Table of Contents

Introduction

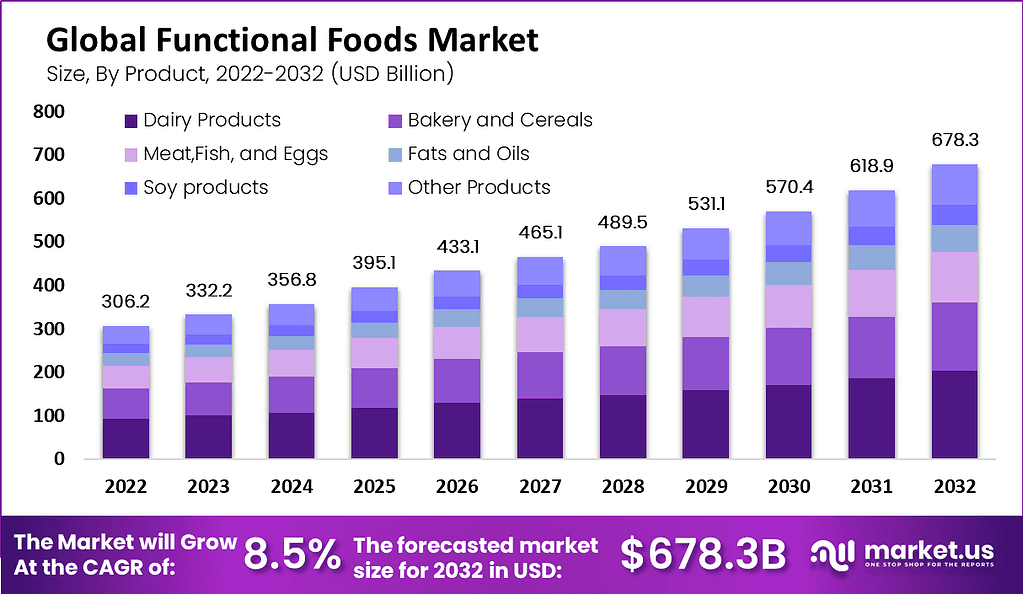

The global functional foods market is poised for substantial growth, projected to increase from USD 306.2 billion in 2023 to approximately USD 678.3 billion by 2033, at a compound annual growth rate (CAGR) of 8.5% during the forecast period. This significant expansion is driven by rising consumer awareness about the health benefits of functional foods, which are designed to provide additional nutrients and health benefits beyond basic nutrition.

Factors such as an aging population, increased prevalence of chronic diseases, and a growing trend towards preventive healthcare are major drivers of this market. Additionally, advancements in food technology and innovation in outcome development, such as the introduction of fortified and functional ingredients like probiotics, vitamins, and minerals, are contributing to market growth.

However, the market also faces challenges, including high production costs associated with functional ingredients and regulatory hurdles related to health claims and product labeling. These factors can hinder market expansion by increasing product prices and creating consumer skepticism about the actual benefits of functional foods.

Recent developments in the functional foods market include the launching of new products and strategic acquisitions by major companies to expand their product portfolios. For instance, Danone has introduced new fortified yogurt products under its SKYR Energy brand. Mars Inc. has fully acquired KIND North America to enhance its presence in the healthy snacks segment.

BASF SE is actively involved in developing and supplying functional food ingredients, focusing on innovations in omega-3 fatty acids, vitamins, and other essential nutrients. Their collaborations with various food manufacturers aim to enhance the nutritional value of everyday foods. Amway, a leader in health and wellness products, is leveraging its extensive network to promote functional foods that offer specific health benefits. Their product lines increasingly include fortified foods designed to support immune health and overall wellness

The increasing consumer preference for foods that support health and wellness, coupled with innovations in food formulation, is expected to drive the functional foods market’s growth in the coming years, making it a key area of focus for food manufacturers and health-conscious consumers.

Functional Foods Statistics

- The statistics demonstrate this trend—a 2020 Hartman Group study found that 29% of consumers were actively consuming more functional foods and beverages, and separate research by Mintel indicated that 70% of consumers are currently using products that feature a functional benefit.

- In 2022, the production volume of health-functional foods in South Korea amounted to almost 144 thousand tons, up from 136.9 thousand tons in the previous year.

- According to WHO (World Health Organization), a healthy diet consists of 5 servings of different fruits and vegetables or 400 g of them daily.

- According to the World Health Organisation data, 39% of the global population above 18 years of age is overweight and of these, 13% are obese.

- Dietary fibers hold a 14% share, highlighting their importance in digestive health and disease prevention.

- In 2021, 7% of consumers in the United States acknowledged that FFAB could be beneficial to the body, recognizing their potential health advantages.

