Table of Contents

Introduction

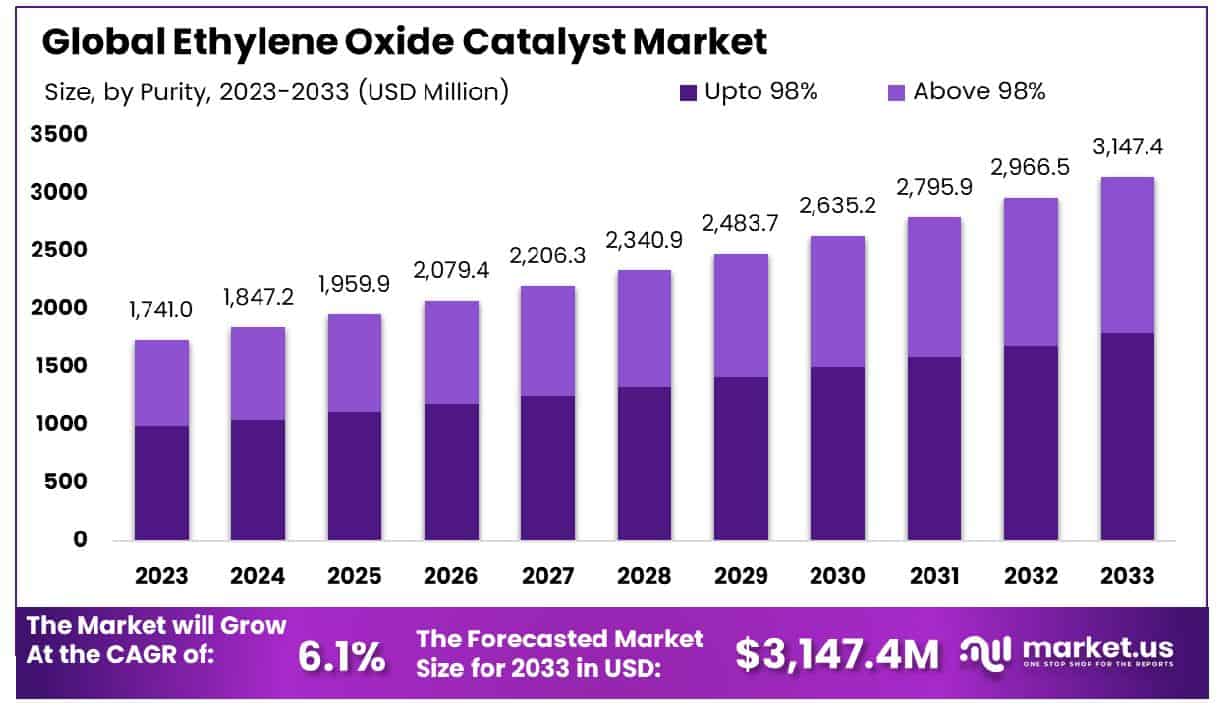

The Global Ethylene Oxide Catalysts Market is poised for significant expansion, forecasted to grow from USD 1,741.0 million in 2023 to approximately USD 3,147.4 million by 2033. This represents a robust compound annual growth rate (CAGR) of 6.1% from 2024 to 2033. Key growth drivers in this market include the increasing demand for ethylene oxide to produce essential derivatives like ethylene glycol, which is widely used in automotive antifreeze and polyester fibers.

However, the market faces challenges such as stringent environmental regulations and the volatility of raw material prices, which could impede growth. Recent developments indicate a focus on innovation, with companies investing in new, more efficient catalyst technologies that minimize byproduct formation and enhance yield, reflecting a trend towards sustainability and efficiency in production processes. These advancements are crucial as they address both environmental concerns and market demand, fostering the potential for sustained growth in the Ethylene Oxide Catalyst market.

AnHui HaiShun Chemical has made headlines with its recent investment in expanding production capacity. This move is aimed at boosting their output to meet the rising global demand for ethylene oxide catalysts, signaling a significant step towards strengthening their market position.

