Table of Contents

Introduction

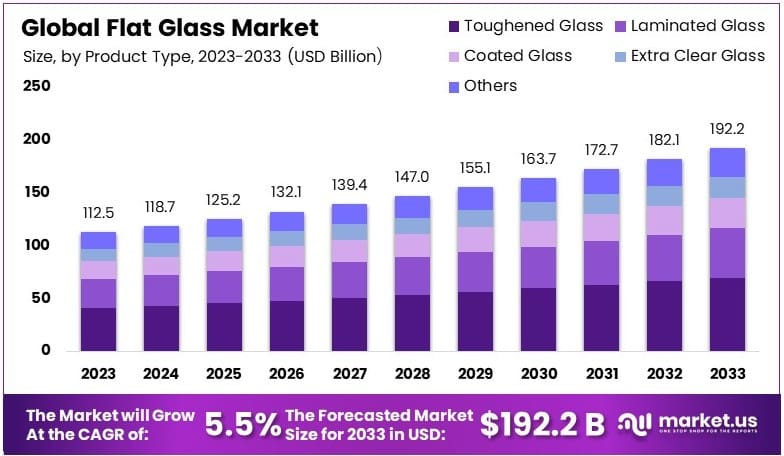

The global flat glass market is anticipated to grow from USD 112.5 Billion in 2023 to USD 192.2 Billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 5.5% from 2024 to 2033. This growth is largely fueled by the increasing demand in key sectors such as construction, automotive, and solar energy. The construction industry, in particular, relies heavily on flat glass for both aesthetic and energy-efficient building solutions, driving substantial market expansion. Additionally, the automotive sector’s ongoing innovation and increased production are boosting the use of flat glass for windows and sunroofs.

Despite these growth factors, the market faces challenges, including high manufacturing costs and the need for continuous technological advancements to produce higher quality glass. Recently, the industry has seen significant developments in glass recycling technologies and the creation of more energy-efficient glass manufacturing processes, which not only address environmental concerns but also reduce production costs, helping to sustain market growth amid global economic fluctuations. These advancements are critical in maintaining the industry’s adaptability and competitiveness in a rapidly evolving market landscape.

Key players such as Asahi Glass, Nippon Sheet Glass, Guardian Industries, and Saint-Gobain are investing heavily in expanding their production capacities, developing new products, and enhancing their technological capabilities to meet the rising demand and maintain their competitive edge.

Asahi Glass, also known as AGC Inc., has been actively expanding its production capacities to meet the growing demand for flat glass. AGC has focused on enhancing its capabilities in high-performance glass products for both architectural and automotive applications. Recent developments include investments in new production lines and technological advancements to improve energy efficiency and reduce environmental impact. The company is also exploring collaborations to innovate in the areas of smart and functional glass technologies.

Nippon Sheet Glass has concentrated its efforts on sustainability and technological innovation. In recent developments, NSG has been investing in the production of energy-efficient glass solutions, particularly those that support the construction of green buildings and renewable energy projects. The company has also been working on expanding its market presence in emerging economies through strategic partnerships and acquisitions. Additionally, NSG is enhancing its product portfolio to include advanced glazing solutions for the automotive industry.

Saint-Gobain has been proactive in expanding its flat glass production and advancing its product offerings. A notable recent development is the collaboration with AGC to develop new, advanced technology for flat glass production aimed at achieving carbon neutrality by 2050. Saint-Gobain has also been investing in research and development to produce high-performance glass for various applications, including solar energy and automotive glazing. The company’s commitment to sustainability and innovation is evident in its continuous efforts to reduce the environmental footprint of its manufacturing processes and enhance the functionality of its glass products.

Key Takeaways

- Market Value: The Flat Glass Market was valued at USD 112.5 billion in 2023 and is expected to reach USD 192.2 billion by 2033, with a CAGR of 5.5%.

- Product Type Analysis: Toughened Glass dominated with 36.3%; it is critical for safety and durability in various applications.

- Technology Analysis: Sheet technology led with 42.8%; it is preferred due to its versatility and cost-effectiveness in production.

- Application Analysis: Building & Construction held 40.5%; it is a major consumer of flat glass due to urbanization and infrastructure growth.

- Dominant Region: APAC dominated with 47.8%; its significance is driven by rapid industrialization and construction activities in the region.

Flat Glass Production and Materials

- Around 95 percent of all flat glass is manufactured using the float process, which involves molten glass being floated onto molten tin to create a very smooth surface.

- The production of float glass primarily uses silica sand (SiO2) at 71 percent and soda (Na2O) at 14 percent.

- In 2019, the UK glass industry accounted for 0.5% of total UK energy consumption and 0.4-0.6% of total UK greenhouse gas (GHG) emissions.

- Recycled glass, known as cullet, can reduce the energy intensity per unit of output in glass production by requiring lower furnace operating temperatures.

