Table of Contents

Introduction

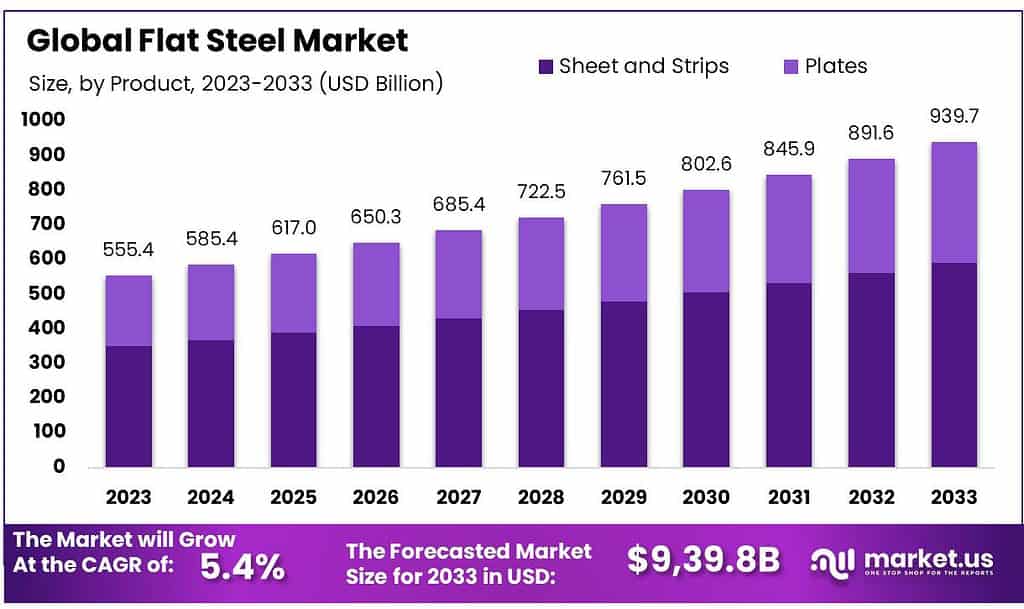

The Global Flat Steel Market is poised for significant growth, projected to reach approximately USD 939.8 billion by 2033, up from USD 555.4 billion in 2023, representing a compound annual growth rate (CAGR) of 5.4% during the forecast period. This growth can be attributed to several factors, including increasing demand from key end-user industries such as automotive, construction, and appliances, which are driving the need for flat steel products.

Moreover, the expansion of infrastructure projects worldwide is further fueling market demand. However, the industry faces challenges such as fluctuating raw material prices and environmental regulations that could hinder production capabilities. Recent developments in technology, such as advancements in steel manufacturing processes and a shift toward sustainable practices, are also shaping the market landscape. The integration of innovative solutions aimed at enhancing product quality and reducing waste is gaining traction, which aligns with the growing emphasis on sustainability in manufacturing.

Additionally, the rising trend of electric vehicles is anticipated to significantly increase the consumption of flat steel, thereby contributing to market expansion. In summary, while the Flat Steel Market encounters certain hurdles, the overall outlook remains positive, driven by robust demand across various sectors and ongoing technological advancements.

ArcelorMittal is the world’s largest steel producer, known for its diverse portfolio of flat steel products. The company continues to lead in innovation, focusing on developing high-strength and lightweight steel solutions, which are crucial for industries like automotive manufacturing. With operations in over 60 countries, its global reach positions it well to capture market opportunities, particularly in emerging economies.

Ansteel Group has established itself as a major player in the flat steel segment, particularly in Asia. With a strong emphasis on R&D, Ansteel has recently expanded its product offerings, which include specialized steel grades tailored for automotive applications. This focus on product differentiation is expected to enhance its competitive edge in the market.

Baosteel Group, one of China’s largest steel manufacturers, is renowned for its high-quality flat steel products. The recent merger with a regional firm is anticipated to enhance Baosteel’s production capabilities and market presence. The company’s strategic initiatives in expanding its flat steel range are likely to position it favorably in both domestic and international markets.

Key Takeaways

- Market Growth Projection: The global flat steel market is poised to grow significantly, reaching an estimated worth of around USD 939.8 billion by 2033. This growth is anticipated at a CAGR of 5.4% from the USD 555.4 billion in 2023.

- Product Analysis: Sheets and strips constitute a significant portion (over 63.2%).

- Material Types and Applications: Carbon steel dominates the market (over 49%).

Flat Steel Statistics

- Our Consultants estimate that the weight of a typical passenger vehicle is ~1440kg. Of this, ~75% is metal (including iron, steel, aluminium, magnesium, copper and zinc) – with steel itself weighing some 830kg.

