Table of Contents

Introduction

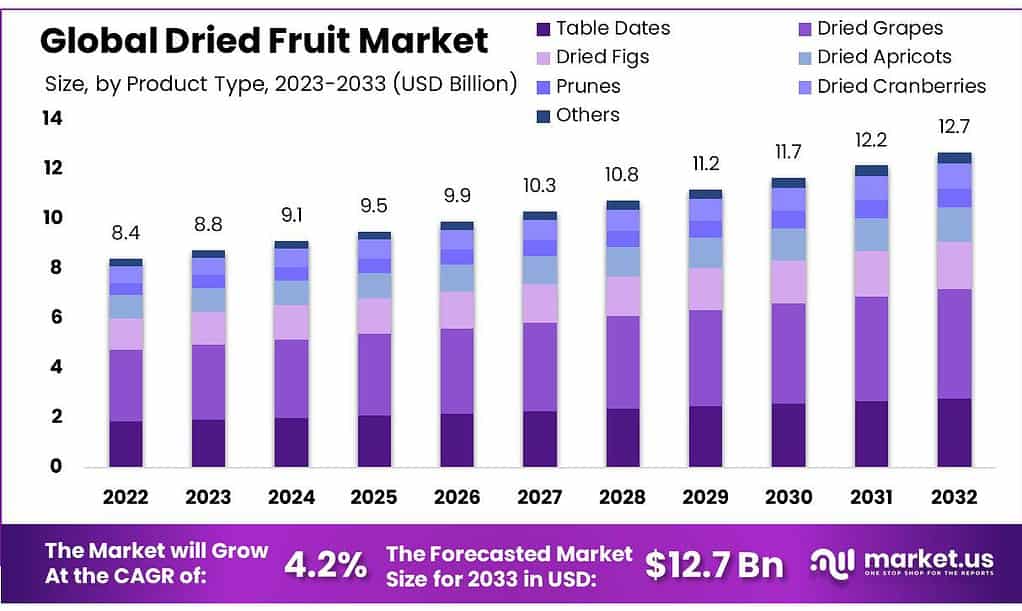

The global dried fruit market is projected to grow from USD 8.4 billion in 2023 to USD 12.7 billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.2% during the forecast period. This market encompasses the processing, marketing, and sale of fruits from which most of the original water content has been removed, extending their shelf life and making them a convenient, nutritious snack. Dried fruits, including raisins, dates, prunes, figs, apricots, and more, are rich in fiber, vitamins, and minerals, retaining most of the nutritional value of fresh fruits.

Several factors are driving this market growth. Rising awareness of health and nutrition has significantly boosted the demand for dried fruits as healthy snack options. Consumers are increasingly looking for convenient, portable food options that align with their busy lifestyles. The versatility of dried fruits has expanded their use beyond traditional snacks and culinary ingredients to include applications in dairy products, confectioneries, health bars, cereals, and natural sweeteners.

Europe currently dominates the global dried fruit market, holding a market share of 40.1% in 2023. This dominance is attributed to the region’s high consumption of healthy and natural food products, robust culinary traditions, and well-established supply chains. The demand for dried fruits is particularly high in the U.K., Germany, France, and Italy, where consumers are highly health-conscious. The Asia-Pacific region is the fastest-growing market, driven by increasing disposable incomes and growing health awareness in countries such as China, India, and Vietnam.

Recent developments in the market include significant investments and innovations. For instance, in April 2022, Norfund invested USD 8 million in Redsun Dried Fruit and Nuts, a sultana manufacturer in South Africa, enhancing their market presence. Additionally, the growing trend towards organic and naturally processed fruits is driving demand for healthier and more sustainable food options.

Despite the positive growth trends, the market faces several challenges. One major challenge is the seasonal and climatic dependency of fruit production, which can lead to supply fluctuations and affect prices. Additionally, maintaining the nutritional quality and taste during the drying process remains a technical challenge. The market is also impacted by global trade policies and regulations that can affect the export and import dynamics of dried fruits.

Key Takeaways

- Market Growth: Expected CAGR of 4.2% till 2033, reaching USD 12.7 billion, driven by health-conscious consumer demand for nutritious snacks.

- Segmentation: Products include Dried Grapes (34.6% market share), Table Dates, Figs, Apricots, Prunes, Cranberries, and others.

- Applications: Dominated by Bakery & Confectionery (25.6% market share), followed by Frozen Desserts, Breakfast Cereals, Beverages, and Snacks.

