Table of Contents

Introduction

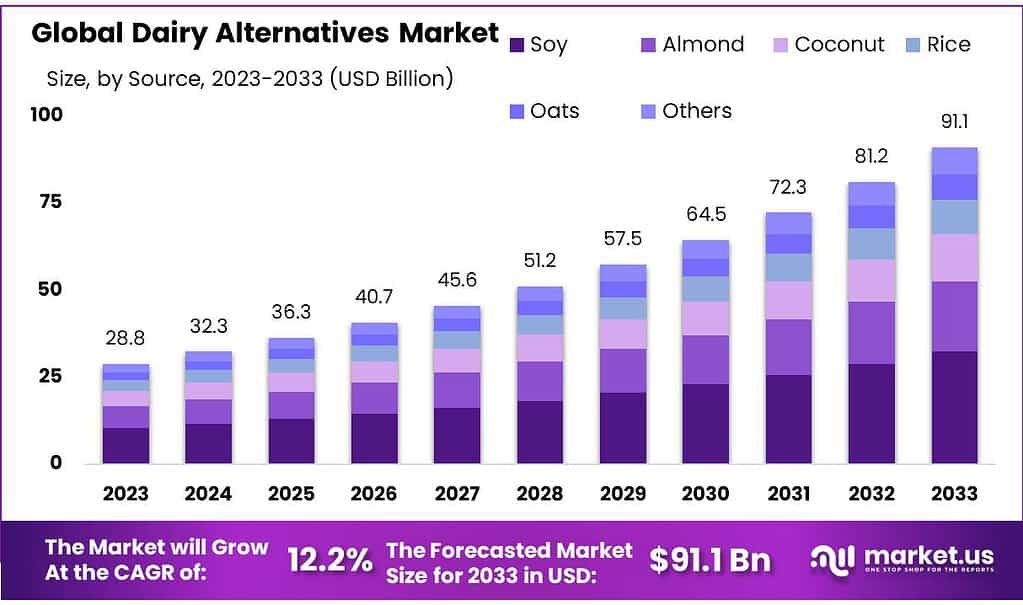

The global Dairy Alternatives Market is projected to expand significantly, with its value expected to increase from USD 28.8 billion in 2023 to approximately USD 91.1 billion by 2033, reflecting a robust (CAGR) of 12.2% during the forecast period. This market, which includes products designed to replace traditional dairy items, is driven by various factors including consumer dietary preferences, health considerations, environmental concerns, and ethical reasons.

One of the primary growth drivers for the dairy alternatives market is the increasing awareness of the nutritional benefits offered by plant-based products. These alternatives, derived from sources such as soy, almond, coconut, rice, oats, and peas, are often fortified with vitamins and minerals, enhancing their nutritional profile to compete effectively with traditional dairy products. The advancements in taste and texture of these products have also contributed to their wider acceptance among consumers.

The market’s growth is further bolstered by the rising prevalence of lactose intolerance and milk allergies, which prompt consumers to seek non-dairy alternatives. Moreover, the surge in veganism and plant-based diets has significantly influenced market demand. Environmental concerns, particularly the desire to reduce the carbon footprint associated with dairy farming, also play a crucial role in driving this market’s expansion.

However, the dairy alternatives market faces several challenges. One of the main obstacles is the perceived taste and texture differences between dairy and non-dairy products, which can affect consumer acceptance. Additionally, the higher cost of dairy alternatives compared to conventional dairy products can deter some consumers. Despite these challenges, continuous product innovation and marketing strategies are expected to overcome these barriers, making dairy alternatives more appealing and accessible.

Recent developments in the market include significant investments in product innovation and new product launches by key industry players. For instance, Califia Farms introduced a new plant-based milk made from a blend of pea, chickpea, and fava bean protein, while Chobani LLC launched a line of plant-based coffee creamers. These innovations enhance the product range and cater to the evolving consumer preferences for plant-based options.

The market is also witnessing increased penetration of dairy alternatives in mainstream supermarkets and food service outlets, making these products more accessible to a broader consumer base. Online retail channels are also gaining traction, driven by the convenience of online shopping and increased digital literacy among consumers.

Regionally, the Asia Pacific is expected to dominate the global dairy alternatives market due to the increasing prevalence of lactose intolerance, rising disposable incomes, and growing awareness of the health benefits associated with plant-based diets. North America and Europe are also significant markets, driven by the high demand for plant-based beverages and the increasing adoption of vegan diets.

