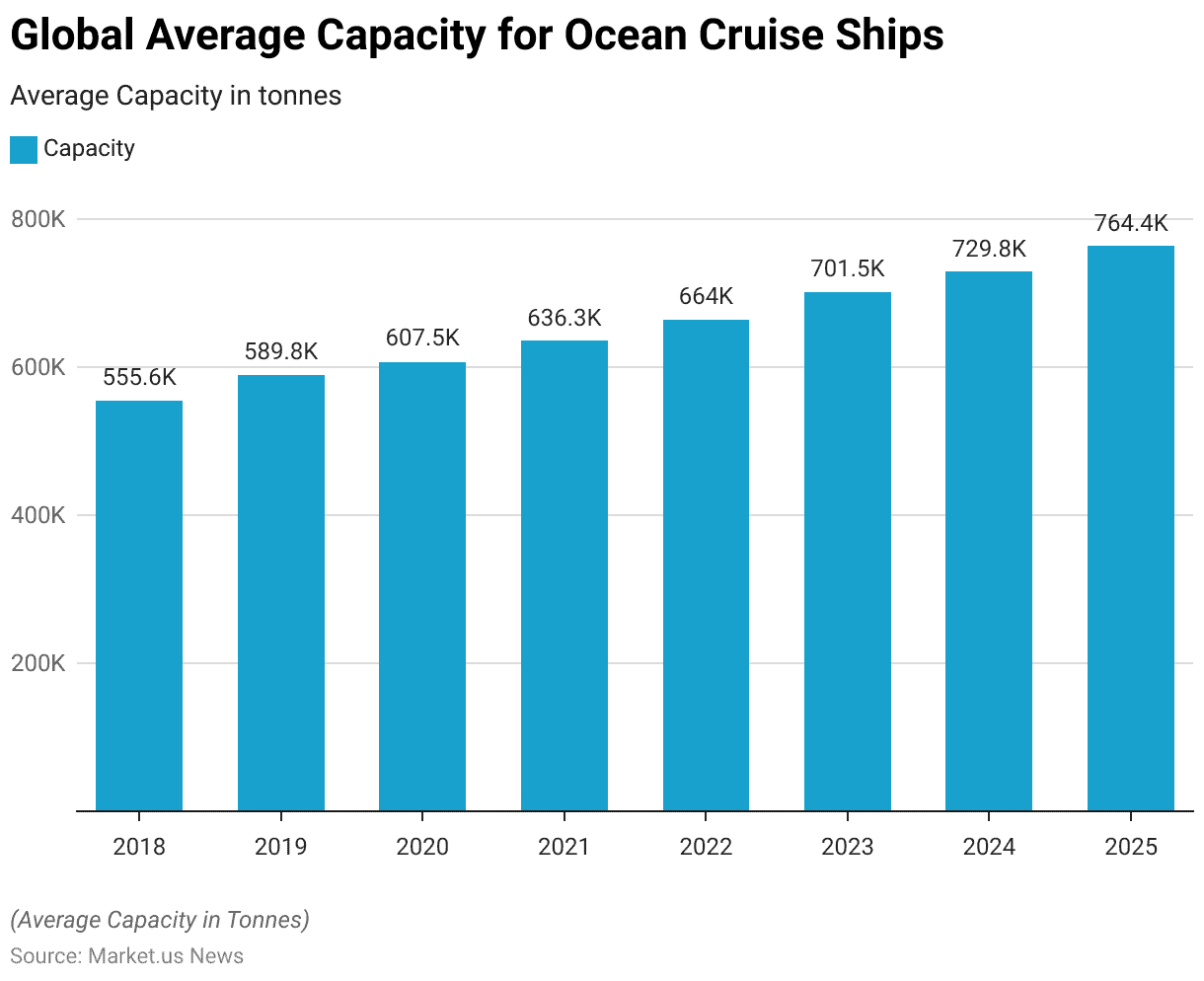

Global Average Capacity for Ocean Cruise Ships

- The global average capacity for ocean cruise ships has demonstrated steady growth from 2018 to 2025, reflecting the expansion of the cruise industry.

- In 2018, the average capacity stood at 555,570 tonnes, increasing to 589,820 tonnes in 2019 and further to 607,500 tonnes in 2020.

- Despite challenges posed by the global pandemic, the capacity continued to rise, reaching 636,270 tonnes in 2021 and 663,970 tonnes in 2022.

- Subsequently, significant growth was observed, with the average capacity surging to 701,490 tonnes in 2023 and 729,820 tonnes in 2024.

