Table of Contents

Introduction

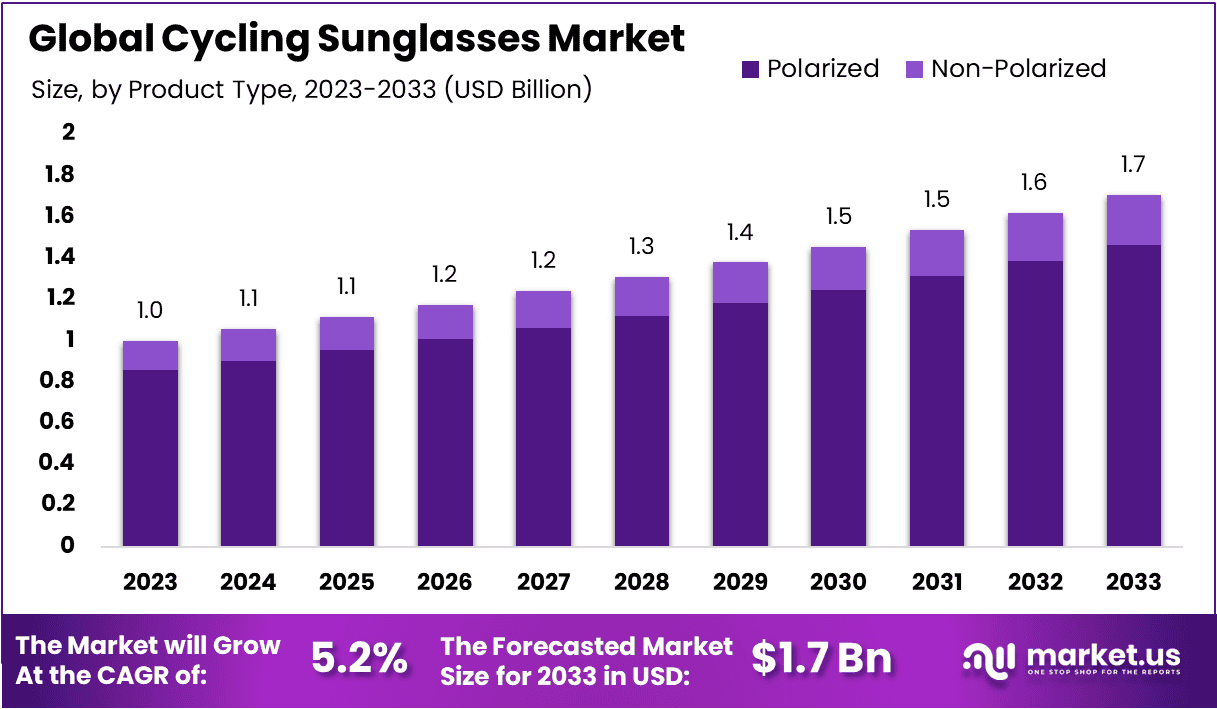

The Global Cycling Sunglasses Market is projected to grow from USD 1.0 billion in 2023 to approximately USD 1.7 billion by 2033, registering a compound annual growth rate (CAGR) of 5.5% during the forecast period of 2024 to 2033.

Cycling sunglasses are specialized eyewear designed to enhance the performance and comfort of cyclists. They provide essential protection against UV rays, glare, wind, dust, and debris, while also improving visual clarity in various lighting conditions. Equipped with advanced features like interchangeable lenses, anti-fog coatings, and aerodynamic designs, cycling sunglasses cater specifically to the needs of both professional and recreational cyclists. Their role extends beyond aesthetics, contributing significantly to safety and performance during cycling activities.

The cycling sunglasses market refers to the global industry focused on the production, distribution, and sale of sunglasses tailored for cycling enthusiasts. This market encompasses a wide range of products, including high-end professional-grade models and more affordable options aimed at casual cyclists.

Key players in the market range from established sports eyewear brands to emerging companies introducing innovative features and materials. The market operates within the broader context of the cycling industry, closely linked to trends in outdoor sports, fitness, and environmental sustainability.

