Table of Contents

Introduction

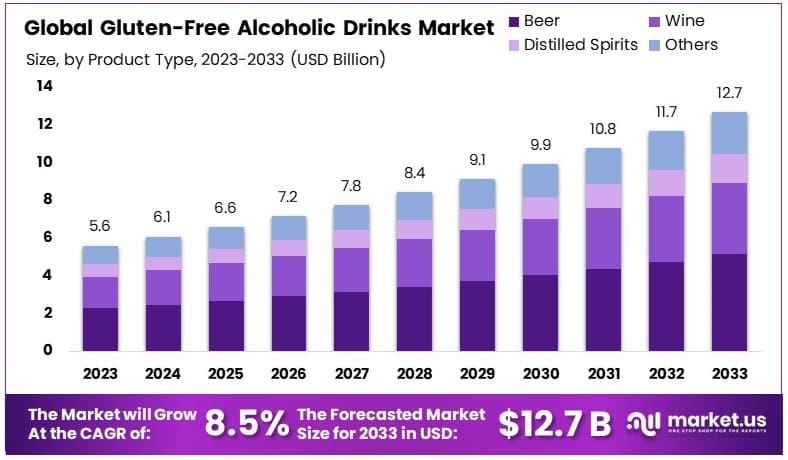

The global gluten-free alcoholic drinks market is poised for substantial growth, projected to increase from USD 5.6 billion in 2023 to approximately USD 12.7 billion by 2033, with a compound annual growth rate (CAGR) of 8.5% during the forecast period from 2024 to 2033. This growth is primarily fueled by the increasing consumer awareness of dietary restrictions and a surge in demand for gluten-free products, which includes alcoholic beverages. Furthermore, the rising prevalence of celiac disease and gluten sensitivity among the global population has led to a higher demand for these specialized drinks.

Recent market developments have included innovations in product variety and flavor, as manufacturers strive to meet consumer preferences while maintaining compliance with gluten-free standards. However, the market faces significant challenges, such as high production costs and stringent regulatory requirements for labeling and certification of gluten-free products. These factors necessitate ongoing attention and adaptation by market players. Additionally, the effective distribution of gluten-free alcoholic drinks remains a critical challenge due to the limited availability in some regions, affecting overall market penetration and growth.

Recent developments in the gluten-free alcoholic drinks sector, focusing on notable brands such as Captain Morgan and Diageo plc, illustrate significant innovation and market expansion efforts.

William Grant & Sons Ltd has been actively expanding and enhancing its portfolio, particularly in the gluten-free and low-alcohol sectors. They’ve introduced new products like the Hendrick’s Gin Neptunia, and their Atopia brand which offers non-alcoholic spirits like Rhubarb & Ginger and Hedgerow Berry. These developments underscore their commitment to catering to health-conscious consumers and those interested in moderate alcohol consumption. Furthermore, the company continues to invest in its operations, having implemented a new enterprise resource planning system to streamline its processes.

Captain Morgan, under the umbrella of Diageo plc, has launched a vibrant new marketing campaign titled ‘Spice On,’ which introduces a refreshed packaging design to emphasize the adventurous and flavorful spirit of Captain Morgan. This initiative aims to enhance brand visibility and appeal in a competitive market. Additionally, Captain Morgan has broadened its product line with the introduction of Captain Morgan Spiced Gold 0.0%, an alcohol-free spirit that mimics the brand’s signature rum and spice flavor.

Diageo plc, as a global leader in the beverage alcohol sector, continues to innovate by expanding into the no-and-low-alcohol categories. This strategic direction not only diversifies Diageo’s product offerings but also caters to the growing consumer trend towards mindful drinking and wellness. The launch of new products and brands, along with engaging marketing campaigns, demonstrates Diageo’s commitment to leading the industry in both traditional and emerging market segments.

These developments indicate a strong focus on innovation, consumer trends, and market expansion by major players in the gluten-free alcoholic drinks market. The introduction of new products that maintain brand ethos while adapting to consumer preferences for lower alcohol options is pivotal in this dynamically changing industry landscape.

Key Takeaways

- Market Value: The Gluten-Free Alcoholic Drinks Market was valued at USD 5.6 billion in 2023 and is expected to reach USD 12.7 billion by 2033, with a CAGR of 8.5%.

- Product Type Analysis: Beer dominated with 40.5%; it is popular due to increasing consumer preference for gluten-free options.

- Packaging Type Analysis: Bottles led with 48.5%; they are preferred for their traditional appeal and convenience.

- Distribution Channel Analysis: On Trade dominated with 65.8%; it is significant due to high consumption in bars and restaurants.

- Dominant Region: Europe dominated with 41.7%; driven by a large celiac population and growing health awareness.

- High Growth Region: North America shows promising growth; rising health consciousness and demand for gluten-free products fuel the market.

- Analyst Viewpoint: The market is rapidly growing with high competition. Future trends indicate a rise in premium and craft gluten-free alcoholic beverages.

