Table of Contents

Introduction

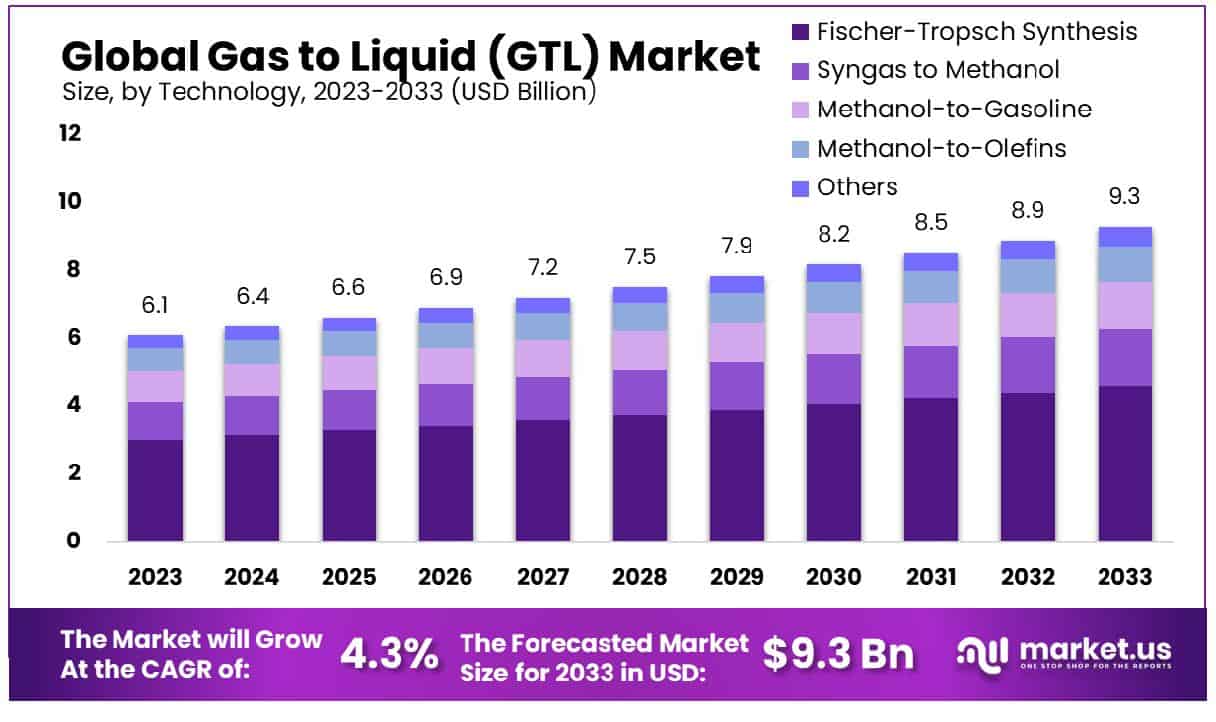

The global Gas to Liquid (GTL) market is projected to experience steady growth from USD 6.1 billion in 2023 to USD 9.3 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.3% during the forecast period from 2024 to 2033. This growth is propelled by increasing demands for cleaner alternative fuels and the technology’s ability to convert natural gas into higher-quality liquid fuels like diesel and naphtha.

The GTL market faces challenges, notably the high capital investments required for setting up and operating GTL plants. This factor may hinder growth by deterring new entrants and the expansion of existing facilities. Furthermore, the market’s dynamics are influenced by geopolitical factors and fluctuations in natural gas supply and prices.

Velocys has made substantial progress by enhancing its technology for producing sustainable aviation fuel. Their process, which upgrades the Fischer-Tropsch method, allows the conversion of hydrogen and carbon monoxide into synthetic fuel. This fuel is pivotal for sectors like aviation and heavy goods transportation aiming for net zero emissions. Velocys is now transitioning from research and development into the commercial phase, capitalizing on legislative and policy support for sustainable fuels globally.

CompactGTL has recently entered a joint venture with EQTEC plc, marking a significant step in its expansion into the production of liquid fuels from waste, including sustainable aviation fuel (SAF). The partnership aims to establish a commercial-scale reference plant to validate the viability of their integrated waste-to-liquid fuel solution. This venture is expected to enhance CompactGTL’s positioning in the market by leveraging its patented technology in small-scale, modular gas-to-liquid processes, particularly focusing on converting waste to valuable liquid fuels.

Petróleo Brasileiro S.A., commonly known as Petrobras, has been involved in several developments that could impact the Gas To Liquid (GTL) market. A notable progression is the successful completion of a qualification test program for a modular small-scale GTL facility by Petrobras’ CENPES Research and Development Centre. This facility, designed to offer alternatives to gas flaring, has passed extensive testing and is approved for use, indicating Petrobras’ ongoing commitment to innovative energy solutions.

