Table of Contents

Introduction

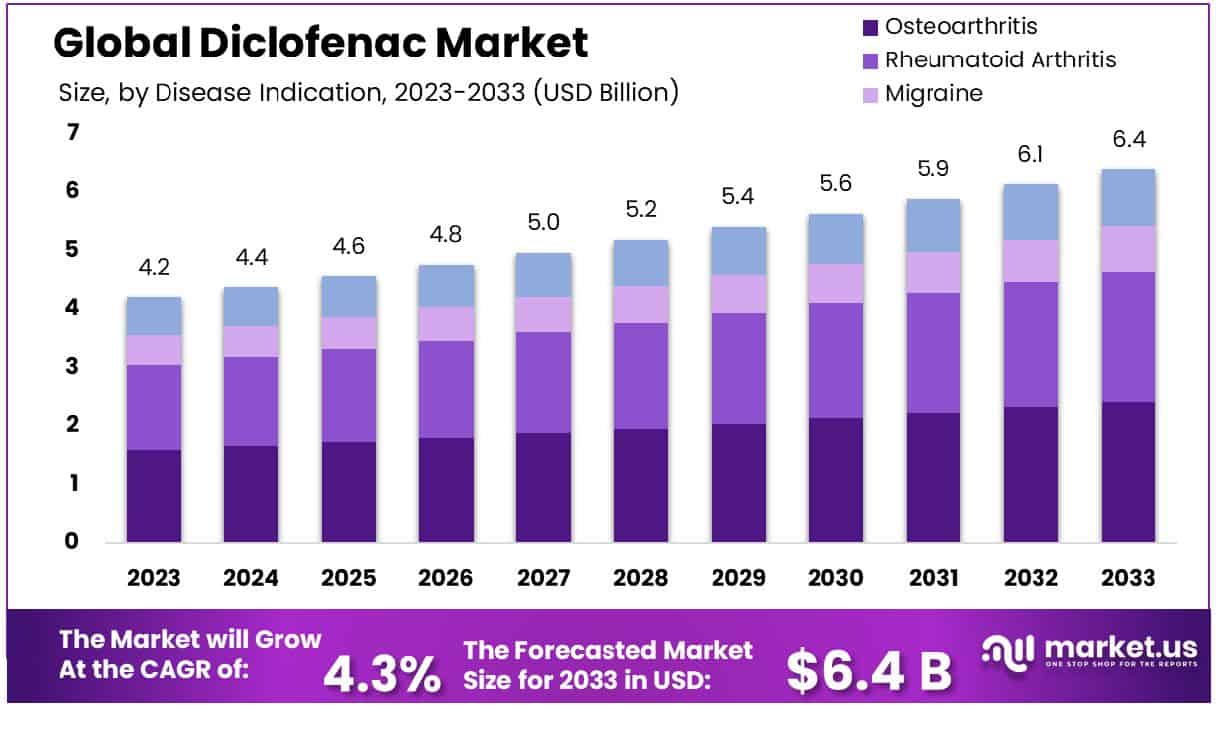

The global diclofenac market, a widely used non-steroidal anti-inflammatory drug (NSAID), is projected to experience significant growth in the coming years. From a valuation of USD 4.2 billion in 2023, the market size is expected to reach approximately USD 6.4 billion by 2033, expanding at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2033. This growth is primarily driven by increasing incidences of chronic pain and arthritis globally, coupled with the rising geriatric population who are more prone to such ailments.

However, the market faces challenges, including potential side effects associated with diclofenac, such as cardiovascular and gastrointestinal issues, which could restrain its usage and market expansion. Recent developments in the formulation and delivery methods of diclofenac aimed at minimizing side effects are likely to support the market’s growth. Enhanced safety profiles and improved patient outcomes through these innovations are critical factors that may contribute to the ongoing demand and market expansion of diclofenac.

Amneal Pharmaceuticals LLC has been active in enhancing its product offerings in the diclofenac domain. In recent years, Amneal introduced a new generic version of diclofenac, aiming to capture a larger share of the market by providing cost-effective alternatives for pain management. This move is expected to bolster their market position and address the growing demand for affordable NSAID options.

Aurobindo Pharma Limited has expanded its reach in the global diclofenac market through strategic partnerships and scaling up its production capabilities. This expansion strategy is designed to meet the increasing demand for diclofenac, particularly in emerging markets where the prevalence of chronic conditions like arthritis is rising.

Bayer AG, a leading player in the pharmaceutical sector, continues to innovate in the diclofenac market. Bayer has recently launched a new formulation of diclofenac that focuses on improved patient compliance and reduced side effects, which could set a new standard in NSAID treatments. This development is part of Bayer’s broader strategy to strengthen its foothold in the pain management sector.

Cipla Inc. is focusing on market penetration by launching diclofenac products tailored to specific regional health needs and regulatory environments. Their strategic focus on localized formulations allows them to effectively compete in diverse markets, thereby expanding their global presence and market share.

GSK plc has recently invested in marketing and clinical research to substantiate the efficacy and safety of their diclofenac products. These efforts are aimed at reinforcing their market position and trust with healthcare providers and patients alike. GSK’s commitment to high standards in product development and patient safety is a significant driver of their competitive edge in the diclofenac market.

