Introduction

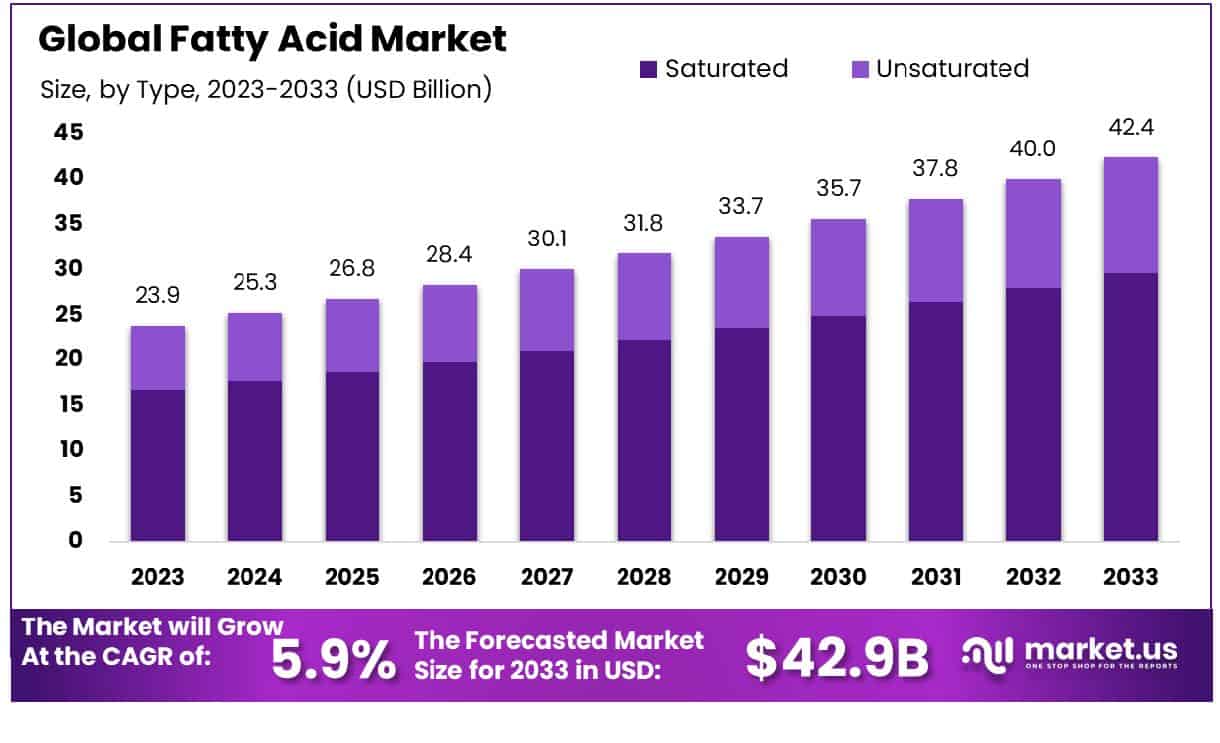

The Global Fatty Acid Market is poised for significant expansion, projected to grow from USD 23.9 billion in 2023 to USD 42.4 billion by 2033, at a compound annual growth rate (CAGR) of 5.9%. This growth is primarily driven by increasing demand in various industries such as food, cosmetics, and pharmaceuticals, where fatty acids are valued for their nutritional and preservative qualities.

However, the market faces challenges, including stringent regulatory frameworks concerning product safety and environmental impact, which could impede growth. Recent developments in the industry have focused on sustainable and efficient production methods, responding to global demand for environmentally friendly products. These advancements, along with strategic partnerships and technological innovations within the sector, are pivotal in overcoming existing challenges and fueling the market’s growth trajectory.

Akzo Nobel has been focusing on expanding its bio-based products line, introducing new fatty acids derived from renewable sources. This initiative not only caters to the growing consumer preference for sustainable products but also aligns with global environmental regulations.

Arizona Chemicals, a leader in the production of naturally derived fatty acids, recently enhanced its production capacity by 20% to meet increasing demand in the adhesives and coatings sectors. This expansion underscores the company’s commitment to maintaining a competitive edge in high-growth markets.

Ashland Inc. has launched a new range of specialty fatty acids aimed at the personal care sector. These products, designed to improve skin hydration and elasticity, are a response to consumer demand for high-performance, natural cosmetic ingredients.

