Table of Contents

Introduction

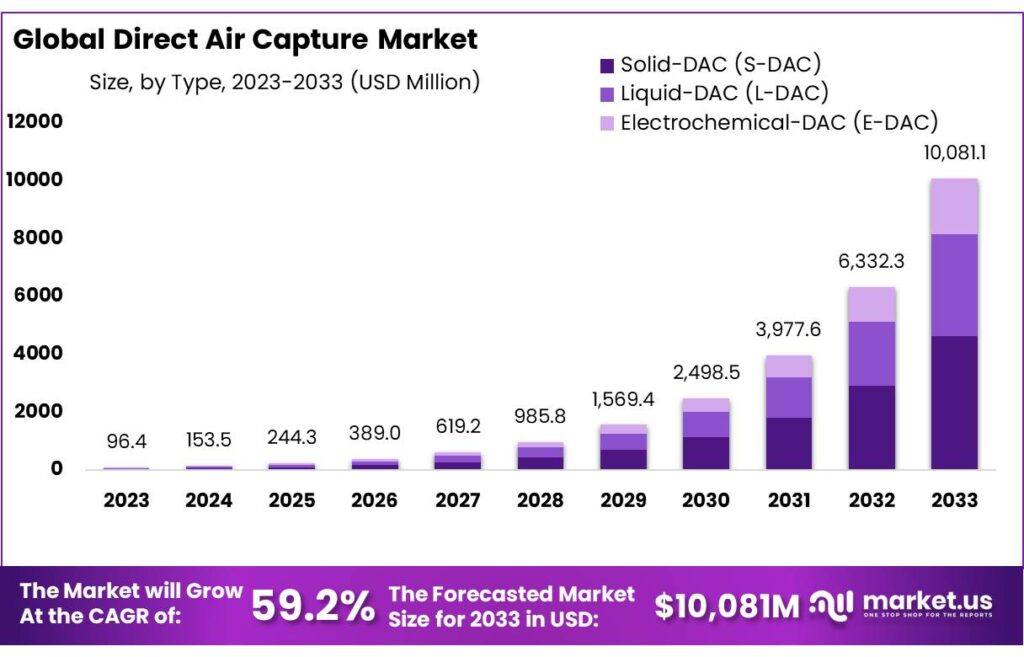

The global Direct Air Capture (DAC) market, valued at USD 96.4 million in 2023, is anticipated to surge to USD 10,081.1 million by 2033, growing at an impressive compound annual growth rate (CAGR) of 59.2%. This burgeoning sector focuses on developing technologies to extract carbon dioxide (CO2) directly from the atmosphere, a critical approach in addressing climate change and mitigating the impact of greenhouse gases.

Several factors drive the growth of the Direct Air Capture Market. Key among these is the increasing investment from both governmental and private sectors. For instance, significant projects and pilot plants are being developed globally to demonstrate the feasibility and scalability of DAC technologies. These initiatives build confidence among stakeholders and investors regarding the technical and financial viability of DAC systems, thereby fostering market growth.

Technological advancements are also playing a pivotal role. Innovations aimed at enhancing capture efficiency and reducing costs are making DAC technologies more accessible and commercially viable. For example, Climeworks, a leading company in this field, launched Orca, the world’s largest DAC and storage plant in Iceland in 2021, capable of capturing substantial amounts of CO2 annually. Similarly, Carbon Engineering is expanding its plant in Squamish, Canada, targeting an annual capture capacity of one million tons of CO2.

Moreover, regulatory frameworks and policies supporting carbon reduction initiatives are propelling the market forward. Governments across regions, particularly in North America and Europe, are implementing stringent regulations and offering incentives to adopt carbon capture technologies. In North America, the presence of key market players and a robust industrial infrastructure are significant growth drivers. The region leads in technological advancements and has a substantial demand for DAC solutions across various industries, including manufacturing and energy production.

Despite these growth drivers, the Direct Air Capture Market faces several challenges. High initial costs and energy requirements for DAC technologies pose significant barriers. However, ongoing research and development aim to overcome these hurdles, focusing on improving cost-efficiency and energy utilization. Additionally, the market must navigate the complexities of scaling operations to meet the ambitious global carbon neutrality goals.

Recent developments highlight the dynamic nature of the Direct Air Capture Market. Companies like Global Thermostat and ExxonMobil are forming strategic partnerships to advance carbon capture technologies, while Prometheus Fuels is exploring innovative applications such as CO2-based rocket fuels. These collaborations and advancements underscore the market’s potential and the diverse applications of DAC technologies, from synthetic fuels to enhanced oil recovery and agricultural uses.