Key Takeaways

- Market Growth: The Global Diclofenac Market is projected to grow from USD 4.2 billion in 2023 to USD 6.4 billion by 2033, with a CAGR of 4.3%.

- Asia Pacific dominates the Diclofenac market with a 35.5% share, valued at USD 1.5 billion.

- By Type: Tablets lead Diclofenac types with a 55.5% market share.

- By Disease Indication: Osteoarthritis indications account for 37.5% of Diclofenac usage.

- By Administration Route: Oral administration is preferred by 37% of Diclofenac users.

- By Distribution Channel: Distribution channels Retail Pharmacy dominates with a 68.4% market share.

Diclofenac Market Statistics

- Diclofenac is prescribed to approximately 1 in 10 patients with osteoarthritis and rheumatoid arthritis in the United States.

- In clinical trials, about 2% of patients experienced liver enzyme elevations (ALT) during diclofenac treatment.

- A meta-analysis indicated that out of 1,000 patients treated with diclofenac for one year, there were three additional major vascular events compared to a placebo group.

- It is recommended to monitor liver transaminases within 4 to 8 weeks after starting diclofenac therapy due to the risk of hepatotoxicity.

- The maximum recommended daily dose of diclofenac for chronic pain management is typically 150 mg, divided into multiple doses.

- Patients on diclofenac should be monitored for gastrointestinal distress, as up to 15% may experience gastrointestinal side effects.

- Diclofenac has potential interactions with over 100 medications, including anticoagulants and certain antihypertensives.

- The risk of serious adverse effects increases in elderly patients, particularly those over 65 years of age, who are more likely to experience gastrointestinal bleeding.

- Approximately 1% of patients may experience serious gastrointestinal complications, such as ulcers or bleeding, during diclofenac treatment.

- Diclofenac is commonly prescribed to adults aged 40-70, with a higher prevalence in those with chronic pain conditions.

- In long-term studies, about 4% of patients showed significant elevations in liver enzymes after 6 months of diclofenac therapy.

- Diclofenac was prescribed over 11 million times in 2021, indicating its widespread use for various inflammatory conditions.

- The gel formulation of diclofenac, at 1% strength, was the most dispensed form in 2021, comprising 45.4% of all diclofenac products dispensed.

- The tablet forms of diclofenac, at doses of 75 mg and 50 mg, accounted for 33.3% and 13.7% of the distribution, respectively.

- Diclofenac is known for its significant gastrointestinal risks, including fatal outcomes such as bleeding, ulceration, and perforation, occurring in 1% to 4% of patients treated over one year.

Emerging Trends

- Topical Formulations: There is a noticeable shift towards the development of topical forms of diclofenac, such as gels, creams, and patches. These formulations are designed to reduce systemic side effects and provide targeted pain relief. The preference for topical diclofenac is increasing among patients who are concerned about the gastrointestinal and cardiovascular risks associated with oral NSAIDs.

- Combination Therapies: Another emerging trend is the combination of diclofenac with other analgesics to enhance pain relief without increasing the dosage. This approach aims to achieve better pain management for conditions like severe arthritis while minimizing the potential for side effects.

- Improved Delivery Systems: Innovations in drug delivery systems, such as nano-emulsions and microencapsulation, are being explored to improve the absorption and effectiveness of diclofenac. These technologies can potentially offer quicker relief from pain and reduce the frequency of dosing, enhancing patient compliance.

- Focus on Geriatric Pain Management: As the global population ages, there is an increasing focus on developing diclofenac products that are tailored for the elderly. This demographic is more susceptible to chronic pain conditions, driving demand for NSAIDs that are both effective and gentle on the elderly body systems.

- Regulatory and Safety Monitoring: In response to concerns over the safety of long-term NSAID use, there is a trend towards stricter regulatory oversight and enhanced safety monitoring of diclofenac products. Companies are investing in more rigorous clinical trials to better understand and mitigate the risks associated with diclofenac, ensuring compliance with global health regulations.

Use Cases

- Arthritis Management: Diclofenac is extensively used in the treatment of both osteoarthritis and rheumatoid arthritis. It helps reduce joint inflammation, pain, and stiffness associated with arthritis. Approximately 350 million people worldwide suffer from arthritis, and diclofenac’s ability to improve daily function and quality of life makes it a cornerstone of arthritis therapy.

- Postoperative Pain: Post-surgical pain management often involves diclofenac due to its potent pain-relieving properties. It is prescribed to reduce pain and inflammation post-surgery, helping patients recover more comfortably and quickly. Diclofenac is used in approximately 20-25% of postoperative care cases, depending on the type of surgery and the patient’s overall health profile.

- Migraine Headaches: Diclofenac is also effective in treating acute migraine attacks. By reducing inflammation and pain signaling, it can alleviate the symptoms of migraines. Studies suggest that when used at the onset of migraine symptoms, diclofenac can reduce the severity of pain by up to 50% for many patients.

