Table of Contents

Introduction

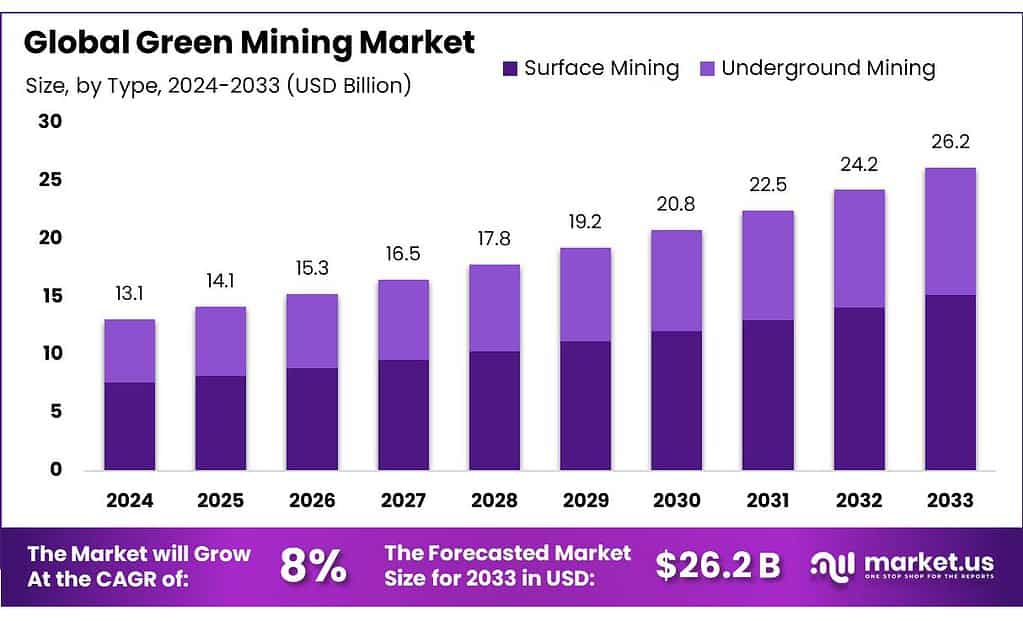

The global green mining market is projected to experience robust growth, expanding from USD 13.1 billion in 2023 to an estimated USD 26.2 billion by 2033, achieving a compound annual growth rate (CAGR) of 8.0% over the forecast period. This growth is driven by the increasing awareness of environmental impacts associated with traditional mining practices and the subsequent shift towards more sustainable methods. Green mining involves technologies and practices that aim to reduce the environmental footprint of mining operations, including water and energy conservation, emissions reduction, and advanced waste management techniques.

However, the transition to green mining presents challenges, such as high operational costs and the need for significant investments in new technologies. Despite these hurdles, recent advancements in eco-friendly mining technologies and growing regulatory support are encouraging more mining companies to adopt green practices. These developments are crucial for the industry as it seeks to balance profitability with environmental stewardship.

BHP Billiton, a leader in the global mining industry, has taken significant steps towards green mining with its recent initiatives to reduce carbon emissions and enhance energy efficiency across its operations. The company has committed to substantial investments in renewable energy projects and carbon capture technologies, aiming to become one of the most environmentally sustainable mining companies in the world. These efforts are part of BHP’s broader strategy to minimize its environmental impact while maintaining profitability, setting a benchmark in the industry for responsible mining practices.

CODELCO, the largest copper producer in the world, has recently intensified its focus on green mining practices by launching new initiatives aimed at drastically reducing greenhouse gas emissions and water usage in its operations. The company has invested in modernizing its equipment and optimizing its processes to enhance energy efficiency and sustainability. CODELCO’s commitment to environmental stewardship is also demonstrated by its projects aimed at rehabilitating mining areas and promoting biodiversity, reinforcing its position as a leader in sustainable mining.

Key Takeaways

- Market Expansion: The global PLA market is expected to grow from USD 866 million in 2023 to USD 4,568 million by 2033, with an 18.10% CAGR.

- Standard PLA Dominance: Standard PLA held a 54.3% market share in 2023, driven by widespread use in packaging and disposable products.

- Films & Sheets Lead: Films & Sheets applications led the market in 2023, capturing a 35.6% share, especially in food and agricultural packaging.

- Thermoforming grade Polylactic Acid (PLA) held a dominant market position, capturing more than a 27.8% share.

