Table of Contents

Introduction

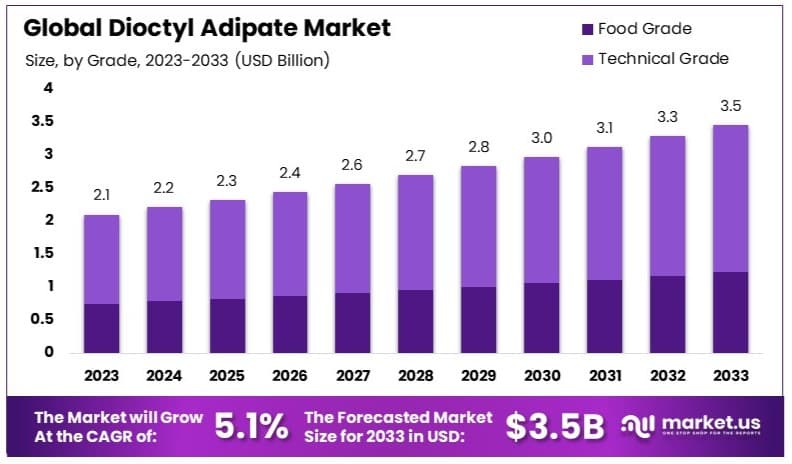

The Global Dioctyl Adipate Market is poised for steady growth, projected to increase from USD 2.1 Billion in 2023 to an estimated USD 3.5 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.1% during the forecast period from 2024 to 2033. This expansion is largely driven by the increasing demand for Dioctyl Adipate in various applications such as plasticizers in PVC manufacturing, where it enhances the flexibility and durability of products. Additionally, its low-temperature resistance properties are boosting its use in consumer goods and automotive applications, further fueling market growth.

However, the market faces several challenges that could impede its trajectory. Regulatory scrutiny over the environmental and health impacts of phthalate-based plasticizers presses the industry towards more sustainable and less harmful alternatives. Moreover, fluctuations in the prices of raw materials used to produce Dioctyl Adipate pose a persistent challenge, affecting the overall production costs and market stability.

Recent developments have seen significant innovation in product formulations and manufacturing processes aimed at reducing the environmental footprint of these chemical products. Market players are increasingly investing in research and development to enhance the biodegradability and efficiency of Dioctyl Adipate, which could provide new opportunities for growth in environmentally sensitive markets. These efforts are crucial in maintaining the market’s expansion and addressing the pressing challenges it faces.

Recent strategic moves by key players in the Dioctyl Adipate market indicate a focus on expanding production capabilities and enhancing product portfolios to meet growing market demands.

Hallstar recently finalized the acquisition of LANXESS’ ester manufacturing facility in Greensboro, North Carolina. This acquisition is pivotal for Hallstar as it not only boosts its manufacturing capacity but also diversifies its product offerings, incorporating brominated flame retardants and phthalate-free plasticizers into its portfolio. This move is aimed at enhancing Hallstar’s ability to serve the industrial market more effectively, bolstering its competitive position in the Dioctyl Adipate sector.

ExxonMobil has also been active, streamlining its business operations to enhance efficiency and cost-effectiveness, which are crucial for sustaining its competitive edge in the market. In a significant expansion of its chemical business, ExxonMobil acquired Materia, Inc., a company known for its innovative structural polymers technology. This acquisition allows ExxonMobil to integrate Nobel Prize-winning technologies into its offerings, providing new materials that are stronger and more durable for applications such as wind turbine blades and electric vehicle parts. This not only broadens ExxonMobil’s product range but also enhances its capabilities in sustainable product development.

These developments underscore a strategic emphasis on growth through acquisition of advanced technologies and expansion of production capacities among the leading companies in the Dioctyl Adipate market. This approach not only addresses current market needs but also positions these companies to better meet future demands in a rapidly evolving industry landscape.

Key Takeaways

- Market Value: The Dioctyl Adipate Market is expected to grow from USD 2.1 Billion in 2023 to USD 3.5 Billion by 2033, at a CAGR of 5.1%.

- Grade Analysis: Technical Grade dominates with 64.5%; pivotal in various industrial applications due to its cost-effectiveness and compatibility with large-scale processes.

- Application Analysis: Plasticizers lead with 38.9%; essential for enhancing properties of materials like PVC, vital in construction and automotive sectors.

- End-Use Industry Analysis: Packaging sector prevails at 37.5%; driven by increasing demand for flexible packaging solutions

- Dominant Region: APAC dominates with 36.8% market share; a key player due to substantial industrial and manufacturing activities.

- High Growth Region: North America follows with a 25.5% share; significant due to advanced industrial infrastructure and regulatory standards.

- escalating demand for flexible packaging solutions across various industries.

- Analyst Viewpoint: The Dioctyl Adipate market exhibits moderate competition and growth potential, with innovations and industrial demand driving expansion.

Dioctyl Adipate Statistics

- Around 90% of all plasticizers are used in the production of flexible polyvinyl chloride (PVC), also known as vinyl. Dioctyl adipate (DOA) is one of the most common plasticizers used in this process due to its excellent flexibility and low-temperature properties.