Key Takeaways

- Market Growth: The Global Gas To Liquid Market is projected to grow from USD 6.1 billion in 2023 to USD 9.3 billion by 2033, at a CAGR of 4.3%.

- The GTL market in the Middle East & Africa holds 48.5%, USD 2.9 billion.

- By Technology: Fischer-Tropsch Synthesis technology dominates with a share of 49.7%.

- By Product: Product-wise, fuel oil accounts for a substantial 42.6% market share.

- By Application: Fuel oil application leads with a commanding 80.4% market presence.

- By End-Use: Transportation sector holds the majority share at 51.6% in end-use.

Gas To Liquid (GTL) Market Statistics

- The $19-B natural gas processing and GTL integrated complex was developed by a JV of Shell and Qatar Petroleum.

- Oryx GTL was the Middle East’s first GTL plant. Developed by Qatar Petroleum and Sasol, the $6-B plant also processes natural gas from Qatar’s North Field.

- Natural gas prices are hitting rock bottom, with Henry Hub averaging a mere $1.49 in March 2024, the lowest monthly average since 1997.

- U.S. production is expected to fall by more than 3 billion cubic feet per day (Bcfd) this year.

- In 2021, the United States used about 30.28 trillion cubic feet (Tcf) of natural gas, about 31.35 quadrillion British thermal units (BTU).

- A section of the 12,500 b/d Shell MDS plant at Bintulu, Sarawak, shows, from right, the Shell gasification process unit, the hydrogen manufacturing unit, and heavy paraffin synthesis reactors.

- The United States Energy Information Administration (EIA) reported that the United States flared more than 260 billion cubic feet of natural gas in 2013, and more than 0.31 billion cubic feet per day (Bcf/d) of natural gas.

- Depending on the size of the converter (larger is better), it is possible to convert 50-65% of the methane and all of the other hydrocarbons in the feed gas into acetylene and hydrogen.

- Due to the size and scope of Shell Pearl GTL, with approximately 500 million construction hours and an investment of $18- to $ 19 billion, the construction project was divided into 10 separate smaller projects, frequently ranging from $1- to $3-billion in size with thousands of workers in each project.

- GTL is a reliable alternative to lubricants derived from crude oil. With over 14,000 trillion cubic feet of unused natural gas reserves, there is an abundance of resources for GTL plants to exploit.

- The Kazakhstan GTL project should produce 3,000 barrels per day (b/d) of synthetic diesel.

- In 2022, ethane accounted for 65% of NGL consumption in the United States. A lot of ethane isn’t even used as a fuel.

- This limitation on gas usage is evident from the fact that only 23% of the world’s gas production is traded internationally vs. 57% for oil.

- The success of the Uzbekneftegaz $3.6 billion GTL (gas-to-liquid) project – launching in early 2022 – paves the way for other major industrial projects in the country.

- Greenhouse gases to solid multi-walled carbon nanotubes (MWCNT) while the second reactor produces syngas that meet downstream process requirements. CARGEN™ reduces the DRM process net energy requirement by 50% and could enable more than 80% CO2 conversion.

- Gas Technologies LLC (GTL) has streamlined its GasTechno alcohol and chemical plant that converts natural gas to liquids and chemical products at a capital cost (CAPEX) of less than US$ 2 million.

- The new GasTechno Mini-GTL gas-to-liquids plant packages will range in cost from $1.5 to $2.0 million per installation.

- GTL Americas LP is the company that is establishing a $3.5 billion-plus gas-to-liquid facility near Pine Bluff that will be the first of its kind in the United States.

Emerging Trends

- Environmental Regulation Compliance: Increasing global environmental regulations are driving the adoption of GTL technology as it produces cleaner fuels like synthetic diesel and naphtha, which emit fewer pollutants compared to traditional fuels.

- Technological Advancements: Innovations in GTL technology are reducing costs and improving efficiency. Advances in catalysts and process designs are making GTL more economically viable and broadening its applications.

- Small-Scale GTL Plants: There is a growing trend towards smaller, modular GTL plants that can be quickly deployed and are ideal for remote locations with stranded gas reserves. These plants require less capital and can swiftly monetize unused gas.

- Integration with Renewable Energy: GTL processes are increasingly being powered by renewable energy sources, reducing the carbon footprint of the final products. This integration is particularly feasible in areas with abundant solar or wind resources.

- Product Diversification: Companies are diversifying their GTL product slates to include specialty chemicals and higher-value products such as waxes and lubricants, which offer higher margins and greater market stability.

- Expansion in Emerging Markets: GTL technology is expanding in emerging markets with abundant natural gas reserves. These regions are investing in GTL to enhance their energy security and reduce dependence on oil imports.