- By 2025, the global average capacity for ocean cruise ships peaked at 764,440 tonnes.

- This upward trajectory underscores the industry’s resilience and its commitment to meeting the growing demand for cruise travel worldwide despite occasional disruptions.

(Source: CLIA One Resource 2022 Passenger Data)

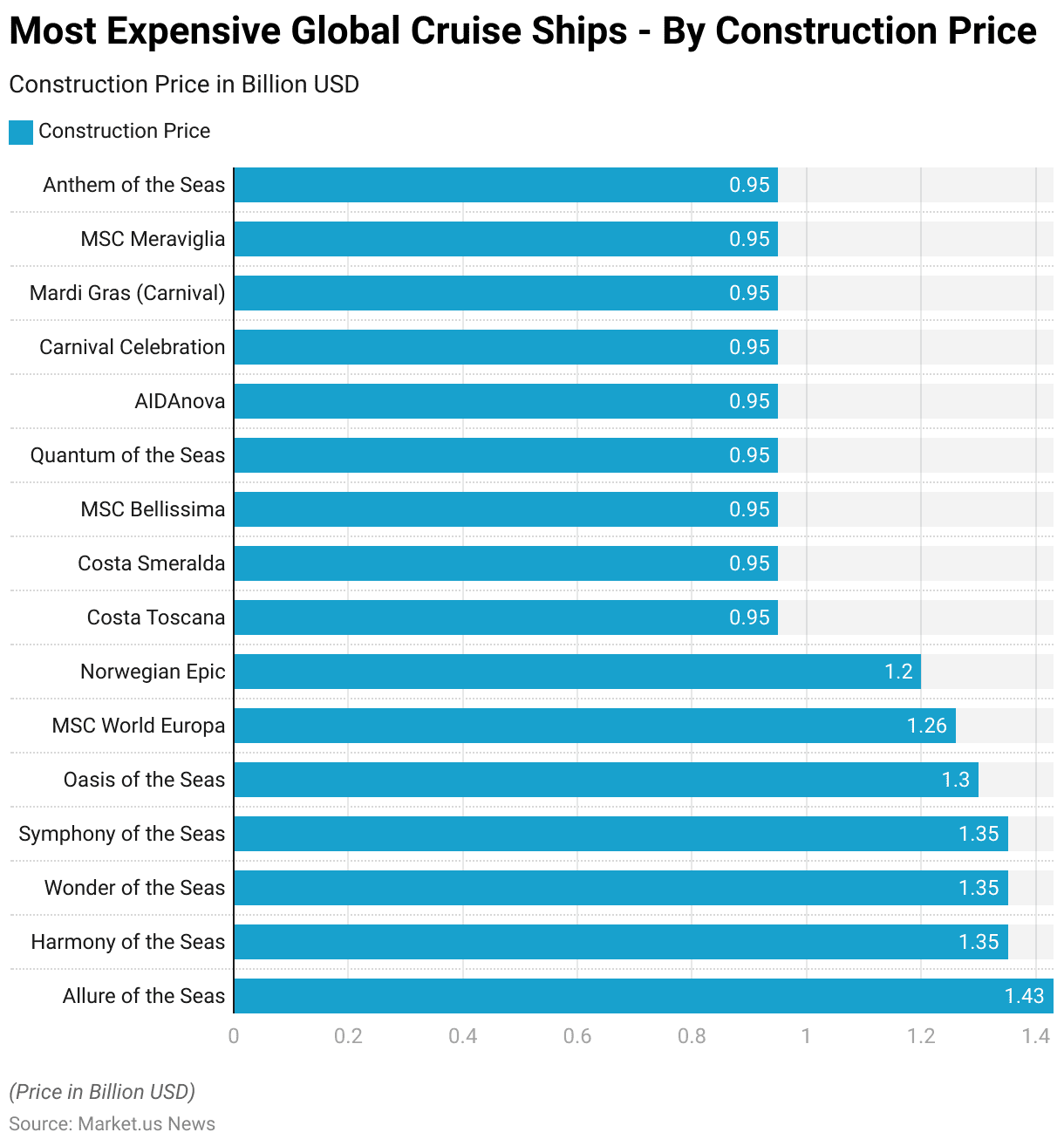

Most Expensive Global Cruise Ships- By Construction Price

- The list of the most expensive global cruise ships, ranked by their construction prices, reveals a spectrum of luxurious vessels commanding substantial investment.