BASF, a leader in chemical innovations, has recently introduced a new generation of catalysts that promise higher selectivity and lower energy consumption. This product launch not only enhances their product portfolio but also aligns with the growing industry emphasis on sustainability and efficiency.

Bayer has entered into a strategic partnership with a technology startup to develop biodegradable catalysts for ethylene oxide production. This collaboration highlights Bayer’s commitment to sustainability and its strategy to innovate through partnerships, aiming to reduce the environmental impact of its production processes.

Corteva has been involved in a merger that consolidates its position in the agriculture sector but also enhances its capabilities in chemical production, including ethylene oxide catalysts. This merger is part of Corteva’s strategy to diversify its offerings and leverage synergies across different sectors.

Element Solutions has secured substantial funding for research into advanced catalyst technologies that are less toxic and more efficient. This funding boost is a testament to the company’s dedication to leading-edge research and development, aimed at meeting the future demands of the market more effectively.

Key Takeaways

- Market Growth: The ethylene oxide catalyst market is projected to grow from USD 1,741.0 million in 2023 to USD 3,147.4 million by 2033, at a 6.1% CAGR.

- Asia-Pacific holds 39.8% of the Ethylene Oxide Catalyst Market, USD 692.9 Mn.

- By Purity: Up to 98% holds 61.2% of the market share.

- By Formulations: Formulations include Technical Material, Wettable Granules, Suspo-Emulsion, and others.

- By Application: Cereals and Grains application dominates with 47% market coverage.

- By End-use: Agriculture constitutes 67.5% of market utilization.

Ethylene Oxide Production Parameters

- The feed composition entering the layer with the epoxidation catalyst is adjusted to 30% ethylene and 8% oxygen corresponding to ethylene-rich conditions adjusted in industrial ethylene oxide production.

- The temperature of the fixed bed was adjusted to a temperature of 240 °C by controlling the temperature of an aluminum heating block containing a heating cartridge.

- The narrow temperature window between 220 and 280 °C imposed by the epoxidation catalyst is an inevitable requirement for a suitable ethanol dehydration catalyst placed as a layer in front of an ethylene epoxidation catalyst layer in the same reactor tube at more or less the same reaction temperature.

- Even after numerous studies aimed at increasing efficiency, the current state-of-the-art EO process produces a large amount of waste CO2, usually 20%-25% of the ethylene raw material.

- In 2019 alone, the United States produced 2.8 million metric tons of Ethylene Oxide (EO) which is projected to increase 3-4% per year over the next decade.

Ethylene Oxide Market Dynamics

- Ethylene glycols (mono-, di-, trimethylene glycol) constitute by far the single-largest outlet for ethylene oxide, accounting for about 65% of the EO market in 2018.

- The molecular weight or molar mass of ethylene glycol is 62.07 grams per mole.

- The density of ethylene glycol is 1.11 grams per centimeter cube.

- The boiling point of ethylene glycol is 197.3°C. The melting point of ethylene glycol is −12.9°C.

- The highest yields of ethylene glycol are at acidic or neutral pH with excess water. Under these conditions, ethylene glycol yields up to 90%.

Economic Aspects of Ethylene Oxide

- The separation of these oligomers and water is an energy-intensive process. About 6.7 million tonnes are produced annually.

- The price of Ethylene Oxide (Europe) rose slightly throughout April 2019, reaching 1,450 USD per metric ton. The price is 2% higher than the average price in the previous month and 0.7% lower than the average price one year before.

- Meanwhile, the average price of Ethylene Oxide (China) amounted to 1,180 USD per metric ton, from 1,710 USD per metric ton one year earlier.

- On a year-over-year basis, the prices of Ethylene Oxide (United States) decreased by 4%.

- The effect on ethylene oxide production of the rate of gas flow through the catalyst bed was determined by making three series of runs at gas flow rates of 12.5, 25, and 50 liters/cm²/hr. respectively.

Ethylene and Its Derivatives

- In 2020, the worldwide ethylene production capacity was 201 million tons, with an expected increase to 263 million tons in 2030.

- Polyethylene is the single-largest outlet, accounting for about 60% of global ethylene consumption in 2020.

