Table of Contents

Introduction

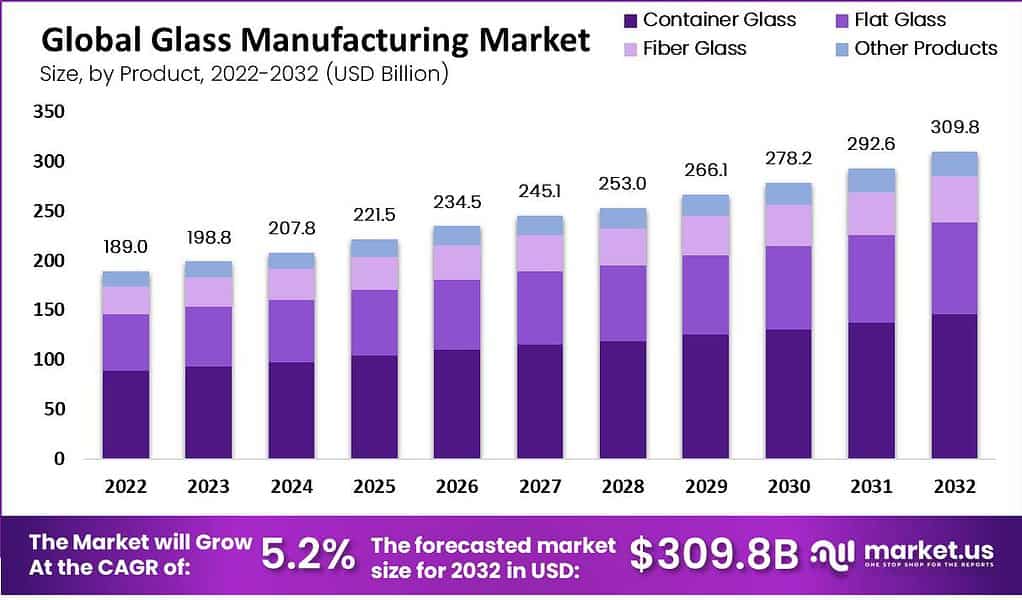

The Global Glass Manufacturing Market, poised to grow from USD 189 billion in 2023 to USD 309.8 billion by 2033, is forecasted to experience a steady compound annual growth rate (CAGR) of 5.2% during this period. This growth trajectory can be attributed to several key factors. Firstly, the increasing demand across various industries, including automotive for advanced glass technologies, and construction for energy-efficient buildings, drives this upward trend. Specifically, innovations in smart glass and the development of glass suited for electric vehicles and energy-efficient homes are significant contributors.

Challenges within the industry, however, include high energy consumption and costs associated with glass production, fluctuations in raw material prices, and environmental concerns linked to CO2 emissions during production. These factors not only impact operational costs but also affect supply chain dynamics, posing potential risks to steady market growth.

Recent developments highlight a robust adoption of smart glass technologies, catering to energy efficiency demands in residential and commercial settings. Additionally, the sector has seen advancements in manufacturing processes and materials that contribute to both aesthetic and functional enhancements in various applications. For instance, the use of glass in 3D printing and other high-tech applications has been increasing, offering new market opportunities.

AGC Inc., another significant player, has been focusing on technological advancements to meet evolving market needs. The company has invested in enhancing its production of float glass and other high-performance glass types, catering to demands from the automotive and architectural sectors. AGC’s strategic initiatives are geared towards expanding its global footprint and enhancing its product offerings to stay competitive.

Key Takeaways

- Glass Manufacturing Market size is expected to be worth around USD 309.8 billion by 2033, from USD 189 billion in 2023, growing at a CAGR of 5.2%

- flat glass held a dominant market position, capturing more than a 46.3% share.

- Float Process held a dominant market position, capturing more than a 54.5% share.

- construction held a dominant market position, capturing more than a 44.3% share.

Glass Manufacturing Statistics

- In 2020, an astounding 690 billion glass bottles and containers were produced globally. Fast forward to 2028, and this figure is expected to reach a staggering 916 billion units.

- The process of producing float glass relies on several raw materials. Silica sand (SiO2) claims the lion’s share at 71 percent, followed by soda (Na2O) at around 14 percent.

- Different market segments command distinct pricing for fabricated flat glass. Motor vehicle applications topped the list in 2022, with prices around £34 per square metre.

- In 2022, the global demand for fabricated flat glass reached an impressive £100 billion.

- This marked a significant leap from 2003, when the demand stood at an estimated £31.5 billion worldwide.

- In 2022, global carbon dioxide emissions from glass production amounted to a substantial 95 million metric tonnes. Notably, Europe accounted for over 20 percent of this total.

- China took the lead as the world’s largest glass exporter in 2022, boasting an impressive export value of nearly £27 billion.

