Table of Contents

Introduction

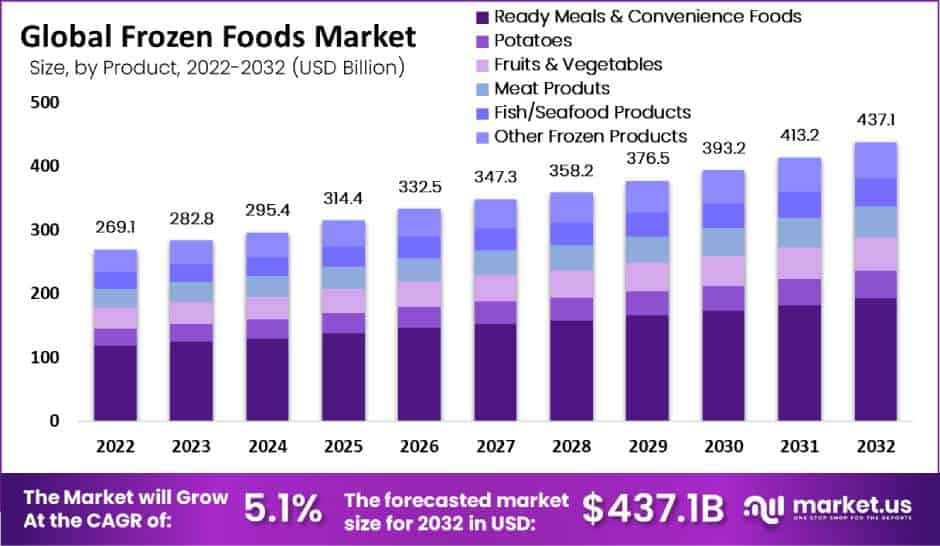

The global frozen food market is experiencing significant growth, with the market size expected to surge from USD 269.1 billion in 2022 to USD 437.1 billion by 2032, marking a compound annual growth rate (CAGR) of 5.1%. This expansion is driven by increasing consumer demand for convenience foods, the rising adoption of ready-to-eat meals, and improvements in freezing technologies which enhance the quality and shelf life of frozen products. The market also benefits from trends like the growing population and urbanization, which increase the reliance on easy and quick meal solutions.

However, challenges such as the high cost of logistics and storage, as well as the energy-intensive nature of maintaining frozen products, pose significant hurdles. The industry also faces shifting consumer perceptions about the nutritional value of frozen foods compared to fresh alternatives.

Recent developments highlight active innovation and expansion within the sector. For example, major players like Conagra Brands have introduced over 50 new products across their frozen, grocery, and snacks divisions, aiming to capture a broader market segment. Such innovations are crucial in responding to the sophisticated palate of modern consumers and expanding the reach of frozen foods in global markets.

Unilever PLC continues to expand its frozen food portfolio, focusing on sustainable and healthier product options, aligning with global consumer trends towards well-being and environmental responsibility. Nestle S.A. has been active in launching innovative frozen products that cater to the increasing demand for convenience combined with nutritional benefits. Their efforts are aimed at capturing a broader consumer base seeking quality and ease in meal preparations.

Key Takeaways

- Frozen Food Market is expected to reach a value of USD 437.1 billion by 2032, showing significant growth from USD 269.1 billion in 2022, with a CAGR of 5.1%.

- The Ready Meals & Convenience Foods Segment Dominates With a 44% Market Share

- offline segment had a roughly 88% revenue share.

- Europe is the world’s largest market for frozen food items, with a 33% market share in 2022.

Frozen Food Statistics

- A combination of broccoli, cauliflower, and carrots make up this mixture that packs 2 grams of fiber and 2 grams of protein in just 30 calories per serving.

- This Eggland’s Best Three Cheese Cage Free Omelet provides a whopping 15 grams of protein for 220 calories.

- Per serving (two patties), you’ll get 13 grams of protein for only 130 calories.

- Registered dietitians in the Good Housekeeping Institute Nutrition Lab tested over 35 frozen pizzas.

