Table of Contents

Introduction

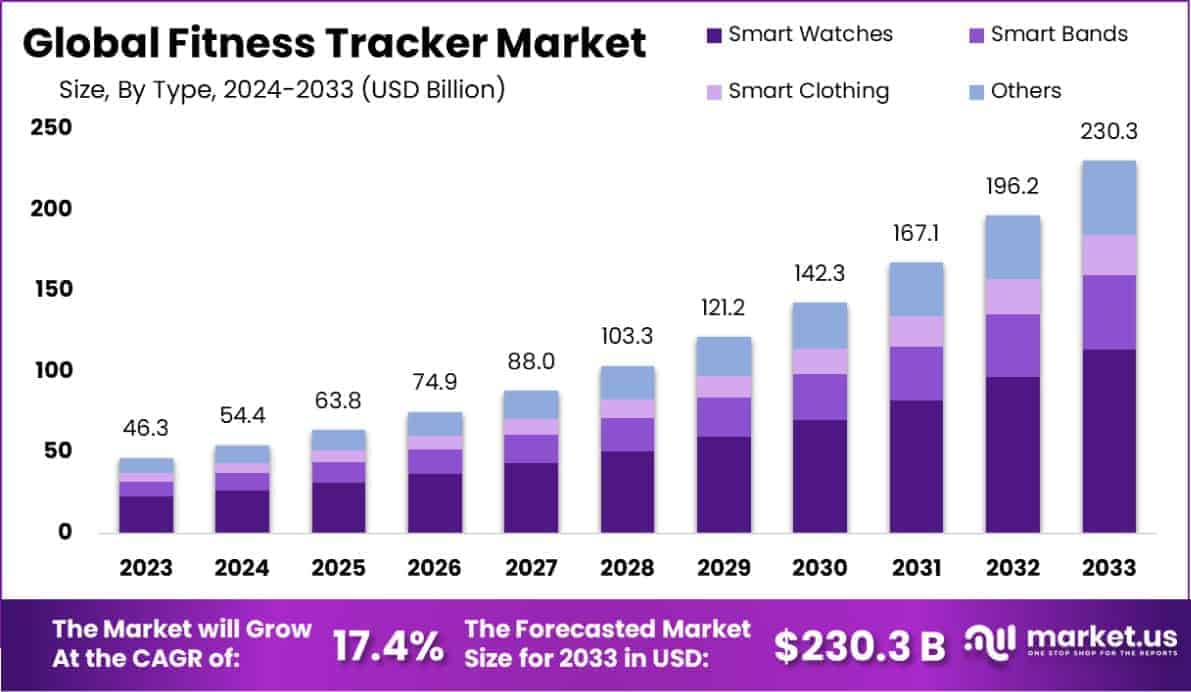

The Global Fitness Tracker Market is projected to grow significantly, with an estimated value of USD 230.3 billion by 2033, up from USD 46.3 billion in 2023. This reflects a robust compound annual growth rate (CAGR) of 17.4% over the forecast period from 2024 to 2033.

A fitness tracker is a wearable device or application designed to monitor and track physical activity, fitness-related metrics, and health data such as steps taken, heart rate, calories burned, sleep patterns, and more. These devices leverage advanced sensors and algorithms to provide real-time feedback and analytics, helping users achieve their fitness goals and maintain an active lifestyle. Fitness trackers have become integral tools in promoting health awareness and facilitating preventive care through personalized health insights.

The fitness tracker market encompasses the production, distribution, and sale of wearable devices designed to monitor health and fitness metrics. This market includes a variety of products such as wristbands, smartwatches, clip-on devices, and even integrated applications. It caters to a broad consumer base, including fitness enthusiasts, individuals with health conditions, and professionals seeking to improve overall well-being. The market is characterized by technological innovation, with leading brands competing on features such as accuracy, durability, and user experience. The growing integration of fitness trackers with smartphone applications and healthcare ecosystems has expanded its relevance beyond fitness into broader health and wellness applications.

