Table of Contents

Introduction

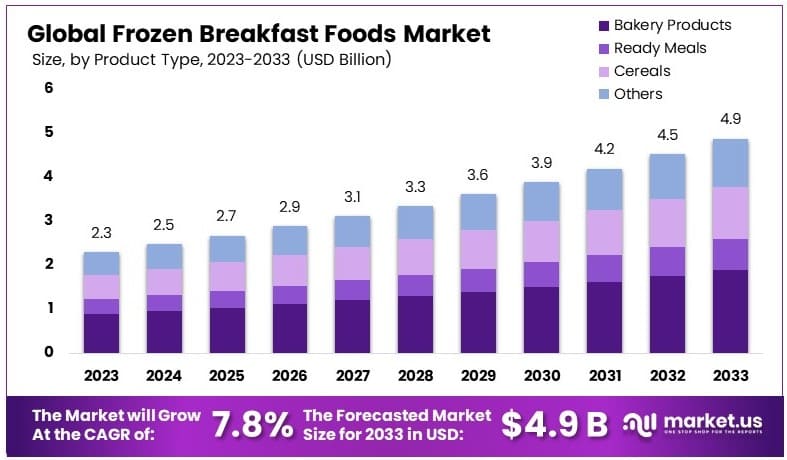

The global frozen breakfast foods market is projected to experience significant growth, expanding from an estimated USD 2.3 billion in 2023 to around USD 4.9 billion by 2033, with a compound annual growth rate (CAGR) of 7.8% over the forecast period from 2024 to 2033. This robust expansion is driven by several key factors, including the increasing demand for convenient and quick meal options among time-pressed consumers and a rising preference for nutritious breakfast solutions.

However, the market faces challenges such as fluctuating prices of raw materials and the need for constant innovation to meet consumer preferences. Recent developments in the industry have seen major players introducing a variety of healthier and more diverse product options, aiming to cater to the growing health-conscious demographic. Additionally, advancements in freezing technology have improved the quality and shelf life of these products, further fueling market growth. Despite these positive trends, regulatory complexities and supply chain disruptions could pose hurdles to the market’s trajectory.

Nestlé SA, a dominant player in the frozen breakfast foods market, continues to expand its portfolio with several recent strategic moves and product innovations. In March 2023, Nestlé unveiled a new line of products including a plant-based beverage and a BBQ Chicken Frozen Pizza with a cauliflower crust, which reflects the company’s emphasis on healthier and plant-based options. Additionally, the Protein Lover’s Breakfast Burrito was reintroduced with a new recipe, showcasing Nestlé’s focus on enhancing product offerings in line with current consumer trends.

Nomad Foods has demonstrated a strong commitment to sustainable sourcing. By the end of 2023, 99.5% of their sourced fish and seafood was certified by MSC or ASC, and they are on track to achieve 100% sustainable sourcing for fish and seafood by the end of 2025. Moreover, 92.3% of their agricultural suppliers achieved a silver or higher rating on the Sustainable Agriculture Initiative Platform (SAI Platform) Farm Sustainability Assessment (FSA).

Quirch Foods is also committed to sustainability and corporate social responsibility, focusing on sourcing environmentally conscious and sustainable food products. This commitment is evident in their comprehensive approach to ensuring harmony with employees, customers, communities, and the environment.

These developments highlight robust approach to integrating sustainability with business growth, leveraging both to strengthen their market position in the competitive frozen breakfast foods industry.

Key Takeaways

- Market Value: The Frozen Breakfast Foods Market was valued at USD 2.3 billion in 2023 and is expected to reach USD 4.9 billion by 2033, with a CAGR of 7.8%.

- Product Type Analysis: Bakery Products dominated with 38.7%; they are highly popular due to their convenience and variety.

- Distribution Channel Analysis: Convenience Stores led with 36.8%; they offer easy access and a wide range of products for consumers.

- Dominant Region: Europe dominated with 38.5%; driven by high consumption rates and a preference for convenient breakfast options.

- High Growth Region: North America is experiencing significant growth; increased busy lifestyles and demand for quick meal options boost the market.

- Analyst Viewpoint: The market is competitive with rapid growth. Future trends indicate a shift towards healthier and organic breakfast options.

Frozen Breakfast Foods Statistics

- Frozen food sales amount to $65 billion.

- The frozen food industry generates $11.3 billion in tax revenue.

- The industry supports 670,000 jobs nationwide.