- Our top picks for the healthiest frozen pizzas are about 30 grams of net carbs or less, less than 4 grams of total sugar and less than 600 milligrams of sodium per serving.

- Snack-type frozen meals are also on the rise, and research firm Mintel’s marketing studies say that 48% of customers are looking for healthier options even among snacky foods.

- The compound annual growth rate for non-alcoholic beer and wine is projected at 7% between 2023 and 2032

- Some low-alcohol drinks and cocktails with only 0.5% to 25% alcohol by volume (ABV) will also make waves.

- Spam claims that people around the world consume 12.8 cans of its product every second, which comes out to 768 cans per minute, 46,080 per hour, and over 1.1 million cans per day.

- However, a basic can of Spam costs $3.58 at Walmart ($4.77 per pound), making it $0.65 per pound more expensive than store-brand ham lunch meat and $2.29 per pound more expensive than a whole ham.

- With the U.S. Department of Agriculture predicting restaurant food prices to rise another 4.9% in 2024,

- So, it’s not surprising that the Upgraded Points website found that 78% of people in the U.S. still use food delivery services at least occasionally.

- The problem is that customers are paying $2 to $5 in delivery fees and 15% in customer service fees.

- According to BuildingH, 56% are ordering food delivery only once or twice a month (via Fit Small Business).

- The problem is that customers are paying $2 to $5 in delivery fees and 15% in customer service fees.

Emerging Trends

Emerging trends in the frozen food market are shaping the future landscape of the industry, driven by evolving consumer preferences and advancements in food technology. One significant trend is the increasing demand for globally inspired flavors, as consumers seek diverse culinary experiences even in their convenience meals. This has led to the introduction of more exotic, ethnic food options within the frozen food aisles, ranging from Asian-inspired dishes to traditional European cuisines.

Additionally, there’s a growing emphasis on healthier options within the frozen food sector. Consumers are now looking for products that not only offer convenience but also align with their health and dietary needs. This includes low-calorie meals, options rich in proteins, and dishes that cater to specific dietary restrictions like gluten-free or vegan. Manufacturers are responding by reformulating their products to reduce sodium content, eliminate artificial additives, and include more natural ingredients.

Another key trend is the integration of advanced technology in the production and packaging of frozen foods, which enhances product quality and shelf life. Innovations such as improved freezing techniques and smarter packaging solutions that prevent freezer burn are pivotal in maintaining the taste and nutritional value of frozen products.

Moreover, the shift towards more sustainable practices is also evident in the frozen food industry. Companies are increasingly adopting eco-friendly packaging and focusing on reducing their carbon footprint throughout the supply chain. This not only helps meet regulatory requirements but also appeals to the environmentally conscious consumer.

Use Cases

- Convenience Meals: One of the most significant uses of frozen food is in providing convenient meal options for individuals and families. Frozen dinners, pizzas, and breakfast items cater to busy lifestyles, offering quick, hassle-free meals that require minimal preparation.

- Food Preservation: Freezing is an effective method for preserving the nutritional value, texture, and flavor of foods. It significantly extends the shelf life of products like fruits, vegetables, meats, and seafood, reducing food waste and allowing seasonal foods to be available year-round.

- Food Service Industry: In the restaurant and catering industries, frozen foods are crucial for managing inventory and reducing waste. They allow for better portion control and ensure a consistent supply of ingredients, regardless of seasonal variations.

- Retail and Merchandising: Supermarkets and grocery stores rely heavily on frozen food sections to provide consumers with a wide variety of dietary choices. These include specialty foods such as gluten-free, vegan, and organic options, which might not be feasible to offer in fresh formats due to quicker spoilage rates.

- Health and Diet: Frozen foods increasingly cater to health-conscious consumers by offering nutritionally balanced meals that control portion sizes, calories, and nutrient content. This is particularly important in diet plans and health-focused meal programs.

Key Players Analysis

Tyson Foods, a prominent player in the global frozen food market, recently expanded its operations by inaugurating a new $300 million fully-cooked food production facility in Virginia. This strategic move is aimed at accelerating long-term growth and enhancing operational efficiency. With a robust portfolio that includes popular brands like Tyson, Jimmy Dean, and Hillshire Farm, Tyson Foods continues to solidify its position in the market, responding dynamically to evolving consumer demands for convenience and quality in frozen foods.