- The start up costs for a float glass manufacturing operation can be in the region of £100 million.

- Glass furnaces operate at temperatures in excess of 1500°C.

2000 tons of molten glass is continuously held within a furnace. - A float line is in excess of 650 metres long. Over 700 tons of glass can be produced in a day. The largest sheet size is 3210mm x 6000mm.

- Laminating lines can produce laminated glass up to 30mm thick.

- Soft Coat glass is manufactured on a Magnetron glass coater that has 25 coating chambers.

- A glass manufacturer will typically hold 25,000 tons of glass waiting to be despatched.

- A Magnetron glass coater costs in the region of £35 million and a laminating line in the region of £6 million.

- Glass is 100% recyclable and can be recycled time and time again. In fact, glass is

- Europe’s most recycled food and beverage packaging material – the latest figures put the collection rate at 80%.

Emerging Trends

- Augmented Reality (AR) Glass: The integration of AR technology into everyday eyewear is becoming more prevalent. This technology allows for features like navigation assistance and real-time translation, enhancing how users interact with their environments.

- Textured and 3D-Printed Glass: Advancements in 3D printing are expanding into glass manufacturing, allowing for intricate designs and textures previously not possible. This trend is gaining traction in both functional and decorative applications.

- Sustainable Glass Solutions: The industry is increasingly focusing on eco-friendly production methods. This includes the use of recycled materials, development of low-energy production techniques, and innovative products like biophilic designs that incorporate natural elements to enhance thermal regulation and reduce carbon footprints.

- Smart Glass Technology: Smart glass, or switchable glass, is making significant advances. This technology enables glass to alter its properties, such as opacity, to adjust light or provide privacy. It’s becoming more accessible, finding applications in residential, commercial, and automotive sectors.

- Kinetic and Interactive Glass: Emerging as a captivating trend, kinetic and interactive glass can change patterns or display dynamic visuals in response to user interactions. Such features are being explored for retail and hospitality, offering unique consumer experiences.

- Energy-Efficient Practices: The focus on energy efficiency continues to grow, with developments in insulation techniques like double and triple glazing and the use of materials that improve insulation properties. Additionally, the integration of renewable energy sources, such as solar panels in glass panels, is being pursued to enhance sustainability.

Use Cases

- Packaging and Containers: Glass is extensively used in packaging for the food and beverage industry due to its non-reactive nature, which ensures that contents are not contaminated by the material of the container. This sector remains one of the largest for glass usage, with the demand for glass bottles and containers still growing, particularly as concerns about plastic pollution drive a shift back to glass.

- Automotive Industry: Glass is critical in automotive manufacturing, used for windshields, windows, and increasingly for sophisticated applications such as display panels that integrate digital interfaces.

- Construction and Architecture: The use of glass in construction is widespread, from residential windows to large architectural projects with glass facades. Glass used in these applications often has special properties such as thermal insulation, UV protection, and energy efficiency, thanks to advanced coatings and manufacturing techniques.

- Solar Energy Systems: A growing and innovative use case for glass is in photovoltaic (PV) modules and other solar energy applications. Special types of glass are used to enhance the efficiency and durability of solar panels.

- High-Tech Applications: With the advancement in technology, glass is now also used in more high-tech applications, such as fiber optics for telecommunications and as a substrate in electronic displays. These uses leverage the clarity, durability, and insulating properties of glass.

- Smart and Energy Efficient Glass: Technological innovations have led to the development of ‘smart glass’, which can change its optical properties based on external stimuli, thereby contributing to energy conservation in smart buildings and vehicles. This type of glass can be controlled to adjust its transparency, affecting heat and light transmission.

- Sustainability Initiatives: The glass industry is increasingly focusing on sustainability through the use of recycled materials and energy-efficient production processes. Recycled glass, also known as cullet, reduces the need for raw materials and energy, lowering the carbon footprint of glass production. There’s a growing emphasis on increasing the use of cullet in new glass production to enhance environmental sustainability.

Major Challenges

- High Energy Costs and Environmental Impact: Glass production is energy-intensive, contributing to high operating costs and substantial greenhouse gas emissions. Efforts to reduce these impacts involve costly technology upgrades and operational changes to meet stricter environmental regulations.

- Supply Chain Disruptions: The industry is experiencing supply chain vulnerabilities, particularly in the availability of raw materials and the logistical challenges of transporting them. These disruptions are exacerbated by global events such as geopolitical tensions and economic fluctuations, which can lead to delays and increased costs.

- Labor Shortages: A significant challenge within the industry is the shortage of skilled labor. Many companies are investing in training programs to build their workforce, but the lack of available talent remains a critical issue, affecting production and expansion plans.

