Table of Contents

Introduction

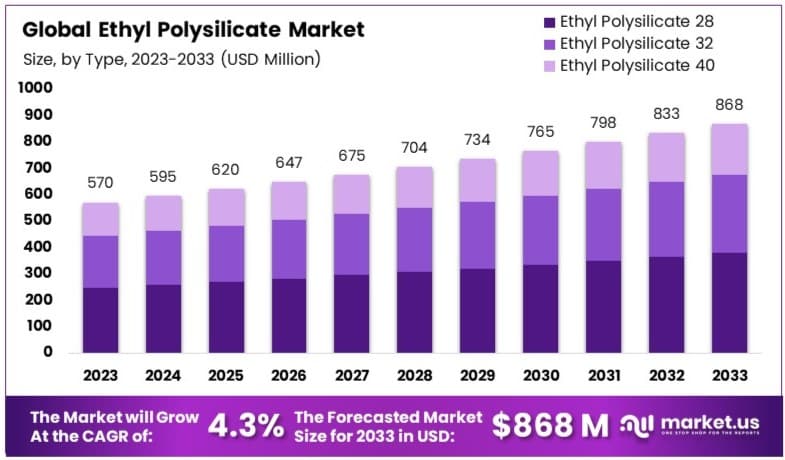

The global Ethyl Polysilicate Market is projected to expand from USD 570 Million in 2023 to approximately USD 868 Million by 2033, reflecting a CAGR of 4.3% over the forecast period from 2024 to 2033. This growth is primarily driven by the increasing demand for Ethyl Polysilicate in applications such as binders for paints and coatings, which are essential in the construction and automotive industries. Moreover, its utilization in the production of silica, which is pivotal in the electronics industry, supports the market’s expansion.

However, the market faces challenges, including stringent environmental regulations related to volatile organic compound (VOC) emissions, which are prevalent in its applications. Recent developments indicate a shift towards more environmentally friendly formulations, aiming to reduce the environmental impact and comply with global regulations. These innovations are crucial for sustaining growth in the face of regulatory challenges and enhancing market penetration in environmentally conscious sectors.

The ethyl polysilicate market is experiencing robust growth, supported by strategic expansions, acquisitions, and continuous product innovations by major players such as Wacker Chemie AG, Evonik, COLCOAT, and Momentive. These developments are aimed at addressing the growing demand across various industrial applications while also focusing on sustainability and advanced material performance.

Wacker Chemie AG has undertaken significant expansions and strategic acquisitions to bolster its position in the ethyl polysilicate market. The company is investing over $200 million to expand its production facilities at its Charleston site in Tennessee, USA. This expansion, which will occur in phases over several years, aims to meet the increasing demand for silicone specialties, creating more than 200 new jobs.

Evonik Industries continues to focus on innovation and sustainability within the ethyl polysilicate sector. The company has been enhancing its product offerings to cater to the high-performance requirements in various industrial applications. Evonik’s recent developments emphasize the integration of advanced materials and chemicals to improve product efficiency and environmental footprint, though specific recent acquisitions or expansions were not detailed in the latest updates.

Momentive Performance Materials has been expanding its product portfolio to include a wide range of silicones and specialty solutions, significantly impacting the ethyl polysilicate market. The company’s recent focus has been on developing advanced materials that cater to diverse industries such as automotive, aerospace, and healthcare. Momentive continues to invest in research and development to innovate and improve its product offerings.

Key Takeaways

- Market Value: Projected to increase from USD 570 Million in 2023 to USD 868 Million by 2033, at a CAGR of 4.3%.

- Type Analysis: Ethyl Polysilicate 28 dominates with 43.6%; its balance of reactivity and stability makes it ideal for numerous industrial applications.

- Application Analysis: Cross-linking agents hold the lead at 37.8%; crucial for enhancing mechanical properties across various sectors including automotive and construction.

- End-Use Industry Analysis: Paints and coatings dominate with 39.5%; high demand for durable, performance coatings in construction and automotive boosts this segment.

- Dominant Region: APAC leads with 38.5% market share; significant growth driven by expanding industrial sectors in emerging economies.

- High Growth Region: North America maintains approximately 25% market share; steady growth due to technological advancements and high industrial standards.

Ethyl Polysilicate Statistics

- The molecular formula of Ethyl Polysilicate is C8H20O4Si.

- Ethyl Polysilicate has a molar mass of 208.33 g/mol.

- The exposure limits for Ethyl Polysilicate are ACGIH: TWA 10 ppm, OSHA: TWA 100 ppm (850 mg/m³), and NIOSH: IDLH 700 ppm; TWA 10 ppm (85 mg/m³).

- The occupational standard time-weighted average (TWA) for Ethyl Polysilicate is 85 mg/m³, with a short-term exposure limit (STEL) of 170 mg/m³.

- As of June 15, 2024, there have been 374 import shipments of Ethyl Polysilicate worldwide, involving 22 importers and 23 suppliers.

