Table of Contents

Introduction

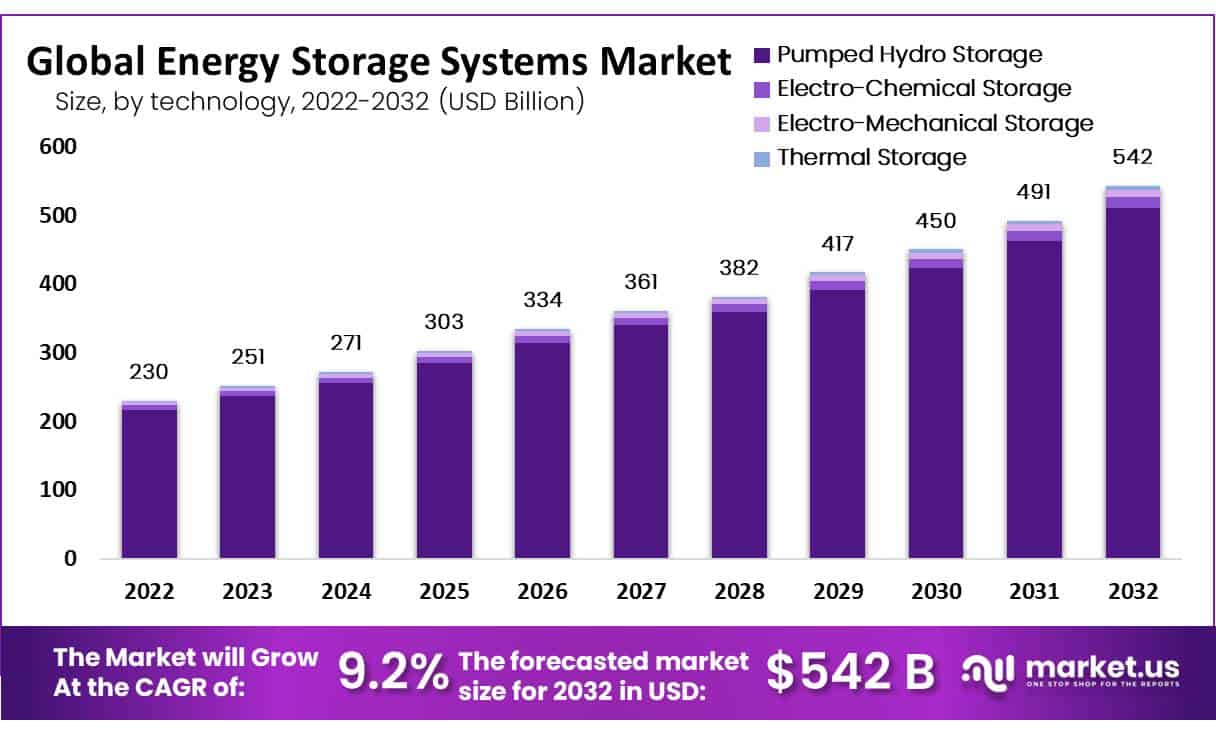

The global energy storage systems (ESS) market, valued at USD 230 billion in 2022, is projected to reach USD 542 billion by 2032, reflecting a compound annual growth rate (CAGR) of 9.2%. ESS technologies, crucial for storing and releasing energy on demand, support a consistent energy supply for homes, businesses, and communities. This need is amplified as renewable energy sources, which are intermittent and variable, become more prevalent.

Growth in the ESS market is driven by several factors. Advances in battery technology, particularly the development of more cost-effective and efficient lithium-ion batteries, have made energy storage solutions more accessible. The declining costs of these batteries are encouraging wider adoption across residential, commercial, and industrial sectors. Additionally, government policies and incentives, including subsidies and tax credits, are promoting investment in energy storage technologies. For instance, in the Asia-Pacific region, government support has led to significant market growth, with China expected to remain a dominant player due to its extensive renewable energy integration policies.