The fitness tracker market has witnessed robust growth, driven by several factors. Rising health consciousness among consumers and the global emphasis on fitness and well-being have fueled demand. Advances in sensor technologies, AI-powered analytics, and smartphone integration have enhanced the functionality and appeal of these devices. Additionally, the increasing prevalence of lifestyle-related diseases such as obesity and diabetes has encouraged individuals to adopt fitness trackers for preventive health monitoring. Corporate wellness programs and partnerships between wearable manufacturers and healthcare providers are further propelling market growth by driving adoption at organizational and institutional levels.

Demand for fitness trackers is being driven by both consumer and professional segments. Among consumers, younger demographics, particularly millennials and Gen Z, are adopting these devices for fitness tracking and lifestyle management. Older generations, on the other hand, value the health monitoring capabilities, particularly heart rate tracking and sleep analysis. The demand surge is also apparent in professional sectors such as sports, healthcare, and insurance, where fitness trackers are used to monitor performance, track recovery, and incentivize healthy behavior. The affordability of entry-level devices alongside premium offerings ensures a diverse market appeal.

The fitness tracker market offers numerous growth opportunities, particularly in emerging economies where rising disposable incomes and increasing smartphone penetration are creating a fertile ground for wearable adoption. Integration with telemedicine platforms and healthcare systems presents another untapped potential, allowing fitness trackers to act as diagnostic tools and enhance patient care. The burgeoning interest in mental health tracking, such as stress monitoring, also provides opportunities for innovation. Additionally, the rise of eco-friendly and sustainable devices is likely to attract environmentally conscious consumers, paving the way for product differentiation and new revenue streams.

Key Takeaways

- The global fitness tracker market is projected to reach approximately USD 230.3 billion by 2033, up from USD 46.3 billion in 2023, growing at a CAGR of 17.4% from 2024 to 2033.

- In 2023, smartwatches led the market, capturing 49.3% of the share in the product category.

- Running tracking emerged as the leading application in the fitness tracker market in 2023, holding a 23.5% share.

- Online sales dominated the distribution channel segment in 2023, accounting for 65.2% of the market share.

- North America was the largest regional market in 2023, holding 43.2% of the global share, contributing USD 20.0 billion in revenue.

Fitness Tracker Statistics

- In 2023, 45% of Americans owned a wearable fitness tracker or smartwatch, with Apple Watches making up 20% and Fitbit devices accounting for 16%.

- Household incomes between $75,000 and $90,000 showed 58% higher likelihood of owning a fitness tracker compared to incomes of $35,000 or less.

- Around 69% of Americans expressed interest in wearing fitness trackers to receive discounted health insurance.

- Approximately 93% of wearable device owners use them to track health data and manage stress effectively.

- Fitness trackers were pivotal in achieving health goals for 88% of users, demonstrating their effectiveness in lifestyle improvements.

- Users of wearable fitness trackers reported a 48% increase in daily steps and a 34% rise in exercise levels and calories burned.

- Owners of fitness devices exercised 4.3 days per week on average, compared to 3 days for those without devices.

- Health, sleep quality, and stress management ratings averaged 3.5 out of 5 among fitness tracker users, slightly better than non-users at 3.3.

- Women are 38.88% more likely to use fitness trackers than men, with 25% of women responding positively compared to 18% of men.

- Women under 55 years are the most frequent users of fitness trackers, while men over 55 are the least likely to use them.

- Among Americans, 31% of those earning over $75,000 annually use fitness trackers, compared to only 12% earning $30,000 or less.

- Nearly 42% of fitness tracker owners have discussed their tracked health data with healthcare providers.

- Fitness tracker owners tend to focus on tracking stress management (30%), exercise routines (27%), nutrition and diet (26%), and daily accumulated steps (24%).

- Around 34% of Americans have tried using fitness trackers such as Apple, Garmin, or Fitbit devices for monitoring their health and fitness.

- An additional 32% have used smartphones or tablets for health and fitness tracking purposes.

