Table of Contents

Introduction

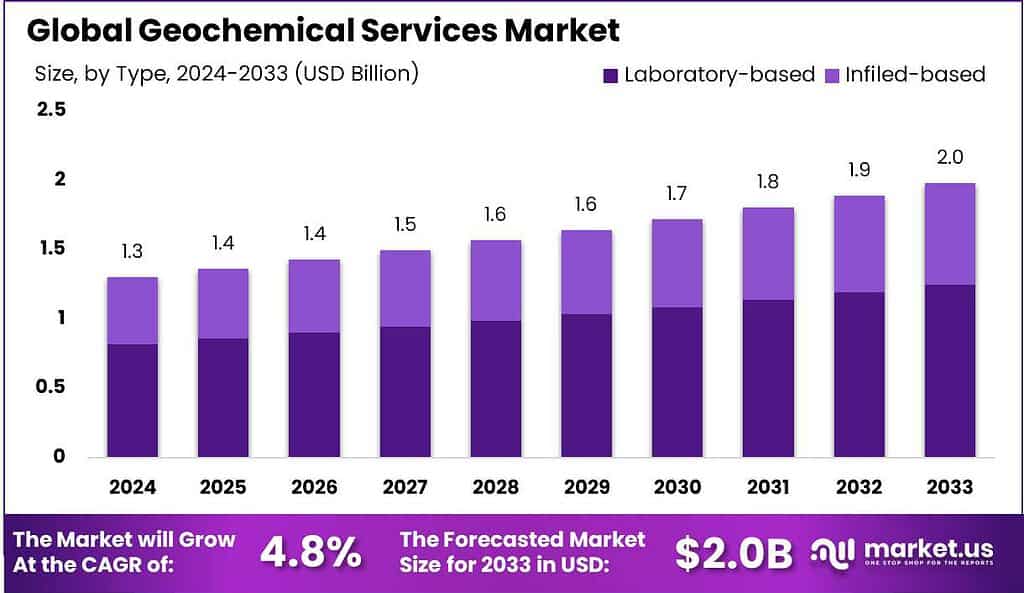

The global Geochemical Services Market is poised for growth, projected to expand from USD 1.3 billion in 2023 to approximately USD 2.0 billion by 2033, at a compound annual growth rate (CAGR) of 4.8%. This growth is driven by increased demand from the mining sector, where geochemical services play a crucial role in mineral exploration and environmental assessments.

Recent developments in the market underscore the dynamism and expansion within the industry. Actlabs Group, a notable player, continues to enhance its analytical capabilities, offering precise and reliable laboratory-based geochemical services. ALS Limited has also been instrumental, particularly in sample preparation and X-ray fluorescence, which are pivotal for accurate mineral analysis. Bureau Veritas Group has expanded its services to incorporate advanced technologies like machine learning for better data analysis and decision-making in mineral exploration. Capital Limited, on the other hand, remains a key participant, leveraging its expertise in fire assay and hydrogeochemistry to support the mining and oil & gas sectors.

Challenges, however, persist alongside opportunities. These include the need for high initial investments in laboratory infrastructure and the variability in geochemical testing methodologies, which can affect result consistency and data comparability. Furthermore, the industry faces pressure from environmental regulations and must adapt to rapid changes in technology to stay competitive.

Regionally, the Asia-Pacific market holds the largest share, driven by significant investments in mineral and metal production, especially in countries like China and India. This region’s growth is further supported by its substantial involvement in the metals and mining sectors, which extensively utilize geochemical services for exploration and environmental assessments. North America also exhibits robust growth, supported by favorable government policies and funding for energy and mining projects.

Key Takeaways

- The Global Geochemical Services Market size is expected to be worth around USD 2.0 Billion by 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

- Laboratory-based geochemical services dominated the market with a 62.5% share due to their precision and reliability.

- Sample Preparation dominated the Geochemical Services with a 28.4% share.

- Machine Learning dominated the Geochemical Services Technology segment with a 34.5% share.

- Mineral & Mining dominated the Geochemical Services with a 54.6% share.

- Asia Pacific leads the Geochemical Services market with 37.2%, valued at USD 0.4 billion.

Geochemical Services Statistics

- For copper, the QLs for the three instruments are determined to be 3.7 mg/kg, 3.8 mg/kg, and 4.1 mg/kg.

- USGS performed a low sample density study (one sample per 1,600 km2) to determine elemental soil background values across the conterminous United States.

- USGS used a total metals digestion of the <0.15 mm fraction using four acids as the digestion method, which yields higher concentrations for metals than the less aggressive USEPA digestion methods used to determine environmentally available concentrations.

- The disaggregated sample is passed through a 10-mesh (<2 mm) sieve and the fraction passing through the sieve is digested.