Technological innovations also play a significant role. Emerging technologies like flow batteries and hydrogen storage are providing new ways to store energy for extended periods, enhancing the flexibility and reliability of energy storage systems. The development of microgrids, which can operate independently or in conjunction with the main power grid, is another trend supporting the market’s growth. These systems are essential in providing reliable power during grid disruptions and are increasingly being adopted in remote or underserved areas.

However, the ESS market faces several challenges. High initial costs of installation and technological limitations, such as lower energy density and shorter cycle life of some storage solutions, pose significant barriers. Additionally, environmental concerns related to the disposal of batteries and potential chemical leaks must be addressed to ensure sustainable growth. Regulatory complexities across different regions further complicate the deployment of energy storage systems, making it difficult for companies to standardize their products and expand into new markets.

Recent developments in the ESS market highlight both opportunities and ongoing efforts to overcome these challenges. For instance, the U.S. has seen substantial investment in large-scale battery storage projects, driven by the need for reliable backup power and grid stability. Europe is witnessing rapid growth in residential battery installations due to high electricity prices and government incentives. In India, the government has issued guidelines to promote pumped hydro energy storage, recognizing its potential to support the country’s renewable energy targets.

Key market players such as LG Chem, Siemens AG, and Panasonic Corporation are investing heavily in research and development to enhance their product offerings and maintain competitive advantage. Collaborative efforts, including partnerships and acquisitions, are also shaping the market dynamics, as companies aim to expand their global footprint and address the diverse energy storage needs of different regions.

Statistics

- Prices have fallen by 90% since 2010 and energy density has increased by 50% during this period.

- The US. Solar alone has created more than 250,000 jobs in the US and wind tech jobs are anticipated to grow 68% by 2030,

- 25% of solar jobs are filled by minorities and wind employs America’s veterans at a rate 67% higher than the national average.

- India aims to develop 500 GW of installed clean energy by 2030, with 420 GW of solar- and wind-based power.

- According to NITI Aayog, the annual market for stationary and mobile batteries in India could range between $6 billion and $15 billion by 2030, with almost $12 billion from cells and $3 billion from pack assembly and integration. India will have 50-100 MW of BESS storage in 2022-23.

- The Ministry of Heavy Industries also extended production-linked incentives (PLI) worth Rs 181 billion for setting up advanced chemistry cell facilities in India.

- The Union Minister for New & Renewable Energy and Power has informed that the installed renewable energy capacity in India has increased from 115.94 GW in March 2018 to 172.00 GW in March 2023.

- As per information provided by the Central Electricity Authority (CEA), 365.60 Billion Units (BU) of electricity have been generated during the year 2022-23, from renewable energy sources across the country.

- Union Budget 2023-24, the Ministry of Power announced a Viability Gap Funding Scheme for 4,000 MWh Battery Energy Storage Systems, customs duty exemptions for machinery to manufacture EV batteries, and a significant Rs. 19,700 crore outlay for the Green Hydrogen Mission.

- With a population of 1.4 billion, India’s energy demand is massive. From a power deficit nation a decade ago, India has transformed into the world’s third-largest producer of renewable energy. Today, 40% of its installed electricity capacity (157.32 GW) comes from non-fossil fuel sources.

- Over 260 major global corporations have already committed to switching to 100% renewable energy, with thousands of smaller companies doing the same.

- Reported experience rates for CCS used with a natural gas combined-cycle plant range from 2% to 7%, compared to a 23% median experience rate for solar PV since 1976.

PV modules decrease by 23% every time the global installed capacity doubles. - Most of Zimbabwe’s electricity is generated through coal thermal power and hydropower plants at a ratio of 58 % to 38 %, respectively.

Emerging Trends

Declining Costs and Increased Capacity: The energy storage market is experiencing a significant decrease in costs, particularly for lithium-ion batteries. This decline is driven by the overproduction and overcapacity of battery manufacturing, which has outpaced demand. As a result, prices for energy storage systems are expected to fall, making them more affordable for both residential and commercial applications.

