Table of Contents

Introduction

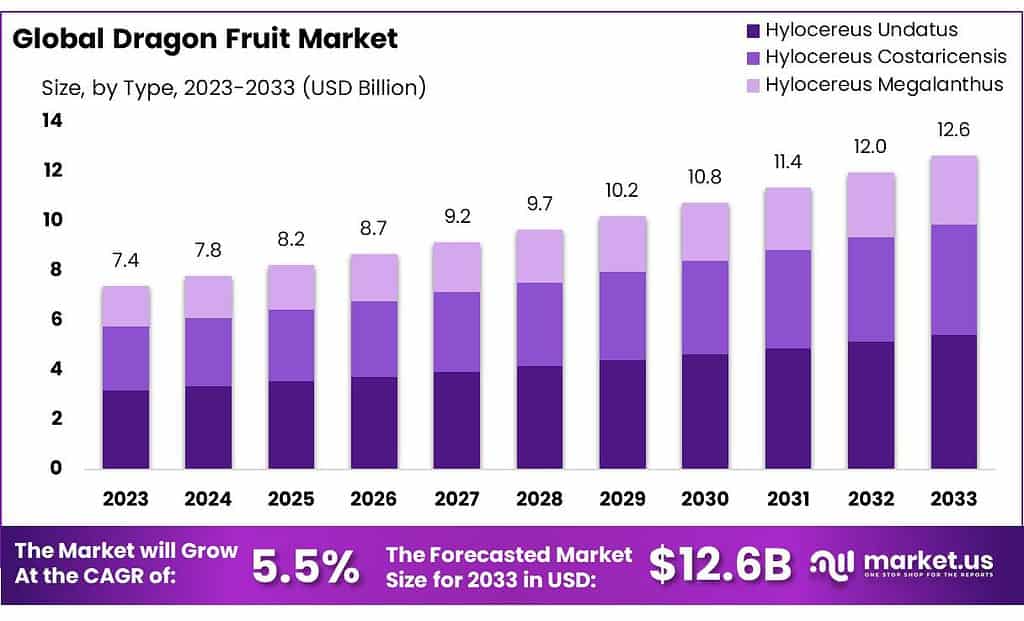

The Dragon Fruit Market, valued at USD 7.4 billion in 2023, is projected to reach USD 12.6 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 5.5% during the forecast period. This market encapsulates the global activities related to the cultivation, distribution, and commercialization of dragon fruit, also known as pitaya, which is increasingly recognized for its distinctive appearance, texture, and health benefits.

Dragon fruit, originally from Central America, has expanded its cultivation footprint to regions including Southeast Asia (notably Vietnam and Thailand), Israel, and Colombia. The market for dragon fruit includes not only the sale of fresh fruit but also various processed products like juices, smoothies, and dietary supplements, which leverage the fruit’s nutrient-dense profile.

The growth of the Dragon Fruit Market is primarily driven by a rising global consumer base that values health and nutrition. Dragon fruit is celebrated for its high content of vitamins, minerals, and antioxidants, appealing to health-conscious consumers. Additionally, its versatility in culinary applications—spanning both sweet and savory dishes—has contributed to its increasing popularity.

Key factors influencing the market’s expansion include evolving global dietary trends favoring exotic and healthy food options, advancements in agricultural practices that enhance crop yield and fruit quality, and the dynamics of international trade that facilitate the global distribution of dragon fruit. The market is composed of various stakeholders, including farmers, wholesalers, retailers, and processing companies, all of whom play integral roles in the supply chain.

As interest in nutritious and exotic fruits continues to grow, the Dragon Fruit Market is expected to see sustained growth, providing opportunities for innovation in product offerings and the development of new distribution channels.

A Natural Farm: A Natural Farm has focused on expanding its product offerings by increasing the cultivation of organic dragon fruit. They have also invested in diversifying their product line to include dragon fruit cuttings and plants, catering to the growing demand among hobbyist gardeners and small-scale farmers. This move aims to enhance the availability of high-quality dragon fruit varieties across different regions, particularly in North America.

Bai Brands, under the Dr Pepper Snapple Group, has launched a new line of dragon fruit-flavored beverages. These products are designed to cater to health-conscious consumers looking for low-calorie, antioxidant-rich drinks. The introduction of these beverages aligns with the rising consumer demand for exotic flavors and nutritious ingredients in the beverage industry, contributing to Bai Brands’ expanding portfolio in the wellness segment.