Key Takeaways

- Dairy Alternatives Market Expected to reach USD 91.1 billion by 2033, up from USD 28.8 billion in 2023, growing at a CAGR of 12.2%.

- Milk: Dominates with a 65.1% market share due to popular almond, soy, oat, and coconut milk.

- Soy: Holds 35.6% market share due to high-protein content and established presence.

- Supermarkets/Hypermarkets: Lead with a 38.5% market share.

- Asia Pacific, especially China, leads with a 40.8% market share.

Dairy Alternatives Statistics

- The value of the global dairy market is USD 450 billion, 54% of which is fluid milk (USD 243b).

- The dairy market is expected to grow by 1.8% in the next decade, while the fluid milk market is on the decline.

- Chinese per capita milk consumption has grown at 6.5% CAGR over the past 10 years.

- Fluid milk sales in the US have steadily fallen at over 2% CAGR over the past 10 years.

- According to a Euromonitor report, APMEA accounted for 50% of the global dairy beverages retail volume sales in 2020.

Milk Alternatives Statistics

- Oat-based milk alternatives grew the fastest of the alternatives between 2017 and 2018, with global volume sales increasing by 71%.

- The U.S. plant milk market is a $2 billion industry that grew by 6.4 percent last year.

- According to the National Consumer Panel, 41 percent of U.S. households purchased plant-based milk alternatives in 2022, with 76 percent of these customers being repeat purchasers.

- Tmall reported an 800% increase in plant-based beverage sales and a more than 900% increase in consumers buying plant-based drinks, raking in around US$130 million in online sales for plant-based beverages in 2020.

- The most popular plant-based milk is almond milk, which has 63% of the total market and sales worth $1.497 billion in that same 52-week period.

Health Factors Statistics

- U.S. consumers are routinely buying the least environmentally friendly plant milk – almond milk, which uses almost 60 percent of the water needed for an equal amount of cow’s milk.

- California produces 80 percent of the world’s almonds, making the U.S. almond milk supply reliant on this drought-stricken state.

- Switching from cow’s milk to oat milk can save up to 73% of carbon dioxide emissions.

- The body can absorb about 30–32% of the calcium in dairy products and only 20–30% of the calcium from plant sources such as almonds.

- Doctors estimate the incidence of dairy allergy is 2 to 5% in children under 3 years old, with a lower incidence in adults

Emerging Trends

Increased Focus on Health and Nutrition: Consumers are increasingly prioritizing health, driving demand for dairy alternatives that offer nutritional benefits. Products fortified with vitamins, minerals, and proteins are gaining popularity. For instance, the trend towards high-protein and fiber-enriched dairy alternatives is growing, as consumers seek products that support their overall health and well-being.

Sustainability and Environmental Impact: Sustainability is a significant driver in the dairy alternatives market. Products with environmental claims, such as reduced carbon footprint and sustainable farming practices, are increasingly appealing to consumers. Innovations in plant-based dairy alternatives, such as those derived from oats, almonds, and other low-water-use crops, are particularly popular due to their lower environmental impact.

Diverse Product Offerings: The market is expanding beyond traditional soy and almond bases to include a variety of plant sources such as oats, peas, hemp, and coconut. This diversification caters to a wider range of dietary preferences and allergies. Notably, oat milk has surged in popularity, overtaking almond milk in new product launches in the U.S.

Advancements in Technology: Technological innovations are enhancing the quality and variety of dairy alternatives. Techniques like precision fermentation and cell-cultured dairy production are being used to create animal-free dairy products that closely mimic the taste and texture of traditional dairy. Companies are leveraging synthetic biology to produce milk proteins without the need for cows, resulting in products that offer similar nutritional profiles to conventional dairy.

Consumer Preferences and Market Demand: Younger generations, particularly Generation Z, are leading the shift towards plant-based diets for both health and environmental reasons. This demographic shows the highest acceptance and consumption rates of dairy alternatives. Additionally, there is a growing preference for products that are free from artificial additives and have clean label claims, emphasizing natural ingredients.

Product Innovation and Flavors: The market is witnessing a surge in innovative dairy alternative products, including flavored milk, yogurt, cheese, and butter. Companies are exploring novel flavors and formulations to cater to the evolving tastes of consumers. Innovations such as oat milk with boba, fungi-based yogurt, and vegan mochi are examples of the creative approaches being taken to attract consumers.

Ethical and Social Considerations: Ethical concerns about animal welfare and the environmental impact of traditional dairy farming are driving consumers towards plant-based alternatives. Claims related to ethical production, such as cruelty-free and regenerative agriculture, are becoming more prominent and influencing purchasing decisions.