- Topping the list is the Allure of the Seas, constructed for 1.43 billion USD, followed closely by the Harmony of the Seas, Wonder of the Seas, and Symphony of the Seas, each with a construction price of 1.35 billion USD.

- The Oasis of the Seas follows suit at 1.3 billion USD, showcasing a trend of significant investment in these maritime marvels.

- Other notable entries include the MSC World Europa, Norwegian Epic, and several ships from Costa, MSC, and Carnival, all constructed at approximately 0.95 billion USD.

- These figures underscore the considerable financial commitments required to bring these monumental vessels to fruition, reflecting the thriving and competitive nature of the global cruise industry.

(Source: CLIA One Resource 2022 Passenger Data)

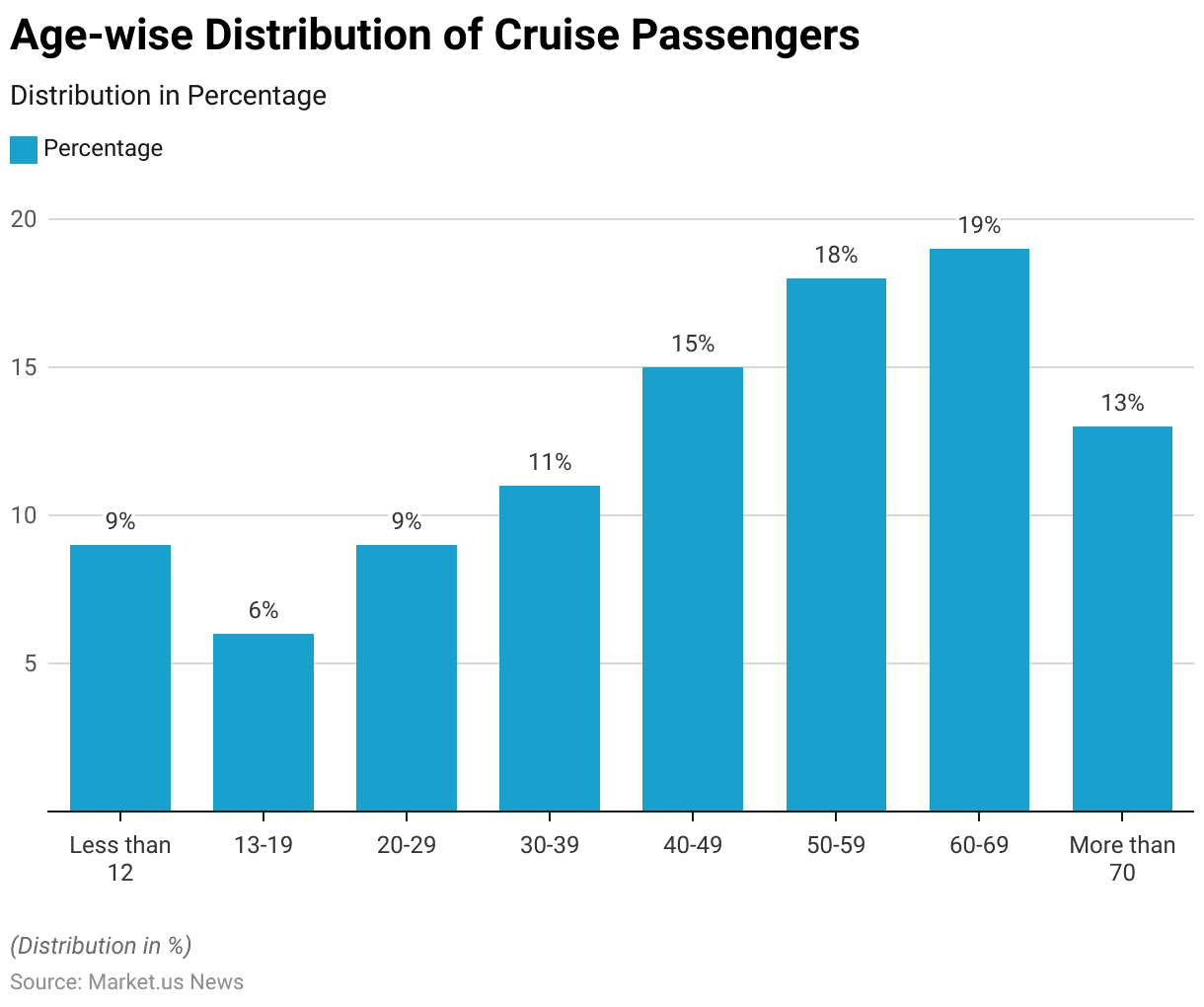

Demographics of Cruise Passengers Statistics

By Age Group

- The demographics of cruise passengers, segmented by age group, offer insights into the composition of travelers in the industry.