Conagra Brands Inc., also a key competitor in the frozen food sector, is recognized for its focus on innovation and market adaptation. The company’s portfolio, featuring brands such as Marie Callender’s and Healthy Choice, emphasizes responding to consumer preferences for convenience and nutritional value. Conagra’s efforts in the frozen food market are characterized by a strategic blend of product development and marketing, aimed at maintaining a strong presence in this competitive industry.

Wawona Frozen Foods, established in 1963, excels in producing high-quality frozen fruits like peaches, strawberries, and plums, primarily for food manufacturers, foodservice distributors, and schools. Operating from California’s fertile San Joaquin Valley, Wawona is recognized for its commitment to quality and safety in food processing. The company’s long-standing experience and family-led management contribute significantly to its reputation in the frozen fruit market, enabling it to deliver products that combine taste, texture, and natural sweetness.

Bellesio Parent, LLC” in the frozen food sector. If you have a specific aspect of their operations or a different company name under which they might operate, please let me know, and I can look further into it.

The Kellogg Company has diversified its product portfolio to include frozen waffles as part of its extensive range of convenience foods. Operating globally, Kellogg focuses on health and wellness trends, responding to consumer demand for nutritious and easy-to-prepare meal options. The company’s presence in the frozen food sector contributes significantly to its revenue, particularly in North America, which remains its largest market.

The Kraft Heinz Company, renowned for its broad range of food products, actively participates in the frozen food sector with offerings that emphasize convenience and flavor. The company aims to meet consumer needs for quick and easy meal solutions, leveraging its extensive distribution network to ensure wide availability of its frozen products in various retail settings. This strategic approach helps Kraft Heinz maintain a strong position in the competitive frozen food market.

Unilever PLC plays a significant role in the European frozen food market, emphasizing the development of child-centric and healthy frozen food options. Their strategic efforts focus on catering to emerging consumer preferences for vegetarian and free-from foods, which include gluten-free and low-sodium options. Unilever’s presence in this market is bolstered by innovations such as expanding their product range to include healthier and more diverse frozen food choices, thereby meeting the growing demand for affordable, healthy frozen foods with longer shelf lives.

Nestlé S.A. is a dominant player in the global frozen food sector, focusing on offering a wide range of high-quality frozen products that cater to varying consumer needs. Their strategy includes a significant emphasis on health and convenience, which aligns with the rising consumer demand for nutritious and easy-to-prepare meal options. Nestlé’s extensive distribution network ensures their frozen food products are widely available, enhancing their market position and catering to the convenience sought by consumers across different regions.

General Mills, Inc. is significantly enhancing its capabilities in the frozen food sector by investing $48 million to expand its frozen dough facility in Joplin, Missouri. This expansion, expected to be completed in early 2024, aims to boost the company’s production capacity and includes the addition of semi-automated processing and packaging lines. This strategic move not only supports General Mills’ growth in the frozen dough market but also underscores its commitment to innovation and efficiency in operations.

Nomad Foods stands out in the frozen food market with a strategic focus on expanding its product range to include more sustainable and health-oriented options. As a major player in the European market, Nomad Foods leverages product innovation and market expansion tactics to strengthen its position. This includes targeting a broad consumer base through both traditional retail channels and emerging online platforms, ensuring widespread accessibility and appeal of their frozen food offerings.

Conclusion

In conclusion, the frozen food market is poised for continued growth, driven by the increasing demand for convenience, variety, and healthier food choices among consumers globally. Innovations in freezing technology have significantly enhanced the quality and appeal of frozen products, ensuring they remain a staple in household kitchens. Furthermore, the industry’s adaptability in incorporating global flavors and catering to specific dietary needs has broadened its consumer base. As manufacturers continue to focus on sustainable practices and improving nutritional profiles, frozen foods are set to remain a key component of the global food industry, providing practical solutions that align with the fast-paced and health-conscious lifestyles of modern consumers.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)