Table of Contents

- Introduction

- Editor’s Choice

- Diamond Market Overview

- Global Diamond Reserves – By Country

- Diamond Production Statistics

- Global Diamond Import Statistics

- Global Diamond Export Statistics

- Diamond Sales Statistics

- Diamond Price Statistics

- Spending on Diamond Ornaments

- Consumer Preference and Awareness of Diamond Types

- Regulations for Diamonds

Introduction

According to Diamond Statistics, Diamonds are renowned for their exceptional brilliance and durability. Stemming from their pure carbon composition and formation deep within the Earth. They rank as the hardest natural substance, scoring a perfect ten on the Mohs scale.

The clarity of diamonds refers to the absence of internal flaws and external blemishes. Their diverse range of colors, from colorless to fancy hues like yellow and pink, adds to their allure.

The cut of a diamond plays a crucial role in its sparkle and brilliance. While carat weight measures its size and rarity.

Certified by esteemed laboratories like GIA or AGS. Diamonds are valued not only for their aesthetic appeal in jewelry but also for their industrial applications. Where their hardness makes them ideal for cutting tools and technological uses.

Editor’s Choice

- The global diamond market revenue reached USD 101.9 billion in 2023.

- By 2032, the market is expected to grow to USD 140.1 billion. With natural diamonds at USD 86.86 billion and synthetic diamonds at USD 53.24 billion.

- The global diamond market is predominantly driven by the jewelry and ornaments segment. Which holds a commanding market share of 65%.

- In 2022, the market value of diamond jewelry worldwide was prominently led by the United States. Which accounted for USD 47.7 billion, reflecting its significant consumer demand and purchasing power.

- In 2023, Russia led the world in diamond reserves, boasting an impressive 860 million carats.

- In 2022, India led the global diamond export market with an export value of USD 26.1 billion, representing 21.20% of total diamond exports.

- As of January 2024, the average price per carat was USD 213.6. With a slight decrease to USD 209.2 by April 2024.

Diamond Market Overview

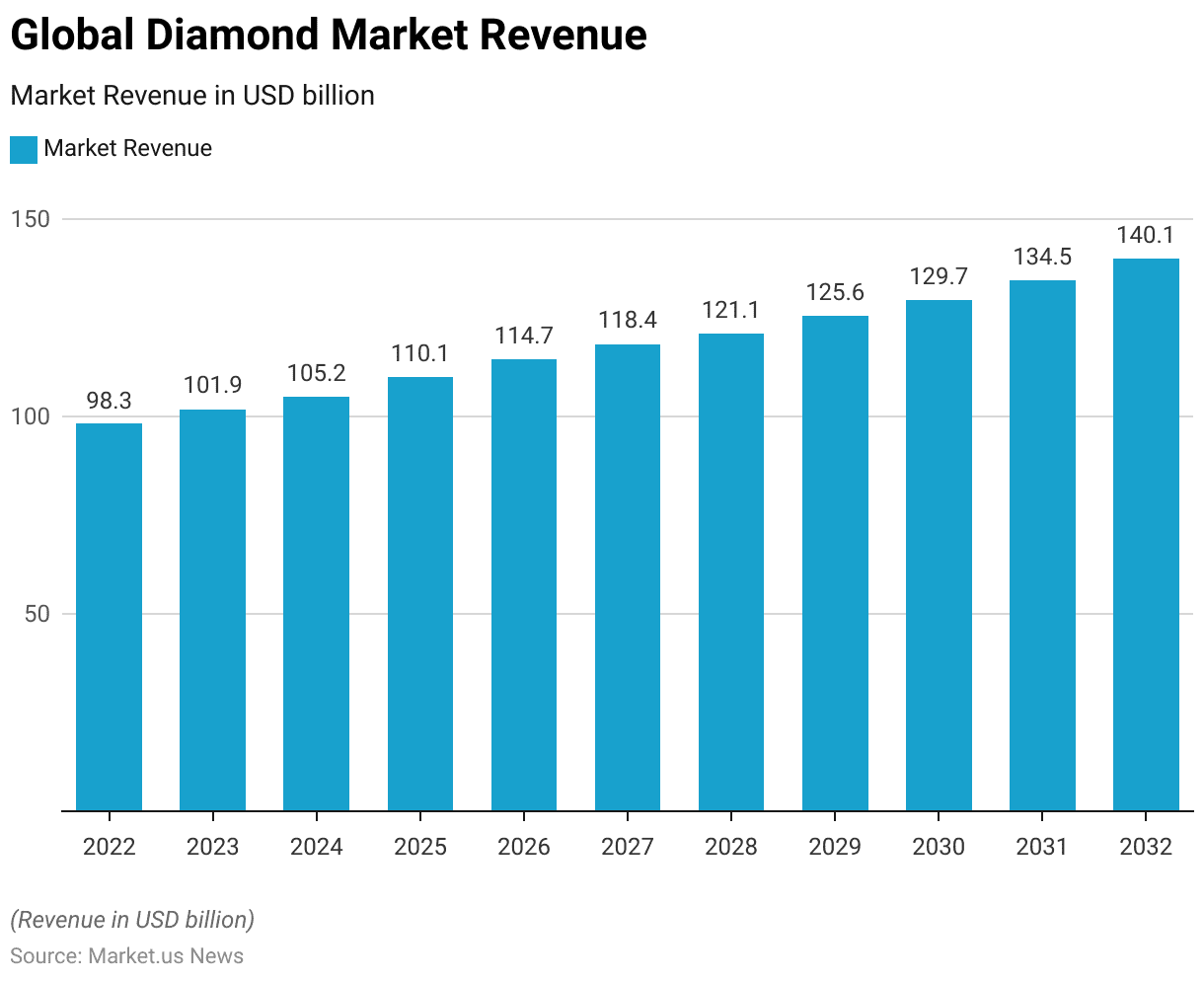

Global Diamond Market Size

- The global diamond market has exhibited consistent growth over the years at a CAGR of 3.70%. With revenues escalating from USD 98.3 billion in 2022 to USD 101.9 billion in 2023.

- Looking towards the next decade, the market is projected to achieve revenues of USD 129.7 billion in 2030, USD 134.5 billion in 2031, and an impressive USD 140.1 billion by 2032.

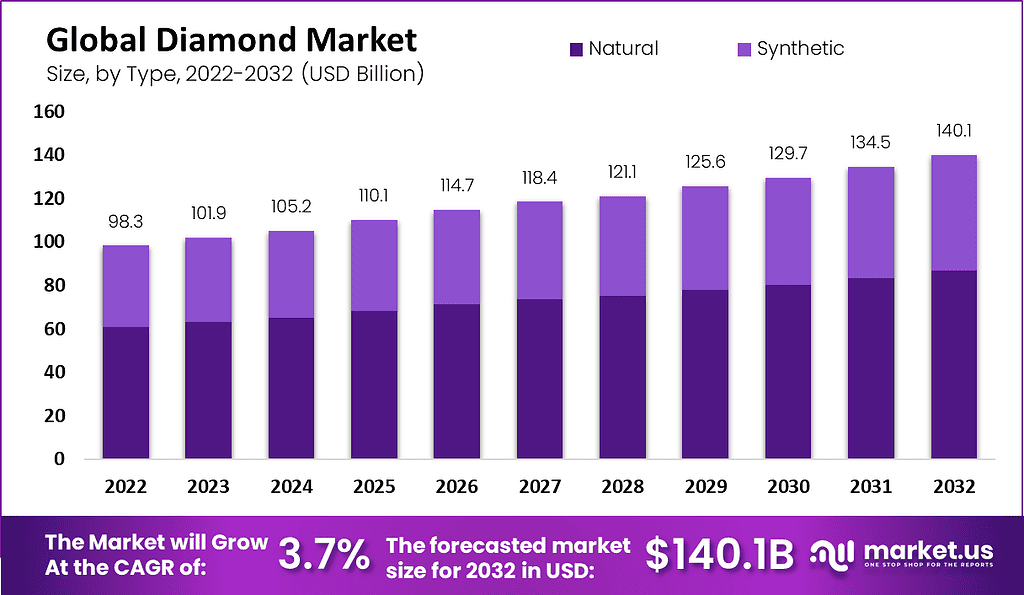

Global Diamond Market Size – By Type

- The global diamond market, segmented by type, has shown notable growth in both natural and synthetic diamonds.

- In 2022, the total market revenue was USD 98.3 billion. Natural diamonds contribute USD 60.95 billion and synthetic diamonds account for USD 37.35 billion.

- By 2032, the market is expected to grow to USD 140.1 billion. With natural diamonds at USD 86.86 billion and synthetic diamonds at USD 53.24 billion.