Use Cases

Lactose Intolerance and Allergies: Individuals with lactose intolerance or dairy allergies constitute a significant portion of the dairy alternatives market. According to the National Institute of Diabetes and Digestive and Kidney Diseases, approximately 68% of the global population has lactose malabsorption, driving demand for alternatives like almond milk, soy milk, and oat milk. These products provide essential nutrients without causing digestive discomfort.

Vegan and Plant-Based Diets: The rise of veganism and plant-based diets is a major driver of the dairy alternatives market. As of 2023, around 10% of U.S. adults identify as vegan or vegetarian, according to a survey by the Vegetarian Resource Group. Dairy alternatives such as cashew cheese, coconut yogurt, and plant-based butter offer essential nutrients and satisfy dietary preferences while avoiding animal products.

Health and Wellness: Health-conscious consumers are increasingly turning to dairy alternatives for their perceived health benefits. For instance, almond milk is often enriched with calcium and vitamin D, which are essential for bone health. Additionally, oat milk has gained popularity for its high fiber content, which supports digestive health.

Sustainable and Ethical Consumption: Environmental concerns and ethical considerations are motivating consumers to choose dairy alternatives. Plant-based milk like almonds, soy, and oats typically have a lower carbon footprint compared to traditional dairy farming. A study by the University of Oxford found that producing a glass of dairy milk results in almost three times more greenhouse gas emissions than any plant-based milk. Consequently, brands like Oatly and Silk are expanding their product lines to cater to environmentally conscious consumers.

Culinary Applications: Dairy alternatives are being increasingly used in culinary applications, both in households and by professional chefs. For instance, cashew cream is a popular substitute for heavy cream in vegan recipes, offering a similar texture and richness. Similarly, coconut milk is widely used in Asian cuisines for its creamy consistency and flavor. According to Innova Market Insights, the use of plant-based claims in new food and beverage products grew by 17% annually from 2018 to 2023, reflecting broader culinary adoption.

Children’s Nutrition: Parents are increasingly seeking nutritious dairy alternatives for their children, especially those with allergies or lactose intolerance. Fortified plant-based milk such as soy milk and pea milk offer essential nutrients like calcium, vitamin D, and protein, making them suitable substitutes for traditional cow’s milk. According to a study published in the journal Pediatrics, plant-based milk can be nutritionally adequate for children when properly fortified.

Fitness and Sports Nutrition: Dairy alternatives are also popular in the fitness and sports nutrition markets. Products like protein-enriched almond milk or pea milk provide a plant-based source of protein that is essential for muscle recovery and growth.

Major Challenges

Taste and Texture: One of the primary challenges is replicating the taste and texture of traditional dairy products. Many consumers find the taste of some plant-based milk, such as soy or almond milk, to be less appealing compared to cow’s milk. According to a survey by Mintel, 47% of Americans who tried plant-based milk reported that they did not like the taste. Achieving a creamy texture similar to that of dairy products remains a technical hurdle for manufacturers.

Nutritional Profile: Matching the nutritional benefits of dairy products is another challenge. While plant-based alternatives can be fortified with vitamins and minerals, they often lack the natural protein content found in cow’s milk. For example, an 8-ounce serving of cow’s milk contains about 8 grams of protein, whereas the same amount of almond milk typically contains only 1 gram of protein. This discrepancy can deter consumers from seeking high-protein options for their dietary needs.

Cost: The cost of dairy alternatives is generally higher than that of traditional dairy products. The production processes for plant-based milks and cheeses are often more complex and resource-intensive. According to the Good Food Institute, the retail price of plant-based milk is on average twice that of cow’s milk. This price difference can be a barrier for price-sensitive consumers, especially in markets with lower disposable incomes.

Allergen Concerns: Many popular dairy alternatives, such as almond and soy milk, are common allergens. This limits their suitability for a portion of the population. As noted by the Food Allergy Research & Education organization, tree nuts (including almonds) and soy are among the top eight allergens in the United States. Finding hypoallergenic alternatives that appeal to a broad consumer base is a continuing challenge.

Environmental Impact: While generally considered more sustainable than dairy farming, some plant-based milk production, such as almond milk, has significant environmental drawbacks. Almond cultivation requires large amounts of water, with estimates suggesting it takes approximately 1.1 gallons of water to produce a single almond. This has raised concerns about the sustainability of certain dairy alternatives, particularly in regions facing water scarcity.

