Table of Contents

Introduction

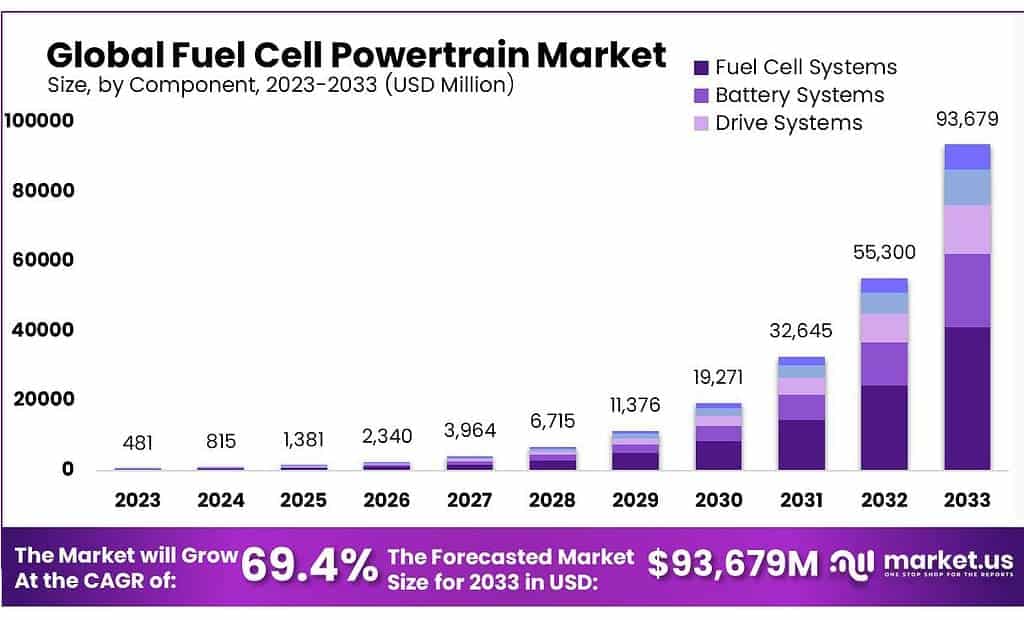

The global Fuel Cell Powertrain Market, valued at approximately USD 481.4 Million in 2023, is poised for substantial growth, with projections suggesting a rise to around USD 93679 Million by 2033.

This expansion reflects a robust compound annual growth rate (CAGR) of 69.4% over the forecast period from 2023 to 2033. Key drivers of this growth include increasing awareness of greenhouse gas effects, the rise in electric vehicle adoption, and advancements in fuel cell efficiency. Market demand is fueled significantly by the automotive sector’s shift towards green energy solutions, particularly in regions with stringent emissions regulations.

The Asia Pacific region, led by countries like South Korea and China, dominates the market due to aggressive governmental pushes towards hydrogen infrastructure and fuel cell vehicle adoption. North America, particularly California, follows closely, supported by developments in hydrogen refueling stations and incentives for zero-emission vehicles.

Opportunities for market expansion are abundant, especially in heavy-duty and industrial transportation, where the demand for clean, efficient, and high-capacity power solutions is rising. Innovations in fuel cell technology, such as improved hydrogen storage systems and advanced drive systems, are crucial for increasing the market’s reach and efficiency.

Overall, the fuel cell powertrain market is set to experience significant growth and expansion, driven by technological advancements, supportive regulatory frameworks, and increasing market demand for sustainable transportation solutions.

Key Takeaways

- Market Growth: Fuel cell powertrain market projected to reach USD 93,679 million by 2033, growing at 69.4% CAGR from 2023’s USD 481.4 million.

- Component Dominance: Fuel cell systems hold 44.2% market share, followed by battery and drive systems, driving vehicle efficiency.

- Vehicle Type: Passenger vehicles dominate with 47.3% market share, followed by Light Commercial Vehicles (LCVs) and buses.

- Power Output Segment: <150 kW segment holds 49.3% market share, catering to diverse vehicle needs.

- By 2024, the number of hydrogen refueling stations in Europe is projected to reach over 1,000, with Germany, France, and the UK leading the way.

- In 2023, the European Union announced a €5.4 billion investment in the development of hydrogen technologies, including fuel cell powertrains.

Fuel Cell Powertrain Statistics

- HMC shipped its first shipment of 47 XCIENT Fuel Cells, hydrogen-powered, zero-emission electrified commercial vehicles, to Switzerland in 2020.

- It takes 3 to 5 minutes to fill up and is as easy as filling up a conventional gasoline-powered vehicle.