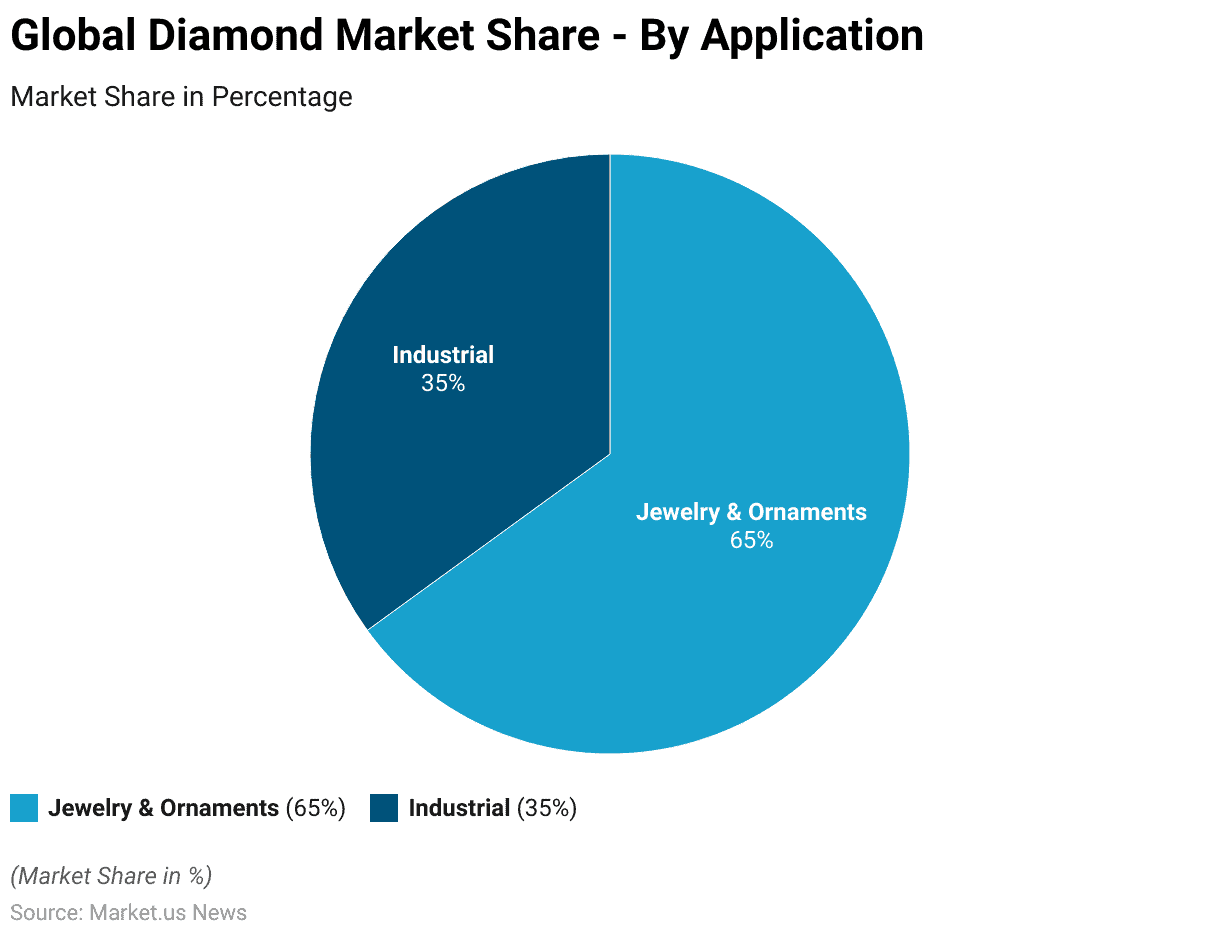

Diamond Market Share – By Application

- The global diamond market is predominantly driven by the jewelry and ornaments segment, which holds a commanding market share of 65%.

- Meanwhile, the industrial segment accounts for the remaining 35% of the market share.

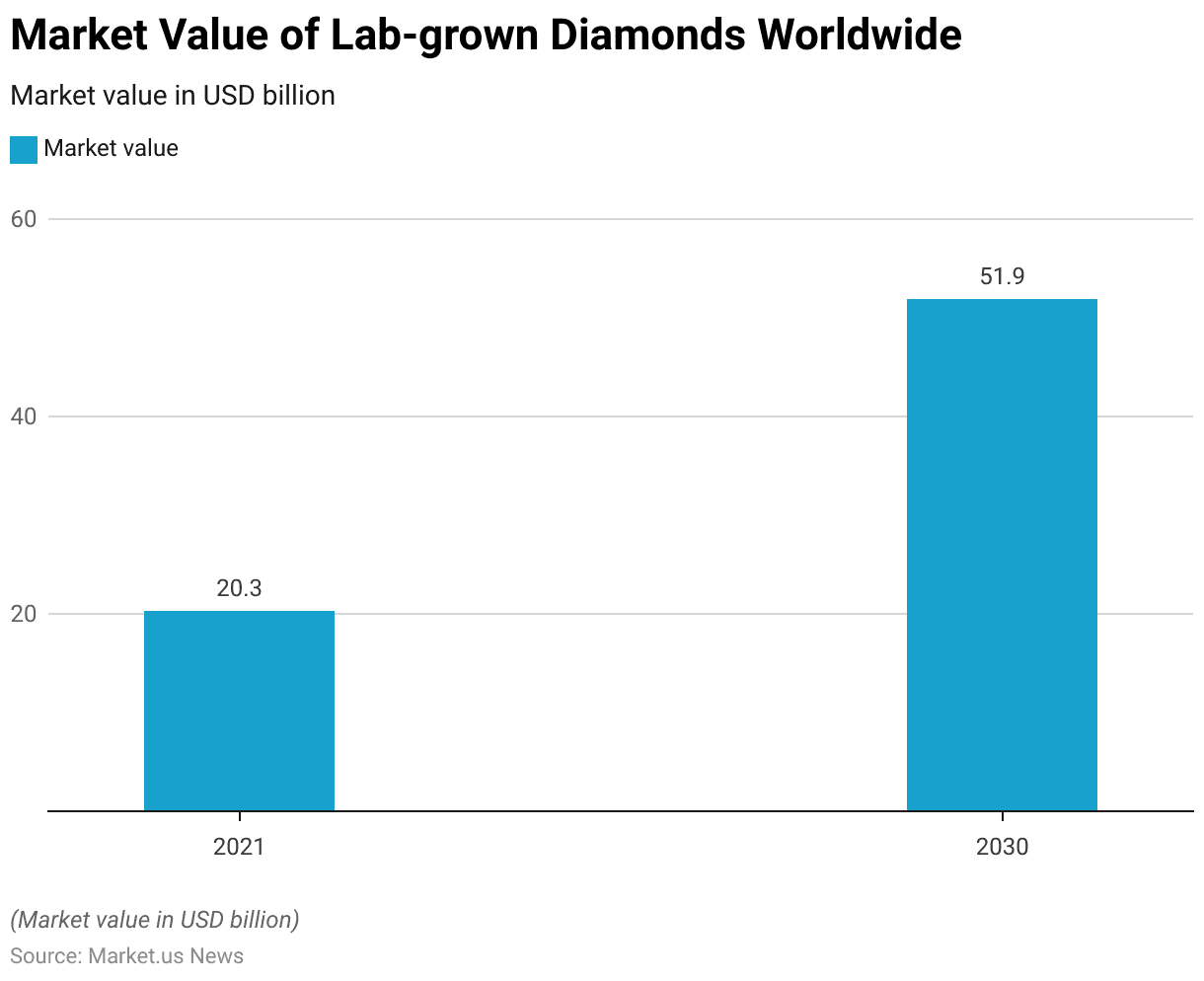

Market Value of Lab-Grown Diamonds Worldwide

- The market for lab-grown diamonds has experienced substantial growth and is poised for significant expansion.

- In 2021, the global market value of lab-grown diamonds was recorded at USD 20.3 billion.

- This market is projected to witness a robust increase, with forecasts indicating that by 2030, the market value will reach USD 51.9 billion.

