Table of Contents

Introduction

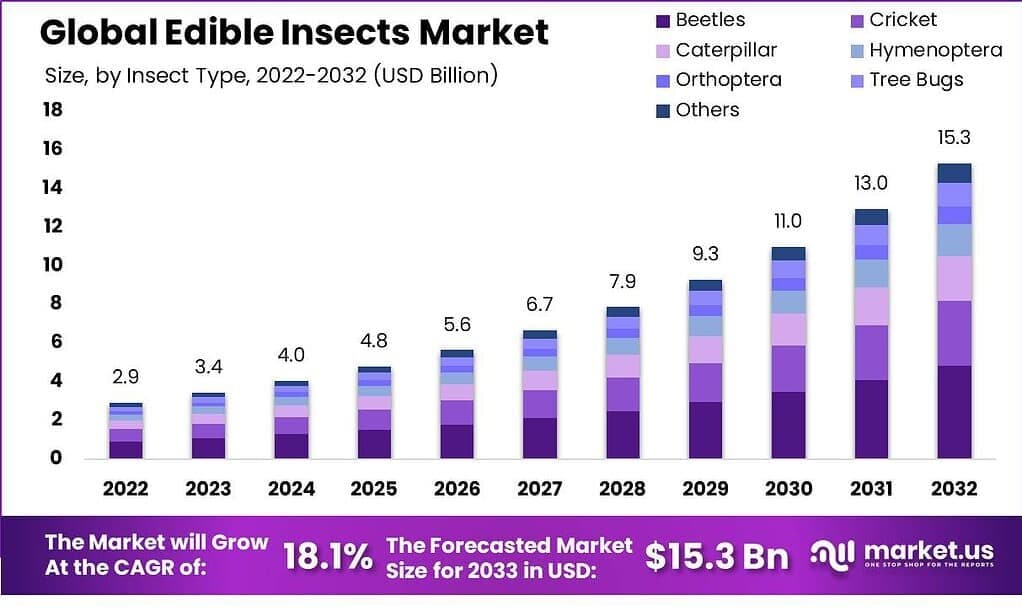

The global edible insects market is poised for significant growth, with a forecast to reach USD 15.3 billion by 2032 from an estimated USD 3.4 billion in 2023, progressing at a steady CAGR of 18.1% over the forecast period.

This expansion is driven by increasing nutritional awareness and the health-conscious preferences of younger demographics, alongside the environmental benefits of insect farming compared to traditional livestock. These factors are propelling the adoption of edible insects as a sustainable protein source.

However, the market faces several challenges, including cultural and psychological barriers, regulatory complexities, and concerns about allergens which may slow down market acceptance. Furthermore, scaling up production, ensuring consistent quality, and educating the market about the benefits of edible insects remain significant hurdles.

Recent developments in the industry include technological advancements that enhance the efficiency of insect farming and processing, broadening the range of products available in the market. Companies are also exploring business-to-business opportunities and expanding into new geographical markets to capitalize on the growing demand.

In 2023, Beta Hatch made significant advancements in the edible insect market. They opened what is described as North America’s largest regenerative mealworm hatchery in Cashmere, Washington. This facility spans 50,000 square feet and focuses on producing sustainable proteins from mealworms for various uses, including animal feed and pet food.

The operation prides itself on using innovative technologies that significantly reduce food waste and decrease greenhouse gas emissions associated with traditional protein production methods. Additionally, Beta Hatch successfully completed the assembly of the yellow mealworm genome, which was published to aid further scientific research on commercially relevant insect species.

Key Takeaways

- Edible Insects Market is anticipated to be USD 15.3 billion by 2032. It is estimated to record a steady CAGR of 18.1% in the forecast period 2022 to 2032. It is likely to total USD 3.4 billion in 2023.

- In 2023, the Beetles segment held a dominant market position in the Edible Insects Market, capturing more than a 31.6% share.

- In 2023, the Powder segment held a dominant market position in the Edible Insects Market, capturing more than a 40% share.

- In 2023, the Animal Feed segment held a dominant market position in the Edible Insects Market, capturing more than a 36% share.