- At 300–400°C and complete conversion of ethylene oxide, the selectivity of its conversion to acetaldehyde (SAA) reaches at least 90%.

- The single-pass conversion of ethylene is 20%, and for every 100 moles of ethylene consumed in the reactor, 90 moles of ethylene oxide emerge in the reactor products.

- Most studies have found that the temperature in the range of 240 °C to 280 °C and pressure of 5 MPa to 6 MPa can produce 18 wt% to 64 wt% of MEG.

Emerging Trends

- Increased Efficiency of Catalysts: There is a clear trend towards the development of catalysts that offer higher yields and efficiencies. This includes innovations aimed at increasing the selectivity of ethylene oxide production, reducing unwanted byproducts, and lowering energy consumption. Such advancements not only improve operational cost-effectiveness but also cater to the growing environmental concerns related to chemical manufacturing.

- Focus on Environmental Sustainability: As global regulatory frameworks become stricter regarding environmental impact, the demand for eco-friendly catalysts is rising. This trend is pushing manufacturers to develop catalysts that are less toxic and more biodegradable. The goal is to reduce the ecological footprint of production processes without compromising on efficiency or output quality.

- Advancements in Material Science: The use of new materials and composites in catalysts is an emerging trend. Research in material science is leading to the discovery of innovative materials that can act as catalysts or catalyst supports, offering better performance and durability. These materials are designed to withstand the harsh conditions of ethylene oxide production while maintaining high catalytic activity.

- Integration of Digital Technologies: Digital technologies like artificial intelligence (AI) and machine learning (ML) are beginning to play a role in the optimization of catalyst performance. These technologies are used for predicting catalyst behavior, optimizing production processes, and enhancing the maintenance and lifecycle of the catalysts. This integration leads to smarter, more predictive operations that can dynamically adjust to changing production conditions.

- Regional Production Shifts: There is a noticeable shift in production capacities in regions with growing industrial sectors, such as Asia-Pacific. This region is experiencing rapid industrialization and infrastructure development, leading to increased demand for ethylene oxide and its catalysts. Companies are strategically expanding their presence in these regions to capitalize on local growth opportunities.

Use Cases

- Production of Ethylene Glycol: One of the most significant uses of ethylene oxide is in the production of ethylene glycol, which accounts for approximately 75% of its consumption. Ethylene glycol is a key component in the manufacture of polyester fibers for textiles, polyethylene terephthalate (PET) resins used in packaging, and automotive antifreeze solutions. Efficient catalysts are crucial here to maximize yield and minimize waste and energy consumption.

- Manufacture of Detergents and Surfactants: Ethylene oxide is also used to produce detergents and surfactants, which are components in household and industrial cleaning solutions. Catalysts used in this process ensure that ethylene oxide reacts appropriately to produce the desired products with minimal byproducts, enhancing product quality and reducing the environmental impact.

- Sterilization and Fumigation: Ethylene oxide itself is a potent sterilizing agent used in medical equipment and food packaging industries, where sterility without the use of water or heat is necessary. Catalysts in the production phase of ethylene oxide ensure the availability of pure ethylene oxide necessary for effective sterilization practices.

- Production of Solvents and Other Chemicals: Catalysts enable the production of solvents and a variety of other chemicals such as ethanolamines and glycol ethers, used in industries ranging from pharmaceuticals to paints and coatings. The efficiency of these catalysts directly affects the purity and performance of these chemicals, impacting a wide array of downstream products.

Major Challenges

- Regulatory Compliance: The production of ethylene oxide is tightly regulated due to its potential environmental and health hazards. Catalysts must not only be efficient but also compliant with increasingly stringent global environmental regulations. For instance, the U.S. Environmental Protection Agency (EPA) and the European Union have set strict limits on emissions from ethylene oxide production facilities. Meeting these standards requires continuous investment in R&D to develop catalysts that minimize emissions and byproducts.

- Raw Material Volatility: The cost and availability of raw materials necessary for producing ethylene oxide catalysts, such as silver and other precious metals, are subject to significant market fluctuations. For example, the price of silver, a key component in many catalysts, can vary widely due to economic, geopolitical, or trade factors, impacting the overall cost-effectiveness of catalyst production.