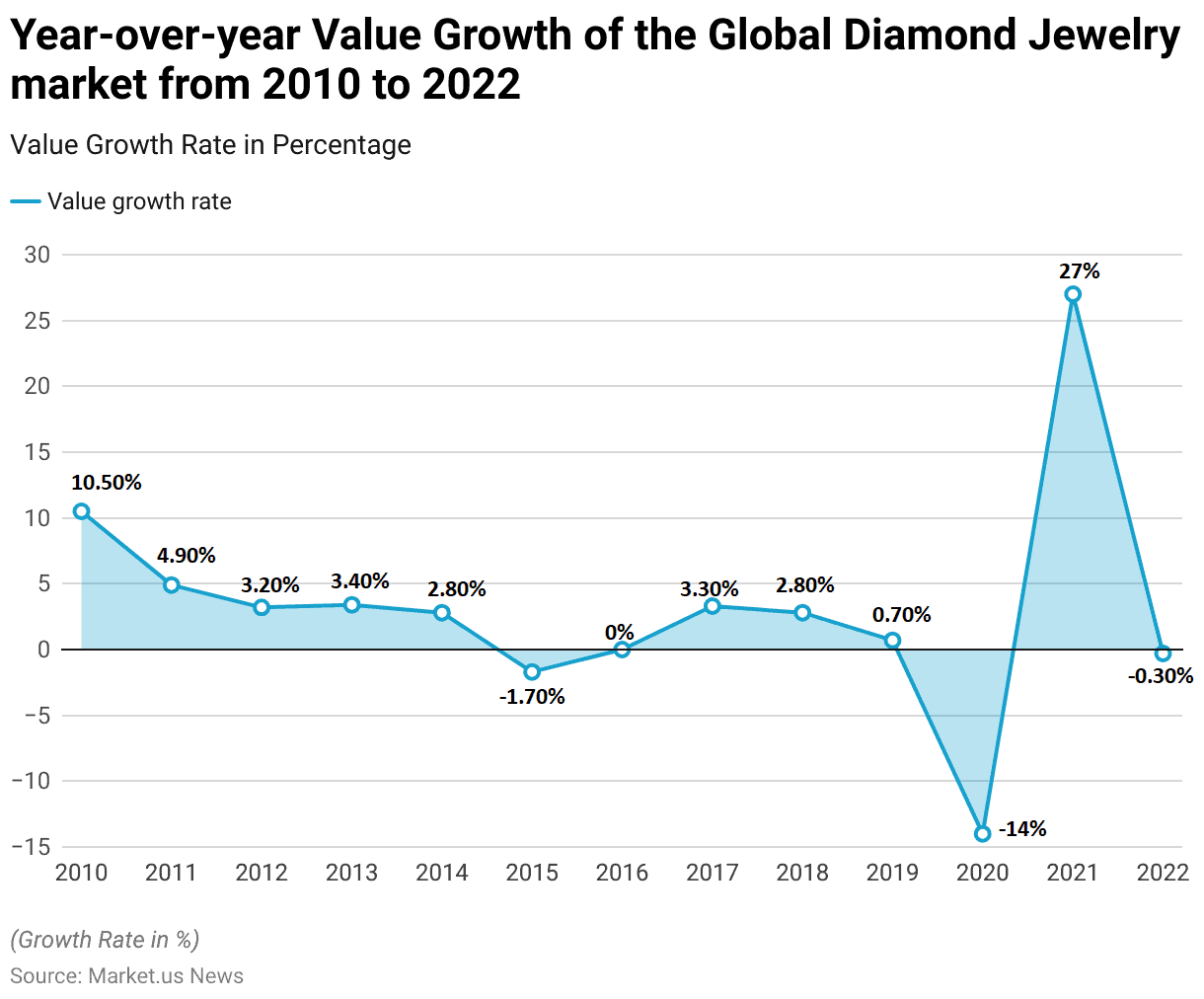

Growth of The Global Diamond Jewelry Market

- The global diamond jewelry market has experienced varying growth rates from 2010 to 2022.

- In 2010, the market saw a robust value growth rate of 10.50%.

- The growth rate slowed to 0.70% in 2019.

- The year 2020 marked a significant downturn, with the market experiencing a sharp decline of -14% due to the global pandemic’s impact.

- A substantial recovery occurred in 2021, with a remarkable growth rate of 27%.

- However, in 2022, the market faced a slight decline of -0.30%.

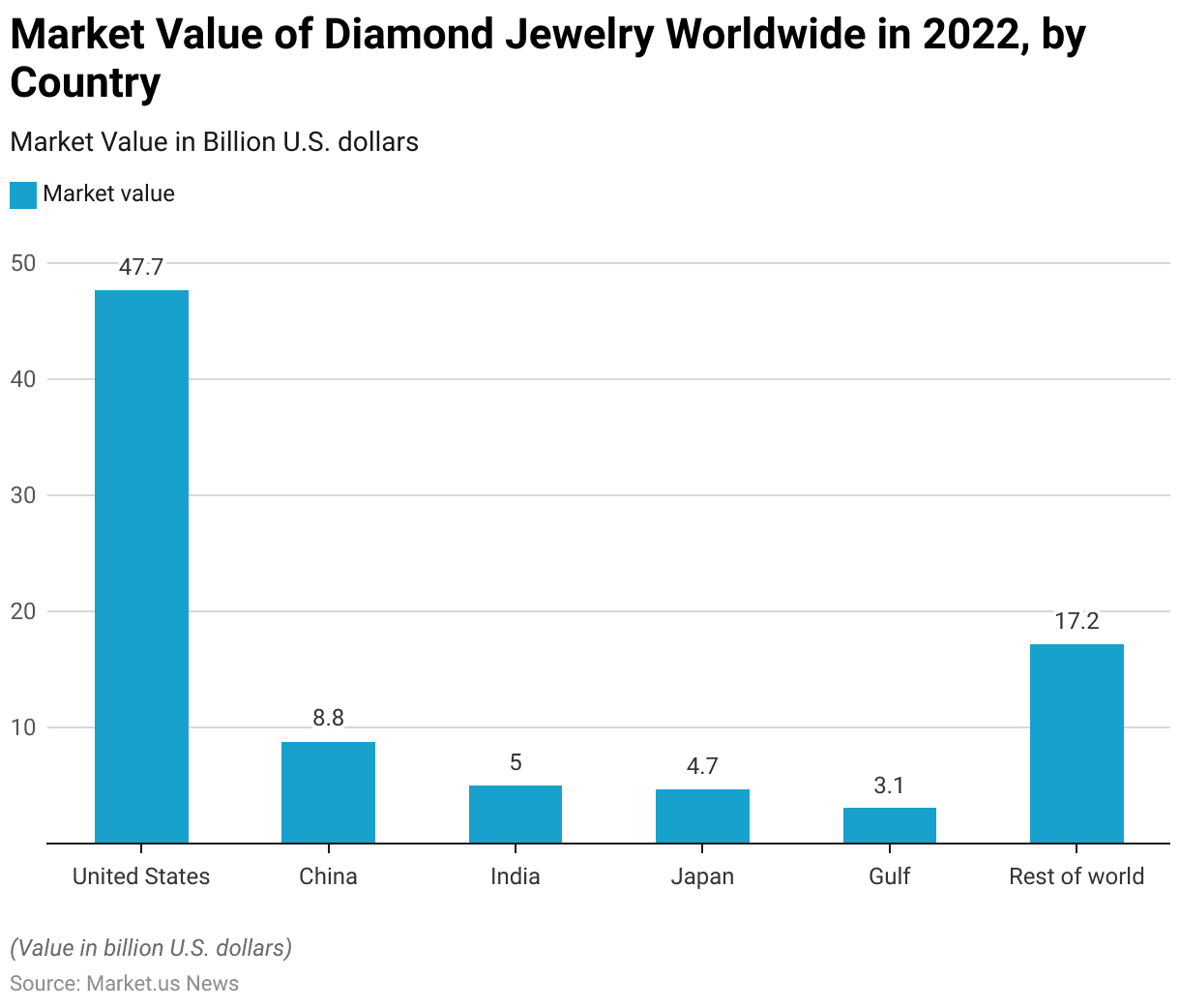

Market Value of Diamond Jewelry Worldwide – By Country

- In 2022, the market value of diamond jewelry worldwide was prominently led by the United States, which accounted for USD 47.7 billion, reflecting its significant consumer demand and purchasing power.

- China followed with a market value of USD 8.8 billion, showcasing its substantial influence in the global diamond jewelry market.

- India, with its rich cultural affinity for diamonds, contributed USD 5 billion.

- Japan’s market value stood at USD 4.7 billion, while the Gulf region accounted for USD 3.1 billion, driven by its luxury goods market segment.

- The rest of the world collectively represented a market value of USD 17.2 billion.

