Table of Contents

Introduction

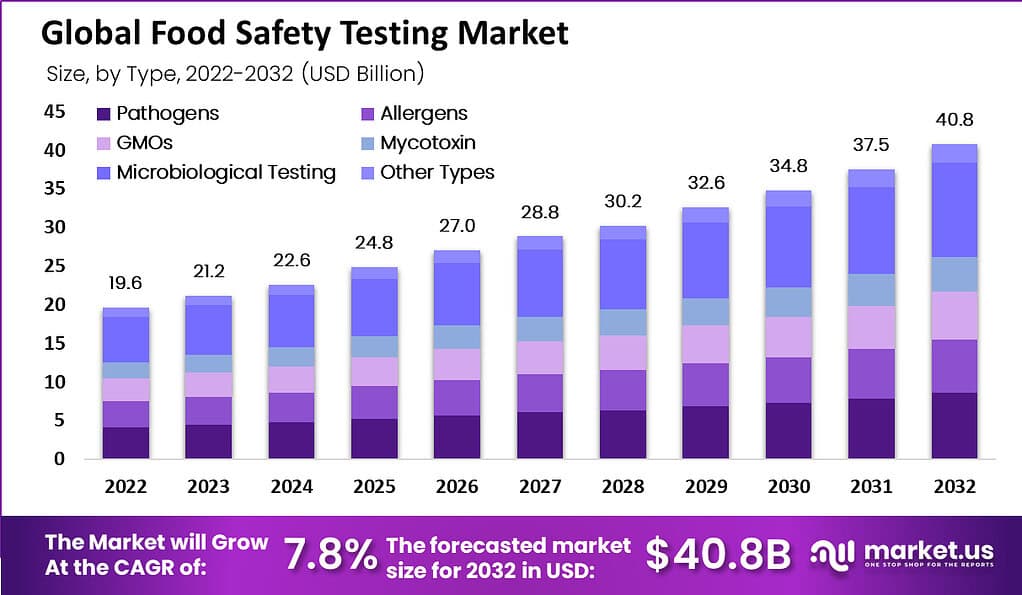

The Food Safety Testing Market is set to grow substantially, with projections indicating its escalation from USD 19.6 billion in 2022 to USD 40.8 billion by 2032, driven by a compound annual growth rate (CAGR) of 7.8%. This growth is underpinned by increasing global awareness and regulatory pressures regarding food safety, necessitated by the rising incidence of foodborne illnesses and consumer demand for transparency.

Key growth drivers include the escalating consumption of meat, dairy, and processed foods, each requiring rigorous safety protocols to detect contaminants like pathogens, chemicals, and genetically modified organisms (GMOs). Particularly, meat and dairy products are critical areas due to their high risk of contamination and substantial market share in safety testing. Enhanced regulatory standards worldwide, especially in North America and Europe, continue to push the expansion of this market, with a marked increase in testing technologies such as PCR (Polymerase Chain Reaction) and immunoassay-based tests.

However, the market faces challenges such as the high costs associated with advanced food safety testing technologies and a lack of infrastructure in developing regions, which may impede accessibility and affordability of food safety testing solutions. Additionally, complexities related to the diverse range of food products and varying regulatory landscapes across different countries require tailored and sophisticated testing approaches.

Recent developments highlight a focus on technology adoption and geographical expansion, with significant investments in research and development by major companies to enhance food safety protocols. For instance, advancements in rapid testing methods are being adopted to provide quicker and more reliable results, which are essential for maintaining the integrity of the global food supply chain.

Key Takeaways

- The Food Safety Testing Market is expected to grow at a CAGR of 7.8%.

- It is projected to reach a valuation of USD 40.8 Billion by 2032.

- In 2022, the market was valued at USD 19.6 Billion.

- Microbiological testing held more than 30.0% of the revenue share in 2022.

- Rapid technology had the highest revenue share of almost 55.0% in 2022.

- The meat, poultry & seafood sector led the market in 2022 with a market share of about 30.0%.

- Europe held a revenue share of approximately 36% in 2022.

Salmonella Statistics

- Salmonella causes over 19,000 hospitalizations each year in the U.S.

- Estimated annual medical costs of Salmonella in the U.S. amount to $3.7 billion.

- The Centers for Disease Control and Prevention reports 1.4 million individuals affected by Salmonella.

- Of the 1.4 million affected by Salmonella, 450 lead to death.

- Salmonella was the target in approximately 120 million of the 280 million tests for pathogens in 2016.

Foodborne Disease Statistics

- Approximately 600 million cases of foodborne diseases occur globally each year.

- Out of 600 million cases, 420,000 deaths occur globally due to pathogens and food contaminants.

