Table of Contents

Introduction

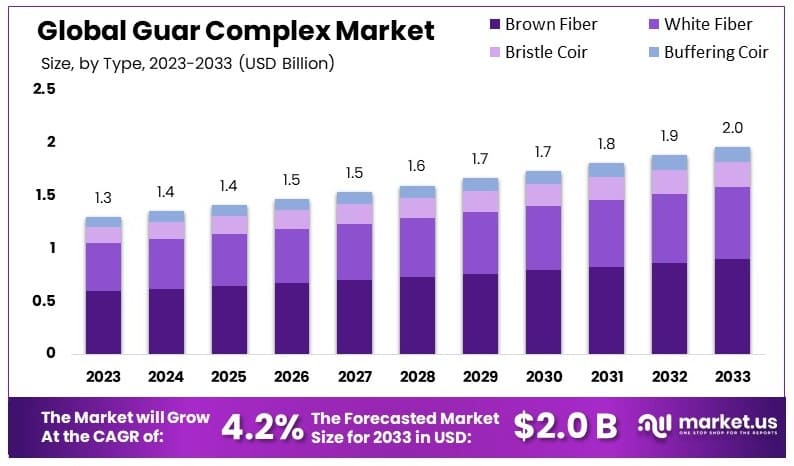

The Global Guar Complex Market, encompassing products derived from the guar plant such as guar gum, is projected to expand from its current valuation of USD 1.3 Billion in 2023 to an estimated USD 2.0 Billion by 2033. This growth is expected at a compound annual growth rate (CAGR) of 4.2% over the forecast period from 2024 to 2033. This market expansion can be attributed to increasing demands in industries such as food processing, pharmaceuticals, and hydraulic fracturing, where guar gum is used for its thickening, stabilizing, and emulsifying properties.

However, the market faces challenges including price volatility due to dependency on seasonal production and the limited growing regions, primarily in India and Pakistan, which are susceptible to climatic changes. Recent developments in the market include technological advancements in extraction and processing methods that have improved yield and purity. Additionally, a growing emphasis on sustainable and environmentally friendly agricultural practices within these regions aims to enhance production capacity, thereby supporting market growth.

The guar complex market is evolving, with key players like Vikas WSP Ltd, Shree Ram Industries, Lucid Colloids Ltd, and Ashland leading the way in innovation and sustainability. As the demand for natural ingredients and versatile industrial applications grows, these companies are well-positioned to capitalize on emerging opportunities, driving the market towards sustained growth and development.

Vikas WSP Ltd, a major player in the guar gum industry, has focused on expanding its production capabilities and enhancing its product portfolio. The company has invested in research and development to create high-quality guar gum derivatives tailored for the food, pharmaceutical, and oil industries. Vikas WSP’s emphasis on innovation has led to the introduction of new products that cater to the evolving needs of its diverse customer base.

Shree Ram Industries has been actively involved in increasing its market presence through strategic alliances and product diversification. The company has expanded its operations to meet the rising demand for guar derivatives in various sectors, including food processing and cosmetics. Recent initiatives include the enhancement of sustainable farming practices to ensure a steady supply of raw materials, addressing environmental concerns associated with guar cultivation.

Lucid Colloids Ltd has focused on broadening its application scope, particularly in the food and beverage sector. The company has launched new guar-based products that serve as stabilizers, thickeners, and emulsifiers. These products are designed to meet the growing consumer preference for natural and plant-based ingredients. Lucid Colloids’ advancements in extraction techniques and sustainable practices have positioned it as a leader in the guar complex market.

Ashland has leveraged its expertise in specialty chemicals to develop innovative guar gum products for diverse applications. The company’s recent developments include the introduction of guar gum derivatives for enhanced oil recovery and advanced food processing solutions. Ashland’s commitment to sustainability and environmental stewardship is reflected in its efforts to minimize the ecological impact of guar production and processing.

Key Takeaways

- Market Value: The Guar Complex Market was valued at USD 1.3 billion in 2023 and is expected to reach USD 2.0 billion by 2033, with a CAGR of 4.2%.

- Type Analysis: Brown Fiber dominated with 45.4%; it is crucial for its use in various industrial applications.

- Form Analysis: Guar Seed led with 39.6%; it is the primary raw material for producing guar gum and other derivatives.

- End-use Analysis: Food and Beverage held 45%; it is significant due to the widespread use of guar products as thickeners and stabilizers.

- Dominant Region: APAC dominated with 43.7%; driven by large-scale production and consumption in countries like India and China.

- High Growth Region: North America is experiencing growth; increased demand in the food, pharmaceutical, and oil industries boosts the market.