- Overall demand for auto steel and other metals and materials is therefore broadly distributed as shown in the chart below. In our assessment, flat steel products come to ~667 kg and long products ~163 kg.

- This chart shows the shares of countries where Estonia exports Flat-rolled products of stainless steel, of a width of >= 600 mm, hot-rolled or cold-rolled ‘cold-reduced’ to.

- The steel usually exits the last stand at a temperature around 900 °C (depending on the steel grade), which ensures that all the deformation takes place in the single-phase austenite of the phase diagram.

- It is then cooled with water on a run-out table (ROT), before coiling at a coiling temperature that is usually close to 600 °C.

- Some of the hot-rolled coils, covering the complete gauge range, are sold for direct use and some, usually in the gauge range up to about 5 mm, are cold rolled to thinner gauges.

- For example, according to Industrial Metal Service, high-grade steel has a high UTS of approximately 1,000 megapascals (MPa), while aluminum alloys typically have a UTS of around 500.

- Flat bars are available in a range of options. Typically, the range between 12 – 100 mm with a thickness of 2 mm, 2.5 mm, 2.7 mm, and 3 mm and a length of 6 m.

- Standard ASTM A276 flat bars are usually 1.2 to 150 mm in width and 25 to 33 mm in thickness.

- Mild Steel Flat Bar Sizes: Generally available in 6.100 to 6.400 Metre lengths and in Grade 43A, however in certain sizes other Grades such as 50B may also be available.

- Grade 304 stainless steel stands out even among steel alloys for its high tensile strength, approximately 621 MPa (90 ksi). Because of its tensile strength, temperature, and corrosion resistance, 304 stainless steel is used for various applications.

- Thickness: Standard thicknesses for mild steel flat bars typically range from 3 mm to 25 mm or more.

- Common thicknesses include 3 mm, 5 mm, 6 mm, 8 mm, 10 mm, 12 mm, 15 mm, 20 mm, 25 mm, and larger.

Emerging Trends

- The Flat Steel Market is experiencing several emerging trends that are shaping its future landscape. One notable trend is the increasing demand for advanced high-strength steel (AHSS). This type of steel is gaining popularity, particularly in the automotive industry, as manufacturers seek to improve vehicle safety while reducing weight. AHSS can lead to fuel efficiency and better overall performance, making it a key focus for car makers.

- Another significant trend is the shift towards sustainability and eco-friendly production practices. Many companies are investing in green technologies to reduce carbon emissions during manufacturing. For instance, some steel producers are adopting electric arc furnace (EAF) technology, which significantly lowers energy consumption compared to traditional methods. This trend aligns with global efforts to combat climate change and meets the rising consumer demand for environmentally responsible products.

- Digitalization and automation are also transforming the Flat Steel Market. Smart manufacturing techniques, including the use of IoT (Internet of Things) and AI (Artificial Intelligence), are being implemented to optimize production processes. These technologies enable real-time monitoring and predictive maintenance, which can enhance efficiency and reduce operational costs.

- Additionally, there is a growing trend towards customization in flat steel products. As industries become more specialized, the need for tailored steel solutions is increasing. Manufacturers are responding by offering a wider variety of flat steel grades and finishes to meet specific customer requirements.

- Lastly, the expansion of the renewable energy sector is influencing the flat steel market. The construction of wind turbines and solar panels requires high-quality flat steel, driving demand in this area. As investments in renewable energy grow, so too will the need for specialized steel products.

Use Cases

- Automotive Industry: Flat steel is extensively used in vehicle manufacturing, accounting for approximately 40% of the total steel used in cars. Advanced High-Strength Steel (AHSS) is particularly popular, as it provides safety and fuel efficiency. The global demand for flat steel in this sector is projected to grow by around 6% annually, driven by the rise of electric vehicles, which require lightweight materials for better performance.

- Construction: In the construction industry, flat steel serves as a fundamental component for structural applications, including beams, columns, and roofing. The construction sector consumes about 30% of flat steel produced globally. With infrastructure investments expected to reach USD 4 trillion by 2025, the demand for flat steel is anticipated to increase significantly, particularly in developing economies.

- Appliances and Consumer Goods: Flat steel is used in the manufacturing of household appliances like refrigerators, washing machines, and ovens. This segment is estimated to represent about 15% of the flat steel market. As the global appliance market is projected to grow to USD 750 billion by 2025, the demand for flat steel in this category is expected to rise accordingly.