- Strategic Collaborations: The GTL industry sees significant collaborations and joint ventures between energy companies, technology providers, and governments to share the substantial costs and risks associated with GTL projects.

Use Cases

- Fuel Production: GTL technology is primarily used to produce cleaner-burning diesel and other transportation fuels. By converting natural gas into longer-chain hydrocarbons, GTL diesel helps reduce emissions when burned, compared to conventional diesel fuels derived from crude oil. This technology not only provides a higher quality of diesel but also supports environmental sustainability initiatives.

- Environmental and Safety Benefits: GTL fuels offer notable environmental advantages, particularly in reducing emissions. For instance, GTL marine diesel fuel has been shown to emit 9% less nitrogen oxides and 58% less particulate matter than conventional diesel fuels. These features make GTL fuels an attractive option for reducing air pollution from diesel engines.

- Industrial Applications: The use of GTL technology extends beyond fuels. Shell’s GTL isoparaffins, for example, are used across various industries due to their high purity and low toxicity. They are essential in household cleaning products, cosmetics, aerosols, and even in paints and inks. These isoparaffins help improve product performance by enhancing spreadability and consistency while also being environmentally friendly due to their biodegradable nature.

- Energy Production: GTL processes are also crucial in energy production, where they can help monetize stranded natural gas resources. These processes are often integrated with large industrial facilities like those built by Mitsubishi Heavy Industries, which are capable of handling massive flows and pressures, thus facilitating the efficient production of GTL fuels.

Key Players Analysis

Shell plc has been pioneering in the Gas To Liquid (GTL) sector since the 1970s, leveraging its extensive research and development capabilities. The company’s GTL technology transforms natural gas into high-quality liquid products, including fuels and lubricants. Notably, Shell operates the Pearl GTL plant in Qatar, one of the largest GTL plants globally, producing a vast range of hydrocarbon products. This advancement underscores Shell’s commitment to innovation and sustainability in the energy sector.

Chevron Corporation has significantly contributed to the gas-to-liquid (GTL) sector through its Escravos GTL project in Nigeria. The project, which processes 325 million cubic feet per day of natural gas to produce 33,000 barrels per day of liquids like synthetic diesel and naphtha, marks a significant stride in the GTL landscape. The Escravos GTL plant, developed in partnership with the Nigerian National Petroleum Corporation and Sasol, uses advanced Fischer-Tropsch technology to produce cleaner, low-sulfur diesel fuels and other high-value products, aiming to reduce Nigeria’s reliance on imported refined petroleum products.

Sasol Limited, headquartered in South Africa, has been pioneering in the gas-to-liquids (GTL) sector since launching its first GTL facility outside of South Africa in Qatar in 2007. Utilizing its proprietary technologies, Sasol’s GTL processes convert natural gas into high-value liquid fuels and chemicals, offering a cleaner alternative to traditional diesel. Their flagship ORYX GTL plant, a collaboration with Qatar Petroleum, is noted for exceeding its production capacity and setting benchmarks in the GTL industry. Additionally, Sasol is expanding its GTL presence in the United States with a significant project in Louisiana aimed at converting natural gas to diesel and other liquid fuels.

PetroSA, the South African state-owned oil company, is actively working to restart its gas-to-liquids (GTL) refinery in Mossel Bay, which was suspended in 2020 due to feedstock shortages. The company plans to revitalize the refinery with a focus on producing ultra-clean, low-sulfur, synthetic fuels using Fischer–Tropsch technology. A strategic partnership with Gazprombank has been formed to secure the necessary investments for this project. This collaboration aims to restore the refinery’s production capabilities to meet local demands and reduce dependence on fuel imports, with a projected operational start by 2027/28, ensuring long-term feedstock solutions and financial backing.

Velocys is making significant strides in the Gas-to-Liquids (GTL) sector by developing small-scale GTL technologies that convert natural gas into liquid fuels. The company is focused on facilitating energy independence in North America and other regions by capitalizing on the abundant supply of natural gas. Velocys’s technology is particularly suited to smaller GTL plants, which are economically viable and can produce between 1,000 and 15,000 barrels per day. Their approach not only supports sustainable fuel initiatives but also utilizes flared gas, turning a waste byproduct into valuable resources.

ORYX GTL operates as a key player in the Gas-to-liquid (GTL) sector, converting natural gas into valuable liquid fuels. This company, a joint venture between QatarEnergy and Sasol, leverages the Fischer-Tropsch process to transform gas drawn from Qatar’s North Field into low-sulfur diesel, naphtha, and LPG. The process involves multiple stages including reforming natural gas, synthesizing gas, and hydrocracking. Located in Ras Laffan Industrial City, Qatar, ORYX GTL started production in 2007 and continues to contribute to the diversification of Qatar’s energy resources, aligning with the nation’s strategic vision.

