Table of Contents

Introduction

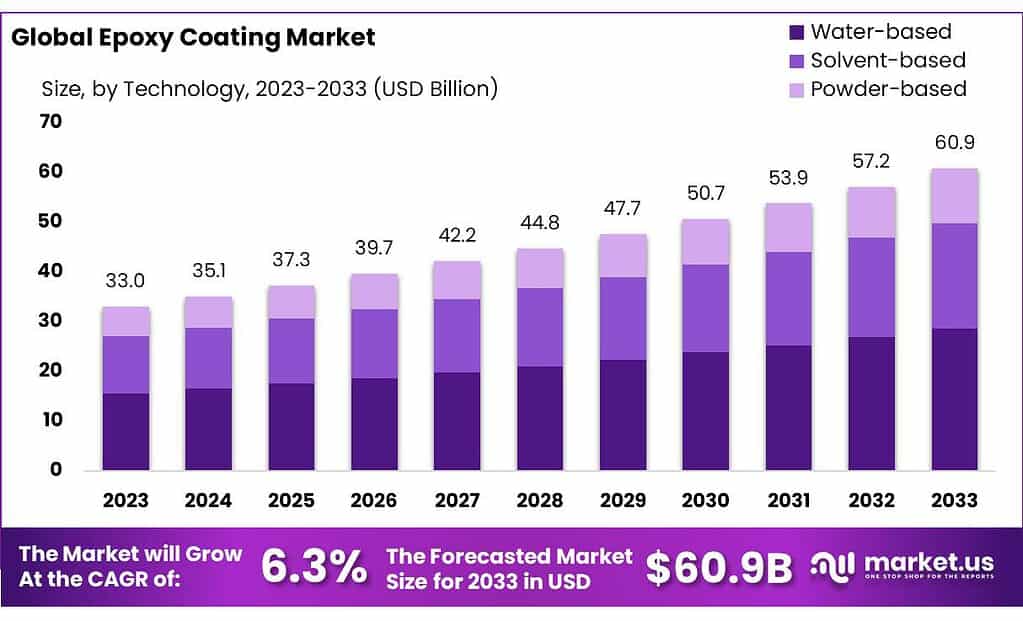

The global epoxy coating market is projected to expand significantly, growing from USD 33.0 billion in 2023 to USD 60.9 billion by 2033, with a compound annual growth rate (CAGR) of 6.3%. This growth is largely driven by increasing demand from various sectors such as construction, automotive, and industrial applications due to epoxy’s superior properties like durability, chemical resistance, and aesthetic finish.

The market’s expansion is fueled by several factors including the surge in infrastructural developments and the rising demand for sustainable and environmentally friendly products. Innovations such as low-VOC (volatile organic compounds) and hybrid epoxy coatings are increasingly adopted due to their enhanced performance characteristics like faster curing times and improved UV resistance, which meet stringent environmental standards.

However, the market faces challenges such as the fluctuating costs of raw materials which can impact production budgets and final product pricing. Moreover, the need to comply with strict environmental regulations adds additional layers of complexity to the manufacturing process, potentially increasing costs and influencing market dynamics.

Recent developments in the industry highlight a trend towards capacity expansions and strategic alliances by key players aiming to bolster their market presence and meet the growing demand efficiently. For example, companies are enhancing their production facilities to include advanced epoxy resin systems, which are integral to catering to the evolving needs of high-performance coatings.

AkzoNobel NV has been active in launching new products that emphasize sustainability. This aligns with a growing industry trend towards eco-friendly products that meet stringent environmental regulations. This strategy not only complies with global sustainability goals but also enhances AkzoNobel’s product offerings in the competitive market.

Asian Paints continues to expand its influence and operations across various regions, emphasizing the importance of eco-friendly and advanced coating solutions. This approach caters to the rising demand for environmentally sustainable products, particularly in markets with strict regulatory standards.

Key Takeaways

- The epoxy coating market is projected to reach USD 60.9 billion by 2033, growing from USD 33.0 billion in 2023, at a CAGR of 6.3%.

- Concrete floors led the market with a 35.4% share in 2023 due to their durability and resistance to wear and tear.

- Solvent-based coatings held 47.5% of the market in 2023, favored for their quick-drying and durable properties in industrial uses.

- Building & Construction dominated the market with a 36.5% share in 2023, driven by demand for robust coatings in commercial and residential projects.

- Asia-Pacific (APAC) led with a 46.7% market share, valued at USD 15.4 billion in 2023, fueled by rapid industrialization.