- Energy Sector: The renewable energy sector increasingly utilizes flat steel for constructing wind turbines and solar panel frames. The global renewable energy market is projected to reach USD 2 trillion by 2025, creating significant opportunities for flat steel manufacturers. For instance, each wind turbine requires around 100 tons of flat steel, highlighting its critical role in this industry.

- Packaging: Flat steel is also used in the production of metal packaging, including cans and containers. The global metal packaging market is anticipated to grow at a CAGR of 4.3%, increasing the demand for flat steel products used in this sector. With the rising focus on sustainable packaging solutions, the use of flat steel in this area is likely to expand.

Major Challenges

- Fluctuating Raw Material Prices: The prices of key raw materials, such as iron ore and coal, have been highly volatile. For instance, iron ore prices surged by nearly 80% from 2020 to 2021, leading to increased production costs for flat steel manufacturers. These fluctuations can affect profit margins and pricing strategies, making it difficult for companies to maintain stability.

- Environmental Regulations: Stringent environmental regulations aimed at reducing carbon emissions are becoming more prevalent worldwide. For example, the European Union’s Green Deal mandates a significant reduction in greenhouse gas emissions by 2030. Compliance with these regulations often requires substantial investments in cleaner technologies, which can strain financial resources, especially for smaller manufacturers.

- Overcapacity Issues: Many regions, particularly in Asia, are facing overcapacity in steel production. According to the World Steel Association, global steel production capacity exceeds demand by approximately 20%. This surplus can lead to price wars and reduced profitability as companies compete for market share.

- Trade Barriers and Tariffs: Protectionist measures, such as tariffs and quotas imposed by various countries, can disrupt global supply chains and create uncertainty in the market. For instance, the U.S. imposed tariffs on imported steel in 2018, which impacted trade dynamics and forced manufacturers to adjust their pricing and sourcing strategies.

- Technological Disruptions: The rapid pace of technological advancements poses a challenge for traditional flat steel manufacturers. Companies must invest in modernizing their production processes to remain competitive. This transition can be costly and requires skilled labor, which may not be readily available, especially in developing regions.

- Market Demand Variability: The demand for flat steel is highly dependent on economic cycles and sector-specific trends. For example, fluctuations in the automotive sector can significantly affect flat steel consumption, with the industry projected to grow at 3% to 4% annually. Any downturn in this sector can lead to reduced demand and excess inventory.

Market Growth Opportunities

- Increased Demand in the Automotive Sector: The automotive industry is transitioning towards lightweight materials to improve fuel efficiency and reduce emissions. Flat steel, particularly Advanced High-Strength Steel (AHSS), is expected to see a growth rate of approximately 6% annually as automakers seek to enhance vehicle performance. This shift is especially significant with the rise of electric vehicles, which often require more steel per vehicle compared to traditional models.

- Expansion in Renewable Energy: As global investments in renewable energy sources surge, the demand for flat steel in constructing wind turbines and solar panels is increasing. The renewable energy market is projected to reach USD 2 trillion by 2025, leading to a higher consumption of flat steel, with each wind turbine requiring about 100 tons of steel. This trend presents a lucrative opportunity for steel manufacturers.

- Infrastructure Development: Government spending on infrastructure is on the rise, particularly in emerging economies. The global construction market is anticipated to grow by 5% annually, with significant investments in roads, bridges, and buildings. Flat steel plays a crucial role in structural applications, and this demand is expected to drive substantial growth in the flat steel sector.

- Technological Advancements: The adoption of advanced manufacturing technologies, including automation and digitalization, is creating opportunities for improved efficiency and product quality. Companies that invest in smart manufacturing and Industry 4.0 solutions can enhance their competitiveness, potentially increasing production efficiency by 20% or more.

- Customization and Specialty Products: There is a growing trend toward customized flat steel products tailored to specific industry needs. As sectors like aerospace and construction demand specialized grades and finishes, manufacturers can tap into niche markets. This trend could lead to an increase in sales by approximately 10% as companies respond to the need for tailored solutions.

- Sustainable Practices: The push for sustainability is prompting manufacturers to develop eco-friendly flat steel products. Investments in electric arc furnaces and recycling processes can attract environmentally conscious customers. The global market for green steel is projected to grow to USD 100 billion by 2030, offering a significant opportunity for companies that prioritize sustainability.

Key Players Analysis

ArcelorMittal, the world’s largest steel producer, plays a pivotal role in the flat steel sector by offering a wide range of high-quality products for industries such as automotive, construction, and appliances. The company emphasizes innovation, investing heavily in advanced high-strength steel (AHSS) to meet the growing demand for lightweight and durable materials. With operations in over 60 countries, ArcelorMittal aims to enhance sustainability by implementing eco-friendly practices, targeting a significant reduction in carbon emissions as part of its long-term strategy.

