Table of Contents

Introduction

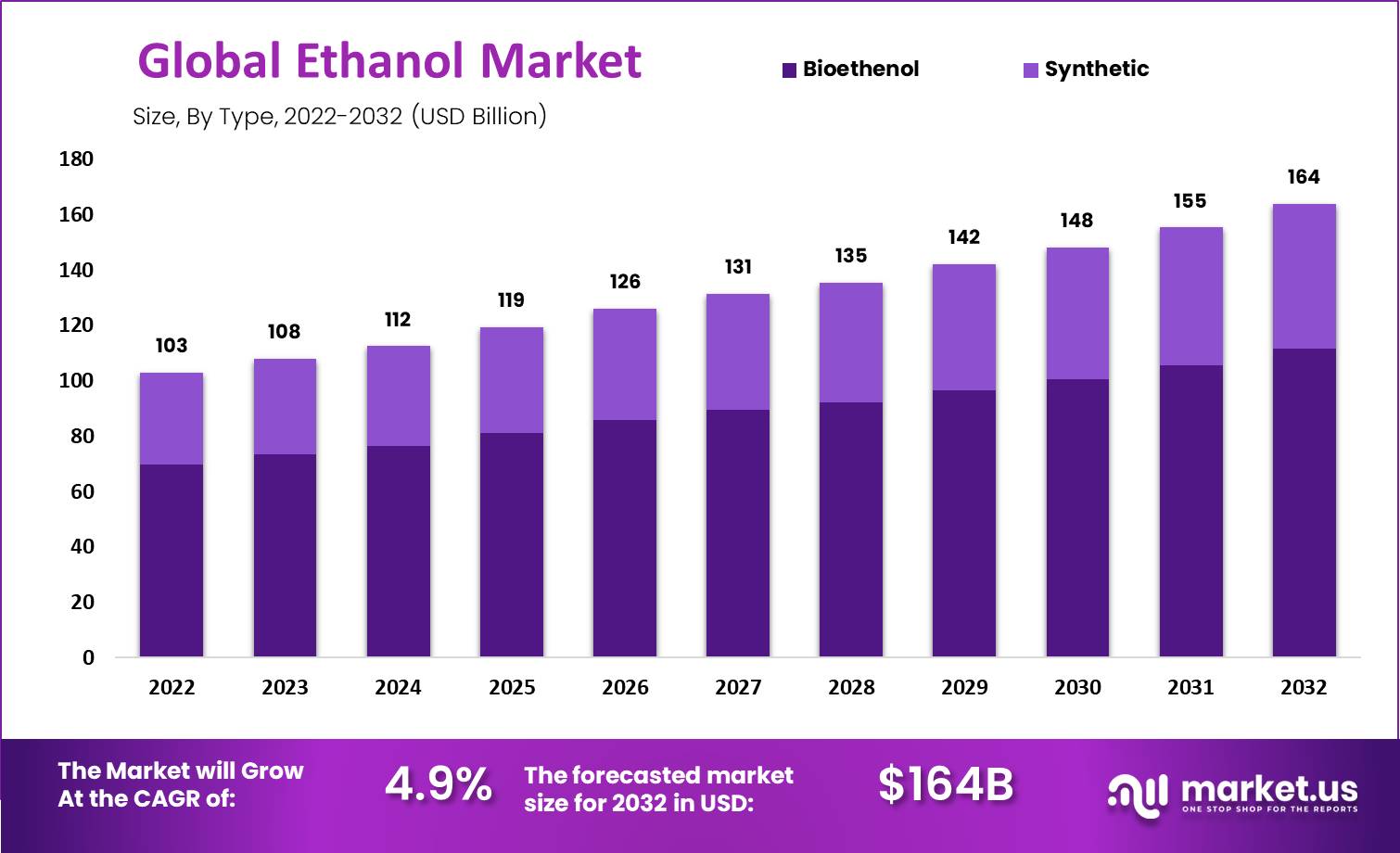

The global ethanol market is set for significant growth, projected to increase from USD 102.8 billion in 2022 to around USD 163.9 billion by 2032, with a Compound Annual Growth Rate (CAGR) of 4.9% during the forecast period from 2024 to 2033. This growth is primarily driven by the rising demand for biofuels, which utilize ethanol as a key component, particularly in the automotive and energy sectors. The shift towards sustainable and environmentally friendly fuel options has significantly boosted the ethanol market, as governments worldwide implement policies to reduce carbon emissions and promote renewable energy sources.