- With thousands more kilometers to go, a fleet of 70 client trucks outfitted with fuel cell power modules successfully traversed the highway between Chongqing and Chengdu in 2021.

- The EU aims to reduce CO2 emissions from automobiles and commercial vehicles by 15% by 2025. Other parts of the world are also establishing targets for reducing emissions; for example, China wants to have 2 million fuel cell electric vehicles (FCEVs) by 2030.

- In the case of a fuel cell, the additional weight of 90 kg raises the average power by 3 kW (185 g H2 per hour).

- The additional weight of 209 kg in the case of a battery-powered machine results in an increase in average load of 6 kW.

- Given this and the need for a minimum of 48 minutes of charging time with 50 kW of charge power, a fuel cell powertrain appears to be a better option for this use case.

- According to FEV, electronic traction machines will soon be able to reach speeds of between 20,000 and 30,000 rpm.

- The fuel cell is placed beneath the operator seat to eliminate the need for extra counterweights. 4 of the 6 fuel cell systems are not included in this since they do not fit between the machine’s upper frame and main frame.

- The fuel cell needs a coolant inlet temperature of no more than 60 °C and can run at a maximum temperature of 70 °C.

- Because electrification and hybridization can lower peak power requirements, a fuel cell system’s net power output of 300 kW is the goal.

- The fleet of grid-connected fuel cell electric vehicles can always balance the energy systems, and they use very little energy 2.1 to 5.5 percent load factors, or 190 to 480 hours per car annually on average.

- Between 26 and 43 percent of grid-connected fuel cell electric vehicles are needed during peak hours, which only happen a few hours a year. This is especially true for energy systems that have a large percentage of solar energy.

- High efficiency is achieved with a 10 kW output per passenger car in FCEV2G mode, which only represents 10% of the approximately 100 kW fuel cell system load.

- Each kilogram of hydrogen used generates 23.6 kWh of power due to the fuel cell system’s efficiency in converting hydrogen back into electricity.

- According to the U.S., hydrogen fuel cells typically have an energy efficiency of 40% to 60%.

- Utilizing fuel cell forklifts to increase the range of electric cars, hydrogen fuel cell efficiency can increase warehouse productivity by up to 15%.

- The 2010-2011 LCOE would be between USD 174 and USD 191 for MWh, according on U.S. DOE H2FC Powertrain data (which is based on a high predicted production volume).

Emerging Trends

- Increased Vehicle Integration: Modern advancements in fuel cell powertrains have led to designs that are smaller, lighter, and more cost-effective. These new systems are engineered for ease of integration into various vehicle types, including trucks and buses, allowing for flexible installation options such as engine bay or rooftop placements.

- Rise of Modular Fuel Cell Systems: There is a growing trend towards modular fuel cell systems, which offer scalability and flexibility for different power needs. This modularity supports a wide range of applications from small passenger vehicles to heavy-duty trucks, aligning with the varying power requirements across different vehicle segments.

- Enhanced Focus on Durability and Efficiency: Continuous improvements in fuel cell technology are focusing on enhancing the durability and efficiency of fuel cell systems. Innovations aim to extend the life span of these systems while optimizing their performance, which is crucial for their long-term adoption in mainstream transportation.

- Expansion of Hydrogen Infrastructure: Significant investments in hydrogen fuel infrastructure are crucial for the broader adoption of fuel cell powertrains. The development of extensive hydrogen refueling networks is essential to support the operational needs of fuel cell electric vehicles, particularly in heavy-duty and long-range applications.

- Government Incentives and Regulations: Increasingly, government policies and incentives are playing a pivotal role in accelerating the adoption of fuel cell technologies. Subsidies, grants, and stricter emissions regulations are compelling automotive manufacturers and consumers alike to consider fuel cell solutions as viable alternatives to conventional powertrains.

- Integration with Renewable Energy Systems: The integration of fuel cell powertrains with renewable energy sources is becoming a key trend. By coupling these powertrains with energy systems that utilize solar or wind power to produce hydrogen, the overall sustainability of fuel cell vehicles is significantly enhanced, promoting a greener transportation ecosystem.

- Advancements in Hydrogen Storage: Emerging trends in hydrogen storage technologies are critical for the practical deployment of fuel cell powertrains. Innovations aimed at increasing hydrogen storage capacity and reducing refueling times are making fuel cell vehicles more comparable in convenience to traditional internal combustion engines.

- Proliferation of Zero-Emission Zones: Urban areas are increasingly establishing low-emission and zero-emission zones to combat air pollution, which is propelling the demand for vehicles equipped with fuel cell powertrains. This regulatory push is encouraging both public and private transportation sectors to adopt cleaner energy vehicles.