- Technological Advancements: Keeping pace with rapid advancements in catalyst technology presents a challenge. As new materials and techniques become available, manufacturers must continuously invest in updating their products and processes. This requires substantial capital investment and can strain resources, especially for smaller players in the market.

- Operational Hazards: Ethylene oxide is highly reactive and flammable, making its production a high-risk operation. Catalyst systems must be designed to not only be highly efficient but also extremely safe. Incidents related to ethylene oxide can lead to severe repercussions, both financially and in terms of human safety. For instance, any leakage or malfunction during the production process can lead to catastrophic outcomes, including explosions or severe environmental damage.

- Market Competition: The global market for ethylene oxide catalysts is competitive, with numerous players striving for technological and market leadership. Companies must differentiate themselves through technological innovations, cost-effectiveness, and comprehensive service offerings to maintain and grow their market share.

Market Growth Opportunities

- Expansion in Emerging Markets: There is significant growth potential in emerging markets, particularly in Asia-Pacific regions like China and India, where industrial growth is accelerating. These regions are seeing an increase in demand for polyester products for textiles and PET for packaging, both of which rely on ethylene glycol produced using ethylene oxide. Establishing production facilities or distribution channels in these areas can provide catalyst manufacturers with access to new, fast-growing markets.

- Innovations in Catalyst Efficiency: There is an ongoing demand for catalysts that are more efficient, cost-effective, and environmentally friendly. Investing in research and development to create catalysts that yield higher ethylene oxide outputs with fewer byproducts and lower energy consumption can give companies a competitive edge. For example, advancements that reduce silver content or utilize alternative materials could reduce costs and attract customers seeking sustainable production solutions.

- Integration of Advanced Technologies: Employing advanced technologies such as artificial intelligence and machine learning to optimize catalyst performance and production processes presents a significant opportunity. These technologies can help in predicting equipment failures, optimizing catalyst life, and enhancing overall production efficiency. Companies that integrate these technologies into their operations can improve yield and reduce downtime, leading to better profitability.

- Strategic Alliances and Acquisitions: Forming strategic alliances or acquiring smaller companies with innovative technologies or market presence in untapped regions can provide significant growth opportunities. Such moves can enable companies to quickly scale their operations, enhance their product portfolios, and gain immediate access to new markets or technologies.

Key Players Analysis

BASF, a leading global company, has significantly expanded its production capabilities in the ethylene oxide sector at its Antwerp site, investing over €500 million to enhance output by 400,000 metric tons annually. This expansion supports growing demand across several industries, including home care and industrial applications. BASF has also introduced the innovative CircleStar™ catalyst, which offers high selectivity and efficiency in converting ethanol to ethylene, significantly reducing the carbon footprint of this process.

Bayer is actively engaged in the Ethylene Oxide Catalyst sector, focusing on catalyst formulations and applications that support various industrial needs, particularly in agriculture. Their catalysts are tailored for efficiency and high-grade applications in sectors where quality is critical.

Corteva, Inc. has initiated “Corteva Catalyst,” a novel investment and partnership platform aimed at advancing agricultural innovations that align with the company’s research and development priorities to foster value creation. This initiative seeks to expedite the growth of early-stage, transformative technologies that enhance sustainable agricultural practices. Through collaborations with startups and academic institutions, Corteva Catalyst is positioned to leverage Corteva’s extensive R&D capabilities and global reach, fostering innovative solutions directly to the agricultural sector.

AnHui HaiShun Chemical Co., Ltd., a key player in the Ethylene Oxide Catalyst sector, specializes in the manufacture and sale of chemical products. Their work primarily focuses on leveraging innovative catalyst technologies to enhance production efficiency and output quality. This positions them strategically within the market, catering to both domestic and international chemical industries.

Element Solutions has not specifically disclosed involvement in the ethylene oxide catalyst sector. Their operations focus on providing specialty chemical products and technical services across various industries such as consumer electronics, automotive, and industrial surface finishing.

