Table of Contents

Introduction

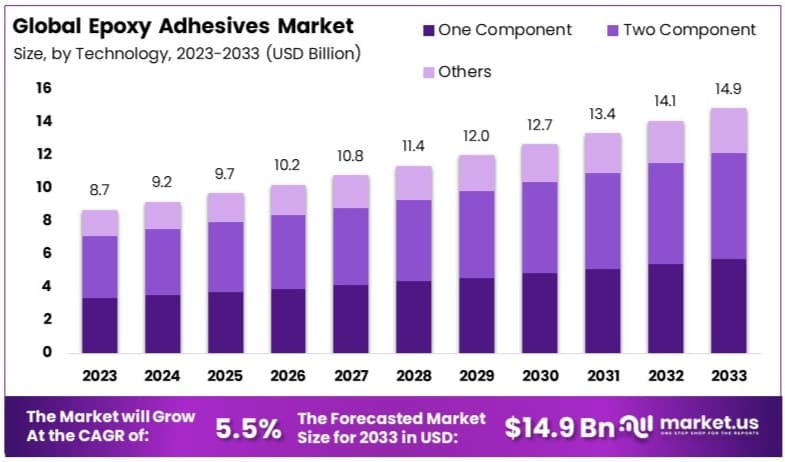

The Global Epoxy Adhesives Market is poised for significant expansion, projected to grow from USD 8.7 Billion in 2023 to USD 14.9 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2024 to 2033. This growth can be attributed to several key factors, including the increasing demand for high-performance adhesives in industries such as automotive, aerospace, and construction. Epoxy adhesives are favored for their superior properties like high thermal resistance, excellent mechanical strength, and durability, which are essential for critical applications.

However, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations regarding volatile organic compound (VOC) emissions. Recent developments in the industry have focused on addressing these challenges, with innovations aimed at developing eco-friendly and sustainable adhesive solutions. These advancements are likely to provide new opportunities and sustain market growth over the coming decade.

The epoxy adhesives market is characterized by the presence of key players such as Henkel AG & Co. KGaA, Sika Group, 3M, and H.B. Fuller Company. These companies are at the forefront of technological advancements and market expansion activities, driving the overall growth of the industry.

Henkel AG & Co. KGaA is leveraging its strong research and development capabilities to introduce innovative products that meet the evolving demands of various industries. The company’s focus on improving the performance and sustainability of its adhesives positions it well to capture a significant share of the market.

Sika Group has reinforced its market position through strategic acquisitions and the development of high-performance epoxy adhesives. By expanding its product portfolio and addressing the specific needs of industries such as aerospace and automotive, Sika is poised for continued growth.

3M remains a leader in the market due to its commitment to innovation and quality. The company’s development of advanced epoxy formulations with superior properties demonstrates its ability to meet the stringent requirements of high-tech industries.

H.B. Fuller Company is enhancing its market presence by investing in new facilities and focusing on sustainable adhesive solutions. The company’s strategic initiatives and product innovations are designed to cater to the growing demand for high-performance adhesives in various industrial applications.

Overall, the epoxy adhesives market is expected to grow significantly, driven by continuous advancements in adhesive technologies and increasing demand from key industries such as construction, automotive, and electronics. The ongoing efforts of major players to innovate and expand their product offerings will play a crucial role in shaping the future of this market.

Key Takeaways

- Market Value: The Epoxy Adhesives Market was valued at USD 8.7 billion in 2023, and is expected to reach USD 14.9 billion by 2033, with a CAGR of 5.5%.

- Technology Analysis: Two Component systems dominated with 43.6%; essential for their superior bonding strength and versatility.

- Application Analysis: Automotive & Transportation led with 42.6%; crucial for high-performance bonding in vehicle manufacturing.

- Dominant Region: APAC held 41.3%; significant due to extensive manufacturing activities and demand in automotive and construction sectors.

- Analyst Viewpoint: The epoxy adhesives market is moderately saturated with strong competition. Future predictions indicate steady growth driven by automotive, construction, and electronics applications.

Epoxy Adhesives Statistics

- 280,000 tonnes of epoxy resins are produced every year in Europe.

- Energy applications account for 26% (69,000 tonnes) of the total epoxy resin production.

- Transport applications use 19% (49,000 tonnes) of the total production.

- Construction applications use 23% (60,000 tonnes) of the total production.

- Food and water applications use 11% (28,000 tonnes) of the total production.

