Introduction

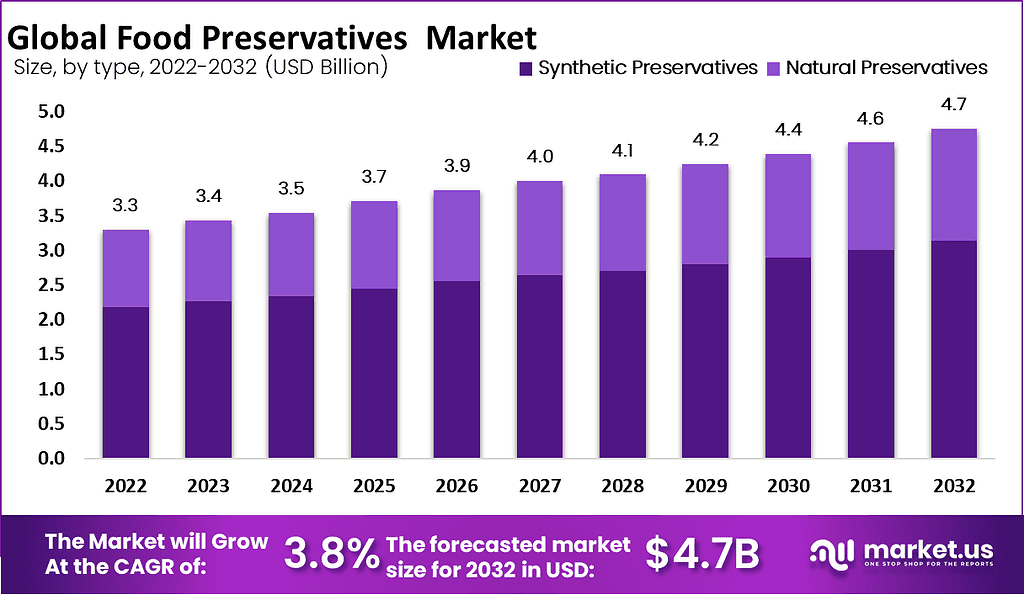

The global food preservatives market is projected to grow significantly, reaching an estimated value of USD 4.7 billion by 2032 from USD 3.3 billion in 2022, at a CAGR of 3.8% during the forecast period from 2022 to 2032. This growth is primarily driven by increasing consumer awareness about food safety and the rising demand for convenience and processed foods, which require preservatives to extend shelf life and maintain quality.

Key growth factors include the expanding global food supply chain, the growing trend of ready-to-eat meals, and the shift towards natural and clean-label preservatives. Synthetic preservatives currently dominate the market due to their cost-effectiveness and efficiency in preventing microbial growth, but there is a notable shift towards natural alternatives like rosemary extract and vinegar, driven by consumer preferences for healthier options. Innovations in preservation technologies, such as High-pressure Processing (HPP) and Pulsed Electric Field (PEF), are also contributing to market growth.

However, the market faces challenges such as stringent regulatory requirements and the high cost of natural preservatives compared to synthetic ones. Manufacturers must navigate these challenges to meet consumer demands and regulatory standards effectively.

Recent developments in the market include BASF SE’s launch of eco-friendly preservatives and Kerry Group’s focus on natural preservatives like plant extracts. The meat and poultry segment holds the largest market share due to the high perishability of these products and the necessity for effective preservation methods to ensure safety and extend shelf life. The North American market leads in terms of revenue, driven by a developed food and beverage sector and stringent food safety regulations.

Cargill Inc. has been actively expanding its portfolio of natural preservatives to meet the growing demand for clean-label products. They are investing in research to develop innovative solutions that offer effective preservation without synthetic additives. Cargill’s focus on natural preservatives aims to cater to consumer preferences for healthier and safer food options.

Kemin Industries Inc. has made strides in enhancing its production capabilities and expanding its product range. In 2021, Kemin opened a new quality control laboratory and logistics office in Belgium to better serve its European customers. This expansion is part of their strategy to improve the quality and safety of food preservatives while meeting the stringent regulatory standards in the region.

Statistics

- Consumers are not just checking food labels for ingredients. According to the Food & Health Survey 2016, more than 70% of consumers check expiry dates in the supermarket.