- Distribution Channels: Supermarkets & Hypermarkets lead (45.6% market share), followed by Specialty Stores, Convenience Stores, and Online platforms.

- Regional Dynamics: Europe holds the largest market share (30.5%), followed by North America, with APAC, Latin America, and MEA presenting growth prospects.

Grape and Fig Production Statistics

- Türkiye produces 1200 types of fresh grapes, with an annual production of about 4 million tons.

- 60% of Türkiye’s grape production is seedless.

- Fresh figs contain 80% water and 12% sugar; dried figs contain 50% sugar.

- Nearly 45% of fig exports go to European Union countries.

- 50% of Türkiye’s dried fruit exports in 2021 were to the UK, Germany, France, the USA, and the Netherlands.

Tree Nuts and Peanuts Statistics

- Tree nut production reached over 5.3 million metric tons in 2020/21, a 65% increase from 10 years ago.

- Almonds had 31% of the world’s share of tree nuts, followed by walnuts and pistachios (19% each).

- Pecans, macadamias, Brazil nuts, and pine nuts represented the remaining 5% of tree nut production.

- Tree nut exports grew by 103,000 MT per year, reaching over 2.9 million MT in 2019.

- World peanut production in 2020/21 totaled over 47.5 million MT, a 7% increase from the previous season.

Dried Fruit Market and Exports Statistics

- Türkiye exports dried fruits to five continents and over 130 countries.

- Dried fruit exports totaled approximately 2.8 million MT in 2019, increasing by 130,000 MT/year.

- Overall dried fruit consumption has risen by 80,000 MT per year.

- In 1Q2023, Georgia’s dried fruit exports decreased by 52.7% in value and 71.9% in volume from the previous year.

- Dried fruit export decrease from Georgia in January-March 2023 was 200 tons worth USD 774 thousand.

Emerging Trends

Health and Wellness Focus: Consumers are increasingly prioritizing health and wellness in their dietary choices, driving the demand for dried fruits. Dried fruits are seen as a nutritious snack alternative, rich in vitamins, minerals, and dietary fiber. This shift towards healthier eating habits is supported by a growing awareness of the benefits of natural and minimally processed foods. The popularity of plant-based and vegan diets also contributes to this trend, as dried fruits fit well into these dietary patterns.

Organic and Clean Label Products: There is a significant increase in demand for organic dried fruits. Consumers are looking for products that are sustainably produced and free from artificial additives, aligning with their values around environmental sustainability and personal health. This trend is reflected in the growth of organic food sales, which saw significant increases in recent years, as noted by the Organic Trade Association.

Convenience and On-the-Go Snacking: The convenience factor of dried fruits makes them a popular choice for on-the-go snacking. Their long shelf life and portability make them ideal for busy lifestyles. Supermarkets are capitalizing on this trend by placing dried fruits in convenient locations and promoting them alongside other quick snack options like nuts and trail mixes.

Innovative Flavors and Packaging: The market is seeing an introduction of new flavors and innovative packaging solutions. Companies are launching flavored dried fruits to attract consumers looking for variety and unique taste experiences. Packaging innovations, such as single-serve packs and resealable bags, enhance the convenience and appeal of dried fruits.

Culinary Applications: Dried fruits are being increasingly used in various culinary applications beyond snacking. They are popular ingredients in bakery products, cereals, dairy products, and even beverages. The versatility of dried fruits in enhancing flavor, texture, and nutritional content in these products is driving their demand in the food industry.

Technological Advancements: Innovations in drying technology are improving the quality and variety of dried fruits available in the market. These advancements help in retaining more nutrients and improving the texture and taste of dried fruits, making them more appealing to consumers.

Market Expansion in Emerging Regions: The Asia-Pacific region is emerging as the fastest-growing market for dried fruits, driven by increasing disposable incomes and growing health awareness. Countries like China, India, and Vietnam are seeing a rise in demand for dried fruits as consumers become more health-conscious and seek nutritious snack options.

Sustainability and Ethical Sourcing: There is a growing trend towards sustainable and ethically sourced dried fruits. Consumers are increasingly concerned about the environmental and social impacts of their food choices, leading to a preference for products that are sustainably produced and ethically sourced.

Use Cases

Healthier Snack Option: Dried fruits like raisins, apricots, and figs are popular as healthy snacks. For instance, raisins alone accounted for over $2.5 million in sales due to their sweet taste and high nutritional value. Their convenience and portability make them a favorite among consumers looking for nutritious on-the-go snacks.