Gluten-Free Alcoholic Drinks Statistics

- According to non-profit Beyond Celiac, 1 in 133 people are affected by celiac disease, with 83% of sufferers being undiagnosed or misdiagnosed.

- The prevalence of celiac disease cases increased from 1% to almost 2% according to various studies conducted in recent years.

- Up to 83% of Americans with celiac disease are either undiagnosed or misdiagnosed with other conditions.

- Approximately 1% of the population has celiac disease, approximately 30 million in the US and 7 million in the UK.

- People with celiac disease wait an average of six to 10 years for a correct diagnosis.

- Up to 90% of people globally do not realize they have celiac disease.

- The number of people with celiac disease has been growing at an average rate of 7.5% annually for the past several decades.

- Alcoholic beverages in the beginners’ guide to gluten-free drinks range from 0% to 40% ABV (alcohol by volume).

- Over 80% of gluten-free people have difficulty finding everything they want to eat.

- Cutting out whole grains can increase all-cause mortality risk by up to 17%.

- Only 31% of women on a gluten-free diet get the recommended amount of calcium.

- Only 44% of women on a gluten-free diet get adequate iron.

- Gluten is a protein found in wheat, barley, and rye.

- Common drinks that may contain gluten include beer (ales, lagers), malt beverages and vinegars, malted milk or milkshakes, bottled or canned wine coolers (spritzers and sangrias), pre-made coffee drinks, and certain liqueurs not distilled from gluten-containing grains.

- The legal standard for a gluten-free product is a gluten content below 20 ppm (parts per million).

- Cross-contamination during manufacturing is a significant risk for gluten-free products.

- Gluten-free products are, on average, $1.10 more expensive per unit.

- Gluten-free cereals are 205% more expensive.

- Gluten-free baked products are 267% more expensive.

- Only 5% of gluten-free breads are fortified with mandatory calcium, iron, niacin, and thiamin.

- Around one-third of US adults are believed to be looking to reduce the amount of gluten in their diets regardless of any medical diagnosis.

- 23% of Americans regularly shop for gluten-free products.

- Despite the low incidence of celiac disease, 23% of consumers buy gluten-free products.

- The words “gluten-free” appear on 26% of menus, up 182%.

- North America had nearly 37% of the highest sales of gluten-free products in 2021, closely followed by Europe.

- Gluten-free products are most popular in Europe, North America, and Canada.

Emerging Trends

- Increased Product Variety: More gluten-free options are becoming available beyond beer, including ciders, spirits, and seltzers. Distillers and brewers are expanding their offerings to include a wider range of gluten-free alcoholic beverages to cater to diverse tastes and preferences.

- Craft and Artisanal Brands: Small craft producers are gaining popularity in the gluten-free market. These brands often focus on creating high-quality, distinctive gluten-free alcoholic drinks, using traditional methods and unique ingredients to enhance flavor and appeal.

- Label Transparency: Consumers demand clear labeling about the gluten content in alcoholic drinks. Brands are responding by providing more detailed ingredient lists and certification labels like “Certified Gluten-Free,” making it easier for consumers to make informed choices.

- Health-Conscious Marketing: Marketing strategies are increasingly highlighting the health aspects of gluten-free alcoholic drinks, such as lower calorie counts and no artificial additives. This appeals to health-conscious consumers who are mindful of their dietary intake but still wish to enjoy alcoholic beverages.

- Flavor Innovation: There is a significant push towards flavor innovation in the gluten-free alcoholic drink sector. Exotic fruits, herbs, and spices are being used to create unique and appealing flavors that differentiate products in a crowded market.

- Sustainable Production: Sustainability practices are becoming more prevalent among producers of gluten-free alcoholic drinks. This includes using locally sourced ingredients, sustainable farming practices, and eco-friendly packaging, which not only appeals to environmentally conscious consumers but also helps brands build a positive image.

- Expansion into New Markets: Gluten-free alcoholic drinks are expanding beyond traditional markets to include regions where gluten intolerance and celiac awareness are growing. This global expansion is accompanied by tailored marketing strategies to suit local tastes and cultural preferences.

Use Cases

- Social Inclusivity: Gluten-free alcoholic drinks ensure that individuals with gluten intolerance or celiac disease can partake in social gatherings without concern. These beverages allow everyone to enjoy a drink together, promoting inclusivity at events and celebrations.

- Dietary Compliance: For those strictly following a gluten-free diet, these alcoholic drinks offer a way to comply with dietary restrictions without compromising on social or culinary experiences. This compliance is crucial for maintaining health while still enjoying a diverse range of beverages.

- Health-Conscious Choices: Many gluten-free alcoholic drinks are marketed as healthier options, often with lower calories and less sugar. This appeals to health-conscious consumers who are looking to enjoy alcoholic beverages without straying from their health goals.

- Gastrointestinal Comfort: Gluten can cause discomfort or adverse reactions in sensitive individuals. Gluten-free alcoholic beverages provide a safer alternative, ensuring that consumers can enjoy their drinks without experiencing gastrointestinal distress.