- Up to 15% of manufactured flat glass is collected and used as internal cullet in new glass production, saving energy and reducing emissions.

- The sourcing of primary raw materials for glass production requires 3.8-4.8 MJ/kg of molten glass, generating 0.33-0.35 kg CO2-eq/kg of molten glass.

- Soda ash, one of the main constituents of glass, is produced via the Solvay process, which requires 6.1-10.0 MJ/kg of soda ash, equivalent to 0.7-1.0 kg CO2-eq/kg.

Flat Glass Regional Market Insights

- China was the largest glass exporter in 2022, with an export value of nearly £27 billion, followed by Germany with £8 billion.

- In 2022, China contributed to over a quarter of global glass and glassware exports.

- As of 2021, the United States was the world’s largest importer of glass and glassware, with an import value of £9.8 billion, followed by Germany with £6.5 billion.

- In July 2024, the float glass price in North America remained unchanged at US$0.75 per kilogram.

- In Europe, the float glass price remained unchanged at US$0.6 per kilogram in July 2024.

- In Northeast Asia, the float glass price decreased by 2.3% to US$0.43 per kilogram in July 2024.

- Since 2015, the competition in the flat glass market in Indonesia has intensified due to the influx of imported glass.

- The rapid rate of imported glass entering Indonesia is driven by the free trade pact in Southeast Asia and the expansion of Chinese glass factories in the region, particularly in Malaysia.

Flat Glass Environmental Impact and Sustainability

- A study found that efficient systems for flat glass collection are yet to be established in the UK, resulting in a limited supply of cullet for the flat glass market.

- The reutilization of end-of-life flat glass as cullet in new production could reduce the annual emissions of the UK flat glass value-chain by up to 18.6%.

- In 2022, global carbon dioxide emissions from glass production amounted to 95 million metric tonnes, with Europe contributing over 20 percent of this total.

- Energy costs accounted for 9.5 percent of the purchases of goods and services in the EU’s other non-metallic mineral products manufacturing sector in 2006.

Emerging Trends

- Increased Energy Efficiency Focus: Flat glass manufacturers are intensifying efforts to produce energy-efficient glass to meet global standards for environmental sustainability. This glass helps in reducing energy costs in buildings and vehicles by improving thermal insulation.

- Advancements in Smart Glass Technology: The adoption of smart glass, which can change its transparency based on the environment or an electrical input, is growing. This technology is particularly popular in automotive and architectural applications, enhancing comfort and energy savings.

- Rising Demand in Automotive Industry: There is a significant increase in the use of flat glass in the automotive industry, driven by trends towards larger and more complex windows in vehicles, as well as increasing safety regulations requiring tougher glass.

- Growth in Solar Energy Sector: The solar energy sector is expanding the use of flat glass as a component of solar panels. This trend follows the global shift towards renewable energy sources, with flat glass being key to improving solar panel efficiency and durability.

- Recycling and Sustainability Initiatives: Recycling initiatives are becoming more prevalent, with an emphasis on reducing waste in the flat glass production process. Companies are focusing on sustainable practices that not only comply with environmental regulations but also reduce overall manufacturing costs.

- Innovation in Glass Composition and Coatings: Innovations in the composition of flat glass and the development of advanced coatings are enhancing functionalities such as self-cleaning, UV protection, and enhanced durability. These innovations cater to evolving consumer and industrial needs.

- Expansion in Emerging Markets: The flat glass market is witnessing rapid growth in emerging markets, particularly in Asia and Africa, due to urbanization and industrial growth. Increased construction activity in these regions is driving demand for flat glass in both commercial and residential buildings.

Use Cases

- Building Windows Flat glass is predominantly used in residential and commercial buildings as window panes. It provides clarity, allows natural light to enter interiors, and offers weather resistance, contributing to energy efficiency by reducing the need for artificial lighting and temperature control.

- Automotive Industry In the automotive sector, flat glass is essential for windshields, side windows, and rear windows of vehicles. It provides structural integrity, clarity, and protection from environmental elements, enhancing visibility and safety for drivers and passengers.

- Solar Panels Solar energy systems use flat glass as a protective cover over photovoltaic cells. This glass not only protects the cells from the elements but also enhances light penetration, increasing the efficiency of solar panels in converting sunlight into energy.

- Glass Facades Glass facades on commercial buildings are made from flat glass, which adds aesthetic appeal while offering durability and energy efficiency. These facades allow for natural light while reducing heat loss or gain, supporting sustainable building practices.

- Furniture and Interior Design Flat glass is used in furniture such as tabletops and shelves, as well as in interior design elements like mirrors and partitions. Its clarity and sleek appearance enhance the aesthetic of various spaces while providing functionality and durability.

- Safety and Security Glass Laminated or tempered flat glass is used in situations requiring enhanced safety and security measures. This includes glass in public transportation stations, banks, and schools, where additional strength and the ability to withstand impacts are critical.

