Table of Contents

Introduction

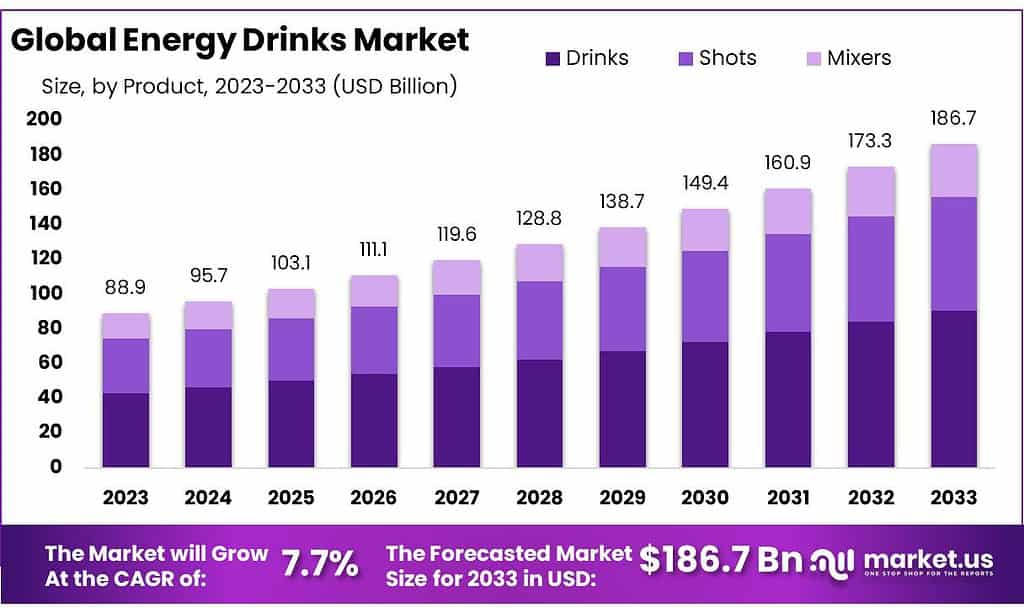

The global energy drinks market is poised for substantial growth, projected to expand from USD 88.9 billion in 2023 to an estimated USD 186.7 billion by 2033, with a CAGR of 7.7% during the forecast period. This growth is fueled by increasing consumer demand for beverages that offer enhanced alertness, focus, and physical performance, especially among younger demographics who are active or face demanding lifestyles.

However, the market faces challenges, including health concerns related to high sugar and caffeine content which could potentially restrict growth. Regulatory scrutiny, particularly regarding marketing towards minors, is also intensifying, demanding more cautious promotional strategies from manufacturers.

Recent developments reflect a trend towards product diversification, such as the introduction of energy drinks with natural ingredients, reduced sugar, and functional additives, catering to a health-conscious consumer base. Innovations in packaging, with a shift towards sustainable materials like glass bottles and an increase in e-commerce sales, are shaping distribution strategies. Moreover, key players are expanding their market presence through innovations and strategic partnerships.

Red Bull GmbH continues to innovate within the energy drinks sector. Recent years have seen the brand expand its product range to include new flavors and limited editions aimed at maintaining its competitive edge and market share. Such strategies keep the brand relevant and appealing to a diverse global audience, especially among young adults and athletes seeking performance enhancement from their beverages. Monster Beverage Corp has also been active, focusing on expanding its market presence through strategic partnerships and launching new products tailored to health-conscious consumers. This includes low-sugar and natural ingredient options which cater to the growing demand for healthier functional beverages.

Rockstar has similarly adapted to consumer preferences by introducing products that blend energy drinks with alcoholic beverages, tapping into the rising trend of ready-to-drink alcoholic energy drinks. This move is aimed at capturing the young adult demographic that frequents social settings like bars and clubs. TC Pharmaceutical Industry Co Ltd, known for its Red Bull products in specific regions, has focused on solidifying its presence in both established and emerging markets by adapting to local tastes and preferences, which often involves introducing region-specific flavors and formulations.

Key Takeaways

- The global energy drinks market is expected to reach around USD 186.7 billion by 2033, growing at a CAGR of 7.7% from USD 88.9 billion in 2023.

- Energy drinks dominated the market with over 48.6% market share, known for their quick energy and focus-enhancing effects.

- Cans held the majority of revenue share at more than 44.8% in 2023, favored for their portability.

- Conventional energy drinks accounted for the highest revenue share at over 50.9% in 2023.

- The off-trade segment contributed to 68.9% of total revenue in 2023, driven by consumers’ preference for evaluating quality, brands, and ingredients.

- North America accounted for the highest revenue share, with over 32.3% in 2023.

Energy Drinks Facts And Statistics

- Energy drinks typically contain 80mg of caffeine per 250ml – equivalent to an espresso coffee.