BASF SE recently acquired a smaller chemicals company, expanding its portfolio of fatty acids used in high-performance lubricants. This acquisition not only increases BASF’s production capabilities but also broadens its foothold in the automotive and industrial sectors.

Key Takeaways

- Market Growth: The Global Fatty Acid Market is projected to grow from USD 23.9 billion in 2023 to USD 42.4 billion by 2033, with a CAGR of 5.9%.

- Asia-Pacific leads Fatty Acid Market at 43.5%, valued at USD 10.4 billion.

- By Type: Unsaturated fatty acids dominate the market at 70.2%.

- By Source: Animal sources contribute 59.7% to the fatty acid market.

- By Form: Oil form leads to fatty acid types, comprising 51.2%.

- By Length of Chain: Medium-chain fatty acids represent 51.2% of the market.

- By End-use: Food & Beverage end-use stands at 33.3% market share.

Fatty Acid Market Statistics

- There are fatty acids with 2 to 30 carbon atoms or more, but the most common and important ones have 12 to 22 carbon atoms and are found in many different animal and plant fats.

- Short-chain fatty acids: up to 6 carbon atoms

- Medium-chain fatty acids: 8 to 12 carbon atoms.

- Long-chain fatty acids: 14 to 18 carbon atoms

- Very long-chain fatty acids: 20 carbon atoms and up.

- The American Heart Association recommends that people limit their intake of saturated fats to 5% to 6% of their caloric intake and their intake of trans fats to less than 1%.

- It’s an essential part of the cell membrane, with roughly 20% to 30% of the phospholipids found in the cell membrane containing palmitic acid.

- Long-chain fatty acids are those that have 13 to 21 carbon atoms. Palmitic acid makes up around 20% to 30% of your body’s total fatty acid content. In the U.S., palmitic acid accounts for around 60% of the total saturated fatty acid intake.

- Intake of Trans-fatty acids (TFA) over 1% of total dietary energy per day is associated with an increased risk of ischemic heart disease events and mortality.

- Worldwide in 2019, 645 thousand ischemic heart disease deaths were attributable to diets high in trans-fatty acids, and 109 thousand occurred in the Region of the Americas.

- Less than 20% of the world’s population achieves the minimum intake of eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA) recommended by most expert bodies.

- Made from fermented non-GMO micro-algae, life’s™OMEGA is around 85% more potent than omega-3 derived from fish oils.

- The inclusion of Ca-PFA in the diet did not affect the saturated fatty acids (p>0.05) but showed a significant effect on unsaturated fatty acids and omega-3 fatty acids (p<0.05). Body fat distribution was not affected by the inclusion level of Ca-PFA at a level of 15%.

- Peanut is an important food crop grown in over 100 countries with a total production of 38 million tons in 2010.

- Peanut seeds are a rich source of oil (48 to 50%), protein (25 to 28%), vitamins and minerals.

- The study analyzed data on blood fatty acid levels in 2,240 people over the age of 65, who were monitored for an average of eleven years.

- Fatty acids yield the most ATP per gram compared to other macronutrients when completely oxidized, generating about 9 kcal (37 kJ) per gram. This is much higher than the 4 kcal (17 kJ) per gram for carbohydrates.

- The human body stores fat reserves averaging 10-20 kg, while only storing about 400 g of glycogen, with 300 g locked in skeletal muscles.

Emerging Trends

- Sustainable Sourcing: There is a growing trend towards the sustainable sourcing of fatty acids, particularly those derived from plant-based and waste materials. This shift is in response to increasing consumer awareness about environmental impact and a preference for products that are both eco-friendly and renewable. Companies are investing in R&D to tap into sources like algae and used cooking oils, which do not compete with food crops and offer a reduced carbon footprint.

- Technological Advancements in Production: Technological innovations are enabling more efficient processing of fatty acids, reducing energy consumption, and improving yield. Advanced enzymatic processes and fermentation technologies are being developed to enhance the extraction and purification of fatty acids. These advancements not only improve the environmental profile of production processes but also reduce costs, making plant-derived fatty acids more competitive with traditional sources.