Technological Innovations: The sector is witnessing advancements in various technologies. Notably, there is a push towards the development of non-lithium battery technologies, such as solid-state batteries and flow batteries, which promise enhanced safety and longer duration of energy storage. Innovations in AI and smart grid technologies are also being integrated to improve grid stability and energy utilization.

Integration with Renewable Energy: Energy storage systems are becoming crucial for the integration of renewable energy sources. The ability to store energy generated from solar and wind power helps in addressing the inconsistency of these sources. This trend is supported by decreasing storage costs, which make renewable energy solutions more viable and cost-effective.

Government Support and Investment: Government initiatives and funding are playing a significant role in the growth of the energy storage market. Policies and grants, particularly in regions like California and Europe, are promoting the adoption of energy storage technologies. This support is crucial for advancing research and development in the sector.

Market Growth and Employment: The energy storage industry is expanding rapidly, with substantial growth in the number of companies and employees. In 2023, the industry employed 1.7 million people globally, with significant additions to the workforce. This growth reflects the increasing market presence and potential of energy storage solutions.

Increasing Energy Storage Installations: There is a notable increase in energy storage installations worldwide. The global energy storage capacity is projected to reach 71 GW/167 GWh in 2024, marking a significant year-on-year growth. This increase is driven by the rising demand for reliable and efficient energy storage solutions across various sectors.

Use Cases

Utilities: Utilities deploy large-scale energy storage systems to balance supply and demand, integrate renewable energy sources, and enhance grid stability. For instance, utility-scale energy storage systems, such as pumped hydro storage and compressed air energy storage (CAES), store excess energy during low demand and release it during peak periods. This ensures a reliable power supply and supports the integration of intermittent renewable sources like solar and wind power. The utility-scale battery energy storage market is expected to reach 57 gigawatts (GW) of installed capacity by the end of 2024, up 40% from 2023.

Commercial Sector: Businesses use ESS for load shifting, peak shaving, and load leveling. By storing surplus energy from renewable sources like solar and wind, businesses can reduce grid dependence and lower energy costs. ESS also provides an uninterrupted power supply during outages or voltage fluctuations, ensuring continuous operations. For example, Wattstor’s Smart Charging feature optimizes energy usage by charging batteries when renewable energy is abundant and prices are low, and discharging during high-demand periods.

Industrial Applications: In industrial settings, ESS ensures consistent power supply, integrates renewable energy, and supports carbon reduction efforts. Industrial ESS solutions help manage the variability of renewable energy sources, ensuring operational efficiency and reducing reliance on fossil fuels. For example, industries can use sodium-ion batteries for applications requiring extended storage durations, offering a balance of affordability, safety, and suitable energy density.

Construction Industry: Construction projects integrate battery energy storage systems to store excess energy from renewable sources and utilize it when needed, reducing operating costs and environmental impact. Thermal energy storage (TES) technologies, such as phase change materials, optimize heating and cooling systems, contributing to energy savings. Battery-powered construction equipment like electric excavators and cranes are also gaining popularity, improving sustainability.

Residential Use: Homeowners increasingly pair energy storage systems with solar panels to store excess energy generated during the day and use it at night or during power outages. This not only enhances energy independence but also provides cost savings by reducing reliance on the grid. The adoption of home energy storage is projected to grow, with many new solar installations including battery storage systems.

Transportation: The automotive and aerospace industries are integrating hydrogen fuel cells and other advanced energy storage technologies to power electric vehicles (EVs) and aircraft. This reduces emissions and enhances the efficiency of transportation systems. The EV market, supported by ESS, is expected to see record sales, driven by the decreasing costs of battery storage solutions.

Grid Service: ESS provides essential grid services such as load balancing, frequency regulation, and capacity markets. By rapidly responding to changes in electricity demand or supply, ESS maintains grid stability and prevents power outages. Incapacity markets, ESS acts as a buffer during high demand or generation shortfall, enhancing grid reliability and opening new revenue streams for operators.

