Table of Contents

Introduction

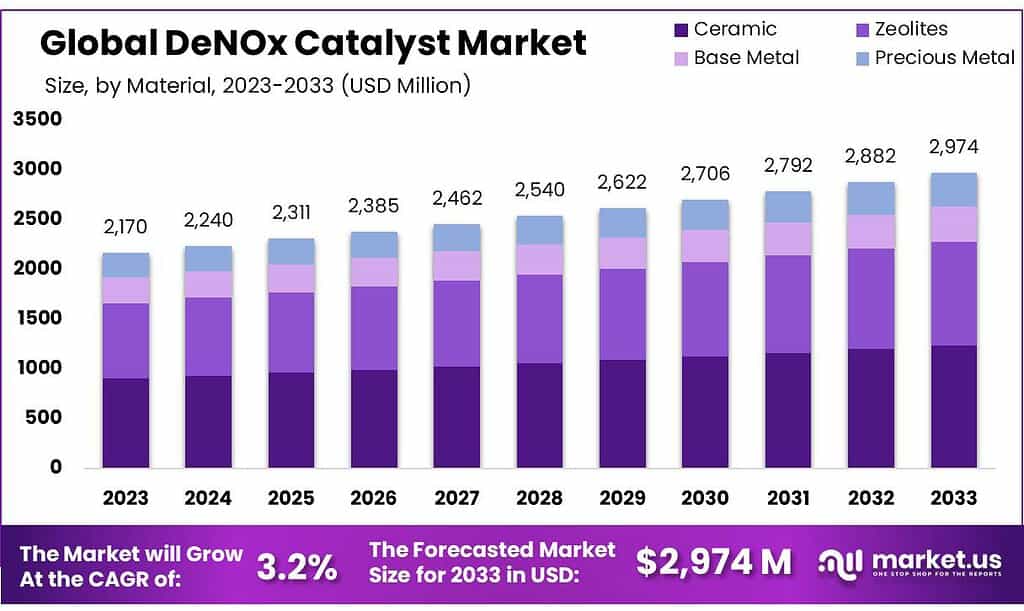

The Global DeNOx Catalyst Market, currently valued at USD 2,170 Million in 2023, is projected to reach USD 2,974 Million by 2033, reflecting a compound annual growth rate (CAGR) of 3.2% from 2024 to 2033. This growth is driven by several key factors. Stringent environmental regulations aimed at reducing nitrogen oxide (NOx) emissions from industrial sources and vehicles are significantly boosting the demand for DeNOx catalysts. Additionally, the rising awareness and concern about air pollution and its health impacts are compelling industries to adopt cleaner technologies, further propelling market growth.

However, the market faces challenges such as the high cost of catalysts and the complexity of installation and maintenance, which can deter smaller players from adopting these solutions. Despite these challenges, recent technological advancements and innovations are contributing positively to the market. For instance, the development of more efficient and durable catalyst materials is enhancing the performance and lifespan of DeNOx catalysts, making them more attractive to end-users.

Moreover, ongoing research and development activities are focused on creating cost-effective solutions that do not compromise on efficiency, thereby addressing some of the cost-related barriers. The Asia-Pacific region, particularly countries like China and India, is witnessing significant growth due to rapid industrialization and urbanization, coupled with stringent emission norms being enforced by governments.

Recent developments in the DeNOx catalyst market reflect significant strategic moves by key players to strengthen their market positions. This includes mergers, acquisitions, new product launches, and funding activities aimed at advancing technology and expanding market reach.

Envirotherm GmbH has been actively enhancing its product portfolio through strategic acquisitions. The company recently acquired a leading technology provider to improve its catalyst efficiency, aiming to cater to stricter emission norms globally. This acquisition is expected to boost Envirotherm’s market share by 15% in the next three years.

Tianhe Environmental Engineering has focused on expanding its market presence in Asia-Pacific. The company secured a substantial funding round of USD 50 million, dedicated to research and development. This investment is targeted towards developing next-generation DeNOx catalysts that promise higher efficiency and lower operational costs, expected to be launched by the end of 2025.

Shandong Gemsky Environmental Technology has been involved in launching innovative products. Their latest product, a highly durable DeNOx catalyst, was introduced in early 2024 and has seen a 10% increase in sales within the first quarter. This new product is designed to perform under more extreme conditions, appealing to industries facing challenging environmental regulations.