- Corn Starch held a dominant market position in the Polylactic Acid (PLA) sector, capturing more than a 56.8% share.

- Packaging held a dominant market position in the Polylactic Acid (PLA) market, capturing more than a 44.5% share.

- North America Leadership: North America led the global PLA market in 2023, holding a 36.5% share, valued at USD 315.9 million.

Statistics

- The mining industry contributes significantly to greenhouse gas emissions, accounting for 4-7 percent of the total emissions.

- An investment plan of Rs 2,500 billion has been chalked out by the PSUs for clean coal technologies by 2030.

- It contributes around 95 percent of Coal India Limited’s (CIL) production and around 85 percent of Singareni Collieries Company Limited’s, which are among the key players in the sector.

- Furthermore, the use of biofuel is incentivised by the Goods and Services Tax Council’s recent decision to reduce tax rates on ethyl alcohol from 18 percent to 5 percent.

- It also aims to achieve a total renewable energy capacity of 6,031 MW by 2030.

- Furthermore, the use of biofuel is incentivised by the Goods and Services Tax Council’s recent decision to reduce tax rates on ethyl alcohol from 18 percent to 5 percent.

- Two powered support long wall (PSLW) machines operating in ECL and BCCL produced 1.58 MTs in FY’22 against 1.13 MTs in FY’21 posting 40% growth.

- CIL is planning to deploy 10 High Wall machines in its OC mines during the ongoing fiscal with a projected production potential of 5 MTs/Year

- The waste heat utilization saves 7000 tons of standard coal for the mine every year, which has the characteristics of low operation cost, high efficiency, energy conservation, and green environmental protection.

- The five boreholes were constructed in the east of 12 mining area

- Thus, in China, it accounts for 70% of primary energy consumption and its share in 2030 is predicted at 50%.

- The 12 mining areas have 6 working faces, and the #21 coal is the current mining coal seam ranges from 1.38 to 16.1 m in thickness with an average of 5.86 m.

- These two mines, each producing over 100 million tons of coal annually and accounting for around 10% of India’s total coal production, utilize some of the world’s largest and most advanced mining machines.

- State Governments are entitled to receive 14% of Royalty on the sale price of coal.

- It is anticipated through comprehensive studies that coal demand in 2030 will likely reach 1462 MT and 1755 MT by 2047.

Emerging Trends

- Automation and Robotics: Automation is becoming increasingly prevalent in the mining industry as a means to reduce human involvement in hazardous areas and decrease the environmental footprint. Robotics, particularly drones and automated machinery, are being used for tasks like drilling, blasting, and transporting materials, which significantly minimizes energy consumption and improves safety.

- Water Reclamation Technologies: Water management is a critical concern in mining operations. Emerging trends include the implementation of advanced water reclamation technologies that allow for the recycling and reuse of water within mining sites. These systems not only conserve water but also prevent the contamination of local water sources, aligning with environmental regulations and sustainability goals.

- Renewable Energy Integration: As the global push towards renewable energy gains momentum, mining companies are increasingly investing in solar, wind, and bioenergy solutions to power their operations. This shift not only reduces dependency on fossil fuels but also cuts operational costs and emissions, supporting broader environmental sustainability initiatives.

- Tailings Reduction Techniques: Tailings, the materials left over after the extraction of valuable minerals, are a major environmental concern due to their toxic nature. New technologies and processes are being developed to reduce tailings production or repurpose them into useful products such as building materials. This not only mitigates the environmental impact but also adds value to waste materials.

- Advanced Geospatial and AI Technologies: The use of geospatial data and artificial intelligence (AI) is transforming green mining by enabling more precise exploration and resource estimation with minimal environmental disturbance. AI algorithms help predict mineral locations and process optimization, reducing waste and improving yield efficiency.

Use Cases

- Energy-Efficient Equipment: Green mining often involves the adoption of energy-efficient mining equipment and machinery that reduces the overall energy consumption of mining operations. For example, electric and hybrid vehicles used in mining can reduce diesel consumption by up to 30%, significantly cutting down on greenhouse gas emissions and operating costs.

- Solar Power for Mining Operations: Many mining companies are integrating solar power into their operations to reduce reliance on fossil fuels. For instance, solar panels are used to provide electricity for remote drilling sites, reducing diesel generator use. In Chile, some of the world’s largest copper mines have constructed massive solar farms to power operations, aiming to be fully powered by renewable energy shortly.

