Table of Contents

Introduction

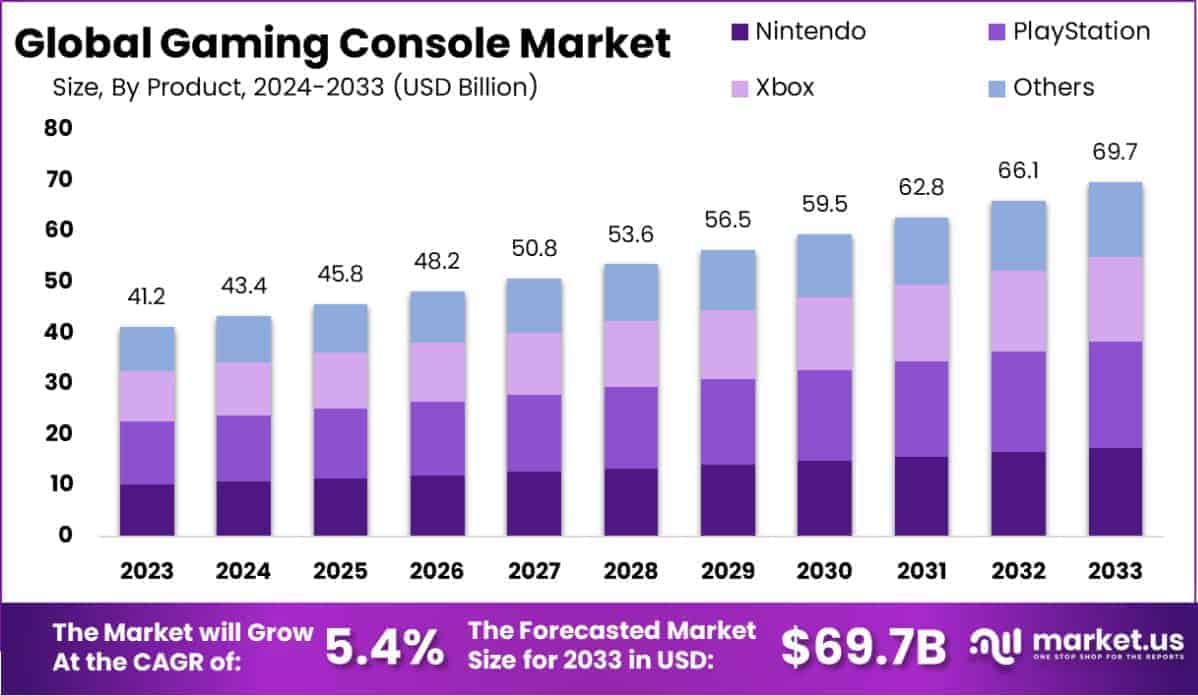

The Global Gaming Console Market is projected to grow from USD 41.2 billion in 2023 to an estimated USD 69.7 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.4% over the forecast period (2024–2033).

A gaming console is a dedicated electronic device designed specifically for playing video games. These devices offer users an immersive gaming experience through advanced graphics, audio, and gameplay features, often tailored for home use or portable convenience. Gaming consoles are equipped with specialized hardware and software to support high-performance gaming and are frequently compatible with proprietary game titles and peripherals. Examples include consoles like PlayStation, Xbox, and Nintendo Switch, which cater to various demographics and gaming preferences.

The gaming console market encompasses the global industry involved in the development, manufacturing, marketing, and sales of gaming consoles. This market includes both home consoles and portable handheld devices, along with associated accessories and services such as subscriptions to online gaming platforms. It is a dynamic sector that bridges consumer electronics, entertainment, and gaming, attracting a wide range of stakeholders, including manufacturers, game developers, retailers, and end-users. The market is characterized by intense competition, innovation-driven growth, and cyclical product releases.

The gaming console market is propelled by several key factors. Technological advancements, such as the integration of virtual reality (VR) and augmented reality (AR), have significantly enhanced the appeal of modern consoles. The rise in disposable income and increased consumer spending on entertainment, especially in emerging economies, have also contributed to the market’s expansion. Furthermore, the growing popularity of eSports and multiplayer online games has driven demand for advanced consoles capable of delivering high-quality graphics and seamless online connectivity.

The demand for gaming consoles has seen a substantial increase, driven by a shift in consumer preferences towards high-quality gaming experiences. The COVID-19 pandemic played a notable role in boosting demand, as people turned to gaming as a primary form of entertainment during lockdowns. The sustained growth in gaming as a hobby across various age groups, coupled with the continuous release of blockbuster game titles, ensures steady demand. Additionally, the adoption of subscription-based gaming services and cloud gaming platforms has further bolstered the market’s appeal.

The gaming console market holds considerable growth potential, especially in emerging markets where the penetration of gaming devices remains relatively low. Innovations like cloud-based gaming, cross-platform compatibility, and subscription services present lucrative opportunities for manufacturers to capture new audiences. Moreover, the integration of AI-driven gaming features and next-generation consoles with enhanced capabilities offers a pathway for differentiation in a competitive landscape. Strategic partnerships between console manufacturers, game developers, and streaming platforms also provide avenues for long-term revenue generation and market expansion.