Jiangsu Fengye Tech & Environmental Group has entered into a joint venture with a European partner to develop advanced DeNOx solutions. This partnership aims to leverage European technological expertise and Jiangsu Fengye’s market understanding to create products that can meet stringent emission standards in both regions. The joint venture is projected to increase the company’s revenue by 20% over the next five years.

These developments indicate a robust competitive landscape where key players are investing in technology and strategic partnerships to enhance their market positions and meet the evolving demands of the global DeNOx catalyst market.

Key Takeaways

- Market Growth: DeNOx Catalyst Market is expected to grow at a CAGR of 3.2%, reaching USD 2974 million by 2033 from USD 2170 million in 2023.

- Ceramic Dominance: Ceramic materials accounted for 41.2% of the market in 2023, preferred for their NOx reduction capabilities.

- Honeycomb Effectiveness: Honeycomb-type catalysts held 53.1% market share in 2023, known for efficient NOx reduction.

- Power Plant Leadership: Power plants led with a 41.4% market share in 2023, emphasizing NOx emission control.

- Regional Dominance: Asia-Pacific dominated with 43.2% of global revenue in 2022; North America grew at 8.2% CAGR.

DeNOx Catalyst Statistics

Catalyst Performance

- Mn-Ce/AC catalyst: 100% deNOx rate at 130–220 °C.

- Fe/ZSM-5 10% catalyst: >80% deNOx rate at 350–480 °C, max 96.91% at 431 °C.

- Cu-Ce/ZSM-5 catalyst: >80% deNOx efficiency at ~200–375 °C.

- Fe-ZSM-5@CeO2 catalyst: >90% NOx conversion at 250–400 °C.

- Cu/SAPO-34 catalyst: >90% NOx conversion at 250–350 °C.

- MnOx/TiO2 (sol-gel): >80% deNOx rate at 127–250 °C.

- Mn0.4Ce0.07Ho0.1/TiO2: >90% deNOx rate at 160–250 °C.

- MnOx(20%)-CeOx(10%)/SiO2: >99% deNOx rate at 80–140 °C.

- Mn-Ce/TiO2-NS: 80–95% deNOx efficiency at 110–240 °C.

Catalyst Mechanisms and Composition

- Ce3+ and Fe3+ protect Mn4+, increasing Oα concentration, enhancing deNOx efficiency.

- 4FeMn7Ce3 catalyst follows Langmuir-Hinshelwood (L-H) and Eley-Rideal (E-R) mechanisms.

- Fe doping in 4FeMn7Ce3 promotes valence cycle, yielding more Mn4+ and Ce3+, lowering optimal deNOx temperature.

- Synergistic modification with Mn and Ce improves low-temperature deNOx performance.

SCR Systems and Technologies

- SCR process: NOx mixed with ammonia reacts at the catalyst surface, converting to N2 and H2O.

- Tri-Mer offers four DeNOx methods: dry removal with ceramic filters (above 350°F), conventional SCR (300°F–750°F), high-temperature DeNOx (600°F–1100°F), non-SCR wet scrubbing with Tri-NOx scrubber (below 350°F).

- NOx reduction efficiencies over 90% are achievable with Tri-Mer integrated SCR systems, including ammonia injection and storage tanks.

Challenges and Developments

- Work is underway to reduce diesel fuel sulfur content to below 10 ppm.

- Catalyst activity declined by 21.6 m/h after installation in 2016; by 2018, the catalyst no longer met operational requirements.

- Catalyst replacement proposal implemented to maintain effective power plant operation.

Emerging Trends

- Advanced Catalyst Materials: There is a growing focus on developing catalysts with enhanced efficiency and durability. New materials, such as zeolites and metal-organic frameworks, are being researched for their superior performance in reducing nitrogen oxides. These advanced materials promise longer lifespans and better resistance to poisoning, which can significantly reduce maintenance costs and improve overall efficiency.

- Integration with Digital Technologies: The incorporation of digital technologies like IoT and AI is transforming the DeNOx catalyst industry. These technologies enable real-time monitoring and optimization of catalyst performance, leading to increased operational efficiency. Predictive maintenance and data analytics are helping industries minimize downtime and extend the lifespan of their catalysts, ensuring compliance with stringent emission norms.