- Water Reuse and Recycling Systems: Implementing advanced water management systems that facilitate the recycling and reuse of water within mining processes is a crucial aspect of green mining. These systems help minimize water withdrawal from natural sources, which is particularly important in water-scarce areas. Companies can reduce freshwater usage by up to 50% through such recycling practices.

- Digital Technologies for Resource Efficiency: Utilizing digital technologies, including IoT (Internet of Things) sensors and AI (Artificial Intelligence), enables precise monitoring and control of mining operations. These technologies help optimize resource use and reduce waste by ensuring that only the necessary amount of material is extracted and processed.

- Mine Site Reclamation: After mining operations are complete, restoring the land to its natural state or repurposing it for other uses is a key aspect of green mining. This includes reforestation, creating wildlife habitats, or converting exhausted mine pits into recreational lakes or solar farms. Successful reclamation not only mitigates the environmental impact but also benefits local communities.

Major Challenges

- High Initial Costs: Implementing green mining technologies often requires significant upfront investment. For example, transitioning to renewable energy sources like solar or wind can involve costs in the range of $1 million to $5 million per megawatt of installed capacity. These high initial costs can be a barrier for smaller mining companies.

- Technological Limitations: Despite advancements, some green mining technologies are still evolving and may not yet be fully efficient or widely available. For instance, advanced water treatment and recycling systems can be expensive and complex to integrate into existing operations, potentially limiting their adoption.

- Regulatory and Compliance Issues: Navigating environmental regulations and compliance requirements can be challenging and vary significantly across regions. Companies may face regulatory hurdles that can slow down the implementation of green technologies. Compliance with stringent environmental laws can also increase operational costs.

- Supply Chain Constraints: Securing materials for green mining technologies, such as rare earth elements for batteries and renewable energy systems, can be challenging. Supply chain disruptions and price volatility for these materials can impact the feasibility and cost-effectiveness of green mining initiatives.

- Training and Skill Gaps: Green mining often requires specialized knowledge and skills to manage and operate new technologies. Training existing personnel and recruiting new talent with expertise in sustainable practices can be time-consuming and costly, impacting the smooth adoption of green mining solutions.

- Economic Viability: The economic viability of green mining practices can be affected by fluctuating commodity prices and market conditions. For instance, during periods of low metal prices, the additional costs associated with green mining technologies might be less justifiable, potentially affecting investment decisions.

Market Growth Opportunities

- Expansion of Renewable Energy: As the cost of renewable energy continues to decrease, the opportunity for integrating these technologies into mining operations becomes more economically feasible. The global renewable energy market is expected to grow at a CAGR of about 6.1% from 2021 to 2027, presenting a significant opportunity for mining companies to reduce their carbon footprint and energy costs.

- Advancements in Electric and Autonomous Vehicles: The development of electric and autonomous vehicles for mining operations offers a dual benefit of reducing greenhouse gas emissions and increasing operational efficiency. The market for electric vehicles in mining is projected to grow substantially, driven by innovations in battery technology and autonomous systems, providing a lucrative opportunity for green mining practices.

- Waste Management Innovations: There is a growing market for technologies that enable the effective treatment and recycling of mining waste. Companies that can innovate in this area not only help reduce environmental impact but also turn waste into valuable byproducts, opening new revenue streams. The global mining waste management market is expected to reach USD 233.56 billion by 2027, growing at a CAGR of 6.1%.

- Regulatory Compliance and Incentives: Increasingly strict environmental regulations worldwide are pushing mining companies towards sustainable practices. Markets that can offer technological solutions to help achieve compliance are likely to expand. Additionally, governmental incentives for green technologies can lower the cost of adoption and speed up the return on investment.

- Collaborations and Partnerships: Strategic partnerships between mining companies and technology providers can accelerate the development and implementation of green mining solutions. These collaborations can also facilitate knowledge sharing and reduce the technological and financial risks associated with deploying new technologies.

- Growing Consumer Demand for Sustainable Products: As consumers become more environmentally conscious, there is an increasing demand for products made with sustainable materials, including minerals and metals extracted through green mining processes. Companies that can certify their products as sustainably sourced may gain a competitive edge in the market.

Key Player Analysis

Anglo American is a leader in the green mining sector, emphasizing sustainable mining practices across its global operations. The company has implemented several innovative technologies to reduce its environmental impact, including water reprocessing systems and carbon-neutral mining processes. Anglo-American’s commitment to reducing greenhouse gas emissions and enhancing energy efficiency is evident in its ambitious goals to achieve carbon neutrality in its operations by 2040. These efforts position Anglo American as a pioneer in sustainable mining practices, driving the industry towards more responsible extraction methods.

