Table of Contents

Introduction

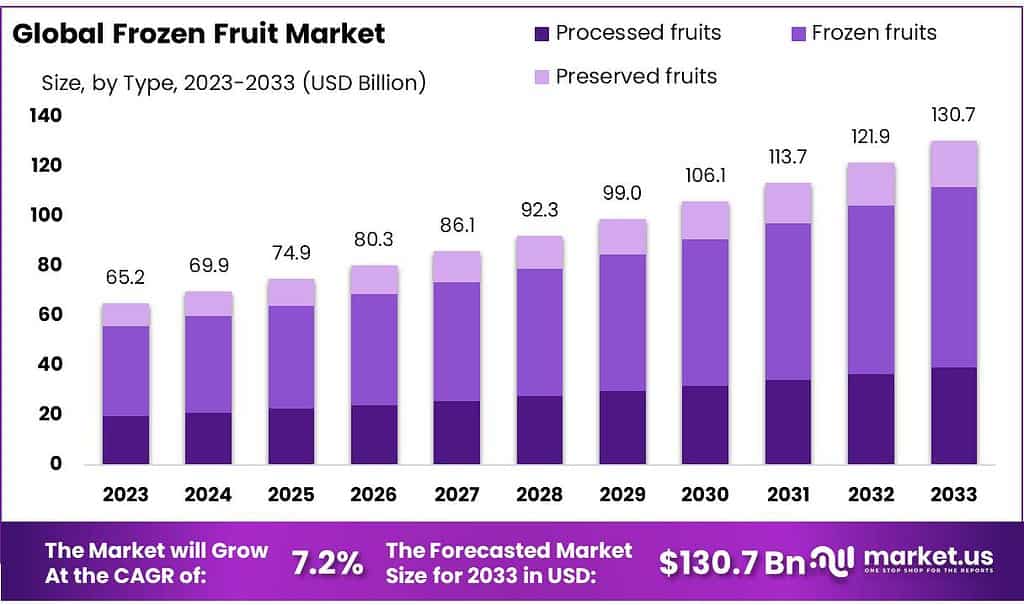

The global frozen fruit market is projected to grow significantly, expected to double from USD 65.2 billion in 2023 to around USD 130.7 billion by 2033, with a CAGR of 7.2% during the forecast period. This growth is driven by several key factors. Increasing health consciousness among consumers and the convenience of frozen fruits, often pre-washed and pre-cut, cater to busy lifestyles and are available year-round, fueling their demand.

Technological advancements in freezing and packaging have played a crucial role in preserving the quality and extending the shelf life of these products, enhancing their appeal. The market faces challenges such as maintaining product quality through consistent cold chain management and the impact of high moisture in some fruits which affects texture upon thawing.

Recent market developments include innovations in eco-friendly packaging and expansions in product offerings, such as introducing new flavors and fruit combinations which are helping to attract a broader consumer base. Furthermore, the Asia Pacific region is poised for rapid growth due to increasing online retailing and changing consumer preferences towards healthier diets.

The market is also influenced by geographical and seasonal variations in fruit production, which have led companies to rely on frozen options to manage supply shortfalls, particularly in tropical fruits like mangoes and avocados, which have seen high demand. While the market faces logistical and quality control challenges, the increasing global demand for convenient and healthy food options offers ample growth opportunities for the frozen fruit sector.

Recent developments in the frozen fruit market reflect strategic movements by key players such as Unilever Plc, Vivartia S.A., Lamb Weston, H.J. Heinz, Ardo, and Dole, each focusing on expansion, innovation, and sustainability.

Unilever Plc has been actively pursuing sustainability and innovation as core aspects of its strategy. The company’s focus extends into developing its food sector with a strong emphasis on enhancing sustainable practices across its supply chain. This includes leveraging advanced technology and fostering partnerships aimed at sustainability, a move that underscores the company’s commitment to responsible business practices.

Vivartia S.A. has expanded its portfolio through acquisitions, recently acquiring a significant stake in a regional dairy and snacks producer. This strategic move is aimed at diversifying its offerings and strengthening its market presence in the frozen food sector, particularly in Europe.

Key Takeaways

- Market Size: The global frozen fruit market is projected to reach USD 130.7 billion by 2033, growing from USD 65.2 billion in 2023, and is expected to grow at a (CAGR) of 7.2%.

- In 2023, strawberries held the dominant market share of 35.6%, widely used in smoothies, desserts, and as a healthy snack option.

- Frozen Fruits: Held over 55.6% market share in 2023 due to consumer preference for convenient, nutritious options.

- Offline channels dominated the market with a 75.6% share in 2023, preferred for physical inspection and selection of products.

- North America held a 31.5% revenue share in 2023, driven by high health consciousness and the cultural significance of frozen fruits.

Frozen Fruit Statistics

- Revenue in the Processed & Frozen Fruits market amounts to €64.78bn in 2024. The market is expected to grow annually by 6.97% (CAGR 2024-2029).

- In global comparison, most revenue is generated in China (€9,351m in 2024).

- About total population figures, per-person revenues of €8.36 will be generated in 2024.