Key Takeaways

- The global gaming console market is anticipated to reach USD 69.7 billion by 2033, up from USD 41.2 billion in 2023, growing at a CAGR of 5.4% between 2024 and 2033.

- In 2023, PlayStation led the market in the By Product segment, accounting for 25.3% of the market share.

- The Gaming application category dominated the By Application segment in 2023, capturing 56.6% of the market.

- The Online Distribution Channel emerged as the leading By Distribution Channel segment in 2023, with a 46.1% share.

- Handheld Game Consoles led the By Type segment in 2023, holding a 31.3% market share.

- In the By Component segment, Console Units were dominant in 2023, contributing 36.4% of the market share.

- The Asia Pacific region held the largest regional market share at 46.2% in 2023, generating USD 19.0 billion in revenue from the gaming console market.

Gaming Console Statistics

- Gaming penetration in the US is 82.9%.

- 21% of video game players are under 18 years old.

- 26% of players in the US are aged between 34 and 54.

- 64% of US adults and 70% of individuals under 18 play video games regularly.

- Among teens aged 13-18, 46% play on mobile, 27% on consoles, and 17% on computers.

- In 2022, 54% of gamers used smartphones for gaming.

- 22% of tweens and teens play on tablets, 11% on computers, and 2% on iPod Touch.

- Under 18s make up 21% of console gamers in the US.

- Gamers aged 26-35 average the highest weekly playtime at 7.5 hours.

- 43% of adults aged 18-34 play video games for seven or more hours weekly.

- Women accounted for 48% of gamers in the US in 2022, up from 45% in 2021.

- Gaming addiction affects 1.7%-10% of the American population.

- Minecraft sold over 300 million copies by October 2023.

- Tetris has sold 520 million copies globally.

- 32% of developers worked in indie studios in 2023, most in teams of 50 or fewer.

- 49% of game developers use AI tools in their work.

- Total console sales are projected to reach 63.49 million units by 2028, with a 1.9% increase expected in 2025.

- Global console shipments grew by 32% in Q1 2023, totaling 10.3 million units.

- 62% of US console gamers played action games in 2023, while 47% played shooter games.

- Europe leads in weekly gaming hours, but US players average 13 hours per week.

- 57% of gamers use smartphones, while 52% use dedicated gaming consoles.

- 83% of gamers aged 16-24 play online, and 49% of players aged 65 and older also play online.

- 53% of men and 51% of women in the UK consider themselves gamers.

- Mobile phones are the most popular gaming device, with 34% using them as the main access point.

- Chinese players lead eSports earnings, with nearly $300 million won.

Emerging Trends

- Integration of Cloud Gaming Services: Leading companies are incorporating cloud-based platforms into their consoles, enabling users to stream games without the need for physical media or extensive downloads. This shift enhances accessibility and offers a seamless gaming experience.

- Expansion of Subscription-Based Models: There’s a growing emphasis on subscription services, providing gamers with access to extensive libraries of games for a monthly fee. This model promotes continuous engagement and offers a cost-effective alternative to purchasing individual titles.

- Advancements in Virtual Reality (VR) Integration: The development of VR-compatible consoles and peripherals is gaining momentum, offering immersive gaming experiences. Companies are investing in VR technology to attract both hardcore gamers and new audiences seeking innovative entertainment forms.

- Rise of Handheld and Hybrid Consoles: There’s an increasing demand for portable gaming solutions, leading to the popularity of handheld and hybrid consoles. These devices cater to gamers seeking flexibility, allowing play both at home and on the go.

- Focus on Backward Compatibility: Manufacturers are prioritizing backward compatibility, enabling new consoles to support games from previous generations. This approach enhances the value proposition for consumers and encourages brand loyalty by preserving gamers’ existing libraries.

Top Use Cases

- Entertainment Hubs: Modern consoles double as entertainment centers, allowing users to stream movies, TV shows, and music. This multifunctionality enhances their appeal to non-gaming audiences, making consoles a central part of home entertainment systems.

- Social Connectivity: Consoles enable users to connect through online multiplayer games, chat features, and competitive platforms. Features like leaderboards and live streaming integrations foster engagement and build a community-driven ecosystem.

- Fitness and Health Applications: Leveraging motion-tracking technologies, gaming consoles provide interactive fitness solutions. Games designed for physical activity, such as motion-based workouts or sports simulations, cater to health-conscious consumers.

- Educational and Training Tools: Consoles now support educational software and simulations, offering interactive ways to learn new skills or concepts. These tools are especially valuable for children, providing a fun yet effective way to supplement traditional learning methods.

- Virtual Reality (VR) Integration: VR-enabled consoles provide highly immersive experiences, transforming gaming, virtual tourism, and training scenarios. As VR becomes more accessible, its integration into consoles is expanding their use cases and broadening their market reach.