- Technological Advancements and Adoption: While technology can offer solutions to many challenges, the cost of adopting new technologies, such as advanced glass manufacturing equipment and environmentally friendly practices, can be prohibitive. Keeping up with these advancements requires significant investment in both equipment and expertise.

- Market Competition and Price Fluctuations: The glass manufacturing market is highly competitive, with significant pressure on prices and margins. Fluctuations in the prices of raw materials, such as silica sand and soda ash, add to the instability, affecting profitability and strategic planning

Market Growth Opportunities

- Sustainable and Energy-Efficient Solutions: The growing emphasis on sustainability and energy efficiency in construction and automotive sectors is boosting demand for advanced glass products. Energy-efficient, low-emissivity (Low-E) glass and solar panels are seeing increased adoption due to green building standards, which favor high-performance glass to reduce energy consumption in buildings.

- Technological Innovations: Innovations in glass manufacturing, such as smart glass technologies, are creating new avenues for growth. Smart glass, capable of changing its light transmission properties based on external conditions, is gaining popularity in residential and commercial buildings for its energy efficiency and user comfort. This technology is also expanding into the automotive sector, where it contributes to energy efficiency and enhances vehicle functionality.

- Urbanization and Industrialization: Rapid urbanization and industrialization, particularly in emerging economies, are driving demand for glass across various applications, including construction, automotive, and electronics. The Asia Pacific region, for example, is witnessing significant market growth due to these factors, with substantial investments in smart cities and infrastructure developments that require advanced glass solutions.

- Recycling and Eco-Friendly Practices: There is a rising consumer preference for sustainable and eco-friendly packaging solutions, which has led to an increased use of glass in packaging, especially in the food and beverage industry. Glass is favored for its inert properties that ensure product quality and extend shelf life, further supported by its 100% recyclability.

- Expansion of Fiberglass Applications: The use of fiberglass in insulation for buildings and vehicles, owing to its thermal and acoustic insulating properties, continues to expand. Additionally, fiberglass is being utilized in telecommunications for fiber optic cables, essential for high-speed data transmission, which is crucial for the expanding global communications networks.

Key Players Analysis

3B-the fiberglass company has significantly contributed to the glass manufacturing sector by producing high-performance fiberglass used in various industries, including automotive and wind energy. The company focuses on sustainability, utilizing green electricity and innovative materials to enhance the environmental friendliness of its products. This approach not only helps reduce the carbon footprint of their production processes but also supports the sustainability goals of their clients like BASF. In 2023, 3B continued to leverage its expertise in fiberglass production to provide solutions that are both effective and environmentally responsible.

AGC Inc. is a prominent player in the glass manufacturing sector, known for its comprehensive range of glass products and materials for construction, automotive, and electronics applications. The company is committed to innovation and sustainability, continually developing new glass compositions and solutions to meet the evolving needs of the market. AGC’s operations are global, with a significant presence in Asia, where it taps into robust industrial growth to drive its development strategies.

AGI glaspac, a significant entity in the glass manufacturing sector, has made substantial investments to enhance its production capabilities and sustainability practices. In 2023, the company launched a new facility in Bhongir, Telangana, with a substantial investment of Rs 220 crore. This plant, specializing in high-quality specialty glass, has a daily capacity of processing 154 metric tonnes, producing around 70 lakh bottles and containers. These products cater to a diverse range of industries including pharmaceuticals, perfumery, and high-end liquors. AGI glaspac’s strategic advancements are expected to bolster their position in the market, emphasizing sustainability and innovation in its operations.

Amcor, not traditionally known for glass manufacturing, is a global leader in developing and producing responsible packaging solutions, including plastic, fiber, metal, and glass. Amcor focuses on sustainable packaging innovations and has operations worldwide to meet the packaging needs of food, beverage, pharmaceutical, medical, home- and personal-care, and other products. While specific year-wise data for 2023 or 2024 was not detailed in your current inquiry’s scope, Amcor continues to lead in sustainable packaging solutions across various materials, emphasizing innovation and environmental responsibility in its global operations.

Central Glass Co., Ltd., a prominent player in the glass manufacturing sector, continues to expand its influence through strategic collaborations and innovations. In 2023, the company entered a toll manufacturing agreement to enhance the production of electrolytic solutions in North America, aiming to bolster its supply chain and meet growing market demands efficiently. Central Glass is committed to sustainable practices and innovation, striving to align with global environmental standards while enhancing its product offerings and manufacturing capabilities.

Fuyao Glass Industry Group Co. Ltd. is recognized for its extensive involvement in the global glass manufacturing market, particularly in automotive and industrial applications. The company focuses on producing high-quality automotive glass and has expanded its operations globally to serve major automotive markets efficiently. Fuyao Glass is known for its commitment to technological advancement and quality, ensuring its products meet the rigorous safety and performance standards required in the automotive industry.

