Table of Contents

Introduction

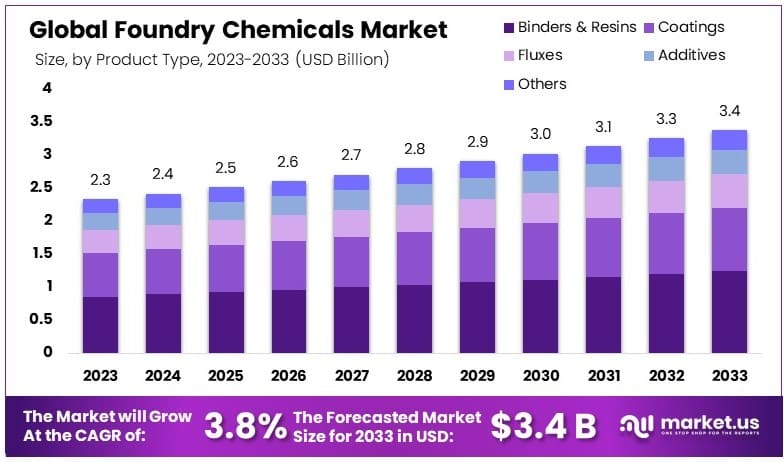

The global foundry chemicals market is anticipated to witness notable growth from USD 2.3 Billion in 2023 to USD 3.4 Billion by 2033, with a compound annual growth rate (CAGR) of 3.8%. This expansion is driven by the increasing demand for high-quality casting products in the automotive, aerospace, and construction sectors. Growth factors include technological advancements in foundry processes and the development of eco-friendly chemicals that meet stringent environmental regulations.

However, the market faces challenges such as the volatility of raw material prices and the need for continuous innovation to reduce waste and improve efficiency. Recent developments in the industry have focused on optimizing chemical formulations to enhance the quality and durability of castings, which are essential for meeting the evolving specifications of end-users. These advancements are pivotal in supporting the sustainable growth of the foundry chemicals market, ensuring it meets global industrial demands efficiently.

The foundry chemicals industry is set for significant growth, driven by technological advancements and increasing demand from key industries such as automotive and construction. Key players like Vesuvius, ASK Chemicals, HÜTTENES-ALBERTUS, and Imerys are focusing on innovation, sustainability, and strategic expansions to strengthen their market positions. The continuous development of eco-friendly and high-performance foundry chemicals will be crucial in meeting the evolving demands of the industry and ensuring regulatory compliance.

Vesuvius has been actively involved in enhancing its product portfolio and expanding its market reach through strategic acquisitions. In 2023, Vesuvius acquired Universal Refractories, a leading provider of refractory solutions, which significantly boosted its capabilities in foundry chemicals. This acquisition aligns with Vesuvius’ strategy to strengthen its position in high-growth markets and improve its technology offerings.

ASK Chemicals continues to innovate within the foundry chemicals market. Recently, the company launched a new series of environmentally friendly binder systems designed to reduce emissions during the casting process. This development underscores ASK Chemicals’ commitment to sustainability and addressing environmental concerns in the foundry industry. Additionally, ASK Chemicals has increased its R&D investments to develop advanced additive agents that enhance casting quality and reduce production costs.

Imerys has made significant strides in the foundry chemicals sector by diversifying its product range and enhancing its technological capabilities. In 2023, Imerys launched a new line of coatings and fluxes designed to improve the efficiency and quality of metal castings. This product launch is part of Imerys’ strategy to offer comprehensive solutions that meet the evolving needs of foundries worldwide. Furthermore, Imerys has invested in digital transformation initiatives to streamline its supply chain and improve customer service.

Key Takeaways

- Market Value: The Foundry Chemicals Market was valued at $2.3 billion in 2023 and is expected to reach $3.4 billion by 2033, with a CAGR of 3.8%.

- Product Type Analysis: Binders & Resins dominated with 36.8%; they are essential for improving mold strength and casting quality.