- The U.S. alone accumulates around 48 million cases of food poisoning per year.

- Of the 48 million cases in the U.S., 128,000 are hospitalized.

- India reports 100 million cases of foodborne diseases annually.

Food Safety and Testing Statistics

- The total market value for microbiology testing in the food sector has grown at a 7.1 percent CAGR over the past 5 years.

- Listeria/Listeria monocytogenes tests totaled about 115 million tests, representing 41 percent of pathogen testing.

- 0.7% of producers, 42.8% of restaurants, and 12.5% of supermarkets in North America follow food safety regulations and have food safety certificates.

- FSSAI has released about Rs 300 crore to various states in the past three years for food safety initiatives.

Emerging Trends

Increased Digitalization and Automation: The food safety sector is experiencing a significant shift towards the digitalization of processes. This trend includes the adoption of artificial intelligence (AI) and machine learning to enhance the efficiency and accuracy of food safety testing, helping to address labor shortages and improve operational efficiencies.

Advancements in Traceability Technologies: Enhanced traceability systems are becoming a priority, particularly in North America, spurred by regulatory amendments like the FDA’s Food Safety Modernization Act (FSMA) Rule 204. These systems are crucial for quickly identifying and addressing potential contamination issues.

Blockchain for Enhanced Safety and Transparency: Blockchain technology is increasingly being utilized to improve transparency in the food supply chain. By offering detailed tracking from production to consumption, blockchain helps ensure the integrity and safety of food products, making it easier to pinpoint sources of contamination during outbreaks.

Sustainability and Consumer-Driven Changes: There is a growing integration of sustainability in food safety practices. Food and beverage companies are incorporating eco-friendly practices and focusing on sustainability not just as a regulatory compliance measure but also as a response to consumer preferences for environmentally responsible products.

Regulatory Focus and Compliance: Governments are intensifying regulations around food safety, which is leading to a more stringent compliance landscape. Companies are required to adhere to increasingly rigorous standards, which is driving the adoption of advanced testing technologies and methodologies.

Integration of Food Safety and Quality: The lines between food safety and quality are blurring, with a combined focus on ensuring product integrity and safety. This trend is reflected in the integration of comprehensive safety protocols that address both quality assurance and contamination prevention.

Use Cases

Outbreak Response: In response to a multistate Salmonella outbreak linked to flour, food safety testing was crucial in identifying the source and extent of the contamination, leading to a nationwide recall of the affected products. The outbreak investigation, which included testing food samples from the production facility, helped pinpoint the exact source, ensuring that further spread of the infection was contained.

Monitoring and Prevention: Food safety testing played a critical role in identifying potential risks such as the presence of Listeria monocytogenes in leafy greens. This proactive testing is vital for preventing foodborne illnesses by ensuring that contaminated products do not reach consumers. Regular monitoring and testing help in maintaining public health standards and trust in food safety.

Enhancing Traceability: Cyclospora outbreaks in the United States, which affected over 2,000 people across multiple states, highlighted the need for enhanced traceability in the food supply chain. Food safety testing for pathogens like Cyclospora not only helps in controlling the spread of the disease but also in tracing back the source of contamination to prevent future outbreaks.

Regulatory Compliance: In the case of raw pork products, increased testing has been highlighted due to a rise in pork-associated Salmonella outbreaks. This testing is part of regulatory efforts to comply with new standards aimed at reducing foodborne illnesses linked to pork.

Major Challenges

High Costs: One of the major barriers is the high cost associated with conducting comprehensive food safety tests. These costs stem from the need for advanced technological tools and skilled personnel to carry out the tests accurately. High operational costs can deter food processors from conducting routine inspections, which is crucial for maintaining food safety standards.

Complex Regulatory Environment: Food safety testing is governed by a myriad of regulations that vary significantly from one region to another. This diversity in regulations can be overwhelming, requiring companies to stay constantly updated and compliant, which involves significant resources and continuous training of staff. Failure to meet these regulations can lead to severe penalties, including fines and product recalls.

Accuracy of Rapid Testing Methods: While rapid testing methods provide the advantage of quick results, they also carry risks of false positives or negatives. False positives can lead to unnecessary recalls, causing financial loss, while false negatives may result in the distribution of unsafe food, posing health risks to consumers.

Digitalization and Technological Integration: The food safety sector is increasingly leaning towards digital solutions to enhance traceability and efficiency. However, the cost of digital transformation can be high, and the industry faces challenges in adopting these technologies uniformly. There is also a concern about the return on investment for such technologies, making it crucial for companies to choose solutions that offer tangible benefits.

Labor Shortages: There is a noticeable shortage of skilled labor in the food safety industry, which complicates the situation further. This shortage is exacerbated by the increasing complexity of food safety testing processes which require specialized knowledge and skills.