Key Takeaways

- Market Growth: Dragon Fruit Market is projected to reach USD 12.6 billion by 2033, with a 5.5% CAGR from 2023.

- Consumer Preference: Red Dragon Fruit dominates with over 69.7% market share in 2023.

- Product Form: Powder form leads, holding over 65.5% market share in 2023.

- Nature Preference: Organic dragon fruit captures more than 67.8% market share in 2023.

- Application Focus: Direct consumption leads, capturing over 32.5% market share in 2023.

- Distribution Channels: Supermarkets/hypermarkets hold over 47.5% market share in 2023.

- Regional Dominance: Europe leads, holding 37% market share with USD 2.7 billion value in 2023.

Dragon Fruit Statistics

- Department of Agriculture’s (USDA) MyPlate guidelines. If you’re watching your waistline and want to reduce your caloric intake, you’ll be happy to know that 100 grams (g) of dragon fruit contains about 57 calories, according to the USDA.

- The dietary fiber in dragon fruit also can help promote healthy digestion and gut health. Adults need between 21 and 38 g of fiber per day.

- About 100 g of dragon fruit contains 3.1 g of fiber which is about 11 percent of the recommended daily value.

- Brand owners are responsible for descriptions, nutrient data, and ingredient information. USDA calculates values per 100g or 100 from values per serving. Values calculated from %DV

use current daily values for an adult 2,000-calorie diet (21 CFR 101.9(c)). - Yellow Dragon fruit is a small to medium-sized species, averaging 8 to 10 centimeters in length and 6 to 7 centimeters in diameter, and has an oval to elliptical shape.

- The fruits grow on a climbing cactus that sprawls over other plants, trees, trellises, or support structures, and the stems can extend over 6 meters in length.

- The fruit’s seeds contain fiber to regulate the digestive tract and omega-3 fatty acids to reduce inflammation. The flesh is also almost 80% water, acting as a natural source of hydration.

- Yellow Dragon fruit should be ripened at room temperature. Once ripe, the fruits can be stored in an airtight container in the refrigerator for 3 to 4 days.

- Statistics show that growing dragon fruit using high technology increases profits by an average of about 2.5–5 million VND/ha.

- The most suitable temperature for dragon fruit to grow is 21–290 °C, the maximum temperature is about 38–400 °C with rainfall from 800 to 2000 mm/year.

- It has an average temperature of 27 °C, average rainfall of 1024 mm, relative humidity of 79 %, and total sunshine hours of 2459 h.

- Dragon fruit grows on a climbing cactus plant that can grow from 15-20 feet high and can live for as long as two decades.

- Dragon fruit is cultivated on over 2,000 acres across Karnataka and avocado on at least 1,000 acres, according to Indian Institute of Horticultural Research (IIHR) scientists.

- The dragon fruit, which measures roughly 10 cm in length and can weigh up to 500 g, actually belongs to the cactus family.

- One of the reasons why dragon fruit tastes so refreshing is its high water content of almost 90%.

- Red Dragon fruits are small to medium-sized varietals, averaging 4 to 9 centimeters in diameter, and have an oval to oblong shape.

- Seeds grow well in a compost or potting soil mix – even as a potted indoor plant. Pitaya cacti usually germinate after between 11 and 14 days after shallow planting.

- Once the plant reaches a mature 4.5 kilograms (10 pounds) in weight, the plant may flower.

- Commercial plantings can be done at high density with between 1,100 and 1,350 per hectare (445 and 546/acre).

- The plants can endure temperatures up to 40 °C (104 °F) and short periods of frost but will not survive long exposure to freezing temperatures.

- The majority of the fruit by weight is water (87g out of 100g). One serving of 100 grams (3+1⁄2-ounce) provides 240 kilojoules (57 kilocalories) of food energy.

- The USDA also reports one limited product label entry from a manufacturer of a branded product, showing that a 100-gram (3+1⁄2-ounce) reference serving of dried pitaya provides 1,100 kilojoules (264 kilocalories) of food energy, 82% carbohydrates, 4% protein, and 11% of the Daily Value each for vitamin C and calcium.

Emerging Trends

- Increased Adoption of Sustainable Farming Practices: Dragon fruit farming is increasingly adopting sustainable practices, including organic cultivation and the use of smart irrigation systems. This trend is driven by the growing consumer preference for organically grown produce and the need to minimize environmental impact. Farmers are integrating these practices to improve yield and fruit quality while reducing water usage and pesticide dependence.

