Table of Contents

Introduction

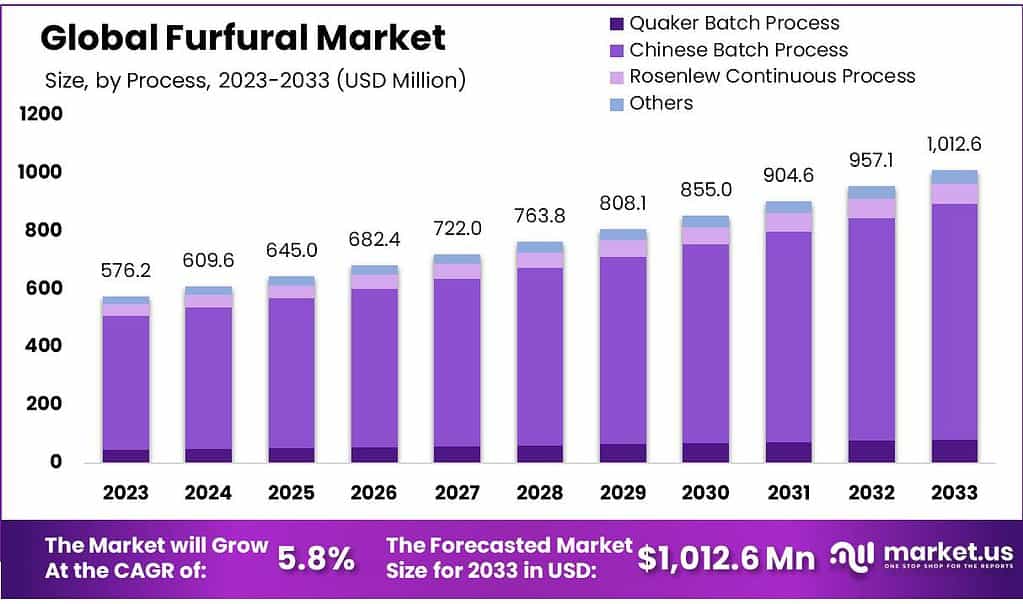

The Global Furfural Market is set to experience significant growth over the next decade, with projections estimating the market size to increase from USD 576.2 million in 2023 to around USD 1012.6 million by 2033, achieving a compound annual growth rate (CAGR) of 5.8% during the forecast period from 2024 to 2033.

This growth is primarily fueled by the rising demand for furfural in various industrial applications, including the manufacture of furfuryl alcohol, solvents, and other chemical intermediates. Furfural, derived from biomass such as agricultural byproducts like corn cobs and oat hulls, is gaining prominence due to its renewable nature and the shifting preference towards sustainable and eco-friendly products.

However, the market faces challenges such as the volatility in the availability and price of raw materials and the stringent environmental regulations concerning the production processes. Technological advancements in production techniques that aim to increase yield and reduce environmental impact are critical to overcoming these challenges. Recent developments in the market include an increased focus on optimizing supply chain management and expanding production capacities to meet the growing global demand.

Recent developments in the furfural market among key players illustrate strategic expansions and technological innovations that align with growing environmental and economic trends. Central Romana Corporation, a significant producer located in the Dominican Republic, leverages locally sourced sugarcane bagasse to produce furfural, emphasizing the utilization of agricultural waste for high-value chemical production. This process represents a sustainable approach to industrial manufacturing, aligning with global environmental goals.

ILLOVO SUGAR AFRICA (PTY) LTD is enhancing its capabilities in the sugar sector, which indirectly supports its involvement in the furfural market through the production of by-products used in furfural synthesis. Their expansion projects aim to increase production capacity significantly, thereby potentially increasing the availability of raw materials for furfural production.

KRBL Ltd., known for its agricultural innovations, contributes to the furfural market through its expertise in managing agricultural residues, which are key raw materials for furfural production. Their approach helps in the sustainable management of agro-waste, aligning with eco-friendly production practices.

Additionally, companies are exploring new applications of furfural in pharmaceuticals and food and beverage industries, further broadening the market’s scope. These factors collectively contribute to the dynamic expansion of the furfural market, with a strong emphasis on sustainability and innovation driving its future growth.