- Among passengers less than 12 years old, they constitute 9% of the total, indicating a notable presence of families with young children onboard.

- Teenagers aged 13-19 represent 6% of passengers, suggesting a smaller but still significant demographic.

- Young adults aged 20-29 and individuals in their 30s to 40s comprise 9% and 11%, respectively, indicating a modest representation of these age brackets.

- The largest demographic segments are individuals aged 40-49, 50-59, and 60-69, accounting for 15%, 18%, and 19% of passengers respectively.

- Notably, passengers over 70 years old make up 13% of the total, indicating a significant portion of older adults who partake in cruise travel.

- This breakdown highlights the diverse age range of cruise passengers, ranging from young children to senior citizens, contributing to the industry’s broad appeal across generations.

(Source: CLIA 2018 Global Passenger Report)

By Gender

- In 2017, the cruise industry saw a total of 222,000 passengers visiting New Zealand ports, with a noteworthy trend towards female passengers outnumbering males with a ratio of 121 to 100.

- This reflects the prevailing notion of cruising as a popular choice among older adults, as three-quarters of these passengers fell within the 50 to 80 age range.

- Particularly striking was the gender imbalance within the 50 to 69 age group, where female passengers significantly outnumbered males, with 63,000 women compared to 46,000 men.

(Source: Stuff Limited)