- The top three importing countries for Ethyl Polysilicate are China, Vietnam, and Japan.

- The primary Harmonized System (HS) codes for Ethyl Polysilicate imports are 35069900 and 3506990000.

- China exported 310 shipments of Ethyl Polysilicate, Vietnam exported 29 shipments, and Japan exported 26 shipments.

- The preparation process for producing Ethyl Polysilicate uses silicon tetrachloride, a byproduct of trichlorosilane production.

- The reaction occurs at a temperature range of 85-95°C.

- The volume ratio of silicon tetrachloride to absolute ethyl alcohol is 1:0.7-1.

- The reaction time for generating crude Ethyl Polysilicate is 1.5-2 hours, during which a small amount of hydrogen chloride gas is generated as a byproduct.

- The crude Ethyl Polysilicate is neutralized and rectified to remove acids and ethanol byproducts at a temperature range of 160-180°C.

- The hydrolyzing process involves mixing Ethyl Polysilicate and water at a volume ratio of 1:0.28.

- The final product, Poly(ethyl silicate) Si-40, has a viscosity of 4-7 mPa.s and a SiO2 content of 39-43%.

Emerging Trends

- Increased Demand in Paints and Coatings: Ethyl polysilicate is increasingly used in paints and coatings for its ability to enhance durability and resistance to environmental factors. This trend is driven by rising construction activities globally and the need for long-lasting building materials.

- Growth in Electronics Sector: The electronics industry is adopting ethyl polysilicate for its use in semiconductor manufacturing and as a binder in electronic components. This trend is fueled by the miniaturization of electronic devices and the requirement for high-purity silicon sources.

- Advancements in Dental Applications: There’s a notable increase in the use of ethyl polysilicate in dental care, particularly in dental impressions and molds. This application benefits from the material’s precision and stability, enhancing the quality and reliability of dental products.

- Expansion in Renewable Energy: Ethyl polysilicate is finding applications in renewable energy sectors, particularly in solar panels as a silicon source. This aligns with global shifts toward renewable energy sources and the demand for more efficient solar technologies.

- Bio-Compatible Material Innovations: Innovations in biocompatible materials for medical implants and devices incorporate ethyl polysilicate, given its non-toxic and stable nature. This trend is growing with technological advances and increasing demand for more compatible and safe medical materials.

- Environmental Regulations Impact: Stricter environmental regulations are shaping the production and disposal processes of ethyl polysilicate. Manufacturers are investing in cleaner production technologies and developing eco-friendly formulations to comply with these new standards.

- Enhanced Focus on Research and Development: There is an enhanced focus on R&D to improve the properties and applications of ethyl polysilicate. Efforts are particularly directed towards increasing its effectiveness and reducing costs, which is crucial for expanding its adoption across various industries.

Use Cases

- Ceramics Production Ethyl polysilicate serves as a vital binding agent in ceramics manufacturing. It enhances the durability and structural integrity of ceramic products by promoting a better bond among the materials during firing, resulting in a higher quality finish and greater resistance to environmental stress.

- Investment Casting In the precision casting process, ethyl polysilicate is utilized as a binder in the ceramic shell. It contributes to the shell’s strength and heat resistance, allowing for the accurate casting of metals such as aluminum and steel. This application is crucial for creating complex shapes with high dimensional accuracy in aerospace and automotive industries.

- Coatings and Paints This compound is used in the production of silicon-based coatings, offering benefits such as increased hardness and weather resistance. Coatings containing ethyl polysilicate are applied to buildings and vehicles to protect surfaces from environmental damage and to extend the life of the underlying materials.

- Adhesives and Sealants Ethyl polysilicate is effective in enhancing the adhesive properties of silicon-based sealants and adhesives. These enhanced adhesives are used in construction and manufacturing for bonding materials that are exposed to extreme temperatures and chemicals, providing long-lasting seals and joints.

- Protective Layer in Electronics Its application in electronics is critical for providing a protective, insulating layer on silicon wafers and other semiconductor materials. This layer helps in preventing moisture and contaminants, thereby ensuring the durability and functionality of electronic components.

- Synthesis of Zeolites The compound is used in the synthesis of zeolites, materials used as adsorbents and catalysts in the chemical industry. Ethyl polysilicate helps in forming the framework of zeolites which is essential for their ability to filter harmful substances or accelerate chemical reactions.

- Dental Materials In dental medicine, ethyl polysilicate is incorporated into impressions and molding materials due to its excellent binding properties and its ability to create precise molds, which are crucial for the production of dental implants and prosthetics.

Key Players Analysis

Wacker Chemie AG is a prominent player in the ethyl polysilicate market, leveraging its advanced chemical expertise to cater to various industrial applications such as coatings, adhesives, and sealants. Recently, the company has focused on expanding its production capabilities and optimizing its product portfolio to meet the growing demand for high-performance materials. In 2023, Wacker reported robust financial results, driven by increased sales volumes and strategic investments in R&D. These efforts underscore Wacker’s commitment to maintaining its leadership position in the specialty chemicals market.

