Table of Contents

Introduction

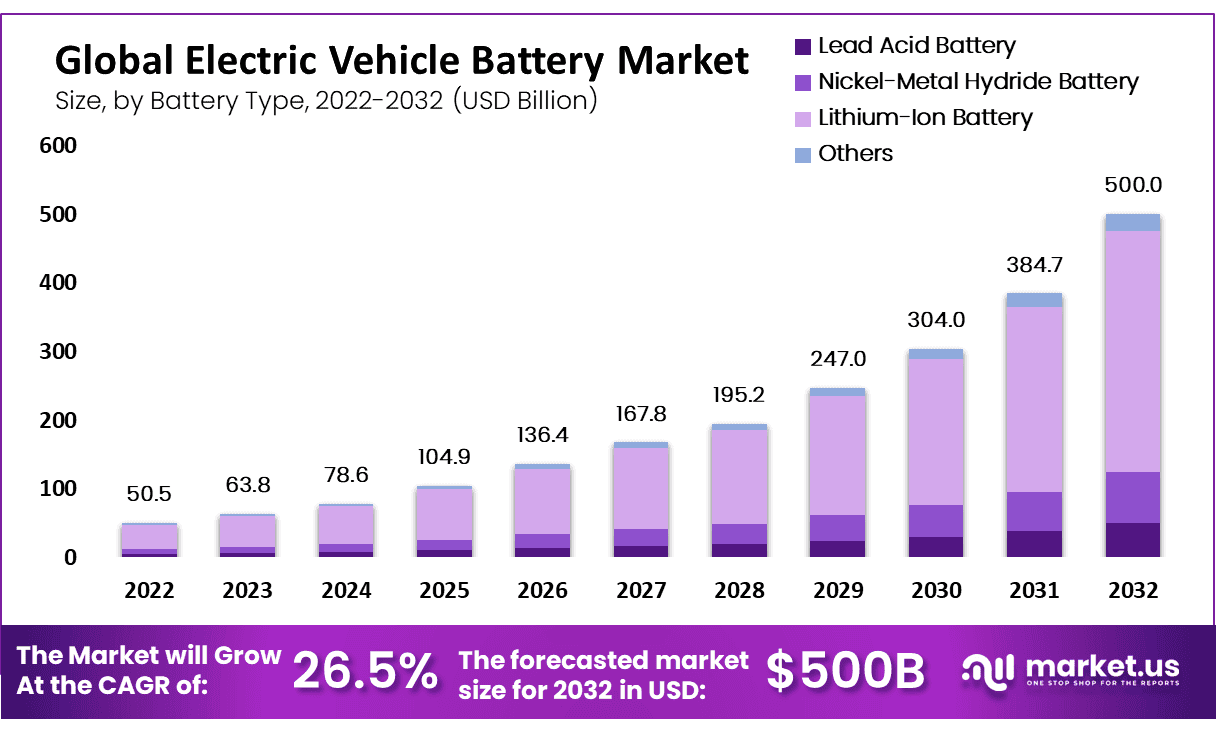

The global electric vehicle (EV) battery market, estimated at USD 63.8 billion in 2023, is poised for significant expansion with projections indicating a growth to approximately USD 500 billion by 2032, reflecting a compound annual growth rate (CAGR) of 26.5%. This growth is driven by several key factors, including technological advancements in battery performance, increasing adoption of electric vehicles due to rising environmental concerns, and substantial support from government policies promoting electric mobility.

However, the market faces challenges such as the high cost and complexity of raw material procurement, concerns over the environmental impact of battery production, and technical constraints related to charging times and battery safety. Recent developments have shown active industry responses to these challenges, such as strategic partnerships and innovations aimed at enhancing battery efficiency and sustainability.

Notable recent activities include Panasonic’s investment plans in North America to boost production capacity and collaborations between major automotive players and battery manufacturers to secure supply chains and advance battery technologies. In the electric vehicle (EV) battery market, several key players have been active with notable developments that signify the dynamic nature of this industry.

ATLASBX Co. is among the companies that stand out, particularly in terms of expanding their global reach and technological capabilities in the EV battery sector. They continue to enhance their market position through strategic advancements and are integral to the market’s growth. Sony, traditionally known for electronics, has been venturing into the EV battery space, contributing with their extensive R&D capabilities. Their involvement is expected to bring innovations, particularly in battery efficiency and lifecycle improvements.

Overall, while the electric vehicle battery market is navigating through these complexities, the concerted efforts from manufacturers and policymakers are expected to drive robust market growth and technological innovation in the coming years.

Electric Vehicle (EV) Battery Statistics

- Electric car battery lifespan: Typically 7-8 years, potentially up to 10 years before replacement.