- Home and leisure applications use 10% (25,000 tonnes) of the total production.

- Other uses account for 11% (28,000 tonnes) of the total production.

- The maximum amount of BPA that may be released from the 150,000 tonnes of epoxy resins used annually in key application sectors in Europe is 573 kg.

- Marine coating applications could release a maximum of 96 kg of BPA annually.

- Automotive manufacturing could release a total of 105 kg of BPA annually.

- Flooring production could release up to 0.2 kg of BPA annually.

- Automotive coatings are estimated to release about 15 kg of BPA annually through paint losses.

- Forgeway manufactures over 3000 tonnes of adhesives every year.

- Some epoxies can have a strength of up to 30 Mpa.

- A typical high-strength, but more brittle epoxy will cost between £40-£50 for a 400ml cartridge.

- A high-strength but flexible epoxy will cost between £30-£40 for a 200ml cartridge.

- The first commercial production of epoxy resins took place in the late 1940s.

- The tensile strength of thermosetting epoxies ranges from 90 to 120 MPa.

- Glass transition temperatures (Tg) of thermosetting epoxies range from 150 to 220 °C.

- Epoxy resins can bond to substrates with a bonding strength of up to 2,000 psi.

- Polyester resin has a bonding strength generally less than 500 psi.

- Epoxy resins have been used in food packaging since the 1950s, providing a protective layer that separates food and drinks from the metal used to make cans.

- Epoxy coatings help minimize the corrosion of metal, which could compromise the safety of the food or drink inside the can.

- Epoxy-based coating technology has been used on vehicles for more than 30 years.

- Epoxy resins are estimated to cover 75% of the volume of industrial and home needs.

- DGEBA epoxy resin is constructed by combining epichlorohydrin and bisphenol A, covering 75% of the volume of industrial and home needs.

- In 2022, Epoxide resins were the world’s 479th most traded product with a total trade value of $8.43 billion.

- In 2022, the top exporters of Epoxide resins were South Korea ($1.41 billion), Germany ($1.25 billion), Chinese Taipei ($933 million), United States ($884 million), and Japan ($582 million).

- In 2022, the top importers of Epoxide resins were China ($1.2 billion), United States ($859 million), Germany ($599 million), Mexico ($378 million), and Italy ($336 million).

- In Q1 2024, China’s epoxy resin exports amounted to 56,700 tonnes, marking a 23.70% year-on-year increase.

- In March 2024, China exported 23,632 tonnes of epoxy resin with a total export value of $47,128,263 and an average export price of $1,994.26 per tonne.

Emerging Trends

- Eco-Friendly Formulations: There is a growing trend towards developing environmentally friendly epoxy adhesives. These adhesives are formulated to be low in volatile organic compounds (VOCs) and free of hazardous solvents, catering to the increasing demand for sustainable manufacturing practices.

- Enhanced Durability and Strength: Recent advancements focus on enhancing the durability and strength of epoxy adhesives. These improvements aim to extend the lifespan of bonded materials and reduce maintenance costs, making them more appealing for critical applications in construction and aerospace industries.

- Temperature and Chemical Resistance: The development of epoxy adhesives that can withstand extreme temperatures and harsh chemical environments is on the rise. This makes them suitable for use in challenging conditions like those found in automotive and industrial applications.

- Faster Curing Times: Manufacturers are innovating to reduce the curing time of epoxy adhesives to increase production efficiency. Faster curing adhesives help industries speed up their assembly processes and bring products to market more quickly.

- Thixotropic Properties for Vertical Applications: There is an increasing demand for epoxy adhesives with thixotropic properties, which prevent dripping and sagging when applied to vertical surfaces. This is particularly useful in construction and shipbuilding where vertical and overhead applications are common.

- Expansion into Electronics: Epoxy adhesives are being increasingly used in the electronics industry due to their excellent electrical insulation properties. They are utilized for encapsulating and bonding electronic components, where high precision and reliability are crucial.

- Customization for Specific Applications: Companies are offering more customized adhesive solutions tailored to specific customer needs and applications. This trend is driven by the diverse requirements of industries such as automotive, aerospace, and healthcare, where specialized adhesives can significantly improve product performance.

Use Cases

- Aerospace Applications: Epoxy adhesives are critical in the aerospace industry for bonding parts of aircraft. They offer excellent resistance to extreme temperatures and environmental conditions, ensuring structural integrity in crucial components like wings and fuselage panels.