- A mug of filter coffee typically contains 90mg of caffeine.

- A mug of tea typically contains 50mg of caffeine.

- No marketing communications concerning energy drinks will be placed in any media with an audience of more than 35% of people under 12 years of age.

- Daily caffeine intakes from all sources up to 400 mg do not raise safety concerns in the general population of healthy adults, and are not associated with adverse health effects.

- They are also affordable with prices ranging from $1 to $5 depending on the brand.

- one serving of an energy drink contains about 25 g – 39 g of sugar.

- The consequences of poisoning these drinks can be serious health and manifest as tachycardia (3.2%), agitation or confusion (29.3%), abdominal pain (7.9%), and hypertension (19.4%).

- In Morocco, some statistics show that, on average, 5 million cans of energy drinks are consumed every year, including all brands, including those derived from smuggling.

- Our study showed that 195 of those surveyed are consumers of energy drinks, of which 22.0% are girls and 78.0% are boys.

- Among drinkers, 6.7% consume them daily, 26.7% consume them regularly (1 to 3 times a week), and 33.3% often enough (three to five times/month).

- 195 of those surveyed are consumers of energy drinks, of which 78.0% are boys and 22.0% are girls

- For this reason, 19.4% had hypertension, 7.9% experienced abdominal pain and vomiting, 6.5% suffered from anxiety, agitation, or confusion 29.3% and 3.2% of tachycardia.

- In the Carbonated Soft Drinks market, volume, at home is expected to amount to 166.8bn L by 2024.

- Volume, out-of-home is expected to amount to 23.5bn L in 2024.

- Volume, combined is expected to amount to 190.3bn L in 2024.

- The Carbonated Soft Drinks market is expected to show a volume growth, at home of 0.9% in 2025. The average volume per person, at home in the Carbonated Soft Drinks market is expected to amount to 21.53L in 2024.

Emerging Trends

Emerging trends in the energy drinks market highlight a dynamic shift towards health consciousness, innovation, and expanded consumer choice. Recent trends show a significant move towards incorporating natural ingredients and reducing sugar content, reflecting a broader consumer preference for healthier options. Notably, there is a growing interest in energy drinks that include superfoods, nootropics, and adaptogens, which are believed to offer mental and physical performance benefits without the health drawbacks of traditional formulations.

The market is also seeing a rise in the availability of caffeine-free options, utilizing ingredients like B vitamins and amino acids to provide an energy boost. This diversification caters to a segment of consumers looking for energy enhancements without the effects of caffeine.

Another significant trend is the blending of energy drinks with alcoholic beverages, a space where brands like Red Bull and Monster are particularly active. This crossover appeals mainly to younger demographics looking for innovative drinking options that combine the stimulant effects of energy drinks with alcohol.

Furthermore, the energy drinks sector is experiencing a boost from the e-commerce sector, making these products more accessible to a global audience. Online platforms offer a broader range of products and the convenience of direct-to-consumer sales models.

Use Cases

- Enhancing Physical Performance: Energy drinks are commonly consumed by athletes and fitness enthusiasts to improve endurance and performance. The caffeine and other stimulants in these drinks can increase alertness and reduce the perception of effort during physical activity, which is especially valued in endurance sports and intense training sessions.

- Mental Alertness for Work and Study: Particularly popular among students and professionals, energy drinks are used to enhance mental alertness and prolong focus during long working hours or study sessions. This use case is driven by the stimulant properties of caffeine which can enhance cognitive functions such as memory, focus, and reaction times.

- Social and Recreational Uses: Mixing energy drinks with alcohol to create high-energy cocktails for social events is another common use. While this practice can mask the depressive effects of alcohol, making individuals feel more awake and less drunk, it also poses significant health risks, such as not recognizing one’s actual level of intoxication.

- As a Quick Energy Boost: For those leading busy lifestyles, energy drinks offer a quick source of energy to overcome mid-day slumps or cope with demanding schedules. The convenience of canned energy drinks makes them a popular choice for on-the-go consumption.

Key Players Analysis

Red Bull GmbH has established itself as a dominant force in the global energy drinks market, leveraging innovative marketing strategies and a broad product range to cater to a diverse consumer base. Since its inception in 1987, Red Bull has not only introduced energy drinks but has also pioneered the energy drink category itself. The brand’s success is evident in its significant sales figures, with over 12 billion cans sold in 2023 alone. Red Bull continues to focus on key markets in Western Europe and the USA while expanding in emerging markets, emphasizing the original 250ml can as its core product unit.

Monster Beverage Corp has similarly carved out a substantial presence in the energy drinks sector, known for its wide array of energy drink options that appeal to a young, active demographic. Monster’s strategy includes a strong emphasis on marketing and partnerships with sports and music events, helping to embed its products in youth culture. The company has been effective in maintaining a significant market share by continually evolving its product offerings to include new and innovative flavors, catering to a global audience that seeks variety and excitement in their energy drink choices.