- Over 50% of searches for the top 10 trending functional foods happen on mobile devices.

- 35% of food and beverage searches are exclusively on mobile phones.

- Searches for “places to eat near me” increased by over 2 times year-over-year.

- There’s been a 300% increase in searches for “turmeric.”

- Searches for the top 10 functional foods peak on Mondays and decline throughout the week.

- 86% of post-Christmas shoppers use Search for holiday-related shopping.

- Carotenoids constitute 24% of the market, primarily due to their antioxidant properties and associated health benefits.

- Minerals, crucial for numerous bodily functions, represent 13% of the market.

- Probiotics and prebiotics, renowned for their positive impacts on gut health, make up 5% of the market.

- The remaining 14% is attributed to other ingredients, demonstrating the sector’s diversity and ongoing innovation in functional foods.

Emerging Trends

- Mood and Mind Health: There is a growing demand for functional foods that support mental well-being, including mood enhancement, stress reduction, and improved sleep quality. Products containing probiotics and adaptogenic mushrooms, such as Lion’s mane, are gaining popularity for their potential to support the gut-brain axis and enhance cognitive functions.

- Clean Label and Real Food Movement: Consumers are increasingly seeking clean-label products with simple, natural ingredients. This trend emphasizes transparency and the use of minimally processed ingredients. Products with recognizable, whole-food ingredients are preferred, reflecting a shift towards more natural and authentic food options.

- Personalized Nutrition: Advances in technology are enabling more personalized nutrition solutions. Consumers are looking for products tailored to their individual health needs and genetic profiles. This trend is driving the development of customized functional foods that cater to specific dietary requirements and health goals.

- Probiotics and Gut Health: The popularity of probiotics continues to rise, with a focus on enhancing digestive health and immunity. Probiotic-rich foods and beverages are being integrated with additional benefits for mood and cognitive health, expanding their appeal beyond traditional digestive health benefits.

- Sustainability and Environmental Impact: There is a strong trend towards sustainability in the functional foods market. Consumers are increasingly aware of the environmental impact of their food choices and are gravitating towards products that are sustainably sourced and packaged.

- Functional Ingredients for Specific Health Conditions: There is a growing interest in functional ingredients that target specific health conditions such as cardiovascular health, blood sugar management, and immune support. Ingredients like omega-3 fatty acids, dietary fibers, and plant-based proteins are being incorporated into functional foods to address these health concerns.

- AI and Technology Integration: The use of artificial intelligence (AI) is becoming more prevalent in the functional foods sector. AI is being used to develop new products, optimize supply chains, and enhance marketing strategies, making the industry more efficient and consumer-focused.

Use Cases

- Mental and Emotional Well-being: Functional foods are being developed to support mental health, including reducing stress, enhancing mood, and improving sleep quality. Ingredients such as ashwagandha, L-theanine, and probiotics are commonly used in these products. For example, probiotic drinks like Yakult 1000 have shown significant market success by claiming to alleviate stress and improve sleep.

- Enhanced Gut Health: Foods enriched with probiotics and prebiotics are popular for their benefits to digestive health. Products like yogurts, kombucha, and fermented vegetables help maintain a healthy gut microbiome, which is essential for overall health. Approximately 23% of Americans seeking prebiotics look for them in wellness drinks.

- Immune Support: Functional foods with ingredients like elderberry, echinacea, and various vitamins are being marketed for their immune-boosting properties. These products became especially popular during the COVID-19 pandemic as consumers sought natural ways to enhance their immune systems.

- Functional Hydration: The market for functional beverages is expanding, including products with added electrolytes, vitamins, and clean caffeine. These drinks are designed to provide hydration along with additional health benefits, such as improved energy levels and better sleep.

- Protein-Rich Snacks: There is a growing trend towards protein-fortified snacks, including bars, shakes, and even cereals. These products cater to consumers looking to increase their protein intake for muscle building, weight management, and overall health. The demand for high-protein foods is driven by their perceived benefits in supporting active lifestyles.

- Sustainable and Plant-Based Options: Functional foods that are plant-based and sustainable are gaining traction. These include alternatives like plant-based meats, dairy substitutes, and snacks made from nutrient-dense ingredients such as legumes and whole grains. The focus on sustainability also extends to the use of ingredients that require less water to produce.

- Adaptogens and Nootropics: Ingredients known as adaptogens and nootropics, such as mushrooms (e.g., Lion’s mane) and botanicals, are increasingly included in functional foods. These ingredients are believed to help the body adapt to stress and enhance cognitive function.