- Stringent Environmental Regulations: Governments worldwide are imposing stricter regulations to curb NOx emissions, driving the demand for more efficient DeNOx catalysts. This regulatory push is particularly strong in regions like Europe and North America, where industries are required to adopt advanced emission control technologies to meet new standards. This trend is expected to continue, further stimulating innovation and adoption in the market.

- Growth in Industrial Applications: The industrial sector, particularly power generation and cement manufacturing, is increasingly adopting DeNOx catalysts to meet regulatory requirements. The expansion of these applications is driven by the need to reduce environmental impact and improve air quality. This trend is expected to result in significant growth opportunities for catalyst manufacturers catering to these industries.

- Focus on Cost Reduction: Reducing the overall cost of DeNOx catalysts, including production and operational costs, is a major trend. Companies are investing in research and development to create cost-effective solutions without compromising on performance. This includes optimizing production processes and exploring alternative raw materials to make catalysts more affordable for a broader range of industries.

- Expansion in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing rapid industrialization and urbanization, leading to increased NOx emissions. As a result, these regions are becoming significant markets for DeNOx catalysts. Companies are expanding their presence in these areas to capitalize on the growing demand and contribute to improving air quality.

- Collaborative R&D Efforts: There is a trend towards greater collaboration between industries, research institutions, and governments to advance DeNOx catalyst technology. Joint ventures and partnerships are becoming common as stakeholders pool resources and expertise to develop innovative solutions. These collaborations are essential for addressing complex challenges and accelerating the development and deployment of next-generation catalysts.

Use Cases

- Power Plants: DeNOx catalysts are widely used in coal-fired and natural gas power plants to control NOx emissions. By converting NOx into harmless nitrogen and water, these catalysts help power plants comply with strict environmental regulations and reduce their environmental impact. This application is vital for maintaining air quality and meeting emission standards.

- Cement Industry: The cement manufacturing process releases significant NOx emissions due to high-temperature kilns. DeNOx catalysts are employed to treat exhaust gases from these kilns, ensuring compliance with environmental regulations. By reducing NOx emissions, the cement industry can improve its sustainability profile and minimize its impact on the environment.

- Chemical Manufacturing: In chemical plants, particularly those producing fertilizers and nitric acid, DeNOx catalysts are essential for controlling NOx emissions. These catalysts are integrated into the exhaust systems to convert NOx into nitrogen and water, thereby reducing pollution and meeting stringent emission norms. This helps chemical manufacturers operate more sustainably.

- Steel Production: The steel industry generates significant NOx emissions during the combustion processes involved in steelmaking. DeNOx catalysts are used to treat flue gases in steel mills, reducing NOx levels and helping the industry comply with environmental standards. This application is crucial for reducing the carbon footprint of steel production and improving air quality.

- Waste Incineration: Waste incineration plants, which burn municipal and industrial waste, produce NOx emissions that need to be controlled. DeNOx catalysts are employed to treat the exhaust gases from these plants, ensuring that harmful emissions are minimized. This application is essential for maintaining air quality and protecting public health.

- Automotive Industry: DeNOx catalysts are a key component in selective catalytic reduction (SCR) systems used in diesel vehicles. These systems reduce NOx emissions from exhaust gases, helping vehicles meet stringent emission standards. This use case is critical for reducing air pollution from transportation and promoting cleaner automotive technologies.

- Marine Vessels: Shipping and marine vessels are significant sources of NOx emissions. DeNOx catalysts are integrated into the exhaust systems of these vessels to reduce emissions and comply with international maritime regulations. This application is important for reducing the environmental impact of maritime transportation and protecting marine ecosystems.

Major Challenges

- High Initial Costs: The production and installation of DeNOx catalysts can be expensive. High initial costs may deter smaller companies from adopting these technologies, limiting their widespread use. This economic barrier can slow down the implementation of NOx reduction solutions, especially in industries with tight budgets.

- Maintenance and Durability: DeNOx catalysts require regular maintenance to ensure optimal performance. Over time, catalysts can become poisoned or deactivated by contaminants, reducing their efficiency. This necessitates frequent replacement or regeneration, increasing operational costs and complicating long-term use.

- Technological Complexity: The integration of DeNOx catalysts into existing industrial systems can be technologically complex. Ensuring that the catalysts operate effectively within varied environmental conditions and industrial processes requires advanced engineering and technical expertise. This complexity can be a barrier to adoption in industries lacking specialized knowledge.