- Expansion of Dragon Fruit Cultivation in Non-Traditional Regions: Traditionally grown in Southeast Asia and Latin America, dragon fruit is now being cultivated in non-traditional regions like the United States (Florida, California, and Texas) and Southern Europe (Spain and Israel). This expansion is fueled by both rising demand and advancements in agricultural technology that allow for cultivation in diverse climates. These new growing regions are helping to stabilize supply and meet the growing global demand.

- Rising Popularity of Dragon Fruit-Infused Products: Dragon fruit is being increasingly incorporated into various food and beverage products, such as smoothies, juices, and even skincare products. The fruit’s vibrant color and rich nutrient profile make it a popular choice for health-conscious consumers. This trend is not only seen in large commercial products but also in small-scale artisanal goods available at local farmers’ markets and specialty stores.

- Increased Use of Dragon Fruit in Animal Feed: An emerging trend is the use of dragon fruit by-products, particularly peels, in animal feed. The peel, rich in fiber and antioxidants, is being recognized for its potential to enhance animal health and reduce methane emissions from livestock. This trend highlights the broader use of dragon fruit beyond human consumption and taps into the growing interest in sustainable animal husbandry practices.

- Growth in Direct-to-Consumer Sales Channels: There is a noticeable shift towards direct-to-consumer sales channels, especially through online platforms. Farmers and small producers are increasingly selling dragon fruit directly to consumers via e-commerce, farmers’ markets, and subscription boxes. This trend is partly driven by the desire for fresh, high-quality produce and the increasing popularity of supporting local agriculture.

Use Cases

- Nutritional Supplements: Dragon fruit is rich in vitamins C, B1, B2, and B3, as well as minerals such as calcium, iron, and phosphorus. These nutrients make it a popular ingredient in dietary supplements aimed at boosting immunity and supporting overall health. For instance, dragon fruit powder is commonly used in health supplements, often marketed as a superfood due to its high antioxidant content.

- Skin Care Products: The antioxidants and vitamins in dragon fruit are also beneficial for skin health, which has led to its use in skincare products. Dragon fruit extract is included in facial masks, serums, and creams to promote skin hydration, reduce signs of aging, and protect against free radicals.

- Smoothies and Juices: Dragon fruit is increasingly popular in the beverage industry, particularly in smoothies and juices. Its vibrant color and mild, sweet flavor make it a visually appealing and tasty addition to fruit blends. According to industry reports, the global smoothie market is expected to grow significantly, with dragon fruit being a key ingredient in this expansion.

- Desserts and Pastries: Dragon fruit is also used in a variety of desserts, such as sorbets, ice creams, and cakes. The fruit’s texture and color add a unique element to these products, appealing to consumers looking for exotic and healthy dessert options.

- Livestock Feed: Dragon fruit by-products, particularly the peel, are being utilized in animal feed. The peel contains high levels of fiber and antioxidants, which contribute to better digestion and overall health in livestock. This use case is growing, especially in regions where dragon fruit is produced in large quantities, offering a sustainable way to repurpose waste from fruit processing.

- Organic Fertilizer: Dragon fruit waste, including peels and pulp residues, is being converted into organic fertilizers. This process not only helps in waste management but also provides a nutrient-rich fertilizer option for organic farming. The use of dragon fruit-based fertilizers is particularly beneficial in enhancing soil health and supporting sustainable farming practices.

Cultural and Medicinal Uses: - Traditional Medicine: In some cultures, dragon fruit is used in traditional medicine to treat conditions like high blood pressure and diabetes. The fruit’s high antioxidant content is believed to help reduce inflammation and improve overall health, making it a popular natural remedy in regions where it is cultivated.

Decorative Uses: - Gourmet Presentations: The vibrant color and unique shape of dragon fruit make it a popular choice for gourmet food presentations. Chefs use it to add visual appeal to dishes, particularly in high-end restaurants where presentation is as important as taste. Dragon fruit slices are often used as garnishes in salads and appetizers, enhancing both the look and nutritional value of the meal.

Major Challenges

- Limited Climatic Suitability: Dragon fruit requires specific climatic conditions, such as warm temperatures and consistent sunlight, to thrive. This limits its cultivation to certain regions, primarily in Southeast Asia and Latin America. As a result, expanding production to new areas can be challenging, particularly in regions with colder climates or inconsistent weather patterns. This climatic dependency restricts the scalability of dragon fruit cultivation and makes it vulnerable to climate change and extreme weather events, which can adversely affect yield and quality.