- Approximately 19% of Americans combine wearable fitness trackers with cellphone health and fitness apps.

- Over 60% of gym-goers used technology to enhance their workouts, reflecting widespread integration of fitness tracking in physical activities.

- Fitness app users who engaged three times weekly retained usage rates above 40%, showcasing the appeal of regular tracking.

- About 72% of fitness app users stated these tools motivated them to achieve daily physical activity goals.

- Gen Z (70%), Millennials (57%), and women (51%) are the primary demographics owning fitness trackers in the United States.

Emerging Trends

- Integration of Advanced Health Monitoring Features: Modern fitness trackers are expanding beyond basic activity tracking to include sophisticated health metrics such as heart rate variability, blood oxygen saturation, sleep patterns, and stress levels. This trend aligns with the growing consumer demand for comprehensive health monitoring solutions that provide actionable insights for improving overall well-being.

- Expansion into Healthcare and Corporate Wellness Programs: There is a growing demand for wearable devices, including fitness trackers, to promote health monitoring and physical activity among populations. This expansion into healthcare and corporate wellness programs presents a significant opportunity for growth in the fitness tracker market.

- Rising Adoption of Wearable Technology: The popularity of wearable fitness trackers is increasing, with the market expected to grow in the coming years. This trend is driven by the increasing importance of health and fitness among consumers.

- Integration with Digital Health Platforms: Fitness tracker manufacturers are increasingly collaborating with digital health platforms to enhance user experience and provide more comprehensive health monitoring solutions. This integration allows for better data analysis and personalized health recommendations.

- Focus on Preventive Healthcare: There is a growing emphasis on preventive healthcare, with consumers seeking tools to monitor and manage their health proactively. Fitness trackers serve as valuable tools for tracking physical activity, setting fitness goals, and measuring progress, thereby motivating users to adopt healthier habits and lifestyles.

Top Use Cases

- Casual Fitness Tracking: A significant majority of users, approximately 61%, utilize fitness trackers to monitor daily activities such as step counts and general movement. This feature promotes increased physical activity and awareness of personal fitness levels.

- Health and Well-being Monitoring: Around 57% of users employ fitness trackers to monitor health metrics, including heart rate, sleep patterns, and stress levels. These insights enable individuals to make informed lifestyle adjustments to enhance overall well-being.

- Notification Management: Fitness trackers serve as convenient tools for managing notifications, with 59% of users checking messages, calls, and alerts directly on their devices. This functionality helps users stay connected without constantly accessing their smartphones.

- Alarms and Reminders: Approximately 52% of users set alarms and reminders on their fitness trackers, aiding in time management and ensuring adherence to daily schedules and commitments.

- Music Control and Playback: About 32% of users control music playback through their fitness trackers, enhancing the convenience of managing audio entertainment during workouts or daily activities.

Major Challenges

- Data Privacy and Security Concerns With fitness trackers collecting sensitive personal health data, concerns over data privacy and security are rising. The devices track critical information such as heart rate, sleep patterns, and even glucose levels, making them attractive targets for cyberattacks. The risks of unauthorized data access, data leaks, or misuse have become significant hurdles. For instance, in 2023, security concerns were highlighted by incidents where connected devices suffered breaches, raising questions about the reliability of cloud-based storage and the robustness of security protocols. As consumers become more aware of these risks, manufacturers must invest heavily in securing user data to maintain trust.

- High Product Costs and Affordability Fitness trackers, especially those with advanced features like smartwatches, come with premium price tags, limiting their accessibility. For instance, in 2023, smartwatches dominated the market with a share of 49.3%, yet many consumers are still hesitant to invest in such high-cost devices. While lower-cost smart bands are an alternative, they often lack advanced functionalities, further limiting their appeal. As the market matures, balancing affordability with advanced features remains a key challenge for manufacturers seeking to capture a broader consumer base.