- The president should ask for at least $200 million to address chronic food illness in his Fiscal Year 2024 budget and Congress should appropriate it. It won’t be easy. In last year’s budget, the president asked for $135 million to cover USDA nutrition security, FDA nutrition regulation, and NIH nutrition research.

- 38.9% of the students stated that they consumed packaged processed food every day, 41.6% for nourishment, and 43.5% due to its pleasant taste. 23.4% of the students indicated that they consumed all types of packaged food, 55.9% of them cared about the brand when buying it and 63.4% of them were affected by the taste and smell while buying these food items.

- In addition, 47.7% of the students stated that they did not care about food ingredients when buying packaged processed food and 46% of them did not have any information on the additive content of packaged processed food.

- It’s estimated that up to 20% of the world’s population may have a food intolerance it is estimated that 65% of the world’s population has trouble digesting lactose a milder form of gluten intolerance that has been estimated to impact anywhere from 0.5 to 13% of the population.

- According to statistics, up to 1.3 billion tons of food is wasted every year on a global scale, which can feed 1 billion people lacking in food.

- According to information provided by the World Packaging Organization (WPO), the turnover of the global packaging industry is more than $500 billion, in which food packaging is a pillar area.

- A staggering 1.5 million Americans are diagnosed with diabetes every year. In 2015, 30.3 million Americans, or 9.4% of the population, had the disease.

- A single serving (56 g) of a market sample turkey deli meat contains 440 mg sodium, with 170 mg of that being contributed by its preservative, a market solution of sodium lactate/diacetate (dosed at 2.5%)

- A resounding 82% of consumers agreed that “natural products are better for me.” 70% of the global population agreed that “when purchasing a packaged food/beverage product, I prefer those that are more natural.”

- The U.S. and Japan are wealthy industrialized countries, but they occupy opposite ends of the obesity spectrum. Currently, 43% of the U.S. population has obesity — nearly 10 times Japan’s rate of 4.5%.

- Superfood makhana is rich in proteins and fiber and low in fat. 100 grams of makhana gives around 347 calories of energy.

- There are around 9.7 grams of proteins and 14.5 grams of fiber in makhana. Makhanas are a very good source of calcium.

- The Dietary Guidelines for Americans suggest that consumers keep their added sugar intake less than 10% of overall calories, which would be less than 50 grams a day for a 2000-calorie diet.

- A recent review of nearly 4,000 food additives showed that 64% of them had had no research showing they were safe for people to eat or drink. While some changes to the current law could be achieved by the FDA, some may require congressional action.

- This represents a 10% increase since 2001. The findings also present compelling evidence that the prevalence of food additives is on the rise; manufacturers have increased the mean number of additives contained in purchased food and beverage products from 3.7 in 2001 to 4.5 in 2019.

Emerging Trends

- Shift Towards Natural Preservatives: There is a significant shift from synthetic to natural preservatives driven by consumer demand for clean-label products. Natural preservatives, derived from sources like plant extracts, essential oils, and herbs, are gaining popularity. Ingredients such as neem oil, rosemary extracts, and vinegar are being increasingly used due to their perceived health benefits and safety.

- Technological Advancements: Innovations in food preservation technologies are transforming the market. Methods such as High-pressure Processing (HPP), Pulsed Electric Field (PEF), and cold plasma technology are being developed to enhance the efficacy of preservatives and extend the shelf life of food products without compromising their quality. These technologies help in maintaining the nutritional value and sensory properties of food while ensuring safety.

- Increased Focus on Antimicrobial Agents: Antimicrobial preservatives continue to dominate the market, accounting for a significant share due to their effectiveness in inhibiting the growth of bacteria, yeasts, and molds. The demand for these agents is driven by the need to prevent foodborne illnesses and spoilage, particularly in meat, poultry, and dairy products.

- Growing Popularity of Clean-Label Products: Consumers are increasingly looking for food products with minimal and easily recognizable ingredients. This trend is boosting the market for clean-label preservatives, which are free from artificial additives and chemicals. Clean-label preservatives often utilize natural ingredients and simple processing methods to appeal to health-conscious consumers.

- Regulatory Challenges and Compliance: The food preservatives market faces stringent regulatory requirements aimed at ensuring the safety and efficacy of preservation methods. Companies are investing in research and development to comply with these regulations and to develop preservatives that meet both safety standards and consumer expectations. The regulatory landscape is particularly strict in regions like North America and Europe, influencing global market dynamics.