- The adhesives industry generates more than 11 billion dollars annually in the United States alone. DOA is frequently used as a plasticizer in adhesive formulations to enhance their flexibility and durability.

- Estimates show that each year, 18.2 kg of glue is used for every person in America. The inclusion of DOA in glue formulations helps improve the product’s performance and longevity.

- In 2018, there were nearly 50,000 paint and coatings establishments in the United States. DOA is utilized in the paint and coatings industry to provide improved flow and application properties.

- The United States exported $2.4 billion in paint and coatings products in 2019, the highest level in more than a decade. The industry posted a positive trade surplus of $1.54 billion in 2019. The export success is partly due to the use of high-quality plasticizers like DOA, which enhance product performance.

- The U.S. paint and coatings industry exports to Canada ($1.3 billion) and Mexico ($815 million) in 2023 totaled $2.1 billion combined, accounting for 70% of all U.S. paint and coatings industry exports. DOA’s role in improving the quality of these products contributes significantly to their international demand.

- The third-largest paint and coatings export market was China at $117 million, followed by Japan ($50 million) and South Korea ($48 million). The consistent quality provided by DOA in paint formulations supports this strong export performance.

- Globally, more than 50% of the total lubricant volume is used for automobiles, approximately 40% for industrial purposes, and the remainder in the marine industry. While DOA is primarily a plasticizer, its use in certain lubricant formulations can enhance low-temperature performance.

- Proper lubrication reduces friction between moving parts, increasing fuel economy by up to 2%, which also helps lower a vehicle’s overall CO2 output. DOA’s properties can contribute to improved efficiency in specialized lubricant applications.

- Dioctyl adipate (DOA) is a widely used plasticizer, particularly valued for its flexibility and durability in applications such as PVC, adhesives, and coatings. Its versatility and performance characteristics make it an essential component in these industries.

- Proper lubrication reduces friction between moving parts, increasing fuel economy by up to 2%, which also helps lower a vehicle’s overall CO2 output.

- Dioctyl Adipate (DOA) is a widely used plasticizer with the chemical formula C₂₂H₄₂O₄ and a molecular weight of 370.574 g/mol.

- DOA is notable for its high flash point of 196°C and an auto-ignition temperature of 377°C. Its dynamic viscosity is measured at 13.7 mPa.s at 20°C, with a kinematic viscosity of 14.8 mm²/s at the same temperature.

Emerging Trends

- Increased Demand for Non-Phthalate Plasticizers: As regulatory pressures and health concerns regarding traditional phthalate plasticizers grow, there is an increasing shift towards non-phthalate alternatives like Dioctyl Adipate. This trend is driven by Dioctyl Adipate’s ability to meet safety standards without compromising performance.

- Growth in Bio-Based Plasticizers: The demand for sustainable and eco-friendly solutions is pushing the development of bio-based Dioctyl Adipate. These products are derived from renewable resources, offering a lower carbon footprint and reduced environmental impact compared to their synthetic counterparts.

- Technological Advancements in Production: Innovations in production technology are enabling more efficient and cost-effective manufacturing of Dioctyl Adipate. These advancements are not only improving yield and purity but are also enhancing the environmental profile of the production process.

- Expansion in Emerging Markets: Rapid industrialization in Asia-Pacific and Latin American countries is fueling the expansion of the Dioctyl Adipate market. Increased production of consumer goods, automotive components, and construction materials in these regions is driving demand.

- Integration with Flexible PVC Applications: Dioctyl Adipate is increasingly being integrated into flexible PVC applications, where it enhances the flexibility, durability, and longevity of products. This trend is particularly evident in industries like automotive, cable manufacturing, and flooring.

- Advances in Recycling Technologies: As environmental sustainability becomes a priority, advancements in recycling technologies for Dioctyl Adipate-containing materials are becoming more prevalent. These technologies aim to reduce waste and promote the reuse of Dioctyl Adipate in various applications.

- Regulatory Impact on Market Dynamics: Global regulatory changes are significantly impacting the Dioctyl Adipate market. Regulations aimed at reducing VOC emissions and environmental exposure to hazardous chemicals are shaping the development and adoption of safer, more sustainable Dioctyl Adipate formulations.

Use Cases

- Plasticizer in PVC: Dioctyl Adipate is extensively used as a plasticizer in polyvinyl chloride (PVC) manufacturing. It imparts flexibility and durability to PVC products, making it suitable for applications like garden hoses, cables, and flooring. PVC production heavily relies on effective plasticizers like DOA to enhance product performance.

- Consumer Goods: In the consumer goods sector, Dioctyl Adipate is employed to produce flexible and durable plastics found in items such as toys, packaging materials, and kitchenware. The ability of DOA to maintain stability and flexibility at low temperatures makes it ideal for consumer products that require high flexibility.

- Automotive Applications: Within the automotive industry, Dioctyl Adipate is used in the production of interior coverings and dashboard panels. Its high plasticizing efficiency ensures that these components remain flexible and resistant to cracks, contributing to the vehicle’s overall durability and aesthetic appeal.