- In 2023, it was reported that the Asia-Pacific (APAC) area had the highest share of the market for edible insects, with more than 32.6% of the world market share valued at USD 1.0 billion in 2023.

Edible Insects Statistics

Growing Global Demand for Insect Ingredients

- Protix is a fully integrated insect ingredients company, producing and processing 14,000 metric tons of LLE annually in its Netherlands facility which has been in operation since 2019. It serves major global companies in the pet food, aquaculture feed, livestock feed, and organic fertilizer industries as the demand for insect ingredients continues to grow.

- Ÿnsect—which has just raised €160 million ($175 million) in the first tranche of a series D round—has recently cut jobs at its facility in Paris and is turning its production facility in the Netherlands into a research center dedicated to the Buffalo beetle.

- More than 80% of feed processors and farmers are willing to integrate insects into their livestock and fish feeds.

- Over 65% of those consuming insects as food would prefer processed flour to whole insect products.

- The Center for Environmental Sustainability Through Insect Farming, established under a newly awarded $2.2 million grant from the National Science Foundation, is a collaboration between the School of Science at IUPUI, Texas A&M AgriLife Research, and Mississippi State University.

Edible Insects: Nutritious and Sustainable

- Edible Insects and Human Evolution, humans have been farming and eating insects throughout their history, as evidenced by bone tools dating back 1.7 million years discovered in South Africa.

- Insects are an essential food source for at least 2 billion people, but the Western world has only recently begun to re-evaluate their role in our food systems.

- Up to 80 percent of insects’ body weight is made up of protein and micronutrients, with the protein content exceeding that of all traditional livestock.

- Mopane worms are also widely traded across the region and beyond, mostly informally. Unofficial estimates put the trade in this tasty insect at more than US$1 million annually.

- Agrifood’s biggest news this week is PE firm Paine Schwartz closing its $1.7 billion food- and agribusiness-focused fund. Fund VI is “exclusively focused on sustainable investments” in food and agribusiness, and the firm has already deployed 40% of the capital to the likes of AgroFresh, Costa Group, and others.

Emerging Trends

- Widespread Adoption: Edible insects are gaining traction as a viable and sustainable protein source, offering an alternative to conventional animal proteins. Their impressive nutritional profile, which includes high-quality protein and essential vitamins, is propelling their inclusion in a variety of culinary settings, from starters to entrees.

- Diverse Product Development: Innovation in the edible insects sector is burgeoning, with a variety of products emerging. Insect-derived ingredients, such as powders and meals, are being utilized not only in animal nutrition but are also making their way into innovative consumer food products like snacks, bakery items, and beverages.

- Sustainability Focus: The ecological advantages of insect farming—significantly lower carbon footprints and minimal usage of water and land—are boosting their appeal as a diet choice. This trend aligns closely with global initiatives aimed at diminishing the environmental impact associated with food production.

- Broadening Applications: Beyond their role in nutrition, insects are finding uses in other industries, including animal feed, beauty products, and even pharmaceuticals. This expansion is paving the way for new market opportunities and broadening the scope of the edible insect industry.

- Variations in Regional Growth: Leading the way, the Asia-Pacific region benefits from longstanding cultural acceptance and advanced insect farming technologies. Meanwhile, North America and Europe are experiencing fast-paced growth, fueled by rising interest in sustainable food sources and ongoing development of new insect-based products.

Use Cases

- Sustainable Protein Source: Edible insects are emerging as a sustainable alternative to traditional livestock, requiring significantly less land, water, and feed. They produce a fraction of the greenhouse gases compared to traditional meat sources, making them an environmentally friendly option for protein production.

- Animal Feed: Insects are being increasingly used as a high-protein feed ingredient for poultry, aquaculture, and even pet foods. Their high feed conversion efficiency makes them a cost-effective and nutritious option for feeding animals.

- Waste Management: Insect farming can contribute to waste reduction by utilizing organic waste materials as feed. This not only helps manage waste but also produces less pollution compared to traditional animal farming.