- In the Processed & Frozen Fruits market, volume is expected to amount to 16.69bn kg by 2029. The Processed & Frozen Fruits market is expected to show a volume growth of 4.4% in 2025.

- The average volume per person in the Processed & Frozen Fruits market is expected to amount to 1.8kg in 2024.

- The market is growing steadily, with a 6% annual increase equating to $740 million.

- Inflation Rate: Average annual inflation of 2.36%.

- Price Change: A $17.50 difference in value over the period.

- Highest Inflation Years: 2022 (10.64%), 2023 (10.48%), and 2008 (5.89%).

- CPI Data: Started at 100.000 in 1997, and rose to 187.481 by 2024.

- The frozen fruit market is growing at a CAGR of 5.7%, reaching $4.4 billion by 2027.

- North America dominates the frozen fruit market with a share of 35%.

- Blueberries are the most popular frozen fruit, accounting for 27% of global sales.

- Supermarkets hold the largest distribution channel for frozen fruits, covering 45% of sales.

- Organic frozen fruits are witnessing a surge, expected to grow by 8% annually.

Emerging Trends

Emerging trends in the frozen fruit market showcase a dynamic shift towards health, convenience, and global flavors, driven by evolving consumer preferences and technological advancements. A notable trend is the increasing demand for non-seasonal, exotic fruits which are preserved through advanced freezing techniques, ensuring year-round availability and retaining nutritional quality.

Consumers are increasingly gravitating towards global flavors, influencing the types of frozen fruits being demanded. For instance, there’s a growing popularity for tropical and Asian-inspired fruits, which cater to diverse palates and culinary explorations. This trend is supported by improved freezing technologies that maintain the integrity and taste of these fruits, making them more appealing to health-conscious consumers.

The market is also seeing a shift towards convenient food options that align with busy lifestyles. Frozen fruits are becoming integral components of quick-prep meals and healthy snacks. There’s a significant rise in the use of frozen fruits in smoothies, breakfast bowls, and desserts, facilitated by their ease of use and perceived health benefits.

Additionally, the online sales channels for frozen fruits are expanding rapidly, driven by advancements in cold chain logistics and packaging technology that ensure product quality from transportation to delivery. This shift is expected to continue to drive significant growth in the frozen fruit sector, especially in regions like North America and Asia Pacific where convenience and health trends are particularly pronounced.

Use Cases

- Beverages and Smoothies: Frozen fruits are a staple in the beverage industry, particularly in the production of juices, smoothies, and even alcoholic beverages. Their ability to be stored long-term and used as needed allows beverage manufacturers to maintain consistent quality and flavor.

- Dairy Products: In the dairy sector, frozen fruits are used in products like yogurts and ice creams. They provide natural flavor and color, enhancing the appeal of dairy products without the need for artificial additives.

- Baked Goods and Desserts: Frozen fruits are used in the bakery industry as fillings for pastries, pies, and other desserts. They offer a convenient option for adding fruit flavors, as they are pre-prepared and can be used directly in recipes.

- Culinary Applications: In culinary settings, frozen fruits are used in a variety of dishes, from breakfast items to desserts. Chefs appreciate the consistency and convenience of frozen fruits, which can be used to make compotes, sauces, or as toppings for dishes.

- Retail and Foodservice: Frozen fruits are provided in various forms like whole, sliced, or diced to meet the needs of retail and food service sectors. They are used in everything from fruit bars and salsas to garnishes for cocktails.

Key Players Analysis

Unilever Plc has made significant strides in the frozen fruit sector, particularly with its Fruttare brand, which offers a range of frozen fruit bars. These products capitalize on the appeal of real fruit flavors, combined with ingredients like sugar and water to deliver refreshing treats. Unilever’s strategy includes a focus on sustainability and leveraging global brand recognition to expand its presence in the frozen fruit market. The company aims to meet consumer demands for healthy, convenient options with a focus on natural ingredients.

Vivartia S.A. is a key player in the European frozen food market, known for its innovation and product development. The company has been expanding its product lines to cater to changing consumer preferences, including the rising demand for plant-based and convenience food options. Vivartia’s efforts in the frozen fruit sector are part of its broader strategy to enhance brand image and market reach through both online and offline retail channels. This includes launching new ranges of frozen fruits across various platforms to meet the diverse needs of consumers.

Lamb Weston, Inc. does not appear to have a significant presence or dedicated line of business within the frozen fruit sector. The company is primarily known for its specialization in frozen potato products and a variety of other vegetable-based items for the food service industry. Their main focus remains on providing innovative potato product offerings to restaurants and retailers worldwide.

H.J. Heinz, which is now part of Kraft Heinz, does not specifically highlight frozen fruits as a major product line either. Heinz is traditionally known for its extensive range of condiments, sauces, and canned goods. The company has a history of diversification into various food products, but the core emphasis remains on categories such as ketchup, sauces, meals, snacks, and baby foods. While they operate in many segments of the food industry, frozen fruits do not stand out as a key area of operation based on available data.