The growth of the cycling sunglasses market is driven by several factors. First, the increasing popularity of cycling, both as a recreational activity and a competitive sport, has expanded the customer base. Second, rising awareness about eye protection and the harmful effects of prolonged UV exposure has led to greater demand for specialized eyewear.

Additionally, technological advancements in lens materials and frame designs, offering superior comfort and functionality, have fueled market expansion. Growing disposable incomes, particularly in emerging economies, have also contributed to the adoption of premium cycling sunglasses.

Demand for cycling sunglasses is primarily fueled by the growing global cycling community. As urban areas promote cycling for environmental and health benefits, more individuals are investing in quality gear, including protective eyewear. Furthermore, competitive cycling events, such as road races and triathlons, have seen a rise in participation, further driving demand for high-performance sunglasses. The trend towards personalization and customization in sports gear also adds to the appeal, with consumers seeking tailored solutions for their cycling needs.

The cycling sunglasses market presents significant opportunities for growth and innovation. One key area is the development of smart sunglasses equipped with features like heads-up displays, GPS navigation, and real-time performance tracking. Another opportunity lies in expanding market penetration in developing regions, where cycling is gaining traction as an affordable and eco-friendly mode of transportation.

Partnerships with cycling clubs and event sponsorships can also enhance brand visibility and drive sales. Moreover, sustainability-focused initiatives, such as eco-friendly materials and manufacturing processes, align with consumer preferences for environmentally responsible products, opening new avenues for market differentiation.

Key Takeaways

- The global cycling sunglasses market is projected to grow from USD 1.0 billion in 2023 to USD 1.7 billion by 2033, with a CAGR of 5.50% over the forecast period (2024–2033).

- Men’s cycling sunglasses dominate, holding 46.6% of the market.

- Polarized sunglasses are the top choice, commanding an 85.6% share.

- Offline sales channels remain dominant, capturing 71.6% of the market.

- Europe emerges as the leading region, accounting for 33.6% of the global market share.

Cycling Sunglasses Statistics

- 4 billion people worldwide wear glasses (2023 data).

- The UK sunglasses market projected to generate £420 million in 2022.

- Only 78,900 UK consumers spent £200+ on sunglasses.

- The UK holds 1.2% of the global sunglasses export market.

- 59% of UK citizens wear glasses.

- 50% of women globally wear spectacles, compared to 42% of men.

- Over 25,000 visually impaired children under 16 in the UK.

- Over 500 million people wear Italian-manufactured frames.

- 8,200 sunglasses stores in the U.S. employ over 46,000 people.

- Average price for Dior sunglasses in the U.S. is $600, Vogue sunglasses $100.

- Chopard sunglasses priced up to $400,000.

- Online sales account for over 30% of total sunglasses sales.

- Millennials (25-40) are the largest buyers, followed by Gen X and Baby Boomers.

- Rising demand from consumers aged 18-24 due to fashion and social media trends.

- Ray-Ban holds about 20% of the global market.

- Cycling sunglasses range from below $40 to $400.

- 100% Aerocraft features a Purple Multilayer Mirror lens with 29% light transmission.

- 80% of consumers prefer plastic lenses over glass.

- Women account for 65% of sunglasses purchases.

- Polarized lenses reduce glare by up to 99%.

- 90% of consumers prioritize UV protection.

- Photochromic lenses represent 12% of sunglass lens sales.

- 90% of luxury sunglasses use acetate frames.

- Top 5 brands hold 40% of the global market; top 3 luxury brands own 25% of the premium market.

- 70% of buyers aged 18-34 prioritize brand name.

- 75% of older consumers prefer larger lenses for better coverage.

- 65% of consumers aged 35-54 own prescription sunglasses.

- 60% of young buyers prefer bold, statement sunglasses.

- 85% of consumers prefer sunglasses with 100% UVA/UVB protection.

- 85% of buyers favor sunglasses that come with a case.