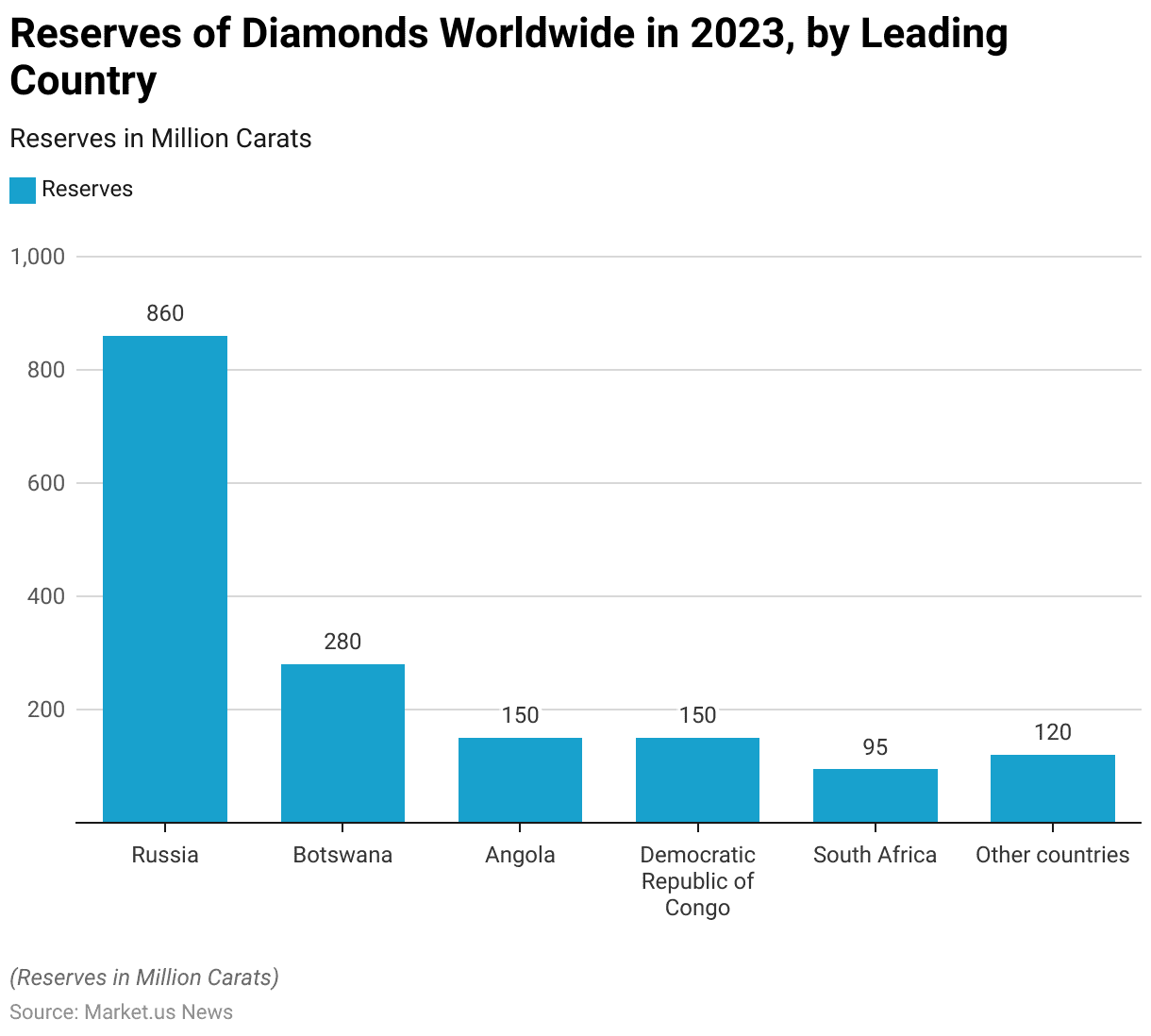

Global Diamond Reserves – By Country

- In 2023, Russia led the world in diamond reserves, boasting an impressive 860 million carats.

- Botswana followed with significant reserves of 280 million carats, underscoring its pivotal role in the global diamond industry.

- Both Angola and the Democratic Republic of Congo held substantial reserves of 150 million carats each.

- South Africa, another key player in the diamond market, had reserves amounting to 95 million carats.

- Other countries collectively accounted for 120 million carats of diamond reserves.

Diamond Production Statistics

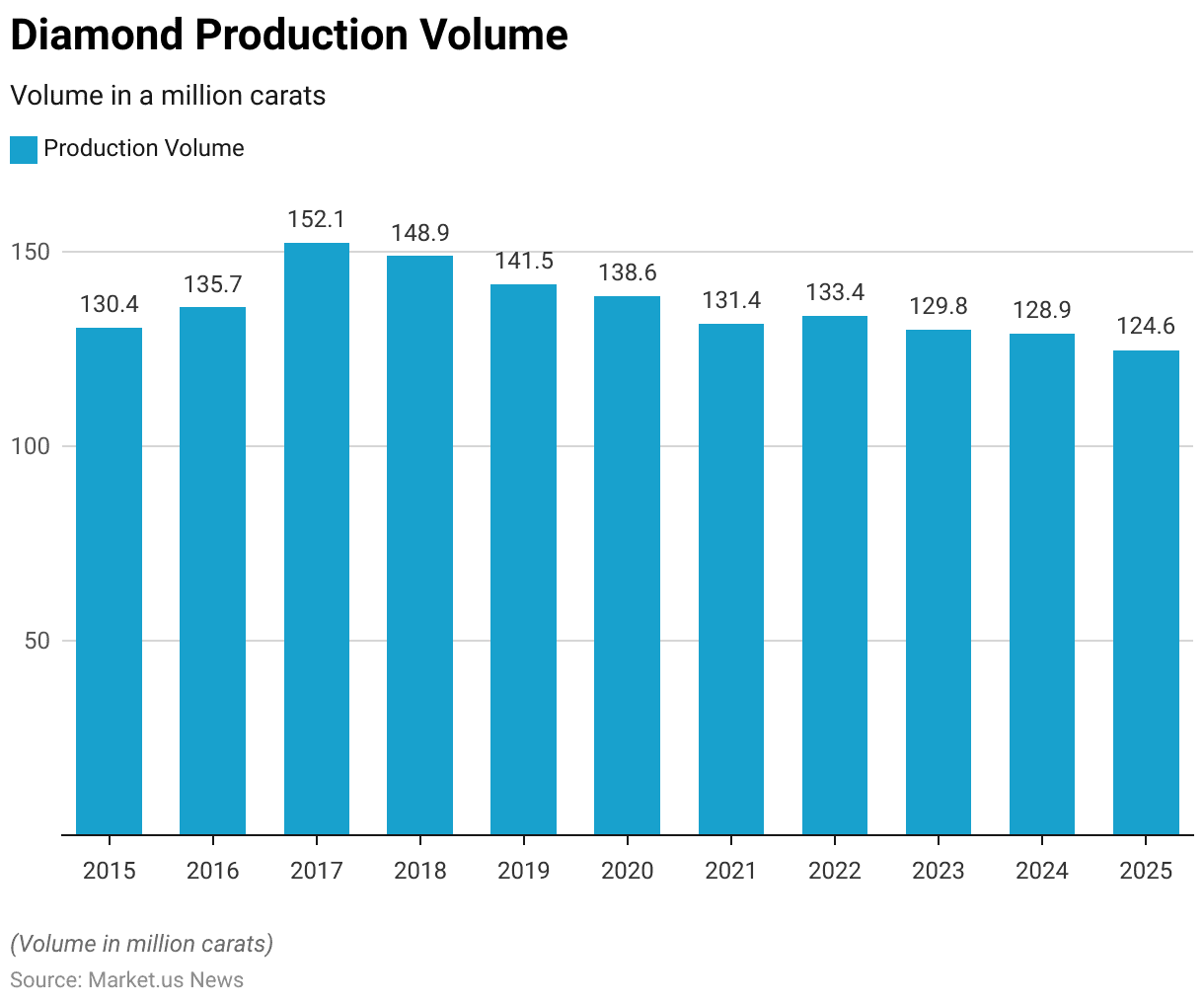

Global Diamond Production Volume

- The global diamond production volume has shown significant fluctuations between 2015 and 2025.

- In 2015, the production volume was 130.4 million carats, which increased to 135.7 million carats in 2016.

- However, forecasts indicate a decline in the subsequent years, with production expected to fall to 129.8 million carats in 2023, 128.9 million carats in 2024, and further to 124.6 million carats by 2025.