- Susceptibility to Pests and Diseases: Dragon fruit plants are susceptible to various pests and diseases, including fruit rot, stem rot, and infestations by mealybugs and aphids. Managing these issues requires significant investment in pest control and plant management, which can increase production costs. In some cases, the use of chemical pesticides may be necessary, which can conflict with the growing demand for organic produce and sustainability. The high cost and effort required to maintain healthy crops can be a barrier for small-scale farmers and limit the overall supply of dragon fruit.

- High Transportation and Storage Costs: Dragon fruit is perishable and requires careful handling during transportation and storage to maintain its quality and freshness. The fruit’s delicate skin and high water content make it prone to damage, leading to potential losses during transit. Additionally, the cost of refrigerated transportation and storage can be high, particularly for exports to distant markets like Europe and North America. These logistical challenges can drive up the final cost of the fruit, making it less competitive compared to other fruits that are easier and cheaper to transport.

- Market Awareness and Consumer Education: While dragon fruit is becoming more popular, many consumers are still unfamiliar with its taste, nutritional benefits, and potential uses. This lack of awareness can limit market demand, particularly in regions where the fruit is not widely known. Educating consumers about the benefits and versatility of dragon fruit is essential but requires time and investment in marketing and promotional efforts.

Market Growth Opportunities

- Rising Health Consciousness: As consumers become more health-conscious, there is a growing demand for fruits that offer high nutritional value. Dragon fruit is rich in antioxidants, vitamins, and fiber, making it an attractive option for those seeking to improve their diet. This trend is particularly strong in North America and Europe, where consumers are increasingly prioritizing health and wellness. The market can capitalize on this by promoting dragon fruit as a superfood and expanding its presence in health-related products, such as smoothies, supplements, and functional foods.

- Expanding Cultivation in New Regions: Traditionally grown in Southeast Asia and Latin America, dragon fruit cultivation is expanding to new regions like Southern Europe, Australia, and the United States. This expansion is facilitated by advancements in agricultural practices that allow the fruit to be grown in different climates. As cultivation spreads, the supply of dragon fruit will increase, making it more accessible to global markets. This expansion also presents opportunities for local economies in these new regions to benefit from the growing demand.

- Increasing Use in the Food and Beverage Industry: Dragon fruit’s vibrant color and unique flavor are increasingly being used in the food and beverage industry. From gourmet dishes to mass-market beverages, the fruit’s versatility is driving its popularity. There is significant potential to develop new product lines, such as dragon fruit-flavored beverages, desserts, and even alcoholic drinks. As the global smoothie and juice markets continue to grow, incorporating dragon fruit into these products could lead to substantial market expansion.

Key Player Analysis

A Natural Farm has been actively involved in the dragon fruit sector, focusing on the cultivation and education regarding this exotic fruit. The farm specializes in growing several varieties of dragon fruit, emphasizing organic practices and sustainability. Throughout 2023 and into 2024, A Natural Farm has not only offered dragon fruit plants for sale but also provided comprehensive care guides and educational resources to support both commercial growers and hobbyists. Their efforts are geared towards promoting the growth of dragon fruit in non-traditional regions, such as certain parts of the United States, where the climate allows for such cultivation. This approach helps expand the availability and popularity of dragon fruit, catering to a growing market of health-conscious consumers who are drawn to the fruit’s nutritional benefits. A Natural Farm’s initiatives in the dragon fruit market exemplify their commitment to sustainable agriculture and educational outreach in horticulture.

Bai Brands, part of the Dr Pepper Snapple Group, Inc., has been actively engaging in the dragon fruit sector by incorporating the fruit into their beverage line. In 2023, Bai Brands continued to focus on its Bai Boost product line, which includes dragon fruit among its flavors. These drinks are marketed as antioxidant-infused, low-calorie options, appealing to health-conscious consumers who are looking for beverages that offer both flavor and health benefits. Bai Brands emphasizes the use of natural ingredients and minimal sugar, aligning with current market trends that favor healthier lifestyle choices. Their product range, particularly featuring dragon fruit, showcases the company’s commitment to innovative, health-oriented products in the beverage industry throughout 2023 and into 2024.