Key Takeaways

- Market Growth Projection: The Furfural market is anticipated to grow significantly, with an expected worth of around USD 1012.6 Million by 2033, marking a substantial increase from USD 576.2 Million in 2023, at a CAGR of 5.8%.

- Process Analysis: The Chinese Batch Process dominates, accounting for 80.3% of global revenue in 2023. Rosenlew Continuous Process is reliable but less preferred due to high production costs. Quaker Batch Process, an older method, remains in use despite modifications.

- Raw Material Influence: Corncob, with over 68.5% market share in 2023, stands out due to its high yield and extensive use in furfural production. Sugarcane bagasse, despite being easily available, faces challenges in storage and transportation, limiting its utilization.

- Application Areas: Furfuryl Alcohol leads with 82.1% market share in 2023, favored for its diverse applications in various industries like automotive and electronics. Solvents find steady demand in paints, coatings, and cleaning products due to their dissolving properties.

- End-Use Significance: Refineries hold a dominant share (48.9% in 2023) due to Furfural’s use as a solvent and agrochemical component. Its role in pharmaceuticals, agriculture, and food & beverage industries continues to expand.

- Regional Insights: Asia Pacific was the dominant region, with a market share of over 72.3% by 2023. Europe’s market growth is attributed to its use in food as a flavoring agent, especially in countries like Austria, Slovenia, and Italy.

Furfural Statistics

- In 2022, the market volume of furfural amounted to over 365.42 metric tons worldwide.

- By the year 2030, this figure is forecast to grow to nearly 505.41 metric tons.

- Meanwhile, the market value of furfural reached some 595.15 million U.S. dollars in 2021.

- Hemicellulose (19%), cellulose (40%), silica (17%), and lignin (16%), are the main components of rice husk.

- Nominal solids content for all of the trials was 8.5%.

- Typically, the product stream has a 3% (w/w) concentration of furfural, recovery, drying, and use of residual solids.

- Initially, the reactor condensate is added to the first column (C1), also known as the azeotropic column, which contains 90% water, 4% by-products (such as acetic acid and

- methanol), and 6% furfural.

- The Quaker Oats Company used a continuous version of this method to achieve 55% yields.

Emerging Trends

Emerging trends in the furfural market reflect a vibrant industry poised for significant growth, driven by heightened environmental consciousness and the increasing demand for sustainable and renewable resources. As industries and consumers alike move toward greener solutions, furfural stands out due to its derivation from agricultural waste such as corn cobs, sugarcane bagasse, and rice husk, positioning it as an environmentally friendly alternative to traditional petrochemicals.

One notable trend is the rising utilization of furfural in the production of biofuels and bioplastics. These applications capitalize on furfural’s properties as a platform chemical, offering a pathway to more sustainable production methods that reduce reliance on fossil fuels and decrease carbon footprints. Additionally, the pharmaceutical and food industries are increasingly adopting furfural for its applications in flavor and fragrance agents, underscoring its versatility and broad market appeal.

Moreover, technological advancements in the extraction and processing of furfural are enabling more efficient production methods, reducing waste and improving yield from raw materials. These innovations are crucial in meeting the growing demand and ensuring the economic viability of furfural production on a larger scale.

Another emerging trend is the strategic expansion of production capacities and the exploration of new geographical markets by key players in the industry. Companies are investing in new facilities and entering untapped markets, particularly in Asia and South America, where agricultural waste resources are abundant. This expansion not only addresses global demand but also supports local economies by providing alternative uses for agricultural byproducts.

The furfural market is also seeing a trend toward forming strategic alliances and partnerships between key players to synergize their technological and logistical capabilities. These collaborations are aimed at optimizing the supply chain from raw material sourcing to final product delivery, ensuring that the industry can sustainably scale up to meet global needs.

Use Cases

- Chemical Industry: Furfural serves as a crucial precursor for manufacturing furfuryl alcohol, widely used in resins, solvents, and as a binder in foundry sand molds. The demand for furfural in this sector is driven by its effectiveness in enhancing the properties of materials it is added to.

- Pharmaceuticals and Food: In the pharmaceutical industry, furfural is employed in the synthesis of Tetrahydrofuran (THF), a solvent that facilitates various chemical reactions essential for drug development. In the food industry, it is used as a flavoring agent, adding a unique aroma to a variety of products.