- Functional and Specialty Fatty Acids: There is an increasing demand for functional and specialty fatty acids in various industries such as pharmaceuticals, nutraceuticals, and cosmetics. These fatty acids are tailored for specific health benefits, like anti-inflammatory properties or improved mental health, which cater to the growing health-conscious consumer base. Innovations in this area often involve modifying fatty acid profiles to enhance specific functional properties.

- Regulatory Influence: Regulatory bodies across the globe are imposing stricter guidelines on the sourcing and manufacturing of fatty acids, especially concerning sustainability and traceability. This regulatory environment is prompting companies to adapt their sourcing strategies and invest in cleaner technologies. As a result, compliance with these regulations is becoming a competitive advantage in the marketplace.

Use Cases

- Nutritional Supplements: Fatty acids are integral components of dietary supplements. Omega-3 and Omega-6 fatty acids are commonly incorporated into products aimed at improving heart health, reducing inflammation, and enhancing brain function. The global market for omega-3 supplements has shown robust growth, with consumer awareness of health benefits driving the demand.

- Pharmaceuticals: Fatty acids play a crucial role in the pharmaceutical industry. They are used in the formulation of drugs that treat a variety of conditions, such as high cholesterol, arthritis, and depression. The utilization of omega-3 fatty acids in pharmaceuticals is expanding, as research continues to reveal their therapeutic properties.

- Food Industry: In the food industry, fatty acids are used as food additives to enhance texture, taste, and preservation qualities. They are also employed in the production of cooking oils and fats. The trend towards healthier eating has increased the use of polyunsaturated and monounsaturated fatty acids in food products.

- Cosmetics and Personal Care: Fatty acids are key ingredients in the cosmetics sector, particularly in skin and hair care products. They help moisturize and improve skin elasticity, making them popular in anti-aging products. The market for natural cosmetic products is growing, which in turn boosts the demand for natural fatty acids derived from plant sources.

- Animal Nutrition: Fatty acids are essential in animal feed, contributing to better growth, health, and coat quality in animals. The pet food industry, particularly, invests significantly in adding value through nutritional enhancements, including fatty acids to support overall pet health.

- Industrial Uses: Fatty acids find applications in various industrial processes. They are used in the manufacture of soaps, detergents, and lubricants. The industrial sector demands consistent and scalable sources of fatty acids, with sustainability being a key concern in sourcing practices.

Key Players Analysis

AkzoNobel has ceased merchant sales of fatty acids in China, closing two of its three production facilities in Binzhou, resulting in 200 job cuts. This decision is part of a strategic shift in their operations, as the company aims to streamline its business and enhance sustainability practices. Notably, AkzoNobel has been integrating advanced technologies in its other global facilities to boost manufacturing efficiency and innovation.

Arizona Chemicals, a key player in the fatty acid sector, specializes in deriving these acids from tall oil, a by-product of the wood pulping process. The company is particularly noted for its production facilities in the southeastern U.S., where it processes tall oil into fatty acids in products like paints and printing inks. These fatty acids are valued for their ability to replace more volatile organic compounds in various applications, aligning with industry trends toward more sustainable and environmentally friendly products.

Ashland Inc. is actively involved in the fatty acid sector, focusing on optimizing its portfolio and improving profitability in this area. The company’s strategy includes strengthening its core businesses through targeted actions aimed at enhancing margins and overall financial performance.

BASF SE is a prominent player in the fatty acid market, strategically expanding its product offerings to meet the rising demand for sustainable and high-performance ingredients. The company focuses on developing innovative fatty acid derivatives like polyglycerol fatty acid esters, utilized in various applications including personal care products. These developments are part of BASF’s broader commitment to sustainability and innovation within its care chemicals portfolio.

Cargill Incorporated plays a significant role in the fatty acid sector by providing a diverse range of vegetable-based fatty acids. These products are primarily used in various industrial applications including coatings and lubricants. Cargill’s fatty acids are noted for their versatility and renewable sourcing, aligning with industry demands for sustainable and efficient solutions.

Croda International Plc is a significant player in the fatty acid sector, focusing on producing high-quality lipids and surfactants, including essential fatty acids like Omega-3 and Omega-6. These products are integral to a wide range of applications in personal care products, emphasizing Croda’s commitment to delivering specialty chemicals that cater to both industrial needs and consumer health.