Market Growth Opportunities

Innovative Product Development: There is a substantial opportunity for developing new and innovative products that cater to diverse tastes and dietary needs. Beyond traditional almond and soy milk, emerging alternatives such as oats, peas, and hemp milk are gaining traction.

Nutritional Enhancements: Fortifying dairy alternatives with additional nutrients, such as proteins, vitamins, and minerals, can enhance their appeal. For instance, products enriched with plant-based proteins or omega-3 fatty acids can attract health-conscious consumers. According to the Food and Nutrition Research Institute, there is increasing demand for fortified plant-based beverages that can match or exceed the nutritional benefits of dairy milk.

Expansion in Emerging Markets: Expanding into emerging markets presents a significant growth opportunity. As disposable incomes rise and awareness of lactose intolerance and dairy allergies increases, demand for dairy alternatives in regions such as Asia-Pacific and Latin America is expected to surge. The Asia-Pacific region, for instance, is anticipated to witness substantial growth due to its large lactose-intolerant population. The market in China alone is expected to grow rapidly, supported by the government’s efforts to promote healthier dietary choices.

Sustainable and Ethical Products: There is a growing consumer trend towards products that are environmentally sustainable and ethically produced. Companies that can market their products as having a lower carbon footprint and being free from animal cruelty can gain a competitive edge. According to a survey by the International Food Information Council, over 60% of consumers are willing to pay more for sustainably produced food and beverages. Developing dairy alternatives that emphasize sustainability can attract environmentally conscious consumers.

Digital and E-commerce Channels: Leveraging digital platforms and e-commerce can drive sales growth. With the increase in online shopping, especially post-pandemic, there is a significant opportunity for dairy alternative brands to reach a broader audience.

Recent Development

Nestlé SA has been actively expanding its presence in the dairy alternatives sector, focusing on innovation and market growth throughout 2023 and into 2024. In February 2023, Nestlé launched new plant-based milk products under its popular brand, expanding its range to include oat and pea-based beverages. By April 2023, the company reported a 7.2% increase in organic growth, attributing part of this success to the growing demand for its dairy alternative products. In October 2023, Nestlé introduced a new line of plant-based creamers and desserts, further diversifying its offerings.

Danone S.A. has been actively expanding its dairy alternatives sector, marked by significant developments throughout 2023 and 2024. In February 2023, Danone completed the conversion of its Villecomtal-sur-Arros plant in France to a dedicated facility for producing Alpro-branded oat-based beverages. This move reflects the growing consumer demand for plant-based foods, with Danone reporting that 25% of French consumers now identify as flexitarians. By April 2023, Danone’s dairy alternatives had driven notable sales growth, contributing to an overall like-for-like sales increase of 7% for the company. In October 2023, Danone further bolstered its plant-based segment by launching new products and expanding manufacturing capacities.

The Hain Celestial Group, Inc. has been actively expanding its presence in the dairy alternatives sector, focusing on innovation and strategic restructuring throughout 2023 and 2024. In May 2023, Hain Celestial announced a consolidation of its product lines, including its plant-based offerings, as part of the “Hain Reimagined” strategy aimed at driving growth and efficiency. This included reducing the number of stock-keeping units (SKUs) and enhancing distribution channels. By August 2023, the company reported a significant reduction in SKUs, which led to double-digit growth in core product areas and increased sales velocity.

The WhiteWave Foods Company, a key player in the dairy alternatives sector, continued to expand its market presence through 2023 and 2024 under Danone’s ownership. In January 2023, WhiteWave launched new products under its Silk brand, including almond and oat milk blends, which contributed significantly to sales growth. By April 2023, the company reported increased distribution of its So Delicious Dairy Free line, emphasizing non-GMO and organic products. In September 2023, WhiteWave introduced new plant-based yogurt alternatives under the Horizon Organic brand, targeting health-conscious consumers.

Conclusion

The dairy alternatives market is poised for significant growth, driven by evolving consumer preferences towards healthier and more sustainable food options. This growth is fueled by increasing incidences of lactose intolerance, rising veganism, and a growing awareness of the environmental impact of traditional dairy farming.

Key trends include the expansion of product offerings to include not just soy and almond milk, but also oat, rice, and pea-based alternatives. Innovations in flavor and texture, as well as fortified products that provide comparable nutritional benefits to traditional dairy, are attracting a wider consumer base. Major players like Danone, The Hain Celestial Group, and Oatly are leading the market with continuous product development and strategic acquisitions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)