Key Takeaways

- Market Growth: Direct Air Capture market to reach USD 10,081.1 Million by 2033, with a CAGR of 59.2% from 2023.

- Technological Dominance: S-DAC leads with a 45.5% market share in 2023, advancing capture efficiency and reducing costs.

- Application Focus: CCS will capture 59.8% market share in 2023, crucial for CO2 emission reduction.

- Energy Source: Electricity powers 76.5% of DAC systems in 2023, aligning with renewable energy integration.

- Collector Preference: Systems with Less than 10 collectors hold 58.9% market share, indicating accessibility.

- Regional Leadership: North America dominates with a 47% market share in 2023, driven by robust infrastructure and regulations.

Direct Air Capture Statistics

- LCFS market size: ~15 million tons of CO2/year.

- Technology cost: ~$500 per ton of CO2 (NASEM 2018).

- US merchant market: >$100/ton for high-purity CO2.

- EOR market: ~$40/ton for CO2.

- 45Q tax credit: $50/tCO2 for sequestered CO2, $35/tCO2 for utilized CO2.

Legislative and Financial Support Statistics

- LCFS prices in 2020: averaged $200/tCO2.

- Proposed 45Q increase: up to $180/tCO2.

- US government funding: $1.2 billion for two plants.

- US government grants: $3.5 billion for DAC companies.

- Largest DAC plant: Climeworks’ Orca in Iceland, removes 4,000 tons/year.

Future Projections and Challenges Statistics

- IEA 2030 capture capacity: <5% of needed 80 million t/y.

- IEA 2050 DAC capture: 980 million tons CO2.

- DAC plant energy needs: up to 300 exajoules/year by 2100.

- Required DAC factories: ~30,000 large-scale by 2100.

- DAC cost estimates: $100 to $1,000 per ton of CO2.

Emerging Trends

Cost Reduction and Efficiency Improvements: Significant efforts are being made to reduce the high costs associated with DAC technology. Currently, the cost ranges between $600 and $1,000 per ton of CO2. However, innovations are aimed at bringing this cost down to below $150 per ton. Key strategies include the development of more energy-efficient processes, mass production of DAC components, and the adoption of modular designs that simplify manufacturing and installation.

Technological Advancements: New DAC technologies are being developed to improve efficiency and scalability. These include electro-swing adsorption (ESA) systems that use electrochemical cells to capture and release CO2, and hybrid systems combining solid and liquid absorbents. These innovations aim to lower the energy intensity of DAC processes, making them more cost-effective and scalable.

Increasing Government and Private Sector Support: Governments and private entities are increasingly investing in DAC technologies. For example, Japan has set a roadmap to capture between 6 and 12 million tons of CO2 per year by 2030. Additionally, substantial funding from private companies and governmental grants is helping to scale up DAC projects and drive technological innovation.

Scaling Up of Demonstration Projects: Large-scale demonstration projects are crucial for proving the feasibility of DAC technologies at scale. Projects like Climeworks’ Orca in Iceland, which is currently the largest operational DAC plant, are paving the way for future large-scale deployments. More projects are planned in various parts of the world, including the United States and Europe, indicating a strong pipeline of DAC initiatives.

Integration with Carbon Utilization and Storage: DAC technology is increasingly being integrated with carbon utilization and storage solutions. Captured CO2 can be stored underground or used in various industrial applications such as synthetic fuel production, enhanced oil recovery, and the production of carbon-neutral materials. This integration helps in creating closed-loop systems that recycle CO2, contributing to a circular carbon economy.

Strategic Partnerships and Collaborations: Collaborative efforts between research institutions, industries, and governments are driving the Direct Air Capture Market forward. Partnerships aim to share knowledge, reduce costs, and accelerate the development of new technologies. Examples include collaborations between major oil companies and DAC technology providers to enhance carbon capture capabilities and develop new market applications for captured CO2.

Regulatory and Policy Support: Increasingly stringent environmental regulations and policies aimed at achieving carbon neutrality are bolstering the adoption of DAC technologies. Governments are introducing incentives, tax credits, and funding programs to support the deployment of DAC projects. This regulatory support is crucial for driving investment and encouraging the adoption of carbon capture technologies.