Market Growth Opportunities

The food safety testing market is experiencing robust growth, driven by several key factors that offer substantial opportunities for expansion and innovation. Here are some of the primary growth opportunities in the market:

Increasing Demand for Processed Foods: The global rise in consumption of processed foods is pushing the need for stringent food safety testing to ensure these products are free from contaminants and safe for consumption. This trend is particularly prominent in regions with rapid urbanization and rising consumer income, which heightens the demand for convenience foods that must meet high safety standards.

Technological Advancements in Testing Methods: The adoption of rapid testing technologies such as PCR (Polymerase Chain Reaction) and immunoassay techniques is accelerating. These methods provide faster, more accurate results, reducing the risk of foodborne illnesses and allowing for quicker responses to potential contamination. This technological shift is expected to continue driving market growth as industries seek more efficient, cost-effective testing solutions.

Regulatory Tightening and Consumer Awareness: Globally, there is a tightening of food safety regulations combined with a growing consumer awareness about food safety. This is compelling food producers to adopt advanced safety testing methods to comply with regulatory standards and meet consumer expectations. This regulatory pressure is particularly strong in North America and Europe but is also increasing in the Asia-Pacific region, where food safety concerns are becoming more prevalent.

Expansion into New Markets: The Asia-Pacific region shows significant growth potential due to its expanding food and beverage industry and stringent safety regulations. This expansion is fueled by the increased globalization of the food supply chain, requiring rigorous safety testing to maintain quality and safety standards across international markets.

Recent Developments

BIOTECON Diagnostics GmbH has been active in advancing its offerings in the food safety testing sector throughout 2023 and into 2024. Notably, in 2023, BIOTECON expanded its PCR portfolio with over 25 new kits as part of its food proof® SL product line. These kits are designed for detecting pathogens, spoilage organisms, and genetically modified organisms (GMOs), as well as for conducting food allergen tests.

In January 2024, BIOTECON launched the real-time PCR foodproof® Aspergillus Detection LyoKit specifically for the cannabis testing industry. This kit, which identifies four species of pathogenic Aspergillus, represents a significant step forward in ensuring the microbial safety of cannabis and cannabis-infused products. This launch underscores BIOTECON’s commitment to adapting its robust food safety technologies to new market needs, such as the burgeoning cannabis industry.

FoodChain ID Group, Inc. has made significant strides in the food safety testing sector throughout 2023 and into 2024. In 2023, the company was very active in enhancing its regulatory compliance services, particularly with the introduction of new digital tools to help manage changes in global pesticide Maximum Residue Levels (MRLs) and food contact materials. This reflects their ongoing commitment to staying ahead of regulatory changes and ensuring compliance in the dynamic food industry landscape.

By 2024, FoodChain ID continued to expand its services, notably by enhancing its commitments to sustainable supply chains in May. This includes the implementation of deforestation-free services to ensure due diligence and compliance in sourcing from sustainable supply chains. Moreover, in July 2024, they announced a new soil carbon methodology in collaboration with ReSeed, which rewards farmers for both maintaining and removing emissions from soil organic carbon, highlighting their focus on sustainability and responsible farming practices.

AsureQuality Limited has been actively enhancing its capabilities and offerings in the food safety testing sector throughout 2023 and into 2024. The company, renowned for its comprehensive range of food assurance services in New Zealand, is undertaking significant initiatives to bolster its laboratory testing services. A major project initiated in June 2024 involves the redevelopment of its Food Laboratory in Auckland, aimed at expanding its capacity and integrating advanced automation technologies for more efficient testing processes. This redevelopment is part of AsureQuality’s commitment to maintaining high standards in food safety and quality across New Zealand.

Intertek Group plc has been actively expanding and enhancing its services in the food safety testing sector throughout 2023 and into 2024. The company, recognized globally for its extensive network, provides a wide array of testing, inspection, and certification services aimed at ensuring the quality and safety of food products across multiple markets. Over the past year, Intertek has focused on leveraging its expertise to aid businesses in adhering to complex food safety regulations and maintaining high standards of public health and safety.

Conclusion

In conclusion, the food safety testing market plays a crucial role in ensuring the safety and quality of food products globally. With advancements in testing technologies and increasing global regulations, this sector is set to grow substantially. The continuous integration of new testing methodologies, including rapid testing and automation, is enhancing the efficiency and accuracy of food safety testing processes. These developments are critical for meeting the rising consumer demand for transparency and accountability in the food supply chain. As the market expands, the emphasis on implementing more stringent safety protocols and innovative solutions will further solidify the importance of food safety testing in safeguarding public health and maintaining consumer trust in food products.