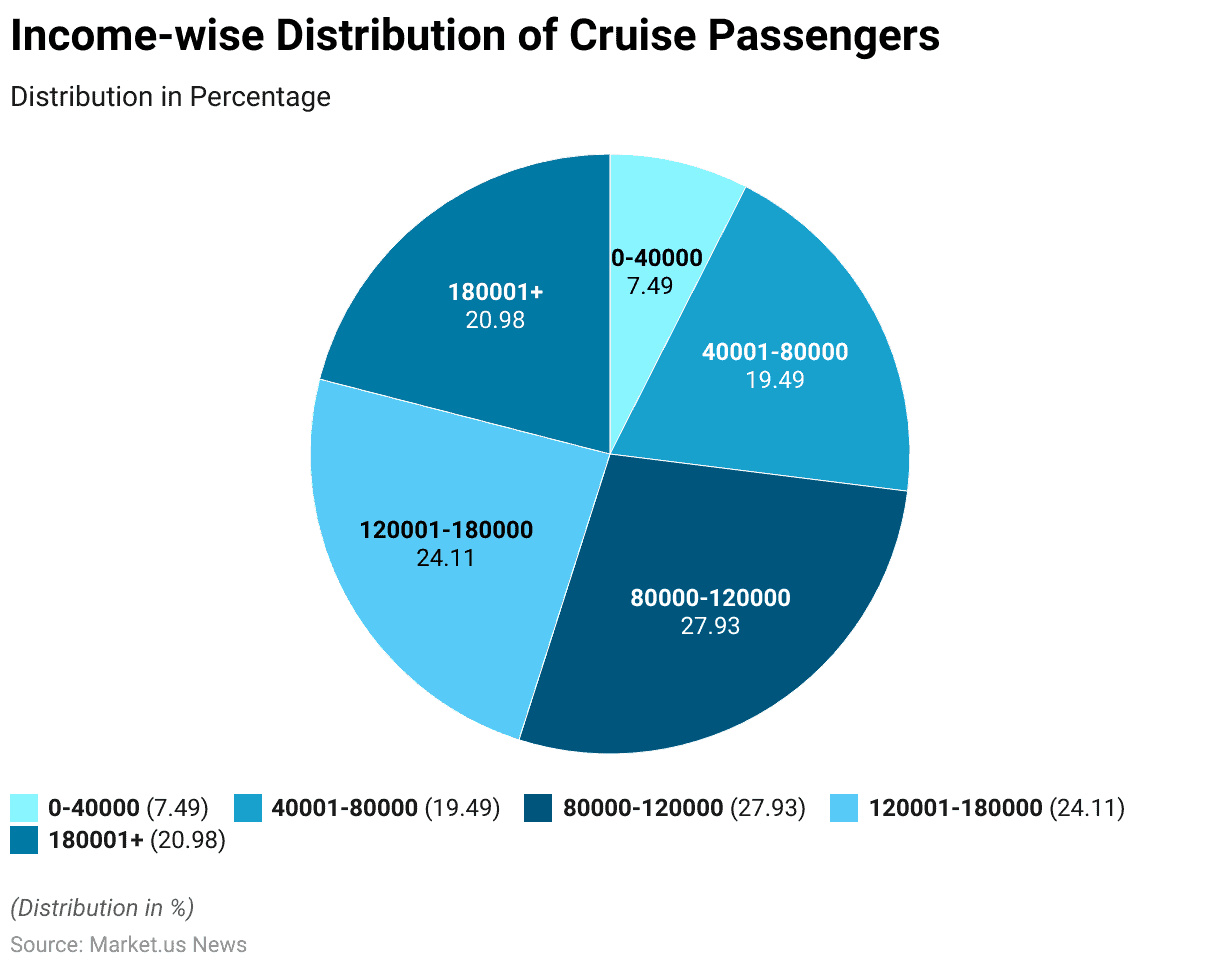

By Income

- The demographics of cruise passengers, categorized by income range, provide valuable insights into the socioeconomic composition of travelers in the industry.

- Among cruise passengers, 7.49% fall within the income range of 0-40,000, indicating a segment of more budget-conscious travel planners apps.

- The largest portion of passengers, comprising 27.93%, earn between $80,000 and $120,000, suggesting a significant representation of middle to upper-middle-income individuals.

- Similarly, 19.49% of passengers earn between $40,001 and $80,000, reflecting a diverse mix of middle-income earners.

- The demographic profile continues to diversify, with 24.11% falling within the $120,001-$180,000 income range, indicating a substantial presence of upper-middle-class passengers.

- Lastly, 20.98% of passengers belong to the highest income bracket of $180,001 and above, representing a segment of affluent travelers within the cruise industry.

- This breakdown highlights the varying income levels among cruise passengers, contributing to the industry’s broad appeal across different socioeconomic groups.

(Source: Stuff Limited)

