Table of Contents

Introduction

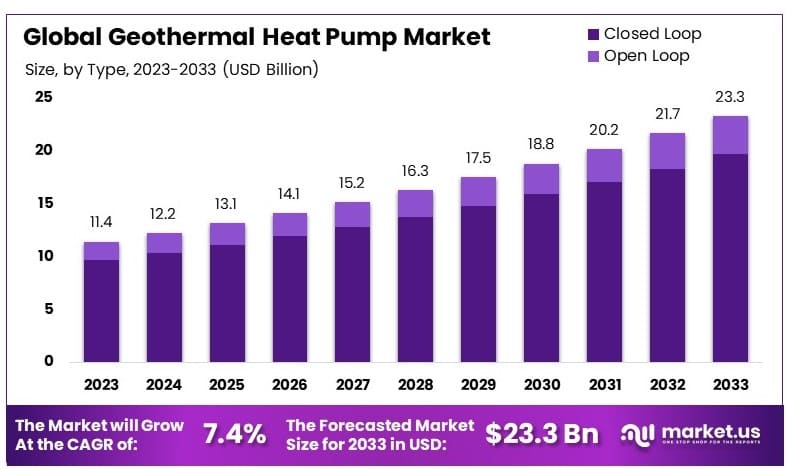

The Global Geothermal Heat Pump Market is poised for significant expansion, projected to grow from USD 11.4 billion in 2023 to approximately USD 23.3 billion by 2033, exhibiting a CAGR of 7.4% over the forecast period from 2024 to 2033. This growth is primarily driven by increasing energy efficiency requirements and the rising demand for sustainable heating solutions. Geothermal heat pumps, which utilize the earth’s stable underground temperature to provide heating and cooling, are gaining traction due to their lower operational costs and minimal environmental impact compared to conventional systems.

However, the market faces challenges, including high initial installation costs and the geographical limitations associated with accessing suitable underground temperatures. Recent developments in the industry have focused on overcoming these barriers. Advances in drilling technologies have reduced installation costs, and enhancements in heat pump efficiency have made the technology accessible to a broader range of climates.

Furthermore, government incentives and supportive policies in various countries are bolstering market growth by making investments in geothermal technologies more appealing. These factors collectively contribute to the robust growth trajectory of the geothermal heat pump market, reflecting its increasing adoption as a viable and environmentally friendly alternative to traditional heating and cooling methods.

Recent developments in the geothermal heat pump sector include significant advancements and strategic moves by key players like Daikin. Daikin has launched its new Altherma 3 GEO, a ground source heat pump utilizing geothermal energy and inverter technology to provide efficient heating, cooling, and hot water solutions across all climates. This model is noted for its exceptional energy efficiency, achieving about 5 kW of heat with just 1 kW of electricity, and features a highly quiet operation with a sound pressure level of only 27 dBA at one meter distance.

Ingersoll Rand has demonstrated significant strategic moves to bolster its capabilities within the geothermal heat pump market. Notably, the company completed two acquisitions in 2023, purchasing Oxywise and Fraserwoods for a combined total of approximately $26 million. These acquisitions are strategically aligned with Ingersoll Rand’s focus on enhancing its technological and service offerings in sustainable end markets, indicating a clear commitment to growth and innovation in sectors with high sustainability demands.

These developments suggest Ingersoll Rand is not only expanding its market reach through strategic acquisitions but also enhancing its product offerings and corporate operations to align with global sustainability trends, which is crucial for maintaining competitiveness in the evolving geothermal heat pump market.

Key Takeaways

- Market Value: The Geothermal Heat Pump Market was valued at USD 11.4 billion in 2023, and is expected to reach USD 23.3 billion by 2033, with a CAGR of 7.4%.

- Type Analysis: Closed Loop systems dominated with 84.5%; essential for their efficiency and reliability.

- Application Analysis: Residential use led with 50.1%; significant for its role in reducing household energy consumption.

- Dominant Region: APAC held 36.9%; crucial due to growing demand for energy-efficient solutions.

- Analyst Viewpoint: The geothermal heat pump market is moderately competitive with steady growth. Future trends suggest increased adoption driven by energy efficiency initiatives.

Geothermal Heat Pump Statistics

- Geothermal heat pumps can reduce energy costs by up to 50% and produce zero direct emissions.

- Network geothermal systems can achieve more than 500% efficiency, with every unit of energy input resulting in five units of output.

- Geothermal heat pumps produce approximately 85% fewer emissions than gas furnaces and 90% fewer emissions than propane furnaces through 2050.

- They consume four times less electricity on extreme cold days than air-source heat pumps.

- Federal tax credits, grants, and rebates can decrease household geothermal project costs by up to 50%, saving as much as $15,000 for higher-cost installations.