Ansteel Group is a key player in the flat steel market, primarily focused on producing high-quality steel products for various applications, including automotive and construction. The company has made significant investments in research and development, aiming to enhance its product offerings and expand its market share. Ansteel is committed to sustainable practices and has adopted advanced technologies to improve production efficiency. With a strong presence in Asia, Ansteel is positioned to capitalize on growing demand and contribute to the evolving landscape of the flat steel industry.

Baosteel Group, one of China’s largest steel manufacturers, is a significant player in the flat steel sector, known for its high-quality products used in automotive, construction, and appliances. The company focuses on innovation and sustainability, investing in advanced technologies to enhance production efficiency and reduce environmental impact. Baosteel’s strategic initiatives include expanding its product range to meet the growing demand for specialized flat steel solutions, positioning itself to capture a larger share of the competitive global market.

Botou Steel is an emerging player in the flat steel market, specializing in producing a variety of flat steel products, including sheets and coils. The company emphasizes quality and customization, catering to diverse industries such as construction and manufacturing. Recently, Botou Steel has invested in eco-friendly production methods, aligning with global sustainability trends. By focusing on innovation and meeting specific customer needs, Botou Steel aims to enhance its market presence and compete effectively in the rapidly evolving flat steel landscape.

Benxi Steel, one of China’s prominent steel producers, is actively involved in the flat steel sector, supplying a wide range of products including hot-rolled and cold-rolled sheets. The company focuses on high-quality production processes to meet the demands of various industries, such as automotive and construction. Benxi Steel has been investing in modernizing its facilities and enhancing its R&D capabilities, aiming to improve product performance and sustainability. This strategic focus positions Benxi Steel to better compete in the dynamic flat steel market.

China Steel Corporation (CSC) is a leading player in the flat steel market, recognized for its extensive range of products including steel sheets and coils. The company emphasizes innovation and quality, implementing advanced manufacturing techniques to enhance efficiency and reduce waste. CSC is also committed to sustainability, with initiatives aimed at lowering carbon emissions and promoting eco-friendly practices. As a key supplier to various industries, CSC continues to expand its market presence by focusing on customer needs and adapting to industry trends.

Evraz Group is a significant player in the flat steel market, known for its production of high-quality steel products, including flat and rolled steel. The company operates primarily in Russia and North America, supplying key industries such as construction, automotive, and manufacturing. Evraz focuses on innovation and operational efficiency, investing in modern technologies to enhance product quality and reduce environmental impact. With a commitment to sustainability and customer-centric solutions, Evraz aims to strengthen its position in the competitive flat steel landscape.

Fangda Steel is an emerging player in the flat steel sector, specializing in the production of a variety of flat steel products such as sheets and strips. The company prioritizes quality and efficiency, employing advanced manufacturing techniques to meet the specific needs of industries like construction and machinery. Fangda Steel is also focused on sustainability, implementing eco-friendly practices in its production processes. By continually improving its product offerings and adapting to market trends, Fangda Steel aims to expand its presence in the global flat steel market.

Gerdau is a prominent player in the flat steel market, headquartered in Brazil, and is known for producing high-quality flat steel products, including sheets and coils. The company serves various industries, such as construction, automotive, and appliances, focusing on innovation and sustainability. Gerdau has invested in modernizing its facilities and enhancing its production processes to improve efficiency and reduce environmental impact. By leveraging its extensive distribution network, Gerdau aims to strengthen its competitive position in both domestic and international markets.

Anyang Steel is a key manufacturer in the flat steel sector, primarily based in China, specializing in producing a wide range of flat steel products like hot-rolled and cold-rolled sheets. The company emphasizes quality and technological advancement, using modern production techniques to meet the diverse needs of industries such as construction and automotive. Anyang Steel is also committed to sustainable practices, striving to reduce its environmental footprint. By focusing on customer satisfaction and continuous improvement, Anyang Steel aims to expand its market reach and enhance its competitive edge.

Conclusion

In conclusion, the Flat Steel Market is poised for substantial growth, driven by key trends such as increasing demand from the automotive and construction industries, advancements in manufacturing technologies, and a growing emphasis on sustainability. With the market expected to reach approximately USD 939.8 billion by 2033, growing at a CAGR of 5.4% from 2023, companies have significant opportunities to innovate and expand their product offerings.

However, challenges such as fluctuating raw material prices, regulatory pressures, and overcapacity must be strategically managed to capitalize on these growth prospects. By focusing on advanced materials and sustainable practices, stakeholders in the flat steel sector can position themselves for long-term success in a dynamic and competitive landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)