Cruise Passenger Attitudes and Behaviour Statistics

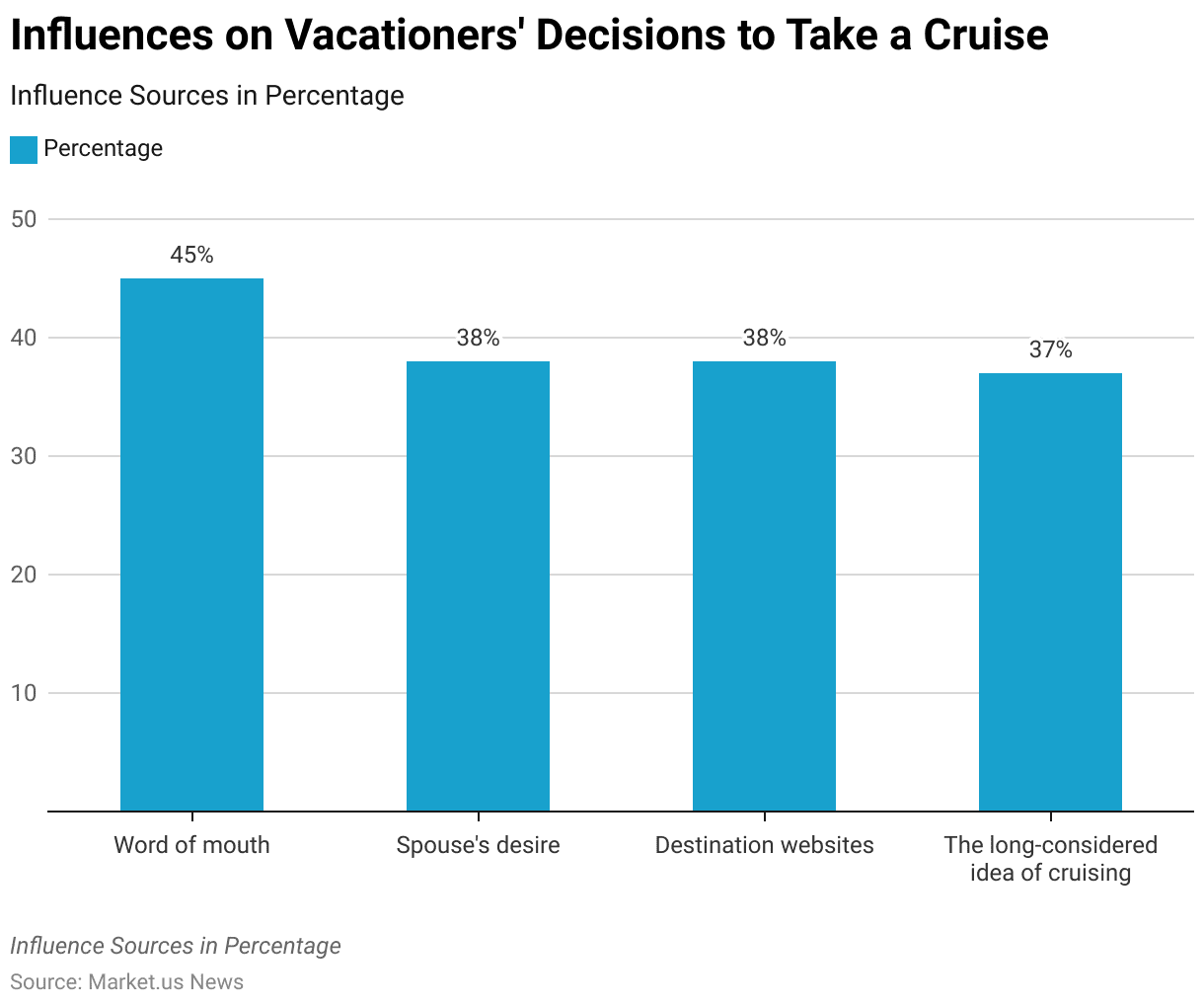

Influences on Vacationers’ Decisions to Take a Cruise Statistics

- When considering the prospect of taking a cruise, vacationers are influenced by a variety of factors.

- The most significant influence is word of mouth, which affects 45% of potential passengers.

- Close behind, the desires of a spouse and the allure of destination websites each impact 38% of individuals.

- Additionally, a long-standing consideration of cruising as a vacation option influences 37% of those surveyed.

- These factors collectively play a crucial role in shaping the decision-making process for potential cruise travelers.

(Source: Wind Rose Network)