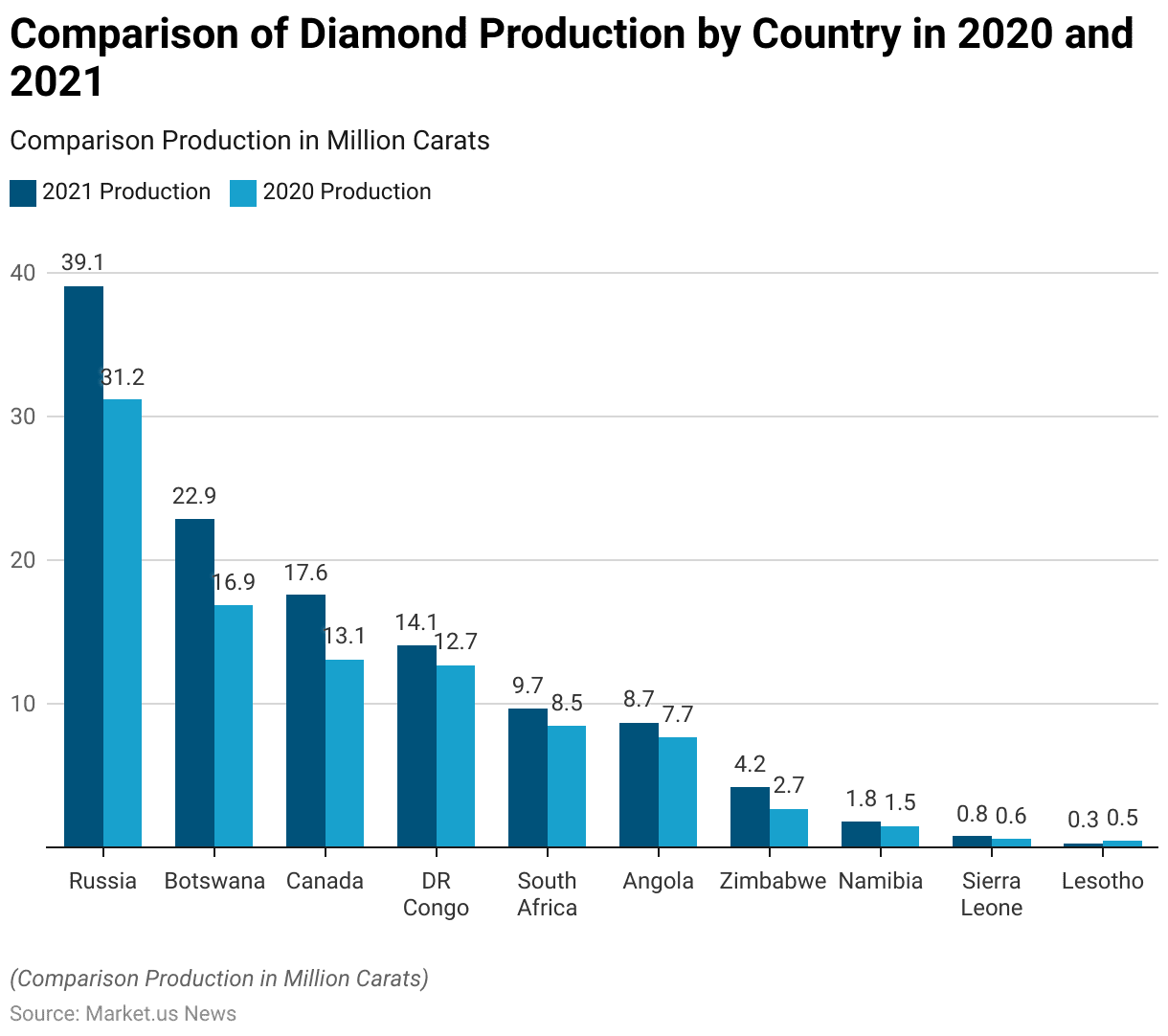

Diamond Production – By Country

- In 2021, diamond production across key countries saw notable increases compared to 2020.

- Russia led the global production with 39.1 million carats, up from 31.2 million carats in 2020.

- Botswana followed, producing 22.9 million carats in 2021, a significant rise from 16.9 million carats the previous year.

- Canada also experienced a substantial increase, producing 17.6 million carats in 2021 compared to 13.1 million carats in 2020.

- The Democratic Republic of Congo (DR Congo) saw its production grow from 12.7 million carats in 2020 to 14.1 million carats in 2021.

- South Africa produced 9.7 million carats in 2021, up from 8.5 million carats in 2020.

- Angola’s production increased from 7.7 million carats in 2020 to 8.7 million carats in 2021.

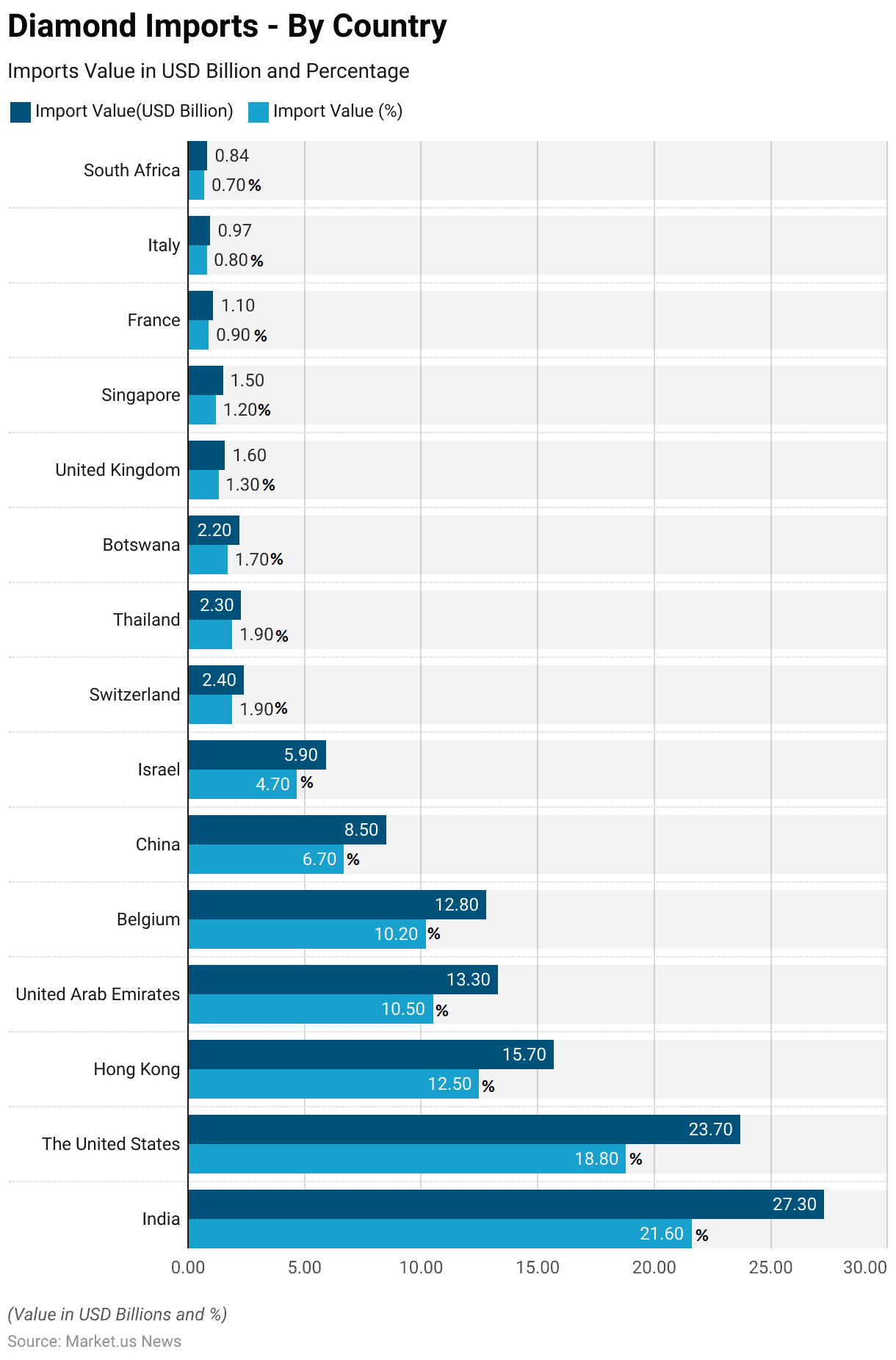

Global Diamond Import Statistics

- In the global diamond import market, India emerged as the leading importer in 2022, with a value of USD 27.3 billion, accounting for 21.60% of total diamond imports.

- The United States followed closely with imports valued at USD 23.7 billion, representing 18.80%.

- Hong Kong imported diamonds worth USD 15.7 billion, contributing 12.50% to the global import market.

- The United Arab Emirates had an import value of USD 13.3 billion, making up 10.50%, while Belgium’s diamond imports amounted to USD 12.8 billion, or 10.20%.

- China imported diamonds valued at USD 8.5 billion, equating to 6.70% of the total imports.

- Israel’s imports stood at USD 5.9 billion, representing 4.70%, followed by Switzerland with USD 2.4 billion (1.90%) and Thailand with USD 2.3 billion (1.90%).

- Botswana’s imports were valued at USD 2.2 billion, making up 1.70% of the market.