- Limited Battery Life and Charging Inconvenience Despite advancements in technology, many fitness trackers still face the challenge of limited battery life, particularly for devices that include features like GPS tracking or continuous heart rate monitoring. In 2023, a substantial number of trackers required frequent charging, with battery life ranging from 1 to 5 days on average. This limitation not only reduces user convenience but also impacts device performance, as many users seek wearables that offer more extended use without constant recharging. Overcoming this challenge requires continuous innovation in battery technology and energy-efficient sensors.

- Consumer Reluctance to Adopt Health Monitoring Features While fitness trackers are popular for basic functions like step counting and running tracking, more advanced health monitoring features (e.g., glucose monitoring, ECG, or stress tracking) have faced slow adoption. In some regions, consumer skepticism about the accuracy and reliability of these health metrics hinders widespread use. Additionally, some consumers do not perceive the need for features such as glucose monitoring unless they have pre-existing conditions. Overcoming these barriers will require manufacturers to focus on educating consumers and improving the functionality and trustworthiness of these features.

- Intense Market Competition and Product Differentiation The fitness tracker market is highly competitive, with major players like Apple, Fitbit, and Xiaomi continually launching new products . As of 2023, the market was fragmented with no single dominant player in terms of market share. This competition intensifies the need for brands to differentiate themselves through unique features, design, or pricing strategies. However, achieving differentiation is becoming increasingly challenging as the feature set of devices across brands becomes more standardized. As the market grows, smaller or new entrants must offer truly innovative solutions to carve out a niche, while established players must continuously innovate to maintain their leadership.

Top Opportunities

- Expanding Preventive Healthcare Demand : As health-consciousness increases globally, particularly in emerging markets like China and India, the demand for fitness trackers as tools for preventive healthcare is growing. These devices are pivotal in monitoring key health metrics such as heart rate, blood oxygen levels, and sleep patterns, which support early detection of diseases and promote healthier lifestyles. The rise of chronic conditions like diabetes and cardiovascular disease, particularly in aging populations, is further driving this demand.

- Technological Advancements in Biometric Features: The incorporation of advanced biometric capabilities, such as continuous glucose monitoring, advanced sleep tracking, and ECG features, is significantly enhancing the appeal of fitness trackers. This trend is especially evident in markets like the United States and Europe, where consumers are increasingly seeking more comprehensive health data. These innovations not only expand the scope of fitness trackers but also align them with medical-grade monitoring, which appeals to a broader demographic.

- Growth in Digital and E-Commerce Channels : Online distribution of fitness trackers is experiencing robust growth due to increasing internet penetration and the convenience of e-commerce. The shift toward digital shopping has accelerated in regions like India, where over 75% of smartwatches and fitness trackers are now sold online. This trend presents opportunities for manufacturers to reach a global audience with lower distribution costs, while consumers benefit from a wider product selection and competitive pricing.

- Integration with Smart Health Ecosystems : The trend of integrating fitness trackers with broader smart health ecosystems, such as home healthcare devices and mobile health apps, is transforming them into central components of personal health management. These ecosystems allow for real-time health tracking, data storage, and actionable insights, which are particularly attractive to tech-savvy consumers. This integration also facilitates seamless updates and synchronization across devices, driving repeat purchases and enhancing customer loyalty.

- Emerging Markets with Younger Demographics: Emerging markets, particularly in the Asia Pacific region, offer substantial growth potential due to the large, tech-savvy, and fitness-oriented younger populations. In countries like India, where 60% of the population is under 35 years old, there is a strong inclination toward adopting wearable fitness technology for tracking personal health and fitness goals. As these regions embrace digital lifestyles, fitness trackers are becoming a staple in youth culture, presenting long-term growth opportunities for manufacturers.

Key Player Analysis

- Apple Inc.: Apple continues to lead the fitness tracker market with its Apple Watch series. The company’s market share in wearable devices was approximately 30% in 2023. Apple’s innovation in health-focused features, such as ECG monitoring and blood oxygen levels, has propelled its dominance. Their continuous integration of advanced AI for health tracking and new features, like a sleep tracker and fitness coaching, strengthens their position.