- Application Analysis: Cast Iron led with 38.5%; it is significant due to its extensive use in automotive and industrial machinery.

- Dominant Region: APAC dominated with 42.1%; driven by the large-scale manufacturing and automotive industries in the region.

- High Growth Region: North America shows promising growth; technological advancements and investments in the foundry industry boost demand.

- Analyst Viewpoint: The market is moderately competitive with steady growth. Future trends indicate increased use of eco-friendly chemicals and technological innovations.

Foundry Chemicals Statistics

- The foundry industry is required to reduce greenhouse gas emissions and participate in the EU’s CO2 emission certificate trading system.

- Rusty steel scrap can take 2 to 3 times longer to melt compared to non-rusty scrap, requiring a 40% to 60% higher power input.

- The melting process accounts for 55–70% of the energy consumption in the metal casting industry.

- Using unclean foundry returns containing 20 kg of sand per tonne of iron accounts for an additional energy consumption of 10 kWh/t.

- Packing densities in the range of 2 to 2.7 tonne/m³ can be achieved in the furnace.

- Decreasing the packing density from 2.5 to 2.0 tonnes/m³ resulted in a 25 kWh increase in power consumption.

- Adding carburizing agents to the molten metal bath after the melting process can result in an additional energy consumption of approximately 1 to 2 kWh per kilogram of carburizing agent.

- A temperature rise of 50 K can consume approximately 20 kWh per tonne of iron.

- The total energy consumption for melting 1 ton of cast iron is 656 kWh/ton.

- The American foundry industry finished 2022 with total sales of $47 billion.

- US castings sales grew by an estimated 9.5% year-over-year.

- In a recent survey, 63% of foundries confirmed expectations of rising sales in 2023.

- AFS expects casting sales to increase by 4.3% in 2023.

- 96% of foundries plan to invest in 2023.

- The U.S. foundry industry saw a second strong year of growth in 2022, with casting sales reaching $46.3 billion.

- In 2020, overall industry revenue was $36.7 billion, down from $44.2 billion.

- The American Foundry Society (AFS) forecasts casting sales to reach $48.3 billion in 2023, a 4.3% increase over 2022.

- In 2022, operating expenses were 82.8% of revenue for foundries, growing 12.1% year over year.

- Foundry operating expenses break down as follows: 51.5% for cost of materials, 32.8% for employee expenses, 7.3% for buildings and expenses, and 8.9% for other expenses.

- An estimated 89% of foundries are profitable, with an average net income of 9.2% of revenues.

- The number of U.S. foundry facilities (excluding art and educational foundries) is estimated to be 1,715.

- The European Foundry Industry Sentiment Indicator (FISI) recorded an upward correction of 2.76 index points in February 2023.

- India stands 2nd in casting export in the world.

- The Indian foundry industry is the second-largest in the world, with more than 6,000 foundries in India alone.

- The Indian foundry industry produces 10 million tons per annum.

- Export values of the Indian foundry industry could reach approximately $3-3.5 billion in the near future.

Emerging Trends

- Eco-Friendly Products: There’s a growing shift towards environmentally friendly foundry chemicals. Companies are developing products that reduce emissions and waste, responding to increasing environmental regulations and a general shift towards sustainability in manufacturing processes.

- High-Performance Chemicals: Demand for high-performance chemicals that improve the quality and durability of cast metals is rising. These chemicals are designed to enhance the mechanical properties of metals, leading to more robust and long-lasting end products.

- Innovation in Binders: Binders are crucial in the molding process of casting. Innovations in binder technology are focused on reducing emissions and improving the recyclability of sand molds, which are significant for environmental compliance and cost efficiency.

- Advanced Degassing Solutions: The development of advanced degassing agents that effectively remove hydrogen and other impurities from molten metals is on the rise. These solutions are critical for producing high-quality castings, especially in aerospace and automotive industries.