- Lithium-ion battery capacity: Average around 40 kWh, some models up to 100 kWh.

- Battery range: Varies by model, e.g., Nissan Leaf with a 40 kWh battery offers a 168-mile range.

- Charging efficiency: Overnight charging using a 7 kW home charger is recommended over rapid chargers.

- Battery replacement cost: Depends on car make/model, but generally not needed for up to 500,000 miles.

- Driving at highway speed drains EV batteries faster than stop-and-go traffic, reducing range by up to 32% in freezing temperatures.

- Extreme weather conditions can decrease EV range by up to 32%, necessitating more frequent charging in cold climates.

- Maintain charge between 20% and 80%.

- Battery Recycling: Some manufacturers aim to recycle up to 97% of materials, including nickel, copper, lithium, and plastic.

- Expected Improvement in Battery Tech: Predicted 2-3% enhancement annually in lithium-ion battery technology.

- Charging Advancements: Anticipated rate: 100 miles for every 5 minutes of charge by 2024.

- Global Transportation Pollution: Transportation accounts for 27% of global greenhouse gas emissions, urging the need for EV adoption.

- Cell Count: EVs contain different numbers of cells based on formats: cylindrical (5,000-9,000 cells), pouch (few hundred), and prismatic (even fewer).

- Electric motors in BEVs have an efficiency of 85% to 95% across the entire speed range.

- The overall efficiency of converting battery DC power to AC for the motor is around 70%.

- BEVs can cost up to 35% less to maintain than ICEVs.

Emerging Trends

- Increasing Adoption of Lithium Iron Phosphate (LFP) Batteries: The shift towards LFP batteries is becoming more pronounced due to their lower cost and safety profiles. These batteries are gaining market share, with companies like Tesla, Ford, and Volkswagen starting to offer models using this chemistry. This trend is driven by improvements in LFP chemistry and manufacturing, which have enhanced performance levels.

- Growth in Battery Demand and Production: The global demand for EV batteries is rising sharply, supported by the increased adoption of electric vehicles. This demand is particularly robust in China, the U.S., and Europe. For instance, battery production in Europe and the U.S. reached significant volumes in 2023, with major contributions from countries like Poland and Hungary. Furthermore, the lithium-ion battery segment is witnessing massive investments to expand capacity and improve technology.

- Technological Advancements in Battery Chemistries: Research and development into new battery chemistries are ongoing. Innovations include the development of batteries with higher energy densities and the integration of materials like silicon in anodes, which could enhance battery performance and charging speeds.

- Expansion of EV and Battery Production: Legislative actions such as the U.S. Inflation Reduction Act are propelling the expansion of battery manufacturing capacity. This expansion is in response to both increasing demand for electric vehicles and strategic moves to localize production chains to reduce dependencies.

- Strategic Industry Shifts: The market is also witnessing strategic shifts such as developing more affordable EV models and electrifying commercial vehicle segments. This trend is largely driven by regulatory support, technological advancements, and evolving consumer preferences.

Use Cases

- Automotive Applications: The primary use case for EV batteries remains in automotive applications, particularly electric cars, which are essential for powering vehicles. The demand for EV batteries is expected to continue growing as the market for electric vehicles expands globally. For example, battery demand for vehicles like the popular Wolding Hong Guang Mini EV, which features a 9 to 14 kWh battery providing a range of 75 to 106 miles, showcases how EV batteries are tailored to meet the specific needs of different vehicle models and their respective driving ranges.

- Energy Storage Systems (ESS): Beyond automotive uses, EV batteries are increasingly employed in stationary energy storage systems. These systems are crucial for balancing grid demands, especially with the intermittent nature of renewable energy sources like wind and solar. The ability of these batteries to store and release electricity as needed helps in managing supply and demand, ensuring stability and efficiency in power grids.

- Commercial and Industrial Applications: EV batteries are also making their way into commercial and industrial applications. For instance, in sectors where heavy machinery and vehicles are used, such as mining and construction, companies are beginning to adopt electric versions powered by robust EV battery systems. This not only helps in reducing the carbon footprint of these heavy-duty activities but also aligns with global sustainability goals.

- Second-Life Applications: Once EV batteries reach the end of their lifecycle in vehicles, they are increasingly being repurposed for second-life applications such as backup power systems or even as part of larger renewable energy projects. This not only extends the useful life of the batteries but also contributes to environmental sustainability by reducing waste and the demand for new raw materials.

Key Players Analysis

ATLASBX Co. has positioned itself prominently within the electric vehicle (EV) battery market as part of Hankook & Company’s broader strategy. As a recognized leader in automotive batteries, especially after receiving the Korea Master Brand Awards in 2022, ATLASBX is expanding its influence globally, providing advanced battery solutions across approximately 100 countries. Their commitment to continuous research and development is aimed at enhancing battery performance and longevity, supporting the dynamic needs of the modern electric vehicle industry.