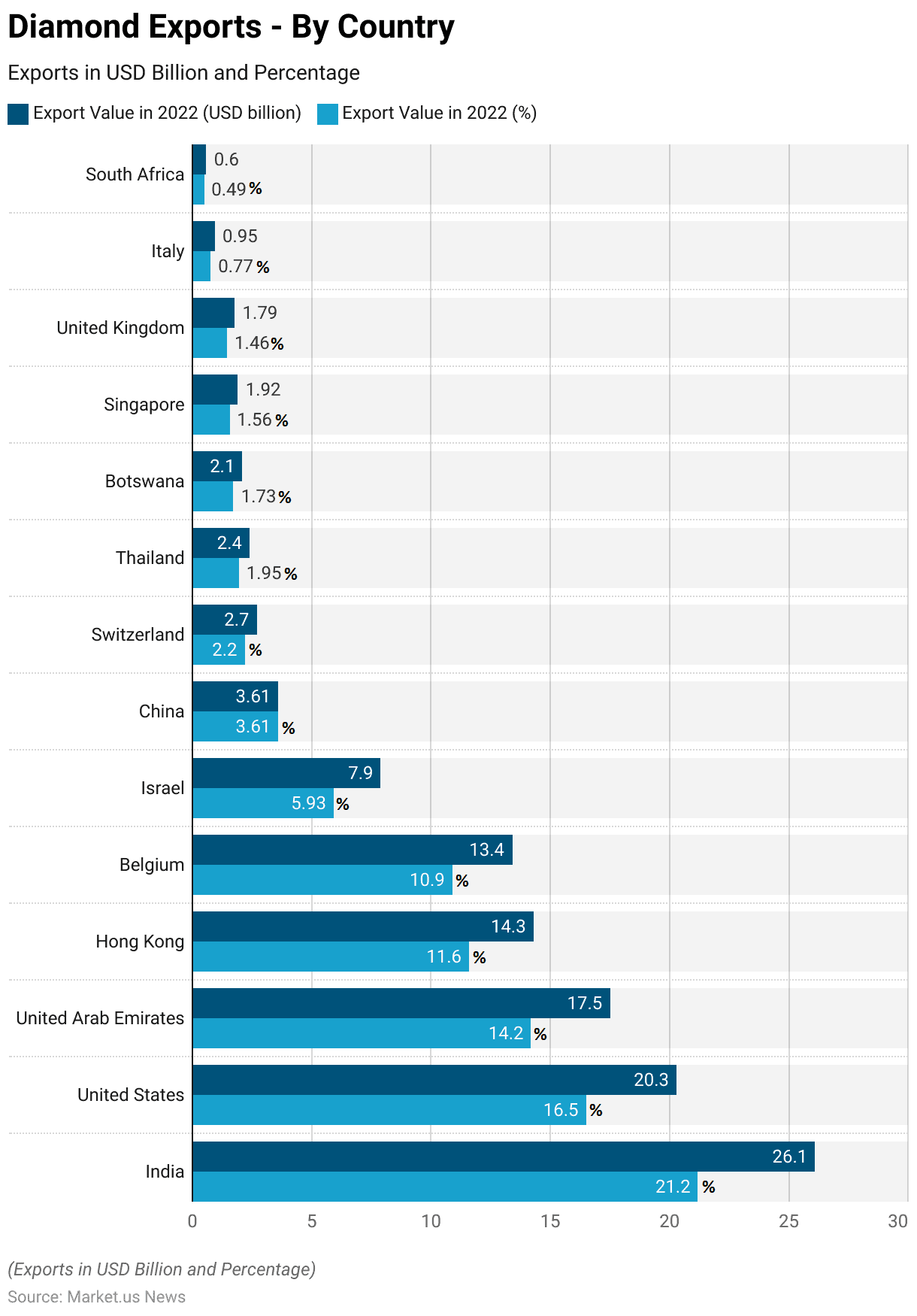

Global Diamond Export Statistics

- In 2022, India led the global diamond export market with an export value of USD 26.1 billion, representing 21.20% of total diamond exports.

- The United States followed with exports worth USD 20.3 billion, accounting for 16.50%.

- The United Arab Emirates exported diamonds valued at USD 17.5 billion, contributing 14.20% to the global market.

- Hong Kong’s diamond exports stood at USD 14.3 billion, making up 11.60%, while Belgium exported diamonds worth USD 13.4 billion, or 10.90%.

- Israel had diamond exports valued at USD 7.9 billion, representing 5.93%, followed by China, with exports totaling USD 3.61 billion, equating to 3.61% of the market.

- Switzerland’s diamond exports were valued at USD 2.7 billion, contributing 2.20%, and Thailand exported diamonds worth USD 2.4 billion, accounting for 1.95%.

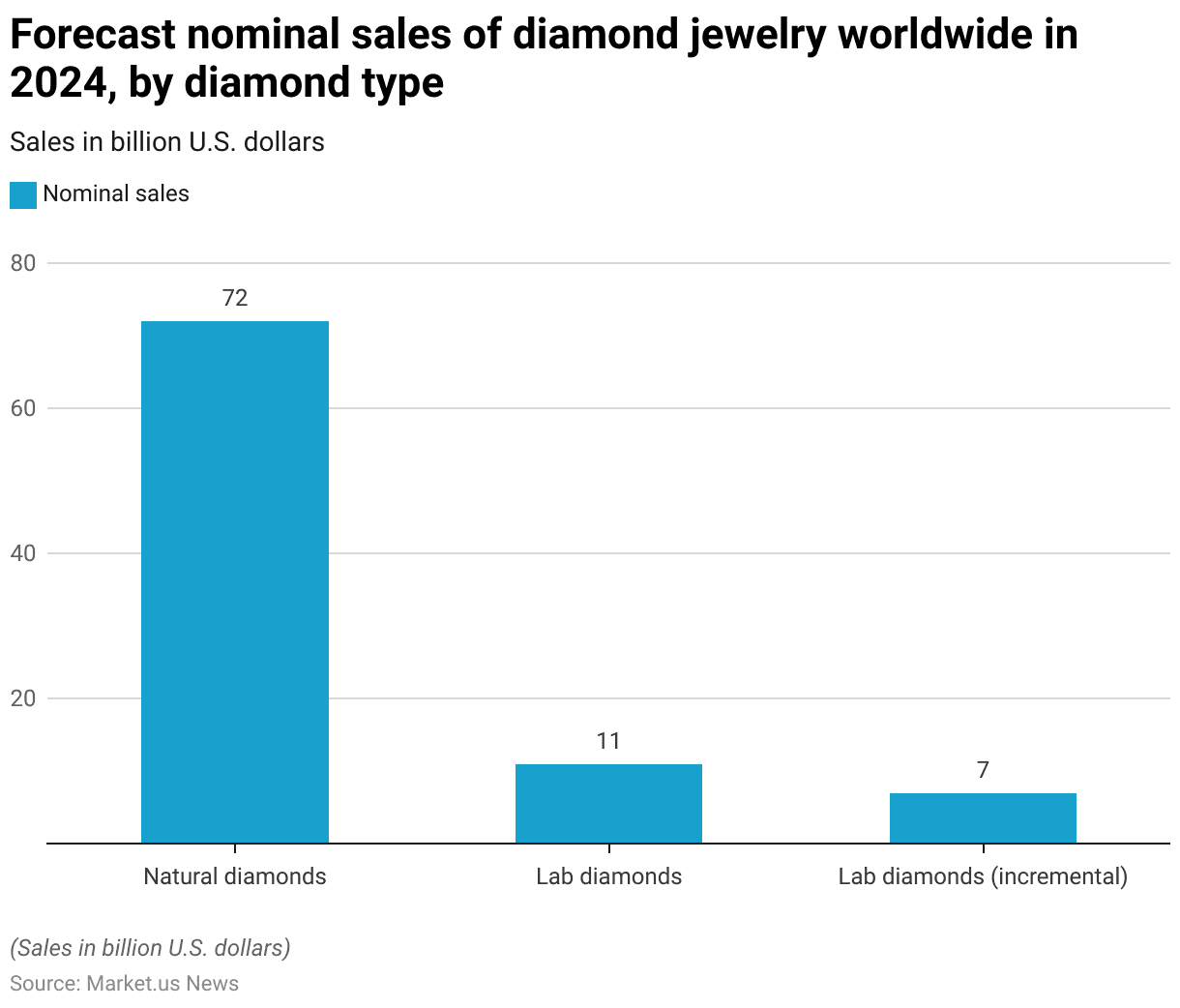

Diamond Sales Statistics

- In 2024, the global sales of diamond jewelry are forecasted to exhibit substantial growth, segmented by diamond type.

- The nominal sales of jewelry featuring natural diamonds are projected to reach USD 72 billion, reflecting their continued dominance and enduring appeal in the market.

- Lab-grown diamonds are also expected to see significant sales, with nominal sales anticipated at USD 11 billion.

- Additionally, the market for lab-grown diamonds is expected to experience incremental sales growth of USD 7 billion.