Ingredient in Bakery Products: Dried fruits are extensively used in baking. In 2024, the bakery and confectionery segment is projected to hold over a 25.6% share of the dried fruit market. Products like cakes, muffins, cookies, and bread often include dried fruits for added flavor and texture. Dried cranberries, for example, are frequently used in baking due to their tartness and health benefits.

Breakfast Cereals:

Enhancing Breakfast Options: Dried fruits are common in breakfast cereals, muesli, and granola. They add natural sweetness and nutritional value. The breakfast cereal segment is a significant part of the dried fruit market, with many consumers incorporating dried fruits into their morning routines for a nutritious start to the day.

Yogurt and Ice Cream Additions: Dried fruits are popular additions to dairy products. They are often used in yogurts and ice creams to enhance flavor and nutritional content. The dairy segment dominated the market in 2023, with a market share of 30.5%. Products like fruit yogurt and frozen desserts benefit from the inclusion of dried fruits.

Cooking and Salads: Dried fruits are used in various culinary applications, including salads, stews, and sauces. Their rich flavors and textures make them ideal for both savory and sweet dishes. They are especially popular in Mediterranean and Middle Eastern cuisines.

Nutritional Bars and Energy Foods:

Health Bars and Snacks: Dried fruits are key ingredients in nutritional bars, providing natural sweetness and essential nutrients. This segment caters to health-conscious consumers and athletes looking for quick, nutritious energy sources.

Flavor Enhancements: Dried fruits are used in teas, smoothies, and fruit-infused waters. They impart natural flavors and beneficial nutrients, making beverages more appealing and healthy.

Nutraceuticals: Dried fruits are used in the nutraceutical industry for their health benefits. Products like prune extract are popular for their digestive health properties. The rising interest in natural and organic ingredients is driving the inclusion of dried fruits in various health supplements and cosmetic products.

Gift and Festive Use:

Holiday Gifts: Dried fruits are often included in gift baskets, especially during festive seasons. They are seen as premium and healthy gift options, contributing to seasonal sales spikes.

Major Challenges

Seasonal and Climatic Dependency: Dried fruit production is highly dependent on seasonal and climatic conditions. Adverse weather conditions, such as droughts, floods, or unseasonal rains, can significantly affect the yield and quality of fruits. For example, California, a major producer of raisins and other dried fruits, often faces drought conditions that impact crop production and subsequently the supply of dried fruits.

Supply Chain and Logistics: The dried fruit industry requires a robust supply chain to ensure the fruits are dried, processed, and delivered efficiently. Any disruptions in the supply chain, such as transportation delays or storage issues, can lead to significant losses. The perishability of fruits before drying and the need for proper storage conditions pose logistical challenges.

Market Competition: The dried fruit market is highly competitive, with numerous players ranging from large multinational corporations to small local producers. This competition can lead to price wars and reduced profit margins. Additionally, dried fruits compete with a variety of other snack options, including fresh fruits, nuts, and processed snacks, making market penetration challenging.

Consumer Perception and Preferences: While dried fruits are recognized for their health benefits, they also face negative perceptions due to added sugars and preservatives in some products. Health-conscious consumers are increasingly wary of these additives, preferring fresh fruits or minimally processed options. Educating consumers about the benefits of naturally processed dried fruits without additives is a continual challenge.

Regulatory and Compliance Issues: Different countries have varying regulations regarding the processing, packaging, and labeling of dried fruits. Compliance with these regulations can be complex and costly, particularly for exporters. Issues such as pesticide residues, use of sulfur dioxide as a preservative, and organic certification standards are significant hurdles that producers must navigate.

Market Growth Opportunities

Health and Wellness Trends: As consumers become more health-conscious, the demand for nutritious snack options like dried fruits is increasing. Dried fruits are rich in vitamins, minerals, and antioxidants, making them a preferred choice for those seeking healthier snack alternatives. The trend towards plant-based and vegan diets also supports this growth. A survey by Gelesis found that 60% of Americans aim to eat healthier, with many turning to plant-based foods, which include dried fruits.

Expansion into Emerging Markets: Regions such as Asia-Pacific and Latin America are experiencing rapid economic growth, increasing disposable incomes, and greater awareness of healthy eating. Countries like China, India, and Brazil offer substantial growth potential due to their large populations and rising middle class. The Asia-Pacific region, in particular, is expected to see significant market expansion due to increasing demand for convenient and healthy snacks.

Product Innovation and Diversification: Developing new dried fruit products with innovative flavors and formats can attract a broader customer base. Companies are introducing flavored dried fruits and blends that cater to diverse taste preferences. Additionally, incorporating dried fruits into other products like health bars, cereals, and dairy products can drive market growth. For example, Ocean Spray Cranberries introduced a new line of flavored dried fruits to enhance its product portfolio.