Epoxy Coating Statistics

- At typical coating application temperatures, usually in the range of 180 to 250 °C (356 to 482 °F), the contents of the powder melt and transform to a liquid form.

- FBE extruders incorporate a single or dual screw setup, rotating within a fixed clamshell barrel. A temperature range[vague] from 50 °C to 100 °C is used within the extruder barrel.

- Normal storage temperatures of FBE powder coatings are below 25 °C (77 °F) in air-conditioned warehouses.

- Standard coating thickness range of stand-alone FBE coatings is between 250 and 500 micrometers, even though lower or higher thickness ranges might be specified, depending on service conditions.

- The highest improvement of the mechanical properties was observed for epoxy resin coatings modified with 20% of natural fine aggregate and 80% of recycled fine aggregate.

- Most constructions are designed as reinforced concrete buildings, and the concrete mixture in 75% of such objects is based on aggregate.

- The pull-off strength values for these specimens were around 1.8 MPa.

- Typical numbers most non-flexible epoxies start at slightly under 10,000 psi (pounds per square inch) and work their way up from that. To put this into perspective typically quality concrete has a compressive strength of about 3,000 psi.

- Very high end concrete can have compressive strength of about 5,000 psi but concrete at that high a strength is not typical. Most concrete is 3,000 psi plus or minus.

- In the case of concrete the compressive strength normally tests out at about 10% of the compressive strength. So concrete with 3,000 lb.

- Typically, epoxy floors last between 10 and 20 years; much longer than a painted concrete floor, which will chip and wear quickly in high-traffic areas.

- The least expensive epoxy option is water-based, which costs between $30 and $50 per gallon. Approximately $45 per gallon is the price range for solvent-based epoxy. There are many types of epoxy available, but solid epoxy is the most expensive. It can cost up to $150 per gallon.

- In general, epoxy flooring materials costs between $0.37 and $1.40 per square foot. Water-based epoxy is less expensive, costing $0.37 to $1.20 per square foot, compared to solid epoxy, which costs $1.40 per square foot.

Emerging Trends

- Environmental Sustainability: There is a significant shift towards the development of eco-friendly epoxy coatings. Innovations are increasingly focusing on waterborne epoxy systems that offer low volatile organic compound (VOC) emissions. These advancements meet stricter environmental regulations and growing consumer preference for sustainable products, which are seen as crucial for future market growth.

- Advanced Performance Features: Epoxy coatings are evolving to include hybrid formulations that offer faster curing times and improved mechanical and UV resistance. These enhanced performance characteristics make epoxy coatings more effective for longer protection and diverse industrial uses, including harsh environmental conditions where traditional coatings might fail.

- Increasing Use in Protective Applications: Epoxy coatings are valued for their exceptional adhesion, durability, and resistance to corrosion, making them ideal for protective applications. They are extensively used in sectors such as automotive and construction for underbody coatings and as a protective layer on metals and floors, safeguarding against physical and chemical damages.

- Technological Integration: The market is seeing a trend towards integrating advanced technologies into coating applications. This includes the use of digital tools for color matching and application techniques that enhance efficiency and effectiveness in industrial applications.

- Growth in Developing Regions: Rapid industrialization in the Asia-Pacific region, coupled with infrastructure development in emerging economies like China and India, is propelling the demand for epoxy coatings. The market is benefiting from increased foreign investments and the expansion of manufacturing capacities in these regions.

Use Cases

- Industrial Flooring: Epoxy coatings are particularly favored in industrial settings where floors need to withstand heavy traffic, chemical spills, and extensive wear and tear. They are commonly applied in warehouses, manufacturing plants, and commercial garages to provide a durable, easy-to-clean surface that resists staining and abrasion.

- Construction Applications: In construction, epoxies are used for a variety of tasks including concrete repairs, as adhesives, and for protective overlays. Their ability to bond to various materials and withstand environmental and mechanical stress makes them ideal for reinforcing concrete, repairing cracks, and anchoring bolts or dowels in structural applications.

- Marine Uses: Epoxy coatings are critical in marine applications due to their excellent corrosion resistance properties. They are used to protect ships and marine structures from the harsh marine environment, preventing rust and extending the lifespan of the vessels and infrastructure.

- Automotive and Aerospace: In both the automotive and aerospace industries, epoxy coatings are used to provide a protective layer that resists moisture, chemicals, and physical impacts. This ensures that parts and assemblies within these vehicles resist corrosion and wear, thereby enhancing their durability and lifespan.