- Agriculture: Furfural also has applications in agriculture as a fungicide and weed killer. Its effectiveness in controlling pests and diseases contributes to its utility in integrated pest management systems.

- Renewable Energy and Materials: Innovatively, furfural is utilized in the production of biofuels and bioplastics. Its role in creating bio-based alternatives to traditional fossil fuel-derived products underscores its importance in the transition to a more sustainable economy.

Key Players Analysis

Central Romana Corporation is a significant player in the furfural market, primarily utilizing locally sourced sugarcane bagasse to produce furfural. This approach not only leverages agricultural waste, thereby enhancing sustainability, but also supports the local economy in the Dominican Republic. Central Romana’s involvement in the furfural market underscores their commitment to innovative and environmentally friendly practices, aligning with global trends towards sustainable industrial production. Their strategic use of byproducts from sugar production demonstrates an efficient integration of resource utilization.

Illovo Sugar Africa (PTY) LTD plays a critical role in the furfural market through its sugar production processes, which generate significant quantities of sugarcane bagasse. This byproduct serves as a primary raw material for furfural production, making Illovo a key supplier in the value chain. The company’s operations contribute to the furfural industry by ensuring a steady supply of essential raw materials, while also promoting sustainability through the effective use of agricultural residues. Illovo’s expansion and enhancement of production capabilities further solidify its position in the market, emphasizing its impact on the broader agricultural and chemical sectors.

KRBL Ltd. is actively involved in the furfural sector through its rice milling processes, which produce rice husk, a key raw material for furfural production. Leveraging its position as a leading rice processor, KRBL has focused on optimizing the value extracted from rice byproducts. The company’s commitment to sustainability is evident in its efforts to convert agricultural waste into valuable chemicals like furfural, highlighting its innovative approach to waste management and resource utilization in the agricultural sector.

LENZING AG has made significant strides in the furfural market through its innovative biorefinery processes at its facilities. By utilizing beech wood as a primary raw material, LENZING AG produces furfural as a byproduct during the manufacture of viscose and lyocell fibers. This process not only underscores the company’s commitment to sustainability but also enhances its product offering in the specialty chemicals market. LENZING AG’s approach demonstrates a successful integration of sustainable practices with commercial operations, setting a benchmark in the industry for environmental responsibility and innovation in product development.

Pennakem, LLC has made significant strides in the furfural market by developing innovative production methods to enhance the sustainability and efficiency of furfural production. Their approach leverages eco-friendly processes that align with the growing demand for green chemical solutions. Pennakem’s commitment to environmental sustainability is complemented by their focus on creating high-quality, renewable solvents that serve a variety of industrial applications, reinforcing their position as a leader in the bio-based chemicals sector.

Hongye Holding Group Corporation Limited is a prominent player in the furfural market, leveraging its comprehensive capabilities in biochemical engineering to produce furfural and related chemicals. Based in Puyang, China, Hongye is recognized for its substantial production scale and commitment to environmental sustainability. The company’s furfural production is part of a broader portfolio that includes furfuryl alcohol and other chemical products, highlighting their versatility and innovation in utilizing biomass and other raw materials to meet global chemical demand effectively.

Silvateam SpA actively participates in the furfural sector by utilizing its expertise in plant extracts to produce furfural as a byproduct of its industrial processes. The company’s approach not only emphasizes the sustainable use of natural resources but also aligns with global trends towards environmentally responsible manufacturing. Silvateam’s commitment to innovation and sustainability helps meet the growing demand for bio-based chemicals, positioning them as a key player in the eco-friendly chemicals market. Their strategic use of renewable raw materials for furfural production exemplifies their role in promoting sustainability in the chemical industry.

Tanin d.d. is recognized for its specialized use of chestnut wood in producing furfural, showcasing a unique approach to the bio-based chemicals market. Located in Slovenia, Tanin d.d. leverages its extensive experience in plant extracts to innovate within the furfural sector, contributing to the development of renewable and sustainable chemical solutions. Their focus on using underutilized wood resources highlights their commitment to environmental sustainability and their capability to adapt to market needs while maintaining eco-friendly practices.