- Nutraceuticals: The unique nutritional profile of insects makes them suitable for health and wellness products. Insects like crickets and mealworms are rich in proteins, vitamins, and minerals and are being incorporated into various health-focused products such as protein bars and dietary supplements.

- Culinary Innovations: With their versatility, insects are being used in a myriad of culinary applications. From gourmet dishes served in restaurants to being processed into flours and powders for use in baking and cooking, insects are slowly making their way into the mainstream culinary world.

Major Challenges

- Gaining Consumer Acceptance: Overcoming the discomfort and reluctance many consumers feel towards eating insects is crucial, especially outside regions where it is not traditionally done. The distaste, often called the ‘ick’ factor, requires targeted education and marketing strategies to transform perceptions.

- Expanding Production Capacities: Meeting the growing demand for insect-based products means scaling up farming operations. This involves refining farming methods, enhancing production facilities, and increasing output without sacrificing quality or safety.

- Navigating Regulatory Environments: The absence of uniform regulations for insect agriculture can stall market progress. Companies must navigate varying local and global standards concerning the safety, production, and sale of insect products, which can create operational uncertainties.

- Managing High Costs: Insect farming can be costly, particularly due to the need for specialized feeds and the maintenance of optimal farming conditions. These expenses can make insect-based products less competitive price-wise compared to more conventional protein sources.

- Addressing Food Safety Issues: It’s vital to ensure that insect-based foods are safe for consumption. Concerns include potential allergens and the risk of disease transmission from insects to humans, which necessitate stringent processing, packaging, and labeling practices to foster consumer confidence and ensure safety.

Market Growth Opportunities

- Boosting Consumer Acceptance: As recognition of the environmental and nutritional advantages of edible insects increases, there’s an opportunity to widen the customer base. By implementing educational initiatives and creative marketing techniques, the integration of insects into everyday diets can be normalized, particularly in Western regions where substantial market expansion is possible.

- Geographical Market Expansion: With an uptick in interest from regions such as North America and Europe towards sustainable and alternative protein sources, these areas offer great potential for market extension. Enhanced regulatory frameworks and growing public awareness create conducive environments for this expansion.

- Product Line Diversification: The market stands to gain by broadening its array of insect-based products, including protein bars, flours, snacks, and drinks. Food technology innovations can aid in the development of tastier and more adaptable offerings, appealing to diverse dietary needs and preferences.

- Utilizing Online Retail: The surge in online shopping presents a prime opportunity for marketing edible insect products. E-commerce platforms can simplify consumer access and enable companies to tap into a worldwide market efficiently, minimizing distribution costs.

- Incorporation into Health and Wellness: Targeting the health-conscious demographic, insect proteins can be promoted as superior, nutrient-rich options compatible with specialized diets such as keto and paleo. This approach aligns with the increasing consumer demand for innovative and healthful dietary choices in the fitness and wellness sector.

Key Players Analysis

- Beta Hatch Inc. specializes in pioneering insect farming technology to produce sustainable animal feed and crop fertilizer. They operate a state-of-the-art facility that uses advanced automation and data-driven approaches to enhance mealworm production, focusing on efficiency and sustainability.

- Deli Bugs Ltd. specializes in selling a variety of edible insects, offering products like freeze-dried insects and insect powders. They focus on promoting insects as nutritious and suitable for various diets, emphasizing the health benefits and advocating for wider acceptance of entomophagy (the practice of eating insects) in Europe and beyond.

- InnovaFeed is a biotech company specializing in sustainable agriculture by producing insect protein for animal and plant nutrition. They use advanced technology to reproduce the natural lifecycle of black soldier flies on a large scale, creating a competitive and eco-friendly production model.

- AgriProtein Technologies focuses on converting organic waste into sustainable protein sources using black soldier fly larvae. Their innovative approach aims to reduce landfill waste and produce MagMeal, a protein-rich product for animal feed, supporting global sustainability efforts.

- Protix B.V. is at the forefront of producing sustainable insect-based ingredients, aiming to balance the food system with nature. They transform food waste into high-quality proteins and lipids, providing a sustainable alternative to traditional animal feeds and contributing to environmental sustainability.