- Automated Dosing Systems: Automation in the dosing of foundry chemicals is becoming more prevalent. These systems ensure precise and consistent chemical application, reducing waste and improving the overall efficiency of the casting process.

- Growth in Emerging Markets: Rapid industrialization in Asia, Africa, and South America is driving demand for foundry chemicals. The expansion of automotive, construction, and manufacturing industries in these regions is expected to continue, creating significant opportunities for market growth.

- Customized Chemical Solutions: There is an increasing trend towards customized chemical solutions tailored to specific foundry needs and applications. Manufacturers are collaborating closely with foundries to develop bespoke solutions that address unique casting challenges and enhance product performance.

Use Cases

- Mold and Core Making: Foundry chemicals are used to enhance the properties of molds and cores, ensuring they are strong enough to withstand the pouring of molten metal. These chemicals help in achieving precise casting shapes and fine details in finished metal products.

- Metal Cleaning and Refining: Chemicals designed for metal cleaning remove impurities and surface defects from metals before casting. This ensures that the final products are of high quality, free from defects that could weaken the metal structure.

- Sand Conditioning: Foundry chemicals are integral in sand conditioning, which involves treating the sand used in mold making to ensure it performs optimally. These treatments improve the sand’s cohesiveness and ability to accurately capture the details of the mold design.

- Degassing of Metals: Degassing agents are used to remove dissolved gases from metals before they are cast. This is crucial for preventing gas pockets or porosity in the final cast, which can lead to structural weaknesses and surface irregularities in the metal.

- Surface Finishing: Certain foundry chemicals are used in the surface finishing of metals to improve their appearance, corrosion resistance, and surface properties. These chemicals ensure that the final product meets specific aesthetic and functional criteria.

- Heat Treatment: Foundry chemicals play a role in the heat treatment process by facilitating the hardening, tempering, and annealing of metals. This treatment enhances the mechanical properties of the metal, such as strength, toughness, and resistance to wear.

- Binder Systems: Binders are used to hold the sand in molds together until the metal is poured and solidifies. These chemical systems are vital for maintaining the integrity and stability of the mold during the casting process, ensuring that the finished products maintain their intended shape and size.

Key Players Analysis

Vesuvius, a global leader in molten metal flow engineering, operates in the foundry chemicals sector under the Foseco brand. In 2023, the Foundry Division reported revenues of £551 million, reflecting a 13% increase. Recent initiatives include a significant investment in a new manufacturing facility in North America, aimed at enhancing production efficiency and sustainability. This facility is expected to meet 75% of regional demand. Additionally, Vesuvius continues to innovate with new product launches such as the SEMCO formaldehyde-free coating to reduce environmental impact.

ASK Chemicals is a prominent player in the foundry chemicals sector, specializing in binders, coatings, and other foundry consumables. In 2023, ASK Chemicals expanded its global footprint by acquiring the industrial resin business of SI Group. This acquisition aims to strengthen its product portfolio and market presence. The company continues to innovate in sustainable solutions, such as low-emission binders, to meet the evolving needs of the foundry industry and enhance its environmental performance.

Hüttenes-Albertus Chemische Werke GmbH, a global leader in the foundry chemicals sector, continues to innovate with advanced products and technologies. Recently, the company focused on sustainable solutions, launching new refractory coatings that enhance efficiency and reduce environmental impact. Their commitment to digitalization is evident through partnerships aimed at developing digital core production. In 2023, Hüttenes-Albertus strengthened its market position by acquiring Hexion’s interest in HA International, enhancing its product portfolio and market reach.

Imerys, a key player in the foundry chemicals sector, specializes in high-performance mineral solutions. In 2023, the company reported significant revenue growth driven by its strategic focus on sustainability and innovation. Imerys recently launched new eco-friendly binders and coatings that improve casting quality while minimizing environmental impact. The company’s acquisition of the foundry sand business from S&B Industrial Minerals further expanded its product offerings, reinforcing its market leadership.