- Analyst Viewpoint: The market is moderately competitive with steady growth. Future trends suggest increased demand in food and pharmaceutical sectors due to guar’s functional properties.

Guar Complex Statistics

- The cost of cultivation for guar crop is very low, making it a low-risk crop for farmers.

- The crop yields around 20-25 quintals per hectare in irrigated areas.

- The by-products of guar gum processing, such as guar korma and guar meal, contain 15%-20% and 40%-50% of guar seed, respectively.

- The area under guar cultivation is expected to increase by 15%-20% in irrigated regions and 20%-30% overall.

- India contributes about 90% to the global production of cluster bean (Cyamopsis tetragonoloba [L.] Taub.), ranking first in the world.

- India exported 0.41 million tonnes of guar gum in 2022–23, earning USD 617.14 million.

- Good quality guar seed is traded at Rs 5550 per 100 kg, and average quality at Rs 5400 per 100 kg.

- India earned foreign exchange of INR 21,287 crore from the export of guar gum, around 25% more than the previous year.

- Guar gum’s share in total agricultural export increased from 7% in 2010-11 to 18%.

- The total agricultural exports from India in the first quarter of the current year stood at INR 34,132 crore, marginally higher than INR 32,061 crore in the previous year.

- India exported 53,497.82 metric tonnes of guar gum to the USA, valued at INR 88,005.20 lakhs.

- Germany imported 47,367.70 metric tonnes of guar gum from India, valued at INR 60,243.24 lakhs.

- Russia received 37,301.86 metric tonnes of guar gum from India, valued at INR 56,347.85 lakhs.

- Norway imported 96,640.24 metric tonnes of guar gum from India, valued at INR 51,888.78 lakhs.

- The export of guar gum increased by 2.67% in the year 2023-24, totaling 417,691 MT, which is 11,160 MT higher than the previous year’s 406,531 MT.

- The revenue from guar gum exports was USD 542 million in 2023-24, down 12.16% or USD 75 million from the previous year’s USD 617 million.

- The lowest export volume of guar gum was 0.23 million tonnes during 2020–21.

- India’s foreign exchange earnings from guar gum export increased significantly from 2010–11 to 2022–23, with a notable decline of 33.6% in 2020–21.

- The top importing countries of Indian guar gum during 2022–23 were the USA (24.2%) and Norway (20.1%).

- The cultivation acreage required would be approximately 1.56 million hectares, based on the recent estimated average yield of 0.81 Mg ha−1 in 2017.

- The length of guar growing periods varied from 111 days in 2019, 144 days in 2020, to 150 days in 2021.

- Guar requires about 203–254 mm of water during the growing season.

- Optimum temperatures for guar development are 25℃ for reproductive growth and 34℃ for vegetative growth.

Emerging Trends

- Increased Demand in Oil & Gas Industry: The guar complex, particularly guar gum, is experiencing increased demand in the hydraulic fracturing process. As global energy needs rise, the oil and gas industry’s reliance on guar gum for its superior thickening properties is pushing up both demand and prices. This trend is pivotal as it affects global supply chains and pricing structures within the market.

- Expanding Applications in Food Industry: Guar gum’s role in the food industry as a thickener and stabilizer is expanding. It’s increasingly used in gluten-free and vegan products, responding to consumer demands for healthier, dietary-specific options. This shift not only diversifies the application areas of guar gum but also stabilizes its market growth against fluctuations in other sectors.

- Sustainable Farming Practices: There’s a growing trend towards sustainable and organic farming practices among guar farmers, driven by increased global awareness and demand for eco-friendly products. This movement is improving the quality and appeal of guar products, potentially leading to premium pricing and market differentiation.

- Technological Advancements in Processing: Technological innovations in the processing of guar beans are enhancing efficiency and yield, reducing waste, and improving the quality of the final product. These advancements are crucial for maintaining competitiveness and meeting the stringent quality requirements of industries like pharmaceuticals and food.

- Market Volatility and Price Sensitivity: The guar complex market is notably volatile, with prices sensitive to changes in demand from the oil and gas industry, weather conditions affecting crop yields, and international trade policies. This unpredictability necessitates robust risk management strategies for stakeholders within the market.

- Health and Nutrition Awareness: The health and wellness trend is bolstering the use of guar gum in nutritional supplements and functional foods. Its fiber content and low calorie profile make it a preferred ingredient for health-conscious consumers, fostering growth in this niche segment.

- Global Expansion in Emerging Markets: As markets in Asia, Africa, and South America develop, new opportunities are emerging for the guar complex. These regions are experiencing increased industrialization and a burgeoning middle class, which is likely to increase the demand for processed foods and personal care products containing guar gum.