- Automotive Manufacturing: In the automotive sector, epoxy adhesives are used to bond metal, composite, and plastic materials. This enhances vehicle performance by reducing weight while maintaining durability and safety standards, essential for parts such as doors, hoods, and chassis components.

- Electronics Assembly: Epoxy adhesives are utilized in electronics for attaching components to circuit boards and sealing enclosures. Their superior electrical insulation properties and mechanical strength make them ideal for ensuring the longevity and reliability of electronic devices.

- Construction and Building: Epoxy adhesives play a significant role in construction, providing high-strength bonding solutions for concrete, wood, and metal structures. They are particularly valued for their ability to cure quickly and resist moisture and chemical exposure, making them suitable for both indoor and outdoor applications.

- Marine Applications: In marine environments, epoxy adhesives are chosen for their strong bonding capabilities and resistance to water and salt corrosion. They are used for repairing boats, assembling hulls, and sealing joints, contributing to vessel durability and safety.

- Sports Equipment Manufacturing: Epoxy adhesives are integral in manufacturing sports equipment, bonding materials like carbon fiber and fiberglass. This results in lightweight yet robust products such as golf clubs, bicycles, and hockey sticks, which require high performance and endurance.

- Medical Device Fabrication: In the medical field, epoxy adhesives are used to assemble devices that must meet stringent sterilization and biocompatibility standards. These adhesives provide durable bonds in equipment ranging from surgical instruments to diagnostic devices, ensuring patient safety and device reliability.

Key Players Analysis

Henkel AG & Co. KGaA has recently expanded its portfolio by acquiring Seal for Life Industries, a US-based company specializing in protective coatings and sealing solutions for infrastructure. This acquisition aims to enhance Henkel’s maintenance, repair, and overhaul (MRO) capabilities, particularly in sustainability-focused markets like renewable energy and water supply. Seal for Life reported sales of €250 million in 2023 and employs over 650 people globally, integrating advanced epoxy and urethane coatings into Henkel’s offerings.

Sika Group has strengthened its epoxy adhesives segment by acquiring MBCC Group, a leader in construction chemicals. This strategic move, completed in 2023, aims to enhance Sika’s portfolio with innovative and sustainable solutions for various construction applications, contributing to a combined annual sales exceeding CHF 11.24 billion. The integration of MBCC’s brands, such as Master Builders Solutions and Thermotek, is expected to yield significant synergies and bolster Sika’s position in the market.

3M offers high-performance solutions designed for strength, durability, and resistance to demanding conditions. Their Scotch-Weld™ Epoxy Adhesives are widely used in industries such as aerospace, automotive, and electronics. These adhesives bond diverse materials, providing exceptional resistance to shock, vibration, and impact loads. Recently, 3M introduced innovations like the Scotch-Weld™ DP 410, which enhances durability and efficiency in various industrial applications.

H.B. Fuller Company has significantly expanded its epoxy adhesives portfolio by acquiring ND Industries Inc. in May 2024. This strategic acquisition adds specialty adhesives and fastener locking solutions to H.B. Fuller’s offerings, enhancing their presence in the automotive, electronics, and aerospace sectors. ND Industries generated approximately $70 million in revenue in 2023, and its integration is expected to boost H.B. Fuller’s growth and technological capabilities.

DuPont has been focusing on advanced adhesive solutions that provide superior peel strength, chemical, and heat resistance. Their products, such as the Betamate series, are extensively used in the automotive and electronics industries. Recently, DuPont opened a new adhesives manufacturing facility in Zhangjiagang, China, to cater to increasing demand and enhance production capabilities. This expansion aligns with DuPont’s strategic goals to drive innovation and sustainability in adhesives technology.

Bostik SA, a subsidiary of Arkema, has strengthened its position in the epoxy adhesives market through strategic acquisitions and expansions. Notably, Bostik’s acquisition of Ashland’s Performance Adhesives business in 2022 has enhanced its high-performance adhesives portfolio, positioning it as a leader in pressure-sensitive and structural adhesives in the United States. Additionally, the acquisition of Permoseal in 2022 has bolstered Bostik’s presence in South Africa’s DIY and construction markets. These strategic moves align with Arkema’s goal to become a major player in specialty materials by 2024.

Mapei S.p.A., a global leader in building materials and adhesives, continues to innovate within the epoxy adhesives market. Recently, Mapei has focused on expanding its product range to include sustainable and high-performance solutions, catering to increasing demands in construction and industrial applications. The company’s recent launch of Mapei Ultrabond Eco line, an eco-friendly adhesive solution, highlights its commitment to sustainability and innovation in the adhesive sector. This strategic focus has enabled Mapei to maintain its competitive edge and drive growth in key markets.