Dow is recognized as a major player in the global fatty acids market, which is valued significantly and expected to continue growing. The company is involved in the production and sales of various chemical products, including those in the fatty acids segment, contributing to a wide range of industrial applications. Dow’s commitment to sustainability is evident in its extensive initiatives aimed at advancing environmental and social goals, which aligns with the broader industry trend towards sustainable and responsible production practices.

Eastman Chemical Company is actively engaged in the fatty acid sector, primarily through its Additives & Functional Products segment. This segment produces a variety of specialty chemicals, including amine derivative-based building blocks and organic acid-based solutions, which are integral to numerous industrial applications. Eastman’s work in this sector supports industries ranging from personal care to agriculture, highlighting its role in producing essential components for a diverse range of products.

Koninklijke DSM NV is actively involved in the fatty acid sector, particularly through innovations like Veramaris® algal oil, which offers a sustainable alternative to fish oil. This product is rich in omega-3 fatty acids, essential for human and animal health, and represents a significant step towards reducing the environmental impact of traditional fish oil production. DSM’s approach aligns with its broader commitment to sustainability and health, utilizing bioscience to address nutritional needs while minimizing ecological footprints.

Oleon N.V. specializes in transforming natural fats and oils into a wide array of oleochemical products like fatty acids, glycerine, and esters. As a leader in oleochemistry, Oleon focuses on sustainability and the efficient use of renewable raw materials. Their commitment to environmental stewardship is evident in their adoption of sustainable practices and products that support a net-zero carbon economy. Oleon’s innovations in oleochemicals are driven by a desire to provide high-performance, biodegradable solutions across various industries.

Wilmar International Ltd. plays a significant role in the fatty acid sector, specializing in producing various fatty acids derived from palm oil and palm kernel oil. Their products, which are processed under high temperature and pressure, cater to a broad range of applications including rubber processing, cosmetics, and as feedstock for producing derivatives like soap and metallic soaps. Wilmar’s approach emphasizes versatility in product offerings, ensuring they meet diverse customer requirements through both broad cuts and more refined fatty acid products. This capability underlines their strong position in the global market as a provider of essential oleochemicals.

Musim Mas is significantly involved in the fatty acid sector, producing a wide range of fatty acids under the MASCID™ brand. These fatty acids are extensively used in various industries, serving as raw materials for antimicrobial pesticides and chemical synthesis. The company emphasizes sustainable practices in its production processes, aligning with global sustainability standards.

VVF Ltd. is India’s largest producer and exporter of high-quality distilled fatty acids, leveraging 100% vegetable-based renewable feedstocks like palm and rapeseed oils. The company offers a broad spectrum of specialty fatty acids including Caprylic, Capric, Lauric, Myristic, Palmitic, Stearic, Oleic, Erucic, and Behenic. VVF is recognized for its technological prowess and capacity to produce tailored products for diverse industrial needs ranging from personal care to lubricants and metal soaps, underpinning its global leadership in the oleochemical sector.

Permata Hijau Group (PHG), established in 1984, is actively engaged in the fatty acid sector with a recently added 200,000 tonnes plant in Medan, Indonesia. This expansion aligns with their comprehensive approach across the palm oil value chain, from plantation to refined products, emphasizing sustainability and integrated operations. PHG’s commitment to environmental and social responsibilities is underscored by its continuous efforts to produce value-added products for global distribution.

Godrej Industries is a significant player in the fatty acid sector, with a strong focus on manufacturing a variety of C16 and C18 fatty acids. Their products find diverse applications across several industries including textiles, rubber, polymers, pharmaceuticals, foods and feeds, and personal care products. They have also diversified into high-purity specialty fatty acids like Behenic and Erucic acids, derived from mustard oil, which cater to specific industrial needs. The company has a longstanding presence in the chemical industry, demonstrating a commitment to innovation and sustainability in its operations.

Conclusion

Fatty acids are pivotal in a myriad of industries, from healthcare and nutrition to cosmetics and industrial applications. Their diverse functionalities and health benefits drive their widespread use and growing demand across global markets. As consumer preferences increasingly lean towards health-conscious and sustainable products, the role of fatty acids is expected to expand further.

Industries are continually adapting to integrate fatty acids more effectively, responding to consumer demands and regulatory standards. This ongoing adaptation and increased utilization highlight the significant and growing impact of fatty acids on both market trends and product innovations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)