- The soil sample is air dried (or dried in an oven at 30°C) and disaggregated.

- The study of fluid-rock interactions and pollution and remediation processes can be regarded as the principal geochemical modeling objectives, constituting 37% and 36% of the reviewed studies, respectively.

- This review seeks to provide an overview of case studies that applied geochemical modeling in the 2019 year, which includes over 250 articles.

- This primary geochemical differentiation of the Earth can be interpreted in terms of the system iron–magnesium–silicon–oxygen–sulfur, because these five elements make up about 95 percent of the Earth.

- There is a projected 7% increase in this type of work between 2020 and 2030.

- The range is from $51,890 for the lowest 10% grade up to $201,150 for the highest paid employees.

- Geochemists, who fall under the broader BLS category of geoscientists, earned a median salary of $93,580 as of May 2020.

- A particular problem with major element geochemical data is that it is constrained; that is, the compositions sum to 100% and the data are ‘closed’.

- The Boyd crusher with attached rotary sample divider reduces samples from less than 50mm to less than 4mm grains.

- The sample divider can be set to sample between 2% and 50% of the fine crush.

- The equipment can measure concentrations as low as 1ppm and as high as 100%.

Emerging Trends

- Technological Advancements: The integration of advanced technologies in geochemical analysis is a key trend. This includes the adoption of AI and machine learning for enhanced data analysis and precision in predicting mineral locations.

- Environmental and Regulatory Compliance: There is an increasing application of geochemical services in environmental monitoring and compliance with regulatory frameworks. This is particularly relevant in the oil and gas sectors where geochemical analysis helps in reducing exploration risks and optimizing production.

- Increased Demand in Mining and Oil & Gas: Geochemical services are crucial in the mining and oil & gas industries for exploring new resources and ensuring efficient extraction processes. The market is seeing a surge in demand particularly from regions rich in natural resources like Asia Pacific and the Middle East & Africa.

- Laboratory and Field Services: The market is segmented into laboratory-based and field-based services, with laboratory services taking the lead due to their critical role in precise sample analysis. Sample preparation is highlighted as a significant contributor to market growth, owing to its impact on analytical accuracy and project cost efficiency.

Use Cases

- Mining and Minerals: Geochemical services are crucial for the mining sector, facilitating the discovery and quantification of ore deposits. Through methods like sample preparation and chemical analysis of soil and rock, these services help identify the composition and quantity of minerals, supporting efficient mining operations.

- Oil and Gas: In the oil and gas industry, geochemical analysis helps in identifying the molecular and isotopic compositions of resources, which is critical for exploration and optimizing production strategies. This reduces risks associated with drilling and production, increasing efficiency and discovery rates.

- Environmental Monitoring: These services play a vital role in assessing environmental pollution and the ecological impact of industrial activities. By analyzing soil and water samples, geochemical services help monitor and manage environmental health and compliance with regulatory standards.

- Archaeological and Scientific Research: Geochemical techniques are also applied in archaeological studies to understand historical site compositions and preservation needs. In scientific contexts, they assist in various research endeavors to analyze natural processes and material compositions.

Major Challenges

- High Costs and Time Consumption: Geochemical services are inherently expensive due to the sophisticated equipment and expert analysis required. Additionally, the time needed to complete geochemical surveys can significantly delay project timelines. These factors pose substantial hurdles, especially for small to medium-sized enterprises operating with limited budgets and tighter schedules.

- Regulatory Compliance: Geochemical services must adhere to strict environmental regulations, which vary widely by region and can impact both the scope and execution of geochemical projects. Compliance with these regulations requires additional resources, thus increasing operational costs and complexity.

- Geo-Political and Economic Instabilities: The global nature of the geochemical services market means it is susceptible to geopolitical and economic shifts. These can affect market stability and cause fluctuations in demand, particularly in regions heavily reliant on industries like mining and oil & gas, which are primary users of geochemical services.

Market Growth Opportunities

- Laboratory-Based Services: Dominating the market, laboratory-based services offer precise chemical analysis critical for mining and environmental assessments. This segment benefits from continuous technological improvements in sample analysis, which ensures accurate results and compliance with industry standards.

- Emerging Markets: The Asia-Pacific region, led by countries like China and India, is expected to continue as the largest market due to significant investments in mineral exploration and industrial growth. This region’s growth is propelled by the expanding metal and mining sectors, alongside considerable R&D activities.

- Industrial Applications: The industrial sector, including mining and oil & gas, remains the largest user of geochemical services. These services are crucial for exploring and developing new resource fields, ensuring environmental compliance, and optimizing production processes.

- Technological Advancements: The incorporation of advanced technologies such as Machine Learning and Data Analytics is enhancing the efficiency and accuracy of geochemical analyses. These technologies help in predictive modeling and risk assessments, crucial for decision-making processes in resource-intensive industries.