- Ynsect SAS is leading the way in transforming the food industry by producing sustainable insect-based ingredients. They focus on using mealworms to develop high-quality, nutrient-rich products for animal feed, plant fertilizers, and even human consumption. Their efforts aim to create a more sustainable food system that significantly reduces environmental impact

YNSECT. - ReeseFiner Foods Inc., initially known for its imported food delicacies, ventured into the edible insects market by incorporating unique offerings like chocolate-covered South American ants and Japanese fried butterflies. Their approach was to enhance their exotic food product range with these distinctive items, tapping into the niche market of edible insects for a broader audience.

- Tiny Farms is a California-based company dedicated to optimizing the efficiency of cricket farming for broader commercial use. They focus on developing technology to reduce the costs and labor of insect production, aiming to make insect-derived products, like cricket flour, more accessible and cost-effective.

- Aspire Food Group specializes in sustainable cricket protein production, aiming to lead the global industry by using advanced technologies. They focus on environmentally responsible methods to produce high-quality cricket powder, which serves as a nutrient-rich food ingredient for humans and animals.

- HaoCheng Mealworm Inc. specializes in the production of edible insects, primarily focusing on mealworms. They operate extensive breeding farms and are significant players in the global edible insect market, producing a range of products from whole and processed insects to insect powders and snacks.

- Global Bugs Asia Co., Ltd specializes in the production of cricket-based protein powders, promoting sustainable protein sources. They oversee the entire process from cricket farming to the production of their EntoPowder, ensuring high-quality output that caters to both B2C and B2B markets, primarily in Asia. Their products are designed to enrich food and beverages with essential nutrients like protein and vitamin B12, which are crucial for vegan diets.

- EnviroFlight is committed to developing sustainable insect-based products, primarily using black soldier fly larvae, for both animal feed and agricultural use. Their operations focus on environmentally responsible practices to produce high-quality ingredients that contribute to a more sustainable global food system.

- Hargol FoodTech is revolutionizing the edible insect industry by producing grasshoppers as a sustainable and nutritious protein source. They employ advanced farming techniques to produce grasshoppers efficiently, ensuring minimal environmental impact. Their products, which include protein-rich grasshoppers, are recognized for their high nutritional value and are both kosher and halal certified.

- Kreca V.O.F.LLC specializes in the production of various edible insects, offering products like crickets, grasshoppers, and mealworms for both animal and human consumption. They focus on sustainable production practices and provide their insects in various forms such as whole, frozen, or powdered.

- Armstrong Cricket Farm Georgia has been a pioneer in the commercial cricket farming industry since 1947, offering a variety of live crickets and worms primarily used for pet and reptile feed. They focus on producing high-quality, nutritious insects that are easily digestible and have a soft exoskeleton, which makes them ideal for a range of animals.

- Entomo Farms focuses on sustainable agriculture, producing a variety of insect-based products like cricket flour and mealworm powder. They are known for their commitment to eco-friendly practices, aiming to provide nutrient-rich, sustainable food options globally.

- EntoCube Ltd. specializes in developing cutting-edge technology for farming edible insects, aiming to provide sustainable food solutions. Their innovative approach involves climate-controlled environments, making it possible to grow insects efficiently and sustainably. This technology not only caters to local markets but also aims to support global food security by enabling scalable and mobile insect farming solutions.

- Protifarm Holdings NV specializes in producing a variety of insects, focusing on the lesser mealworm, for use in human nutrition. Their production processes are designed for efficiency and sustainability, utilizing advanced technologies to ensure high-quality, safe products

Conclusion

Edible insects are gaining recognition as a sustainable and nutritious food source that offers a smaller ecological footprint compared to traditional livestock. They require less land, water, and energy and produce fewer greenhouse gases during farming. Additionally, insects convert feed into protein more efficiently than cattle or pigs, making them a potent solution for future food security needs.

However, despite these benefits, the widespread acceptance of insects as a daily diet component faces challenges, particularly in cultures unaccustomed to entomophagy. To truly integrate edible insects into global food markets, ongoing education, innovative food products, and supportive policies will be crucial.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)