- Each frozen food job produces 3.35 jobs elsewhere in the economy.

- There are 160,000 direct jobs in the frozen food industry.

- There are 510,000 indirect jobs related to the frozen food industry.

- California has the highest employment impact from the frozen food industry with 49,000 jobs.

- The direct impact of frozen food manufacturing supports 160,000 jobs.

- The labor income from the frozen food industry is $8 billion.

- The frozen food category in India is growing fast at 20% – 25% year-on-year.

- Florida, California, and Texas rank as the top three-selling states, while Oklahoma, Wyoming, and Arizona rank as the top three-growth states.

- A recent survey from the American Frozen Food Institute (AFFI) reveals that 68% of Americans purchase frozen food products at least weekly, if not more frequently.

- Frozen fruit and vegetable sales by volume are 271 million pounds ahead of pre-pandemic numbers, according to AFFI statistics.

- Strong demand and increased food prices have driven an additional $1.2 billion in sales in a four-year period.

- Frozen fruits and vegetables represent a healthy $7 billion of the entire frozen category in the United States.

- Some 1,525 U.S. consumers participated in the AFFI online survey, conducted in June 2022, representing ages 18-75.

- Of those who participated, 98.4% said they purchase from the frozen food department at least once a year.

- Of those, 40% are high-frequency consumers, meaning they purchase frozen food daily or every few days.

- An additional 28% make purchases at least weekly.

- America’s core frozen fruit and vegetable consumers are more likely older millennials, located in the Northeast, from larger households with high income, and likely to have children in the household, especially between the ages of 7 and 12.

- 69% of core consumers plan meals with frozen fruits and vegetables in mind, while 89% said they like to have frozen produce available as a backup solution.

- 86% of surveyed consumers liked that buying frozen allowed them to stock up on a mix of different fruits and vegetables at once.

- Another 76% said frozen fruits and vegetables offered an easy alternative to fresh products that they either do not want to make or do not know how to.

- 86% said purchasing frozen allows them to get more fruits and vegetables in their diet.

- 80% said they save money when opting for frozen over fresh.

- Frozen fruit and vegetables have experienced below-average inflation when compared to fresh.

- Of the AFFI consumers surveyed, 68% said they never or rarely ever throw frozen fruits and vegetables away.

- Market penetration for frozen fruits and vegetables is high, with 94% of American households buying in this segment.

- Almost one-third of the core consumers of frozen food reported that they increased their at-home freezer capacity during the pandemic.

- The core shoppers of frozen produce noted that the most important packaging features for them were resealable packages, a variety of bag/serving sizes, and microwaveable options.

- Core consumers use frozen produce for various applications: as sides to an entree, in smoothies, as part of breakfast dishes, and in soups and casseroles.

- Household penetration of frozen food is 99% over an entire year.

- The top reasons for purchasing more frozen food are long shelf-life (60%), desire to stock up in case of food shortages (58%), limiting grocery store trips (51%), ease of preparation (46%), saving time on preparation and cleanup (36%), and belief that frozen foods are safer than fresh items (33%).

- Consumers rate their satisfaction with the frozen foods they purchased highly, with convenience receiving an average rating of 4.3 on a five-point scale, and quality receiving an average rating of 4.1.

- 50% of consumers expect to purchase a lot more (18%) or somewhat more (32%) frozen foods in the next few months compared to pre-pandemic levels.

Emerging Trends

- Health and Wellness Focus: Consumers are increasingly seeking healthy options in their frozen breakfast choices. Products that feature high protein, low sugar, and added vitamins are gaining popularity. Brands are reformulating recipes to include superfoods like quinoa and chia seeds to meet these health-focused demands.

- Plant-Based Innovations: The rise of veganism and concerns about animal welfare are driving the growth of plant-based frozen breakfast products. More companies are introducing vegan options such as plant-based sausages, pancakes, and waffles, which are not only animal-free but also designed to be environmentally friendly.

- Convenience and Portability: Busy lifestyles demand convenience, leading to innovative single-serving and on-the-go frozen breakfast solutions. Portable breakfast sandwiches, burritos, and wraps that are easy to prepare and consume while commuting are becoming more prevalent in the market.

- Ethnic Flavors: There is a growing interest in ethnic and exotic flavors in the frozen breakfast category. Products featuring bold and authentic flavors from Latin American, Asian, and African cuisines are expanding, providing consumers with varied and unique taste experiences.