- Display Glass Flat glass is utilized in the displays of various electronic devices, including smartphones, televisions, and digital signage. It provides a protective, scratch-resistant surface that enhances the visibility and durability of these devices.

Key Players Analysis

Nippon Sheet Glass (NSG) remains a key player in the flat glass sector, with extensive global operations. In recent developments, NSG has focused on expanding its product range and production capacity. The company reported a substantial revenue increase in 2023, driven by the growing demand for energy-efficient glass products. NSG’s innovative approaches in automotive and architectural glass have positioned it strongly in the market, ensuring robust growth and competitive advantage.

Guardian Industries, a subsidiary of Koch Industries, is a major player in the flat glass sector, producing high-performance glass for architectural, residential, interior, and automotive applications. Recently, Guardian signed an agreement to acquire Vortex Glass, expanding its make-to-order fabrication business to supply hurricane-resistant glass in Florida and the Caribbean. The company also announced innovations in energy-efficient glass, enhancing its product range. Guardian’s strategic focus on innovation and sustainability underscores its commitment to meeting global market demands and maintaining competitive advantage.

Saint-Gobain, a global leader in the flat glass market, continues to drive innovation in the industry. The company recently launched new high-performance glass solutions aimed at improving energy efficiency and sustainability in buildings. In 2023, Saint-Gobain reported strong financial results, driven by increased demand for its advanced glass products. The company remains committed to research and development, ensuring a steady pipeline of innovative products that meet the evolving needs of the construction and automotive sectors.

AGC Inc., a global leader in the flat glass market, has recently focused on sustainability and innovation. In partnership with Saint-Gobain, AGC is developing a groundbreaking pilot flat glass production line that significantly reduces CO2 emissions. This line, located in Barevka, Czech Republic, will be partially electrified and utilize a combination of oxygen and gas, marking a major advancement in sustainable glass manufacturing. Additionally, AGC launched a low-carbon glass product range at the end of 2022, further emphasizing its commitment to achieving carbon neutrality by 2050.

Cardinal Glass Industries continues to strengthen its position in the flat glass sector. In 2023, the company finalized the acquisition of AGC’s North American Architectural Glass Business for $450 million. This acquisition enhances Cardinal’s manufacturing capabilities and product offerings in the architectural glass market. Cardinal’s strategic investments and expansions underscore its commitment to delivering high-quality, innovative glass products to meet the evolving demands of the construction and automotive industries.

China Glass Holdings Limited is a key player in the flat glass market, engaged in the production, marketing, and distribution of clear, painted, coated, and energy-saving glass products. Recently, the company has been focusing on expanding its production capabilities and optimizing its operations. Notably, China Glass Holdings completed the construction of a new production line in Nigeria, aiming to enhance its international presence. Despite challenges in the domestic market, the company reported revenue of ¥5.31 billion in 2023, demonstrating its resilience and strategic growth initiatives.

Fuyao Glass Industry Group Co., Ltd. is a prominent manufacturer in the flat glass industry, primarily known for its automotive glass products. In 2023, Fuyao Glass achieved significant milestones with the launch of advanced energy-efficient glass solutions designed to meet the increasing demand for sustainable automotive and architectural applications. The company reported robust financial performance, with a notable increase in revenue driven by expanding global operations and continuous innovation in product offerings. Fuyao Glass remains committed to enhancing its market position through strategic investments and technological advancements.

Guardian Industries, a subsidiary of Koch Industries, continues to innovate in the flat glass sector. Recently, Guardian acquired Vortex Glass, enhancing its ability to supply hurricane-resistant glass in Florida and the Caribbean. This strategic acquisition is part of Guardian’s broader efforts to expand its product offerings and manufacturing capabilities in architectural glass. Additionally, Guardian’s focus on energy-efficient glass solutions supports its commitment to sustainability and meeting growing market demands for environmentally friendly building materials.

Şişecam is a major global player in the flat glass market, with extensive operations across multiple countries. In recent developments, Şişecam has invested significantly in its Polatlı facility in Turkey, making it one of the largest flat glass production bases in Europe with an annual capacity of 540,000 tons. The company is also expanding its footprint in Italy, having made an offer to acquire the Sangalli Manfredonia plant, which will double its flat glass production capacity in the country. This acquisition aligns with Şişecam’s strategy to strengthen its leadership in the European market. Additionally, Şişecam has launched new products like the Extra Strong Laminated Glass, demonstrating its continuous innovation and responsiveness to market needs.

Conclusion

The flat glass market is on a trajectory of steady growth, largely fueled by the construction and automotive sectors. The increasing adoption of energy-efficient glass technologies for environmental sustainability and energy savings plays a significant role in boosting the demand for flat glass.

Moreover, innovations in glass compositions and processing techniques are expanding its applications across various industries. As the market evolves, companies that invest in research and development and adhere to sustainability practices are likely to gain a competitive edge.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)