Diamond Price Statistics

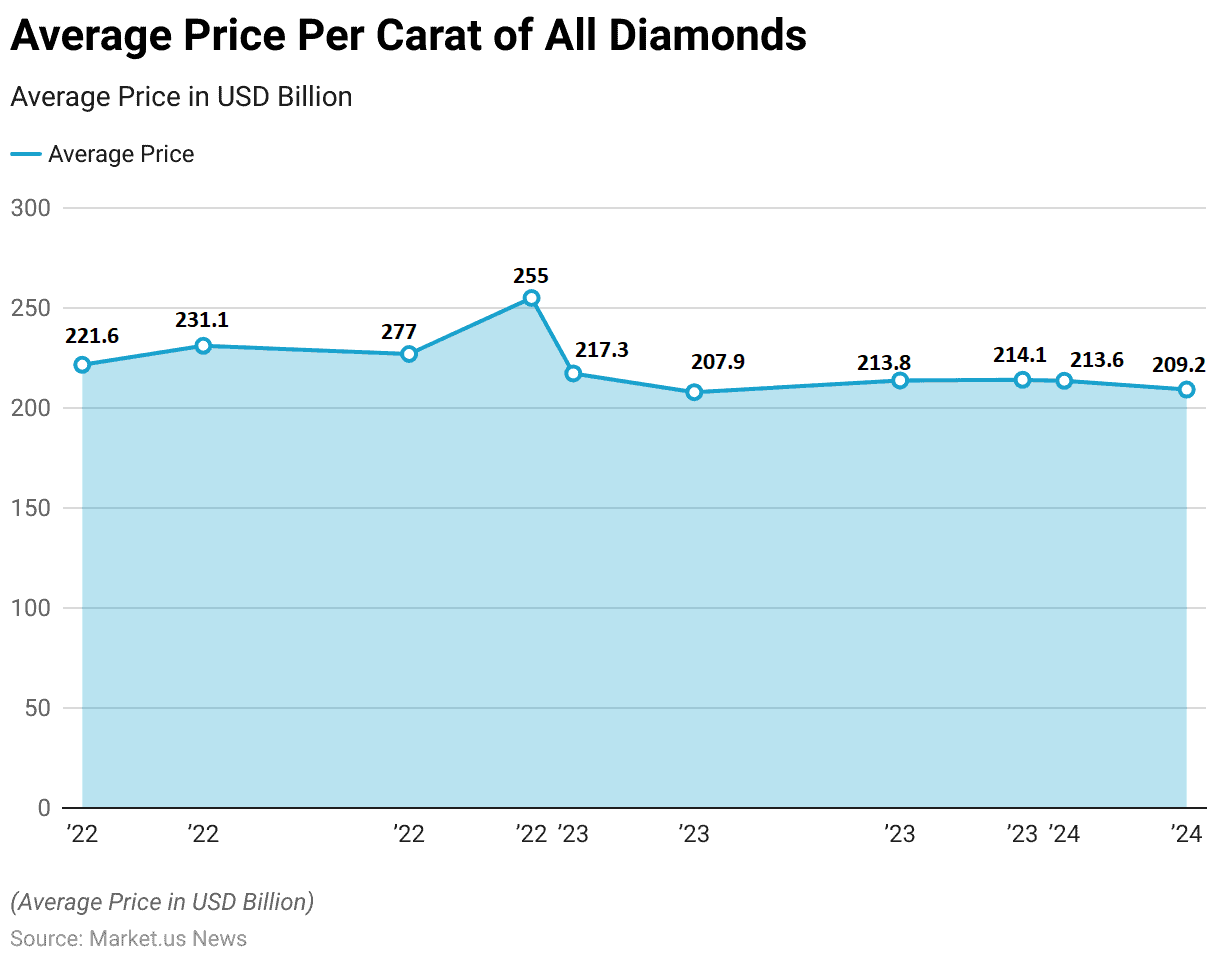

Average Price Per Carat of All Diamonds

- The average price per carat of all diamonds has demonstrated notable fluctuations over the past few years.

- In January 2022, the average price was USD 221.6 per carat, which increased to USD 231.1 per carat by April 2022.

- As of January 2024, the average price per carat was USD 213.6, with a slight decrease to USD 209.2 by April 2024.

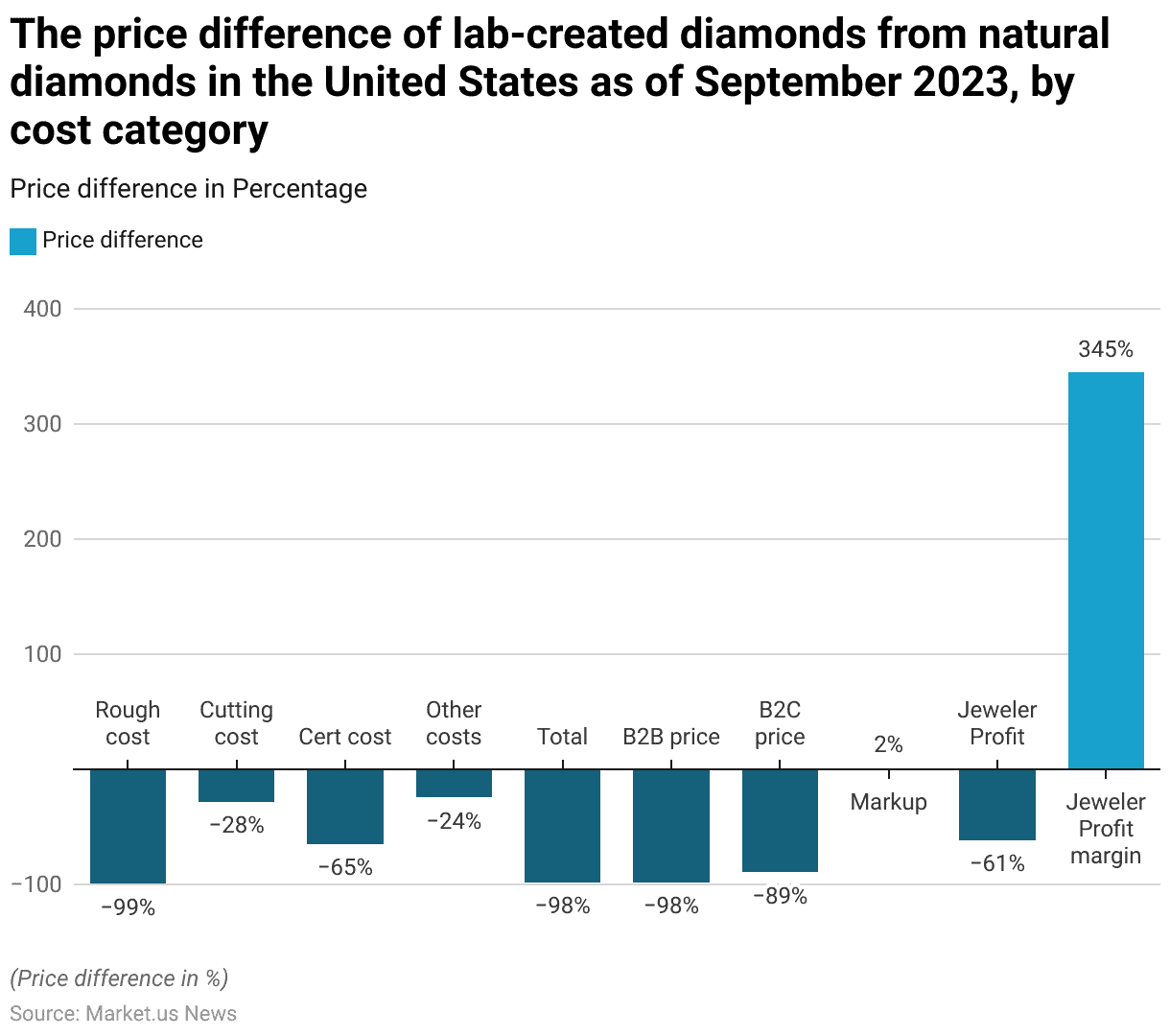

Price Difference of Lab-Created Diamonds from Natural Diamonds – By Cost Category

- As of September 2023, lab-created diamonds in the United States exhibit significant cost differences compared to natural diamonds across various cost categories.

- The rough cost of lab-created diamonds is 99% lower than that of natural diamonds.

- The cutting cost shows a 28% reduction, while the certification cost (cert cost) is 65% less.

- Other associated costs are 24% lower for lab-created diamonds.

- Overall, the total cost difference stands at 98% less for lab-created diamonds.

- In terms of business-to-business (B2B) and business-to-consumer (B2C) prices, lab-created diamonds are 98% and 89% cheaper, respectively.

- Interestingly, the markup for lab-created diamonds is only 1.56% higher.

- However, jewelers’ profit from selling lab-created diamonds is 61% less than that from natural diamonds, despite the jeweler’s profit margin being 345% higher.

Spending on Diamond Ornaments

- In 2021, the average expenditure on diamond engagement rings rose to $7,011, marking a 6.1% increase from the previous year.

- The proportion of lab-grown diamond rings increased from 19% in 2020 to over 24% in 2021.

- The average price of a lab-grown diamond engagement ring rose from $4,037 to $4,383, an 8.6% increase, reinforcing their typical cost advantage of 40% to 50% compared to natural diamonds.

- Expenditure on natural diamond engagement rings also rose, from an average of $7,197 in 2020 to $8,053 in 2021, a nearly 12% increase.