Antofagasta PLC, a prominent mining company based in Chile, is actively engaged in green mining practices, focusing on water conservation and energy efficiency. The company has made significant investments in renewable energy sources to power its operations, aiming to reduce reliance on traditional fossil fuels. Antofagasta’s initiatives to use desalinated water in its mining processes also demonstrate its commitment to sustainable resource management, minimizing the impact on local water resources. These efforts underscore Antofagasta’s dedication to leading the mining industry toward more environmentally friendly and sustainable practices.

ArcelorMittal, a global steel and mining leader, is advancing green mining practices through innovative sustainability initiatives. The company focuses on reducing its carbon footprint by investing in energy-efficient technologies and low-emission processes. ArcelorMittal has committed to reducing its greenhouse gas emissions by 25% by 2030 and achieving carbon neutrality by 2050. Their projects include developing cleaner technologies for iron ore mining and integrating renewable energy sources into their operations, demonstrating a strong commitment to sustainable and environmentally friendly mining practices.

BHP, one of the world’s largest mining companies, is driving green mining through substantial investments in sustainability and environmental stewardship. The company has pledged to achieve net-zero emissions by 2050 and has set interim targets to reduce operational emissions by 30% by 2030. BHP is also focusing on improving water management and reducing waste through advanced technologies and sustainable practices. Their initiatives include transitioning to renewable energy sources for operations and implementing technologies to minimize environmental impacts, highlighting their leadership in green mining.

BHP Billiton, now known simply as BHP, is at the forefront of green mining with its comprehensive sustainability strategies. The company is deeply committed to reducing its environmental impact, aiming for a 30% reduction in emissions by 2030 and achieving net-zero emissions by 2050. BHP is investing in renewable energy projects and advanced technologies that reduce water and energy use across its operations. These initiatives are part of BHP’s broader goal to integrate sustainability into every aspect of its business, from water management to community engagement.

CODELCO, the largest copper producer in the world, is actively pursuing green mining practices to mitigate the environmental impacts associated with its operations. The Chilean state-owned company is implementing initiatives to drastically reduce greenhouse gas emissions and water usage, enhance waste management, and promote biodiversity conservation. CODELCO’s commitment includes investing in renewable energy sources and developing projects aimed at rehabilitating mining areas and promoting sustainable development in surrounding communities. These efforts showcase CODELCO’s leadership in transforming traditional mining into a more sustainable industry.

Doosan Infracore, a leading global heavy machinery manufacturer, is making significant strides in green mining through its innovative construction and mining equipment. The company has focused on developing eco-friendly and fuel-efficient machinery that reduces emissions and energy consumption. Notably, Doosan Infracore has introduced advanced hybrid excavators and wheel loaders equipped with cutting-edge technologies that significantly lower the carbon footprint of mining operations. Their commitment to sustainability is reshaping how mining equipment contributes to environmental conservation.

Dundee Precious Metals is a progressive mining company that integrates green mining practices across its operations with a strong focus on environmental stewardship. The company utilizes advanced technology to enhance the efficiency and sustainability of its mining processes, including state-of-the-art facilities that minimize energy consumption and waste production. Dundee Precious Metals has also implemented real-time data monitoring systems to ensure optimal operational efficiency and environmental compliance, setting a high standard for responsible mining practices that protect the natural environment while delivering economic benefits.

Freeport-McMoRan, Inc., one of the world’s largest copper, gold, and molybdenum mining companies, is deeply engaged in green mining practices. The company has committed to significant reductions in greenhouse gas emissions and aims to achieve a substantial portion of its energy from renewable sources. Freeport-McMoRan’s strategy includes investing in water conservation technologies and reclaiming mining sites to restore them to their natural state. Their proactive approach not only mitigates environmental impacts but also enhances the sustainability of their operations globally.

Glencore Plc is a multinational commodity trading and mining company that has taken significant steps towards green mining. The company focuses on reducing its carbon footprint through the adoption of various sustainable practices, such as improving energy efficiency, increasing reliance on renewable energy sources, and advancing recycling efforts. Glencore is also actively involved in initiatives to restore biodiversity at its mining sites, demonstrating a commitment to environmental stewardship. Their comprehensive sustainability agenda aims to ensure responsible resource extraction while minimizing environmental impacts.