- Menstrual Pain: Diclofenac is commonly prescribed for managing dysmenorrhea, or painful menstrual periods, which affects around 40-70% of women of reproductive age. Its effectiveness in reducing menstrual pain helps improve the quality of life and daily functioning for many women.

- Dental Pain: In dental care, diclofenac is used to manage pain and swelling associated with dental procedures and conditions such as tooth extraction and gum surgeries. It is particularly valued for its ability to control inflammation and provide pain relief in the acute setting of dental pain management.

- Sports Injuries: Athletes frequently use diclofenac to treat sprains, strains, and other sports-related injuries due to its anti-inflammatory and analgesic properties. This application is crucial for both professional and amateur athletes in maintaining physical activity and recovering from injuries.

Key Players Analysis

Amneal Pharmaceuticals LLC has established itself as a key player in the diclofenac sector by launching the first generic version of diclofenac sodium topical gel 1% in the United States. This product, intended for the relief of arthritis pain, highlights Amneal’s commitment to innovation and cost-effective healthcare solutions. The launch not only expands their product line but also underscores their capacity in complex drug formulation, contributing to significant savings in the healthcare system.

Aurobindo Pharma Limited has enhanced its market presence in the diclofenac sector by obtaining FDA approval for its diclofenac sodium topical solution USP, 2% w/w, an AB-rated generic equivalent to Pennsaid® Topical Solution. This approval reflects Aurobindo’s commitment to offering cost-effective therapeutic options for osteoarthritis knee pain relief, leveraging its robust R&D and manufacturing capabilities to meet diverse market needs and support healthcare affordability.

Cipla Inc. has successfully secured final approval from the U.S. FDA for its Diclofenac Sodium Topical Gel, 1%, which is an AB-rated generic equivalent to Voltaren® Gel. This product is designed for the relief of osteoarthritis pain in joints that are suitable for topical treatment, like the knees and hands. The approval underscores Cipla’s capability in developing and marketing generic therapeutic solutions aimed at improving patient care in the diclofenac sector.

Bayer AG has been actively involved in the development of diclofenac, a nonsteroidal anti-inflammatory drug (NSAID) used primarily for its pain-relieving and anti-inflammatory properties. While the company does not originate the drug, Bayer has conducted clinical trials to explore new applications of diclofenac in treating soft tissue injuries through its product formulations. This research underscores Bayer’s commitment to expanding the therapeutic potential of established drugs within its portfolio.

Haleon Group, through its Voltaren products, prominently utilizes diclofenac to manage pain and inflammation, notably in the Voltarol and Voltaren ranges. These products are designed for acute muscular and joint pain relief, leveraging diclofenac’s anti-inflammatory properties by inhibiting enzymes responsible for pain and swelling. Haleon focuses on formulating products like Voltaren Emulgel, which enhances diclofenac absorption, ensuring prolonged relief targeted at inflammation sites.

Krosyl Pharmaceuticals Pvt. Ltd. actively participates in the diclofenac sector by producing Gastro-Resistant Diclofenac Sodium Tablets, which are utilized as non-steroidal anti-inflammatory drugs (NSAIDs). These medications are specifically designed to alleviate pain, swelling, and inflammation associated with various joint conditions.

Novartis AG was involved in the diclofenac sector primarily through the production of Voltaren, a non-steroidal anti-inflammatory drug (NSAID) used to treat pain and inflammation. However, in 2015, Novartis sold the rights to Voltaren to GlaxoSmithKline, shifting its focus away from this particular product line.

Octavius Pharma Pvt. Ltd. has developed and markets Diclofenac Sodium and Diclofenac Potassium DC granules, which are utilized to manufacture plain tablets for pain management. These granules are engineered for uniform particle size, enhancing the flow-ability and consistency in tablet compression, ensuring uniform dosage and dissolution qualities, and adhering to USP standards.

Teva Pharmaceutical Industries Ltd. has introduced a generic version of the Flector® Patch in the U.S., which contains Diclofenac Epolamine for topical pain relief. This product is part of Teva’s extensive portfolio of over 500 generic medicines, affirming its leadership in the generic pharmaceutical market with a focus on pain management solutions.

Wellona Pharma, established in Surat, India, plays a significant role in the pharmaceutical industry, particularly as a manufacturer and supplier of Diclofenac sodium tablets, commonly used for their anti-inflammatory properties. The company ensures the provision of Diclofenac in various dosages, focusing on the synthesis inhibition of prostaglandins to alleviate pain.

Conclusion

Diclofenac continues to be a cornerstone in the management of pain and inflammation across a diverse range of medical conditions. Its effectiveness in treating issues from arthritis to postoperative pain, migraines, menstrual discomfort, dental procedures, and sports injuries underscores its versatility and enduring demand in the pharmaceutical market.

Despite concerns over potential side effects, ongoing innovations in drug delivery and formulation are enhancing its safety profile, thereby sustaining its popularity among healthcare providers and patients alike. As the global population ages and the prevalence of chronic pain increases, the diclofenac market is expected to maintain steady growth, driven by the drug’s proven efficacy and the continuous development of safer, more patient-friendly formulations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)