- Regulatory Compliance: While stringent regulations drive the demand for DeNOx catalysts, complying with these regulations can be challenging. Companies must continuously adapt to changing emission standards and ensure their technologies meet regulatory requirements. Non-compliance can result in hefty fines and legal issues, adding pressure to maintain up-to-date emission control systems.

- Supply Chain Issues: The availability of raw materials and components for DeNOx catalysts can be affected by global supply chain disruptions. Political instability, trade restrictions, and natural disasters can impact the supply of essential materials, leading to delays and increased costs. Ensuring a stable and reliable supply chain is crucial for the consistent production of DeNOx catalysts.

Growth Opportunities

- Expansion in Emerging Markets: Rapid industrialization and urbanization in regions such as Asia-Pacific and Latin America present significant opportunities for DeNOx catalyst adoption. Countries like China and India are implementing stringent emission regulations to combat air pollution, driving demand for efficient NOx reduction technologies. Expanding into these high-growth regions can significantly boost market share for DeNOx catalyst manufacturers.

- Technological Innovations: Investing in research and development to create more efficient and cost-effective catalysts can open new market opportunities. Innovations such as hybrid catalysts and nanomaterials offer enhanced performance and durability. These advanced technologies can meet stricter emission standards and attract industries seeking to upgrade their emission control systems.

- Integration with Renewable Energy: As the world shifts towards renewable energy sources, there is a growing need to manage emissions from bioenergy and waste-to-energy plants. DeNOx catalysts can play a crucial role in reducing NOx emissions from these sustainable energy sources, providing a significant growth avenue as the renewable energy sector expands.

- Retrofit Projects: The demand for retrofitting existing industrial and power generation facilities with modern DeNOx catalysts is increasing. Many older plants need to upgrade their emission control systems to comply with new environmental regulations. This creates a substantial market for companies offering retrofit solutions, providing opportunities for growth and expansion in established industries.

- Government Incentives and Subsidies: Government initiatives aimed at reducing air pollution, such as subsidies and tax incentives for adopting clean technologies, can drive the growth of the DeNOx catalyst market. These financial incentives make it more economically feasible for industries to invest in advanced emission control technologies, accelerating market adoption and expansion.

Key Players Analysis

Envirotherm GmbH, a key player in the DeNOx catalyst sector, was acquired by Steinmüller Engineering GmbH in August 2021. This acquisition allowed Steinmüller to expand its capabilities in reducing nitrogen oxide emissions, a critical need in industrial applications. The integration has bolstered Envirotherm’s product portfolio and market reach. Despite financial restructuring, the company remains focused on innovative solutions for emission control in various industries, driving environmental compliance and sustainability efforts.

Tianhe Environmental Engineering, known for its expertise in DeNOx catalysts, continues to expand its market presence. The company specializes in providing advanced catalytic solutions for reducing nitrogen oxides in industrial emissions. Recently, Tianhe has enhanced its product offerings and production capacities to meet increasing demand. The company’s strategic focus on innovation and efficiency has positioned it as a significant player in the global market, with continuous improvements in technology and market strategies.

Shandong Gemsky Environmental Technology is a prominent player in the DeNOx catalyst sector, focusing on innovative solutions to reduce nitrogen oxides in industrial emissions. Recently, the company has been expanding its market presence and product portfolio, driven by increased demand for emission control technologies. Notably, Shandong Gemsky has strengthened its production capabilities and launched new products tailored for power plants and steel industries, contributing to their robust revenue growth and market share increase in 2024.

Jiangsu Wonder specializes in the development and production of DeNOx catalysts, providing solutions for reducing nitrogen oxide emissions in various industrial applications. The company has recently made significant advancements in its product range, enhancing efficiency and environmental compliance. A recent strategic move includes expanding its manufacturing facilities to meet growing demand. This expansion, along with the introduction of new high-performance catalysts, has bolstered Jiangsu Wonder’s market position and revenue, reflecting positive growth trends in the DeNOx catalyst market for 2024.

BASF SE, a global leader in chemical production, continues to innovate in the DeNOx catalyst sector. The company has carved out its emissions catalyst business to focus more on high-growth areas such as battery materials. This strategic shift is part of BASF’s broader commitment to sustainability and reducing emissions. In 2024, BASF reported mixed financial results, with some segments facing challenges, but it remained committed to expanding its catalyst technologies, including those for emission control, to drive future growth.