Use Cases

- Long-Haul Heavy-Duty Vehicles: Fuel cell powertrains are increasingly used in heavy-duty vehicles like trucks and coaches. These vehicles benefit significantly from the high energy efficiency and range capabilities of fuel cells, making them suitable for long-distance haulage. The integration of fuel cell technology helps meet stringent emission standards while maintaining high performance.

- Urban Public Transportation: Buses equipped with fuel cell powertrains are being adopted in urban settings to reduce carbon emissions and noise pollution. These vehicles can operate with greater energy efficiency and lower environmental impact, aligning with green city policies and improvements in public health.

- Emergency and Utility Vehicles: Fuel cells are used in emergency response and utility vehicles where reliability and operational readiness are critical. The ability of fuel cell powertrains to provide consistent power and rapid refueling is essential in scenarios that require high readiness and are sensitive to operational downtimes.

- Maritime Applications: The maritime industry is exploring fuel cell powertrains for ships and other vessels to reduce emissions in marine environments. These applications benefit from the scalability of fuel cells, allowing for adjustments based on the specific energy needs of different types of vessels.

- Specialized Commercial Fleets: Fuel cell powertrains are being tailored for specialized commercial applications, such as refrigerated transport or logistics vehicles that require additional power for onboard equipment. This use case leverages the ability of fuel cells to efficiently handle varied power demands while maintaining zero emissions.

- Rail Transportation: Fuel cells are utilized in rail applications, providing an alternative to diesel engines with the benefits of zero emissions. Trains powered by fuel cell technology are being tested and deployed in various regions, offering a cleaner solution for passenger and freight rail services, reducing the rail transport’s environmental footprint.

- Light Commercial Vehicles (LCVs): Fuel cell powertrains are increasingly popular in light commercial vehicles used for deliveries and service tasks in urban areas. These vehicles benefit from the quick refueling and long range provided by fuel cells, enabling businesses to maintain high operational efficiency without the emissions associated with traditional combustion engines.

Major Challenges

- High Costs: Fuel cell powertrains are notably more expensive than traditional combustion engines and even some electric vehicle systems. This cost is driven by the expensive materials required for fuel cell systems and the complexity of the technology involved. The high initial investment may deter widespread adoption.

- Infrastructure Deficiencies: A significant barrier to the adoption of fuel cell vehicles is the lack of hydrogen refueling infrastructure. This is particularly challenging outside major urban areas, where fewer stations limit the practicality of owning and operating fuel cell vehicles.

- Hydrogen Storage Issues: Efficiently storing hydrogen is another technical challenge due to its low density. High-pressure tanks are required to store it in a compact form, adding to vehicle weight and complexity. Additionally, hydrogen is not odorized, making leaks hard to detect, which poses safety risks.

- Market Competition: Fuel cell powertrains face stiff competition from battery electric vehicles (BEVs), which are supported by more established technologies and an expanding charging infrastructure. As the market for BEVs grows, fuel cells must differentiate themselves to gain a foothold.

- Regulatory and Environmental Concerns: Varying standards and regulations across regions can complicate the deployment of fuel cell technologies. Moreover, while fuel cells are clean at the point of use, the overall sustainability depends on how hydrogen is produced—using fossil fuels for hydrogen production can negate environmental benefits.

- Durability and Reliability: Fuel cell systems, particularly those in automotive applications, need to meet high standards of durability and reliability. These systems must withstand varied environmental conditions and rigorous use cycles. Achieving this can be challenging, given the delicate nature of some fuel cell components.

- Technological Maturity: Fuel cell technology is still in the development phase compared to more mature automotive technologies like internal combustion engines or even battery electric powertrains. Continuous research and development are required to improve efficiency, reduce costs, and enhance the overall performance of fuel cell systems.

- Supply Chain Limitations: The production of fuel cell components involves specialized materials and technologies, often with limited suppliers. This can lead to vulnerabilities in the supply chain, as seen with other advanced technologies, affecting the production scale and cost.

- Public Perception and Awareness: There is a general lack of awareness about fuel cell technology among consumers. Public perception is often that fuel cells are experimental or less proven than other technologies. This can hinder consumer acceptance and market growth.

- Energy Source Concerns: While fuel cells themselves are clean, the production of hydrogen as a fuel often relies on natural gas or other fossil fuels, which can emit greenhouse gases. To truly benefit from the environmental potential of fuel cells, the production of hydrogen must shift towards more sustainable methods like electrolysis powered by renewable energy.

Market Growth Opportunities

- Expansion in Heavy-Duty and Industrial Transport: There is significant potential for growth in heavy-duty and industrial transportation sectors, including trucks, buses, and maritime vehicles. The demand for clean, efficient, and robust powertrain solutions in these areas provides a substantial market opportunity for fuel cell technologies.