However, the market faces challenges, including the high cost of production and technological hurdles in ethanol processing and refinement. Moreover, fluctuations in raw material supply, particularly corn and sugarcane which are primary feedstocks for ethanol, pose risks to steady market growth. Seasonal variations and the impact of climate on agriculture further complicate the supply landscape.

Recent developments have seen advancements in production technology aimed at enhancing efficiency and reducing costs. For instance, significant investments are being made in the development of second-generation biofuels, which do not compete with food crops for raw materials, thereby addressing the food-versus-fuel debate that has previously hindered the market’s growth.

United Breweries is actively participating in the ethanol market, leveraging its extensive distribution network to enhance its presence. Similarly, Aventine Renewable Energy continues to focus on expanding its production capabilities to meet the growing demand for ethanol, especially in the fuel and industrial solvent sectors.

AB Miller is another significant player in the ethanol market, traditionally known for its role in the beverages sector, now adapting to the broader market demands for ethanol in various applications including fuel additives and industrial solvents.

Overall, the ethanol market is poised to expand as it plays a critical role in the global shift towards cleaner energy sources, with ongoing innovations and government support driving its upward trajectory.

Ethanol Statistics

- Total Ethanol Production: 5.57 billion litres of ethanol.

- Co-products: 6.16 million tonnes of co-products produced.

- Fuel Use: 79% of ethanol output used for fuel.

- Greenhouse Gas Savings: Over 75% savings compared to fossil petrol.

- Food and Beverage Use: 5.6% of ethanol production.

- Industrial Use: 15.2% of ethanol production, including hand sanitiser.

- EU-sourced Feedstock: Over 98% of feedstock grown or sourced in Europe.

- ePURE Members: 35 members, including 19 producers.

- Production Plants: Around 50 plants across the EU and UK.

- Industry Coverage: About 85% of EU renewable ethanol production.

- Fuel: 98% of U.S. gasoline contains ethanol (E10: 10% ethanol, 90% gasoline).

- Exports reached a record 1.43 billion gallons, valued at $3.82 billion, equivalent to 9% of domestic production and the third-highest export volume ever.

- Approximately 73% of global demand was for denatured ethanol. The majority of U.S. ethanol exports, three-fourths, were destined for Canada, the United Kingdom, and the European Union, with the rest distributed across 80 countries.

- However, a 16% tariff-rate quota led to a decline in the Brazilian market, and U.S. ethanol exports remained restricted from entering China due to prohibitive tariffs.

- Despite this, net ethanol exports were the second-highest on record. With imports decreasing to a 13-year low of 21 million gallons, primarily sourced duty-free from Brazil to leverage the Renewable Fuel Standard and California Low Carbon Fuel Standard.

Emerging Trends

Emerging trends in the ethanol market are shaping its future, driven by technological advancements, regulatory shifts, and changing consumer preferences. A significant trend is the increasing demand for bioethanol, seen as a sustainable and renewable fuel source that can help reduce greenhouse gas emissions. This surge is supported by government programs globally that promote the use of biofuels to decrease reliance on fossil fuels.

Another notable trend is the growing adoption of advanced biofuels like cellulosic ethanol, which is derived from non-food feedstocks such as agricultural residues. This type of ethanol is gaining traction due to its minimal impact on food supply chains and its potential to offer a more sustainable alternative to traditional ethanol sources.

In addition, there’s a rising focus on decarbonizing ethanol production to make it even more environmentally friendly. Initiatives such as the partnership between Wolf Carbon Solutions and Archer Daniels Midland aim to accelerate the decarbonization process, enhancing the sustainability profile of ethanol further.

The ethanol market is also witnessing a shift towards the incorporation of ethanol in diverse applications beyond fuel. Its use as a solvent in industrial processes is expanding due to its efficacy and low environmental impact. Moreover, ethanol continues to be a key ingredient in the personal care and pharmaceutical industries, utilized for its antiseptic properties.

These trends highlight the dynamic nature of the ethanol market as it adapts to new technologies and regulatory environments, positioning it for continued growth and innovation in the coming years.

Use Cases

- Fuel and Energy: Ethanol is predominantly used as a biofuel additive to gasoline. It helps reduce greenhouse gas emissions and increases the octane rating of fuel. In India, the government aims to achieve a 20% ethanol blending rate by 2025 to enhance energy security and reduce reliance on imported crude oil, with significant investment planned for expanding ethanol production capacity.

- Automotive Industry: The demand for ethanol in the automotive sector is driven by its use as a sustainable alternative to traditional fuels. Ethanol’s application in this sector helps in reducing carbon emissions and dependency on fossil fuels, supporting global efforts towards more sustainable transportation.