Use Cases

- Hydraulic Fracturing: Guar gum is used as a thickening agent in hydraulic fracturing fluids in the oil and gas industry. It helps in creating a viscous gel that transports proppants like sand into fractures in the rock, facilitating the extraction of oil and gas more efficiently.

- Food Production: In the food industry, guar gum serves as a stabilizer and thickener in products like ice cream, sauces, and soups. It helps prevent oil droplets from coalescing, thus maintaining the homogeneity of the product and improving texture and shelf life.

- Pharmaceuticals: Guar gum is utilized in pharmaceuticals as a binder and disintegrant in tablets, and as a thickening agent in lotions and creams. Its natural properties facilitate controlled drug release and improve the consistency and functionality of topical applications.

- Textile Industry: In textile manufacturing, guar gum is used in the sizing of fabrics and threads. It helps in the strengthening of warp yarns, thereby reducing breakage during the weaving process and enhancing fabric quality.

- Paper Manufacturing: Guar gum aids in improving the quality of paper by enhancing pulp hydration, which results in increased sheet formation and fold strength. It is also used to improve the retention of dyes and inks, leading to clearer and sharper printing.

- Cosmetics and Personal Care: In cosmetics, guar gum is used for its conditioning and viscosity-controlling properties. It is a component in products like shampoo and conditioners where it provides excellent thickening and stabilizes emulsions.

- Pet Food Industry: Guar gum is incorporated into pet foods as a thickening agent. It helps in maintaining moisture content, ensuring that pet foods maintain their shape and texture, making them more palatable for animals.

Key Players Analysis

Vikas WSP Ltd, a leading manufacturer and exporter of guar gum powder, reported a significant net profit increase of 92.38% in Q4 2023-2024, reaching ₹0.47 crore. This growth was driven by a 94.6% jump in quarterly net profits, reflecting improved operational efficiencies and market demand. The company continues to focus on expanding its portfolio in the guar complex sector, catering to industries like food, pharmaceuticals, and oil drilling with its high-quality guar derivatives.

Shree Ram Industries, another key player in the guar complex sector, specializes in producing high-grade guar gum and derivatives used extensively in food processing, textiles, and oil extraction. The company recently reported steady revenue growth attributed to increased demand from international markets and strategic expansions in production capacity. As part of its growth strategy, Shree Ram Industries has focused on enhancing its product line and entering new markets to solidify its position in the industry.

Lucid Colloids Ltd, a prominent player in the guar complex sector, focuses on manufacturing and distributing natural, modified, and derivative hydrocolloids such as guar gum. Recently, the company received a $27.5 million investment from the International Finance Corporation (IFC), aimed at financing expansion plans, including a new guar gum plant in Gujarat and two guar splitting plants in Rajasthan. This investment will help Lucid enhance its supply chain, increase production capacity, and support sustainable agriculture for around 60,000 farmers in India.

Ashland Inc., a global leader in specialty ingredients, recently launched two new cellulose gum products, Aquacel™ GSA and Aquacel™ GSH, to address the guar gum shortage impacting the food and beverage industries. These products offer cost-effective alternatives for applications in beverages, bakery, and dairy products. In the first quarter of fiscal 2024, Ashland reported sales of $565 million to $585 million, with a continued focus on portfolio optimization and strategic growth initiatives.

Supreme Gums Pvt. Ltd, a key manufacturer in the guar complex sector, specializes in high-quality guar gum production for various applications, including food processing, pharmaceuticals, and oil drilling. The company has recently expanded its production capacity to meet increasing global demand. With a focus on innovation and quality, Supreme Gums aims to strengthen its market position and enhance its product offerings in the guar gum industry.

India Glycols Limited, a key player in the guar complex sector, has announced a significant investment of ₹304 crore to expand its ethanol manufacturing capabilities. This includes the establishment of new grain-based distillery units at its Kashipur and Gorakhpur sites. The company’s recent financial performance shows a robust growth with net sales of ₹923.63 crore for the quarter ending March 2024, marking a 49.17% year-on-year increase. This expansion aligns with their strategic focus on enhancing production capacity and market presence.

Lamberti S.p.A, an Italian company specializing in the production of guar derivatives, recently expanded its portfolio by acquiring a new production facility to boost its capacity for guar gum processing. This strategic move aims to meet the growing demand in food, pharmaceuticals, and personal care sectors. Lamberti continues to innovate with new product launches and enhance its market reach through sustainable practices and technological advancements.

Best Agro Group, a diversified agrochemicals company, has significantly expanded its manufacturing capabilities by acquiring a facility in Gajraula, Uttar Pradesh. This facility enhances their production capacity for insecticides, herbicides, and seed enhancement products. The company’s revenue for FY23 crossed ₹1,700 crore, driven by innovative product launches like the proprietary ternary insecticidal combination Ronfen and CTPR-based formulations Citigen and Vistara. The group’s strategic focus includes the “Make in India” initiative and plans for further expansion in technical manufacturing.