Key Player Analysis

Actlabs Group in the Geochemical Services Sector: Actlabs Group provides extensive geochemical services, focusing on the mining and minerals markets globally. They are renowned for their rigorous analytical capabilities, from routine quality control to cutting-edge research applications. Their facilities offer a wide range of services, including sample preparation, gold and silver assays, and multi-elemental analysis using various methods. Actlabs has established a strong international presence with 15 laboratories across six countries, emphasizing their commitment to high quality and rapid service delivery.

ALS Limited in the Geochemical Services Sector: ALS Limited is a global leader in providing comprehensive analytical testing services, including geochemical analysis for the mining sector. They are known for their precision and reliability in testing minerals and ores, essential for exploration and mining operations. ALS leverages advanced technologies and methodologies to deliver detailed analysis and data critical for making informed decisions in the resource extraction industries.

Enviros operates in the geochemical services sector, specializing in data collection and analysis critical for hydrocarbon exploration. Their work includes conducting macro-seepage and micro-seepage geochemical surveys to predict hydrocarbon quantities and map seeps, enhancing exploration efficiency. Additionally, Enviros integrates environmental surveys with their geochemical and geophysical operations to provide comprehensive subsurface profiles, supporting oil and gas operators in making informed drilling decisions.

Chinook Consulting Services Ltd., established in 2002, operates primarily in the geochemical services sector, offering a comprehensive suite of geological and geochemical analysis crucial for the oil and gas industry. Their services encompass mudlogging, which includes detailed geochemical analysis of drill cuttings to determine the geomechanical properties of rocks. This analysis becomes particularly vital in unconventional reservoirs where petrographic features are less discernible. Chinook employs advanced technologies such as X-ray fluorescence (XRF) and Fourier-transform infrared spectroscopy (FTIR) to provide precise chemical characterizations on-site, enhancing decision-making processes during drilling operations.

Intertek Group plc excels in the Geochemical Services sector, operating a state-of-the-art Minerals Global Centre of Excellence in Perth, Australia, which is pivotal for metals and minerals vital for a low-carbon future. This facility, among the largest of Intertek’s laboratories, integrates advanced technology and automation to enhance the efficiency and accuracy of geochemical analysis and assays. The company’s geochemical services play a crucial role in supporting mining companies by providing essential data for making informed decisions, thereby minimizing risks and maximizing resource use.

Fugro delivers geochemical services by conducting detailed geophysical surveys and site appraisals, crucial for industries that require deep understanding of subsurface conditions. They specialize in identifying site-specific geological features, using advanced technology to gather geo-data which helps clients minimize risks and make informed decisions on infrastructure and development projects. Their services are essential for safe, sustainable, and efficient site utilization, underpinning project success in various environments.

Saudi Aramco is deeply involved in geochemical services, primarily through its Exploration and Petroleum Engineering Advanced Research Center (EXPEC ARC). This center focuses on developing advanced geochemical solutions to enhance hydrocarbon discovery and reservoir recovery, which are crucial for the effective management of oil and gas production. EXPEC ARC employs a range of cutting-edge analytical technologies to conduct comprehensive geochemical analyses, aiding in the evaluation of reservoir and source rock potential, and supporting field operations. This scientific approach helps Saudi Aramco maintain its status as a leader in the global energy sector by optimizing resource management and ensuring long-term production reliability.

Geochemic Ltd., established in 2015, specializes in geochemical services for the mining industry, focusing on mining waste characterization and acid rock drainage prediction. They conduct detailed kinetic geochemical testing in their own laboratory and provide services such as environmental impact assessments and mine water treatment solutions. Geochemic’s expertise supports crucial mining operations by enhancing resource management and environmental compliance, thereby playing a vital role in the sector’s sustainability and operational efficiency.

Shiva Analyticals & Testing Laboratories, based in Bangalore, India, is a key player in the geochemical services sector, particularly noted for its specialized ores and minerals testing. The laboratory offers a broad range of analytical services, including the testing of major and minor oxides, trace elements, and rare earth elements from various sample types like soil and rock. Their comprehensive testing capabilities are crucial for mining companies and mineral explorers needing accurate geochemical analysis to guide mining and exploration decisions. Shiva Analyticals employs advanced technologies like WDXRF for elemental analysis, ensuring high precision in their geochemical assays.

Conclusion

In conclusion, the geochemical services market is projected to experience substantial growth over the forecast period, driven by increasing demand in industries such as mining, oil and gas, and environmental monitoring. The market’s expansion is supported by technological advancements in sample analysis and data processing, which enhance efficiency and accuracy. Key regions such as Asia-Pacific are leading the growth due to robust industrial activities and regulatory support, particularly in countries like China and India.