- Premium Options: Consumers are willing to pay more for premium experiences in their breakfast choices. Luxury ingredients, such as truffle-infused scrambled eggs and artisanal breads, are being incorporated into frozen breakfast products to cater to this upscale market segment.

- Sustainable Practices: Sustainability is becoming a significant factor in consumer purchasing decisions. Eco-friendly packaging and responsibly sourced ingredients are key trends in the frozen breakfast foods market, with brands highlighting these features in their product marketing to attract environmentally conscious consumers.

- Child-Friendly Offerings: With parents looking for quick, nutritious options for children’s breakfasts, the market for kid-friendly frozen items is expanding. These products often include fun shapes and flavors that are tailored to appeal to younger palates, while also maintaining nutritional value.

Use Cases

- Quick Morning Meals: Frozen breakfast foods offer a quick and convenient solution for busy mornings. Products like frozen waffles, pancakes, and ready-made omelets can be heated and served within minutes, saving time during the often hectic morning rush.

- Meal Planning for Busy Families: For families with tight schedules, frozen breakfast items provide a way to plan meals ahead of time. These products can be stocked up and used throughout the week, ensuring that a nutritious breakfast is always on hand without daily preparation.

- Dietary Management: Frozen breakfast products that cater to specific dietary needs, such as gluten-free or high-protein options, help individuals manage their diets effectively. These products make it easier for those with dietary restrictions to enjoy a convenient and satisfying breakfast.

- Portion Control: Single-serving frozen breakfast items help in managing portion sizes, which is beneficial for weight management. Consumers can enjoy a fulfilling breakfast with controlled calorie intake, which is an essential aspect of maintaining a healthy lifestyle.

- Diverse Culinary Choices: Frozen breakfast foods provide an opportunity to explore diverse culinary options without extensive preparation. Items like ethnic breakfast burritos or French crepes are available, allowing consumers to enjoy international flavors from the comfort of their homes.

- Camping and Traveling: Frozen breakfast items are ideal for camping trips or travel because they are easy to transport and can be prepared with minimal cooking facilities. These products ensure that travelers can have a hearty breakfast without relying on local dining options, which might be limited.

- Extended Shelf Life: Unlike fresh breakfast items, frozen products do not spoil quickly. This extended shelf life reduces food waste and provides value for money, as consumers can use these products over a longer period without concerns about spoilage.

Key Players Analysis

Nestlé SA has strengthened its position in the frozen breakfast foods market through strategic moves, including a joint venture with PAI Partners for its European frozen pizza business, which concluded in September 2023. This collaboration allows Nestlé to retain a stake while enhancing future growth potential. Additionally, Nestlé’s overall financial performance remained robust, with organic growth of 7.8% in 2023, despite challenges in the frozen foods segment, particularly in Canada and the U.S. market.

Nomad Foods Ltd. reported strong financial results for 2023, highlighting a 1.4% revenue increase to €761 million in the fourth quarter. The company focused on sustainability and nutritional improvements, with 94% of new product innovations classified as healthier meal choices. Notably, the Goodfella’s pizza range met the UK’s 2024 salt targets. A landmark study by Nomad Foods showed that increasing freezer temperatures could reduce energy consumption by 10-11%, positioning the company as a leader in sustainable practices in the frozen food industry.

In 2023, Quirch Foods LLC expanded its distribution capabilities by opening a new 65,000 sq/ft distribution center in Lebanon, Tennessee. This facility enhances the company’s ability to serve the Tennessee and Kentucky regions with a wide array of fresh and frozen products, including well-known brands like Chiquita Frozen Tropicals. This expansion aligns with Quirch Foods’ strategic growth and commitment to superior customer service and operational efficiency.

Rich Products Corp. has been actively expanding its frozen breakfast foods portfolio, leveraging its extensive range of bakery and dessert offerings. The company continues to innovate, with recent product launches focusing on convenience and high quality. Rich Products’ strategic initiatives have bolstered its market presence, reflected in its robust revenue performance and ongoing commitment to meeting consumer demand for premium frozen breakfast options.

Tyson Foods Inc. has made significant strides in the frozen breakfast foods sector, notably through its Jimmy Dean brand. In 2023, the company introduced Jimmy Dean Egg Bites, which offer a convenient, protein-packed breakfast option. Additionally, Tyson Foods completed the acquisition of Williams Sausage Company, enhancing its product portfolio and manufacturing capabilities. For fiscal 2023, Tyson Foods reported a strong financial performance with expected adjusted operating income ranging between $1.0 billion to $1.5 billion for 2024, bolstered by strategic expansions and new product launches.