- Development of Hydrogen Infrastructure: Governments and private sectors are increasingly investing in the development of hydrogen fuel infrastructure. This not only supports the existing demand but also encourages broader adoption of fuel cell technologies across various sectors, enhancing market growth prospects.

- Technological Advancements in Fuel Cells: Continuous research and development aimed at improving the efficiency, durability, and cost-effectiveness of fuel cells are poised to open new applications and markets for these systems, particularly in regions with stringent emission regulations.

- Growing Popularity of Green Mobility: The global push towards sustainable and green transportation solutions continues to drive the demand for zero-emission vehicles. Fuel cell powertrains, known for their high energy efficiency and low environmental impact, are well-positioned to capitalize on this trend.

- Legislative Support and Incentives: Many regions are introducing policies and incentives to promote the adoption of cleaner energy technologies. Such legislative support is expected to lower barriers to entry for new technologies and accelerate the growth of the fuel cell powertrain market.

- Integration with Renewable Energy Systems: Fuel cells can be integrated with renewable energy sources such as wind and solar to produce hydrogen. This integration can help to reduce the carbon footprint of hydrogen production and boost the environmental credentials of fuel cell powertrains, opening up new markets focused on sustainable technologies.

- Advancements in Storage and Distribution Technologies: Improvements in hydrogen storage and distribution technologies can lower the overall cost of fuel cell vehicle operation and ownership. Developing lightweight, high-capacity storage solutions and more efficient distribution networks can significantly enhance market growth.

Key Players Analysis

- AVID Technology Ltd, based in the UK, specializes in developing and manufacturing powertrain systems for heavy-duty and high-performance electric (EV) and hybrid vehicles (HEV). Their product lineup includes advanced thermal management systems and electrification of vehicle components like fans and pumps, which are crucial for improving vehicle efficiency and reliability. AVID has been a pioneer in micro-hybrid systems and holds several patents in these areas.

- Ballard Power Systems, headquartered in Canada, is a leader in proton exchange membrane fuel cell technology. They focus on designing and manufacturing clean energy fuel cell products that power electric vehicles, portable power, and stationary applications. Their technology is pivotal in the commercialization of fuel cells in transportation, emphasizing reliability and cost-effectiveness.

- Brown Machine Group in the US provides innovative thermoforming technology solutions, although their direct involvement in the fuel cell powertrain sector is less documented. Their core expertise lies in the production of plastic forming and cutting machinery.

- Ceres Power from the UK offers solid oxide fuel cell technology that enables the system to operate at lower temperatures compared to traditional methods, which improves efficiency and durability. Their technology is suitable for a variety of applications including residential, data centers, and transportation.

- Cummins Inc., a global power leader, has been expanding its capabilities in fuel cell and hydrogen production technologies. They are actively developing new powertrains and alternative power solutions that contribute to the decarbonization of various industries.

- Delphi Technologies, known for advanced vehicle propulsion solutions, works on integrating and optimizing various powertrain technologies including those for fuel cells, aiming to enhance vehicle performance while reducing environmental impact.

- Denso Corporation, a leading supplier of advanced automotive technology, systems, and components, globally, focuses on developing and producing components that enhance fuel cell efficiency, among other automotive innovations.

- ITM Power manufactures integrated hydrogen energy solutions which are used to enhance the utility of hydrogen as a clean fuel. Their systems are involved in the generation and storage of hydrogen that can be used for both stationary and transportation applications.

- Robert Bosch has been investing significantly in the fuel cell powertrain market, aiming to supply both components and systems for fuel cell vehicles, underpinning the future mobility solutions with zero emissions.

- Bloom Energy is known for its solid oxide fuel cell systems that produce clean, reliable electricity. Their technology is particularly well-suited for stationary power applications and is increasingly being explored for use in maritime and other transportation applications.

- SFC Energy is a leading provider of hybrid power solutions to the stationary and mobile power generation markets. They produce direct methanol and hydrogen fuel cells, which are used in a variety of applications from industrial to defense sectors.

Conclusion

In conclusion, The Fuel Cell Powertrain Market is poised for significant growth, driven by advancements in technology and an increasing global focus on reducing greenhouse gas emissions. Innovations in fuel cell efficiency, alongside the development of hydrogen infrastructure, are crucial factors propelling this market forward.

The adoption of fuel cell technology in various transportation modes, from passenger cars to heavy-duty vehicles, underscores its potential to significantly impact the future of clean mobility. As the industry continues to evolve, strategic investments in research and development, and collaborations across sectors, are expected to further enhance the viability and adoption of fuel cell powertrains, making them a key component in the transition towards sustainable transportation solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)