Biourah Herbal (M) Sdn. Bhd. has been actively participating in the dragon fruit sector, leveraging its expertise in herbal and medicated products to explore the nutritional and health benefits of dragon fruit. In 2023, the company focused on integrating dragon fruit into its product range, particularly targeting health-conscious consumers with supplements and drinks that capitalize on the fruit’s antioxidant properties. This initiative aligns with global trends towards healthier dietary choices and the increasing popularity of functional foods. Biourah Herbal’s work in the dragon fruit market reflects a strategic effort to blend traditional herbal knowledge with modern health trends, aiming to enhance wellness through natural products.

Great Sun Pitaya Farm Sdn. Bhd. has established itself as a key player in the dragon fruit industry, particularly in Malaysia. Throughout 2023 and into 2024, the company has focused on enhancing its cultivation techniques and expanding its market reach. They specialize in red flesh pitaya, known for its deep color and sweet flavor, catering to both local and international markets. The farm has dedicated efforts to improving sustainable farming practices, aiming to increase yield while maintaining environmental responsibility. Additionally, Great Sun Pitaya Farm has been active in the processed fruit sector, producing high-quality dragon fruit juices and related products, meeting the rising global demand for healthy and natural food options. Their continuous innovation in farming and product development has solidified their reputation as a leading provider of premium dragon fruit products.

Hybrid Herbs has been actively involved in the dragon fruit sector, particularly emphasizing the use of pink pitaya (Hylocereus undatus) in their product lineup. Throughout 2023 and into 2024, they have focused on promoting the health benefits of dragon fruit through their range of superfood powders. These powders are particularly noted for their high nutritional content and versatility in culinary applications. Hybrid Herbs markets these dragon fruit products not just as health supplements but also as vibrant additions to foods and drinks, capitalizing on natural pigmentation to enhance the visual appeal of dishes. They utilize a freeze-drying process to preserve the nutritional integrity of the fruit, ensuring that the powders are both potent and easy to use in various recipes. This approach allows them to target health-conscious consumers looking to incorporate superfoods into their diet conveniently and enjoyably.

Light Cellar has been recognized in the global dragon fruit market for its efforts in promoting dragon fruit-based products. In 2023 and 2024, the company has focused on incorporating dragon fruit into its health food offerings, particularly through the production and sale of unique dragon fruit-infused items. Light Cellar has utilized its expertise in superfoods to innovate in the dragon fruit space, exploring both traditional and new ways of integrating this nutritious fruit into the Western diet, making it more accessible to health-conscious consumers internationally.

Madam Sun Sdn. Bhd., throughout 2023 and into 2024, has continued to expand its presence in the dragon fruit sector by focusing on producing and supplying a variety of dragon fruit-based products. They are particularly noted for their Red Dragon Fruit Puree Mix, which is part of their broader range of fruit product offerings that include purees, jams, and syrups. Their products are crafted to maintain the natural flavor and nutritional value of the fruit, appealing to a market that values health and quality. They ensure product quality by adhering to good manufacturing practices and are keen on supplying a wide range of fruit-based products that meet consumer needs for natural and wholesome ingredients. Their commitment to quality and variety has helped them cater to both local and international markets, making them a prominent player in the fruit product manufacturing industry in Malaysia.

Miami Fruit has been actively engaging in the dragon fruit sector throughout 2023 and 2024, focusing on expanding the variety and accessibility of dragon fruits to consumers. They’ve introduced new varieties such as the Sunset Dragonfruit, a pink-fleshed fruit with a yellowish-orange skin, which they began offering in 2022. This variety is noted for its flavor similarities to the red dragonfruit and is grown on their small farm in South Florida. Miami Fruit emphasizes non-GMO cultivation and aims to provide freshly picked fruits that are ready to consume upon delivery. During the dragonfruit season, which peaks in the summer, Miami Fruit encourages consumers to use their dragonfruits quickly due to their ripe picking or to store them refrigerated or frozen for use in smoothies or sorbets. Their product line extends beyond fresh fruits to include frozen fruits and other tropical varieties, promoting a diverse and health-focused range for their clientele.

Conclusion

The dragon fruit market is currently experiencing a period of robust growth and is projected to continue expanding in the coming years. This growth is driven by several factors including increasing global demand for fresh and exotic fruits, attributed to their health benefits and rising disposable incomes, particularly in developing countries. Asia-Pacific remains the dominant player in both the production and consumption of dragon fruit, with Vietnam being a major exporter, particularly to China. The market in China is burgeoning due to the fruit’s nutritional value and its incorporation into the changing dietary preferences of the population. Europe also shows promising growth potential, despite dragon fruit being a relatively new entrant in the market there.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)