Emerging Trends

- Technological Advancements in Lens Materials and Coatings: Manufacturers are investing in research and development to create lenses that offer superior clarity, durability, and protection. Innovations such as photochromic lenses, which adjust to varying light conditions, and anti-fog coatings enhance visual performance and safety for cyclists.

- Integration of Smart Features: The incorporation of smart technologies into cycling sunglasses is gaining traction. Features like heads-up displays, augmented reality functionalities, and real-time performance metrics provide cyclists with valuable information without diverting attention from the road.

- Emphasis on Lightweight and Ergonomic Designs: There is a growing demand for sunglasses that are lightweight and ergonomically designed to ensure comfort during prolonged use. Materials such as polycarbonate and nylon are favored for their strength and minimal weight, catering to both professional athletes and recreational cyclists.

- Customization and Personalization: Consumers are seeking personalized options in cycling sunglasses, including customizable frame styles, lens tints, and fit adjustments. This trend reflects a desire for products that align with individual preferences and enhance the overall cycling experience.

- Sustainability and Eco-Friendly Materials: Environmental consciousness is influencing purchasing decisions, leading to a preference for sunglasses made from sustainable materials. Brands are responding by adopting eco-friendly manufacturing practices and materials, appealing to environmentally aware consumers.

Top Use Cases

- Protection Against Harmful UV Radiation: Cyclists are exposed to prolonged sunlight, increasing the risk of eye damage from ultraviolet (UV) rays. High-quality cycling sunglasses offer 99% to 100% UV protection, safeguarding against conditions like cataracts and photokeratitis.

- Shielding from Environmental Elements: During rides, cyclists encounter wind, dust, insects, and debris, which can impair vision and cause eye irritation. Sunglasses with wraparound designs provide comprehensive coverage, preventing these elements from reaching the eyes and ensuring a clear line of sight.

- Enhancement of Visual Clarity and Contrast: Advanced lenses, such as those with photochromic or polarized features, adapt to changing light conditions and reduce glare. This adaptability improves contrast and depth perception, enabling cyclists to detect obstacles and variations in terrain more effectively.

- Reduction of Eye Strain and Fatigue: Extended exposure to bright light can lead to eye strain and fatigue, diminishing concentration and reaction times. Cycling sunglasses mitigate these effects by filtering excessive light and reducing glare, allowing for longer, more comfortable rides.

- Prevention of Sports-Related Eye Injuries: According to the National Eye Institute, 90% of sports-related eye injuries can be avoided with the use of protective eyewear. Cycling sunglasses made from impact-resistant materials like polycarbonate lenses protect the eyes from potential injuries caused by accidents or flying debris.

Major Challenges

- Intense Market Competition and Brand Differentiation: The market is saturated with numerous brands offering similar products, making it difficult for companies to stand out. This intense competition necessitates continuous innovation and effective marketing strategies to maintain market share.

- Balancing Performance and Style: Consumers demand sunglasses that offer both high performance and aesthetic appeal. Achieving this balance requires advanced design and materials, which can increase production costs and retail prices.

- Pricing and Accessibility: High-quality cycling sunglasses often come with premium price tags, making them less accessible to budget-conscious consumers. This pricing barrier can limit market growth, especially in price-sensitive regions.

- Proliferation of Counterfeit Products: The market is plagued by counterfeit cycling sunglasses that compromise quality and safety. These fake products not only pose risks to consumers but also damage the reputation and revenue of legitimate brands.

- Limited Versatility and Specialized Use: Cycling sunglasses are specifically designed for cycling, which limits their appeal for other activities. This specialization can deter consumers seeking versatile eyewear options, thereby narrowing the potential customer base.

Top Opportunities

- Rising Popularity of Cycling: The global surge in cycling, both as a sport and a mode of transportation, has led to increased demand for specialized gear, including sunglasses. For instance, in Europe, approximately 19.6 million bicycles were sold in 2016, indicating a robust cycling culture that continues to expand.

- Advancements in Lens Technology: Innovations such as photochromic lenses, which adjust to varying light conditions, and polarized lenses that reduce glare, are enhancing the functionality of cycling sunglasses. These technological improvements cater to cyclists’ needs for better visibility and eye protection across diverse environments.