- Sustainability and Eco-Friendly Practices: Sustainability is becoming a crucial factor in the food preservatives market. Companies are focusing on sourcing raw materials responsibly and developing eco-friendly preservation methods. This includes using biodegradable packaging and reducing the environmental impact of production processes. The move towards sustainable practices is aligned with the broader consumer trend towards environmentally conscious products.

- Rise in Processed and Packaged Foods: The increasing demand for convenience foods, including ready-to-eat meals and snacks, is driving the need for effective food preservatives. As lifestyles become busier, consumers are looking for foods that are both convenient and have a longer shelf life. This trend is particularly prominent in urban areas and is contributing to the growth of the food preservatives market.

Use Cases

- Extending Shelf Life of Products: Food preservatives are employed primarily to prolong the shelf life of food items, thereby reducing waste and extending the usability of products. For example, preservatives like sodium benzoate are commonly used in soft drinks and pickles to inhibit microbial growth. In the global food and beverage sector, this growth is driven by the increasing demand for convenience foods and processed products.

- Enhancing Food Safety: Preservatives play a crucial role in enhancing food safety by preventing the growth of pathogens and spoilage organisms. For instance, nitrates and nitrites are used in cured meats to inhibit the growth of Clostridium botulinum, which can cause botulism. The Food Safety and Inspection Service (FSIS) estimates that approximately 1 in 6 Americans suffer from foodborne illnesses each year, highlighting the importance of preservatives in maintaining food safety.

- Improving Product Quality and Stability: Preservatives help maintain the quality and stability of food products. Antioxidants, such as ascorbic acid (vitamin C) and tocopherols (vitamin E), are used to prevent oxidation, which can lead to rancidity in fats and oils. This application is critical for products like baked goods and snacks.

- Reducing Spoilage in Fresh Produce: Preservatives are also used to reduce spoilage in fresh produce. Controlled atmosphere packaging and the use of substances like calcium propionate in bread can significantly reduce mold growth and decay.

- Supporting Supply Chain Efficiency: By extending shelf life and reducing spoilage, preservatives contribute to more efficient supply chains. This efficiency is particularly important in the global food supply chain, which is valued at over USD 10 trillion. Preservatives help reduce the frequency of supply chain disruptions due to spoilage, enabling smoother logistics and distribution processes.

- Facilitating Global Trade: Preservatives enable the global trade of food products by ensuring that items remain safe and consumable during long transit periods. For instance, the use of preservatives in canned goods and dried foods facilitates international trade, contributing to a market estimated at USD 8.5 billion for food preservatives used in global trade.

Key Players Analysis

Cargill Inc. is a major player in the food preservatives market, focusing on developing both synthetic and natural preservatives to meet diverse consumer needs. The company is investing significantly in research and development to create innovative preservation solutions, such as plant-based and clean-label preservatives. Cargill’s recent efforts include the launch of new natural preservative products that align with the growing demand for safer, more sustainable food ingredients. These advancements help maintain food quality and extend shelf life, addressing both industry and consumer concerns.

Kemin Industries Inc. is a key contributor to the food preservatives market, known for its extensive range of both synthetic and natural preservatives. The company emphasizes innovation and quality control, as evidenced by its new quality control laboratory and logistics office in Belgium. Kemin focuses on developing effective natural preservatives derived from plant extracts and essential oils, meeting the increasing consumer demand for clean-label products. Their solutions are widely used in extending the shelf life and ensuring the safety of various food products, including meats, dairy, and bakery items.

ADM (Archer Daniels Midland Company) is a prominent player in the food preservatives market, focusing on both synthetic and natural preservatives. ADM’s approach involves integrating natural ingredients like vinegar and plant extracts to enhance food safety and extend shelf life, catering to the growing consumer demand for clean-label products. They are also investing heavily in innovation and sustainability, developing advanced preservation solutions that meet stringent regulatory standards and consumer preferences for healthier food options.

Koninklijke DSM N.V. is a leader in the food preservatives market, emphasizing sustainability and innovation. DSM develops natural preservatives derived from plant extracts, aiming to reduce reliance on synthetic chemicals and cater to the increasing demand for natural and organic food products. Their strategy includes extensive research and partnerships to introduce eco-friendly preservatives that ensure food safety and longevity without compromising quality. DSM’s commitment to sustainability is reflected in its efforts to create preservatives that align with health-conscious consumer trends.