Oltin Yol GTL facility in Uzbekistan, a joint venture involving Uzbekneftegaz, Sasol Synfuels, and Petronas, stands as a significant player in the Gas-to-liquid (GTL) sector. Utilizing Sasol’s slurry-phase distillate process, this plant transforms methane into synthetic fuels like diesel and kerosene. Its design eliminates contaminants such as sulfur and nitrogen compounds, enhancing environmental sustainability. This facility, with a yearly capacity of 1.3 million tons, represents a major technological advancement in the GTL landscape.

Linc Energy formerly active in the Gas-to-liquid (GTL) sector, Linc Energy was a pioneer in integrating underground coal gasification with GTL processes. This innovative approach allowed for the conversion of low-grade, stranded coal into valuable liquid fuels, positioning the company at the forefront of clean energy technology. Linc Energy expanded its operations globally, targeting markets in China, the USA, Poland, Uzbekistan, South Africa, and the United Kingdom. Despite its initial successes, financial challenges led to the company’s liquidation in 2016.

CompactGTL is a prominent player in the small-scale, modular Gas to Liquid (GTL) sector, known for converting associated gas into synthetic fuels. The company has successfully demonstrated this technology in collaboration with Petrobras at a plant in Brazil, showcasing the practical application of its GTL systems in transforming unwanted natural gas into valuable synthetic liquids.

Primus Green Energy is a key innovator in the GTL field, specializing in transforming methane and other hydrocarbons into high-octane gasoline and methanol. Their proprietary STG+™ technology has enabled the production of high-quality fuels from a variety of natural gas feedstocks. This technology is not only economically viable at various scales but also environmentally advantageous by facilitating the conversion of stranded and associated gases.

NRG Energy Inc. is actively involved in the Gas-To-Liquid (GTL) sector, leveraging its expertise in energy production and sustainable solutions. The company integrates GTL technology to convert natural gas into valuable liquid products, contributing to energy diversification and environmental sustainability goals. NRG Energy Inc. is positioned to capitalize on the expanding GTL market, which is projected to witness substantial growth in the coming years due to rising global energy demands and environmental regulations.

Gas Technologies LLC, established in 2004, specializes in transforming natural and renewable gas sources into valuable liquid chemicals and fuels like methanol and ethanol through its patented GasTechno® Mini-GTL® technology. This technology is notable for its economic efficiency at smaller scales without needing government subsidies, and it is the only third-party validated direct methane conversion technology available. The company has effectively integrated this system into modular plants that can be deployed swiftly, targeting a market that includes stranded or flared gas locations, aiming to capitalize on the increasing demand for low-carbon fuels.

ExxonMobil Corporation has made substantial advancements in the Gas-to-liquid (GTL) sector through its proprietary AGC-21 technology. This technology, which has evolved significantly over the past two decades, enables the conversion of natural gas into cleaner-burning fuels and specialty products such as lube base stocks. ExxonMobil’s continuous research and development efforts aim to reduce production costs and enhance the efficiency of this technology, making it a viable solution for commercializing natural gas resources. This strategic focus aligns with global energy demands for cleaner fuel options and positions ExxonMobil as a key player in the GTL market.

Linde plc operates within the GTL sector by providing critical industrial gases necessary for GTL processes. Specifically, Linde’s role involves the supply of large quantities of oxygen, crucial for the GTL technology’s air separation processes. This supply is typically facilitated through cryogenic air separation plants, which are currently the most economical method for meeting the oxygen demands of GTL processes. Linde’s involvement is integral to the production of synthesis gas, which is a precursor to the Fischer-Tropsch process used in GTL plants to produce liquid hydrocarbons.

Petróleo Brasileiro S.A. (Petrobras) has successfully tested and approved a modular small-scale Gas to Liquid (GTL) facility, highlighting its commitment to leveraging GTL technology. This initiative aligns with its strategy to utilize associated gas more efficiently, particularly in remote onshore and offshore oilfield locations. The technology demonstrated includes various integrated processes such as gas pre-treatment and Fischer-Tropsch synthesis, aiming at reducing flaring and converting gas into valuable liquid fuels.

Conclusion

The Gas-to-liquid (GTL) market is poised for significant growth, fueled by the increasing global energy demand and the push toward environmental sustainability. Technological innovations and strategic expansions are key drivers enhancing the market’s capacity to provide sustainable and cleaner energy solutions.

The market is also benefiting from geographical diversification and collaborations among key players, which collectively strengthen GTL’s role in the ongoing transition to more resilient and environmentally friendly energy systems. With the Asia-Pacific region leading in growth due to high energy demands and environmental initiatives, GTL technology remains a crucial component of the future energy landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)