Sony, meanwhile, is actively engaged in the development of batteries for electric vehicles, although specifics of their recent activities in the battery separator sector were not highlighted. Sony’s broader technological expertise and research capabilities suggest ongoing contributions to the EV battery market, focusing on enhancing energy efficiency and safety of battery systems. Their work likely involves advancements in battery management systems and integration technologies, which are critical for the operational safety and efficiency of electric vehicles.

Hitachi has been significantly involved in the electric vehicle (EV) battery market, primarily through partnerships and collaborations to enhance EV battery technologies and production capabilities. Their efforts focus on increasing energy density and reducing the costs of EV batteries, aiming to support the broader adoption of electric vehicles worldwide.

NEC Corporation has played a pivotal role in the development of electric vehicle batteries, particularly through its joint venture, Automotive Energy Supply Corporation (AESC), established with Nissan. This venture was critical in advancing lithium-ion battery technology, particularly for use in electric vehicles like the Nissan Leaf. NEC’s involvement has been crucial in pushing forward the capabilities and affordability of EV batteries.

Panasonic Corporation is a prominent player in the electric vehicle (EV) battery market, leveraging its long-term partnership with Tesla to enhance lithium-ion battery technology. Panasonic’s batteries are central to Tesla’s lineup, including the Model S and Model X, contributing significantly to their performance and range capabilities. The company focuses on improving energy density and reducing the cost of batteries, driving the adoption of electric vehicles worldwide. Panasonic’s innovations in battery technology are aimed at producing safer, more efficient, and environmentally friendly batteries for the next generation of electric vehicles.

TCL Corporation, although widely known for its consumer electronics, has not been significantly highlighted in the context of electric vehicle batteries. The company’s primary focus remains on the production of televisions and other electronic goods, with no substantial involvement reported in the EV battery sector as of the latest available information. For TCL, any move into the electric vehicle battery space would represent a new and significant expansion of its business activities.

Huanyu New What Energy Technology is actively involved in the electric vehicle (EV) battery market, specializing in the production of advanced lithium power batteries. The company, a joint venture by Henan Huanyu Group and Origo Partners PLC, focuses on the development, manufacture, and sale of these batteries, supplying well-known brands like BOSCH and Black & Decker. Huanyu New Energy is noted for its innovative approach to battery technology, offering products that are not only cost-effective but also technologically advanced, providing superior output and better energy density. Their batteries are particularly tailored for use in EVs, solar storage, grid storage, and backup power applications, making them a significant player in the sector.

Duracell has not been significantly noted for its involvement in the electric vehicle battery sector. Traditionally known for their consumer batteries, Duracell’s primary focus remains on small-scale batteries used in a wide range of devices. As of the latest information, there are no prominent developments or contributions from Duracell specifically geared toward the electric vehicle battery market. For their work in battery technology, Duracell continues to be recognized for reliability and innovation in consumer batteries rather than in the EV sector.

NorthStar has established itself as a key player in the electric vehicle (EV) battery market by offering advanced Absorbed Glass Mat (AGM) batteries. These batteries are designed to be maintenance-free and environmentally friendly, boasting safety features that prevent dangerous spills and allow installation in any orientation. NorthStar’s batteries are suitable for a variety of applications including hybrid electric vehicles, providing reliable power with enhanced durability and performance.

Crown Battery Manufacturing does not have a prominent presence or specific developments in the electric vehicle battery sector based on the current information available from recent industry reports and data. They are primarily known for their work in other types of battery technologies and applications. For updates or more specific involvement in EV batteries, monitoring industry sources and company announcements would be advisable.

GS Yuasa Corp, a renowned Japanese battery maker, has been making significant strides in the electric vehicle (EV) battery market, particularly through a substantial collaboration with Honda. The partnership aims to boost the electric vehicle revolution by investing over $2.99 billion in developing and producing lithium-ion battery cells. This joint venture highlights GS Yuasa’s commitment to enhancing EV battery technologies and capacities, marking a major step in their strategy to support the burgeoning demand for electric vehicles globally. This move also aligns with broader efforts to secure a stable supply of high-quality batteries crucial for the future of electric mobility.

East Penn Manufacturing Co. has been enhancing its lineup in the automotive market, particularly focusing on the electric and hybrid vehicle sectors. Their recent initiative includes the introduction of the new EHP (Electric Hybrid Performance) brand for their 12V AGM batteries, designed to meet the complex demands of vehicle electrification. This branding helps to clarify the application of their AGM batteries in electric, hybrid, and start-stop systems, ensuring that these batteries are easily identifiable for their suitability in such vehicles. East Penn’s efforts are supported by their longstanding commitment to sustainability and recycling, utilizing a high rate of recycled lead in their battery production, which underscores their role in promoting environmentally friendly technologies in the automotive industry.