- Food and Beverage: In the food industry, ethanol is used as a solvent for flavorings and colorants and is a key ingredient in alcoholic beverages. It is used in the production of extracts like vanilla, which are essential in baking and cooking.

- Cosmetics and Personal Care: Ethanol is employed in cosmetics for its antiseptic properties, making it a fundamental component in products like hand sanitizers, perfumes, and mouthwashes. It acts as a solvent that helps in the formulation of various personal care products.

- Pharmaceuticals: In healthcare, ethanol is used as a disinfectant and sanitizer to maintain hygiene standards in medical facilities. It’s also a carrier in many medicinal formulations, enhancing the delivery of active ingredients.

Key Players Analysis

United Breweries, a major player in the beverage industry, has expanded its operations to include the production of ethanol, leveraging its extensive experience in fermentation processes used in brewing. This strategic move allows the company to diversify its product offerings and tap into the growing demand for biofuels, aligning with global trends towards more sustainable energy sources.

Aventine Renewable Energy, established in 2003, has been a prominent producer and marketer of ethanol and related co-products in the United States. The company operates facilities in Pekin, Illinois, and Aurora, Nebraska, focusing on the production of fuel-grade ethanol primarily from corn. Aventine’s production not only supports the energy sector but also produces valuable co-products like distillers grains and corn oil, which are used in animal feed and other industries. In 2015, Aventine was acquired by Pacific Ethanol, enhancing its production capabilities and market reach.

United Breweries has strategically entered the ethanol sector, leveraging its extensive experience in fermentation processes, originally honed in the brewing industry. This diversification aligns with global trends toward sustainable energy sources, allowing United Breweries to tap into the growing demand for biofuels and broaden its product portfolio.

Aventine Renewable Energy, established in 2003, specializes in producing and marketing corn-based fuel-grade ethanol in the United States. Operating primarily from its facilities in Pekin, Illinois, and Aurora, Nebraska, Aventine also produces valuable co-products like distillers grains and corn oil. In 2015, it was acquired by Pacific Ethanol, which enhanced its production capabilities and market presence.

United Breweries in the ethanol sector is primarily known for its strong foundation in brewing, which it leverages to produce ethanol, aligning with global shifts towards sustainable practices. The move into ethanol production allows the company to diversify its portfolio and tap into the growing demand for biofuels. This strategic expansion utilizes United Breweries’ established fermentation technology to produce ethanol, underscoring its commitment to innovation and sustainability in energy sources.

Aventine Renewable Energy has been a significant player in the ethanol industry since its founding in 2003. Specializing in the production and marketing of fuel-grade ethanol, primarily from corn, Aventine operates out of its facilities in Pekin, Illinois, and Aurora, Nebraska. The company produces several co-products, including distillers grains and corn oil, which find applications in animal feed and other industries. Aventine’s integration into Pacific Ethanol in 2015 bolstered its capacity and market reach, enhancing its role in the renewable energy sector.

AB Miller is engaged in the bioethanol sector, contributing to the production of this renewable energy source. The company is part of the larger bioethanol market landscape, focusing on the sustainable production of ethanol which is used widely as a biofuel. The involvement of AB Miller in this sector underscores its commitment to sustainable practices and the growing trend of utilizing bio-based products to reduce environmental impact.

Archer Daniels Midland Company (ADM) is a major player in the ethanol industry, renowned for its extensive operations in the production of ethanol from agricultural feedstocks. ADM’s involvement in ethanol production is a core part of its business, aligning with its broader strategy in the agricultural sector. The company’s operations span various aspects of ethanol production, including the manufacturing and distribution of this important biofuel, which plays a significant role in global efforts to create more sustainable energy solutions.

Conclusion

In conclusion, the global ethanol market is positioned for substantial growth, driven by its diverse applications across various industries and the increasing focus on sustainable energy solutions. The market is projected to grow from approximately USD 85.8 billion in 2023 to around USD 145.6 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.8% during this period. This growth is fueled by the rising demand for cleaner fuel alternatives, particularly in the automotive sector, and the broad adoption of ethanol in personal care products, pharmaceuticals, and food and beverage industries.

Ethanol’s role as a sustainable and renewable energy source is particularly significant, with increasing investments in production capabilities and advancements in technology enhancing its efficiency and environmental credentials. The market’s expansion is also supported by favorable government policies worldwide, which promote the use of ethanol to reduce carbon emissions and reliance on fossil fuels.