Major Challenges

Cost and Economic Viability: One of the most significant challenges facing energy storage systems (ESS) is the high cost of implementation. The initial investment required for ESS, particularly for advanced technologies like solid-state batteries, remains substantial. Although the costs of lithium-ion batteries have decreased, they are still expensive for widespread adoption. The total investment in battery energy storage systems (BESS) reached $5 billion in 2022, with projections indicating the market could grow to between $120 billion and $150 billion by 2030. However, the economic return on these investments can be uncertain due to fluctuating energy prices and evolving market dynamics.

Technical and Operational Challenges: Energy storage systems face several technical hurdles, including efficiency, lifespan, and degradation. Batteries experience reduced efficiency and capacity over time due to repeated charging and discharging cycles. This degradation impacts the overall performance and reliability of the system, necessitating sophisticated battery management systems (BMS) to monitor and manage battery health. Additionally, the integration of ESS with existing grid infrastructure poses challenges, requiring advanced grid management systems to ensure stability and compatibility.

Safety Concerns: Safety is a critical issue, particularly with lithium-ion batteries, which can pose risks of thermal runaway, fires, and explosions if not managed properly. The push towards safer alternatives, like solid-state and sodium-ion batteries, addresses some safety concerns but introduces new challenges related to manufacturing complexity and cost. Ensuring the safety and reliability of ESS under various operational conditions remains a top priority.

Regulatory and Policy Barriers: Regulatory frameworks and policies can significantly impact the deployment of energy storage systems. Inconsistent regulations across regions create barriers for ESS adoption. While some areas have supportive policies and incentives, others lack the regulatory clarity needed to foster investment and development in energy storage technologies. For example, the Inflation Reduction Act in the U.S. provides investment tax credits for stand-alone storage facilities, promoting growth, but such incentives are not universally available.

Market Growth Opportunities

Renewable Energy Integration: The growing emphasis on renewable energy sources like solar and wind presents a significant opportunity for energy storage systems (ESS). These systems are crucial for storing intermittent renewable energy and ensuring a stable and reliable power supply. The global ESS market is expected to grow substantially, with estimates suggesting it could reach between $120 billion and $150 billion by 2030, more than double its current size. This growth is driven by the need to manage the variability of renewable energy sources and enhance grid stability.

Grid Modernization and Stability: Modernizing the electricity grid to accommodate new energy sources and technologies is another growth area for ESS. Energy storage systems provide essential services such as load balancing, frequency regulation, and peak shaving, which are vital for maintaining grid stability and reliability. The implementation of advanced grid management systems and smart grids will further drive the adoption of ESS, supporting a more resilient energy infrastructure.

Government Incentives and Policies: Supportive government policies and incentives play a critical role in accelerating the adoption of energy storage technologies. For instance, the Inflation Reduction Act in the U.S. includes investment tax credits for stand-alone storage facilities, encouraging significant investment in the sector. Similar initiatives in Europe and Asia are expected to boost the deployment of ESS, providing a favorable regulatory environment for growth.

Technological Advancements: Advancements in battery technologies, such as solid-state batteries and sodium-ion batteries, offer new growth opportunities. These technologies promise improved safety, higher energy density, and longer lifespans, making ESS more attractive for various applications. The development of these advanced batteries can lead to more cost-effective and efficient energy storage solutions, further driving market expansion.

Emerging Markets: Emerging markets, particularly in Asia-Pacific and Africa, represent significant growth opportunities for ESS. The rapid industrialization and increasing demand for reliable power in these regions create a strong market for energy storage solutions. For example, Australia is leading the global market for forecasted BESS deployments, with a total pipeline of announced projects exceeding 40 GW.