IVP Limited, established in 1929 and part of the Allana Group, is a key player in the foundry chemicals sector, offering a range of resins, foundry coatings, and allied products. In 2023, IVP reported revenues of ₹4,060.8 million, reflecting a decrease from the previous year due to challenging market conditions. The company continues to innovate, with recent advancements in polyurethane systems for footwear and adhesives for flexible packaging. IVP maintains a strong production capacity with facilities in Tarapur and Bangalore, ensuring a significant market presence.

Asahi Yukizai Corporation is a prominent player in the foundry chemicals sector, specializing in resins, binders, and other chemical solutions. Recently, Asahi Yukizai has focused on expanding its product portfolio and enhancing its manufacturing capabilities to meet the growing demand in the foundry industry. The company reported stable financial performance in 2023, driven by strategic investments and innovation in eco-friendly products. Asahi Yukizai continues to strengthen its market position through technological advancements and sustainability initiatives.

SQ Group is an active player in the foundry chemicals sector, offering a range of products including resins, coatings, and binders. The company continues to innovate, focusing on sustainable solutions to meet industry demands. In recent years, SQ Group has seen steady revenue growth, supported by its strategic acquisitions and investments in advanced manufacturing technologies. These initiatives aim to enhance product quality and environmental performance, positioning SQ Group as a competitive player in the global foundry chemicals market.

General Chemical Corp. specializes in manufacturing specialty chemicals for various industrial applications, including foundry chemicals. The company has been focusing on expanding its product range and improving manufacturing efficiencies. Recent efforts include the development of new environmentally friendly products and coatings to cater to the increasing demand for sustainable solutions in the foundry industry. These initiatives have bolstered General Chemical Corp.’s market position and contributed to stable revenue growth.

Hüttenes-Albertus International is a leading provider of foundry chemicals, known for its innovative products and solutions. In 2023, the company reported significant advancements in digital core production technology and sustainable product development. Hüttenes-Albertus continues to strengthen its market presence through strategic acquisitions and partnerships, which have enhanced its product portfolio and global reach. The company remains committed to sustainability and efficiency, supporting its growth in the competitive foundry chemicals sector.

KAO Chemicals is involved in the foundry chemicals sector, providing high-value products such as resins, binders, and additives. The company focuses on sustainability, with recent innovations like the LUNAFLOW® CNF slippery liquid coating agent and bio-based aromatic compounds aimed at reducing environmental impact. KAO Chemicals continues to expand its product offerings, supporting various industrial applications, and reported strong performance in 2023, contributing to its robust market position in the foundry chemicals industry.

Fincast Foundry Flux Co. is a specialized provider of foundry chemicals, offering products designed to improve the efficiency and quality of metal casting processes. The company focuses on innovative solutions such as fluxes, degassers, and other additives that enhance metal purity and reduce defects. Recent efforts include expanding their product line to meet the growing demands of the automotive and aerospace industries, ensuring consistent revenue growth and market expansion in 2023.

Mazzon SpA is a key player in the foundry chemicals sector, known for its high-quality fluxes and refining agents. The company has strengthened its market presence through continuous innovation and strategic partnerships. In recent years, Mazzon SpA has focused on developing eco-friendly products that meet stringent environmental standards, contributing to sustainable growth. Their 2023 revenue reflected steady growth, supported by increased demand from various industrial sectors.

Conclusion

The foundry chemicals market is poised for steady growth, primarily supported by the rising demand in the automotive and construction sectors. The increasing complexity of casting products and the stringent quality requirements are further driving the need for advanced foundry chemicals.

Although the market faces challenges such as fluctuating raw material prices and environmental concerns, these are being progressively addressed through technological advancements and sustainable practices. As the industry continues to evolve, companies that adapt to these changes and focus on innovation are likely to see sustained success. Therefore, the market outlook remains cautiously optimistic, with substantial opportunities for growth and innovation.