Major Challenges

- Supply Chain Disruptions: The global semiconductor shortage has severely affected console production, leading to supply constraints. For instance, Nintendo reported a 55% drop in profit for the first quarter of its fiscal year, attributed to a decrease in sales of its seven-year-old Switch console.

- Rising Production Costs: The increasing cost of raw materials and components has led to higher manufacturing expenses. Sony’s PlayStation 5 Pro, priced at $699.99, reflects this trend, making it the company’s most expensive console to date.

- Intense Market Competition: The console market is highly competitive, with major players like Sony, Microsoft, and Nintendo vying for market share. Sony holds a 70% share of the global high-end console market, while Microsoft has a 30% market share as of 2023.

- Shift Towards Mobile and Cloud Gaming: The rise of mobile and cloud gaming platforms offers gamers convenient and cost-effective alternatives, potentially reducing the demand for traditional consoles. The global gaming market is projected to grow by 2.1% in 2024, generating $187.7 billion in revenue, with console revenues expected to fall by 1% to $51.9 billion.

- Economic Uncertainty: Global economic challenges can impact consumer spending on non-essential items like gaming consoles. Economic uncertainties further compound the challenge, potentially impacting consumer spending on non-essential entertainment.

Top Opportunities

- Expansion into Emerging Markets: Regions such as Latin America and Southeast Asia present substantial growth potential due to increasing internet penetration and a growing middle class. For example, Brazil has become the 10th largest gaming market globally, with a significant surge in console sales following tax reductions.

- Integration of Advanced Technologies: Incorporating technologies like virtual reality (VR) and augmented reality (AR) can enhance user experiences, attracting a broader audience. The development of VR-compatible consoles and peripherals is gaining momentum, offering immersive gaming experiences.

- Development of Cloud Gaming Services: Offering cloud-based gaming can reduce the need for high-end hardware, making gaming more accessible. This shift enhances accessibility and offers a seamless gaming experience.

- Focus on Backward Compatibility: Manufacturers are prioritizing backward compatibility, enabling new consoles to support games from previous generations. This approach enhances the value proposition for consumers and encourages brand loyalty by preserving gamers’ existing libraries.

- Expansion of Subscription-Based Models: There’s a growing emphasis on subscription services, providing gamers with access to extensive libraries of games for a monthly fee. This model promotes continuous engagement and offers a cost-effective alternative to purchasing individual titles.

Key Player Analysis

- Sony Corporation (Japan): Sony’s PlayStation series has been a cornerstone in the gaming industry. As of 2022, Sony held approximately 45% of the global console gaming market. The PlayStation 5 (PS5), launched in November 2020, has significantly contributed to this dominance, with over 65 million units shipped by November 2024.

- Microsoft Corporation (U.S.): Microsoft’s Xbox series is a key competitor in the console market. In 2022, Microsoft secured nearly 28% of the global console gaming market. The Xbox Series X and Series S, released in November 2020, have collectively sold 21 million units by 2023.

- Nintendo Co., Ltd. (Japan): Nintendo’s innovative approach, particularly with the Switch console, has solidified its market position. In 2022, Nintendo accounted for approximately 27% of the global console gaming market. The Switch has achieved remarkable success, with over 140 million units sold since its launch in 2017.

- Valve Corporation (U.S.): Valve, known for its digital distribution platform Steam, ventured into hardware with the Steam Deck, a handheld gaming device released in February 2022. While specific sales figures are not publicly disclosed, the Steam Deck has been well-received for bringing PC gaming portability.

- NVIDIA Corporation (U.S.): NVIDIA, a leader in graphics processing units (GPUs), has influenced the gaming console market through its technology. The company’s GPUs are integral to the performance of various gaming consoles, enhancing graphics and processing capabilities.

Recent Developments

- In 2023, Playtika Holding Corp. (NASDAQ: PLTK) entered into a definitive agreement to acquire Innplay Labs, an Israeli mobile gaming studio. The upfront cost of the deal was $80 million, with a potential maximum value of $300 million.

- In 2023, Microsoft finalized its acquisition of Activision Blizzard after receiving regulatory approvals worldwide. This merger combined two gaming leaders, fostering innovation and competition in the industry.

- In 2024, NVIDIA unveiled advanced AI features at Gamescom, including digital human technologies and 20 new RTX-powered games. The company also partnered with MediaTek to expand G-SYNC display capabilities.

Conclusion

The gaming console market is poised for significant growth, driven by technological advancements and evolving consumer preferences. The integration of cloud gaming services and virtual reality (VR) capabilities is enhancing user experiences, while subscription-based models are increasing accessibility and engagement. Despite challenges such as supply chain disruptions and rising production costs, the market continues to expand, with emerging regions offering substantial opportunities. As the industry adapts to these dynamics, the focus remains on delivering innovative, immersive, and accessible gaming experiences to a diverse global audience.