Unilever PLC continues to leverage its strong presence in the frozen foods market through its diverse range of breakfast products. The company focuses on innovation and sustainability, ensuring that new product launches meet consumer demand for convenience and health. Recent financial reports indicate steady growth in the frozen foods segment, driven by strategic acquisitions and an emphasis on sustainable sourcing practices. Unilever’s commitment to innovation and sustainability underpins its strategy to maintain and grow its market share in the frozen breakfast foods sector.

Dr. August Oetker KG has bolstered its presence in the frozen breakfast foods market by acquiring Galileo Lebensmittel KG, a company specializing in frozen pizza snacks. This acquisition, completed in March 2023, enhances Dr. Oetker’s product portfolio and market reach in Europe. Dr. Oetker reported a 6.9% increase in total sales, reaching EUR 4.2 billion in 2023, driven by strategic investments and innovative product launches.

General Mills Inc. has been active in the frozen breakfast foods market with several new product launches in 2023. Notable introductions include Kit Kat Cereal and Häagen-Dazs Cultured Crème, expanding their breakfast offerings. The company reported a 13% increase in net sales for the third quarter of fiscal 2023, reaching $5.1 billion. General Mills also increased its quarterly dividend to $0.59 per share, reflecting its strong financial performance and commitment to shareholder returns.

ITC Ltd. has been actively expanding its frozen foods portfolio under the ITC Master Chef brand. Recently, the company has launched several new products aimed at the retail and food services sectors, including Mumbai Vada Pop and Achari Beetroot Kebab. ITC has been increasing its distribution network across 60 cities to enhance the availability of its products. This expansion aligns with ITC’s strategic goal to diversify beyond its traditional cigarette business and achieve significant growth in the fast-moving consumer goods sector by 2030.

Kellogg Co. has continued to innovate within the frozen breakfast foods market, focusing on expanding its product range. In 2023, the company introduced new offerings under its Eggo brand, including Eggo Grab & Go Liège-Style Waffles, which cater to the growing demand for convenient, on-the-go breakfast options. Kellogg reported strong financial performance with a significant increase in net sales driven by its breakfast segment, which remains a core area of growth. The company’s ongoing commitment to product innovation and market expansion underpins its success in the frozen breakfast foods sector.

McCain Foods Ltd. has been actively expanding its operations and product offerings within the frozen food market. In 2023, McCain made its largest investment ever, totaling CAD $600 million, to double the size and capacity of its Coaldale, Alberta facility. This expansion includes sustainability measures such as wind turbines and solar panels to achieve 100% renewable electricity. Additionally, McCain acquired Scelta Products, enhancing its range of frozen vegetable appetizers. These strategic moves support McCain’s growth and sustainability goals in the frozen breakfast foods sector.

Ruiz Food Products Inc., known for its El Monterey brand, continues to lead in the frozen breakfast foods market with a focus on Mexican-inspired products. The company has expanded its product line to include breakfast burritos and quesadillas, catering to the growing demand for convenient and flavorful breakfast options. Ruiz Foods remains committed to quality and innovation, leveraging its expertise to maintain a strong market presence. Recent reports indicate steady growth and expansion plans, aligning with consumer trends towards quick and easy meal solutions.

The Kraft Heinz Co. has strengthened its frozen breakfast foods portfolio through innovation and strategic acquisitions. In 2023, Kraft Heinz introduced new products under its Ore-Ida brand, focusing on breakfast items like hash brown patties and potato-based breakfast bowls. The company has also invested in improving its supply chain efficiency to better serve the frozen foods market. Kraft Heinz’s commitment to quality and convenience drives its success in the frozen breakfast foods segment, contributing to its overall financial performance and market growth.

Conclusion

The market for frozen breakfast foods has shown considerable growth due to changing consumer lifestyles and increasing demand for convenient meal options. As people seek quick and easy breakfast solutions that fit their busy schedules, manufacturers have responded by diversifying their product offerings to include healthier and more varied options.

It is anticipated that the market will continue to expand, driven by innovations in product variety and enhancements in flavor and nutritional value. Continued investment in marketing and distribution channels is recommended to capitalize on this growth trajectory.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)