Use Cases

Carbon Sequestration: Carbon sequestration involves capturing CO2 from the atmosphere and storing it underground in geological formations. This use case is critical for long-term climate goals as it helps to remove excess CO2 from the air and safely stores it, preventing it from contributing to global warming. Projects like Climeworks’ Orca plant in Iceland can capture and sequester up to 4,000 tons of CO2 annually. The International Energy Agency (IEA) forecasts that DAC facilities could capture up to 3 million tons of CO2 per year by 2030, a significant increase from current levels.

Synthetic Fuels Production: DAC technology can be used to produce synthetic fuels by combining captured CO2 with hydrogen produced from renewable energy sources. These fuels can replace conventional fossil fuels, reducing overall carbon emissions. Carbon Engineering in Canada is developing technology to convert captured CO2 into synthetic fuels. Their pilot plant is expected to capture 1 million tons of CO2 per year once fully operational. Synthetic fuels produced using DAC can potentially reduce the carbon footprint of industries such as aviation and shipping, which are hard to decarbonize with existing technologies.

Enhanced Oil Recovery (EOR): DAC can be integrated into enhanced oil recovery processes, where captured CO2 is injected into oil fields to increase oil extraction efficiency. This process not only boosts oil production but also stores CO2 underground. Companies like Occidental Petroleum are investing in DAC for EOR, planning to capture and utilize millions of tons of CO2 annually. This method can help offset some of the emissions associated with oil extraction, making it a transitional strategy towards cleaner energy.

Carbonated Beverages and Food Industry: Captured CO2 from DAC can be used in the food and beverage industry, particularly in the production of carbonated drinks and in food preservation. Several beverage companies are exploring the use of captured CO2 to create a sustainable supply chain for carbonation. Utilizing DAC in the food and beverage industry not only provides a stable supply of CO2 but also supports corporate sustainability goals.

Agriculture and Greenhouses: In agriculture, CO2 captured from the air can be used to enhance plant growth in greenhouses. This application helps in creating a controlled environment with optimal CO2 levels, leading to higher crop yields. Companies like Climeworks are partnering with greenhouse operators to provide CO2 for enhancing plant growth. This use case not only improves agricultural productivity but also promotes the use of clean CO2, reducing reliance on fossil-fuel-derived CO2.

Building Materials and Construction: Captured CO2 can be used to produce building materials such as concrete, which can sequester CO2 for long periods, effectively storing carbon in infrastructure. Technologies are being developed to infuse captured CO2 into concrete production, resulting in stronger and more durable building materials. This method helps in reducing the carbon footprint of the construction industry, which is a significant source of global CO2 emissions.

Major Challenges

High Costs: One of the major obstacles for DAC technology is its high operational and capital costs. Currently, the cost of capturing one ton of CO2 ranges from $600 to $1,000. These high costs are primarily due to the energy-intensive processes required to capture and sequester CO2, making it financially unviable for large-scale deployment without substantial subsidies or financial incentives.

Energy Requirements: DAC processes demand a significant amount of energy, often sourced from renewable or low-carbon energy to ensure overall emission reductions. The energy intensity of DAC is higher compared to other carbon capture methods, primarily because the concentration of CO2 in the atmosphere is much lower than in industrial flue gases. This results in higher operational costs and logistical challenges in ensuring a continuous and sustainable energy supply.

Technological and Infrastructure Challenges: The technology for DAC is still in its nascent stages, requiring further advancements to enhance efficiency and reduce costs. Additionally, the infrastructure needed for DAC, including the transportation and storage of captured CO2, is underdeveloped. Current storage solutions are limited, and there is a need for more robust and extensive CO2 pipelines and storage networks.

Scaling Up: Scaling up DAC technology from pilot projects to commercial-scale operations poses significant challenges. Current DAC plants are relatively small, and scaling up to capture millions of tons of CO2 annually requires substantial investment, robust technological advancements, and supportive regulatory frameworks. Moreover, the learning curve associated with mass production and operation of DAC facilities means that achieving economies of scale will take time and concerted effort.

Regulatory and Market Uncertainty: There is a lack of consistent regulatory frameworks and market incentives to support the deployment of DAC technology. Governments need to implement policies that provide financial support and create market demand for captured CO2, such as carbon pricing mechanisms or mandates for CO2 removal. Without these regulatory drivers, investment in DAC remains risky and uncertain for private investors.