C&D Technologies, Inc. is deeply engaged in the electric vehicle (EV) battery sector, leveraging its expertise in energy storage solutions to address the robust demands of the EV market. The company integrates advanced battery technologies like Nano-Carbon Enhanced Technology to improve the charging efficiency and cycle stability of their batteries, crucial for the demanding environments of electric vehicles. C&D’s batteries are designed to perform under severe conditions, ensuring reliability and efficiency for a range of electric and hybrid vehicles. Their commitment to innovation and quality in the EV battery domain is evident through their continuous development of high-performance, durable battery solutions.

B. Battery Co., Ltd. specializes in the manufacture of valve-regulated lead-acid (VRLA) batteries, which are extensively used in various applications including electric vehicles (EVs). Established in 1992, the company has been dedicated to producing reliable and high-quality batteries. Their VRLA batteries are designed to offer durability and efficiency, making them suitable for the increasing demands of electric vehicles. B. Battery focuses on continuous improvement and innovation in battery technology to meet the evolving needs of the electric vehicle market, ensuring its products are adapted to modern EV requirements.

Narada Power Source Co., Ltd. is a significant player in the electric vehicle (EV) battery market, focusing on lithium-ion and lead-acid batteries. Established in 1994, Narada has expanded globally, providing innovative energy solutions across various sectors including EVs. The company has been proactive in enhancing its lithium battery recycling capabilities, investing significantly in sustainable practices to bolster its supply chain for raw materials. This strategic focus not only supports their battery production but also aligns with global environmental goals, positioning Narada as a leader in both battery technology and ecological responsibility in the EV sector.

CSB Battery Company Ltd., established in 1986, has made significant strides in the electric vehicle (EV) battery sector by specializing in Valve Regulated Lead-Acid (VRLA) batteries. Known for their durability and efficiency, CSB’s batteries cater to a variety of applications, including electric vehicles. The company’s innovative approach includes the development of the EVX Series batteries, which are designed specifically for electric vehicles and have been recognized for meeting stringent environmental standards. This series showcases CSB’s commitment to advancing battery technology to support the growing demands of the EV market.

EnerSys, Inc. is a global leader in stored energy solutions, particularly known for its contributions to industrial applications, including the electric vehicle (EV) battery market. The company is actively involved in developing and distributing energy systems solutions which include motive power batteries used in electric forklift trucks and other industrial electric powered vehicles. EnerSys is also expanding its capabilities in lithium-ion technology and has partnered with Verkor to explore the development of a lithium battery gigafactory in the United States. This move is part of EnerSys’ strategy to enhance its production capabilities and benefit from incentives provided under the Inflation Reduction Act, emphasizing its commitment to advancing energy storage solutions in the EV sector.

Coslight Technology International Group Co., Ltd., established in 2002, is a key player in the design, development, and manufacturing of lithium-ion batteries, primarily focused on the electric vehicle market as well as energy storage applications. The company has made significant strides in supplying batteries both domestically in China and internationally. Coslight is recognized for its innovative approaches in the rapidly growing EV sector, contributing to the advancement of battery technologies that support sustainable transportation solutions.

Zibo Torch Energy Co., Ltd. is a distinguished company in the electric vehicle (EV) battery industry, focusing primarily on the production of lead-acid batteries. Established in 1944, Zibo Torch has evolved to become a key supplier for various industrial applications, including electric vehicles. Their products are integral to China’s burgeoning EV market, where they supply both traction and stationary batteries. The company’s commitment to innovation and quality has secured its position as a preferred supplier in the competitive EV battery sector, contributing significantly to the mobility and energy storage industries.

Conclusion

In conclusion, the electric vehicle (EV) battery market is poised for substantial growth, driven by increasing global demand for electric vehicles, advancements in battery technology, and strong governmental support through incentives and regulatory frameworks. As the backbone of the electric vehicle industry, these batteries are pivotal in transitioning towards more sustainable transportation solutions. Innovations in battery chemistry and improvements in energy density and charging technologies are enhancing the performance and reducing the costs of EV batteries, making electric vehicles more accessible and appealing to a broader audience.

Furthermore, the expansion of applications beyond automotive uses, such as in grid storage and commercial operations, underscores the versatility and critical importance of EV batteries in today’s energy landscape. With continuous investments and research geared towards improving battery efficiency and sustainability, the future of the EV battery market looks promising, offering significant opportunities for industry stakeholders and contributing to global environmental conservation efforts.