- The 30% federal tax credit from the Inflation Reduction Act can help commercial buildings reduce upfront costs by 30-50% for geothermal heat pumps.

- Operating costs for geothermal heat pumps in the Midwest could be less than half the cost of natural gas and propane furnaces.

- The U.S. Environmental Protection Agency found that ground source heat pumps used for heating and cooling can reduce energy consumption and emissions by more than 40% compared to air source heating and over 70% compared to electric resistance heating with standard air-conditioning equipment.

- Geothermal pumps can save up to 70% on heating bills and up to 50% on air conditioning compared to conventional systems.

- Geothermal heat pumps are more efficient when cooling homes compared to conventional systems.

- These systems reduce air pollution by using renewable energy sources.

- Geothermal heat pumps are suitable for use in all areas of the United States.

- Geothermal systems operate at an efficiency approaching or exceeding 400% during the heating season.

- Surveys by utilities show that more than 95% of geothermal customers would recommend geothermal systems to a family member or friend.

- Homeowners can save 25 to 50% on home electric bills compared to conventional heating and cooling systems.

- There are now more than 1,000,000 geothermal installations in the United States.

- These installations eliminate more than 5.8 million metric tons of CO2 annually.

- They also eliminate more than 1.6 million metric tons of carbon equivalent annually.

- Geothermal installations result in annual savings of nearly 8 million kWh of electricity and nearly 40 trillion Btus of fossil fuels.

- The impact of geothermal systems is equivalent to taking close to 1,295,000 cars off the road or planting more than 385 million trees.

- Geothermal systems reduce U.S. reliance on imported fuels by 21.5 million barrels of crude oil per year.

- Approximately 85,000 geothermal heat pumps (GHPs) are installed annually across the United States.

- 75% of GHP thermal production is renewable energy from the Earth.

- The annual GHP capacity installed in the United States is equivalent to 897 megawatts of thermal power (MWTH).

- 75% of the installed GHP capacity, which equals 672 MWTH, is renewable energy from the Earth, displacing three average coal-fired power plants every decade.

- GHP installations displace the equivalent of 1,242,528 tons of CO2 emissions annually.

- This displacement is comparable to taking nearly 220,000 passenger cars off the nation’s highways each year.

- The average residential GHP system installation costs $20,000, depending on various factors like building size, heating and cooling load, and drilling costs.

- At the current installation rate of 85,000 units annually and an average cost of $20,000, the GHP industry is worth $1.7 billion per year in the United States.

- An estimated total of 1.5 million GHP units have been installed in the United States.

- Total U.S. GHP installations offer an energy equivalent to 15,750 MWTH.

- 75% of this total energy, or 11,810 MWTH, is renewable energy from the Earth.

- GHP installations in the United States have doubled in the past decade.

- The demand for U.S. geothermal heat pumps is expected to increase significantly as construction and the economy rebound.

- Geothermal heat pumps can cut utility bills by up to 70%.

- It takes only one kilowatt-hour of electricity for a geothermal heat pump to produce nearly 12,000 Btu of cooling or heating, compared to 2.2 kilowatt-hours for a standard heat pump on a 95-degree day.

- Despite their benefits, only 47,000 geothermal units were installed in the U.S. last year, compared to approximately one million conventional heat pumps sold during the same period.

- A geothermal system’s plastic ground loops should last 50 years or more, providing long-term benefits.

- Geothermal heat pumps can reduce greenhouse gas emissions by the equivalent of planting 750 trees or taking two cars off the road.

- Installation costs for geothermal heat pumps range between $15,000 and $20,000, including ground loops, heat pump, and controls.

- Installing geothermal heat pumps in about 70% of U.S. buildings could save as much as 593 terawatt-hours of electricity generation annually.

- This installation could avoid seven gigatons of carbon-equivalent emissions by 2050.

Emerging Trends

- Increased Adoption in Residential Sectors: Homeowners are increasingly installing geothermal heat pumps due to their long-term cost savings and environmental benefits. The technology’s ability to provide both heating and cooling efficiently is driving its popularity in new residential constructions and renovations, positioning it as a sustainable alternative to conventional HVAC systems.

- Government Incentives and Subsidies: Many governments are now offering financial incentives, such as tax rebates and subsidies, to encourage the adoption of geothermal heat pumps. These incentives aim to reduce the initial installation costs, which are typically higher than those for traditional systems. This governmental support is crucial for market expansion and wider acceptance.

- Technological Advancements: Technological improvements in geothermal heat pump systems, including enhanced heat exchanger designs and more efficient compressors, are making these units more appealing. These advancements lead to higher energy efficiency and lower operational costs, further bolstering their market growth.