Gowan, a global agricultural company, does not specifically engage in the Ethylene Oxide Catalyst sector directly. Instead, their focus is on developing and marketing agricultural inputs such as crop protection products, seeds, and fertilizers, which do not involve the ethylene oxide catalyst market directly.

Junkai (Tianjin) Chemical, a high-tech enterprise, is actively involved in the ethylene oxide catalyst sector, showcasing significant engagement in this market alongside its primary focus on agrochemicals and fine chemicals. The company’s participation in this sector emphasizes its commitment to advancing chemical technologies and serving diverse industrial needs.

ISAGRO will utilize Shell’s S-896 catalyst for ethylene oxide production starting in September 2022. This initiative is part of their strategy to enhance selectivity and reduce CO2 emissions, aligning with both sustainability and economic efficiency goals.

Hangzhou Weiyuan Chemical, featured prominently in the Ethylene Oxide Catalyst sector, plays a significant role, especially in Asia-Pacific. This company contributes dynamically to the market by tailoring solutions to meet regional industrial needs and address unique environmental and operational requirements.

Indofil is not directly involved in the Ethylene Oxide Catalyst sector. Their primary focus lies in manufacturing and marketing agricultural chemicals, including crop protection products and specialty chemicals, rather than engaging in the production or development of ethylene oxide catalysts.

Kaimei Taike (Tianjin) Chemical Technology has significantly contributed to the ethylene oxide catalyst sector, actively participating in market growth. In 2023, the company was involved in the ethylene oxide market which saw a substantial capacity increase, enhancing overall production efficiency and supporting industrial demands.

Nufarm operates in the ethylene oxide catalyst sector by choosing Shell Catalysts & Technologies for its Shell S-896 catalyst, enhancing economic outcomes through raw material savings and assisting in achieving decarbonization targets in their Osaka refinery. This selection underscores the ongoing advancements in catalyst technologies aimed at improving efficiency and environmental sustainability within the industry.

Sumitomo Chemical enhances its position in the ethylene oxide catalyst sector by licensing innovative technologies through partnerships, like with Lummus Technology. This collaboration focuses on the circular economy and polyolefin technologies, aiming to deliver environmentally friendly solutions and achieve carbon neutrality.

Syngenta is enhancing its presence in the Ethylene Oxide Catalyst sector, focusing on the production of ethylene oxide through direct contact of ethylene and oxygen over silver catalysts. Their proprietary SynDox® Ethylene Oxide Catalysts, known for high performance, are pivotal in meeting operational targets and maximizing profitability across the EO industry. These catalysts are especially recognized for their role in supporting a third of the global ethylene oxide output, marking significant contributions to the industry.

UPL actively engages in the Ethylene Oxide Catalyst sector, focusing on the development and production of high-performance catalysts. Their work includes enhancing ethylene oxide production efficiency and sustainability, reflecting an industry trend toward optimizing catalyst selectivity and operational savings.

Vesino Industrial is engaged in the Ethylene Oxide Catalyst market, contributing to the sector with their specialized catalysts that are crucial for producing ethylene oxide, a compound used across various industries including pharmaceuticals and textiles. The company’s participation in this market is marked by its commitment to enhancing catalyst efficiency and supporting sustainable industrial practices.

Wuxi City Jia Bao Pharmaceutical is actively participating in the ethylene oxide catalyst sector, a field that has experienced significant growth recently. The company is involved in this industry segment, contributing to advancements in catalyst technology, which is crucial for improving efficiency and environmental sustainability in ethylene oxide production.

Conclusion

The market for ethylene oxide catalysts is positioned for sustained growth, driven by the increasing demand for ethylene oxide in various industrial applications, including the production of antifreeze, detergents, solvents, and plastics. Advances in catalyst technology are enhancing efficiency and reducing environmental impact, presenting significant opportunities for industry participants.

However, market players must navigate regulatory challenges and potential volatility in raw material prices. Staying informed of technological advancements and maintaining adaptive strategies will be crucial for stakeholders aiming to capitalize on emerging opportunities in this dynamic market.