- Protective Coatings for Pipes and Steel Structures: Due to their strong protective qualities, epoxies are often used on steel structures and pipes, particularly where there is a risk of corrosion or chemical exposure. This application extends across various industries including oil and gas, where epoxy coatings protect infrastructure from harsh operational conditions

Major Challenges

- Raw Material Volatility: One of the primary challenges in the epoxy coatings industry is the volatility in prices of essential raw materials like resins, pigments, and solvents. These materials are crucial for the production of epoxy coatings, and fluctuations in their costs can significantly affect manufacturing budgets, altering profit margins and overall cost structures for producers.

- Technological and Performance Requirements: Developing epoxy coatings that meet specific industrial needs requires substantial research and development investment. The technical demands for creating high-performance coatings that adhere to industry standards can be both resource-intensive and complex.

- Environmental Regulations: Compliance with stringent environmental regulations, particularly regarding the reduction of volatile organic compounds (VOCs), poses another significant hurdle. These regulations compel manufacturers to innovate and perhaps overhaul traditional production methods to develop more environmentally friendly products.

- Economic and Industrial Challenges: The broader economic environment and the health of key end-use industries like automotive, aerospace, and construction also play critical roles. Economic downturns or slowdowns in these sectors can lead to reduced demand for epoxy coatings.

- Supply Chain Disruptions: Like many other industries, the epoxy coatings sector is not immune to supply chain disruptions, which can affect everything from raw material supply to the distribution of finished products. These disruptions can be caused by geopolitical tensions, global pandemics, or other international trade issues.

Market Growth Opportunities

- Waterborne Epoxy Coatings: There’s a growing demand for waterborne epoxy coatings due to their environmental benefits, such as low VOC emissions and less environmental impact compared to solvent-based alternatives. These coatings are increasingly used in construction, automotive, and marine industries for their durability and resistance to chemicals and moisture. The market for waterborne epoxy coatings is expected to grow significantly, with advancements like hybrid waterborne coatings enhancing their performance characteristics.

- Industrial Applications: The industrial sector presents substantial growth opportunities for epoxy coatings due to their ability to enhance energy efficiency, improve durability, and provide protection against harsh conditions. These coatings are essential in industries such as marine, electronics, automotive, and aerospace, supporting the market’s expansion through diverse applications.

- Geographic Expansion: The Asia Pacific region remains a major growth driver due to rapid industrialization and urbanization, especially in countries like China, India, and Japan. The region’s robust economic growth, expanding industrial base, and increasing demand across end-use sectors are expected to continue driving the demand for epoxy coatings. In Europe and North America, investments in construction and infrastructure, along with increasing demand for environmentally friendly materials, are set to boost the market.

- Technological Innovations and Eco-friendly Products: There is a trend towards innovation and the development of new epoxy coating products that align with environmental regulations and consumer preferences for sustainable products. Companies are investing in research and development to produce epoxy coatings that offer enhanced performance and are environmentally friendly, which is crucial for maintaining competitiveness and market growth.

Key Players Analysis

In 2024, AkzoNobel NV has continued to strengthen its position in the epoxy coatings market, demonstrating robust financial performance with significant growth in its performance coatings sector. The company’s revenue in this segment increased by 20% in the first half of the year, indicating strong market demand and operational excellence. AkzoNobel’s focus on sustainability is evident in their introduction of industry-first, low-energy powder coatings, which can be cured at significantly lower temperatures, reducing energy consumption by up to 20%. This innovation not only underscores AkzoNobel’s commitment to sustainability but also positions the company to capitalize on the growing demand for environmentally friendly coating solutions.

Asian Paints has been expanding its portfolio in the epoxy coatings sector, focusing on innovation and quality to meet diverse consumer needs. While specific details on their performance in the epoxy coatings market in 2023 or 2024 are limited, the company’s broad approach includes a range of paint and coating products that cater to industrial and decorative applications. Asian Paints’ strategy emphasizes both market expansion and the enhancement of product offerings to maintain competitiveness in a rapidly evolving industry. Their commitment to sustainability and quality continues to drive their success in the coatings market.

In 2023, Axalta Coating Systems, LLC experienced a positive financial performance, with net sales growing by 6.1% year-over-year to reach $5.2 billion. The company achieved this growth through strategic pricing actions and optimizing cost management, which also led to a significant increase in adjusted EBITDA to $951 million, reflecting a strong improvement in operational efficiency. These financial gains were underscored by successful efforts in reducing debt and increasing free cash flow, positioning Axalta well for continued success in the coatings industry for 2024.