BASF SE is a key player in the food preservatives market, focusing on both synthetic and natural preservatives. They offer a range of products aimed at extending the shelf life and ensuring the safety of various food products. BASF’s recent efforts include the development of eco-friendly preservatives and enhancements in natural preservatives like vinegar and plant extracts. Their innovations address consumer demand for clean-label and safe food preservation solutions, making them a significant contributor to the industry’s growth.

Celanese Corporation is actively engaged in the food preservatives market, providing both synthetic and natural preservative solutions. Their products, including sorbates and benzoates, are widely used to prevent microbial growth in foods such as baked goods and beverages. Celanese focuses on developing high-efficacy preservatives that meet regulatory standards and consumer preferences for safety and quality. Their commitment to innovation and sustainability helps them maintain a strong presence in the competitive food preservatives industry.

Corbion N.V. is a global leader in food preservation, specializing in natural and biobased solutions. The company focuses on extending the shelf life and ensuring the safety of various food products, including meat, bakery items, and dairy. Utilizing innovative fermentation processes, Corbion produces natural preservatives like lactic acid, which not only inhibit microbial growth but also enhance flavor and texture. Their commitment to sustainability and responsible sourcing positions them as a key player in meeting consumer demands for clean-label and eco-friendly food products.

Galactic S.A. is a prominent player in the food preservatives market, known for its expertise in lactic acid and its derivatives. The company offers a wide range of natural preservative solutions aimed at extending the shelf life and ensuring the safety of food products. Galactic’s innovations focus on harnessing the power of fermentation, providing effective and sustainable alternatives to synthetic preservatives. Their products are widely used in the meat, dairy, and bakery sectors, catering to the growing demand for natural and clean-label food preservation solutions.

Kerry Group Plc. is a leading player in the food preservatives market, focusing on natural and clean-label solutions. The company utilizes plant extracts and vinegar to develop effective preservatives that meet consumer demands for healthier options. Kerry’s innovations include Acryleast™, a GMO-free yeast solution aimed at reducing acrylamide levels in food, enhancing both safety and quality. The company’s dedication to research and sustainable practices positions it as a significant contributor to the growth and evolution of the food preservatives industry.

Archer Daniels Midland Company (ADM) is a prominent entity in the food preservatives market, known for its comprehensive portfolio that includes both synthetic and natural preservatives. ADM focuses on enhancing the shelf life and safety of various food products through effective antimicrobial and antioxidant solutions. The company’s strategic acquisitions and continuous investment in research enable it to innovate and provide tailored preservative solutions for the meat, dairy, and bakery sectors, maintaining its strong market presence and addressing evolving consumer preferences.

Tate & Lyle PLC is a prominent player in the food preservatives market, focusing on providing innovative ingredient solutions to enhance food safety and shelf life. The company has been expanding its portfolio through strategic mergers and acquisitions, such as the recent merger with CP Kelco. This partnership aims to leverage Tate & Lyle’s expertise in food and beverage solutions with CP Kelco’s strength in natural, plant-based ingredients, positioning them as a leader in the specialty food ingredients market. Tate & Lyle’s continued investment in R&D and sustainability initiatives underscores its commitment to meeting growing consumer demand for healthier and more sustainable food options.

Chr. Hansen Holding A/S is a global leader in natural solutions for the food industry, particularly known for its strong portfolio of microbial-based food preservatives. The company focuses on developing innovative solutions that extend the shelf life and safety of food products while catering to the increasing consumer demand for natural ingredients. Chr. Hansen’s strategic approach includes extensive R&D investments and collaborations with food manufacturers to develop effective, clean-label preservatives. Their commitment to sustainability and health aligns with current market trends, ensuring their solutions meet the stringent regulatory requirements and consumer expectations for natural and safe food preservation.

Conclusion

This growth is driven by increasing consumer demand for processed and convenience foods that require effective preservation to ensure safety and extend shelf life. Key trends such as the shift towards natural preservatives, technological advancements in food preservation methods, and stringent regulatory requirements are shaping the market. Companies are focusing on innovation and sustainability to meet consumer preferences for clean-label and eco-friendly products. Despite challenges like the high cost of natural preservatives and regulatory compliance, the market offers significant opportunities for growth and innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)