- Functional Foods in Dining: Restaurants are incorporating functional foods into their menus, offering dishes that include superfoods like kale, avocados, and turmeric. This trend caters to health-conscious diners looking for meals that provide specific health benefits, such as improved digestion or enhanced nutrient intake.

Key Players Analysis

BASF SE is a prominent player in the functional foods sector, leveraging its extensive expertise in human nutrition to offer a wide range of high-quality ingredients. The company’s portfolio includes vitamins, omega-3 fatty acids, carotenoids, and plant sterols, which are integrated into various food products to enhance health benefits. BASF focuses on innovation and sustainability, providing ingredients that support health and well-being, such as its Omega-3 oils and phytosterols used in dairy, margarine, and sports nutrition products.

Amway Corp., through its Nutrilite brand, is a significant player in the functional foods sector. Nutrilite, the world’s leading brand in vitamins and dietary supplements, accounted for 60% of Amway’s global sales in 2023. Amway focuses on products that support health areas such as weight management, fitness, healthy aging, and skin health. The company is investing over $100 million in enhancing its manufacturing capabilities, including nutritional tableting and quality control labs, to expedite the development of innovative functional food products.

Herbalife International of America Inc. is actively engaged in the functional foods sector, emphasizing products that support weight management, sports nutrition, and general wellness. The company’s offerings include protein shakes, snack bars, and dietary supplements designed to enhance energy, fitness, and overall health. Herbalife’s nutrition products are backed by scientific research and are part of its broader strategy to promote a healthy, active lifestyle among consumers worldwide.

The Coca-Cola Company has significantly expanded its portfolio in the functional foods sector, focusing on innovations that integrate health benefits into its beverages. Key initiatives include the launch of functional drinks like Aquarius, which is fortified with minerals such as magnesium and zinc. Additionally, Coca-Cola is enhancing its product offerings with beverages that include fiber and coffee, aiming to meet the growing consumer demand for healthier options. The company’s strategy emphasizes scaling successful products globally and leveraging acquisitions like Costa Coffee to broaden its functional beverage range.

Cargill Incorporated is actively involved in the functional foods market, focusing on developing ingredients that enhance the nutritional profile of everyday foods. The company offers a range of products, including plant-based proteins, fibers, and sweeteners, aimed at improving health benefits such as digestive health, weight management, and cardiovascular support. Cargill’s innovations include sugar alternatives like stevia and functional fibers that can be incorporated into various food products, supporting the trend toward healthier and more sustainable food choices.

GFR Pharma is a leading Canadian GMP contract manufacturer specializing in the production of functional foods. The company provides comprehensive services including formulation, blending, and packaging for a variety of functional food products such as powders, tablets, and liquid supplements. GFR Pharma focuses on integrating health-enhancing ingredients like omega-3 fatty acids, probiotics, and antioxidants into their products, ensuring they meet stringent quality and regulatory standards. This approach helps clients create innovative functional foods that cater to the growing consumer demand for health-focused products.

Standard Functional Foods Group Inc. is actively involved in the functional foods market, leveraging its extensive experience to produce high-quality, health-focused food products. The company specializes in developing and manufacturing functional bars, beverages, and snacks that are fortified with nutrients to support various health benefits such as energy, immunity, and digestive health. Standard Functional Foods Group emphasizes innovation and quality, making it a key player in delivering functional food solutions that meet the evolving needs of health-conscious consumers.

Arla Foods is a key player in the functional foods market, focusing on the development of innovative whey protein solutions. The company’s Lacprodan® range includes products like ISO.WaterShake is designed for holistic hydration and is enriched with essential amino acids. Arla Foods has recently opened an Innovation Centre to boost its research and development capabilities, enabling the creation of functional foods that cater to health-conscious consumers seeking benefits like hydration, nutrition, and improved glucose control.

Nutri Nation specializes in developing functional food products that enhance health and wellness. The company focuses on incorporating high-quality, nutrient-dense ingredients into its offerings, such as protein-rich snacks and fortified beverages. Nutri Nation’s products are designed to support various health benefits, including energy enhancement, immune support, and digestive health, aligning with the growing consumer demand for foods that provide added health benefits.

Conclusion

The functional foods market is set to experience substantial growth in the coming years, driven by increasing health consciousness, advancements in food technology, and a shift towards preventive healthcare. The market is projected to expand from USD 306.2 billion in 2023 to approximately USD 678.3 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 8.5%.

Key factors propelling this growth include rising consumer awareness about the health benefits of functional foods, which offer additional nutrients and health advantages beyond basic nutrition. This trend is particularly strong in regions like Asia Pacific, where health awareness and disposable incomes are on the rise. In North America and Europe, the focus on health and wellness is driving demand for products fortified with vitamins, minerals, and other bioactive compounds.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)