Organic and Clean-Label Products: There is a growing demand for organic and clean-label products, which are perceived as healthier and more sustainable. Organic dried fruits, which are free from pesticides and artificial additives, appeal to environmentally conscious consumers. The global organic food market’s growth reflects this trend, providing an opportunity for dried fruit producers to tap into this expanding segment.

E-commerce and Direct-to-Consumer Sales: The rise of e-commerce platforms offers a significant growth opportunity for the dried fruit market. Online sales channels allow producers to reach a wider audience, offer convenience, and provide detailed product information. The COVID-19 pandemic has accelerated the shift towards online shopping, making it a crucial avenue for market expansion.

Recent Developments

In 2023, The Kraft Heinz Company, known for its extensive portfolio of food and beverage products, continued to navigate a highly competitive market, focusing on organic sales growth and improving profitability despite challenges like inflation and fluctuating commodity prices. Over the year, Kraft Heinz reported a notable effort in enhancing their product offerings, including potential expansions in categories like dried fruits, aligning with evolving consumer preferences for healthier and more convenient snack options.

European Freeze Dry is significantly contributing to the freeze-dried fruit sector in Europe, particularly notable in 2023. The company has been instrumental in meeting the rising demand for freeze-dried fruits which are favored due to their long shelf life and retained nutritional values. These products are particularly appealing in the context of Europe’s increasing health consciousness and the growing popularity of convenient, ready-to-eat food options. European Freeze Dry is part of a vibrant market that has seen robust demand across various applications, from morning breakfasts to snacks and confectioneries.

In 2023, the European market for freeze-dried fruit products has been dynamic, with significant growth driven by changing consumer lifestyles and an increasing inclination towards healthier eating habits. The market’s expansion is supported by technological advancements in freeze-drying that maintain the flavor, aroma, and color of the fruits, making these products an excellent choice for both direct consumption and as ingredients in a variety of food products. European Freeze Dry, along with other key players, has been at the forefront of innovations and supply chain enhancements to cater to this growing market demand.

Van Drunen Farms, a family-owned company, plays a significant role in the dried fruit sector by specializing in the processing of culinary, all-natural, and functional food ingredients, including a variety of fruits. In 2023, they have continued to leverage their extensive farming operations and processing facilities located strategically around the world to deliver high-quality, seasonal ingredients that cater to both organic and conventional market demands.

Throughout 2023, Van Drunen Farms has emphasized the use of advanced drying technologies such as freeze-drying and drum-drying to produce ingredients that maintain the taste, color, and nutritional value of the original products. This process ensures that their dried fruits retain the natural flavor and nutrients, which are critical for their applications in snacks, cereals, granola, bakery items, and more. The company’s ability to trace its products from seed to sale underscores its commitment to quality and transparency, making it a trusted supplier in the global food ingredients market.

Mercer Foods has made significant strides in the dried fruit sector in 2023, especially noted for its expertise in natural freeze-dried fruits and vegetables. As a key player in the market, Mercer Foods is recognized for its innovative approach to freeze-drying, which not only preserves the color, flavor, and nutritional content of fruits and vegetables but also caters to a wide range of end markets including food service and retail channels. Their offerings are particularly noted for being clean-label, which is increasingly important to health-conscious consumers.

This year, Mercer Foods has continued to expand its influence in the dried fruit market by capitalizing on the growing trend toward healthy and convenient snack options. The company’s strategic focus on research and development allows it to offer high-quality, differentiated products that meet consumer demands for both taste and nutritional value. Moreover, the investment by Entrepreneurial Equity Partners and Mubadala Capital has poised Mercer Foods for further growth and innovation, aiming to solidify its position as a market leader in North America.

Conclusion

In conclusion, the global dried fruit market is poised for substantial growth, driven by an increasing consumer focus on health and convenience. As lifestyles become busier, the demand for nutritious, easy-to-consume foods is surging, and dried fruits offer a viable solution by providing essential nutrients in a portable and long-lasting format. Innovations in drying technology and packaging are enhancing the appeal of these products, ensuring they retain their nutritional value and taste appeal. Moreover, the rising popularity of organic and natural food products is further propelling the market, as consumers increasingly seek clean-label foods that align with their dietary preferences and sustainability values. With these trends, the dried fruit sector is set to expand its influence in the snack and culinary markets globally, promising exciting opportunities for growth and innovation.