- Fitbit Inc.: Fitbit, now a part of Google, holds a significant share of the fitness tracker market. It contributed to around 12% of the global wearable market share in 2023. Known for its health-centric features like heart rate tracking, sleep monitoring, and workout modes, Fitbit’s devices appeal to a wide demographic, from fitness enthusiasts to individuals monitoring chronic health conditions.

- Garmin Ltd. : Garmin, renowned for its GPS-based fitness tracking, is a leading competitor in sports and fitness devices, accounting for a 10-12% market share in 2023. Garmin’s devices, such as the Forerunner and Fenix series, are especially popular among athletes, offering robust features like VO2 max, pace tracking, and advanced cycling and running metrics. Garmin’s emphasis on rugged, durable products helps maintain its strong position.

- Samsung Electronics Co. Ltd.: Samsung is another strong contender in the global fitness tracker market, with a market share of around 9-10%. The company’s Galaxy Watch series is widely recognized for its comprehensive health features, including heart rate monitoring, sleep analysis, and even body composition tracking. Samsung’s strong focus on integrating wearables with its broader ecosystem, including smartphones and tablets, has helped boost its market presence

- Xiaomi Inc.: Xiaomi has rapidly expanded its footprint in the fitness tracker market, particularly in emerging economies, with a market share of approximately 7-8%. The company’s Mi Band series offers a combination of affordability and functionality, appealing to price-sensitive consumers. Their fitness trackers provide essential features such as sleep monitoring, step counting, and heart rate tracking, making them particularly popular in regions like India and Southeast Asia

Recent Developments

- In 2024, Fitbit continues to hold a strong position in the wearables market, even after being acquired by Google. Known for its easy-to-use fitness trackers, Fitbit offers reliable devices that monitor key health metrics such as heart rate, sleep patterns, and blood oxygen levels. While not targeted at elite athletes, Fitbit remains popular among those seeking a simple and effective way to track their overall health and activity.

- In 2023, ŌURA, the company behind the innovative smart ring, announced the acquisition of Proxy in an all-equity deal. This strategic move integrates Proxy’s digital identity technology with ŌURA’s existing health data platform, enhancing the capabilities of its smart ring. With the added technology, ŌURA strengthens its market position as a leading player in the consumer wearables industry, offering even more personalized health insights.

- In May 2024, Planet Fitness, Inc. revealed plans for a refinancing transaction involving the issuance of a new series of senior secured notes. The $600 million offering aims to restructure existing debt and support the company’s ongoing growth. With approximately $2 billion in outstanding debt, Planet Fitness is positioning itself for continued expansion and investment in its fitness services.

- On March 27, 2024, EGYM, a leader in fitness technology, acquired Hussle, a key player in the UK corporate fitness sector. This acquisition expands EGYM’s reach in Europe and strengthens its position in the corporate wellness market through the Wellpass network. The move aligns with EGYM’s strategy to drive innovation and growth in the fitness and wellness space.

- In 2024, Trive Capital and 808 Capital Partners invested in JF Fitness of North America, a prominent Crunch Fitness franchisee. Based in Richmond, Virginia, JF Fitness operates 16 gyms across the Mid-Atlantic and Southeastern U.S. The investment also facilitated JF Fitness’s acquisition of Team Roldan, expanding its presence further into Alabama, Georgia, and South Carolina.

Conclusion

The fitness tracker market is poised for substantial growth, driven by increasing health awareness, technological advancements, and the growing integration of these devices into broader health and wellness ecosystems. As consumers become more focused on both fitness and preventive healthcare, the demand for advanced tracking features, such as heart rate monitoring, sleep analysis, and stress tracking, will continue to rise.

Additionally, the expansion of e-commerce and the appeal of wearable devices in emerging markets further enhance the market’s potential. However, challenges related to data privacy, product affordability, and battery life must be addressed for sustained growth. Manufacturers that can innovate while offering solutions that cater to diverse consumer needs are well-positioned to capitalize on the opportunities within this dynamic and rapidly evolving market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)