Market Growth Opportunities

Policy and Regulatory Support: Government policies and international agreements, such as the Paris Agreement, are pushing for more aggressive carbon reduction targets. Countries are increasingly setting carbon neutrality goals, which necessitate the deployment of negative emission technologies like DAC. For example, Japan’s roadmap aims to capture between 6 and 12 million tons of CO2 per year by 2030. Such policies can drive investments and create a favorable environment for the growth of the Direct Air Capture Market.

Technological Innovations: Advancements in DAC technology are crucial for reducing costs and improving efficiency. Innovations such as electro-swing adsorption and hybrid systems that combine solid and liquid absorbents are making DAC more viable. These technological improvements can lower operational costs and enhance the scalability of DAC solutions, making them more attractive to investors and industries.

Corporate Sustainability Goals: Corporations are increasingly committing to sustainability goals and carbon neutrality. Companies like Microsoft and Stripe have already invested in DAC technology to offset their carbon footprints. This corporate demand for carbon removal solutions is expected to grow, providing a significant market opportunity for DAC providers.

Integration with Industrial Processes: DAC technology can be integrated with various industrial processes, such as producing synthetic fuels and enhancing oil recovery. For instance, Carbon Engineering’s DAC technology is used to produce low-carbon fuels, which can help decarbonize the transportation sector. This integration not only provides a sustainable CO2 source but also creates new revenue streams for industries.

Funding and Investments: Increased funding from both the public and private sectors is essential for scaling up DAC projects. Governments are offering grants and subsidies, while private investors are recognizing the long-term potential of DAC technology. For example, Climeworks secured CHF 600 million in funding to expand its operations. Such financial support can accelerate the deployment of DAC facilities worldwide.

Recent Developments

Avnos, Inc. has made significant strides in the Direct Air Capture (DAC) sector with its innovative Hybrid Direct Air Capture (HDAC™) technology, which captures both CO2 and water from the atmosphere. In November 2023, Avnos launched its first commercial pilot project in Bakersfield, California, in partnership with Southern California Gas Company and with support from the U.S. Department of Energy. This pilot project is capable of capturing approximately 30 tons of CO2 and producing 150 tons of water annually.

Capture6 is actively advancing its Direct Air Capture (DAC) technology through multiple strategic projects and partnerships. In March 2023, Capture6 received technology approval from the Bay Area Air Quality Management District, which allowed the company to secure debt financing for its pilot DAC and water recovery project in Southern California. This pilot, known as Project Monarch, broke ground in June 2024 and aims to capture CO2 from the atmosphere while recovering freshwater from brine, a byproduct of desalination processes. This integrated facility, developed in partnership with Palmdale Water District, is expected to capture up to 500,000 tons of CO2 annually once fully operational.

CarbonCapture Inc. is advancing its Direct Air Capture (DAC) technology through several significant initiatives. In June 2024, the company announced the lease of an 83,000-square-foot facility in Mesa, Arizona, which will be the world’s first high-volume manufacturing site for DAC systems. This facility, projected to create up to 400 jobs by 2029, will have the capacity to produce 4,000 modular DAC units annually, each capable of removing substantial amounts of CO2 from the atmosphere.

Carbon Collect Limited has made notable advancements in the Direct Air Capture (DAC) sector with its innovative “MechanicalTree” technology. In April 2023, Carbon Collect unveiled its first commercial-scale MechanicalTree at Arizona State University (ASU). This technology, developed in partnership with ASU’s Center for Negative Carbon Emissions, captures CO2 from the air using a passive system that relies on natural wind, making it more energy-efficient compared to conventional DAC methods. The MechanicalTree can capture significant amounts of CO2, with plans to scale up the technology through “carbon farms” capable of capturing up to 1,000 tons of CO2 per day. In July 2023, the U.S. Department of Energy awarded Carbon Collect and ASU $2.5 million to design these carbon farms, marking a significant step towards commercializing this scalable and cost-effective DAC solution.

Conclusion

Direct Air Capture (DAC) technology represents a crucial innovation in the fight against climate change, offering a method to remove carbon dioxide (CO2) directly from the atmosphere. The technology has garnered significant attention and investment, driven by the urgent need to achieve net-zero emissions by 2050. Currently, DAC operates on a small scale, with about 27 facilities worldwide capturing approximately 0.01 million tonnes of CO2 per year. However, this is set to change dramatically with substantial projects under development, such as the U.S. Department of Energy’s DAC Hubs in Texas and Louisiana, which aim to capture up to 1 million tonnes of CO2 annually each