- Exploration of New Flavors: The rise of gluten-free alcoholic drinks has introduced new flavors and brewing or distilling techniques. Consumers interested in culinary diversity can explore unique flavors in beers, ciders, and spirits that are distinct from traditional gluten-containing options.

- Gift Giving: Gluten-free alcoholic beverages are thoughtful gifts for friends or family who are gluten intolerant or prefer gluten-free products. These gifts show consideration for the recipient’s health and preferences.

- Travel Convenience: For gluten-sensitive travelers, finding suitable alcoholic options can be challenging. Gluten-free alcoholic drinks provide a reliable choice for those traveling, ensuring that they can enjoy local beverages without health concerns.

Key Players Analysis

William Grant & Sons Ltd has actively expanded its presence in the gluten-free alcoholic drinks sector through various initiatives and acquisitions. The company, known for its Scotch whisky brands like Glenfiddich and The Balvenie, reported a significant revenue growth of 21.7% in 2022, reaching £1.72 billion. Recently, William Grant & Sons acquired C&C’s spirits and liqueurs business for €300 million, which includes gluten-free brands such as Tullamore Dew Irish Whiskey. This acquisition enhances their portfolio and solidifies their market position in the gluten-free segment.

Cabo Wabo, a tequila brand established by Sammy Hagar, offers gluten-free options in the alcoholic drinks sector. Known for its premium tequila, Cabo Wabo has maintained a strong market presence by ensuring its products are safe for those with gluten sensitivities. The brand’s recent focus includes maintaining high production standards and expanding distribution channels to meet growing consumer demand for gluten-free spirits. Cabo Wabo’s commitment to quality has helped it sustain its reputation as a preferred choice among gluten-free alcoholic beverages.

Captain Morgan, a brand under Diageo, has launched Captain Morgan Spiced Gold 0.0%, an alcohol-free variant of its popular spiced rum, addressing the growing demand for gluten-free and alcohol-free options. This launch marks Captain Morgan’s entry into Diageo’s expanding alcohol-free portfolio, which includes other brands like Guinness 0.0% and Tanqueray 0.0%. The new product maintains the intricate flavors of caramel, molasses, vanilla, and spices, offering a gluten-free alternative that caters to consumers looking to moderate their alcohol consumption.

Diageo plc has been actively catering to the gluten-free alcoholic drinks market with the launch of various gluten-free products. Recently, they introduced Captain Morgan Spiced Gold 0.0%, an alcohol-free and gluten-free version of the iconic rum. This aligns with Diageo’s strategy to innovate in the alcohol-free segment, expanding its portfolio which includes Guinness 0.0% and Tanqueray 0.0%. Diageo reported strong financial performance with a focus on developing products that meet diverse consumer needs.

Glutenberg, a Canadian gluten-free brewery based in Montreal, has made significant strides in the gluten-free alcoholic drinks sector. Known for its high-quality, gluten-free beers like the American Pale Ale and Red Ale, Glutenberg has expanded its U.S. distribution to include states like Tennessee and North Dakota. The brewery’s innovative use of gluten-free grains such as millet, quinoa, and buckwheat has earned it multiple awards, including gold at the 2012 World Beer Cup. This expansion reflects the growing demand for gluten-free options in the craft beer market.

Estrella Damm Daura, a renowned gluten-free beer brand from Spain, continues to lead in the gluten-free sector. Known for maintaining the traditional taste of regular beer while being safe for those with celiac disease, Estrella Damm Daura uses a unique brewing process to remove gluten. This dedication to quality has helped Daura maintain a strong market presence. Recently, the brand has focused on expanding its distribution and increasing its market share globally, responding to the rising demand for gluten-free beers among consumers.

Ghostfish Brewing Company, based in Seattle, Washington, is a dedicated gluten-free brewery renowned for its high-quality beers like Grapefruit IPA and Watchstander Stout. Established in 2015, Ghostfish has rapidly gained acclaim, winning multiple awards including medals at the Great American Beer Festival. Recently, the company expanded its operations to the East Coast, setting up a new production facility in Westfield, New York. This expansion reflects Ghostfish’s commitment to catering to the growing demand for gluten-free craft beers, ensuring a broad distribution across the United States.

Anheuser-Busch Companies has been increasingly active in the gluten-free alcoholic drinks market. Notably, their Redbridge beer is a popular gluten-free option made from sorghum, catering to consumers with gluten sensitivities. The company continues to innovate and expand its portfolio to include more gluten-free options, ensuring they meet the diverse needs of their customers. This strategic focus aligns with the rising consumer demand for gluten-free products, helping Anheuser-Busch maintain its competitive edge in the industry.

Conclusion

The gluten-free alcoholic drinks market is poised for significant expansion, reflecting a broader consumer shift towards health-conscious dietary choices. This market segment benefits from the increasing prevalence of gluten intolerance and celiac disease among the population, as well as a growing consumer preference for products perceived as healthier.

The development of new products and the improvement of existing ones in terms of taste and variety will be critical for tapping into this growing demand. Market participants should focus on strategic promotional activities to enhance visibility and attract a broader consumer base.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)