BASF SE, a key player in the global epoxy coatings market, has been integrating its extensive chemical expertise to expand its footprint in this sector. Although specific year-wise financial performance for 2023 or 2024 was not detailed in the sources, BASF’s approach typically emphasizes innovation in durable and sustainable coatings solutions. Their work in developing new applications for epoxy coatings spans across various industries, including automotive, industrial, and construction, aiming to meet the increasing demands for environmentally friendly and high-performance products.

In 2023, Berger Paints India Limited experienced a solid performance in the epoxy coatings sector, demonstrating growth in a moderately expanding paints market. The company reported significant improvement in various product categories including automotive and industrial coatings. Berger Paints capitalized on reducing raw material costs, which contributed to robust operating profit growth throughout the year. With a diverse range of decorative and industrial paint products, Berger Paints continues to enhance its market presence in India, supported by extensive manufacturing and distribution networks.

Dur-A-Flex, Inc. is recognized for its specialized solutions in the epoxy coatings market, focusing on durable and innovative flooring systems. While specific financial details for 2023 or 2024 are not readily available, Dur-A-Flex is known for its role in providing epoxy, polyaspartic, and resinous floor coatings. These products are particularly valued across commercial, industrial, and institutional facilities for their durability, safety features, and aesthetic qualities. Dur-A-Flex continues to be a key player in the market, driving advancements in epoxy flooring technologies that meet rigorous performance standards.

Endura Manufacturing Company Ltd. has been active in the epoxy coatings sector, focusing on high-performance coatings designed for extreme conditions. The company prides itself on producing durable and resilient products suitable for both industrial and recreational applications, emphasizing their adaptability to harsh environments. While specific financial data for 2023 or 2024 isn’t detailed, Endura’s consistent approach involves a strong emphasis on quality and customer-specific solutions in the protective coatings market.

Kansai Paint Co., Ltd. had a robust performance in the epoxy coatings sector in 2023, further solidifying its market position. The company has expanded its product range, particularly in protective coatings that are used extensively in infrastructure projects across emerging markets. Kansai Paint’s innovative approach includes ultrathick epoxy resin coatings that are crucial for protecting structures from environmental damage and corrosion. In 2023, Kansai Paint continued to advance its technologies in protective coatings, contributing significantly to its growth in this segment.

Koster Bauchemie AG continues to strengthen its expertise in the epoxy coating sector by focusing on innovative waterproofing solutions and concrete protection systems. Throughout 2023 and moving into 2024, the company has concentrated on developing epoxy systems that provide durable protection against moisture and structural damage, particularly in construction and renovation projects. This commitment ensures Koster remains a significant player in delivering specialized coating solutions tailored to maintain and extend the life of building materials.

MBCC Group PPG Industries, Inc., after being acquired by Sika and seeing a partial sale to Cinven in May 2023, remains active in the epoxy coating market through its subsidiary PPG Industries. In 2024, PPG launched the PPG STEELGUARD® 951, an innovative fire protection coating in the Americas, designed to enhance safety in advanced manufacturing facilities. This product expansion highlights PPG’s ongoing commitment to providing specialized, high-performance coating solutions across various industries, including automotive and industrial sectors.

In 2023, Nippon Paint Holdings Co., Ltd. continued to drive significant growth in its epoxy coatings business, leveraging its strong position in automotive and decorative paints, particularly in the Asia-Pacific region. The company’s strategic focus on these areas contributed to a notable increase in revenue, supported by robust sales in China and expanding market activities in other Asian countries. This growth is part of Nippon Paint’s broader strategy to enhance its global footprint and capitalize on the increasing demand for high-quality epoxy coatings in both automotive and industrial applications.

PPG Industries, Inc. has been actively expanding its range of epoxy coatings, with notable developments in 2024. PPG introduced the PPG STEELGUARD 951 in the Americas, an innovative fire protection epoxy coating designed for advanced manufacturing facilities. This product launch highlights PPG’s commitment to delivering solutions that meet critical safety needs in industrial environments. Additionally, PPG’s focus on versatile epoxy products like the PPG AMERLOCK 600, which offers excellent corrosion protection and is suitable for a variety of substrates, underscores their strategic approach to addressing the diverse needs of the coatings market.