- Increased Awareness of Eye Health: Growing recognition of the harmful effects of UV radiation has led to a higher demand for sunglasses offering comprehensive UV protection. This trend is particularly notable among outdoor enthusiasts who prioritize eye safety during activities like cycling.

- Integration of Fashion and Functionality: The fusion of style and performance in cycling sunglasses appeals to consumers seeking both aesthetic appeal and practical benefits. This integration has broadened the market, attracting individuals who value fashionable yet functional eyewear.

- Expansion of E-commerce Platforms: The proliferation of online retail channels has made cycling sunglasses more accessible to a global audience. E-commerce platforms offer a wide range of products, enabling consumers to compare features and prices, thereby driving market growth.

Key Player Analysis

- Oakley, Inc.: Oakley, a subsidiary of EssilorLuxottica, is renowned for its high-performance eyewear tailored for athletes, including cyclists. The company’s cycling sunglasses are distinguished by advanced lens technologies such as Prizm™, which enhances color and contrast for improved visibility. Oakley’s commitment to innovation and quality has solidified its position as a leader in the sports eyewear market.

- Rudy Project S.p.A. : Based in Italy, Rudy Project specializes in sports eyewear and helmets. The company offers a range of cycling sunglasses featuring customizable lenses and ergonomic designs to meet the specific needs of cyclists. Rudy Project’s focus on integrating cutting-edge technology with comfort has garnered a loyal customer base among professional and amateur cyclists alike.

- Tifosi Optics, Inc. : Tifosi Optics, headquartered in the United States, provides affordable yet high-quality eyewear options for sports enthusiasts. Their cycling sunglasses are known for durability, interchangeable lenses, and lightweight frames, catering to various lighting conditions and preferences. Tifosi’s emphasis on value and performance has made it a popular choice among budget-conscious consumers.

- POC Sports POC : a Swedish company, offers a range of cycling sunglasses designed with safety and performance in mind. Their products often feature innovative materials and technologies aimed at enhancing protection and visual clarity. POC’s commitment to safety and research-driven design has positioned it as a respected brand in the cycling community.

- Shimano, Inc.: Primarily known for its cycling components, Japan-based Shimano also produces cycling eyewear. Their sunglasses are designed to complement their cycling gear, offering features like anti-fog lenses and ergonomic designs. Shimano’s integration of eyewear into its comprehensive cycling product lineup underscores its dedication to providing holistic solutions for cyclists.

Recent Developments

- On July 17, 2024, EssilorLuxottica announced the acquisition of the Supreme® brand from VF Corporation for $1.5 billion in cash. This strategic move strengthens EssilorLuxottica’s position in the lifestyle and streetwear segments.

- In 2024, Meta is reportedly exploring a multibillion-euro investment in EssilorLuxottica, aiming to accelerate its smart glasses initiatives. Sources indicate Meta is considering purchasing a minor stake in the €87 billion eyewear giant to bolster its augmented reality (AR) and wearable technology portfolio.

- On January 2, 2024, Decathlon finalized the acquisition of Bergfreunde, a leading German online retailer specializing in mountain sports and outdoor gear. The deal, completed with support from Backcountry and TSG Consumer, enhances Decathlon’s digital footprint. Bergfreunde recorded €242 million in revenue in 2022.

- On July 25, 2023, EssilorLuxottica announced its entry into the hearing solutions market. Through the acquisition of Israeli startup Nuance, the company aims to provide innovative hearing technologies for the 1.25 billion people globally with mild to moderate hearing loss. This expansion is backed by a dedicated Super Audio R&D team.

Conclusion

The global cycling sunglasses market is poised for significant growth, driven by the increasing popularity of cycling as both a sport and a mode of transportation. Advancements in lens technology, heightened awareness of eye health, and the integration of fashion with functionality are key factors propelling this expansion. As consumers seek enhanced performance and protection, the demand for specialized eyewear tailored to diverse cycling needs is expected to rise, presenting substantial opportunities for innovation and market development.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)