- Integration with Renewable Energy Sources: There is a growing trend towards integrating geothermal heat pumps with other renewable energy sources like solar and wind power. This hybrid approach not only increases efficiency but also ensures more reliable and consistent energy supply, enhancing the overall system sustainability.

- Rising Energy Costs: As traditional energy costs continue to climb, the demand for energy-efficient solutions like geothermal heat pumps is rising. Consumers and businesses alike are looking to reduce their reliance on fossil fuels and decrease their energy expenditures, making geothermal technology a compelling choice.

- Focus on Sustainable Development: The global push towards sustainable development is fueling interest in geothermal heat pumps. These systems have a minimal ecological footprint, helping organizations and individuals meet their environmental goals. This trend is particularly prominent in regions with strict environmental regulations and sustainability mandates.

- Urbanization and Smart Cities: Urban growth and the development of smart cities are creating opportunities for the integration of geothermal heat pumps in urban planning. These systems are being considered in the design of energy-efficient buildings and neighborhoods, supporting the vision of greener, more sustainable urban environments.

Use Cases

- Residential Heating and Cooling: Geothermal heat pumps can significantly reduce home heating and cooling costs by up to 70%, utilizing the earth as a stable thermal source. This system is particularly beneficial for homes in regions with extreme weather conditions, providing efficient temperature regulation throughout the year.

- Commercial Buildings: In commercial buildings, GHPs can enhance energy efficiency and comfort. Implementing GHPs across 70% of U.S. buildings could reduce the electricity generation demand by about 593 terawatt-hours annually, representing around 15% of the nation’s current electricity usage.

- Schools and Hospitals: These facilities benefit from GHPs through consistent indoor temperature control crucial for sensitive environments. The systems operate quietly, ensuring a noise-free environment conducive to learning and healing.

- Eco-Friendly Water Heating: GHPs can be configured with desuperheaters to assist in water heating, reducing the use of traditional water heating methods and enhancing overall system efficiency. This configuration is especially advantageous in residential settings.

- Enhanced Property Value: Properties equipped with GHP systems often see an increase in market value due to their enhanced energy efficiency and lower operational costs. Homebuyers and commercial investors value the long-term savings and environmental benefits.

- Retrofitting Older Buildings: Installing GHPs in existing buildings can modernize heating and cooling systems and significantly reduce energy costs. Despite the higher initial installation costs, the investment often pays off within a few years through lower utility bills.

- Community Scale Projects: Large-scale geothermal installations can serve multiple buildings in a community, reducing the need for individual heating and cooling solutions and promoting a community-wide approach to sustainable energy use.

Key Players Analysis

Daikin has made significant strides in the geothermal heat pump sector, notably with the introduction of the Daikin Altherma 3 GEO, an innovative ground-source heat pump system that uses R-32 refrigerant for enhanced efficiency and reduced environmental impact. The company recently reported a 20% turnover growth in its EMEA markets, attributed to the rising demand for low-carbon HVAC solutions. Additionally, Daikin’s acquisition of Robert Heath Heating aims to bolster its service network in the UK, supporting its comprehensive HVAC strategy and reinforcing its market leadership.

Ingersoll Rand has also been active in the geothermal heat pump sector, focusing on enhancing their product offerings and market reach. The company has recently acquired Howden, a leading provider of mission-critical air and gas handling products, which is expected to boost their capabilities in HVAC and energy solutions. Ingersoll Rand reported a robust financial performance with a significant increase in revenue, driven by their strategic acquisitions and expanding product portfolio aimed at providing sustainable and energy-efficient solutions.

Spectrum Manufacturing has established itself in the geothermal heat pump sector by leveraging innovative technologies and strategic partnerships. The company focuses on providing high-efficiency geothermal systems that reduce energy consumption and greenhouse gas emissions. Spectrum has recently expanded its product line to include advanced heat pump models, emphasizing sustainability and cost-effectiveness. Additionally, the company has seen a steady increase in revenue, driven by the growing demand for renewable energy solutions and government incentives supporting green technologies.

Carrier has significantly advanced its geothermal heat pump offerings, particularly with the acquisition of Viessmann Climate Solutions for €12 billion. This acquisition enhances Carrier’s portfolio with sustainable and efficient climate solutions, positioning the company as a leader in intelligent climate and energy solutions. Carrier expects this acquisition to boost its revenue growth and expand its market presence in the residential and light commercial sectors. The integration of Viessmann’s innovative technologies and service network is projected to drive double-digit aftermarket growth for Carrier.