Evonik Industries has strengthened its presence in the ethyl polysilicate sector through its Dynasylan® SILBOND® 40 product, which is widely used as a binder and cross-linking agent in various applications such as coatings, investment casting, and thermal insulation. In the first quarter of 2024, Evonik exceeded market expectations with an adjusted EBITDA of €522 million, reflecting a 28% year-on-year increase. The company attributes this success to higher sales volumes and cost-cutting measures, alongside a positive outlook for the full year with expected EBITDA between €1.9 billion and €2.2 billion.

COLCOAT Co., Ltd., based in Japan, specializes in the production and development of ethyl polysilicate for various industrial applications such as cross-linking agents for silicone rubber, binders for zinc-rich paints, and precision casting. The company is noted for its innovative products that emphasize sustainability and high performance. Recent efforts include enhancing eco-friendly formulations and investing in research and development to meet the growing demand for high-performance materials. COLCOAT’s focus on technological advancement ensures its competitive edge in the ethyl polysilicate market.

Momentive is a significant player in the ethyl polysilicate market, offering products used as binders, cross-linking agents, and surface modifiers. The company’s ethyl polysilicate products, such as Silquest A-187, are integral in coatings, adhesives, and sealants. Recently, Momentive reported strong financial performance, with a notable increase in revenue due to the growing demand in the construction and automotive sectors. Momentive continues to focus on product innovation and sustainability to maintain its market leadership.

Zhejiang Xinan Chemical, a major Chinese chemical company, is actively involved in the ethyl polysilicate market. The company manufactures ethyl polysilicate used in various applications like coatings and adhesives. In 2023, Zhejiang Xinan Chemical reported a significant revenue increase, driven by heightened demand in the construction and electronics industries. The company continues to expand its production capacity and invest in new technologies to enhance product quality and meet market needs.

Nangtong Chengua Chemical is a key player in the ethyl polysilicate market, producing high-quality products used as binders and cross-linking agents in various industrial applications, including coatings and adhesives. The company focuses on continuous innovation and sustainability, investing in new formulations to meet market demands. In recent years, they have enhanced their production capabilities to cater to the increasing demand for high-performance materials in sectors like automotive and construction.

Zhangjiagang Longtai Chemical Co., Ltd. is actively involved in the ethyl polysilicate market, offering products that serve as key ingredients in paints, coatings, and adhesives. The company emphasizes innovation and quality, ensuring their products meet the stringent standards required by various industries. Zhangjiagang Longtai continues to expand its market presence by improving its product portfolio and production processes to address the growing global demand for ethyl polysilicate.

YAJIE Chemical is a significant manufacturer in the ethyl polysilicate market, known for its high-quality products used in silicone rubber, coatings, and precision casting. The company has made notable investments in research and development to enhance the performance and sustainability of its products. YAJIE Chemical’s strategic initiatives focus on meeting the rising global demand and maintaining a competitive edge in the specialty chemicals sector.

Zhangjiagang Xinya Chemical Co., Ltd., established in 2009, is a leading manufacturer in the ethyl polysilicate market, producing high-quality ethyl silicate 32 and 40. The company focuses on technological advancements and strict quality control, adhering to ISO9001 standards. Their products are widely used in various industrial applications, including coatings and adhesives. With an annual production capacity of over 5000 metric tons, Zhangjiagang Xinya aims to meet the increasing global demand and maintain a strong market presence through continuous innovation and quality improvement.

Zhejiang Zhengbang Organosilicon Co., Ltd. is a prominent player in the ethyl polysilicate sector, specializing in the production of high-purity ethyl polysilicate products. The company leverages advanced production technologies to ensure the high quality and performance of its products, catering to diverse industrial needs such as coatings, adhesives, and high-purity silica synthesis. Recent developments include the expansion of their production capacity and the introduction of new formulations to enhance product performance and sustainability.

Changzhou Wujin Hengye Chemical Co., Ltd. is actively engaged in the ethyl polysilicate market, providing products crucial for applications in coatings, adhesives, and precision casting. The company emphasizes research and development to improve product quality and meet the evolving demands of the market. Their strategic focus on innovation and sustainability has enabled them to maintain a competitive edge and expand their market reach globally.

Conclusion

In summary, the ethyl polysilicate market demonstrates promising growth potential, driven by its widespread application in the production of paints and coatings, adhesives, and dental materials. Increased investments in infrastructure and rising demand for high-quality dental care are pivotal factors contributing to the expansion of this market.

Furthermore, technological advancements in product formulation are expected to enhance market opportunities. Stakeholders are encouraged to focus on innovation and strategic partnerships to capitalize on the emerging applications of ethyl polysilicate.