Recent Developments

LG Chem, through its subsidiary LG Energy Solution, has made significant strides in the energy storage systems (ESS) sector. In 2023, LG Energy Solution reported a consolidated revenue of KRW 33.7 trillion and an operating profit of KRW 2.2 trillion, marking increases of 31.8% and 78.2% respectively compared to the previous year. The company achieved steady growth by expanding its market presence, particularly in North America, where it ramped up operations at its GM JV Ultium Cells plant in Ohio and initiated investments in its Arizona production facility for cylindrical and ESS batteries. Notably, LG introduced the LG Energy Solution enblock series, including residential and grid-scale ESS products, at the ees Europe 2023 exhibition. This new product line features advanced LFP batteries with improved energy density and durability, tailored for easy installation and scalability. Additionally, LG Energy Solution recorded KRW 8 trillion in revenue in Q4 2023, reflecting strong performance despite market volatilities.

Convergent Energy and Power Inc., a leading provider of energy storage solutions in North America, has made notable progress in the energy storage sector throughout 2023 and into 2024. By January 2024, the company announced it had over 800 MW/1 GWh of energy storage and solar-plus-storage systems either operating or under development, sufficient to power approximately 750,000 homes. Throughout 2023, Convergent committed over $1 billion to various projects across North America, significantly contributing to the clean energy transition. In March 2024, Convergent reported in its Sustainability and Impact Report that it had saved nearly 21,500 metric tons of CO2 in 2023 and improved its ESG risk rating, being recognized as an “ESG Industry Top-Rated” company by Sustainalytics. Additionally, the company achieved a key milestone by forming a joint venture with Alectra Energy Solutions, securing a contract from Ontario’s Independent Electricity System Operator to build and operate three battery energy storage systems totaling 80 MW.

Eos Energy Enterprises has been making significant advancements in the energy storage systems sector with their innovative zinc-based long-duration storage solutions. In 2023, Eos reported a growing commercial opportunity pipeline valued at $13 billion, including 1.9 GWh of late-stage opportunities. Notably, in September 2023, Eos was selected by Dominion Energy Virginia for the Darbytown Storage Pilot Project, which aims to provide 4 MW (16 MWh) of storage capacity. This project underscores the company’s focus on safe, scalable, and sustainable energy solutions. In June 2024, Eos secured a strategic investment of up to $315.5 million to support further growth and debt restructuring. Their Znyth™ aqueous zinc battery technology continues to receive attention for its non-flammable, scalable, and efficient characteristics, making it a preferred choice for utility and industrial applications. Additionally, Eos expanded its international footprint by shipping the Eos Z3 Cube to Sicily, Italy, to explore diverse use cases, furthering its global reach and impact.

Beacon Power LLC has been actively enhancing the energy storage sector with its flywheel-based systems, known for their fast response and reliability. In 2023, Beacon operated three commercial flywheel energy storage plants located in Stephentown, New York, Hazle Township, Pennsylvania, and a third undisclosed location, providing frequency regulation services. Their plants, which contain over 400 flywheels, collectively exceed 7 million operating hours. Notably, in 2023, Beacon secured a $43 million loan guarantee from the U.S. Department of Energy for a new 20 MW flywheel energy storage project. This project will help balance grid supply and demand, ensuring greater stability and efficiency in power management. Throughout 2023, Beacon’s flywheel systems continued to support grid operators in NYISO, PJM, and ISO-NE markets, contributing to over 30% of Area Control Error correction in the NYISO market with over 95% accuracy.

Conclusion

The energy storage systems sector is poised for significant growth in 2024, driven by technological advancements, policy support, and increasing demand for renewable energy integration. Battery storage capacity in the U.S. is expected to nearly double, with plans to add over 30 gigawatts by the end of the year. This expansion is part of a broader trend where solar and battery storage will comprise 81% of new U.S. electric-generating capacity in 2024, reflecting a strong shift towards sustainable energy solutions.

Innovations in battery technology, such as larger prismatic LFP cells and advancements in long-duration energy storage, are also expected to play a crucial role in enhancing the efficiency and scalability of energy storage systems. Additionally, global markets, including China, the U.K., and Europe, are actively supporting energy storage development, further underscoring the sector’s critical role in the global transition to clean energy.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)