Guardian Industries has been actively enhancing its global footprint and product offerings in the glass manufacturing sector throughout 2023. This year, they focused on sustainable production by advancing the use of hydrogen to reduce carbon emissions in their glass production processes. They also expanded their product line through the acquisition of Vortex Glass, boosting their capability in hurricane-resistant glass products. Additionally, the restart of their Bascharage plant with a new energy-efficient furnace underscores their commitment to innovation and environmental responsibility. These strategic moves demonstrate Guardian’s focus on leading in high-performance and sustainable glass solutions globally.

Heinz Glass, a renowned provider in the high-quality glass packaging market for cosmetics and perfumery, emphasizes craftsmanship and aesthetic design in its offerings. Heinz Glass is recognized for its dedication to bespoke customer service and its ability to deliver distinctive, tailored solutions that enhance brand value through premium packaging. While specific activities in 2023 or 2024 are not detailed, the company consistently strives to innovate within its sector, focusing on both functionality and design excellence to meet the sophisticated needs of its clients.

Koa Glass, a distinguished player in the glass manufacturing sector, celebrated its 80th anniversary in 2023, marking a significant milestone. The company is renowned for its expertise in producing glass containers for various industries including cosmetics and foods. In 2023, Koa Glass and the Pochet Group from France, both family-owned enterprises with a long-standing history, entered a strategic partnership aimed at enhancing their development and production capabilities to cater to the beauty market. This collaboration is set to leverage each company’s strengths in glassmaking to innovate and meet evolving market demands.

Nihon Yamamura Glass Co. Ltd., established in 1923, continues to be a key contributor to the glass manufacturing market with a focus on bottles, jars, and other glass products. The company caters to diverse sectors including food and beverage, pharmaceuticals, and household care. Nihon Yamamura is well-regarded for its commitment to quality and innovation, ensuring that it remains competitive in the global market by adapting to the latest manufacturing technologies and sustainability practices.

Nippon Sheet Glass Co., Ltd. (NSG), a leader in the glass manufacturing sector, marked 2023 with significant achievements and strategic expansions. NSG has been advancing its technology and production capabilities, notably by establishing a new solar glass production line in the United States set to start operations in early 2025. This move is part of their broader strategy to meet the growing demand for solar panels, particularly from major players like First Solar. NSG’s focus on sustainable practices and expanding its value-added business segment underscores its commitment to innovation and environmental responsibility as it continues to serve global markets across architectural, automotive, and creative technology sectors.

NSG Co., Ltd, which operates under the same corporate structure as Nippon Sheet Glass, has been recognized for its commitment to sustainability and innovation. In 2023, the company celebrated the 125th anniversary of its Rossford plant, highlighting its long-standing contribution to the industry. NSG Co., Ltd is integral to the NSG Group’s global operations, focusing on producing high-quality glass and glazing systems that cater to a diverse range of industries, including solar energy production and architectural applications.

O-I Glass Inc. experienced a challenging year in 2023, with a notable financial downturn resulting in a net loss for the fourth quarter, as reported earnings before taxes plummeted from gains in the previous year to a significant loss. This decline was primarily attributed to non-recurring charges, including a substantial goodwill impairment in their North American operations. Despite these setbacks, the company saw some positive developments from their strategic initiatives aimed at improving margin expansion, although these were offset by lower sales volumes and higher operational costs due to increased production curtailment activities aimed at aligning inventory with the softened market demand.

Owens Illinois Inc., operating under the name O-I Glass, has also been actively investing in innovative technologies to enhance its sustainability profile and operational efficiency. One of the significant strides in 2023 was the groundbreaking of a new plant in Bowling Green, KY, specifically designed to utilize their revolutionary MAGMA technology. This technology is expected to revolutionize glass manufacturing by improving scalability, reducing capital intensity, and enhancing supply chain efficiency. The company aims for this new facility to be operational by mid-2024, marking a significant step towards modernizing their manufacturing capabilities with a focus on sustainability and higher efficiency.

Conclusion

In conclusion, the glass manufacturing industry is poised for significant growth, driven by innovations in technology and an increasing focus on sustainability. The push towards energy-efficient building materials and eco-friendly packaging solutions highlights the sector’s adaptation to environmental concerns. Urbanization and industrialization in emerging markets are also key factors fueling the demand for glass products, ranging from construction materials to advanced automotive applications.

Furthermore, the industry’s pivot towards the integration of smart glass technologies showcases its commitment to enhancing product functionality and energy efficiency. As manufacturers continue to navigate challenges such as high energy costs and raw material price volatility, the strategic adoption of new technologies and processes will be crucial. The glass manufacturing market, therefore, represents a dynamic landscape with substantial opportunities for growth, innovation, and a significant shift towards sustainable practices, all of which are expected to shape its future trajectory.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)