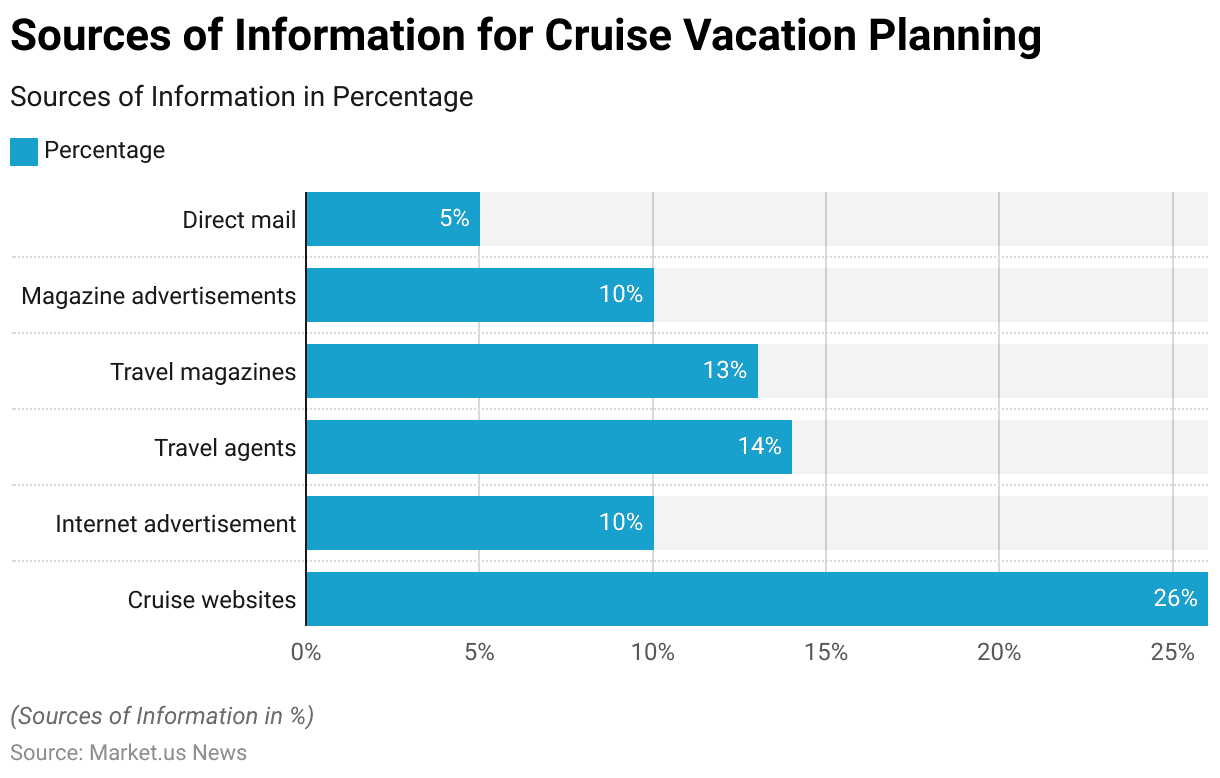

Sources of Information for Cruise Vacation Planning Statistics

- When planning a cruise vacation, potential travelers consult various information sources.

- The most commonly used source is cruise websites, which are utilized by 26% of travelers.

- Other significant sources include travel agents, who are consulted by 14% of individuals, and luxury travel magazines, which influence 13%.

- Internet advertisements and magazine advertisements both hold an equal sway, each capturing the attention of 10% of planners.

- Direct mail, though less frequently used, still plays a role for 5% of those planning their cruise vacations.

- These diverse sources collectively aid travelers in making informed decisions about their cruise experiences.

(Source: Wind Rose Network)