- Most rings feature diamond center stones weighing between 1.0 and 1.5 carats, with the average stone size increasing from 1.20 carats in 2020 to 1.32 carats in 2021.

Consumer Preference and Awareness of Diamond Types

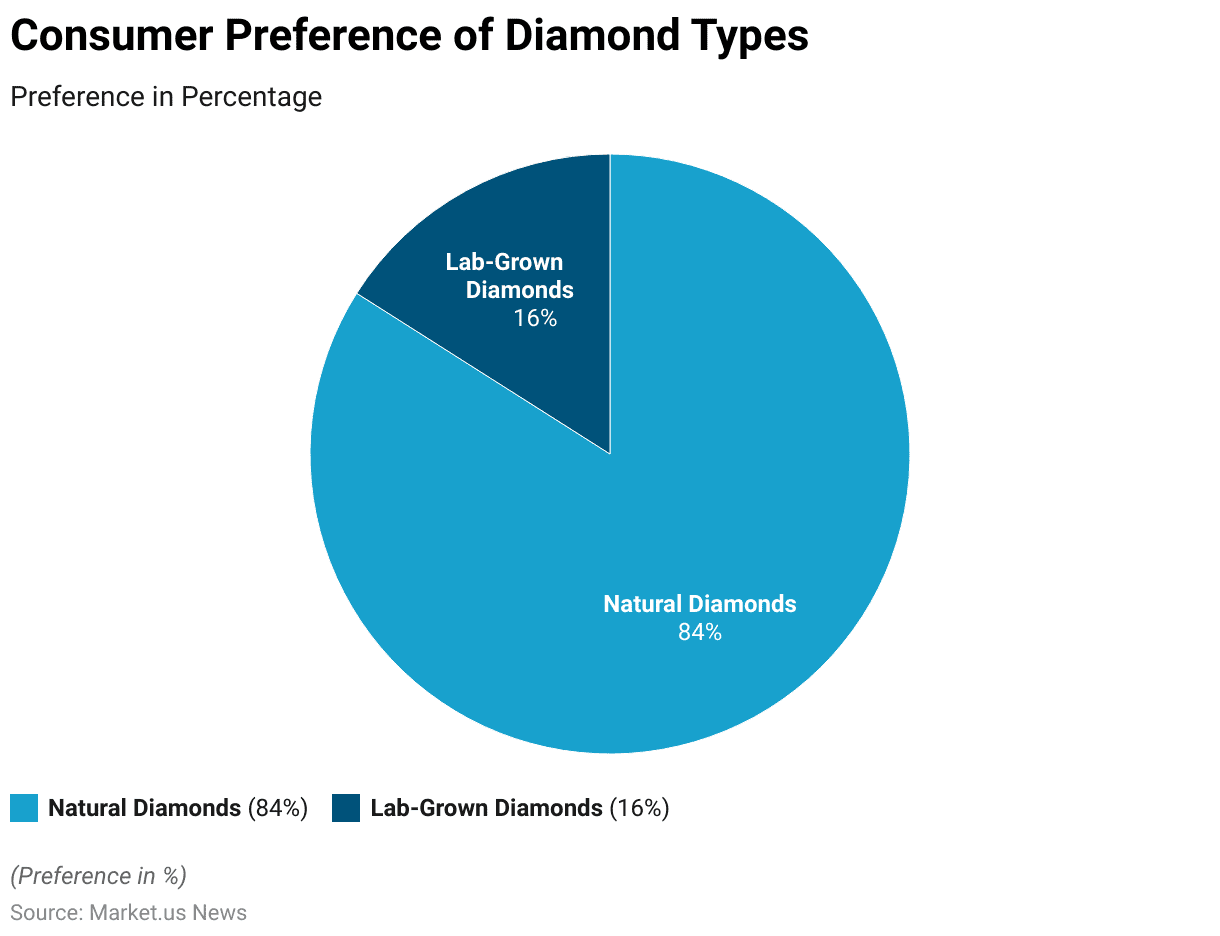

Consumer Preference of Diamond Types

- As of the latest data, consumer preference for diamond types shows a strong inclination towards natural diamonds, which are favored by 84% of consumers.

- In contrast, lab-grown diamonds are preferred by 16% of consumers.

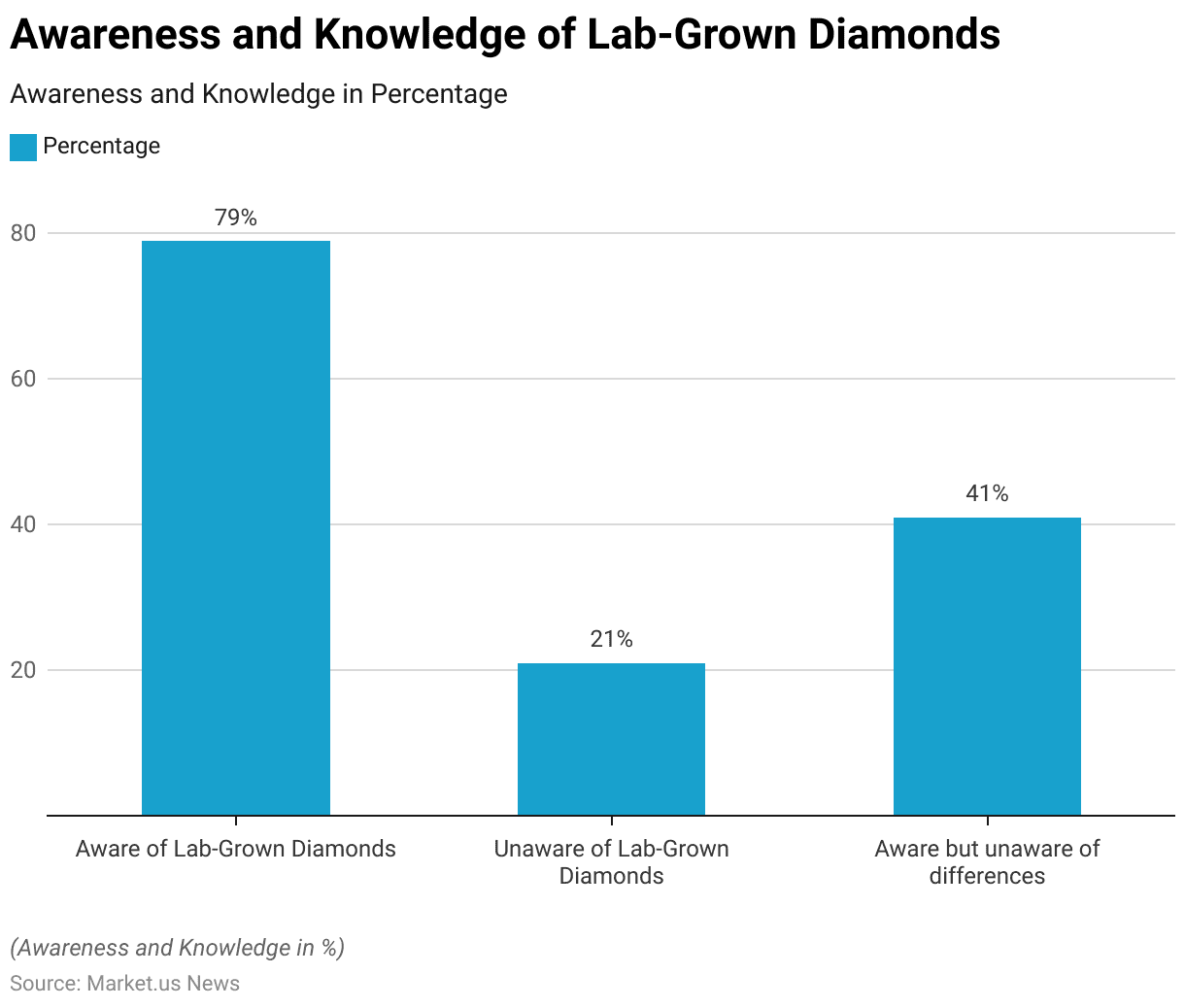

Awareness and Knowledge of Lab-Grown Diamonds

- The awareness and knowledge of lab-grown diamonds among consumers reveal interesting insights. A significant

- 79% of consumers are aware of lab-grown diamonds, while 21% remain unaware of their existence.

- Among those who are aware, 41% do not understand the differences between lab-grown and natural diamonds.

Regulations for Diamonds

- The regulations for diamonds vary by country, focusing on traceability and origin to ensure ethical sourcing and prevent the financing of conflicts.

- The U.S., under the Office of Foreign Assets Control (OFAC), prohibits the import of non-industrial diamonds mined in Russia unless they have been substantially transformed outside of Russia; effective from March 1, 2024, diamonds over 1 carat, and from September 1, 2024, those over 0.5 carats are included.

- The UK mirrors these regulations, banning the import of Russian-origin diamonds processed in third countries, effective March 2024 for diamonds over 1 carat and September 2024 for those over 0.5 carat.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)