Cormetech, a key player in the DeNOx catalyst market, specializes in providing advanced catalytic solutions to reduce nitrogen oxide emissions. The company has been expanding its production capabilities and introducing new products tailored for various industrial applications, such as power plants and transportation. Cormetech’s continuous innovation and strategic market expansion have strengthened its position, contributing to steady revenue growth and enhanced market share in the DeNOx catalyst sector.

IBIDEN Porzellanfabrick Frauenthal GmbH is renowned for its expertise in ceramic-based DeNOx catalysts, which are essential for reducing nitrogen oxide emissions in industrial processes. The company has been focusing on expanding its product range and improving the efficiency of its catalysts. Recent investments in research and development have enabled IBIDEN to maintain a competitive edge, driving growth in revenue and market presence in the DeNOx catalyst sector. The company’s strategic initiatives continue to align with global environmental standards and regulations.

Johnson Matthey Plc continues to excel in the DeNOx catalyst sector, focusing on high-value specialty catalysts, additives, and process solutions in the methanol, ammonia, and hydrogen markets. In 2024, the company aimed for high single-digit sales growth in the short term and mid-teens growth in the medium to long term. The company’s Catalyst Technologies business is poised for significant growth, driven by its extensive portfolio of sustainable technology projects and increasing licensing income, expecting to enhance operating margins substantially by 2028.

Haldor Topsoe is a prominent player in the DeNOx catalyst sector, providing advanced solutions for reducing nitrogen oxide emissions in various industrial applications. The company continues to innovate, focusing on high-efficiency catalysts and expanding its market reach. Recent developments include enhancing its production capabilities and introducing new catalyst technologies that improve emission control efficiency. Haldor Topsoe’s strategic focus on sustainability and technological advancements drives its growth and strengthens its position in the global market.

Hitachi Zosen Corp specializes in environmental technologies, including DeNOx catalysts, which are crucial for reducing nitrogen oxides in industrial emissions. The company has been actively expanding its technological offerings and market presence. Recent initiatives include advancements in catalyst technology and expanding production capacities to meet the increasing demand for emission control solutions. Hitachi Zosen’s commitment to innovation and sustainability positions it as a key player in the DeNOx catalyst market, contributing to cleaner industrial processes globally.

Seshin Electronics Co., Ltd., established in 1982, has diversified into the environmental catalysis sector, focusing on Selective Catalytic Reduction (SCR) technologies. The company has developed various catalysts, including low-temperature catalysts, enhancing its reputation in emission control markets. Recent innovations have strengthened their market position, although specific financial details for 2024 are not disclosed. Their commitment to advancing catalyst technology aligns with global environmental regulations, fostering growth in this sector.

JGC C&C is a significant player in the DeNOx catalyst market, offering advanced catalytic solutions for reducing nitrogen oxides. The company focuses on innovation and expanding its product line to meet stringent environmental standards. Recent developments include enhancing production capabilities and introducing new catalyst technologies to improve emission control efficiency. These strategic initiatives have bolstered their market position, driving revenue growth and expanding their presence in the global market.

CRI Catalyst Company is a leading provider of catalyst technologies, including DeNOx catalysts, essential for reducing nitrogen oxide emissions. The company has been expanding its technological offerings and production capacities, focusing on innovative solutions for various industrial applications. Recent initiatives involve the development of more efficient catalysts and strategic market expansions, contributing to their strong market presence and steady revenue growth in the DeNOx catalyst sector.

Conclusion

The DeNOx catalyst market is poised for significant growth, driven by increasing environmental regulations and the need for cleaner industrial processes. This growth is further supported by advancements in catalyst technology and the rising demand for energy-efficient solutions. Key industries, such as power generation and automotive, are expected to continue their heavy reliance on DeNOx catalysts to meet stringent emission standards.

The market’s expansion is also bolstered by government initiatives promoting the adoption of eco-friendly technologies. As awareness of environmental issues grows, the importance of DeNOx catalysts in reducing harmful emissions becomes more apparent. This trend is likely to persist, ensuring a steady demand for these catalysts in the foreseeable future.

In summary, the DeNOx catalyst market is on an upward trajectory, with strong potential for continued development and innovation. Stakeholders and industry players should focus on leveraging technological advancements and regulatory support to capitalize on emerging opportunities in this critical sector.