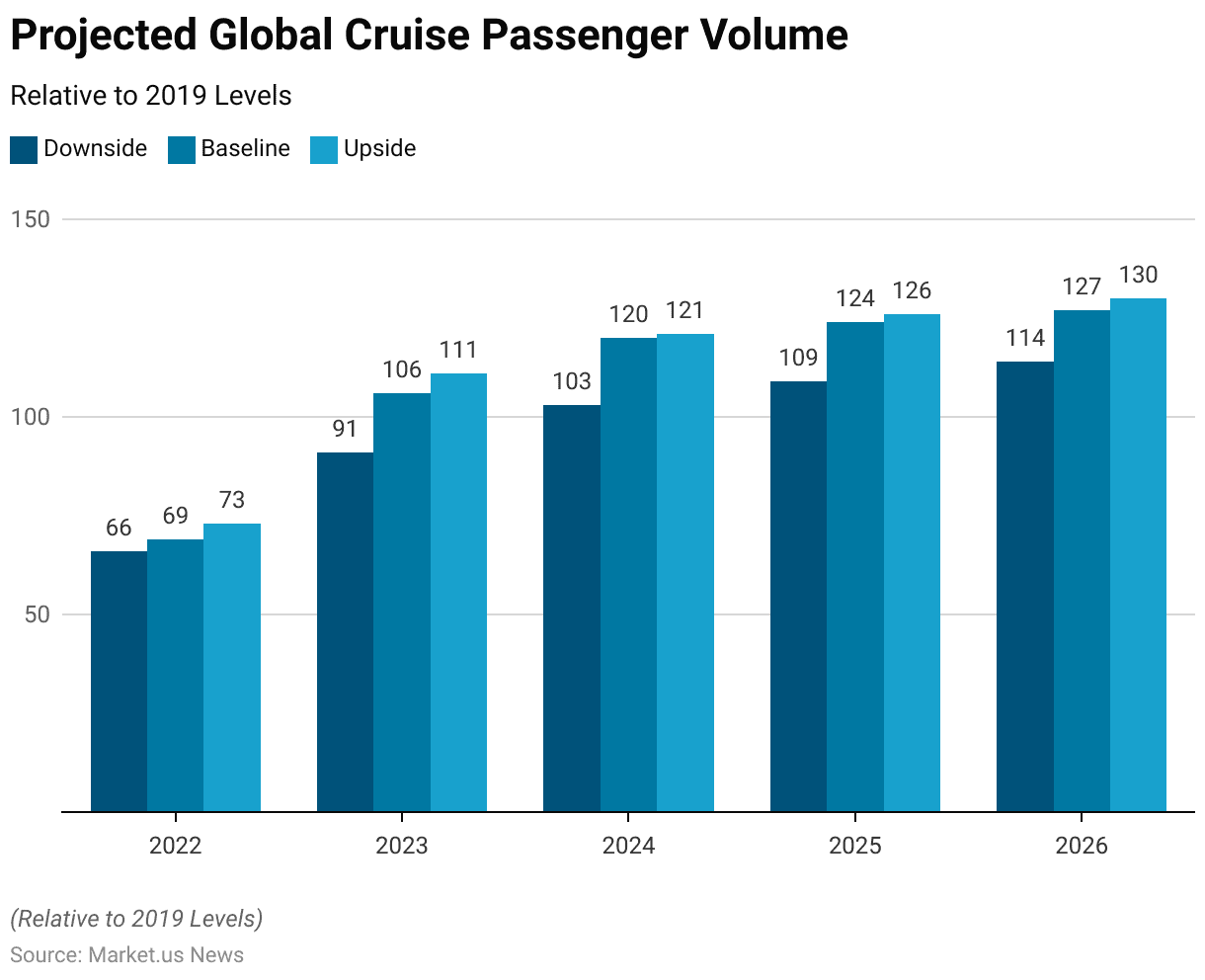

Cruise Tourism Future Projections Statistics

- The projected global cruise passenger volume shows varied growth trajectories from 2022 through 2026, indexed relative to the year 2019, which is set as a baseline of 100.

- In 2022, the downside projection stands at 66, with a baseline of 69 and an upside potential reaching 73.

- The following year, 2023, sees a substantial increase, with downside figures at 91, baseline at 106, and upside at 111.

- The growth continues into 2024, with projections indicating 103 on the downside, 120 on the baseline, and 121 on the upside.

- By 2025, these figures rise slightly to 109 for the downside, 124 for the baseline, and 126 for the upside.

- The upward trend persists into 2026, with the downside estimated at 114, the baseline at 127, and the upside reaching 130.

- These figures reflect optimism in the cruise industry’s recovery and growth post-2019.

(Source: CLIA 2022 Global Passenger Report)

Recent Developments

New Cruise Lines and Ships:

- A significant number of new cruise lines launched in 2023, including Explora Journeys by MSC Cruises Group, marking its debut in the luxury market, along with other new entrants like CFC, Adora Cruises, and Exploris.

- The year also witnessed the delivery of over 20 new ships, enhancing the fleets of several operators like Royal Caribbean, MSC Cruises, and Carnival.

Financial Improvements:

- Major cruise corporations like Carnival Corporation and Royal Caribbean reported financial improvements. Carnival achieved a record full-year revenue of $21.6 billion, while Royal Caribbean projected an adjusted EPS of $6.59 to $6.30 for 2023.

Leadership Changes:

- Notable leadership changes occurred within the industry, such as the retirement of Frank J. Del Rio from Norwegian Cruise Line Holdings, with Harry Sommer stepping in as his successor.

Expansion in China:

- The Chinese cruise market reopened in mid-2023, with both local and international players like Royal Caribbean and MSC Cruises planning their return. This marks a significant recovery phase for the industry in one of the largest markets globally.

Environmental Initiatives:

- The cruise industry continued to advance its sustainability efforts. Notable initiatives included the introduction of new technologies like shore power and hybrid technology systems in ships like the Silver Nova, which is part of the industry’s move towards reducing carbon emissions.

Conclusion

Cruise Statistics – The cruise industry is on a path toward cautious optimism, emphasizing post-pandemic recovery with improved health protocols to boost consumer trust.

It also embraces sustainability through innovations such as liquefied natural gas (LNG) and stricter emission standards.

Technological upgrades enhance guest experiences and efficiency while evolving consumer preferences drive cruise lines to offer tailored services and unique destinations. Economically, the sector boosts local economies through tourism and job creation.

Further, investments in safety and security bolster crisis management capabilities, highlighting the industry’s commitment to sustainable growth and innovative customer engagement.

FAQs

Current trends include a shift towards sustainability, with cruise lines investing in eco-friendly technologies like LNG-powered ships and more efficient waste management systems. Additionally, there’s an increasing emphasis on personalized experiences, luxury cruising, and expedition cruises to less-traveled destinations.

The industry is actively working to reduce its environmental footprint through the adoption of cleaner fuels, advanced wastewater treatment systems, and energy-efficient technologies. Cruise lines are also collaborating with environmental organizations and adhering to stringent international regulations to protect marine ecosystems.

The COVID-19 pandemic significantly impacted the cruise industry, leading to suspended operations, financial losses, and enhanced health protocols. Recovery is underway with the implementation of rigorous health and safety measures, vaccine mandates, and testing protocols to ensure passenger and crew safety.

The cruise industry is a major contributor to the global tourism sector, generating substantial economic activity through direct spending, employment, and the support of related industries such as food and beverage, hospitality, and transportation.

Cruise lines prioritize safety through strict compliance with international maritime safety laws, regular safety drills for crew and passengers, advanced navigation and communication technologies, and onboard security measures. Additionally, ships are equipped with medical facilities and professionals to handle health emergencies.