Xingtai Chunlei Furfuryl Alcohol Co. Ltd (Hebeichem), a major player in the furfural sector, specializes in the production of furfuryl alcohol derived from furfural. The company’s operations focus on utilizing furfural, a chemical produced from agricultural waste like corn cobs and oat hulls, to manufacture furfuryl alcohol. This is primarily used in foundry resins and as a solvent. Xingtai Chunlei’s commitment to leveraging sustainable raw materials highlights their role in promoting environmentally friendly industrial practices while catering to the global demand for renewable chemical solutions.

TransFurans Chemicals bvba is a leader in the European furfural market, with a strong focus on producing furfuryl alcohol, a derivative of furfural. Based in Belgium, the company has established a robust production facility that emphasizes the sustainable processing of biomass into valuable chemicals. TransFurans Chemicals is renowned for its innovation and sustainability, using furfural to produce a variety of bio-based products, including resins and solvents, which are essential in various industrial applications such as in foundry resins and the automotive sector. Their commitment to using renewable raw materials supports the transition to a more sustainable chemical industry.

Zibo Xinye Chemical Co., Ltd is an established name in the furfural sector, known for its significant production capacity and technological expertise in handling furfural and its derivatives. Located in Zibo City, Shandong Province, China, the company specializes in the manufacture of furfural alcohol, which is an essential chemical used widely in foundry resins and solvent applications. With a substantial annual production capacity, Zibo Xinye Chemical demonstrates its capability to meet large-scale industrial demands while adhering to environmental standards, positioning itself as a key supplier in the global chemical market.

Arcoy Industries Pvt. Ltd. plays a critical role in the furfural industry by focusing on the development and supply of specialty chemicals, including furfural. Based in India, Arcoy leverages advanced technology and process innovation to produce high-quality furfural used in various applications, from agriculture to pharmaceuticals. Their commitment to quality and sustainability has established Arcoy as a reliable partner for industries seeking bio-based chemical solutions, underpinning their strategic position in the expanding market for environmentally friendly products.

GoodRich Sugar is actively engaged in the furfural market by leveraging its sugar production processes to extract value from by-products such as bagasse and corn cobs. Located in India, the company utilizes these by-products to produce furfural, demonstrating an innovative approach to waste utilization. GoodRich’s commitment to enhancing its product line through technological advancements and sustainable practices not only bolsters its position in the furfural market but also contributes to the broader goal of sustainable industrial practices.

Zibo Huaao Chemical Co., Ltd. specializes in the production of furfural and its derivatives, playing a significant role in the furfural market. Based in Zibo, China, the company focuses on leveraging local agricultural by-products to produce high-quality furfural. Zibo Huaao’s commitment to innovation and quality control has established it as a reliable supplier in both domestic and international markets. Their strategic emphasis on resource efficiency and product purity helps meet the growing demand for environmentally friendly and sustainable chemical solutions.

Tieling North Furfural (Group) Co. Ltd. is a prominent figure in the furfural market, operating out of Liaoning Province in China. This company specializes in the production of furfural and furfuryl alcohol, utilizing agricultural residues such as corncobs and oat hulls as primary feedstocks. Tieling North Furfural is recognized for its substantial production capabilities, boasting the capacity to produce around 50,000 tonnes of furfural annually. This scale of operation underscores its significant role in meeting global furfural demand, contributing to both the regional economy and the broader chemical industry’s supply chain.

Conclusion

In conclusion, the furfural market is positioned for significant growth, driven by its versatile applications and increasing alignment with global sustainability trends. With the market expected to grow from USD 576.2 million in 2023 to approximately USD 1012.6 million by 2033, at a compound annual growth rate (CAGR) of 5.8%, furfural stands out as a critical component in various industries. The demand for furfural is primarily bolstered by its use in creating furfuryl alcohol, a key ingredient in foundry resins and adhesives, and its role in manufacturing solvents and pharmaceuticals. However, the market faces challenges such as price volatility of raw materials and the need for more environmentally friendly production processes. Innovations in production technology and increased capacity are pivotal to overcoming these obstacles. As industries continue to seek renewable and eco-friendly solutions, furfural’s importance is likely to increase, making it a cornerstone in the evolving landscape of green chemistry.