Jiangxi Copper Corporation Limited, one of China’s largest copper producers, is advancing its green mining initiatives as part of its sustainability strategy. The company has focused on reducing harmful emissions and improving waste management practices within its operations. Jiangxi Copper has also invested in water conservation technologies and energy-efficient systems to minimize its environmental footprint. Their commitment to environmental protection and sustainable mining practices is integral to their business model, aiming to balance resource extraction with ecological stewardship.

Liebherr, a prominent manufacturer of heavy machinery, including for the mining sector, is committed to developing environmentally friendly technologies. The company’s innovative approach includes the production of electric mining equipment and systems that significantly reduce carbon emissions and increase energy efficiency. Liebherr’s focus on sustainability is reflected in its efforts to create machinery that not only meets the operational needs of modern mining operations but also adheres to stringent environmental standards, helping to transform green mining practices globally.

Rio Tinto, a global leader in the mining and metals sector, is pioneering green mining initiatives to mitigate its environmental impact. The company has made significant strides in reducing its carbon footprint by investing in renewable energy projects and developing new technologies that decrease energy consumption and emissions. Rio Tinto is also advancing the recycling of water and waste management practices across its operations, committing to a sustainable future by aiming to reach net-zero carbon emissions by 2050.

Sany, a major Chinese manufacturer of construction and mining equipment, is actively involved in green mining through its development of electric and hybrid machinery designed to lower emissions and reduce environmental impact. Their innovative equipment includes electric excavators and hybrid dump trucks, which are becoming increasingly popular in mining operations seeking to reduce carbon footprints. Sany’s commitment to environmental sustainability is also reflected in their efforts to improve the energy efficiency of their manufacturing processes and products.

Saudi Arabian Mining Corporation (Ma’aden) is advancing green mining practices with its commitment to sustainability and environmental stewardship. The company is focused on reducing its environmental footprint by adopting innovative technologies that enhance energy efficiency and reduce greenhouse gas emissions. Ma’aden is also implementing advanced water management systems and waste recycling processes to minimize the environmental impact of its operations, aligning with its goal to achieve net-zero carbon emissions by 2050.

Shandong Gold Mining Co. Ltd is actively pursuing green mining initiatives to improve its environmental footprint. The company is investing in cleaner technologies and energy-efficient processes to reduce emissions and energy consumption in its mining operations. Shandong Gold is also enhancing its waste management and water conservation strategies to promote sustainability. These efforts are part of the company’s broader commitment to integrating environmentally responsible practices into its operations and contributing to a more sustainable mining industry.

Tata Steel is actively engaged in green mining practices, emphasizing sustainability across its global operations. The company focuses on reducing its carbon footprint through various initiatives, including the use of renewable energy sources and the implementation of energy-efficient technologies in its mining and production processes. Tata Steel’s commitment to environmental stewardship is also evident in its water conservation efforts and waste management strategies, aiming to set a benchmark for sustainable practices in the steel industry.

Vale S.A., one of the world’s largest mining companies, is at the forefront of green mining with a strong emphasis on environmental sustainability. The company is actively reducing its carbon emissions by investing in renewable energy projects and developing new methods to increase energy efficiency in its operations. Vale is also pioneering the use of dry processing for iron ore, which reduces water use by 93% compared to traditional wet processing. These initiatives are part of Vale’s broader commitment to becoming a leader in sustainable mining globally.

Zijin Mining Group Co., Ltd., one of China’s leading mining companies, is making significant strides in green mining practices. The company is committed to reducing its environmental impact through the adoption of cleaner and more sustainable mining technologies. Zijin focuses on improving energy efficiency, reducing emissions, and enhancing waste management across its operations. Their approach includes the use of advanced equipment that minimizes soil and water contamination, aligning with global environmental standards to foster a more sustainable future in mining.

Conclusion

The green mining market is rapidly evolving, driven by the increasing need for sustainable practices and technological advancements. With a projected growth rate of 8.0%, reaching approximately USD 26.2 billion by 2033, this sector is expanding as companies integrate renewable energy sources, electric vehicles, and innovative waste management solutions into their operations.

Despite challenges such as high initial costs and technological barriers, the sector presents significant opportunities for those who invest in green technologies and adapt to regulatory changes. As global demand for environmentally responsible mining practices grows, the industry is likely to see continued investment and development, positioning green mining as a key component of the future of sustainable resource extraction.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)