Avanscure Lifesciences Pvt. Ltd specializes in the production and distribution of high-quality active pharmaceutical ingredients (APIs) and intermediates. Recently, the company has focused on expanding its product portfolio to include advanced intermediates and specialty chemicals, addressing the growing demands in the pharmaceutical and nutraceutical sectors. Avanscure is committed to innovation and quality, continually enhancing its research and development capabilities to stay ahead in the market.

Chemical Allianz is a key player in the guar complex sector, providing a wide range of guar-based products used in various industries, including food, pharmaceuticals, and oil drilling. The company has recently expanded its production capacity to meet the increasing global demand. With a strong focus on quality and innovation, Chemical Allianz aims to strengthen its market position and continue delivering high-performance guar derivatives to its clients worldwide.

Dabur India Limited, a leading FMCG company, continues its strong presence in the guar complex sector through its Natural Gums Division. Dabur manufactures and supplies high-quality guar gum products under the brand name DABISCO, used extensively in food, oil fields, textiles, personal care, pharmaceuticals, and other industries. Recently, Dabur announced a ₹135 crore investment to set up a new manufacturing facility in South India, aimed at producing Ayurvedic healthcare, personal care, and home care products, reflecting their commitment to expansion and sustainability.

Ashapura Proteins Ltd focuses on the production of high-quality guar gum and other natural gum products. They are known for their advanced manufacturing techniques and commitment to quality, catering to industries such as food processing, pharmaceuticals, and oil drilling. The company continues to innovate and expand its product range to meet the growing global demand for natural and sustainable ingredients.

Amba Gums & Feeds Products specializes in the manufacturing and export of guar gum powder and other natural hydrocolloids. Their products are widely used in the food, pharmaceutical, and oil and gas industries for their superior quality and functionality. The company is dedicated to sustainable practices and continuous improvement in their manufacturing processes to deliver high-performance products to their global clientele.

Siddharth Chemicals, also known as SidChem, is a leading manufacturer of industrial biocides and dithiocarbamates in India. With over three decades of experience, SidChem operates a major manufacturing facility in Kundaim Industrial Area, Goa, and a workshop in Dombivili. The company is ISO 9001:2015 certified and focuses on providing high-quality antimicrobial agents and preservatives used in various industrial applications such as oil drilling, water treatment, and paints. SidChem is committed to sustainability and innovation, continuously enhancing its product mix and manufacturing processes.

Dwarkesh Industries is a prominent manufacturer in the guar complex sector, specializing in the production of guar gum and its derivatives. The company is known for its high-quality guar products used in food, pharmaceuticals, and oil drilling industries. Dwarkesh Industries focuses on sustainable practices and innovation, ensuring their products meet international quality standards and cater to the growing global demand for natural ingredients.

Oriental Gums & Biopolymers is a key player in the guar complex sector, producing a wide range of guar-based products. The company’s offerings are utilized in various industries, including food, pharmaceuticals, and personal care. Oriental Gums & Biopolymers is dedicated to quality and innovation, leveraging advanced manufacturing technologies to deliver high-performance guar derivatives to its global clientele. The company emphasizes sustainable practices and continuous improvement to maintain its market leadership.

Ashok Industries, based in Jodhpur, Rajasthan, is a family-managed firm specializing in processing and marketing guar gum, cassia split, and guar meal. With over 22 years of experience, the company maintains strong ties with local guar gum growers and operates modern, automated manufacturing facilities with a combined capacity of 6,000 MT annually. Ashok Industries supplies high-quality products to various industries, including food, pharmaceuticals, textiles, and oil drilling, and emphasizes quality, sustainability, and competitive pricing.

The Saboo Group, a diversified conglomerate, operates in the guar complex sector through its subsidiary, Saboo Sodium Chloro Ltd. The company is involved in the manufacturing and export of guar gum powder and derivatives used in food processing, pharmaceuticals, and oil drilling. With a focus on quality and innovation, the Saboo Group aims to enhance its production capabilities and expand its market presence globally, leveraging advanced technology and sustainable practices.

Conclusion

In conclusion, the guar complex market exhibits promising growth potential, primarily driven by its expanding applications in various industries, including food processing and oil extraction. The demand is bolstered by the complex’s effectiveness as a thickening and stabilizing agent.

Although market volatility and climatic conditions pose challenges, strategic investments and innovations in cultivation and processing techniques could enhance market stability and growth. Stakeholders are encouraged to focus on sustainable practices and market diversification to capitalize on emerging opportunities and mitigate risks associated with supply chain disruptions.