Ardo is recognized for its high-quality frozen fruits, which are quickly frozen after harvesting to retain much of their nutritional value, taste, and texture. This makes them a favorable option compared to fresh fruits which may lose nutrients over time due to long transport and storage periods. Ardo’s offerings include a diverse range of frozen fruits ready for various uses, emphasizing convenience and quality preservation.

Dole is renowned for its extensive range of frozen fruits, delivering consistent quality and freshness. Dole’s Frozen Fruit Line is designed to provide nutritious, convenient, and versatile options for consumers, catering to a global market with a focus on health and practicality. Their products are ideal for a variety of culinary uses, ensuring that peak freshness and flavor are available year-round

Crop’s NV is a prominent player in the frozen fruit sector, renowned for its expertise in growing and processing high-quality frozen fruits. Established in 1977, this family-owned business operates out of Belgium and is deeply rooted in sustainable practices and community involvement. Crop’s nv utilizes advanced freezing technology to ensure that the nutritional value, taste, and texture of their fruits are well preserved, making them ideal for a wide range of culinary applications. The company prides itself on its extensive product line, which includes over 100 different fruit solutions tailored for various needs, from smoothies to desserts.

Simplot has established a strong presence in the frozen fruit sector with its Simple Goodness™ Fruit line. The company specializes in providing high-quality frozen fruit blends like the Triple Berry and Pacific Berry Blends. These products are selected from top-growing regions and are praised for retaining the natural flavor, color, and nutrients of fresh fruits without the prep and waste. Simplot’s products are versatile, easy to portion, and cater to a variety of dietary needs, making them a dependable choice for food service providers looking for consistent quality and convenience.

Conagra Brands, another key player in the frozen food industry, offers a range of frozen fruit products through its various brands, emphasizing convenience and innovation. Conagra’s approach includes integrating trending flavors and convenient packaging to meet the evolving needs of today’s consumers. The company’s focus extends to ensuring food safety and leveraging modern processing techniques to maintain the nutritional and sensory qualities of frozen fruits, aligning with consumer preferences for healthy and practical food options.

Wawona Frozen Foods has a distinguished history in the frozen fruit sector, specializing in producing high-quality fresh frozen fruits like peaches, strawberries, pears, and plums since 1963. Located in California’s San Joaquin Valley, known for its fertile grounds, Wawona leverages advanced freezing processes to lock in the freshness, taste, and nutritional value of fruits, catering extensively to food service, retail, and school sectors. The company is also notable for its commitment to sustainability and community involvement, emphasizing eco-friendly practices and the health benefits of frozen fruits as part of a balanced diet.

SunOpta specializes in sourcing, processing, and supplying organic and non-GMO plant-based and fruit-based food products. Their work in the frozen fruit sector is significant, with a focus on producing and distributing a wide variety of frozen fruits that meet the growing consumer demand for healthy and convenient eating options. SunOpta’s operations are geared towards sustainability, utilizing environmentally friendly practices and focusing on the health benefits and convenience of frozen fruits to cater to health-conscious consumers globally.

General Mills Inc. is actively engaged in the frozen food sector with a focus on providing a range of frozen vegetables and prepared meals under various brand names, including Cascadian Farm, which offers organic frozen fruits and vegetables. This brand emphasizes sustainability and organic farming, catering to a health-conscious consumer base. General Mills’ frozen food offerings are part of its broader product portfolio aimed at providing nutritious and convenient meal options for its global customer base.

J.R. Simplot Co is prominent in the frozen fruit sector, particularly noted for its extensive range of frozen fruits and vegetables. The company provides various frozen fruit products that are used across multiple food service applications, including beverages and desserts. Their operations highlight a commitment to quality and an extensive supply chain that ensures product availability and freshness. Simplot’s expertise in agribusiness and food processing allows them to maintain a significant presence in the frozen fruit market, offering products that are both versatile and essential for culinary uses.

Titan Frozen Fruit is a premium processor of fruit ingredient solutions, well-regarded for its range of high-quality frozen strawberry products among others. Based in Santa Maria, California, a prime strawberry growing region, Titan offers a variety of product forms including Individual Quick Frozen (IQF), Block Quick Frozen (BQF), purees, and concentrates. They cater to diverse market segments, focusing on the retail, beverage, ice cream, and toppings industries. Titan is noted for its commitment to quality and safety, producing products that meet rigorous standards to ensure they provide the best flavor, color, and nutritional value without compromising food safety. Their operations emphasize innovative solutions tailored to customer needs, showcasing their capability to adapt to the evolving demands of the food industry.

Conclusion

The diversification of use across various food industry sectors—from beverages and smoothies to dairy, baked goods, and culinary applications—highlights the versatility and strategic importance of frozen fruits in meeting both consumer preferences and industrial needs. Furthermore, innovations in product offerings, enhanced by sustainable and efficient supply chains, are set to broaden market reach and consumer base, especially in rapidly growing regions such as Asia Pacific. The ongoing developments affirm the frozen fruit market’s pivotal role in the global food industry landscape, driven by consistent demand for health-oriented food choices and the global expansion of food service requirements.