Rockstar has established a robust presence in the energy drinks sector, particularly known for its diverse range of products that cater to various consumer needs for energy and mental boosts. Rockstar continues to innovate within its product lines, recently introducing new flavors and functional ingredients like Lion’s Mane to appeal to health-conscious consumers. Owned by PepsiCo, Rockstar is also expanding its global presence, aiming to double its markets in the next three years, emphasizing new marketing strategies and packaging designs to attract a broader audience.

TC Pharmaceutical Industry Co Ltd is a significant player in the energy drinks market, primarily known for being the originator of the Red Bull brand. This company has successfully leveraged its pioneering status in the sector to maintain a strong market presence globally. TC Pharmaceutical continues to focus on strategic market expansion and product innovation to meet diverse consumer demands across different regions, ensuring it remains competitive in the rapidly evolving energy drink landscape.

Shenzhen Eastroc Beverage Co., Ltd. has carved a niche in the Asia-Pacific energy drinks market with its robust portfolio of beverages. Recognized for its dynamic market presence, Eastroc is actively expanding its reach and enhancing its product offerings to meet the growing consumer demand for energy drinks in the region. The company is known for its strategic focus on innovation and market adaptation, which helps it stay competitive in a rapidly evolving industry landscape.

Fujian Dali Food Co., Ltd. is another significant player in the energy drinks sector, particularly within the Asia-Pacific market. Dali Foods not only produces energy drinks but also has a diversified portfolio including snack foods and beverages. The company emphasizes innovation in its product lines and marketing strategies to appeal to a broad consumer base. Recently, Dali Foods has been involved in strategic expansions and product launches that underscore its commitment to maintaining a competitive edge in the market.

Suntory Holdings Ltd is deeply involved in the global energy drinks market, continuously expanding its presence and product range. Suntory emphasizes innovative beverage solutions that cater to a diverse consumer base seeking healthy and functional drinks. This strategic approach helps Suntory maintain a strong position in various international markets, adapting to consumer preferences for beverages that support an active lifestyle.

National Beverage Corp is recognized in the energy drinks market for its popular brand, ‘Rip It,’ among others. The company focuses on delivering unique flavor profiles and functional benefits that appeal to energy drink consumers, emphasizing taste and energy performance. National Beverage Corp strategically markets its products to align with consumer trends towards healthier and more effective energy solutions, maintaining competitiveness in a rapidly evolving sector.

Dr Pepper Snapple Group, now part of Keurig Dr Pepper, has made significant strides in the energy drinks market with its Venom brand. Venom is part of a diverse portfolio that targets various consumer needs across North America. The brand complements other popular beverages such as Dr Pepper and Snapple, with a focus on providing a robust energy boost. This approach helps the company maintain a strong presence in the competitive energy drink sector.

Living Essentials Marketing LLC is renowned for its 5-hour ENERGY shots, which have significantly impacted the energy drinks sector. These shots are designed to provide quick, convenient energy without the bulk of larger drink sizes, catering especially to busy professionals and others needing a fast boost. Living Essentials’ marketing emphasizes the efficiency and convenience of its products, which has allowed it to carve out a substantial niche in the energy drinks market.

Vital Pharmaceuticals Inc., trading as Bang Energy, has been a notable player in the energy drinks market, especially known for its Bang Energy drinks. Recently, the company went through significant corporate changes, including filing for Chapter 11 bankruptcy in October 2022, which led to Monster Beverage Corporation acquiring it for about $362 million in July 2023. This acquisition includes Bang Energy’s assets like their beverage production facility in Arizona. Bang Energy is well-regarded for its variety of high-performance beverages catering to energetic lifestyles.

Britvic PLC operates in the energy drinks market primarily in the UK, with a portfolio that includes popular brands like Tango, J2O, and Fruit Shoot. Britvic’s approach to the energy drinks sector involves leveraging its strong distribution network to promote a mix of both traditional and low-calorie energy drink options, catering to a diverse consumer base looking for both flavor and energy boosts. Their strategic focus remains on innovation and market expansion to stay competitive in the rapidly evolving beverage industry

Conclusion

The energy drinks market is set for substantial growth, driven by a growing consumer base that values the immediate boost in energy and focus these products offer. With a projected global market size increase, driven by innovations in product formulation and diversification into health-oriented offerings, the industry is responding to consumer demands for healthier and more sustainable options. However, this growth is not without challenges.

Health concerns related to high caffeine and sugar content, as well as regulatory scrutiny, particularly regarding marketing practices, pose ongoing risks. Additionally, the trend of mixing energy drinks with alcohol raises significant health concerns that could impact consumer perception and market growth. As the market evolves, the successful brands will likely be those that continue to innovate while also addressing the health and safety concerns of their products.