Sika AG recently acquired MBCC Group, significantly enhancing its portfolio in the epoxy adhesives sector. This acquisition, the largest in Sika’s history, added CHF 2.1 billion in annual sales and 6,000 new employees, aiming for annual synergies of CHF 180-200 million by 2026. In Q1 2024, Sika reported a 20.1% sales growth in local currencies, with Q1 sales reaching CHF 2,648 million. The integration of MBCC has been a key driver of this growth, further solidifying Sika’s position in the construction chemicals market.

Permabond LLC, a key player in the epoxy adhesives market, continues to innovate with products like its high-strength structural adhesives, ideal for diverse industrial applications including aerospace, automotive, and electronics. In 2023, the company introduced a new fast-curing two-part epoxy, Permabond ET503, which is designed for high-performance bonding. Permabond’s adhesives are known for their excellent chemical and water resistance, making them suitable for harsh environmental conditions. The company has seen significant growth, expanding its product range to include solutions for bonding low and high-density polyethylene without surface treatments.

Lord Corporation, now part of Parker Hannifin, specializes in advanced adhesives, coatings, and motion control technologies. The acquisition, completed in 2019 for $3.675 billion, bolstered Parker’s portfolio and presence in various sectors, including aerospace and automotive. In 2024, Lord Corporation continues to expand its offerings in epoxy adhesives, noted for their high strength, chemical resistance, and suitability for harsh environments, contributing to Parker’s significant growth and strategic advancements in engineered materials.

Illinois Tool Works Inc. (ITW) reported a revenue of $16.06 billion for the trailing twelve months in 2024. The company’s diversified segments, including automotive, food equipment, and construction products, have shown robust performance despite challenging market conditions. ITW’s operating income grew by 4% in Q1 2024, with an expanded operating margin of 25.4%. Known for its innovation in epoxy adhesives and other industrial products, ITW remains a strong player in the manufacturing sector.

DELO Industrie Klebstoffe, a leading manufacturer of industrial adhesives, has continued to innovate in the epoxy adhesives market, focusing on high-performance bonding solutions. The company has been expanding its product line to cater to various industries including automotive, aerospace, and electronics, emphasizing reliability and durability under extreme conditions. Recent developments have included advanced formulations to improve bond strength and environmental resistance, positioning DELO as a key player in high-tech adhesive solutions.

RPM International Inc., a global leader in specialty coatings, sealants, and building materials, reported a strong fiscal performance in 2024. The company achieved a revenue of $7.3 billion and completed six strategic acquisitions in fiscal 2023 to enhance its market presence. Notable brands under RPM, such as Rust-Oleum and DAP, continue to lead in consumer and industrial markets. RPM’s commitment to innovation and sustainability is reflected in its diverse product offerings and continuous market growth.

Huntsman Corporation, a global manufacturer of differentiated chemicals, reported first-quarter 2024 revenues of $1.47 billion, with an adjusted EBITDA of $81 million. The company continues to expand its advanced materials segment, highlighted by the construction of a new 30-ton pilot plant for MIRALON® carbon nanotube materials. This innovative plant aims to produce carbon nanotubes and clean hydrogen, significantly reducing carbon emissions and supporting applications in aerospace, automotive, and construction industries.

DuPont, a leader in industrial chemicals and materials, has been actively enhancing its portfolio in the epoxy adhesives market. In 2024, DuPont’s continued focus on innovation and sustainability has led to significant developments in high-performance adhesives used in automotive, electronics, and industrial applications. The company emphasizes advanced bonding solutions that improve durability and environmental resistance, positioning itself strongly in the competitive adhesives market.

Conclusion

The market for epoxy adhesives is positioned for robust growth, driven by their superior properties and versatility across various industries. These adhesives are increasingly favored for their strength, durability, and chemical resistance, making them indispensable in sectors such as automotive, aerospace, and construction. The ongoing innovations and improvements in epoxy formulations are expected to enhance their applicability and performance, thereby expanding their market reach.

As industries continue to demand more efficient and reliable adhesives, the epoxy adhesives market is likely to witness significant expansion and offer numerous opportunities for stakeholders. However, it is essential for market participants to monitor regulatory developments and advancements in alternative adhesive technologies that may influence market dynamics.