- Low-Temperature Applications: DOA is favored for its excellent low-temperature performance, making it an ideal choice for applications such as outdoor vinyl siding and automotive plastics that must withstand cold environments without becoming brittle.

- Medical Applications: In medical applications, Dioctyl Adipate is used in the production of tubing and bag containers that require flexibility, non-toxicity, and resistance to breakage. Its safety profile makes it suitable for sensitive applications involving direct human contact.

- Agricultural Films: Dioctyl Adipate is also used in agricultural films. These films require flexibility and durability to withstand various weather conditions while providing necessary cover to crops. The use of DOA helps extend the life of these films, reducing the need for frequent replacements.

- Food Contact Applications: Dioctyl Adipate is utilized in components that come into direct contact with food, such as food packaging and storage containers. Its low toxicity ensures safety in food contact applications, adhering to stringent regulatory standards for plastic materials.

Key Players Analysis

BASF SE actively markets dioctyl adipate (DOA) under the Plastomoll® brand, used in flexible PVC products and coatings requiring low-temperature performance. The company recently launched ecoflex® BMB, a biodegradable biopolymer, to enhance sustainability in packaging, replacing fossil feedstocks with renewable materials. BASF’s chemical segment achieved global sales of €7.2 billion in 2023, reflecting its commitment to sustainable innovations.

ExxonMobil Corporation engages in the dioctyl adipate market through its Jayflex™ plasticizers, widely used in flexible PVC and other applications requiring durability and low-temperature resistance. The company reported first-quarter 2024 earnings of $8.2 billion, driven by robust performance in its chemical segment and strategic initiatives like the acquisition of Pioneer Natural Resources.

The HallStar Company is active in the dioctyl adipate (DOA) market with its products like Plasthall® DOA and Rezilube™ DOA, known for enhancing low-temperature flexibility and stability in various applications, including PVC and polychloroprene. Recently, HallStar acquired a polymer additives production site in Greensboro, NC, expanding its capabilities in this sector. This acquisition reflects the company’s ongoing strategy to bolster its market position and meet the growing demand for specialized plasticizers and additives.

Aarti Industries is involved in the dioctyl adipate market, supplying essential chemicals for flexible PVC and other applications requiring good low-temperature performance. The company focuses on high-quality production processes and has seen steady growth in this segment. Recently, Aarti Industries reported a significant revenue increase due to expanded production capacities and strategic market expansions, further strengthening its position in the global chemical industry.

Hanwha Solutions Corporation has made significant strides in the Dioctyl Adipate (DOA) market, focusing on eco-friendly plasticizers to meet growing global demand for sustainable materials. The company recently expanded production of its non-phthalate plasticizer, Eco-DEHCH, aligning with its commitment to environmental, social, and governance (ESG) goals by ceasing production of harmful DOP plasticizers and reducing carbon emissions through renewable energy initiatives.

Eastman Chemical Company is a prominent player in the DOA market, producing non-phthalate plasticizers like Eastman™ DOA and DOA Renew 20, which are used in PVC applications such as food packaging films. These products offer flexibility at low temperatures and good resistance to weathering, positioning Eastman as a key supplier in the market. Recent expansions in their manufacturing capacity have bolstered their market presence, with a focus on sustainable and safe alternatives for various applications.

GJ Chemical supplies Dioctyl Adipate (DOA), a versatile plasticizer widely used in producing flexible PVC and coatings. The company offers DOA in bulk and smaller quantities, catering to various industries, including packaging and consumer goods. Recently, GJ Chemical has enhanced its customer service and streamlined its supply chain to ensure timely delivery and product availability. This focus on efficiency and customer satisfaction underscores their commitment to supporting the growing demand for DOA in the market.

New Japan Chemical Co., Ltd. is actively engaged in the Dioctyl Adipate (DOA) market, providing high-quality plasticizers essential for manufacturing flexible plastics and other materials. The company continues to innovate and expand its product offerings to meet industry standards. Recently, New Japan Chemical has focused on increasing production capacities and enhancing its product line to cater to rising global demand, solidifying its position as a key player in the DOA market.

Penta Manufacturing Company is a key player in the Dioctyl Adipate (DOA) market, supplying high-quality plasticizers for various industrial applications. Known for its strategic partnerships and comprehensive chemical inventory, Penta offers DOA primarily for use in flexible PVC and other plastic products. Recently, Penta has focused on expanding its product range and improving its customer service to meet increasing demand, particularly in the flavor, fragrance, pharmaceutical, and nutraceutical sectors.

Conclusion

Dioctyl Adipate (DOA) stands as a pivotal component in the plasticizer industry, primarily recognized for its versatility and efficiency in enhancing the flexibility and durability of PVC and other polymer products. Its integration into diverse applications—from consumer goods to automotive parts and medical devices—underscores its vital role across multiple sectors.

Despite facing challenges such as regulatory pressures and the need for sustainable alternatives, the DOA market is poised for growth, driven by innovations in bio-based plasticizers and advancements in production technologies. As the industry continues to evolve, Dioctyl Adipate is expected to remain a key player, adapting to changing market demands and environmental standards. This ongoing relevance highlights its indispensable nature in modern manufacturing and product development.