In 2023, RPM International Inc. achieved a strong financial performance, with net sales reaching $7.3 billion, bolstered by strategic acquisitions and product innovations across its specialty coatings and sealants segments. The company emphasized its growth through enhancing operational efficiencies and expanding its global footprint, which has led to sustained increases in sales across various regions, particularly in North America. RPM continues to focus on developing high-performance epoxy and other specialty coatings that cater to a broad range of industrial needs.

The Sherwin-Williams Company, another leader in the coatings industry, has consistently advanced its position in the epoxy coatings market. The company’s strategic initiatives, including expanding its product lines and entering new markets, have successfully driven growth. In 2023, Sherwin-Williams focused on enhancing its global supply chain and operational efficiencies to better serve its diverse customer base across the residential, commercial, and industrial sectors. This approach has helped the company maintain its competitive edge in the market.

TAO-CHUGOKU CO., LTD. has been actively engaged in enhancing its epoxy coating offerings, with a focus on developing high-build and solvent-free products that cater to stringent environmental standards and meet the needs of marine and industrial applications. In 2023, the company continued to innovate within the sector, aiming to harmonize technological advances with environmental sustainability. TAO-CHUGOKU’s dedication to quality and eco-friendly solutions is helping to solidify its presence in the global market, particularly in regions with strict regulatory environments.

The Euclid Chemical Company specializes in high-performance epoxy coatings used primarily in the construction industry. Their products are designed to offer durability and resistance to harsh environmental conditions, making them suitable for both commercial and residential projects. The company’s focus on continuous innovation and quality improvement in 2023 has helped maintain its reputation as a leader in the epoxy coatings market, providing reliable solutions that meet the evolving needs of the industry.

The Valspar Corporation has continued to enhance its market presence in the epoxy coatings sector by focusing on innovation and sustainability. In 2023, Valspar expanded its product range to include more environmentally friendly options, catering to a growing demand for sustainable building materials. Their developments in durable and protective epoxy coatings are designed to meet the needs of both industrial and residential markets, ensuring long-lasting performance under various environmental conditions.

Thermal-Chem Corporation specializes in high-performance epoxy and urethane floor coatings, consistently enhancing their product offerings to meet the specific needs of the industrial flooring market. In 2024, they have emphasized innovation in their floor systems, which include solutions like DecoFlake and FlexGard, aimed at providing durable, flexible, and decorative flooring options. Thermal-Chem’s commitment to quality and customer-specific solutions has solidified its position as a leader in the epoxy coatings industry.

In 2023, Tikkurila continued to make strides in the epoxy coating market with its Temafloor range. This includes products like Temafloor P300, a self-leveling, solvent-free epoxy coating designed for heavy-duty industrial and commercial floors. Tikkurila focuses on combining high performance with environmental safety, offering coatings that provide durable and chemically resistant finishes suitable for various demanding environments. Their innovations in water-based systems and commitment to sustainability are key aspects of their market strategy, enhancing their appeal in regions with strict environmental regulations.

Wanhua has leveraged its expertise in chemical manufacturing to advance its position in the epoxy coatings sector, particularly noted for their innovation in bio-based epoxies. Although specific details for 2023 or 2024 are sparse, Wanhua’s general approach involves enhancing product sustainability and performance. Their development and implementation of new technologies in epoxy formulations continue to highlight their commitment to reducing environmental impact while maintaining the efficacy of their coatings.

West Pacific Coatings has solidified its expertise in the epoxy coatings market by offering specialized services tailored for both commercial and industrial needs. In 2023, the company focused on delivering high-performance epoxy solutions designed to enhance durability and chemical resistance across a range of environments including parkades, commercial buildings, and industrial facilities. Their services extend beyond typical applications, embracing complex needs such as concrete repair and restoration, and the installation of decorative and slip-resistant flooring systems. Their commitment to providing comprehensive flooring solutions is evident in their approach to addressing both aesthetic and functional requirements of modern flooring.

Conclusion

The epoxy coating market is poised for significant growth due to its versatility and adaptability across various industries, including construction, automotive, and marine sectors. The shift towards environmentally friendly waterborne epoxy coatings and the development of high-performance formulations align with global sustainability goals and regulatory requirements, fueling market expansion. Additionally, the Asia Pacific region remains a focal point for rapid market growth, driven by ongoing industrialization, urbanization, and extensive infrastructure development.

As manufacturers continue to innovate and expand their product portfolios to meet diverse and evolving demands, the epoxy coating market is expected to offer abundant opportunities for stakeholders across the value chain. Overall, the future outlook for epoxy coatings is highly positive, with technological advancements and sustainability initiatives at the forefront of market dynamics.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)