Glen Dimplex has been actively advancing its geothermal heat pump sector, marked by significant investments and strategic acquisitions. The company recently acquired the Nordic heating appliance company Adax for approximately €35 million to bolster its capabilities in heat pump development. Additionally, Glen Dimplex is investing €50 million in new manufacturing and R&D facilities in Ireland and Lithuania to focus on low-carbon heating solutions. These efforts are aimed at solidifying its position as a leader in sustainable heating technologies.

Bard HVAC is well-established in the geothermal heat pump market, focusing on innovative and energy-efficient heating solutions. The company continues to enhance its product offerings to meet the growing demand for sustainable HVAC systems. Bard HVAC’s geothermal heat pumps are recognized for their reliability and efficiency, making them a preferred choice for residential and commercial applications. Recent financial performance has shown steady growth, driven by the increasing adoption of renewable energy solutions and Bard’s commitment to quality and customer satisfaction.

Vaillant Group has significantly advanced its geothermal heat pump sector, investing up to €2 billion in heat pump production and development. In 2022, Vaillant expanded its manufacturing capacity, including a new facility in Slovakia and enhanced production lines in Germany, France, and the UK. The company reported a 75% increase in heat pump sales and €3.7 billion in revenue. The popular aroTHERM plus heat pump, using the eco-friendly refrigerant R290, exemplifies their commitment to sustainable heating solutions.

Maritime Geothermal, known for its Nordic brand, has been a key player in the geothermal heat pump market. The company focuses on providing efficient and reliable heating solutions tailored for harsh climates. Recently, Maritime Geothermal expanded its product line with advanced heat pump models designed for higher efficiency and better environmental performance. This expansion has contributed to a steady increase in revenue, reflecting the growing demand for sustainable heating solutions in both residential and commercial markets.

NIBE has significantly advanced in the geothermal heat pump sector with the launch of the NIBE S2125, an air source heat pump featuring the environmentally friendly R290 refrigerant. Despite facing challenges in early 2024, NIBE reported SEK 9.5 billion in sales and is implementing an action plan to address market conditions. The company continues to invest heavily in product development and manufacturing capacity to maintain its strong market position and meet growing demand for renewable energy solutions.

OCHSNER has been a prominent player in the geothermal heat pump market, focusing on high-efficiency and environmentally friendly technologies. The company has recently expanded its product range with new models designed for both residential and commercial applications. OCHSNER continues to see robust revenue growth driven by the increasing adoption of sustainable heating solutions and strategic investments in advanced manufacturing and R&D facilities.

ClimateMaster, Inc. has been at the forefront of the geothermal heat pump sector, focusing on innovative and energy-efficient solutions. The company recently introduced the Tranquility 30 Digital (TE) Series, designed for both residential and commercial applications, which boasts high efficiency and reduced operating costs. ClimateMaster has seen substantial growth due to the increasing demand for sustainable heating and cooling systems, driven by favorable government incentives and a growing market awareness of the benefits of geothermal energy.

Viessmann has made significant strides in the geothermal heat pump market, highlighted by its recent merger with Carrier Global Corporation, forming a global leader in climate and energy solutions. This strategic move aims to capitalize on the growing demand for heat pumps in Europe and beyond. In addition, Viessmann has been investing heavily in expanding its heat pump production capabilities, with plans to introduce next-generation heat pumps suited for both new builds and retrofits, ensuring higher efficiency and sustainability.

Stiebel Eltron has significantly expanded its geothermal heat pump operations, driven by strong demand for environmentally friendly heating solutions. In 2023, the company invested €600 million to enhance its production capacity and R&D efforts, leading to a record production of 80,000 heat pumps, a 60% increase from the previous year. This growth has contributed to the company’s turnover surpassing €1 billion. Additionally, Stiebel Eltron acquired Danfoss Värmepumpar AB (Thermia) to strengthen its market position in the Nordic region.

Robert Bosch LLC continues to be a major player in the geothermal heat pump sector through its Thermotechnology division. Bosch has focused on enhancing the efficiency and sustainability of its products, which has driven its market presence. Recent strategic moves include expanding its product lines and investing in advanced manufacturing capabilities to meet the growing demand for sustainable heating solutions. Bosch’s commitment to innovation and quality has helped it maintain a strong foothold in the competitive geothermal heat pump market.

Conclusion

The geothermal heat pump market demonstrates substantial potential for growth, driven by increasing energy efficiency demands and environmental sustainability goals. These systems, notable for their ability to provide reliable and cost-effective heating and cooling, are gaining favor among consumers and industries alike.

As governments worldwide continue to support renewable energy technologies through incentives and regulatory frameworks, the adoption of geothermal heat pumps is expected to rise significantly. The market’s expansion is further supported by ongoing technological advancements that enhance system performance and cost-effectiveness. Therefore, stakeholders in the renewable energy sector, including investors and policymakers, should consider the geothermal heat pump industry a promising area for development and investment.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)